Fundamentals steadily improve as lease rates rise

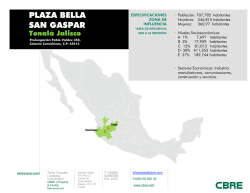

MARKETVIEW Mexico Capital Markets Q2 2015 Mexico’s public debt and demand leads the expansion of Commercial Real Estate. MX Stock Exchange Index (up to May) Total Amount Raised REITS Assets Value US $10,156 (M) US $21,968 (M) 44,703 *The arrows indicate the change from to the previous quarter. Figure 1: Mexico City Office Market: Under Construction, Completions, Gross and Net Absorption, 1998-2015**. 1,700,000 1,600,000 1,500,000 1,400,000 1,300,000 1,200,000 1,100,000 1,000,000 900,000 800,000 700,000 600,000 500,000 400,000 300,000 200,000 100,000 0 Under Construction (sq.m) New Delivered Stock (sq.m) Net Absorption (sq.m) Gross Absorption (sq.m)* Source: CBRE Research, Q2 2015. */Includes pre-lease transactions. **/ Estimated Data. OVERVIEW • FIBRAs (Real Estate Investment Trusts) and CKDs (Capital Development Certificates) in Mexico represent 1.4% of GDP. • The aggressive acquisition of premium properties by FIBRAs has led to the compression of cap rates, particularly in the Class AAA offices market. • Given the increase in interest rates by the U.S. Federal Reserve, we expect a decompression of cap rates of around 50 basis points across the different sectors. The liquidity of FIBRAS in Mexico has provided a boost to the expansion phase of the real estate cycle across all segments. The most obvious example can be found in the Mexico City office market, with 1.6 million square meters of class A and A+ space registered as under construction, and 1.3 million square meters of construction work planned over the next five years. Net absorption (demand for existing spaces) reached a record high of 354,000 square meters in 2014 while lease and sale closed deals (gross absorption) including pre-leases saw a record of almost 430,000 square meters. Source: CBRE Research, Q2 2015 2T 2015 CBRE Research © 2015 CBRE, Inc. | 1 M A R K E T V I E W MEXICO CAPITAL MARKETS OVERVIEW by U.S. Federal Reserve in the coming months, we would expect a decompression of cap rates of around The institutionalization of the commercial real estate 50 basis points across different sectors. market in Mexico has encouraged and created the need for more sophisticated instruments (FIBRAs Even when the absorption rates of the office sector and CKDs are the best examples) to satisfy the remain relatively healthy with respect to the new increasing developer and investor demands. offering incorporated into the inventory, it bears noting that the construction of new corporate spaces Just three years after their introduction, FIBRAs and is unprecedented, and there may be downward CKDs account for 1.4% of GDP, according to data pressure exerted on leases into 2016, particularly in from the Central Bank of Mexico, thus underscoring suburban Mexico City areas. their high potential for growth. On the other hand, the industrial segment will The aggressive dynamics shown by FIBRAs to create continue to benefit from the boost in demand from high-quality portfolios has led to a compression of the automotive and logistics industries, where cap rates, particularly in the premium office market; Mexico has become the primary beneficiary of the however, given the volatility of the financial markets nearshoring of companies that previously produced and the scheduled increase in interest rates their products for the U.S. market in Asia. Figure 2: Cap Rates by Asset Type in Main Markets, 2011 –2017* 11.0 10.0 Cap Rate % 9.0 8.0 7.0 6.0 5.0 4.0 2011 2012 City Office CdMx México Oficinas 2013 2014 Retail Promedio RetailMexico Mx Avg 2015 Cd México Mx City Industrial Industrial 2016 2017 Monterrey Monterrey Industrial Industrial Source: CBRE Research, Q2 2015. */2015 to 2017: estimated data. Q2 2015 CBRE Research © 2015 CBRE, Inc. | 2 M A R K E T V I E W MEXICO CAPITAL MARKETS OVERVIEW In 2014, the FIBRAs index posted a better performance than the Mexican Stock Exchange’s Also, the retail market has begun an Index (13% vs. 0.7% growth), thus making these institutionalization process that will boost its instruments attractive options for investor portfolios. potential to make up for Mexico’s shortcomings in shopping center density (0.2 sq. m. per capita) During the first five months of 2015, financial market compared to other emerging markets such as Brazil volatility affected the progression of the Stock (0.4 sq. m.) and mature markets such as Canada (1.2 Exchange Index; however, we expect the indexes to Sq. m.). resume a less volatile trend once the markets discount the effects of interest rates increases. The hotel sector, and especially the business hospitality segment, maintains a very favorable Rising interest rates may also be indicative of the outlook as the result of benefits deriving from the recovery of the U.S. economy, which may boost automotive boom in markets such as the Bajio in demand for Mexican exports and hopefully, for local Central Mexico and Northwestern Mexico, with the Real Estate, particularly in the automotive, logistics, devaluation of the Mexican peso against the dollar financial services, retail and private services sectors, also making the country an attractive destination for which have become factors driving the Mexican foreign visitors. economy, as well as in areas that we hope will also pick up, such as energy and telecommunications. Figure 3: REITS Index (May 2014 – May 2015) 250 245 REITS Index (BMV) 240 235 230 225 220 215 210 (May -14) (Ago -14) (Nov -14) (May -15) Source: CBRE Research, Q2 2015. Q2 2015CBRE Research © 2015 CBRE, Inc. | 3 M A R K E T V I E W MEXICO CAPITAL MARKETS Figure 4: REITS Main Indicators, Q1 2015. REIT Type Active Value (Millions Pesos) Number of Properties Properties (sq m.) FIBRA UNO Mix (Commercial, Offices and Industrial) 155,364 445 6,041,700 Fibra Hotel Hotel 10,005 71 Fibra Macquarie Mix (Commercial, Offices and Industrial) 36,232 Fibra Inn Hotel Fibra Terrafina Offices (%) Industrial (%) Comercial (%) Hotel (%) 8.2 52.9 38.7 - 9,673 - - - 100 277 3,163,700 6 86.1 8 - 7,362 31 5,538 - - - 100 Industrial 29,509 196 2,619,866 - 100 - - Fibra Shop Commercial 10,874 14 381,089 - - 100 - Fibra Danhos Mix (Commercial, Offices and Industrial) 45,045 11 402,642 28.8 - 68.3 2.9 Fibra Prologis Industrial 31,051 184 2,929,232 - 100 - - Fibra Monterrey Mix (Offices and Industrial) 2,534 9 132,304 63 36.1 1 - Source: CBRE Research with data from REITS Quarterly Reports. *Indicates number of rooms. In Q1 2015, the assets held by FIBRAs were roughly equal to the foreign direct investment (FDI) in Mexico during 2014, with almost US$22 billion of assets compared to US$23 billion of FDI, thus signifying the importance of these instruments within the national economy. These instruments have also yielded resources of almost US$10 billion, as reflected in the acquisitions reported in recent months and the aggressive acquisition plan for premium property across all segments. There are currently 40 CKDs in existence, raising approximately US$7.4 billion since 2009, of which approximately 28% is channeled to specialized Real Estate certificates. We expect investment in these instruments to grow in light of the announcement made by the financial authorities of simplification of the Afores procedures to ensure direct invest in CKDs without the need to go through an intermediary. Figure 5: REITS´s Main Acquisitions (May 2014 to May 2015) Buyer Seller Property Name/ Portfolio Type Price (USD) Cap Rate (%) Transaction Date Fibra Uno Confidential Kansas Portfolio Retail 674,757,908 8.52% May 2015 Fibra Danhos Grupo IPB Via Vallejo Retail 414,744,361 10.00% November 2014 Fibra Uno eGroup Offices Samara Office 268,108,123 8.52% December 2014 Fibra Uno Confidential Gallery Guadalajara Retail 266,570,589 n.a July 2014 Fibra Uno GICSA Masaryk 111 Office 114,365,641 7.59% July 2014 Fibra Uno Prudential RE Investors Río Churrubusco 601 Retail 113,265,306 n.a May 2015 Fibra Uno Siahou Sitton Hilton Mexico City Reforma Hotel 90,000,000 n.a July 2014 Fibra Uno eGroup Samara Shops (1-3F) Retail 79,354,963 8.52% December 2014 Fibra Uno Prudential RE Investors Tower Mitikah Office 71,734,694 n.A May 2015 Fibra Uno Confidential Utah Office 67,900,000 8.84% March 2015 Source: CBRE Research with data from Real Capital Analytics and internal sources. n.a: Not available. Q2 2015 CBRE Research © 2015 CBRE, Inc. | 4 M A R K E T V I E W MEXICO CAPITAL MARKETS CBRE MEXICO OFFICES CONTACTS CBRE MEXICO OFFICE Yadira Torres-Romero Director Ph: + 52 (55) 5284 0014 e: [email protected] Mexico City Torre Virreyes, Pedregal 24 17th Floor Lomas de Chapultepec Mexico City, 11040 Pablo López Gallardo Coordinator Ph: + 52 (55) 8526 8822 e: [email protected] To learn more about CBRE Research, or to access additional research reports, please visit the Global Research Gateway at Luisa Viridiana Alaniz Leyvas Analyst Ph: + 52 (55) 8526 8792 e: [email protected] www.cbre.com/researchgateway. La información contenida en este reporte, incluyendo proyecciones, ha sido obtenida a través de fuentes confiables. A pesar de que no dudamos de su veracidad, no la hemos verificado y por tanto no la garantizamos, justificamos o representamos. Es su entera responsabilidad confirmar la veracidad de esta información en su totalidad. Esta información ha sido diseñada exclusivamente para el uso de los clientes de CBRE y profesionales y no puede ser duplicada sin previa autorización de CBRE.

© Copyright 2026