Mining - Energy and Infrastructure 2016

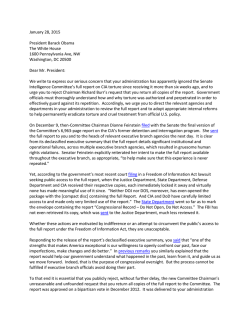

IFLR 1000 Rankings M&A Tier 1 Barros & Errázuriz Abogados Carey Cariola Díez Pérez‐Cotapos & Cía Claro & Cia Tier 2 Baker & McKenzie Guerrero Olivos Larraín & Asociados Morales & Besa Prieto & Cia Tier 3 Alcaíno | Abogados Aninat Schwencke & Cía Bofill Mir & Alvarez Jana Abogados Carey & Allende Noguera Larraín & Dulanto Urenda Rencoret Orrego & Dörr Yrarrázaval Ruiz‐Tagle Goldenberg Lagos & Silva Tier 4 Deloitte Other notable Albagli Zaliasnik Alessandri Abogados Bahamondez Alvarez & Zegers Barros Letelier & González Abogados Chirgwin Larreta Peñafiel Palma Abogados Banking and finance Tier 1 Carey Claro & Cia Philippi Prietocarrizosa & Uría Tier 2 Barros & Errázuriz Abogados Cariola Díez Pérez‐Cotapos & Cía Guerrero Olivos Morales & Besa Tier 3 Larraín & Asociados Prieto & Cia Tier 4 Baker & McKenzie Bofill Mir & Alvarez Jana Abogados Carey & Allende Noguera Larraín & Dulanto Urenda Rencoret Orrego & Dörr Other notable Albagli Zaliasnik Alessandri Abogados Aninat Schwencke & Cía Bahamondez Alvarez & Zegers Chirgwin Larreta Peñafiel Palma Abogados Energy and infrastructure Tier 1 Carey Philippi Prietocarrizosa & Uría Tier 2 Barros & Errázuriz Abogados Bofill Mir & Alvarez Jana Abogados Cariola Díez Pérez‐Cotapos & Cía Guerrero Olivos Morales & Besa Tier 3 Aninat Schwencke & Cía Bahamondez Alvarez & Zegers Urenda Rencoret Orrego & Dörr Other notable Alessandri Abogados Arteaga Gorziglia & Cía Chirgwin Larreta Peñafiel Claro & Cia Prieto & Cia Mining Tier 1 Bofill Mir & Alvarez Jana Abogados Carey Cariola Díez Pérez‐Cotapos & Cía Philippi Prietocarrizosa & Uría Tier 2 Guerrero Olivos Urenda Rencoret Orrego & Dörr Tier 3 Alessandri Abogados Aninat Schwencke & Cía Arteaga Gorziglia & Cía Bahamondez Alvarez & Zegers Chirgwin Larreta Peñafiel Claro & Cia Prieto & Cia IFLR 1000 Review Financial and Corporate / Cariola Díez Pérez‐Cotapos & Cía Cariola Díez Pérez‐Cotapos & Cía is best known for its M&A work, but has a broad practice across the finance and corporate areas. An energy client who the team advised on capital markets and M&A matters describes the firm as a “great team of professionals fully dedicated to the client, great legal experience and business orientation”. Francisco Javier Illanes is also praised specifically. In the finance space Rodrigo Sepúlveda and Illanes led the team that advised Rabobank Curaçao, Banco do Brasil, DNB Group, Agencia en Chile and DNB Bank on a $130 million amendment and restatement agreement with Ewos Invest and Nova Austral. Sepúlveda also advised BNP Paribas and Sumitomo Mitsui Banking Corporation on a $800 million financing to Empresa de Transporte de Pasajeros Metro. In project finance the firm advised Korea Southern Power, Samsung C&T and Kelar on a $476 million financing for the engineering, procurement and operation of a 517MW combined‐cycle gas power plant in Antofagasta. In M&A, much of the firm’s work is confidential but one significant public matter saw José Luis Letelier and Juan Pablo Matus advise Banmédica on a Peruvian joint venture with El Pacífico Peruano Suiza Compañía de Seguros & Reaseguros. Energy & Infrastructure / Cariola Díez Pérez‐Cotapos & Cía Cariola Díez Pérez‐Cotapos continues to be a well‐respected firm in the Chilean market. Peers generally consider the firm to have a strong team with experienced lawyers. Special mention is made of senior and managing partner José Luis Letelier who is described as knowledgeable on all matters relating to the energy and infrastructure sector in the country. Gonzalo Jiménez led the team that advised Kelar on the $400 million financing to build, own and operate an LNG fired power plant in Northern Chile that will supply energy to BHP Billiton. Jiménez also advises Southern Cross Group on finalising the necessary permits to build and operate a $750 million 350MW coal‐fired power plant that will be connected to the country’s northern grid. Rodrigo Sepúlveda led the team that advised Empresa de los Ferrocarriles del Estado on a $75 million 20‐year long term syndicated credit facility from a consortium of Chilean banks and insurance companies led by Banco de Chile. The financing is expected to be used for the construction of a railway in Chile’s eighth region. Sepúlveda also led the team that advised Banco BICE on the $32 million financing provided to Proyecto Raki and Proyecto Huajache to develop an aeolian generation project in the country. Leading Lawyers Source: International Financial Law Review (IFLR 1000)

© Copyright 2026