Renta Variable Equities CARACTERÍSTICAS DE LOS VALORES

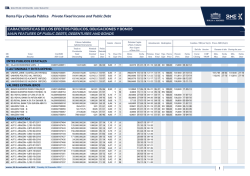

BOLETÍN DE COTIZACIÓN DAILY BULLETIN Renta Variable Equities CARACTERÍSTICAS DE LOS VALORES QUE NEGOCIAN EN EL SISTEMA DE INTERCONEXIÓN BURSÁTIL MAIN FEATURES OF THE SECURITIES TRADED IN THE INTERCONNECTION TRADING SYSTEM Cambios Prices MC MK Valor Security Nº Valores Admitidos N. of Stocks Admitted Cód.ISIN ISIN Code Bol. Exch. ES0173516115 F 1.350.272.389 ES0130960018 ES0130670112 ES0116870314 ES0144580Y14 ES0173093115 F F F F F 238.734.260 1.058.752.117 1.000.689.341 6.307.239.000 135.270.000 IT0004618465 ES0136463017 F F ES0116494016 ES0165386014 Del día Session Precedente Previous Fecha Date Cierre Closing Ampliaciones Capital Increase Dividendos Brutos Gross Dividends Durante el año During the year Importe Amount Tipo Type Fecha Date Importe Amount Última Ampliación Last Capital Increase Tipo Type Fecha Date Condiciones Conditions Última Admitida Last Admitted CMP VWAP Máx. Max. Fecha Date Mín. Min. Fecha Date Fecha Date 17,6800 03-11-14 17,1900 17,3861 21,0650 03-06 15,8150 16-10 19-06-14 0,4850 C 2013 06-06-14 1,0000 A 2014 19-06-14 PAR L. 07-14 26,1500 14,9800 22,5900 5,5680 67,5000 17-07-99 30-05-12 03-07-14 PAR L. PAR L. 07-99 06-12 07-14 PETROLEO Y ENERGIA PETROLEO MC REPSOL ELECTRICIDAD Y GAS MC MC MC MC MC ENAGAS ENDESA GAS NATURAL SDG IBERDROLA RED ELECTRICA CORPORACION 03-11-14 03-11-14 03-11-14 03-11-14 03-11-14 25,9400 14,9850 22,5000 5,5250 67,5500 26,0532 15,0443 22,5908 5,5442 67,9981 26,8900 31,6850 24,4450 5,7690 70,3800 03-11 07-10 05-09 05-09 31-10 18,6300 14,8900 17,8300 4,4550 47,3500 02-01 29-10 05-02 06-02 02-01 03-07-14 29-10-14 01-07-14 03-07-14 01-07-14 0,7636 7,7950 0,5040 0,1140 1,8185 C 2013 E 2014 C 2013 C 2013 C 2013 19-12-13 29-10-14 08-01-14 03-07-14 02-01-14 0,5030 6,0000 0,3930 0,0300 0,7237 A 2013 A 2014 A 2013 A 2013 A 2013 5.000.000.000 140.003.778 1,8710 03-11-14 0,4250 03-11-14 1,8710 0,4150 1,8795 0,4205 2,2000 0,7850 08-05 20-02 1,7110 0,3800 02-01 02-01 19-05-14 26-07-10 0,0256 U 2013 0,0086 U 2009 20-05-13 24-07-09 0,0259 U 2012 0,0138 U 2008 05-06-08 F F 15.000.000 102.264.250 1,1350 03-11-14 0,8850 03-11-14 1,1400 0,8550 1,1332 0,8628 1,5350 1,7850 26-02 20-01 1,0100 0,7500 21-05 02-01 14-02-07 03-10-11 0,2000 A 2006 0,0200 A 2010 27-11-06 23-05-11 0,2000 A 2006 0,0150 A 2010 09-02-07 26-09-14 10,00PR 04-07 09-14 ES0132105018 LU0569974404 F F 261.702.140 78.049.730 11,8800 03-11-14 11,6200 22,6500 03-11-14 21,5550 11,7086 22,1596 14,3050 28,8800 20-06 19-09 8,9590 11,9300 09-01 27-01 24-06-14 19-11-12 0,4490 U 2013 0,1247 A 2012 18-06-13 20-08-12 0,4330 U 2012 0,1291 A 2012 24-06-14 PAR L. 07-14 LU0323134006 ES0105630315 ES0146940012 ES0158480311 ES0163960018 ES0132945017 ES0180850416 F F A F 2 F F 1.560.914.610 129.000.000 8.208.000 9.600.000 515.453 132.978.782 174.680.888 10,3700 10,9550 0,5500 3,8000 10,9500 3,4900 2,3000 9,9710 11,1589 3,9008 13,4000 12,2850 1,7500 4,9000 17-01 22-09 20-03 19-05 9,0100 7,2100 0,5500 3,2600 16-10 04-02 10-07 03-01 4,4200 2,8500 19-09 10-06 2,7150 1,7100 27-01 27-01 10-05-13 0,1290 A 2012 03-01-14 0,0900 A 2013 27-12-11 0,0812 A 2011 04-11-13 0,1265 A 2013 12-02-13 25,8000 A 2012 11-11-13 0,0230 A 2013 20-06-13 0,0230 U 2012 13-11-07 11-06-14 08-02-02 02-06-98 3,4361 2,2486 12-05-14 0,1233 C 2012 03-07-14 0,0900 C 2013 28-06-12 0,1625 C 2011 20-05-14 0,1265 C 2013 06-03-14 19,4500 A 2013 01-07-14 0,0231 C 2013 20-06-14 0,0180 A 2013 26-02 1,6550 15-01 235,0000 16-10 04-11 03-06-02 0,1803 C 2001 07-07-14 10,5000 U 2013 21-12-01 0,1081 A 2001 08-07-13 10,5000 U 2012 03-10-08 15-05-90 PAR L. 683,00PR 12-02 30-07 03-11 16-10 11-06-14 27-07-12 15-01-14 10-07-12 15-12-91 11-09-14 L. ENERGIAS RENOVABLES MC ENEL GREEN POWER MC FERSA ENERGIAS RENOVABLES MC MONTEBALITO MC SOLARIA ENERGIA Y MEDIO AMBIENTE 06-08 MATERIALES BASICOS,IND.Y CONS. MINERALES,METALES Y TRANSFORM. MC ACERINOX MC APERAM, SOCIETE ANONYME MC ARCELORMITTAL MC CIE AUTOMOTIVE OF HULLERA VASCO LEONESA MC LINGOTES ESPECIALES OF MINERALES Y DERIVADOS MC TUBACEX MC TUBOS REUNIDOS 03-11-14 9,7790 03-11-14 11,0000 11-07-14 0,5500 03-11-14 3,8550 30-11-06 10,9500 03-11-14 3,3500 03-11-14 2,1700 11-07 06-14 L. 21-07-03 FABRIC.Y MONTAJE BIENES EQUIPO MC AZKOYEN MC CONSTRUCIONES Y AUX.FF.CC. (CAF) MC ELECNOR MC GAMESA CORPORACION martes, 04 de noviembre de 2014 ES0112458312 ES0121975017 F F ES0129743318 ES0143416115 F F Tuesday, 04 November 2014 25.201.874 1,8800 03-11-14 1,8450 1,8225 3,2100 3.428.075 252,8000 03-11-14 239,6000 244,8044 397,0000 87.000.000 279.268.787 8,8700 03-11-14 7,8170 03-11-14 8,8300 7,5220 8,8693 7,6484 11,7400 9,9200 8,7200 6,4420 0,1910 C 2013 0,0068 C 2011 0,0496 A 2013 0,0430 A 2011 1 11-08 09-14 BOLETÍN DE COTIZACIÓN DAILY BULLETIN BOLSA DE MADRID MADRID STOCK EXCHANGE Renta Variable Equities CARACTERÍSTICAS DE LOS VALORES QUE NEGOCIAN EN EL SISTEMA DE INTERCONEXIÓN BURSÁTIL MAIN FEATURES OF THE SECURITIES TRADED IN THE INTERCONNECTION TRADING SYSTEM Cambios Prices MC MK Valor Security TECNOLOGICA MC NICOLAS CORREA MC ZARDOYA OTIS Nº Valores Admitidos N. of Stocks Admitted Cód.ISIN ISIN Code Bol. Exch. ES0166300212 ES0184933812 F F 12.316.627 434.970.702 ES0125220311 ES0167050915 F F ES0118900010 ES0122060314 Del día Session Precedente Previous Fecha Date 1,1550 03-11-14 9,2700 03-11-14 Cierre Closing CMP VWAP Ampliaciones Capital Increase Dividendos Brutos Gross Dividends Durante el año During the year Máx. Max. Fecha Date Mín. Min. Fecha Date Fecha Date Importe Amount Tipo Type Fecha Date Importe Amount Última Ampliación Last Capital Increase Tipo Type Fecha Date Condiciones Conditions Última Admitida Last Admitted 1,1800 9,0500 1,1771 9,0975 1,9750 13,9500 11-02 16-01 1,0950 8,2000 10-10 16-10 02-07-08 10-10-14 0,0500 U 2007 0,0900 A 2014 10-06-02 10-04-14 0,0400 U 2001 0,0900 A 2014 13-03-06 15-07-14 PAR L. 03-06 09-14 57.259.550 314.664.594 54,9000 03-11-14 53,8500 29,5700 03-11-14 28,9500 54,7776 29,1952 67,7800 34,4950 26-06 23-06 40,7850 24,5600 03-01 06-01 01-07-13 03-07-14 1,7500 C 2012 0,7070 A 2013 21-01-13 30-01-14 0,9000 A 2012 0,4460 A 2012 30-11-98 03-07-14 100,00PR L. PAR L. 07-14 F F 739.421.648 127.303.296 16,2450 03-11-14 15,6500 15,0350 03-11-14 14,5000 15,8171 14,9567 16,4850 21,9200 19-06 20-01 13,8450 12,4150 06-01 16-10 04-11-14 13-07-12 0,3810 A 2014 0,6500 C 2011 02-07-14 10-01-12 0,2910 C 2013 0,6500 A 2011 04-11-14 30-09-02 PAR L. 07-14 09-02 ES0180918015 F 65.026.083 0,7400 03-11-14 0,7400 0,7341 1,4900 24-01 0,7200 16-10 ES0158300410 F 9.843.618 1,1500 11-06-12 1,1500 23-06-08 0,0853 U 2007 15-06-07 0,0731 U 2006 11-10-10 PAR L. 12-10 ES0142090317 ES0182870214 F F 99.740.942 502.212.433 12,00PR 12-09 04-14 ES0117360117 ES0117390411 4 F 66.115.670 51.786.608 7,5000 03-11-14 4,3400 03-11-14 7,5000 4,2900 ES0182170615 F 197.499.807 0,5900 03-11-14 ES0125140A14 ES0175290008 F F 112.283.591 36.268.734 0,4800 03-11-14 0,7290 17-06-13 ES0105200416 ES0105200002 ES0105022000 ES0162600417 ES0137650018 ES0141571119 F F F F F F 84.439.681 755.330.039 130.016.755 160.000.000 112.629.070 50.611.871 ES0152768612 F 28.500.000 ES0178165017 F NL0000235190 F CONSTRUCCION MC ACCIONA MC ACS ACTIVIDADES CONST.Y SERVICIOS MC FERROVIAL MC FOMENTO CONSTR.Y CONTRATAS(FCC) MC GRUPO EMPRESARIAL SAN JOSE MC LEVANTINA DE EDIFICACION,CLEOP MC OBRASCON HUARTE LAIN MC SACYR SUSP. 12-06-12 24,2050 03-11-14 23,1250 23,8298 3,5510 03-11-14 3,3850 3,4635 34,4950 5,3890 06-05 09-06 21,3700 3,0600 30-10 02-01 02-06-14 24-05-11 0,6777 U 2013 0,1000 A 2011 03-06-13 31-10-08 0,6519 U 2012 0,1500 A 2008 28-11-09 29-04-14 7,5000 4,2832 8,2000 9,3700 02-01 17-02 7,2200 3,7300 29-04 20-10 11-06-14 25-05-10 0,0700 A 2014 0,3164 A 2009 11-06-14 05-06-09 0,0100 C 2013 0,7200 C 2008 26-05-14 05-14 0,5850 0,5856 1,3950 17-01 0,5350 27-10 15-04-10 0,0320 A 2009 17-04-09 0,1000 A 2008 22-12-03 12-03 0,4700 0,7290 0,4821 SUSP. 17-06-13 0,5850 17-01 0,4110 10-07 09-05-77 30-10-07 U 1976 0,0123 A 2007 01-07-76 24-12-98 U 1975 0,1202 A 1998 17-10-14 17-07-10 PAR 10-14 08-10 03-11-14 3,4610 03-11-14 3,2870 03-11-14 10,7000 03-11-14 3,6500 03-11-14 2,5400 03-11-14 0,2300 3,5469 3,3650 10,6947 3,6952 2,5576 0,2238 5,1420 4,7300 17,5050 5,3000 3,6800 0,9100 23-06 04-09 23-06 17-01 31-03 19-02 2,3620 2,0650 8,3900 3,4500 2,3650 0,2100 03-01 02-01 16-10 27-10 17-10 29-10 09-04-14 09-04-14 0,1110 U 2013 0,1110 U 2013 09-04-13 09-04-13 0,0720 U 2012 0,0720 U 2012 09-04-14 09-04-14 PAR L. PAR L. 05-14 05-14 15-09-14 04-10-13 0,0666 A 2014 0,0712 U 2012 16-07-14 05-10-12 0,0666 C 2013 0,0712 U 2011 15-09-10 PAR L. 10-10 0,3650 0,3633 1,1900 10-01 0,3350 27-10 11-07-07 0,0069 U 2006 11-07-06 0,0100 C 2005 55.896.000 39,7300 03-11-14 37,4600 38,2737 46,6200 24-06 36,8400 16-10 15-07-14 0,7285 C 2013 16-01-14 0,6670 A 2013 779.985.229 47,6000 03-11-14 46,8400 47,1381 57,7500 21-01 41,1100 16-10 29-05-14 0,6375 U 2013 31-05-13 0,6000 U 2012 MATERIALES DE CONSTRUCCION OF CEMENTOS MOLINS MC CEMENTOS PORTLAND VALDERRRIVAS MC URALITA INDUSTRIA QUIMICA MC ERCROS MC LA SEDA DE BARCELONA (EN LIQUIDACION) INGENIERIA Y OTROS MC MC MC MC MC MC ABENGOA CLASE A ABENGOA CLASE B APPLUS SERVICES DURO FELGUERA FLUIDRA GENERAL DE ALQUILER DE MAQUINARIA MC INYPSA INFORMES Y PROYECTOS MC TECNICAS REUNIDAS 3,6640 3,4810 10,5000 3,7000 2,5550 0,2200 0,3650 03-11-14 17-10-14 25-07-09 10-14 PAR L. 10-09 AEROESPACIAL MC AIRBUS GROUP 30-08-13 BIENES DE CONSUMO ALIMENTACION Y BEBIDAS martes, 04 de noviembre de 2014 Tuesday, 04 November 2014 2 08-13 BOLETÍN DE COTIZACIÓN DAILY BULLETIN BOLSA DE MADRID MADRID STOCK EXCHANGE Renta Variable Equities CARACTERÍSTICAS DE LOS VALORES QUE NEGOCIAN EN EL SISTEMA DE INTERCONEXIÓN BURSÁTIL MAIN FEATURES OF THE SECURITIES TRADED IN THE INTERCONNECTION TRADING SYSTEM Cambios Prices MC MK MC OF MC OF OF MC MC MC MC Valor Security BARON DE LEY BODEGAS BILBAINAS BODEGAS RIOJANAS C.V.N.E. DAMM DEOLEO EBRO FOODS NATRA PESCANOVA MC VISCOFAN Nº Valores Admitidos N. of Stocks Admitted Cód.ISIN ISIN Code Bol. Exch. ES0114297015 ES0114930011 ES0115002018 ES0184140210 ES0125690513 ES0110047919 ES0112501012 ES0165515117 ES0169350016 F 2 F F 4 F F F F 4.545.222 2.793.640 5.385.600 14.250.000 270.083.272 1.154.677.949 153.865.392 47.478.280 28.737.718 ES0184262212 F 46.603.682 ES0106000013 ES0126962002 F F 9.276.108 67.095.075 ES0108180219 ES0148396007 F F ES0158545030 ES0165380017 Del día Session Precedente Previous 73,0000 6,2500 4,6000 17,5000 5,5600 0,3700 14,3250 1,2000 5,9100 Fecha Date Cierre Closing 03-11-14 73,0000 03-11-14 6,2500 03-11-14 4,6800 03-11-14 17,5000 03-11-14 5,5700 03-11-14 0,3800 03-11-14 14,1500 03-11-14 1,1400 12-03-13 5,9100 Ampliaciones Capital Increase CMP VWAP Máx. Max. Fecha Date Mín. Min. Fecha Date 72,9986 78,0000 7,4500 5,7000 19,6500 5,6000 0,5150 17,3700 2,5000 24-02 02-07 17-01 25-02 29-10 03-02 02-01 21-01 57,7000 6,2500 4,3900 15,0000 4,1100 0,3650 13,8500 1,0300 07-01 03-11 14-10 07-01 16-10 03-03 10-10 16-10 47,3150 03-11 36,2350 4,6166 5,5700 0,3853 14,2521 1,1481 SUSP. 12-03-13 46,7500 03-11-14 46,6100 46,7398 Dividendos Brutos Gross Dividends Durante el año During the year Fecha Date Importe Amount Tipo Type Fecha Date Importe Amount Última Ampliación Last Capital Increase Tipo Type U 2012 U 2012 A 2012 C 2013 U 2006 A 2013 C 2006 U 2010 Fecha Date Condiciones Conditions 30-03-00 500,00PR 02-11-00 100,00PR L. 14-07-14 08-07-13 02-01-03 22-06-09 12-07-12 PAR L. Última Admitida Last Admitted 10-12-13 14-07-14 25-04-14 15-10-14 18-06-08 02-10-14 31-07-08 30-04-12 0,1768 0,1100 0,4300 0,0300 0,0360 0,1250 0,0700 0,5500 U 2013 U 2013 A 2013 A 2014 U 2007 A 2013 U 2007 U 2011 12-12-12 12-07-13 03-05-13 04-07-14 04-07-07 02-07-14 05-07-07 14-04-11 0,1540 0,1000 0,4593 0,0600 0,0182 0,1250 0,0700 0,5000 14-03 04-06-14 0,7040 C 2013 23-12-13 0,4100 A 2013 15-08-11 0,0700 U 2009 30-07-09 0,1500 U 2008 01-02-13 04-09-14 PAR 02-13 10-14 PAR L. 2,65PR 13,45PR 09-14 07-13 01-03 07-09 08-12 08-11 TEXTIL, VESTIDO Y CALZADO MC ADOLFO DOMINGUEZ MC DOGI INTERNATIONAL FABRICS MC GRUPO TAVEX MC IND. DE DISEÑO TEXTIL (INDITEX) OF LIWE ESPAÑOLA MC SNIACE 4,0800 03-11-14 0,6630 03-11-14 3,9700 0,6600 4,0045 0,6640 6,7000 3,8800 21-01 30-06 3,8200 0,6400 04-11 23-10 28-07-10 116.014.703 3.116.652.000 0,2350 03-11-14 0,2340 21,9000 03-11-14 21,4050 0,2342 21,5511 0,3290 24,2000 13-02 22-01 0,1750 19,2900 18-08 16-10 05-07-06 03-11-14 0,0800 U 2005 0,1000 E 2013 05-07-05 03-11-14 0,1000 U 2004 0,1420 C 2013 25-04-08 1,44PR 06-08 8 F 1.666.588 77.992.167 10,0000 26-08-13 10,0000 0,1960 06-09-13 0,1960 01-08-97 31-12-79 0,0991 E 1996 U 1978 01-08-96 15-07-78 0,0901 U 1995 C 1977 08-10-10 24-04-07 PAR L. 3,65PR 11-10 04-07 ES0182045312 F 12.315.391 13,8400 03-11-14 13,0000 13,1011 18,6800 01-07 12,7500 04-11 23-12-13 0,1500 A 2012 23-09-13 0,1400 A 2012 04-11-14 PAR L. 11-07 ES0130625512 ES0147561015 ES0164180012 ES0168561019 F F F F 250.272.500 11.247.357 12.450.000 90.022.528 1,6850 12,0000 28,9900 4,0200 03-11-14 1,6750 03-11-14 12,0000 03-11-14 28,9900 03-11-14 3,9050 1,6862 12,0000 28,7110 3,9650 3,0850 16,5500 36,1700 5,1700 17-01 16-01 23-06 09-09 1,4600 11,8300 23,8000 3,6900 16-10 12-08 01-10 03-03 11-07-14 06-06-14 15-10-14 02-07-14 0,0500 0,2000 0,1445 0,1232 A 2013 C 2013 A 2014 C 2013 11-07-14 04-03-14 17-07-14 24-02-14 0,0300 0,1500 0,1606 0,0400 A 2013 A 2013 C 2013 A 2013 06-03-10 1,56PR 04-10 11-10-11 07-10-14 PAR L. PAR L. 12-11 10-14 IT0001178240 F 585.404 0,7000 0,7000 13-05-02 0,0275 U 2001 22-05-00 0,0263 U 1999 09-06-03 PAR 07-03 IT0001178299 F 269.129.033 0,4170 12-02 0,2550 16-10 13-05-02 0,0165 U 2001 19-05-01 0,0309 U 2000 09-06-03 PAR 07-03 F F F F F F F 172.951.120 12,9500 03-11-14 12,8900 12,9164 13,2200 639.060.790 112,7000 03-11-14 112,7000 112,7000 115,0000 57.699.522 0,5250 03-11-14 0,5150 0,5162 0,9600 235.043.441 1,8050 03-11-14 1,8350 1,8219 2,9300 213.064.899 32,2100 03-11-14 33,9000 33,6649 42,5300 130.712.555 27,9100 03-11-14 28,4000 28,5956 34,6000 50.000.000 8,3600 03-11-14 8,3100 8,3341 10,2300 31-10 19-09 13-02 15-01 10-06 09-06 21-01 10,6000 90,1000 0,4850 1,7300 27,9100 22,6050 7,9000 16-04 28-04 16-10 16-10 16-10 16-10 17-10 17-05-13 30-04-14 0,1530 U 2013 1,5461 U 2013 15-05-12 29-04-13 0,1720 U 2011 1,3988 U 2012 17-05-13 PAR L. 06-13 06-06-14 05-06-14 05-06-14 03-07-14 0,0300 0,2006 0,0100 0,1612 24-12-13 05-06-13 05-06-14 03-07-13 0,0400 0,2000 0,2006 0,1366 SUSP. 09-09-13 PAPEL Y ARTES GRAFICAS MC ADVEO GROUP INTERNATIONAL MC ENCE ENERGIA Y CELULOSA MC IBERPAPEL GESTION MC MIQUEL Y COSTAS MC PAPELES Y CARTONES DE EUROPA OF RENO DE MEDICI,AHORRO CONV. MC RENO DE MEDICI,ORDINARIAS SER.A 0,2850 03-11-14 SUSP. 21-03-07 0,2770 0,2854 PROD.FARMACEUT.Y BIOTECNOLOGIA MC MC MC MC MC MC MC ALMIRALL BAYER A.G. BIOSEARCH FAES FARMA GRIFOLS CLASE A GRIFOLS CLASE B LABORATORIOS ROVI martes, 04 de noviembre de 2014 ES0157097017 DE000BAY0017 ES0172233118 ES0134950F36 ES0171996012 ES0171996004 ES0157261019 Tuesday, 04 November 2014 C 2012 A 2013 U 2013 U 2013 A 2012 A 2013 A 2013 U 2012 21-01-03 06-06-14 22-04-13 22-04-13 3 PAR L. 01-03 07-14 04-13 04-13 BOLETÍN DE COTIZACIÓN DAILY BULLETIN BOLSA DE MADRID MADRID STOCK EXCHANGE Renta Variable Equities CARACTERÍSTICAS DE LOS VALORES QUE NEGOCIAN EN EL SISTEMA DE INTERCONEXIÓN BURSÁTIL MAIN FEATURES OF THE SECURITIES TRADED IN THE INTERCONNECTION TRADING SYSTEM Cambios Prices MC MK Valor Security Nº Valores Admitidos N. of Stocks Admitted Del día Session Cód.ISIN ISIN Code Bol. Exch. ES0165359011 ES0170884417 ES0184940817 F F F 328.713.946 17.347.124 222.204.887 0,2030 03-11-14 6,2700 03-11-14 2,6350 03-11-14 0,2000 6,2400 2,5300 MC INDO INTERNACIONAL ES0148224118 F 22.260.000 0,6000 17-06-10 0,6000 MC VIDRALA ES0183746314 F 23.972.705 ES0119256115 LU1048328220 ES0176252718 F F F 55.036.470 104.878.049 184.776.777 0,4100 03-11-14 2,0380 03-11-14 8,1000 03-11-14 0,4000 2,0100 7,9800 ES0161560018 F 350.271.788 3,7600 03-11-14 MC DIA-DISTRIBUIDORA INT. DE ES0126775032 ALIMENTACION MC SERVICE POINT SOLUTIONS ES0143421G11 F 651.070.558 F 176.509.910 ES0109427734 ES0152503035 F F 224.551.504 406.861.426 ES0171743117 F 2.143.699.014 0,2150 03-11-14 0,2150 ES0183304312 F 337.535.058 0,0440 14-04-14 0,0440 ES0114820113 F 124.970.306 ES0177542018 F 2.040.078.523 ES0105027009 ES0110480136 F F ES0110480219 MC NATRACEUTICAL MC PRIM MC ZELTIA Precedente Previous Fecha Date Cierre Closing Ampliaciones Capital Increase Dividendos Brutos Gross Dividends Durante el año During the year Importe Amount Tipo Type Fecha Date Importe Amount Última Ampliación Last Capital Increase CMP VWAP Máx. Max. Fecha Date Mín. Min. Fecha Date Fecha Date Tipo Type Fecha Date Condiciones Conditions 0,2020 6,2531 2,5805 0,3380 6,8800 3,1300 22-01 24-06 19-06 0,1960 5,5100 2,3100 16-10 28-02 02-01 06-06-13 17-07-14 13-06-97 0,0370 U 2012 0,1517 C 2013 0,3005 U 1996 16-01-14 01-07-95 0,0500 A 2013 0,6010 C 1994 10-10-06 16-10-08 21-12-07 0,75PR PAR L. 12-07-07 0,0200 C 2006 14-12-06 0,0800 A 2006 04-07-08 1,50PR Última Admitida Last Admitted 11-06 12-08 12-07 OTROS BIENES DE CONSUMO SUSP. 18-06-10 31,4000 03-11-14 31,4000 31,4162 41,0500 18-03 31,4000 30-10 14-07-14 0,1748 C 2013 14-02-14 0,4798 A 2013 30-10-14 PAR L. 12-11 0,4029 2,0531 8,0171 1,3900 11,9000 9,9900 09-01 13-05 10-01 0,3800 1,0230 7,2750 04-11 24-10 16-10 05-08-14 0,0400 U 2013 08-08-13 0,0400 U 2012 22-12-00 7.500,00PR 3,5650 3,6021 5,2650 28-03 3,0600 16-10 08-07-08 0,2600 U 2007 16-05-06 0,2600 U 2005 09-07-14 07-14 5,0180 03-11-14 4,8940 4,9485 7,1100 02-07 4,4790 16-10 16-07-14 0,1600 U 2013 16-07-13 0,1300 U 2012 0,0710 31-01-14 0,0710 SUSP. 03-02-14 0,1070 09-01 0,0620 21-01 01-07-91 0,5288 U 1990 01-07-90 0,4327 U 1989 12-10-11 10-11 11,6900 03-11-14 11,6800 10,2750 03-11-14 9,9190 11,7660 10,0683 14,8000 10,3600 17-02 04-11 9,4800 7,2810 16-05 19-05 18-06-14 18-04-12 0,1100 A 2013 0,1379 U 2011 20-12-12 04-05-11 0,1100 A 2012 0,1055 U 2010 14-11-12 26-01-11 11-12 01-11 0,2146 0,5140 06-03 0,1720 09-10 19-03-08 0,1840 U 2007 27-03-07 0,1600 U 2006 22-10-14 10-14 0,0700 08-01 0,0440 14-04 24-01-14 01-14 1,4850 03-11-14 SUSP. 15-04-14 1,4900 1,4699 2,8650 28-03 1,4400 30-10 5,2970 03-11-14 5,2430 5,2723 5,5690 26-02 3,8500 08-08 11-10-13 10-13 132.750.000 90.000 13,9650 03-11-14 14,0000 0,6600 0,6600 14,0880 15,1500 31-10 12,5850 16-10 F 1.689.049 33,0000 03-11-14 33,0000 F 898.305.042 16,5650 03-11-14 15,8600 SERVICIOS DE CONSUMO OCIO, TURISMO Y HOSTELERIA MC CODERE MC EDREAMS ODIGEO MC MELIA HOTELS INTERNATIONAL MC NH HOTEL GROUP COMERCIO MEDIOS COMUNICAC. Y PUBLICIDAD MC ATRESMEDIA MC MEDIASET ESPAÑA COMUNICACION MC PROMOTORA DE INFORMACIONES CLASE A MC VERTICE TRESCIENTOS SESENTA GRADOS MC VOCENTO 12-05-08 0,1942 C 2007 10-10-07 0,3078 A 2007 TRANSPORTE Y DISTRIBUCION MC INTERNATIONAL CONSOLIDAT.AIRLINES GROUP MC LOGISTA HOLDINGS OF LOGISTICA DE HIDROCARBUROS - A OF LOGISTICA DE HIDROCARBUROS - D 12-05-14 0,5634 C 2013 19-12-13 1,6200 A 2013 35,5300 25-06 26,5100 09-01 12-05-14 0,5634 C 2013 19-12-13 1,6200 A 2013 17,6400 25-02 13,7200 16-10 04-11-14 0,3300 A 2014 08-04-14 0,3300 C 2013 AUTOPISTAS Y APARCAMIENTOS MC ABERTIS INFRAESTRUCTURAS, SERIE martes, 04 de noviembre de 2014 ES0111845014 Tuesday, 04 November 2014 16,0090 14-05-14 4 PAR L. 06-14 BOLETÍN DE COTIZACIÓN DAILY BULLETIN BOLSA DE MADRID MADRID STOCK EXCHANGE Renta Variable Equities CARACTERÍSTICAS DE LOS VALORES QUE NEGOCIAN EN EL SISTEMA DE INTERCONEXIÓN BURSÁTIL MAIN FEATURES OF THE SECURITIES TRADED IN THE INTERCONNECTION TRADING SYSTEM Cambios Prices MC MK Valor Security Nº Valores Admitidos N. of Stocks Admitted Del día Session Cód.ISIN ISIN Code Bol. Exch. Precedente Previous Fecha Date Cierre Closing ES0119037010 ES0140441017 ES0143419317 ES0175438003 F F C F 16.307.580 18.396.898 45.092.100 617.124.640 ES0113211835 F 5.928.914.751 ES0113860A34 ES0113790226 ES0113900J37 ES0113307021 ES0113679I37 ES0140609019 ES0114400007 F F F F F F F 4.013.205.919 2.100.706.458 11.988.091.130 11.517.328.544 898.866.154 5.650.923.717 50.000.000 ES0168675009 F 2.612.245.277 ES0116920333 F 120.000.000 ES0124244E34 F 3.079.553.273 2,7370 03-11-14 2,7070 ES0162292017 C 22.803.171 2,0700 23-09-14 2,0700 MC CORPORACION FINANCIERA ALBA MC DINAMIA CAPITAL PRIVADO OF INV. MOBILIARIAS BARCINO OF INVERPYME ES0117160111 F 58.300.000 ES0126501131 ES0155972237 ES0155151014 F 8 4 16.279.200 2.759.012 7.554.378 OF OF OF ES0164228019 ES0174300014 ES0181222011 4 2 4 2.850.000 9.940 130.000 ES0181480114 E 25.914.598 CMP VWAP Ampliaciones Capital Increase Dividendos Brutos Gross Dividends Durante el año During the year Máx. Max. Fecha Date Mín. Min. Fecha Date Fecha Date Importe Amount Tipo Type Fecha Date Importe Amount Última Ampliación Last Capital Increase Tipo Type Fecha Date Condiciones Conditions Última Admitida Last Admitted A OTROS SERVICIOS MC MC OF MC CLINICA BAVIERA FUNESPAÑA INVERFIATC PROSEGUR COMPAÑIA DE SEGURIDAD 7,3300 5,6500 0,2700 4,6800 03-11-14 03-11-14 03-11-14 03-11-14 7,5000 5,6500 0,2500 4,6100 7,4162 5,8800 0,2500 4,6374 12,1700 6,6000 0,4200 5,5000 07-05 07-07 30-01 16-07 6,7300 5,3000 0,2100 4,1600 16-10 14-10 30-10 03-03 14-05-14 28-07-08 0,4900 A 2013 0,1060 U 2007 14-05-13 25-07-06 0,1000 A 2012 0,1000 U 2005 17-11-12 16-10-14 0,0267 A 2013 17-07-14 0,0267 A 2013 28-01-02 8,7780 03-11-14 8,5870 8,6530 9,9900 09-06 8,2930 16-10 29-09-14 0,0800 A 2014 10-07-14 0,0800 A 2014 29-09-14 2,2310 4,4190 6,9900 1,3820 6,3840 4,1950 1,3400 2,1600 4,2800 6,7500 1,3470 6,2810 4,1630 1,3400 2,1923 4,3410 6,8428 1,3635 6,3655 4,1938 SUSP. 09-12-11 0,6440 0,6563 2,7130 5,9480 7,9600 1,6270 7,0900 4,9990 09-06 04-04 04-09 11-03 19-09 19-09 1,8200 4,1310 6,2010 1,1100 4,9300 3,7240 03-01 08-08 04-02 02-01 03-01 02-01 03-04-14 29-09-14 20-10-14 0,0100 A 2013 0,0120 A 2014 0,1510 A 2014 05-04-13 01-07-14 15-07-14 0,0100 A 2012 0,0100 C 2013 0,1520 A 2014 01-11-14 09-09-14 10-06-10 0,0273 A 2014 0,0500 A 2014 0,0891 C 2009 02-08-14 03-06-14 22-12-09 0,0273 A 2014 0,0500 C 2013 0,0709 A 2009 11-08-14 29-09-14 20-10-14 28-05-13 09-06-14 09-09-14 1,0350 08-05 0,5780 10-07 23,6765 31,6500 19-03 21,3500 15-10 09-10-14 0,1214 A 2014 10-07-14 2,7244 3,4630 17-01 2,3990 16-10 20-06-14 0,0800 C 2013 2,1000 11-09 1,4500 04-07 05-07-11 41,6930 48,4400 01-07 39,5100 30-01 7,4958 9,4800 1,4800 02-06 17-06 6,8600 1,3400 03-01 22-08 4,3200 05-05 4,3200 05-05 7,00PR 12-12 01-02 SERVS.FINANCIEROS E INMOBILIA. BANCOS Y CAJAS DE AHORRO MC BANCO BILBAO VIZCAYA ARGENTARIA MC BANCO DE SABADELL MC BANCO POPULAR ESPAÑOL MC BANCO SANTANDER MC BANKIA MC BANKINTER MC CAIXABANK MC CAM, CUOTAS PARTICIPATIVAS MC LIBERBANK 03-11-14 03-11-14 03-11-14 03-11-14 03-11-14 03-11-14 08-12-11 0,6790 03-11-14 PAR L. 10-14 PAR L. 08-14 10-14 08-14 05-13 06-14 10-14 28-05-14 0,48PR 05-14 0,1214 A 2014 15-06-98 L. 20-12-13 0,0500 A 2013 07-06-11 2,46PR 07-11 0,1000 U 2010 21-07-10 0,1000 U 2009 04-06-13 PAR L.43,47% 07-13 30-10-14 0,5000 A 2014 16-06-14 0,5000 C 2013 15-12-89 15-07-05 05-06-98 0,7000 U 2004 0,1202 A 1998 15-07-03 15-04-97 0,7000 U 2002 0,1202 U 1996 03-10-11 27-10-97 PAR L. L. 11-11 14-07-14 7,4000 A 2013 22-11-13 2,9000 A 2013 23-01-12 0,1329 A 2011 26-04-11 0,1350 A 2011 27-11-06 28,20PR 12-06 PAR L. PAR L. SEGUROS MC GRUPO CATALANA OCCIDENTE MC MAPFRE, S.A. 23,6700 03-11-14 23,4500 SOCIEDADES CARTERA Y HOLDINGS OF OF CARTERA INDUSTRIAL REA MOBILIARIA MONESA RONSA UNION CATALANA DE VALORES UNION EUROPEA DE INVERSIONES 41,7400 03-11-14 41,5300 7,5900 03-11-14 1,3400 22-08-14 0,3100 06-05-13 7,4200 1,3400 0,3100 4,3200 05-05-14 4,3200 49,0000 25-11-13 49,0000 4,8000 4,8000 3,3000 29-10-14 3,3000 SUSP. 08-05-13 3,9000 30-06 2,8500 03-06 SICAV martes, 04 de noviembre de 2014 Tuesday, 04 November 2014 5 BOLETÍN DE COTIZACIÓN DAILY BULLETIN BOLSA DE MADRID MADRID STOCK EXCHANGE Renta Variable Equities CARACTERÍSTICAS DE LOS VALORES QUE NEGOCIAN EN EL SISTEMA DE INTERCONEXIÓN BURSÁTIL MAIN FEATURES OF THE SECURITIES TRADED IN THE INTERCONNECTION TRADING SYSTEM Cambios Prices MC MK Del día Session Cód.ISIN ISIN Code Bol. Exch. ES0141960635 F ALZA REAL ESTATE AXIA REAL ESTATE AYCO GRUPO INMOBILIARIO ESP. VIVIENDAS ALQUILER (CEVASA) MC FERGO AISA ES0138436011 ES0105026001 ES0152960011 ES0132955016 4 F E D 121.514.413 3,5700 36.006.000 9,5460 4.446.795 3,8100 1.162.690 131,8500 ES0106585013 F 774.280.952 OF ES0138152113 1 1.521.709 ES0105019006 F 55.060.000 ES0139140042 ES0154653911 ES0105015012 ES0137998A12 ES0161376019 F F F 1 F 3.165.939.978 16.971.847 40.030.000 21.914.438 93.191.822 MC MERLIN PROPERTIES MC NYESA VALORES CORPORACION MC QUABIT INMOBILIARIA MC REALIA BUSINESS MC RENTA CORPORACION MC REYAL URBIS ES0105025003 ES0150480111 F F 129.212.001 162.329.555 ES0110944016 ES0173908015 ES0173365018 ES0122761010 B F F F 1.444.128.352 307.370.932 27.276.575 292.206.704 OF OF ES0138109014 ES0170885018 F F 44.912.588 115.475.788 ES0182280018 F 2.074.394.442 ES0115056139 F 83.615.558 ES0173358039 F 40.693.203 ES0105322004 F ES0105321030 F OF Valor Security Nº Valores Admitidos N. of Stocks Admitted COMPAÑIA GENERAL DE INVERSIONES 8.811.384 Precedente Previous Fecha Date 1,7300 31-10-14 Cierre Closing 1,4700 Ampliaciones Capital Increase Dividendos Brutos Gross Dividends Durante el año During the year Importe Amount Tipo Type Fecha Date Importe Amount Última Ampliación Last Capital Increase CMP VWAP Máx. Max. Fecha Date Mín. Min. Fecha Date Fecha Date Tipo Type Fecha Date 1,5656 1,7800 19-06 1,4700 04-11 04-07-14 0,0400 A 2013 03-07-13 0,0300 A 2012 02-02-06 9,5035 10,1900 09-07 8,9500 12-08 23-01 108,0000 03-06 10-10-07 02-07-14 0,3300 U 2006 1,3000 U 2013 12-07-06 15-05-13 0,3000 U 2005 1,3000 U 2012 21-12-01 17-11-05 14-09-07 0,0800 U 2006 Condiciones Conditions Última Admitida Last Admitted INMOBILIARIAS Y OTROS OF MC OF OF MC MC OF MC OF MC FINANZAS E INV.VALENCIANAS HISPANIA ACTIVOS INMOBILIARIOS INMOBILIARIA COLONIAL INMOBILIARIA DEL SUR LAR ESPAÑA REAL ESTATE LIBERTAS 7 MARTINSA-FADESA SOTOGRANDE TESTA INMUEBLES EN RENTA MC URBAS GRUPO FINANCIERO 12-04-13 3,5700 03-11-14 9,4800 31-12-13 3,8100 17-10-14 131,8500 0,0170 20-04-12 0,0170 148,5000 SUSP. 20-04-12 100,00PR L. PAR L. 12-05 13-01-12 01-12 03-04-14 04-14 39,9500 26-07-12 39,9500 9,8300 03-11-14 9,8700 9,8629 11,3900 09-06 9,4480 04-08 0,5520 7,1500 9,2000 2,3500 7,3000 03-11-14 03-11-14 03-11-14 14-07-14 14-07-08 0,5450 7,1500 9,2000 2,3500 7,3000 0,5453 2,6500 15,0000 11,1750 2,3500 10-04 08-01 18-03 27-06 0,4810 5,6000 8,3510 1,0000 16-10 23-06 08-08 03-01 9,5000 03-11-14 0,1700 29-09-11 9,4000 0,1700 10,6500 03-07 9,1000 08-08 0,0800 1,1000 1,2450 0,1240 0,0780 1,0700 1,0900 0,1240 03-11-14 03-11-14 03-11-14 18-02-13 9,1967 SUSP. 14-07-08 9,5214 SUSP. 29-09-11 0,0793 1,0877 1,1376 SUSP. 19-02-13 4,5500 03-11-14 4,5500 15,2300 31-10-14 15,2300 0,0210 03-11-14 31-03-05 01-07-14 0,0275 U 2004 0,0700 U 2013 20-02-04 16-07-12 0,0275 U 2003 0,0700 C 2011 23-05-14 01-10-08 10-06-11 0,0500 U 2010 12-07-10 0,0500 U 2009 16-07-07 0,1200 U 2006 17-07-06 0,1200 U 2005 30-05-11 05-11 09-14 05-14 01-10 PAR L. 05-14 12-08 0,1550 1,6400 1,8000 28-02 26-06 30-10 0,0680 0,7350 1,0400 16-10 06-01 30-10 27-10-06 19-06-08 07-05-08 0,2400 A 2006 0,0140 C 2007 0,4271 U 2007 19-06-08 12-04-07 0,0600 A 2008 0,5693 U 2006 08-09-14 28-05-14 05-12-09 2,20PR 4,7500 18,4500 17-10 02-06 2,4500 7,2300 03-01 16-01 01-07-08 10-06-14 0,1300 U 2007 0,1800 C 2013 06-07-07 07-11-13 0,1300 U 2006 0,1800 A 2013 26-10-09 02-02-01 100,00PR 03-09-14 09-14 26-10-11 10-11 0,0210 0,0204 0,0400 10-06 0,0190 08-08 03-07-90 0,0601 C 1989 12-02-90 0,2404 A 1989 30,1400 03-11-14 29,7750 30,0265 36,1900 06-06 27,2450 16-10 12-09-14 0,4000 A 2014 09-05-14 0,6500 C 2013 5,1642 6,1000 26-02 5,0100 02-01 31-10-14 0,0630 A 2014 06-05-14 0,0210 C 2013 31-03-14 1,4147 A 2013 07-03-14 0,8586 A 2013 11-08-14 0,6909 A 2014 17-02-14 0,2303 A 2014 10-09 SERVICIOS DE INVERSION MC BOLSAS Y MERCADOS ESPAÑOLES MC RENTA 4 BANCO 5,2000 03-11-14 5,1200 FONDOS COTIZADOS FC FC ACCION BRASIL ETF ( EN LIQUIDACION) ACCION DJ EUROSTOXX 50, ETF martes, 04 de noviembre de 2014 Tuesday, 04 November 2014 4.768 132,1000 31-01-12 132,1000 4.740.000 SUSP. 01-02-12 30,9150 03-11-14 30,4250 30,8701 33,8300 20-06 28,0000 16-10 6 BOLETÍN DE COTIZACIÓN DAILY BULLETIN BOLSA DE MADRID MADRID STOCK EXCHANGE Renta Variable Equities CARACTERÍSTICAS DE LOS VALORES QUE NEGOCIAN EN EL SISTEMA DE INTERCONEXIÓN BURSÁTIL MAIN FEATURES OF THE SECURITIES TRADED IN THE INTERCONNECTION TRADING SYSTEM Cambios Prices Nº Valores Admitidos N. of Stocks Admitted MC MK Valor Security Cód.ISIN ISIN Code Bol. Exch. FC FC ACCION IBEX 35 ETF ACCION LATAM TOP ETF (LIQUIDACION) DB X-TRACKERS EURO STOXX 50® LEVERAGED DB X-TRACKERS DAX UCITS ETF (DR) DB X-TRACKERS EURO STOXX 50 SHORT DB X-TRACKERS EURO STOXX 50 UCITS 1C DR DB X-TRACKERS EURO STOXX 50 UCITS 1D DR DB X-TRACKERS EURO STOXX SEL DIVID30 DB X-TRACKERS FTSE CHINA 50 UCITS ETF DB X-TRACKERS IBEX 35® UCITS ETF (DR) 1C DB X-TRACKERS IBEX 35® UCITS ETF (DR) 1D DB X-TRACKERS LEVDAX® DAILY UCITS ETF DB X-TRACKERS LPX PRIVATE EQUITY UCITS DB X-TRACKERS MSCI BRAZIL UCITS ETF DR DB X-TRACKERS MSCI EM ASIA UCITS ETF DB X-TRACKERS MSCI EM LATAM UCITS ETF DB X-TRACKERS MSCI EMERGING MKTS UCITS DB X-TRACKERS MSCI JAPAN UCITS ETF DB X-TRACKERS MSCI MEXICO UCITS ETF (DR) DB X-TRACKERS MSCI RUSSIA UCITS ETF DB X-TRACKERS MSCI WORLD UCITS ETF ES0105336038 ES0105304002 F F 32.600.000 41.212 LU0411077828 F 840.000 LU0274211480 F LU0292106753 FC FC FC FC FC FC FC FC FC FC FC FC FC FC FC FC FC FC FC martes, 04 de noviembre de 2014 Del día Session Fecha Date Cierre Closing CMP VWAP Dividendos Brutos Gross Dividends Durante el año During the year Fecha Date Mín. Min. Fecha Date Fecha Date 10,3844 SUSP. 22-12-11 19,1300 03-11-14 18,5100 18,6023 11,3850 19-06 9,3850 16-10 11-08-14 07-04-14 0,2287 A 2014 0,2477 A 2013 17-02-14 31-03-14 0,1930 A 2014 0,0049 A 2013 21,9200 19-09 17,1600 04-02 28.853.192 91,1400 03-11-14 90,3300 98,5800 20-06 82,7700 16-10 F 12.372.804 21,1100 23-10-14 21,4500 23,0800 06-02 19,9900 09-06 LU0380865021 F 33.854.824 38,7100 03-11-14 38,0800 41,1900 11-06 35,4500 16-10 LU0274211217 F 49.443.669 31,3300 22-10-14 30,8100 34,6000 11-06 30,0000 17-10 24-07-14 1,0500 A 2014 25-07-13 0,9000 A 2013 LU0292095535 F 7.302.183 17,3500 16-10-14 17,2300 17,2237 19,7000 19-06 15,8700 16-10 24-07-14 0,7900 A 2014 25-07-13 0,6900 A 2013 LU0292109856 F 7.149.247 25,1600 10-10-14 25,0900 25,1600 26,2600 09-09 19,0000 21-03 LU0592216393 F 28.784.130 21,4900 03-11-14 21,0300 21,3889 23,0000 20-06 19,3400 16-10 LU0994505336 F 624.568 21,6000 03-11-14 21,1400 22,4900 30-09 20,1600 16-10 LU0411075376 F 715.000 75,9100 31-10-14 74,5100 89,4300 06-06 65,7300 16-10 LU0322250712 F 3.584.978 35,5000 30-09-14 35,2200 36,4200 22-07 34,5100 27-01 LU0292109344 F 4.183.003 35,0600 30-10-14 34,7100 43,8400 03-09 29,4400 20-02 LU0292107991 F 18.520.583 32,5200 31-10-14 32,2000 32,7000 17-09 28,6600 07-04 LU0292108619 F 4.608.829 38,4300 31-10-14 38,0100 41,5200 06-10 32,4900 30-01 LU0292107645 F 70.979.771 31,8100 15-10-14 31,5700 33,7600 08-09 26,0900 14-03 LU0274209740 F 13.790.884 38,1700 10-10-14 37,0200 36,4100 23-09 30,9900 15-04 LU0476289466 F 30.475.000 5,0000 18-09 3,8000 14-03 LU0322252502 F 8.094.195 18,6700 24-10-14 18,1900 21,5500 13-01 16,4700 17-03 LU0274208692 F 55.508.979 35,7100 03-11-14 35,2400 35,8000 03-11 30,1900 07-02 10,4300 03-11-14 10,2500 42,1300 21-12-11 42,1300 4,8900 30-10-14 4,8500 4,8500 35,5206 Importe Amount Tipo Type Fecha Date Importe Amount Última Ampliación Last Capital Increase Máx. Max. Tuesday, 04 November 2014 Precedente Previous Ampliaciones Capital Increase Tipo Type Fecha Date Condiciones Conditions 7 Última Admitida Last Admitted BOLETÍN DE COTIZACIÓN DAILY BULLETIN BOLSA DE MADRID MADRID STOCK EXCHANGE Renta Variable Equities CARACTERÍSTICAS DE LOS VALORES QUE NEGOCIAN EN EL SISTEMA DE INTERCONEXIÓN BURSÁTIL MAIN FEATURES OF THE SECURITIES TRADED IN THE INTERCONNECTION TRADING SYSTEM Cambios Prices Nº Valores Admitidos N. of Stocks Admitted MC MK Valor Security Cód.ISIN ISIN Code Bol. Exch. FC DB X-TRACKERS S&P 500 2X INVERSE DAILY DB X-TRACKERS S&P 500 2X LEVERAG DAILY DB X-TRACKERS S&P 500 INVERSE DAILY DB X-TRACKERS S&P 500 UCITS ETF DB X-TRACKERS SHORTDAX DAILY UCITS DB X-TRACKERS SHORTDAX® X2 DAILY UCITS DB X-TRACKERS STOXX EU.600 UCITS ETF(DR) DB X-TRACKERS STOXX EUROPE 600 BANK DB X-TRACKERS STOXX EUROPE 600 BANK SH LYXOR UCITS ETF BONO 10Y -MTS SPAIN G.B. LYXOR UCITS ETF BRASIL (IBOVESPA) LYXOR UCITS ETF CHINA ENTERPRISE (HSCEI) LYXOR UCITS ETF COMMODITIES T.R. CRB E. LYXOR UCITS ETF COMMODITIES THOM.R. CRB LYXOR UCITS ETF DOW JONES IND. AVERAGE LYXOR UCITS ETF EASTERN EUROPE(CECE EUR) LYXOR UCITS ETF EURO CASH LYXOR UCITS ETF EURO CORPORATE BOND LYXOR UCITS ETF EURO STOXX 50 - D-EUR LYXOR UCITS ETF EURO LU0411078636 F 18.925.000 LU0411078552 F LU0322251520 FC FC FC FC FC FC FC FC FC FC FC FC FC FC FC FC FC FC FC martes, 04 de noviembre de 2014 Del día Session Precedente Previous Fecha Date Máx. Max. Fecha Date Mín. Min. Fecha Date 3,9600 3,9352 5,2200 05-02 3,8300 24-07 1.760.000 29,6300 17-10-14 29,0800 29,0427 29,2000 04-11 21,0100 03-02 F 12.120.673 18,3700 31-10-14 18,4400 20,2400 05-02 17,4600 07-07 LU0490618542 F 45.477.500 27,0200 03-11-14 26,7000 27,0900 03-11 21,2800 04-02 LU0292106241 F 10.277.033 34,1500 31-10-14 34,4600 36,6700 14-10 31,9800 10-06 LU0411075020 F 8.230.000 10,8600 03-11-14 11,0600 13,2500 16-10 9,5900 04-07 LU0328475792 F 14.228.634 62,6700 31-10-14 62,0900 65,3500 03-07 57,4700 16-10 LU0292103651 F 3.938.128 40,3000 27-10-14 39,6400 42,5500 06-06 39,6500 14-07 LU0322249037 F 1.350.013 21,3100 11-08-14 21,6300 22,6000 10-07 20,8300 04-04 FR0011384148 F 13-10 113,9300 03-01 FR0010408799 F 19,4200 01-09 12,7000 05-03 FR0010204081 F 5.248.839 116,1500 03-11-14 116,7000 117,5000 121,1000 09-09 85,0000 14-03 FR0010346205 F 9.475.000 18,8300 10-10-14 18,5500 18,9000 22-04 16,8700 13-01 FR0010270033 F 30.655.000 20,2650 28-10-14 19,8050 21,4000 16-06 18,9500 15-01 FR0007056841 F 03-11 114,6500 FR0010204073 F 22-09 FR0010510800 26,8400 40,0000 165.000 135,1600 03-11-14 134,8200 134,3500 137,0100 19.908.109 15,7000 31-10-14 15,5200 3.271.967 140,9000 03-11-14 139,9000 139,8500 141,2000 Fecha Date Importe Amount Tipo Type Fecha Date Importe Amount Última Ampliación Last Capital Increase Tipo Type 07-12-11 0,3700 A 2011 06-07-11 2,9400 A 2011 05-02 09-07-14 0,9700 A 2014 11-12-13 0,8100 A 2013 17,4500 27-01 07-12-11 0,4400 A 2011 06-07-11 0,4000 A 2011 18,8300 31-10-14 18,7800 19,5500 F 5.710.000 106,9900 28-10-14 106,9900 107,0000 28-10 106,9700 07-07 FR0010737544 F 6.170.000 140,2600 27-10-14 140,4000 140,2000 141,0000 06-10 132,4400 02-01 FR0007054358 F 181.306.694 30,7650 03-11-14 30,2800 30,5962 33,9050 20-06 28,0250 16-10 09-07-14 0,9600 A 2014 11-12-13 0,1800 A 2013 FR0010468983 F 9.597.504 19,4300 03-11-14 18,8100 18,8940 22,7000 19-06 16,2000 16-10 11-10-10 1,0200 A 2010 12-10-09 1,0300 A 2009 Tuesday, 04 November 2014 14.839.377 Dividendos Brutos Gross Dividends Durante el año During the year CMP VWAP 3,9300 03-11-14 Cierre Closing Ampliaciones Capital Increase Fecha Date 8 Condiciones Conditions Última Admitida Last Admitted BOLETÍN DE COTIZACIÓN DAILY BULLETIN BOLSA DE MADRID MADRID STOCK EXCHANGE Renta Variable Equities CARACTERÍSTICAS DE LOS VALORES QUE NEGOCIAN EN EL SISTEMA DE INTERCONEXIÓN BURSÁTIL MAIN FEATURES OF THE SECURITIES TRADED IN THE INTERCONNECTION TRADING SYSTEM Cambios Prices MC MK FC FC FC FC FC FC FC FC FC FC FC FC FC FC FC FC FC FC FC FC Valor Security STOXX 50 DAILY LEV. LYXOR UCITS ETF EURO STOXX 50 DAILYSHORT LYXOR UCITS ETF EUROMTS HIGHEST RATED M LYXOR UCITS ETF FTSE EPRA/NAREIT ASIAEXJ LYXOR UCITS ETF FTSE EPRA/NAREIT U.STA. LYXOR UCITS ETF IBEX 35 (DR) LYXOR UCITS ETF IBEX 35 DOBLE APALANCADO LYXOR UCITS ETF IBEX 35 DOBLE INV.DIARIO LYXOR UCITS ETF IBEX 35 INVERSO DIARIO LYXOR UCITS ETF IBEX MID D- EUR LYXOR UCITS ETF JAPAN (TOPIX) LYXOR UCITS ETF MSCI EM LATIN AMERICA LYXOR UCITS ETF MSCI EMERGING MARKETS LYXOR UCITS ETF MSCI EMU GROWTH LYXOR UCITS ETF MSCI EMU SMALL CAP LYXOR UCITS ETF MSCI EMU VALUE LYXOR UCITS ETF MSCI EUROPE LYXOR UCITS ETF MSCI INDIA LYXOR UCITS ETF MSCI WORLD LYXOR UCITS ETF NASDAQ-100 LYXOR UCITS ETF NEW martes, 04 de noviembre de 2014 Nº Valores Admitidos N. of Stocks Admitted Cód.ISIN ISIN Code Bol. Exch. FR0010424135 F 1.478.783 FR0010820258 F FR0010833541 F 623.000 FR0010833566 F 590.700 FR0010251744 Del día Session Precedente Previous Fecha Date CMP VWAP Dividendos Brutos Gross Dividends Durante el año During the year Máx. Max. Fecha Date Mín. Min. Fecha Date 27,3300 20-10-14 27,7600 29,5900 14-03 25,8700 19-09 1.053.990 133,5400 31-10-14 133,9200 133,7600 31-10 122,7400 02-01 9,6000 31-10-14 Cierre Closing Ampliaciones Capital Increase Fecha Date Importe Amount Tipo Type Fecha Date Importe Amount Última Ampliación Last Capital Increase Tipo Type 9,5100 9,7800 08-09 7,5400 14-03 09-07-14 0,1500 A 2014 11-12-13 0,1100 A 2013 41,5600 28-10-14 41,1800 39,8400 24-10 31,6600 07-01 09-07-14 0,6000 A 2014 11-12-13 0,2900 A 2013 F 8.656.582 103,4400 03-11-14 101,2600 102,8553 113,1800 19-06 93,1000 16-10 09-07-14 2,5300 A 2014 11-12-13 1,4000 A 2013 FR0011042753 F 3.686.980 FR0011036268 F 2.155.500 FR0010762492 F FR0011855188 19,8421 23,6400 19-06 16,6000 16-10 7,7200 7,5226 9,9100 03-01 6,5800 19-09 549.000 32,5300 03-11-14 33,2000 33,0080 37,0500 03-01 30,6000 19-09 F 140.000 93,3800 30-10-14 91,4300 106,3700 27-06 90,5000 13-10 FR0010245514 F 5.592.818 97,0500 31-10-14 94,4000 96,9500 31-10 78,7500 11-04 09-07-14 1,0000 A 2014 11-12-13 0,7500 A 2013 FR0010410266 F 3.016.303 25,8100 30-10-14 25,5700 30,0000 05-09 21,4900 06-02 07-12-11 0,3600 A 2011 06-07-11 0,7300 A 2011 FR0010429068 F 166.607.825 8,5800 29-08 6,8500 04-02 07-12-11 0,2200 A 2011 13-09-10 0,0500 A 2010 FR0010168765 F 135.978 94,1000 31-10-14 92,9500 101,1500 05-06 89,1500 11-08 09-07-14 1,9100 A 2014 10-07-13 1,7000 A 2013 FR0010168773 F 1.050.610 192,7500 31-10-14 190,8500 221,5500 11-06 176,0000 15-10 09-07-14 3,9700 A 2014 10-07-13 3,6400 A 2013 FR0010168781 F 2.719.070 110,0000 30-10-14 108,5000 123,0500 23-06 103,7000 16-10 09-07-14 3,2200 A 2014 11-12-13 0,6100 A 2013 FR0010261198 F 8.432.172 114,3500 28-10-14 113,2300 120,4900 07-07 105,1800 16-10 09-07-14 2,5200 A 2014 11-12-13 0,7600 A 2013 FR0010361683 F 04-11 9,2500 30-01 FR0010315770 F 04-11 118,8300 03-02 09-07-14 1,5300 A 2014 11-12-13 0,7600 A 2013 FR0007063177 F 25.088.790 13,3000 03-11-14 13,1500 13,2500 31-10 9,9000 14-04 09-07-14 0,1000 A 2014 10-07-13 0,0500 A 2013 FR0010524777 F 2.732.110 15,6600 03-10-14 15,4100 17,6800 07-07 15,0300 05-02 09-07-14 0,2500 A 2014 10-07-13 0,2600 A 2013 Tuesday, 04 November 2014 79.185.383 20,2900 03-11-14 19,4400 7,4200 03-11-14 8,3200 03-11-14 8,2500 13,7100 31-10-14 13,7300 8,2300 13,7289 13,8400 8.324.485 136,9800 31-10-14 135,2400 136,9400 136,9400 13,1500 Fecha Date 9 Condiciones Conditions Última Admitida Last Admitted BOLETÍN DE COTIZACIÓN DAILY BULLETIN BOLSA DE MADRID MADRID STOCK EXCHANGE Renta Variable Equities CARACTERÍSTICAS DE LOS VALORES QUE NEGOCIAN EN EL SISTEMA DE INTERCONEXIÓN BURSÁTIL MAIN FEATURES OF THE SECURITIES TRADED IN THE INTERCONNECTION TRADING SYSTEM Cambios Prices MC MK FC FC FC FC FC FC FC FC FC Valor Security ENERGY LYXOR UCITS ETF RUSSIA LYXOR UCITS ETF S&P 500 LYXOR UCITS ETF STOXX E.600 HEALTH CARE LYXOR UCITS ETF STOXX E.600 OIL&GAS LYXOR UCITS ETF STOXX E.600 TELECOMMUNI. LYXOR UCITS ETF STOXX E.600 UTILITIES LYXOR UCITS ETF STOXX E.SELECT DIVID. 30 LYXOR UCITS ETF STOXX EUROPE 600 BANKS LYXOR UCITS ETF WORLD WATER Nº Valores Admitidos N. of Stocks Admitted Cód.ISIN ISIN Code Bol. Exch. FR0010326140 LU0496786574 FR0010344879 F F F 12.600.017 31.354.000 2.231.989 FR0010344960 F FR0010344812 Del día Session Precedente Previous Fecha Date Cierre Closing CMP VWAP Ampliaciones Capital Increase Dividendos Brutos Gross Dividends Durante el año During the year Máx. Max. Fecha Date Mín. Min. Fecha Date Fecha Date 25,6800 31-10-14 25,0900 16,5000 03-11-14 16,3100 73,7500 31-10-14 73,0600 29,6000 16,4900 77,2500 25-06 31-10 01-10 22,2100 13,0700 62,4000 14-03 05-02 02-01 07-12-11 09-07-14 06-07-11 0,5000 A 2011 0,1100 A 2014 1,2000 A 2011 13-09-10 11-12-13 13-09-10 0,2900 A 2010 0,0800 A 2013 1,0000 A 2010 7.558.861 35,6150 15-10-14 34,2850 42,7450 24-06 34,4700 15-10 06-07-11 0,8900 A 2011 13-09-10 1,0000 A 2010 F 1.497.940 35,1300 31-10-14 34,7350 35,0250 02-07 31,9800 16-10 06-07-11 1,4300 A 2011 13-09-10 1,3800 A 2010 FR0010344853 F 2.014.220 36,7850 29-10-14 36,5850 38,0000 08-09 31,0000 02-01 06-07-11 1,5300 A 2011 13-09-10 1,5000 A 2010 FR0010378604 F 7.013.511 15,2800 27-10-14 15,1000 16,8400 04-07 14,0000 16-10 09-07-14 0,7000 A 2014 11-12-13 0,1800 A 2013 FR0010345371 F 39.712.019 21,1600 03-11-14 20,8300 22,9400 09-06 19,1400 16-10 06-07-11 0,4900 A 2011 13-09-10 0,4300 A 2010 FR0010527275 F 5.565.747 26,5200 03-11-14 26,3000 26,6200 26,6500 03-11 22,4900 31-01 09-07-14 0,3200 A 2014 12-12-12 0,1000 A 2012 0,6950 03-11-14 0,7000 12,7800 03-11-14 12,7600 11,9600 03-11-14 11,8350 0,7031 12,7650 11,9109 1,6780 12,8600 12,9350 08-01 01-10 23-06 0,6130 7,7730 10,7600 16-10 02-01 16-10 01-04-92 0,3005 U 1991 01-04-91 0,3606 C 1990 07-05-14 0,4000 C 2013 06-11-13 0,3500 A 2013 02-06-14 30-10-14 18-05-12 29,4950 0,6000 8,7400 1,3350 29,1443 0,5939 8,0179 1,3263 32,4350 1,3300 15,0550 1,9050 02-06 31-01 03-04 02-04 25,2100 0,4600 7,5600 1,2100 16-10 11-08 04-11 02-01 29-07-14 01-07-09 08-07-14 03-07-01 0,3250 0,1543 0,3400 0,1500 31-01-14 20-06-08 09-07-13 04-04-00 0,3000 0,1331 0,3400 0,1500 24-08-11 10-10-13 29-01-07 02-07-09 15,2000 Importe Amount Tipo Type Fecha Date Importe Amount Última Ampliación Last Capital Increase Tipo Type Fecha Date Condiciones Conditions Última Admitida Last Admitted TECNOLOGIA Y TELECOMUNICACION. TELECOMUNICACIONES Y OTROS MC GRUPO EZENTIS MC JAZZTEL MC TELEFONICA ES0172708234 GB00B5TMSP21 ES0178430E18 F F F 230.843.603 256.571.082 4.551.024.586 ES0109067019 ES0109260531 ES0118594417 ES0147582B12 F F F F 447.581.950 44.134.956 164.132.539 75.025.241 0,70PR PAR L. 07-14 10-14 06-12 ELECTRONICA Y SOFTWARE MC MC MC MC AMADEUS IT HOLDING AMPER INDRA, SERIE A TECNOCOM,TELECOM. Y ENERGIA 03-11-14 28,9250 03-11-14 0,5900 03-11-14 7,7990 03-11-14 1,3200 C 2013 U 2008 U 2013 U 2000 A 2013 U 2007 U 2012 U 1999 DOGI INTERNATIONAL FABRICS - 24/4/14: Agrupación 1x10 - precio cierre: 26/5/09-0,64 DOGI INTERNATIONAL FABRICS - 24/4/14: Reverse Split 1x10 - closing price: 26/5/09-0,64 IND.DE DISEÑO TEXTIL (INDITEX) - 28/7/14: Desdoblamiento 5x1 - precio cierre: 25/7/14-111,45 IND.DE DISEÑO TEXTIL (INDITEX) - 28/7/14: Split 5x1 - closing price: 25/7/14-111,45 martes, 04 de noviembre de 2014 Tuesday, 04 November 2014 10 1,70PR PAR L. 08-11 11-13 01-07 08-09

© Copyright 2026