Instrumentos de Renta Fija

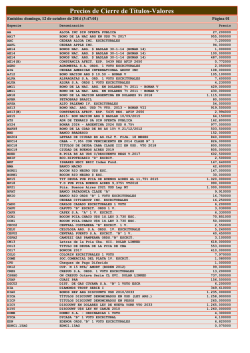

Instrumentos de Renta Fija 13 February 2015 1- 13 February 2015 Bonos en Dolares con Legislacion Argentina DV01 Spread sobre Treasuries 7.39 Vencimiento Proximo Cupon Paridad Precio Precio Venta Precio Sucio TNA TNA Venta Mod. Duration (1MM) 2015-10-05 2015-04-06 99.65% 102.30 102.60 102.30 7.56 7.06 0.58 60 Bonar X 2017 (AA17) 2017-04-17 2015-04-17 97.91% 100.25 100.50 100.25 8.10 7.97 1.91 192 7.31 Bonar 2024 (AY24) 2024-05-07 2015-05-07 100.97% 103.50 103.75 103.50 8.54 8.49 4.83 500 6.76 Disc USD Leg. Arg (DICA) 2034-01-02 2015-06-30 89.25% 89.12 89.50 126.57 9.72 9.67 7.63 966 7.48 Par USD Leg. Arg (PARA) 2038-12-31 2015-03-30 50.48% 50.00 51.00 50.97 9.01 8.84 11.55 589 6.52 Activos Boden 2015 (RO15) 1 Bonos en Dolares con Legislacion New York Activos Global 2017 (GJ17) DV01 Vencimiento Proximo Cupon Paridad Precio Precio Venta Precio Sucio TNA TNA Venta Mod. Duration (1MM) 2017-06-02 2015-06-02 94.70% 96.50 97.50 96.50 11.50 10.97 1.96 189 Spread sobre Treasuries 10.65 Disc USD NY 2005 (DICY) 2034-01-02 2015-06-30 92.56% 93.62 94.50 131.27 9.82 9.69 7.29 957 Disc USD NY 2010 (DIY0) 2034-01-02 2015-06-30 90.09% 91.12 92.00 127.76 10.19 10.06 7.19 918 7.95 Par USD Leg. NY (PARY) 2038-12-31 2015-03-30 51.99% 52.50 53.00 52.50 8.96 8.88 11.31 594 6.47 1 7.58 Rendimiento 11 12 Spread sobre Treasuries Global 2017 (GJ17) 10 11 Global 2017 (GJ17) 10 Disc USD NY 2010 (DIY0) Disc USD NY 2010 (DIY0) 8 9 Par USD Leg. (PARA) Par USD Leg. NYArg (PARY) Spread TNA 9 Disc USD NY 2005 (DICY) Disc USD Leg. Arg (DICA) Bonar 2024 (AY24) Disc USD NY 2005 (DICY) Disc USD Leg. Arg (DICA) Boden 2015 (RO15) Bonar X 2017 (AA17) 7 8 Bonar X 2017 (AA17) Bonar 2024 (AY24) Boden 2015 (RO15) Bonos USD Leg Arg. Bonos USD Leg. NY 0 6 7 Par USD Leg. (PARA) Par USD Leg. NYArg (PARY) 2 4 6 8 Duration 1 Spread sobre la curva de bonos del tesoro americano. 10 12 Bonos USD Leg Arg. Bonos USD Leg. NY 0 2 4 6 8 10 12 Duration Banco Comafi - Research Department 2- 13 February 2015 Bonos con CER PRO 12 (PR12) 2016-01-04 Proximo Pago 2015-03-03 BOGAR (NF18) 2018-02-05 2015-03-04 Activos Vencimiento Valor Tecnico 40.45 Valor Residual 8.4 % Paridad 97.15% 39.30 Precio Venta 39.40 159.30 35.4 % 92.35% 147.12 147.25 Precio DV01 Mod. Duration 0.39 (1MM) 9.32 TNA Venta 8.67 7.61 7.55 1.38 203 TNA 15 PRO 13 (PR13) 2024-03-15 2015-03-16 335.34 90.9 % 77.05% 258.38 259.00 8.52 8.46 3.73 965 Disc Pesos+CER (DICP) 2034-01-02 2015-06-30 389.57 100.0 % 77.91% 303.50 304.00 8.62 8.60 8.52 2586 Par Pesos+CER (PARP) 2038-12-31 2015-03-30 305.70 100.0 % 41.05% 125.50 126.00 7.59 7.57 14.05 1763 10 11 Rendimiento 9 PRO 12 (PR12) Disc Pesos+CER (DICP) 8 TNA PRO 13 (PR13) BOGAR (NF18) 6 7 Par Pesos+CER (PARP) 0 5 10 15 Duration Ars Bonds DV01 BOCAN 2015 (AS15) 2015-09-10 Proximo Pago 2015-03-10 100.19% 42.98 Precio Venta 43.05 25.69 TNA Venta 24.99 3.69 Mod. Duration 0.26 Pro14 (PR14) 2016-01-04 2015-04-06 102.56 100.0 % 97.55% 100.05 100.25 26.76 26.27 4.64 0.44 44 BOCAN 2016 (AS16) 2016-09-29 2015-03-30 103.25 100.0 % 95.88% 99.00 99.30 26.75 26.50 4.63 1.26 125 Activos Vencimiento Valor Tecnico 42.89 Valor Residual 33.4 % Paridad Precio TNA Spread (1MM) 11 BOCAN 2017 (AM17) 2017-03-28 2015-03-30 103.31 100.0 % 92.58% 95.65 95.75 28.46 28.39 6.16 1.55 148 BOCAN 2019 (AMX9) 2019-03-11 2015-03-11 104.43 100.0 % 91.69% 95.75 96.00 27.62 27.50 5.41 2.39 229 Pro15 (PR15) 2022-04-04 2015-04-06 180.06 100.0 % 82.36% 148.30 148.50 26.70 26.65 4.59 2.95 437 * TNA: Tasa nominal anual compuesta semestral. Banco Comafi - Research Department 3- 13 February 2015 Bonos Dollar Linked Bonds BONO NACION 2016 (BONAD16) Maturity 2016-10-28 Next Payment 2015-04-28 Current Coupon Int: 1.75% Residual Value 100.0 % Price 906.00 Offer Price 908.00 YTM DV01 Mod. Duration 1.67 (1MM) -0.51 Offer YTM -0.64 174 Spread over Treasuries NA BONO NACION 2018 (BONAD18) 2018-03-19 2015-03-18 Int: 2.40% 100.0 % 911.50 915.00 0.95 0.82 2.95 310 NA City of Buenos Aires 2016 (BDC16) 2016-05-09 2015-05-11 Int: 7.95% 100.0 % 910.00 915.00 1.83 1.36 1.17 123 NA City of Buenos Aires 2016 (BD4C6) 2016-11-29 2015-05-27 Int: 0.4% 100.0 % 849.00 850.00 1.71 1.64 1.75 172 NA City of Buenos Aires 2018 (BDC18) 2018-03-15 2015-03-16 Int: 3.98% 100.0 % 918.00 922.00 2.18 1.98 2.18 230 NA City of Buenos Aires 2019 (BDC19) 2019-05-17 2015-05-18 Int: 3.98% 100.0 % 895.00 900.00 3.24 3.04 2.77 286 NA City of Buenos Aires 2019 (BD2C9) 2019-12-20 2015-06-22 Int: 1.95% 100.0 % 815.00 825.00 3.90 3.54 3.38 317 NA City of Buenos Aires 2020 (BDC20) 2020-01-28 2015-07-28 Int: 1.95% 100.0 % 820.00 825.00 3.60 3.43 3.49 330 NA Entre Rios 2016 (ERG16) 2016-08-08 2015-05-06 Int: 4.8% - Amort: 11% 67.0 % 590.00 595.00 3.28 2.25 0.82 56 NA Entre Rios 2016 (ERD16) 2016-12-27 2015-03-27 Int: 2.25% - Amort: 11% 89.0 % 745.00 750.00 6.45 5.73 0.93 80 NA Chubut 2019 (PUO19) 2019-10-21 2015-04-21 Int: 4% 100.0 % 885.00 890.00 3.39 3.18 2.59 264 NA NA Mendoza 2016 (PMY16) 2016-05-30 2015-03-02 Int: 3% - Amort: 11.11% 66.7 % 558.50 560.00 9.91 9.46 0.60 38 Mendoza 2018 (PMO18) 2018-10-30 2015-04-30 Int: 2.75% - Amort: 5.88% 88.2 % 722.00 726.00 6.06 5.75 1.79 149 NA Mendoza 2018 (PMD18) 2018-12-18 2015-03-18 Int: 2.75% - Amort: 5.92% 94.1 % 764.00 768.00 7.02 6.72 1.76 155 NA Neuquen 2016 (NDG1) 2016-06-13 2015-03-12 Int: 3% - Amort: 11.11% 66.7 % 590.50 591.00 0.84 0.72 0.68 46 NA Neuquen 2018 (NDG21) 2018-11-12 2015-04-28 Int: 3.9% - Amort: 6.65% 100.0 % 900.00 905.00 2.08 1.78 1.86 193 NA YPF 2015 (OYP18) 2015-04-30 2015-04-30 Int: 0.1% - Amort: 100% 100.0 % 835.00 840.00 21.74 18.26 0.18 17 NA YPF 2020 (YPCNO) 2020-07-29 2015-04-29 Int: 3.5% 85.7 % 745.00 750.00 3.54 3.30 2.73 234 NA * TNA: Tasa nominal anual compuesta semestral. Banco Comafi - Research Department 4- 13 February 2015 Bonos Provinciales en Dolares Activos City of Buenos Aires 2015 Vencimiento Proximo Cupon Paridad Precio Precio Venta Precio Sucio TNA TNA Venta Mod. Duration (1MM) 2015-04-06 2015-04-06 100.96% 101.00 101.60 105.65 4.62 -0.02 0.12 13 Spread sobre Treasuries 4.71 DV01 Bs As 2015 2015-10-05 2015-04-06 100.00% 100.00 100.60 104.41 11.76 10.74 0.56 59 11.59 Bs As Discount USD 2017-04-17 2015-04-15 98.55% 98.50 99.30 50.86 10.68 9.91 1.01 51 10.11 Mendoza 2018 2018-09-04 2015-03-04 87.47% 87.15 88.80 34.58 13.93 12.73 1.51 52 13.02 City of Buenos Aires 2017 2017-03-01 2015-03-02 102.91% 103.05 103.70 107.72 8.21 7.86 1.75 189 7.45 Cordoba 2017 2017-08-17 2015-08-18 97.30% 97.30 98.30 97.40 13.69 13.20 2.07 202 12.78 Chubut 2020 2020-07-01 2015-04-01 99.41% 99.40 100.40 61.39 8.08 7.65 2.29 141 6.91 Neuquen 2021 2021-04-26 2015-04-27 99.35% 99.35 100.70 75.91 8.20 7.69 2.64 201 6.91 Bs As 2018 2018-09-14 2015-03-16 95.29% 95.10 96.10 99.16 11.07 10.72 2.82 279 9.85 Bs As 2021 2021-01-26 2015-07-27 97.52% 97.50 98.40 98.22 11.55 11.30 3.67 360 10.04 Bs As 2028 2028-04-18 2015-04-20 93.71% 93.50 94.50 96.76 10.58 10.43 6.65 643 8.41 Bs As Par USD 2035 2035-05-15 2015-05-15 60.91% 60.50 61.70 61.56 9.57 9.33 8.09 498 7.30 1 Bonos Provinciales en Dolares 12 14 Mendoza 2018 Cordoba 2017 Bs As 2015 Bs As 2021 Bs As 2018 Bs As Discount USD 10 Bs As 2028 TNA Bs As Par USD 2035 6 8 City of BuenosChubut Aires 2017 Neuquen 2020 2021 4 City of Buenos Aires 2015 0 2 4 6 8 Duration * TNA: Tasa nominal anual compuesta semestral. Banco Comafi - Research Department 5- 13 February 2015 Bonos Corporativos - USD Aeropuertos 2000 2020 2020-12-01 2015-03-02 Int: 10.25% - Amort:3.5% Valor Residual 84.0 % 104.65 105.50 8.94 8.60 8.89 NO 2.31 207 Spread sobre Treasuries 7.72 Alto Palermo 2017 2017-05-11 2015-05-11 Int: 7.875% 100.0 % 98.50 99.50 8.63 8.13 8.63 NO 1.95 197 7.81 Arcor 2017 2017-11-09 2015-05-11 Int: 7.25% 100.0 % 104.00 104.90 5.64 5.29 2.14 NO 2.41 255 4.67 Tarjeta Naranja 2017 2017-01-30 2015-07-28 Int: 9% 66.7 % 103.15 104.00 6.64 6.03 6.64 NO 1.33 92 6.06 Bco Galicia 2018 2017-11-06 2015-05-04 Int: 8.75% 100.0 % 103.20 104.00 7.40 7.08 YES 2.33 247 6.43 Bco Galicia 2019 2019-01-02 2015-07-01 Int: 11% - Capit: 5% 78.1 % 107.90 108.80 13.47 13.21 YES 3.05 361 12.17 Bco Hipotecario 2016 2016-04-27 2015-04-27 Int: 9.75% 100.0 % 100.85 101.80 8.98 8.13 NO 1.07 111 8.56 Bco Macro 2017 2017-02-01 2015-08-03 Int: 8.5% 100.0 % 99.30 100.30 8.88 8.31 NO 1.75 175 8.16 Bco Macro 2036 2036-12-18 2015-06-18 Int: 9.75% 100.0 % 95.00 96.00 10.16 10.04 10.16 NO 8.74 845 7.79 Edenor 2022 2022-10-25 2015-04-27 Int:9.75% 100.0 % 65.00 68.50 18.43 17.30 18.43 NO 4.38 299 16.54 HDPA 2017 2017-07-03 2015-07-13 Int: 9.0% - Amort:25% 75.0 % 99.30 100.80 9.55 8.35 9.55 ? 1.23 92 8.90 IRSA 2017 2017-02-02 2015-08-03 Int: 8.5% 100.0 % 100.50 101.40 8.20 7.70 8.20 NO 1.76 178 7.48 IRSA 2020 2020-07-20 2015-07-20 Int: 11.5% 100.0 % 111.35 112.10 8.82 8.65 NO 4.04 453 7.25 PanAmerican 2021 2021-05-07 2015-05-07 Int: 7.875% 100.0 % 103.50 104.00 7.06 6.94 NO 4.14 438 5.49 Petrobras 2017 2017-05-15 2015-05-15 Int: 5.875% 100.0 % 95.15 96.00 8.30 7.86 NO 2.01 194 7.47 Raghsa 2017 2017-02-16 2015-08-18 Int: 8.5% 100.0 % 100.25 102.00 8.31 7.05 NO 1.36 137 7.71 TGS 2017 2017-05-15 2015-05-14 Int: 7.875% - Amort:25% 75.0 % 98.00 99.00 9.67 8.76 NO 1.09 82 9.03 TGS 2020 2020-05-14 2015-05-14 Int: 9.625% 100.0 % 99.90 100.80 9.65 9.39 NO 3.31 339 8.27 Transener 2016 2016-12-15 2015-06-15 Int: 8.875% 50.0 % 93.90 95.30 14.16 12.90 NO 1.15 55 13.61 YPF 18 8.875 2018-12-19 2015-06-19 Int: 8.875% 100.0 % 102.00 102.50 8.25 8.10 NO 3.16 327 6.98 YPF 24 8.75 2024-04-04 2015-04-06 Int: 8.75% 100.0 % 99.80 100.30 8.78 8.69 NO 5.58 575 6.84 Activos Vencimiento Proximo Cupon Cupon Corriente * TNA: Tasa nominal anual compuesta semestral. Precio Precio Venta TNA TNA Venta YTW -5.53 9.67 14.16 Cash Sweep Mod. Duration DV01 (1MM) Banco Comafi - Research Department

© Copyright 2026