January 2015 Quarterly Perspective Click to learn more

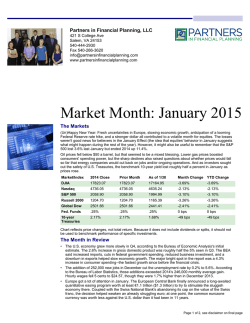

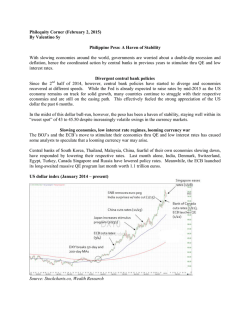

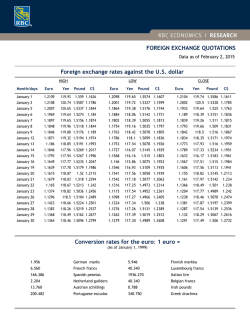

Quarterly Perspective January 2015 By: Jeffrey J. Schappe, CFA, Chief Market Strategist Economic Outlook U.S. economic growth was decent for the second and third quarters in 2014, providing meaningful offsets to the first quarter’s contraction of -2.9 percent. While we expect to see a slowdown the first half of this year, we believe the second half of 2015 GDP will be relatively strong compared to the past few years. The steep fall in oil prices combined with better employment is putting more money in consumers’ pockets, and we expect manufacturing to eventually pick up modestly this year (probably in 2H15) as demand for their products increases. Meanwhile, U.S. services growth should remain decent in 2015. Economies in Europe and China should gradually stabilize as well, again most likely towards the latter part of this year. However, they may get worse before they get better. Please note that I wrote stabilizing, and not accelerating. While Japan’s economy may leave recession this year, there is a possibility it may deteriorate again by the end of the year. The collapse in commodity prices largely reflects the deterioration in the industrial sector of the global economy, although increased supply of oil played a role. However, consumers will benefit as more money instantly appears in their wallets. In an era of very weak wage growth, this is a significant benefit and, combined with an improving job market, should ultimately be reflected in higher consumer spending and thus better GDP numbers. Recall that consumer spending in the U.S. is about 70 percent of GDP. We expect wage growth to remain tepid although there could be modest cyclical improvement throughout the year. According to the Economic Cycle Research Institute, about one-half of the higher employment numbers created last year was second jobs for people. So, although employment is improving, it is not as strong as the total numbers indicate. The plunge in commodity prices (not just oil) has been driven by China’s slowdown, which has dramatically cut its demand. As a result, commodity producing countries in the emerging markets will continue to suffer. A strong dollar will also further pressure these countries as their currencies weaken in response and capital flows out. Many of them (and their local companies) have taken advantage of low U.S. interest rates and borrowed in dollars, so their debt burdens are much heavier simply due to these currency moves. That will add to their problems. However, we don’t expect a collapse in their economies as happened in the latter half of the 1990s, because their currencies are no longer pegged to the U.S. dollar. Back then, a strong U.S. dollar created emerging market currencies that were inappropriate for their relatively weaker economies. The dollar has strengthened versus the euro, the yen, and most emerging market currencies because of relatively robust economic growth here combined with tighter monetary policy compared to the rest of the world. Commodities are priced in dollars, so a stronger greenback means cheaper oil, copper, etc., other factors remaining equal. Market Outlook Global equities have started the year on a very choppy note as weaker global growth and deflationary winds have blown across the globe. U.S. equity valuations look fairly valued to expensive, whether on a price/earnings ratio, price/sales ratio, or cyclically-adjusted price/earnings ratio (the Shiller ratio, or CAPE). A growing economy does not necessarily lead to a strong stock market or vice versa, as we’ve seen the past five years. The strong dollar and hawkish Fed rhetoric have further tightened monetary conditions in the U.S following the end of QE3. About 40 Quarterly Perspective – January 2015 percent of S&P 500 revenues originate overseas, so lower earnings estimates appear inevitable. Moreover, higher unit labor costs, largely caused by declining productivity, put record profit margins at risk. Small-cap stocks’ underperformance, declining market breadth, wider high-yield spreads and spiking volatility pose warning signs to the broader market. According to BCA Research, the period October 2011 through the present represents a tie for the third longest duration in a bull market without a minimum 10 percent correction since 1932. One can never predict short term moves in the market, but a correction does appear to be more probable, perhaps in the first part of 2015. Therefore, we are maintaining our tactical underweight to U.S. equities in our balanced asset allocation model. Our tactical overweight instead to alternative strategies mitigates equity downside risk while maintaining decent return prospects. International developed stocks, as represented by Morgan Stanley’s EAFE Index, appear much more attractively priced in absolute and relative terms. On a relative P/E basis (developed ex-U.S. vs U.S.), the relative P/E of 0.83 at the end of 2014 places it near its historical lows the last 14 years. Thus, our model ranks international developed stocks as very cheap based on their historical relationship with U.S. stocks. On a quarterly rolling three-year basis, international developed stocks have currently underperformed their American counterparts (MSCI EAFE versus MSCI US) for five years, the second longest period drawdown in almost 40 years. The longest was seven years and three months ending on June 30, 2003. Moreover, the European Central Bank (ECB) and the Bank of Japan are prepared to more aggressively ease monetary policy, including quantitative easing (QE). The much weaker euro and yen versus the dollar combined with sharply lower oil prices are also long term positives for their economies and stock markets. We are maintaining our tactical overweight to international developed stocks. A lot of retail and high net worth investors have been chasing the much stronger U.S. stock market while holding little to no international equities. This is a grave mistake, both from a diversification perspective as well as a lack of appreciation of mean reversion – nothing grows to the sun. If an asset class is historically cheap and gets cheaper, one would normally buy more. If another is expensive while getting more so, one should reduce exposure in favor of cheaper assets – Warren Buffet investing (or professional investing 101). We can’t predict when or by how much international stocks will eventually outperform their U.S. counterparts, but it will eventually occur. Those investors, who, for whatever reason, are avoiding them, will miss out or get caught in a steep U.S. stock market correction without any counter balance. Our analytical research shows that not holding international stocks in a balanced or equity only asset allocation is very suboptimal. Don’t be that guy (or woman). Global bond markets have rallied sharply the past year and especially the last six months or so as plunging commodity prices and other deflationary winds blow though the world. Yield curves have flattened as well due to the collapse in inflation expectations. The U.S. 10-year Treasury yield has melted to less than 1.8 percent from 3.0 percent at the end of December 2013 and from about 2.3 percent in early December 2014. There have been many good reasons for interest rates remaining low due to excess global savings, lack of aggregate demand and deleveraging. Bonds may remain well bid the first part of this year due to a slowdown from last year’s growth spurt combined with overseas deflationary forces and the relative attractiveness of U.S. bond yields compared to international rates. However, looking out a year we believe current levels are not justified by our forecast of improving economic fundamentals beginning around the latter half of 2015. Lower oil prices are very long term bullish for the economy and for consumers. Durable goods orders have been impacted by cuts in capital expenditures by energy producers, but that impact will be dwarfed by the benefit to consumers. People may be initially using their oil windfall to pay bills, reduce debt, or simply for saving. However, most of the benefits of lower energy prices go to middle and lower income households who have a much higher propensity to spend than do wealthier folks. International consumers will likewise benefit from lower energy costs. The weaker euro and yen combined with more aggressive ECB and BOF monetary accommodation should eventually stimulate some economic improvement in Europe and Japan. Thus, international developed bond yields could eventually modestly rise, which would tend to make U.S. bond yields rise in concert. Page 2 Quarterly Perspective – January 2015 The Fed would like to hike interest rates starting around the middle of this year to get off the zero bound so that it can lower them if necessary when the U.S. does eventually enter a recession. Low inflation, recent good economic growth and improving employment would appear to give it ample excuse to do so. However, the Fed is aware that wage growth is very weak, global economies are still fragile, and the strong U.S. dollar has de facto tightened monetary policy. If we are correct that our economy will slow before it eventually accelerates, the Fed may have to postpone the interest rate “liftoff.” We will be watching economic indicators and “Fed speak” carefully in order determine which is more likely. Meanwhile, our balanced model allocation to REITS mitigates our tactical underweight to fixed income, and our tactical overweight to alternative strategies should provide more upside potential than bonds, with decent downside protection if yields rise. We believe our balanced asset allocation model is well-positioned to outperform, over the long term, its 60 percent Russell Global Equities/40 percent Barclays Aggregate Bond Index benchmark, given our outlook for the global economy and markets. Thank you for your support for and trust in Sterling Capital Management. The opinions expressed herein are those of Jeffrey J. Schappe, CFA & Chief Market Strategist of Sterling Capital Management, and the Sterling Advisory Solutions Team, and not those of BB&T Corporation or its executives. The stated opinions are for general information only and are not meant to be predictions or an offer of individual or personalized investment advice. They are not intended as an offer or solicitation with respect to the purchase or sale of any security. This information and these opinions are subject to change without notice. Any type of investing involves risk and there are no guarantees. Sterling Capital Management LLC does not assume liability for any loss which may result from the reliance by any person upon such information or opinions. Investment advisory services are available through Sterling Capital Management LLC, a separate subsidiary of BB&T Corporation. Sterling Capital Management LLC manages customized investment portfolios, provides asset allocation analysis and offers other investment-related services to affluent individuals and businesses. Securities and other investments held in investment management or investment advisory accounts at Sterling Capital Management LLC are not deposits or other obligations of BB&T Corporation, Branch Banking and Trust Company or any affiliate, are not guaranteed by Branch Banking and Trust Company or any other bank, are not insured by the FDIC or any other federal government agency, and are subject to investment risk, including possible loss of principal invested. Page 3

© Copyright 2026