The Central Bank Maintains its Monetary Policy Rate at 6.25% per

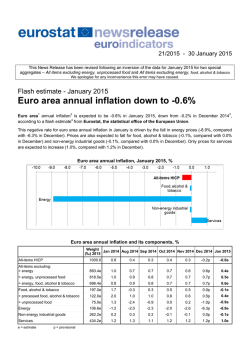

BCDR maintains the Monetary Policy Interest Rate at 6.25% per year At its monetary policy meeting in January 2015, the Central Bank decided to keep unchanged its monetary policy interest rate (TPM) at 6.25% per year, thus continuing the neutral position it has held since August 2013. The decision on the benchmark interest rate was adopted after a thorough analysis of the balance of risks around inflation projections as well as the state of the economy as of its main indicators, market expectations and relevant international environment. Last December, the annual rate of inflation closed at 1.58%, while the underlying inflation, related to the monetary conditions in the economy, was 2.97%. The inflation target as of 2015 is 4.0% + 1% according to what is provided in the Monetary Program under Inflation Targeting, released late last year. On the policy horizon, projections suggest that inflation will converge to the medium-term target, while the economy would continue to grow near its potential. In the international environment, the growth prospects of the world economy for 2015 are moderate due to the projected path for the Euro Area, Japan and other industrial economies. The Unites States of America shows a flattering picture regarding the expansion rate of its output due to the good performance of investment and private consumption. However, at its first monetary policy meeting in 2015, the Federal Reserve Bank kept its TPM in the range of 0% -0.25%, pointing that it would so at least until the third quarter. As to emerging economies, Consensus Forecast has adjusted downward growth projections for Asia and Latin America to 4.7% and 1.1% respectively. Moreover, the trend is still downward in prices of major commodities, particularly fuels and industrial metals, while international financial conditions have become more restrictive for emerging economies. As a result of the implementation of more expansionary monetary policy in the Euro Zone, Japan and other economies with problems of economic growth, the US dollar has tended to appreciate worldwide and long-term interest rates in industrial countries have been reduced. Locally, economic activity grew 7.1% in 2014 and is expected to be maintained in 2015, registering an expansion close to its potential. In January, credit to the private sector in domestic currency was located at 15.6% y/y, while total credit to the private sector, including foreign currency funding, would close this month with a growth above 18.0% over the previous year. On the fiscal side, adjustments continue and is expected that by 2015 the central government deficit would be 2.4% of GDP. This process of fiscal consolidation would help strengthen debt sustainability, which has improved with the liability management operation conducted recently by the Dominican government with the Venezuelan company PDVSA. Additionally, external accounts continue to strengthen in the current year and a current account deficit for the end of 2015 in the range of 1.9% -2.1% of GDP is projected. The continued strengthening of macroeconomic fundamentals of the Dominican economy facilitates maintaining the relative stability of the exchange rate and a greater accumulation of international reserves. The Central Bank confirms its commitment to implement a monetary policy aimed at achieving its inflation target, while continue to monitor developments in the world economy and the domestic situation in order to take steps against risks to price stability and proper functioning of financial systems and payments. Santo Domingo, January 30, 2015.

© Copyright 2026