WEEKLY INVESTMENT COMMENTARY

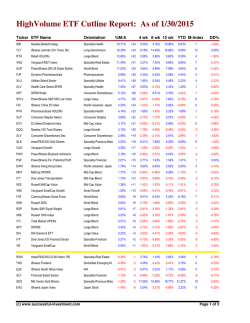

february 2, 2015 WEEKLY INVESTMENT COMMENTARY Seeking Value Amid Volatility Volatility and Violent Swings Stocks struggled last week, and once again the losses were most pronounced in the United States. The Dow Jones Industrial Average lost 2.87% to close the week at 17,164, the S&P 500 Index fell 2.73% to 1,995, and the Nasdaq Composite Index declined 2.56% to 4,635. Meanwhile, the yield on the 10-year Treasury dropped sharply from 1.79% to 1.67% as prices correspondingly rose. Financial markets remain highly volatile, with violent swings in the oil price and interest rates adding to the angst. For now, we believe a combination of international equities and credit offers the best relative value. We also believe oil prices are approaching a bottom. Uneven Earnings Put Pressure on Stocks While U.S. equities are down for the year, stocks in Japan, Europe and even emerging markets have all seen gains. Part of the problem is that the stronger dollar is beginning to hurt the earnings of large-cap U.S. companies. Apple was a notable exception, posting a stellar quarter thanks to surging iPhone sales, but the negative impact of a stronger dollar has been evident in the earnings of a number marquee companies, including Procter & Gamble, United Technologies, Microsoft and Caterpillar. Eventually, the benefits of cheaper energy may offset the impact of a stronger dollar and lower oil prices. Indeed, the fall in gasoline prices is starting to support household spending: During the fourth quarter, personal consumption rose at an annualized rate of 4.3%, the fastest pace since the first quarter of 2006. Russ Koesterich, Managing Director, is BlackRock’s Global Chief Investment Strategist, as well as Global Chief Investment Strategist for BlackRock’s iShares business. Mr. Koesterich was previously Global Head of Investment Strategy for active equities and a senior portfolio manager in the U.S. Market Neutral Group. Prior to joining the firm in 2005, he was Chief North American Strategist for State Street Bank. Financial markets remain Yields and Oil Prices: How Low Can They Go? With stocks remaining under pressure, investors continued to favor Treasury debt, causing interest rates to grind lower (as prices rose). Last week, the yield on the 10-year U.S. Treasury note broke below 1.70%, the lowest level since the spring of 2013. U.S. rates continue to be suppressed by a combination of persistently low supply of U.S. bonds and even more paltry yields in Europe and Japan. With yields down, investors are exploring other parts of the bond market that offer the prospect of higher income. After selling off sharply in December, high yield bonds have stabilized, with the asset class gathering more than $1 billion in fund flows last week. highly volatile, with violent Yields fell even after the Federal Reserve (Fed) upgraded its assessment of U.S. economic growth to “solid,” while in the same statement acknowledging the significance of international conditions and soft inflation. The Fed faces a difficult the best relative value. so what do i do with my money? ® swings in the oil price and interest rates adding to the angst. For now, we believe a combination of international equities and credit offers It’s the question on everyone’s mind. And fortunately, there are answers. Visit blackrock.com for more information. balancing act: trying to reconcile the competing trends of a strong U.S. labor market with a soft global economy and declining inflation expectations. Nonetheless, we still believe the Fed will increase interest rates at either its June or September meeting. With the Fed likely to start The other notable development last week was Friday’s reversal in oil prices. Crude prices pushed lower for most of last week, with markets hit by the news that U.S. commercial crude inventories (excluding the Strategic Petroleum Reserve) rose to over 406 million barrels, the highest level for this time of year in at least 80 years. However, prices reversed sharply on Friday. Lower oil prices are starting to have a dramatic impact on the behavior of energy companies. For example, Shell just announced a $15 billion cut in capital expenditures and the overall number of horizontal U.S. rigs has collapsed by over 200 in just the last two months. A slowdown in future exploration and production should lead to stabilization in oil prices. bound to be a more volatile removing monetary accommodation, 2015 was year than last. But more volatility doesn’t mean less opportunity for investors. Where We See Value With the Fed likely to start removing monetary accommodation, 2015 was bound to be a more volatile year than last. But more volatility doesn’t mean less opportunity for investors. We believe it makes sense to look outside the U.S. for value. European equities are up around 6.5% year-to-date and are benefiting from the European Central Bank’s quantitative easing, as well as stabilization in economic indicators and improvements in lending. Japan’s market also rose last week, aided by a slight decrease in the jobless rate and a pickup in industrial production. Going forward, Japanese stocks should be supported by relatively cheap valuations and rising dividends. Unsurprisingly, energy stocks are trading well below last year’s highs, but investors are advised to choose carefully. We would favor the large, integrated oil companies, which we expect should benefit from any stabilization in the price of crude. In fixed income, with yields continuing to grind lower, it is hard to suggest that investors embrace U.S. Treasuries, unless you believe the global economy is about to enter a period of deflation, which we think is unlikely. Instead, we would prefer tax-exempt municipal bonds, as well as U.S. high yield debt. Want to subscribe to future updates? blackrock.com/subscribe This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of Feb. 2, 2015, and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and nonproprietary sources deemed by BlackRock to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. Past performance is no guarantee of future results. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader. Investment involves risks. International investing involves additional risks, including risks related to foreign currency, limited liquidity, less government regulation and the possibility of substantial volatility due to adverse political, economic or other developments. The two main risks related to fixed income investing are interest rate risk and credit risk. Typically, when interest rates rise, there is a corresponding decline in the market value of bonds. Credit risk refers to the possibility that the issuer of the bond will not be able to make principal and interest payments. Index performance is shown for illustrative purposes only. You cannot invest directly in an index. ©2015 BlackRock, Inc. All Rights Reserved. BLACKROCK, iSHARES and SO WHAT DO I DO WITH MY MONEY are registered trademarks of BlackRock, Inc. or its subsidiaries in the United States and elsewhere. All other trademarks are those of their respective owners. Prepared by BlackRock Investments, LLC, member FINRA. Not FDIC Insured • May Lose Value • No Bank Guarantee 3486A-MC-0215 / USR-5480

© Copyright 2026

![Download Magazine [PDF] - Insurance Times and Investments](http://s2.esdocs.com/store/data/000486708_1-d66ca8d0755541eb24c6e1103676ef96-250x500.png)