India Morning Bell - Anand Rathi Securities

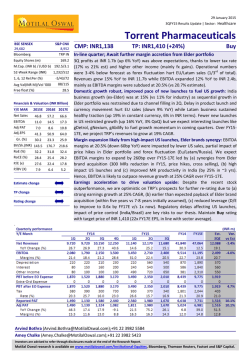

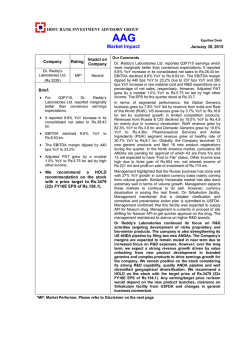

Country India I Equities Daily 29 January 2015 India Morning Bell Sensex: 29559 All the latest research and data Nifty: 8914 Titan Industries – Jewellery sparkles, watch volumes under stress; Buy. Titan Industries’ 3QFY15 revenue increased 9.2% yoy to `29.2bn, below the `32.3bn we expected. The jewellery division posted decent, 11% yoy, growth, boosted by Gold plus growing 30% yoy, though sales of Tanishq declined 4% yoy. We are sanguine about the stock, given the healthy growth in the jewellery division and on looking at early signs of improving consumer sentiment. We value Titan at 29x PE on FY17e EPS of `15.4 and arrive at a target price of `450. Manish Valecha, India Research Team +9122 6626 6666 [email protected] [email protected] ► Cholamandalam Investment and Finance – Improving core; upgrading to a Buy. Cholamandalam Investment and Finance’s AUM rose 12.4% yoy (1.1% qoq), to `247.3bn, led by healthy growth in the home equity vertical. Disbursements were dragged down 7.6% on account of an 11% fall in the vehicle-finance division. On the expected improving CV cycle and higher RoEs, we raise our target price to `670 (from `540 earlier) and value the NBFC at 2.3x FY17e BV (earlier 2.2x FY16). Higher core income and better asset quality could lead to greater profitability (a 32% CAGR over FY14-17) and a higher RoE of 20% by FY17. We upgrade our recommendation on the stock to a Buy. Our target is based on the two-stage DDM (CoE: 15%; earlier 16%). Kaitav Shah, [email protected] ► Chart of the day India: While non-food continued to slide, food increased to 5% Markets 28 Jan ’15 Sensex Nifty Dow Jones S & P 500 FTSE Nikkei* Hang Seng* 1 Day 0.0% 0.0% -1.1% -1.3% 0.2% -0.5% -0.6% YTD 7.5% 7.6% -3.5% -2.8% 4.0% 1.5% 4.7% 645 3,665 92,826 1 Day 1.8% 4.8% 45.8% Avg '15 558 2,827 40,794 28 Jan ’15* MTD YTD 1,178 898 281 83,278 74,601 1,417 83,278 74,601 1,417 11,217 11,491 -274 73,631 71,418 2,213 73,631 71,418 2,213 234 445 -211 2,390 2,171 218 2,390 2,171 218 28 Jan ’15 1 Day YTD 48.7 1,281.5 530.0 61.4 1.1 117.7 6.9% 7.7% 432.71 0.4% -0.2% 0.0% 0.0% 0.0% -0.1% -95.bps 0.bps 9.8bps -16.4% 8.2% -4.5% 2.7% 7.2% 1.8% -185.bps -15.1bps 45.3bps 29559 8914 17191 2002 6826 17716 24710 Volumes (US$m) 28 Jan ’15 Cash BSE Cash NSE Derivatives (NSE) Flows (US$m) FII – Cash Buy Sell Net FII - Derivatives Buy Sell Net DII – Cash Buy Sell Net Others Source: Government of India Oil Brent (US$/bbl)* Gold (US$/oz)* Steel (US$/MT) `/US$ US$/Euro* Yen/US$* Call Rate 10-year G-Secs EMBI spreads @7:30am *Provisional Source: BSE, Bloomberg Anand Rathi Shares and Stock Brokers Limited (hereinafter “ARSSBL”) is a full service brokerage and equities research firm and the views expressed therein are solely of ARSSBL and not of the companies which have been covered in the Research Report. This report is intended for the sole use of the Recipient. Disclosures and analyst certifications are present in Appendix. Anand Rathi Research India Equities 29 January 2015 India Morning Bell Market Data Large Caps Mid Caps Small Caps (>US$1bn) (US$250m-1bn) (US$100m-250m) Price Performance Top-5 gainers Company Price Performance CMP (INR) 1 wk (%) 1 Mth (%) 383 61.1 112.1 SUN PHARMA ADV MAX INDIA LTD APOLLO HOSPITALS Top-5 gainers Company Price Performance 1 wk (%) 1 Mth (%) HITACHI HOME & L 1163 19.4 40.8 DISHMAN PHARMACE CMP (INR) 1 wk (%) 161 24.8 1 Mth (%) 32.4 498 16.6 30.3 SUNDARAM CLAYTON 1978 15.2 23.0 GEOJIT BNP PARIB 45 19.0 27.1 1422 16.1 25.9 TEXMACO RAIL & E 159 14.4 23.9 TRINITY TRADELIN 29 18.9 88.6 188 13.4 13.5 WALCHANDNAGAR 253 15.4 64.6 87 12.2 28.1 INDIABULLS SEC 32 12.3 36.3 CMP (INR) 1 wk (%) 1 Mth (%) CMP (INR) 1 wk (%) 1 Mth (%) 261 (12.8) 9.3 SULABH ENGR & SV 91 (44.5) (46.4) 69 (10.7) 4.9 CENTRUM CAP LTD 18 (18.4) (5.3) (6.8) PMC FINCORP LTD 41 (17.2) (58.0) TILAK FINANCE LT ALSTOM T&D INDIA 541 14.4 16.9 IIFL HOLDINGS LT DLF LTD 163 13.5 19.7 HOUSING DEVELOPM CMP (INR) 1 wk (%) 1 Mth (%) VEDANTA RESOURCE 363 (10.9) (36.1) GRUH FINANCE LTD 276 (10.5) 9.3 UNION BANK INDIA 227 (8.4) (6.0) REDINGTON INDIA 124 (9.0) IPCA LABS LTD 644 (8.0) (12.5) KITEX GARMENTS 513 (7.5) 1.2 M&M FIN SERVICES 249 (6.8) (17.8) BOMBAY BURMAH TR 442 (6.7) 18.4 Top-5 losers Company Top-5 gainers Company CMP (INR) Top-5 losers Company GATI LTD CORPORATION BANK Top-5 losers Company ZUARI AGRO CHEMI Volume Volume Volume Volume spurts Company Volume spurts Company Volume spurts Company 64 (17.0) (76.2) 232 (16.7) (7.8) CMP (INR) 1 wk avg 1/4 wk (%) 135 19 300.0 39 45 239.6 CMP (INR) 1 wk avg 1/4 wk (%) CMP (INR) 1 wk avg 1/4 wk (%) COROMANDEL INTER 293 1,116,994 205.8 GUJARAT STATE F 102 5,239,391 181.4 GLOBUS CONSTRUCT SUN PHARMA ADV 383 11,851,486 191.4 ESSAR PORTS LTD 106 1,377,962 168.7 NEWTIME INFRASTR MAX INDIA LTD 498 3,331,326 173.1 KAVERI SEED 736 556,032 154.7 MATRA KAUSHAL EN 36 78,047 215.0 IPCA LABS LTD 644 865,781 151.8 EDELWEISS FIN SE 72 9,214,448 143.4 SOMANY CERAMICS 344 143,169 205.5 ALSTOM T&D INDIA 541 259,911 136.5 STERLITE TECH LT 62 3,931,137 142.3 DHANLEELA INVEST 137 2,100 200.0 CMP (INR) 200D Avg (%) CMP (INR) 200D Avg (%) CMP (INR) 200D Avg (%) SUN PHARMA ADV 383 184 106.7 FORBES & CO LTD 2,372 965 147.0 SHREYAS SHIPPING 333 97 245.1 BAJAJ FINANCE LT ASHOK LEYLAND 4,323 68 2,607 41 65.5 # 65.3 # HITACHI HOME & L ISGEC HEAVY ENGI 1,163 5,691 526 3,050 119.8 87.1 PODDAR DEVELOPER TAKE SOLUTIONS 1,526 99 519 43 192.7 131.6 62.2 # BOMBAY BURMAH TR 442 252 76.0 EINS EDUTECH LTD 451 195 130.8 61.2 CCL PRODUCTS IND 186.8 106.7 74.6 INDO COUNT INDS 414 183 125.9 Technicals Above 200 DMA Company Technicals WHIRLPOOL OF IND 726 447 BHARAT ELECTRON 3,408 2,121 Below 200 DMA Company CMP (INR) 200D Avg (%) VEDANTA RESOURCE 363 900 (59.6) JINDAL STEEL & P Above 200 DMA Company Below 200 DMA Company JAIN IRRIGATION Technicals CMP (INR) 200D Avg (%) 66 91 (27.6) Above 200 DMA Company Below 200 DMA Company CMP (INR) 200D Avg (%) TILAK FINANCE LT 64 277 (76.9) (73.0) 155 225 (30.6) JAIPRAKASH POWER 12 16 (27.1) PMC FINCORP LTD 41 150 RELIANCE COMMUNI 80 114 (30.0) RISA INTERNATION 185 253 (26.7) SULABH ENGR & SV 91 229 (60.3) RELIANCE INFRAST 481 640 (24.5) JAYPEE INFRATECH 20 27 (25.9) PINE ANIMATION L 39 83 (53.5) CAIRN INDIA 236 306 (22.9) UNITECH LTD 17 23 (25.4) TRINITY TRADELIN 29 57 (49.3) Source: Bloomberg Anand Rathi Research India Equities Retail India I Equities Result Update Change in Estimates Target Reco 29 January 2015 Titan Industries Rating: Buy Target Price: `450 Share Price: `400 Jewellery sparkles, watch volumes under stress; Buy Key takeaways Key data TTAN IN / TITN.BO `424 / `203 29559 / 8914 US$6.89m `355.12bn / US$6bn 887.8m 52-week high / low Sensex / Nifty 3-m average volume Market cap Shares outstanding Jewellery revenue offsets declining watch volumes. Titan Industries’ 3QFY15 revenue increased 9.2% yoy to `29.2bn, below the `32.3bn we expected. The jewellery division posted decent, 11% yoy, growth, boosted by Gold plus growing 30% yoy, though sales of Tanishq declined 4% yoy. The watch division reported a 2% yoy drop in revenue due to a 4% dip in volumes, chiefly because of poor consumer sentiment during the festival season and of higher prices. Shareholding pattern (%) Dec ’14 Sep ’14 Jun ’13 53.05 53.05 53.05 - - - Free Float 46.95 46.95 46.95 - Foreign Institutions 21.57 21.52 21.51 2.92 3.05 2.84 22.46 22.38 22.60 FY15e FY16e FY17e (3.9) (4.1) (4.2) (3.5) (3.6) (3.6) (1.7) (2.4) (2.4) Promoters - of which, Pledged Suspension of the 80:20 scheme. Despite the RBI withdrawing the restrictions on gold imports by scrapping the controversial 80:20 scheme, clarity from custom authorities is lacking regarding restrictions on imports on lease. The benefit from the removal of the 80:20 scheme will start flowing in from 4QFY15. - Domestic Institutions - Public Estimates revision (%) Improved EBITDA. The EBITDA margin was in step with our estimated 9.4%. The 3QFY15 EBIT margin of the jewellery division, at 9.6% (9.5% a year back, 9.2% the previous quarter), was low because of the greater contribution from Gold Plus stores. The EBIT margin of the watch division slipped from 10.4% a year ago to 9.7% in 3QFY15 following the volume decline and keener e-commerce competition. PAT came in at `1.9bn, up 15% yoy, primarily because of the operating performance and lower tax rate. The 100% rebate will continue for the next two years. Sales EBITDA PAT Financials (YE Mar) Sales (` m) Net profit (` m) FY17e 176,444 11,600 13,711 13 15 Growth (%) 25.5 18.2 PE (x) 30.6 25.9 PBV (x) 8.6 6.7 RoE (%) 31.5 29.1 RoCE (%) 35.2 34.2 EPS (`)* ` take. We are sanguine about the stock, given the healthy growth in the Our jewellery division and on looking at early signs of improving consumer sentiment. We value Titan at 29x PE on FY17e EPS of `15.4 and arrive at a target price of `450. Risks: Regulatory hurdles and volatility in gold prices. FY16e 152,659 Dividend yield (%) Net gearing (%) 0.6 0.6 (18.8) (13.5) Source: Anand Rathi Research Quarterly results (YE Mar) Sales (` m) EBITDA (` m) EBITDA margin (%) Interest (` m) Depreciation (` m) Other income(` m) PBT (` m) Tax (` m) Tax rate (%) PAT (` m) 3QFY14 3QFY15 % yoy 9MFY14 9MY15 26,758 29,225 9.2 81,124 94,070 % yoy 16.0 2,452 2,758 12.5 7,519 8,833 17.5 12bps 9.2 9.4 27bps 9.3 9.4 274 211 (23.0) 644 669 4.0 157 232 48.2 452 672 48.8 261 115 (55.8) 947 544 (42.5) Manish Valecha 2,282 2,431 6.5 7,370 8,036 9.0 +9122 6626 6552 [email protected] 639 524 (17.9) 2,063 1,982 (3.9) 28.0 21.6 -643bps 28.0 24.7 -333bps 1,656 1,907 15.2 5,347 6,078 13.7 Source: Company Anand Rathi Shares and Stock Brokers Limited (hereinafter “ARSSBL”) is a full service brokerage and equities research firm and the views expressed therein are solely of ARSSBL and not of the companies which have been covered in the Research Report. This report is intended for the sole use of the Recipient. Disclosures and analyst certifications are present in Appendix. Anand Rathi Research India Equities 29 January 2015 Titan Industries - Jewellery sparkles, watch volumes under stress; Buy Quick Glance – Financials and Valuations Fig 2 – Balance sheet (` m) Fig 1 – Income statement (` m) Year-end: Mar Net revenues Revenue growth (%) - Oper. expenses EBIDTA EBITDA margins (%) - Interest - Depreciation + Other income PBT Income taxes Extra-ordinary items Reported net profit Adjusted net profit PAT growth (%) Adj. FDEPS (`/sh) Adj. FDEPS growth (%) FY13 FY14 FY15e FY16e FY17e 101,127 15.6 91,021 10,106 10.0 506 545 1,008 10,063 2854 7,252 7,252 20.8 8.2 20.8 109,158 7.9 98,674 10,484 9.6 871 656 1,202 10,159 2630 7,411 7,411 2.2 8.3 2.2 129,071 18.2 116,243 12,829 9.9 800 750 1,300 12,579 3333 9,245 9,245 24.7 10.4 24.7 152,659 18.3 136,726 15,933 10.4 700 850 1,400 15,783 4182 11,600 11,600 25.5 13.1 25.5 176,444 15.6 157,540 18,904 10.7 850 900 1,500 18,654 4943 13,711 13,711 18.2 15.4 18.2 FY13 FY14 888 18,761 19,649 (80) 19,568 4,903 185 888 24,352 25,240 8,063 (94) 33,209 6,291 266 FY15e 888 888 888 31,325 40,550 51,885 32,213 41,438 52,773 7,063 5,063 6,063 (94) (94) (94) 39,182 46,407 58,743 7,541 9,191 11,291 266 266 266 FY16e FY17e 3,115 11,365 19,568 (0.6) 7 22 17,763 8,889 33,209 (0.0) 35 28 20,103 24,089 33,992 11,273 12,861 13,194 39,182 46,407 58,743 (0.1) (0.2) (0.1) 54 53 60 36 47 59 Fig 4 – Ratio analysis @ `400 Fig 3 – Cash-flow statement (` m) PAT Non-csh items Cash profit Incr. /(Decr.) in WC Operating cash-flow Capex Free cash-flow Dividend Equity raised Debt raised Investments Miscellaneous items Net cash-flow Opening cash Closing cash Share capital Reserves & surplus Net worth Total debt Minority interest Def. tax liab. (net) Capital employed Net fixed assets Investments - of which, Liquid Working capital Cash Capital deployed Net debt/equity (%) W C turn (days) Book value (`/sh) Source: Company, Anand Rathi Research Source: Company, Anand Rathi Research Year-end: Mar Year-end: Mar FY13 FY14 FY15e FY16e FY17e 7,252 502 7,754 2,296 5,458 1,512 3,946 1,796 (59) 25 306 1,760 9,605 11,366 7,411 643 8,054 14,648 (6,594) 2,044 (8,638) 2,169 0 8,063 81 (348) (2,476) 11,366 8,889 9,245 750 9,995 2,340 7,656 2,000 5,656 2,272 (1,000) 2,383 8,889 11,273 11,600 850 12,450 3,987 8,464 2,500 5,964 2,375 (2,000) 1,588 11,273 12,861 13,711 900 14,611 9,903 4,708 3,000 1,708 2,375 1,000 333 12,861 13,194 Year-end: Mar FY13 FY14 FY15e FY16e FY17e P/E (x) Cash P/E (x) EV/EBITDA (x) EV/sales (x) P/B (x) RoE (%) RoCE (%) Dividend yield (%) Dividend Payout(%) Debt to equity (x) Debtor days Inventory days Payables days Working capital days Fixed asset T/O (x) 49.0 45.8 34.0 3.4 18.1 42.5 56.1 0.4 21.3 (0.6) 6 133 53 7 22.9 47.9 44.1 33.8 3.2 14.1 33.0 37.2 0.5 25.2 (0.0) 5 129 51 35 19.5 38.4 35.5 27.4 2.7 11.0 32.2 33.4 0.6 21.1 (0.1) 5 120 48 54 18.7 30.6 28.5 21.8 2.3 8.6 31.5 35.2 0.6 17.6 (0.2) 5 115 43 53 18.2 25.9 24.3 18.4 2.0 6.7 29.1 34.2 0.6 14.9 (0.1) 5 110 35 60 17.2 Source: Company, Anand Rathi Research Source: Company, Anand Rathi Research Fig 5 – PE band Fig 6 – 3QFY15 revenue break-up (`) 500 36.0 450 Others 4.6% 32.0 400 28.0 350 300 24.0 250 20.0 Un allocated 0.4% Watches 15.1% 200 150 100 Jewellery 80.0% Source: Bloomberg, Anand Rathi Research Anand Rathi Research Jan-15 Jul-14 Oct-14 Apr-14 Jan-14 Jul-13 Oct-13 Apr-13 Jan-13 Jul-12 Oct-12 Apr-12 Jan-12 Jul-11 Oct-11 Apr-11 Jan-11 50 Source: Company 2 29 January 2015 Titan Industries - Jewellery sparkles, watch volumes under stress; Buy Result Highlights Fig 7 – Estimates vs Actuals Quarterly results (YE Mar) 3QFY15 3QFY15e % var 2QFY14 % yoy 1QFY15 % qoq Sales (`m) 29,225 32,398 (9.8) 26,758 9.2 35,931 (18.7) 2,758 3,049 (9.5) 2,452 12.5 3,332 (17.2) EBITDA margin (%) 9.4 9.4 3bps 9.2 27bps 9.3 17bps Interest (`m) 211 120 75.7 274 (23.0) 109 93.8 Depreciation (`m) 232 200 16.0 157 48.2 197 17.9 Other income(`m) 115 200 (42.4) 261 (55.8) 175 (34.2) PBT (`m) 2,431 2,929 (17.0) 2,282 6.5 3,201 (24.1) Tax (`m) 524 732 (28.4) 639 (17.9) 796 (34.1) EBITDA (`m) Tax rate (%) 21.6 25.0 -342bps 28.0 -643bps 24.9 -330bps PAT (`m) 1907 2,197 (13.2) 1,656 15.2 2,399 (20.5) Source: Company, Anand Rathi Research Fig 9 – PBIT and PBIT margin: Jewellery Fig 8 – Sales and sales growth: Jewellery (`m) 35,000 (%) 70 (%) 40 (`m) 2,500 60 35 50 40 2,000 20,000 30 20 1,500 15,000 10 0 1,000 -10 500 -20 -30 0 15 10 5 Sales growth PBIT Source: Company, Anand Rathi Research Dec-14 Sep-14 Jun-14 Mar-14 Dec-13 Sep-13 Jun-13 Mar-13 0 Dec-11 Dec-14 Sep-14 Jun-14 Mar-14 Dec-13 Jun-13 Sales Sep-13 Mar-13 Dec-12 Sep-12 Jun-12 Mar-12 Dec-11 0 20 Dec-12 5,000 25 Jun-12 10,000 30 Sep-12 25,000 Mar-12 30,000 PBIT Margin (RHS) Source: Company, Anand Rathi Research Fig 10 – Sales & sales growth: Watches Fig 11 – PBIT and PBIT margin: Watches (`m) 5,500 (%) 5,000 (`m) 800 (%) 140 25 700 120 20 600 15 500 10 400 5 300 0 200 2,500 -5 100 2,000 -10 Sales Source: Company, Anand Rathi Research Anand Rathi Research Sales growth 40 20 PBIT Dec-14 Sep-14 Jun-14 Mar-14 Dec-13 Sep-13 Jun-13 0 Mar-13 0 Dec-12 Dec-14 Sep-14 Jun-14 Mar-14 Dec-13 Sep-13 Jun-13 Mar-13 Dec-12 Sep-12 Jun-12 Mar-12 Dec-11 3,000 60 Sep-12 3,500 80 Jun-12 4,000 100 Mar-12 4,500 Dec-11 30 PBIT Margin (RHS) Source: Company, Anand Rathi Research 3 29 January 2015 Titan Industries - Jewellery sparkles, watch volumes under stress; Buy Fig 12 – No. of stores: Jewellery Fig 13 – No. of stores: Watches (no's) (no's) 200 700 180 600 160 140 500 120 400 100 80 300 60 200 40 100 20 World of Titans Gold plus Fasttrack Outlets Dec-14 Sep-14 Jun-14 Mar-14 Dec-13 Sep-13 Jun-13 Mar-13 Dec-12 Sep-12 Mar-12 Dec-11 Dec-14 Sep-14 Jun-14 Mar-14 Dec-13 Sep-13 Jun-13 Mar-13 Dec-12 Sep-12 Jun-12 Mar-12 Dec-11 Tanishq Jun-12 0 0 Helios Outlets Source: Company, Anand Rathi Research Source: Company, Anand Rathi Research Fig 14 – OPM and NPM (%) 11.5 10.5 9.5 8.5 7.5 6.5 OPM Dec-14 Sep-14 Jun-14 Mar-14 Dec-13 Sep-13 Jun-13 Mar-13 Dec-12 Sep-12 Jun-12 Mar-12 Dec-11 5.5 NPM Source: Company Valuations We are sanguine about the stock, given the healthy growth of the jewellery division and on looking at early signs of improving consumer sentiment. We value Titan Industries at 29x PE on FY17 EPS of `15.4 and arrive at a target price of `450. Fig 15 – 12-month-forward PE: Standard deviation and Mean (x) 40 +2SD 35 +1SD 30 Mean 25 -1SD 20 -2SD Jan-15 Jul-14 Oct-14 Apr-14 Oct-13 Jan-14 Jul-13 Apr-13 Jan-13 Jul-12 Oct-12 Apr-12 Jan-12 Jul-11 Oct-11 Apr-11 Jan-11 15 Source: Anand Rathi Research Risks Anand Rathi Research Regulatory hurdles Volatility in gold prices. 4 BFSI India I Equities Result Update Change in Estimates Target Reco 29 January 2015 Cholamandalam Investment and Finance Rating: Buy Target Price: `670 Share Price: `520 Improving core; upgrading to a Buy Key takeaways Modest loan growth, driven by home equity. Cholamandalam Investment and Finance’s AUM rose 12.4% yoy (1.1% qoq), to `247.3bn, led by healthy growth in the home equity vertical. Disbursements were dragged down 7.6% on account of an 11% fall in the vehicle-finance division. Management believes that the CV business is closer to bottoming out. Increasing penetration and a diversified product mix could drive a 22% loan CAGR over FY14-17. NIM improves, stable productivity. Calculated NIM on AUM increased 30bps yoy to 8% through higher yields on account of the changing product mix, with a tilt toward higher-yielding assets. We expect this trend to continue. Cost-to-assets was a stable 3.4% yoy as Cholamandalam focuses on leveraging its existing network. This came about despite a 10% yoy rise in its branch network (to 575). In FY15-16, we expect cost-assets to improve to 2.8% (from 3.4% in FY14) as the NBFC better leverages its present setup. Asset quality slips; closer to bottoming out. GNPA increased 20bps qoq to 2.8% as the NBFC saw higher delinquencies in its CV portfolio. Portfolio quality in the home-equity segment, however, is stable. Management has seen, however, collection efficiencies improve. We have built in an 85-bp credit cost over FY16/17. Our take. On the expected improving CV cycle and higher RoEs, we raise our target price to `670 (from `540 earlier) and value the NBFC at 2.3x FY17e BV (earlier 2.2x FY16). Higher core income and better asset quality could lead to greater profitability (a 32% CAGR over FY14-17) and a higher RoE of 20% by FY17. We upgrade our recommendation on the stock to a Buy. Our target is based on the two-stage DDM (CoE: 15%; earlier 16%). Risks. Persistent slowdown in the rural economy, higher NPAs. Key data CIFC IN / CHLA.BO `548/`224 52-week high / low Sensex / Nifty 3-m average volume Market cap Shares outstanding 29559 / 8914 US$1.6m `77bn/US$1254m 143.6m Shareholding pattern (%) Dec-14 Sep-14 Promoters - of which, Pledged Free Float - Foreign Institutions - Domestic Institutions - Public 57.7 42.3 27.1 6.5 8.7 Financials (YE: Mar) Jun-14 57.8 42.2 27.1 6.5 8.7 57.7 42.3 25.5 8.2 8.6 FY15e FY16e 17,496 21,414 4,547 6,496 EPS (`) 31.7 41.8 Growth (%) 24.9 31.6 PE (x) 16.4 12.5 Net interest income (` m) Net profit (` m) PABV (x) 3.8 2.3 RoE (%) 16.7 18.9 RoA (%) 1.9 2.2 Dividend yield (%) 0.8 1.0 Net NPA (%) 1.0 0.8 Source: Anand Rathi Research Quarterly results (YE: Mar) 3QFY14 3QFY15 % yoy 9MFY14 9MFY15 Net interest income (` m) 3,571 4,584 28.4 10,399 12,541 20.6 Non-interest income (` m) 172 65 (62.2) 581 248 (57.4) Operating expenses (` m) 1,649 1,965 19.2 4,863 5,585 14.8 44.0 42.3 (177)bps 44.3 43.7 (62)bps 2,095 2,684 28.1 6,117 7,204 17.8 Cost-to-income (%) Pre-provisioning profit (` m) % yoy 699 997 42.6 1,991 2,666 33.9 Kaitav Shah PBT (` m) 1,396 1,687 20.9 4,126 4,538 10.0 Tax (` m) 474 574 21.1 1,393 1,543 10.8 +9122 6626 6545 [email protected] PAT(` m) 922 1,113 20.7 2,733 2,995 9.6 EPS (`) 6.4 7.7 20.4 16.7 19.1 14.6 Provisions (` m) Source: Company, Anand Rathi Research Anand Rathi Shares and Stock Brokers Limited (hereinafter “ARSSBL”) is a full service brokerage and equities research firm and the views expressed therein are solely of ARSSBL and not of the companies which have been covered in the Research Report. This report is intended for the sole use of the Recipient. Disclosures and analyst certifications are present in Appendix. Anand Rathi Research India Equities 29 January 2015 Cholamandalam Investment and Finance – Improving core; upgrading to a Buy Quick Glance – Financials and Valuations Fig 1 – Income statement (` m) Source: Company, Anand Rathi Research Share capital Reserves & surplus Borrowings Current liab. & prov. Minority Interest Total liabilities 500 10x 400 8x 300 6x CIFC 200 4x 100 Jan-15 Jul-14 Jan-14 Jul-13 0 Source: Bloomberg, Anand Rathi Research Fig 2 – Balance sheet (` m) Year-end: Mar 600 Jan-13 26,454 23.5 501 26,955 23.5 11,591 15,364 23.5 2,922 12,443 4,143 8,299 27.8 53.4 5.0 Jul-12 21,414 22.4 412 21,827 22.4 9,385 12,441 24.5 2,702 9,739 3,243 6,496 42.9 41.8 5.0 Jan-12 17,496 20.3 342 17,838 19.6 7,849 9,989 19.8 3,351 6,638 2,091 4,547 24.9 31.7 4.0 Jul-11 14,548 32.1 370 14,918 31.1 6,582 8,335 44.9 2,833 5,502 1,862 3,640 18.7 25.4 3.5 Jul-10 11,014 48.4 367 11,381 45.0 5,630 5,751 58.3 1,243 4,508 1,443 3,065 77.7 21.4 3.3 Jan-11 FY17e Jul-09 FY16e Jan-10 FY15e Jul-08 FY14 Jan-09 Net interest income NII growth (%) Non-interest inc Total income Total Inc, growth (%) Oper. expenses Operating profit Oper. profit growth (%) Provisions PBT Tax PAT PAT growth (%) FDEPS (`/sh) DPS (`/sh) Fig 4 – PE band FY13 Jan-08 Year-end: Mar Fig 5 – Price-to-book band FY13 FY14 FY15e 1,432 18,216 152,890 9,310 181,848 1,433 21,514 182,091 10,430 215,468 1,433 30,168 218,071 15,734 265,405 FY16e FY17e 1,555 1,555 35,647 43,052 258,783 318,731 20,454 26,591 316,439 389,928 600 500 2.0x 400 CIFC 1.5x 300 Jul-14 Dec-14 Jan-15 Jan-14 Jul-13 Jan-13 Jul-12 Jan-12 Jul-11 Jan-11 Jul-10 Jan-10 Nov-14 550 CIFC 500 450 400 350 Bankex 300 250 200 Jan-15 7.7 1.9 43.0 56.7 9.4 91.1 n.a 1.5 0.7 286.8 270.4 17.5 20.3 2.3 1.0 Oct-14 7.6 1.9 43.0 58.7 12.0 91.0 n.a 1.8 0.8 239.2 223.9 17.6 20.4 2.2 1.0 Sep-14 7.6 1.9 44.0 62.9 12.6 93.5 n.a 2.3 1.0 185.7 135.2 18.0 18.4 1.9 0.8 Aug-14 7.7 2.5 44.1 60.9 13.8 93.7 n.a 2.4 1.0 160.2 146.2 17.4 17.1 1.8 0.7 Jul-14 7.2 3.2 49.5 73.9 15.5 92.0 n.a 0.9 0.3 137.2 134.1 17.7 18.1 1.9 0.6 Jun-14 FY17e May-14 FY16e Apr-14 FY15e Mar-14 FY14 Feb-14 FY13 Source: Company, Anand Rathi Research Anand Rathi Research 0 Fig 6 – Chola vs. Bankex Fig 3 – Key ratios NIM (%) Other inc / total inc (%) Cost-income (%) Provision coverage (%) Dividend payout (%) Credit-Borrowings (%) Investment-deposit (%) Gross NPA (%) Net NPA (%) BV (`) Adj BV (`) CAR (%) RoE (%) RoA (%) Dividend yield (%) 0.5x 100 Source: Bloomberg, Anand Rathi Research Source: Company, Anand Rathi Research Year-end: Mar 1.0x 200 Jul-09 284,428 349,846 1,294 1,594 28,578 35,891 2,139 2,598 316,439 389,928 156 156 18.7 23.2 22.0 23.0 Jan-09 233,137 1,090 29,390 1,788 265,405 143 19.8 20.0 Jul-08 194,281 824 12,215 8,147 215,468 143 19.1 16.9 Jan-08 166,259 2,245 10,882 2,461 181,848 143 33.6 34.8 Jan-14 Advances Investments Cash & bank bal Fixed & other assets Total assets No. of shares (m) Borrowings growth (%) Advances growth (%) Source: Bloomberg 2 29 January 2015 Cholamandalam Investment and Finance – Improving core; upgrading to a Buy Result Highlights Fig 7 – 3QFY15 Results vs Expectations (` m) Net interest income Pre-provisioning profits PAT 3QFY15 3QFY15e Var % 3QFY14 YoY % 2QFY15 QoQ % 4,584 2,684 1,113 4,219 2,402 1,024 8.7 11.7 8.7 3,571 2,095 922 28.4 28.1 20.7 4,113 2,305 951 11.5 16.5 17.0 Source: Company, Anand Rathi Research Fig 8 – 3QFY15 Results (` m) 3QFY15 3QFY14 % Chg 9MFY15 9MFY14 % Chg 4,584 65 1,965 2,684 1,113 3,571 172 1,649 2,095 922 28.4 (62.2) 19.2 28.1 20.7 12,541 248 5,585 7,204 2,995 10,399 581 4,863 6,117 2,733 20.6 (57.4) 14.8 17.8 9.6 Net interest income Non-interest income Operating costs (%) Pre-provisioning profits PAT AUM Disbursements Gross NPA % Net NPA % NPA coverage% Capital adequacy % Tier-1 % 3QFY15 3QFY14 YoY 2QFY15 QoQ 247,363 30,820 2.8 1.50 46.4 20.9 12.7 220,069 33,360 1.7 0.70 58.8 18.2 11.1 12.4 (7.6) 110bps 80bps (1,239)bps 272bps 160bps 244,685 30,280 2.6 1.40 46.2 19.8 12.6 1.1 1.8 20bps 10bps 27bps 114bps 9bps Source: Company, Fig 9 – AUM growth modest as . . . Fig 10 – . . . disbursement growth slows down (`bn) (Nos) (`bn) 260 600 40 (%) 80.0 35 70.0 240 550 220 60.0 30 200 500 180 450 160 140 400 50.0 25 40.0 20 30.0 15 20.0 10.0 10 AUM Branches 5 5 6 6 6 6 6 6 7 8 8 80% 27 29 29 32 33 32 27 28 28 29 29 29 56.0 14 13 13 12 6 11 7 12 11 12 52.0 8 8 9 9 10 10 48.0 38 39 37 36 44.0 15 4 11 7 40% 46 45 44 43 42 11 7 41 45 44 42 41 0 29 28 3QFY15 2QFY15 1QFY15 4QFY14 3QFY14 2QFY14 1QFY14 4QFY13 3QFY13 (%) 5.0 4.5 4.0 3.5 Tractor Anand Rathi Research HCV Car Used CV MUV Cost-income 3QFY15 2QFY15 1QFY15 4QFY14 3QFY14 2QFY14 1QFY14 4QFY13 3QFY13 2QFY13 1QFY13 4QFY12 3QFY12 3QFY15 2QFY15 1QFY15 4QFY14 3QFY14 2QFY14 1QFY14 4QFY13 3QFY13 2QFY13 1QFY13 4QFY12 3QFY12 2QFY12 LCV Source : Company 3.0 2QFY12 40.0 0% 1QFY12 20% 11 6 0 (%) 60.0 5 15 3 2QFY13 Fig 12 – Cost-assets trending lower 100% 2 Disbursement growth Source: Company, Anand Rathi Research Fig 11 – AUM mix – Share of tractors improving 17 1QFY13 Disbursement Source: Company, Anand Rathi Research 60% 4QFY12 (20.0) 1QFY12 (10.0) 0 3QFY15 2QFY15 1QFY15 4QFY14 3QFY14 2QFY14 1QFY14 4QFY13 3QFY13 2QFY13 1QFY13 4QFY12 3QFY12 2QFY12 300 1QFY12 80 - 5 3QFY12 350 100 2QFY12 120 Cost-assets Source : Company, Anand Rathi Research 3 29 January 2015 Cholamandalam Investment and Finance – Improving core; upgrading to a Buy Fig 13 – NPA coverage falls (%) 3.4 (%) 90 85 80 75 70 65 60 55 50 45 40 2.9 2.4 1.9 1.4 0.9 GNPA(% of advances) 3QFY15 2QFY15 1QFY15 4QFY14 3QFY14 2QFY14 1QFY14 4QFY13 3QFY13 2QFY13 1QFY13 4QFY12 3QFY12 2QFY12 0.4 NPA coverage (RHS) Source: Company Valuations On the improving RoEs, we raise our target price to `670 (from `540 earlier) and value the NBFC at 2.3x FY17e BV (earlier 2.2x FY16). Healthy asset growth, stable NIM and better productivity could lead to greater profitability (a 32% CAGR over FY14-17) and higher RoE of 20% by FY17. We upgrade our recommendation on the stock to a Buy. Our target is based on the two-stage DDM (CoE: 15%; earlier 16%). Fig 14 – Past one-year-forward P/BV 3.0 2.5 +2SD 2.0 CIFC +1SD 1.5 Mean 1.0 - 1SD 0.5 - 2SD Jan-09 Apr-09 Jul-09 Oct-09 Jan-10 Apr-10 Jul-10 Oct-10 Jan-11 Apr-11 Jul-11 Oct-11 Jan-12 Apr-12 Jul-12 Oct-12 Jan-13 Apr-13 Jul-13 Oct-13 Jan-14 Apr-14 Jul-14 Oct-14 Jan-15 0.0 Source: Bloomberg, Anand Rathi Research Risks Anand Rathi Research Persistent slowdown in economy could hit the rural sector, leading to slower loan growth and higher delinquencies. NBFCs being highly-regulated entities, regulatory constraints could impact profitability. 4 29 January 2015 Cholamandalam Investment and Finance – Improving core; upgrading to a Buy Financials We expect a 22% CAGR in AUM over FY14-17, with a 32% CAGR in net profit over the same period. Fig 15 – Income Statement Year-end: Mar (` m) FY13 FY14 FY15e FY16e FY17e Interest income 25,187 32,259 37,504 44,780 54,753 Interest expended 14,173 17,711 20,008 23,366 28,298 Net interest income 11,014 14,548 17,496 21,414 26,454 Growth (%) 48.4 32.1 20.3 22.4 23.5 Non-interest income 367 370 342 412 501 11,381 14,918 17,838 21,827 26,955 Total income Non-interest income / total income (%) 3.2 2.5 1.9 1.9 1.9 Operating expenses 5,630 6,582 7,849 9,385 11,591 Employee expenses 1,531 2,106 2,512 3,003 3,709 Other expenses 4,100 4,476 5,337 6,382 7,882 Pre-provisioning profit 5,751 8,335 9,989 12,441 15,364 58.3 44.9 19.8 24.5 23.5 Provisions Growth (%) 1,243 2,833 3,351 2,702 2,922 Profit before tax 4,508 5,502 6,638 9,739 12,443 Taxes 1,443 1,862 2,091 3,243 4,143 Tax rate (%) 32.0 33.8 31.5 33.3 33.3 Profit after tax 3,065 3,640 4,547 6,496 8,299 Growth (%) 77.7 18.7 24.9 42.9 27.8 Number of shares (m) 143 143 143 156 156 Earnings per share (`) 21.4 25.4 31.7 41.8 53.4 Source : Company, Anand Rathi Research Fig 16 – Balance Sheet Year-end: Mar (` m) Share capital Reserves and Surpluses FY13 FY14 FY15e FY16e 1,432 1,433 1,433 1,555 FY17e 1,555 18,216 21,514 30,168 35,647 43,052 Net worth 19,648 22,947 31,600 37,202 44,607 Borrowings 152,890 182,091 218,071 258,783 318,731 Minority Interest - - - - - Total loans 152,890 182,091 218,071 258,783 318,731 Total liabilities 181,848 215,468 265,405 316,439 389,928 Advances 349,846 166,259 194,281 233,137 284,428 Investments 2,245 824 1,090 1,294 1,594 Cash & bank balances 3,890 8,008 23,883 22,520 29,227 Fixed & other assets 9,454 6,089 7,295 8,197 9,261 181,848 215,468 265,405 316,439 389,928 Total assets Source : Company, Anand Rathi Research Anand Rathi Research 5 Appendix Analyst Certification The views expressed in this Research Report accurately reflect the personal views of the analyst(s) about the subject securities or issuers and no part of the compensation of the research analyst(s) was, is, or will be directly or indirectly related to the specific recommendations or views expressed by the research analyst(s) in this report. The research analysts are bound by stringent internal regulations and also legal and statutory requirements of the Securities and Exchange Board of India (hereinafter “SEBI”) and the analysts’ compensation are completely delinked from all the other companies and/or entities of Anand Rathi, and have no bearing whatsoever on any recommendation that they have given in the Research Report. Important Disclosures on subject companies Rating and Target Price History (as of 29 January 2015) 470 440 1 2 3 4 5 6 7 Date Rating 15-Jan-13 Buy 01-Nov-13 Buy 30-Jan-14 Buy 09-Apr-14 Buy 08-May-14 Buy 05-Aug-14 Buy 03-Nov-14 Buy TP (`) 325 316 270 316 342 375 459 Share Price (`) 272 266 215 262 272 337 397 1 2 3 4 5 6 7 Date Rating 12-Dec-11 Buy 25-Sep-12 Buy 21-Jan-13 Buy 25-Feb-13 Buy 31-Oct-13 Buy 30-Jan-14 Buy 04-Aug-14 Buy TP (`) 181 269 343 351 309 325 450 Share Price (`) 133 217 282 286 230 256 405 Titan 410 380 350 7 6 2 5 4 3 Jan-13 Feb-13 Mar-13 Apr-13 May-13 Jun-13 Jul-13 Aug-13 Sep-13 Oct-13 Nov-13 Dec-13 Jan-14 Feb-14 Mar-14 Apr-14 May-14 Jun-14 Jul-14 Aug-14 Sep-14 Oct-14 Nov-14 Dec-14 Jan-15 320 290 260 1 230 200 620 CIFC 520 420 7 4 320 3 220 5 6 2 120 1 Jan-08 Apr-08 Jul-08 Oct-08 Jan-09 Apr-09 Jul-09 Oct-09 Jan-10 Apr-10 Jul-10 Oct-10 Jan-11 Apr-11 Jul-11 Oct-11 Jan-12 Apr-12 Jul-12 Oct-12 Jan-13 Apr-13 Jul-13 Oct-13 Jan-14 Apr-14 Jul-14 Oct-14 Jan-15 20 Anand Rathi Ratings Definitions Analysts’ ratings and the corresponding expected returns take into account our definitions of Large Caps (>US$1bn) and Mid/Small Caps (<US$1bn) as described in the Ratings Table below: Ratings Guide Large Caps (>US$1bn) Mid/Small Caps (<US$1bn) Buy >15% >25% Anand Rathi Research Ratings Distribution (as of 29 January 2015) Buy 60% Anand Rathi Research stock coverage (196) % who are investment banking clients 4% Hold 5-15% 5-25% Sell <5% <5% Hold 27% 0% Sell 13% 0% Research Disclaimer and Disclosure inter-alia as required under Securities and Exchange Board of India (Research Analysts) Regulations, 2014 Anand Rathi Share and Stock Brokers Ltd. (hereinafter refer as ARSSBL) (Research Entity) is a subsidiary of Anand Rathi Financial Services Ltd. ARSSBL is a corporate trading and clearing member of Bombay Stock Exchange Ltd, National Stock Exchange of India Ltd. (NSEIL), Multi Stock Exchange of India Ltd (MCXSX), United Stock Exchange and also depository participant with National Securities Depository Ltd (NSDL) and Central Depository Services Ltd. ARSSBL is engaged in the business of Stock Broking, Depository Participant and Mutual Fund distributor. The research analysts, strategists, or research associates principally responsible for the preparation of Anand Rathi research have received compensation based upon various factors, including quality of research, investor client feedback, stock picking, competitive factors and firm revenues. General Disclaimer: This Research Report (hereinafter called “Report”) is meant solely for use by the recipient and is not for circulation. This Report does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. The recommendations, if any, made herein are expression of views and/or opinions and should not be deemed or construed to be neither advice for the purpose of purchase or sale of any security, derivatives or any other security through ARSSBL nor any solicitation or offering of any investment /trading opportunity on behalf of the issuer(s) of the respective security (ies) referred to herein. These information / opinions / views are not meant to serve as a professional investment guide for the readers. No action is solicited based upon the information provided herein. Recipients of this Report should rely on information/data arising out of their own investigations. Readers are advised to seek independent professional advice and arrive at an informed trading/investment decision before executing any trades or making any investments. This Report has been prepared on the basis of publicly available information, internally developed data and other sources believed by ARSSBL to be reliable. ARSSBL or its directors, employees, affiliates or representatives do not assume any responsibility for, or warrant the accuracy, completeness, adequacy and reliability of such information / opinions / views. While due care has been taken to ensure that the disclosures and opinions given are fair and reasonable, none of the directors, employees, affiliates or representatives of ARSSBL shall be liable for any direct, indirect, special, incidental, consequential, punitive or exemplary damages, including lost profits arising in any way whatsoever from the information / opinions / views contained in this Report. The price and value of the investments referred to in this Report and the income from them may go down as well as up, and investors may realize losses on any investments. Past performance is not a guide for future performance. ARSSBL does not provide tax advice to its clients, and all investors are strongly advised to consult with their tax advisers regarding taxation aspects of any potential investment. Opinions expressed are our current opinions as of the date appearing on this Research only. We do not undertake to advise you as to any change of our views expressed in this Report. Research Report may differ between ARSSBL’s RAs and/ or ARSSBL’s associate companies on account of differences in research methodology, personal judgment and difference in time horizons for which recommendations are made. User should keep this risk in mind and not hold ARSSBL, its employees and associates responsible for any losses, damages of any type whatsoever. ARSSBL and its associates or employees may; (a) from time to time, have long or short positions in, and buy or sell the investments in/ security of company (ies) mentioned herein or (b) be engaged in any other transaction involving such investments/ securities of company (ies) discussed herein or act as advisor or lender / borrower to such company (ies) these and other activities of ARSSBL and its associates or employees may not be construed as potential conflict of interest with respect to any recommendation and related information and opinions. Without limiting any of the foregoing, in no event shall ARSSBL and its associates or employees or any third party involved in, or related to computing or compiling the information have any liability for any damages of any kind. Details of Associates of ARSSBL and Brief History of Disciplinary action by regulatory authorities & its associates are available on our website i. e. www.rathi.com Disclaimers in respect of jurisdiction: This report is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation or which would subject ARSSBL to any registration or licensing requirement within such jurisdiction(s). No action has been or will be taken by ARSSBL in any jurisdiction (other than India), where any action for such purpose(s) is required. Accordingly, this Report shall not be possessed, circulated and/or distributed in any such country or jurisdiction unless such action is in compliance with all applicable laws and regulations of such country or jurisdiction. ARSSBL requires such recipient to inform himself about and to observe any restrictions at his own expense, without any liability to ARSSBL. Any dispute arising out of this Report shall be subject to the exclusive jurisdiction of the Courts in India. Statements on ownership and material conflicts of interest, compensation - ARSSBL and Associates Answers to the Best of the knowledge and belief of ARSSBL/ its Associates/ Research Analyst who is preparing this report ARSSBL/its Associates/ Research Analyst/ his Relative have any financial interest in the subject company? Nature of Interest (if applicable) No ARSSBL/its Associates/ Research Analyst/ his Relative have actual/beneficial ownership of one per cent or more securities of the subject company No ARSSBL/its Associates/ Research Analyst/ his Relative have any other material conflict of interest at the time of publication of the research report or at the time of public appearance? ARSSBL/its Associates/ Research Analyst/ his Relative have received any compensation from the subject company in the past twelve months No ARSSBL/its Associates/ Research Analyst/ his Relative have managed or co-managed public offering of securities for the subject company in the past twelve months ARSSBL/its Associates/ Research Analyst/ his Relative have received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past twelve months ARSSBL/its Associates/ Research Analyst/ his Relative have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past twelve months ARSSBL/its Associates/ Research Analyst/ his Relative have received any compensation or other benefits from the subject company or third party in connection with the research report Other Disclosures pertaining to distribution of research in the United States of America This material was produced by ARSSBL, solely for information purposes and for the use of the recipient. It is not to be reproduced under any circumstances and is not to be copied or made available to any person other than the recipient. It is distributed in the United States of America by Enclave Capital LLC (19 West 44th Street, Suite 1700, New York, NY 10036) and elsewhere in the world by ARSSBL or an authorized affiliate of ARSSBL (such entities and any other entity, directly or indirectly, controlled by ARSSBL, the “Affiliates”). This document does not constitute an offer of, or an invitation by or on behalf of ARSSBL or its Affiliates or any other company to any person, to buy or sell any security. The information contained herein has been obtained from published information and other sources, which ARSSBL or its Affiliates consider to be reliable. None of ARSSBL or its Affiliates accepts any liability or responsibility whatsoever for the accuracy or completeness of any such information. All estimates, expressions of opinion and other subjective judgments contained herein are made as of the date of this document. Emerging securities markets may be subject to risks significantly higher than more established markets. In particular, the political and economic environment, company practices and market prices and volumes may be subject to significant variations. The ability to assess such risks may also be limited due to significantly lower information quantity and quality. By accepting this document, you agree to be bound by all the foregoing provisions. 1. ARSSBL or its Affiliates may or may not have been beneficial owners of the securities mentioned in this report. 2. ARSSBL or its affiliates may have or not managed or co-managed a public offering of the securities mentioned in the report in the past 12 months. 3. ARSSBL or its affiliates may have or not received compensation for investment banking services from the issuer of these securities in the past 12 months and do not expect to receive compensation for investment banking services from the issuer of these securities within the next three months. 4. However, one or more of ARSSBL or its Affiliates may, from time to time, have a long or short position in any of the securities mentioned herein and may buy or sell those securities or options thereon, either on their own account or on behalf of their clients. No No No No No 5. As of the publication of this report, ARSSBL does not make a market in the subject securities. 6. ARSSBL or its Affiliates may or may not, to the extent permitted by law, act upon or use the above material or the conclusions stated above, or the research or analysis on which they are based before the material is published to recipients and from time to time, provide investment banking, investment management or other services for or solicit to seek to obtain investment banking, or other securities business from, any entity referred to in this report. Enclave Capital LLC is distributing this document in the United States of America. ARSSBL accepts responsibility for its contents. Any US customer wishing to effect transactions in any securities referred to herein or options thereon should do so only by contacting a representative of Enclave Capital LLC. © 2014. This report is strictly confidential and is being furnished to you solely for your information. All material presented in this report, unless specifically indicated otherwise, is under copyright to ARSSBL. None of the material, its content, or any copy of such material or content, may be altered in any way, transmitted, copied or reproduced (in whole or in part) or redistributed in any form to any other party, without the prior express written permission of ARSSBL. All trademarks, service marks and logos used in this report are trademarks or service marks or registered trademarks or service marks of ARSSBL or its affiliates, unless specifically mentioned otherwise. Additional information on recommended securities/instruments is available on request. ARSSBL registered address: 4th Floor, Silver Metropolis, Jaicoach Compound, Opposite Bimbisar Nagar, Goregaon (East), Mumbai - 400 063. Tel No: +91 22 4001 3700 | Fax No: +91 22 4001 3770 | CIN: U67120MH1991PLC064106.

© Copyright 2026