2014 Fourth-Quarter and Full-Year Earnings Summary Slides (PDF

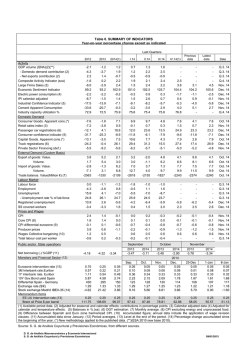

Fourth-Quarter and Full-Year 2014 Earnings Summary January 29, 2015 Caution Concerning Forward-Looking Statements and Non-GAAP Financial Measures This presentation includes certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and Time Warner Cable intends that all such statements be covered by the safe harbor provisions of the federal securities laws. Statements herein regarding future financial and operating results and any other statements about future expectations constitute “forward-looking statements.” These forward-looking statements may be identified by words such as “believe,” “expects,” “anticipates,” “projects,” “intends,” “should,” “estimates” or similar expressions. These statements are based on management’s current expectations or beliefs, and are subject to uncertainty and changes in circumstances. Actual results may vary materially from those expressed or implied by the statements herein due to changes in economic, business, competitive, technological, strategic and/or regulatory factors, and other factors affecting the operations of Time Warner Cable, including the proposed merger with Comcast Corporation. More detailed information about these factors may be found in filings by Time Warner Cable with the SEC, including its most recent Annual Report on Form 10-K and Quarterly Reports on Form 10-Q. Time Warner Cable is under no obligation to, and expressly disclaims any such obligation to, update or alter its forward-looking statements, whether as a result of new information, future events, or otherwise. This presentation includes information regarding the historical financial performance through December 31, 2014 of Time Warner Cable and its expectations regarding future performance, including historical financial performance as reflected in non-GAAP financial measures such as OIBDA (Operating Income before Depreciation and Amortization), Adjusted OIBDA, Adjusted net income attributable to TWC shareholders, Adjusted Diluted EPS and Free Cash Flow. Please note that schedules setting out the reconciliation of historical non-GAAP financial measures to Operating Income, net income attributable to TWC shareholders and cash provided by operating activities or other most directly comparable GAAP financial measures, as applicable, are included in the trending schedules posted on the Time Warner Cable company website at www.twc.com/investors and, as applicable, also are included in the Company’s earnings release for the quarter and year ended December 31, 2014, which can also be accessed from the Company’s website. 2 Highlights Financial Highlights • Full-year 2014 revenue grew 3.1% year over year with Business Services revenue up 22.8%, residential high-speed data revenue up 10.4% and advertising revenue up 10.6%. • Fourth-quarter 2014 revenue grew 3.8% year over year with Business Services revenue up 22.6%, residential high-speed data revenue up 7.4% and advertising revenue up 19.4%. • Full-year Adjusted OIBDA(1) was $8.2 billion — up 3.1% year over year. Operating Income of $4.6 billion increased 1.1% year over year. • Fourth-quarter Adjusted OIBDA(1) was $2.1 billion — up 5.6% year over year. Operating Income of $1.2 billion increased 4.5% year over year. • Full-year Adjusted Diluted EPS(2) increased 14.4% to $7.56. Diluted EPS(3) increased 7.0% to $7.17. • Fourth-quarter Adjusted Diluted EPS(2) increased 11.5% to $2.03. Diluted EPS(3) increased 3.2% to $1.95. Operational Highlights • Fourth-quarter subscriber performance in each category below was the best in at least seven years. o Total customer relationship net additions of 67,000 o Residential high-speed data net additions of 168,000 o Residential voice net additions of 295,000 – best fourth quarter ever o Residential video net declines of 38,000 o Residential triple play net additions of 273,000 – best fourth quarter ever • Full-year capital expenditures of $4.1 billion reflect the Company’s accelerated investment in “TWC Maxx,” improved customer experience and network expansion. o The roll out of TWC Maxx, including the “all digital” conversion and Internet speeds of up to 300 Mbps, was completed in New York City and Los Angeles during 2014. The Company expects to complete the roll out in Austin, Texas in early 2015 and plans to expand TWC Maxx to Charlotte, Dallas, Hawaii, Kansas City, Raleigh, San Antonio and San Diego in 2015. o TWC continued to improve its customers’ experience by deploying more than eight million new set-top boxes, digital-to-analog converters and advanced modems in customers’ homes during 2014. o During 2014, TWC added nearly 70,000 commercial buildings to its network, ending the year with connectivity to 930,000 commercial buildings. • TWC achieved record “on-time” performance with technicians arriving at more than 97% of customer appointments within the designated one-hour appointment window during the fourth quarter. Refer to Endnotes on slide 12 for definitions. 3 Selected Consolidated Financial Results (in millions, except per share data) 4th Quarter Full Year Change 2014 2013 $ Change % 2014 2013 $ % Revenue $ 5,790 $ 5,577 $ 213 3.8% $ 22,812 $ 22,120 $ 692 3.1% Adjusted OIBDA(1) $ 2,140 $ 2,026 $ 114 5.6% $ 8,228 $ 7,980 $ 248 3.1% Operating Income+ $ 1,226 $ 1,173 $ 53 4.5% $ 4,632 $ 4,580 $ 52 1.1% Diluted EPS(3) $ 1.95 $ 1.89 $ 0.06 3.2% $ 7.17 $ 6.70 $ 0.47 7.0% Adjusted Diluted EPS(2) $ 2.03 $ 1.82 $ 0.21 11.5% $ 7.56 $ 6.61 $ 0.95 14.4% Cash provided by operating activities+ $ 1,810 $ 1,599 $ 211 13.2% $ 6,350 $ 5,753 $ 597 10.4% Capital expenditures $ 918 $ 827 $ 91 11.0% $ 4,097 $ 3,198 $ 899 28.1% Free Cash Flow(4)+ $ 891 $ 773 $ 118 15.3% $ 2,347 $ 2,606 $ (259) (9.9%) + Operating Income is reduced by merger-related and restructuring costs of $38 million for each of the fourth quarters of 2014 and 2013 and $225 million and $119 million for the year ended December 31, 2014 and 2013, respectively. Cash provided by operating activities and Free Cash Flow are reduced by merger-related and restructuring payments of $19 million and $20 million for the fourth quarter of 2014 and 2013, respectively, and $128 million and $111 million for the year ended December 31, 2014 and 2013, respectively. Refer to Endnotes on slide 12 for definitions. 4 Record 4Q Subscriber Results 4Q Net Adds (Declines) (in Thousands) 0 4Q 250 4Q 2007 -50 2008 2009 -100 2010 2011 -150 2012 2013 -200 2007 200 2008 2009 150 2010 2011 100 2012 2013 50 2014 -250 2014 0 Residential Video Residential HSD 350 80 4Q 2007 60 4Q 2007 2008 40 2008 2009 20 2009 200 2010 0 2010 150 2011 -20 2011 2012 -40 2012 2013 -60 2013 300 250 100 50 2014 0 -100 Residential Voice 2014 -80 Total Customer Relationships 5 Total Revenue Total Customer Relationship ARPU(5) Revenue ($ in Millions) $5,577 +3.8% $5,790 $434 +2.9% $381 $755 $616 $127.35 $123.81 $4,580 $4,601 4Q13 4Q14 Residential Services Business Services Refer to Endnotes on slide 12 for definitions. 4Q13 4Q14 Other 6 Revenue by Segment Residential Services Business Services ($ in Millions) ($ in Millions) Other Operations+ ($ in Millions) +0.5% $4,580 $4,601 $493 $470 $755 $23 $20 +22.6% $93 $616 $51 $1,531 $1,644 $51 $112 $89 $70 $429 $138 $151 $2,464 $361 $293 4Q13 Video 4Q14 HSD Voice 4Q13 Other HSD Voice $498 $166 $113 $2,536 +16.1% $278 4Q13 4Q14 Wholesale transport + Includes intersegment revenue of $64 million in Q4 2014 and $48 million in Q4 2013. Video Other Advertising $332 4Q14 Other 7 Adjusted OIBDA(1) & Operating Income ($ in Millions) Adjusted OIBDA(1) +5.6% Operating Costs and +2.8% $3,551 Expenses+ $3,650 $191 $217 $371 $387 $551 $537 Margin(6) $2,026 $2,140 4Q13 4Q14 36.3% 37.0% Merger-related and Restructuring Costs — $1,207 $38 $1,191 +3.6% 4Q13 $1,231 $38 4Q14 Operating Income $1,318 +4.5% 4Q13 4Q14 Programming and content Other operating Sales and marketing Technical operations Customer care Margin(7) $1,173 $1,226 4Q13 4Q14 21.0% 21.2% + Total operating costs and expenses excludes depreciation, amortization and merger-related and restructuring costs. Refer to Endnotes on slide 12 for definitions. 8 Diluted Earnings Per Share Diluted EPS(3) Adjusted Diluted EPS(2) +3.2% +11.5% $1.89 $1.95 4Q13 4Q14 $2.03 $1.82 4Q13 4Q14 Average Diluted Common Shares Outstanding (in Millions) Refer to Endnotes on slide 12 for definitions. 4Q13 4Q14 285.2 284.2 9 Capital Expenditures Capital Expenditures ($ in Millions) +28.1% • $3,198 $4,097 FY2013 FY2014 Capital Expenditures increased primarily due to the Company’s investments (including TWC Maxx) to improve network reliability, upgrade older customer premise equipment and expand its network to additional residences, commercial buildings and cell towers. Capital Intensity(8) FY2013 14.5% Refer to Endnotes on slide 12 for definitions. FY2014 18.0% 10 Free Cash Flow(4) Free Cash Flow(4) ($ in Millions) • The decrease in Free Cash Flow was driven by higher capital expenditures, partially offset by an increase in cash provided by operating activities. The increase in cash provided by operating activities was primarily driven by lower income tax payments, higher Adjusted OIBDA and lower interest payments, partially offset by an increase in working capital requirements. • Free Cash Flow was reduced by mergerrelated and restructuring payments of $128 million and $111 million during 2014 and 2013, respectively. (9.9%) $2,606 $2,347 FY2013 Refer to Endnotes on slide 12 for definitions. FY2014 11 Endnotes (1) Adjusted OIBDA is defined as Operating Income before Depreciation and Amortization excluding the impact, if any, of noncash impairments of goodwill, intangible and fixed assets; gains and losses on asset sales; and merger-related and restructuring costs. (2) Adjusted Diluted EPS means net income per diluted common share attributable to TWC common shareholders excluding the impact, if any, of noncash impairments of goodwill, intangible and fixed assets and investments; gains and losses on asset sales; merger-related and restructuring costs; changes in the Company’s equity award reimbursement obligation to Time Warner Inc.; and certain changes to income tax provision; as well as the impact of taxes on the above items. (3) Diluted earnings per share (EPS) is defined as net income per diluted common share attributable to TWC common shareholders. (4) Free Cash Flow is defined as cash provided by operating activities (as defined under GAAP) excluding the impact, if any, of cash provided or used by discontinued operations, plus (i) any income taxes paid on investment sales and (ii) any excess tax benefit from equity-based compensation, less (i) capital expenditures, (ii) cash paid for other intangible assets (excluding those associated with business combinations), (iii) partnership distributions to third parties and (iv) principal payments on capital leases. (5) ARPU represents average monthly revenue per unit. Total customer relationship ARPU represents total revenue divided by the corresponding average customer relationships for the period. (6) Adjusted OIBDA margin is defined as Adjusted OIBDA as a percentage of total revenue. (7) Operating Income margin is defined as Operating Income as a percentage of total revenue. (8) Capital intensity is defined as capital expenditures as a percentage of total revenue. 12

© Copyright 2026