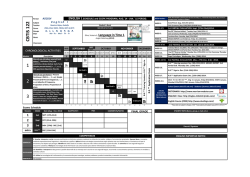

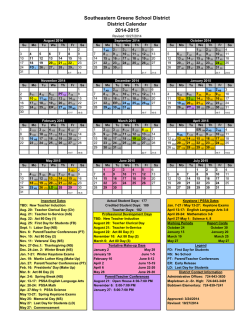

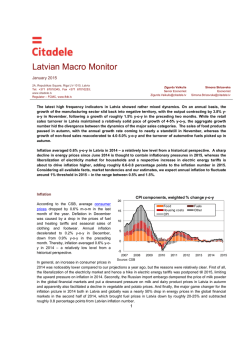

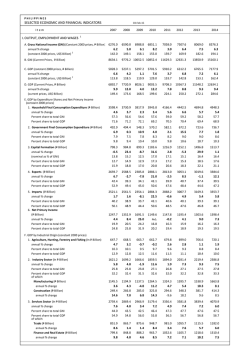

Table 0. SUMMARY OF INDICATORS Year-on-year percentage

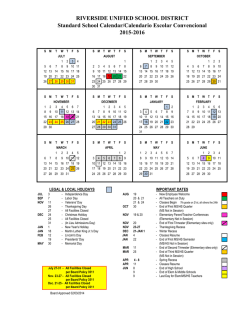

Table 0. SUMMARY OF INDICATORS Year-on-year percentage change except as indicated Last Quarters Activity GDP volume (QNA)(2)(**) - Domestic demand contribution (2) - Net exports contribution (2) Composite Activity Indicator (sca) Large Firms Sales (3) Economic Sentiment Indicator Electric power consumption (4) IPI calendar adjusted Industrial Confidence Indicator (5) Cement Apparent Consumption Industry capacity utilization % Domestic Demand Consumer Goods. Apparent cons.(*) Retail sales index (3) Passenger car registrations (6) Consumer confidence indicator (5) Capital Goods. Apparent cons.(*) Truck registrations (6) Private Sector Financing (def.) External Demand (Custom Basis) Export of goods: Value. Volume. Import of goods: Value. Volume. Trade balance. Value(Million €) (7) Labour Market Labour force Employment Unemployment - Unemployment rate % of lab.force Registered unemployment SS covered workers Prices and Wages CPI Core CPI (8) CPI differential eurozone (9) Producer prices Wages Collective bargaining (10) Total labour cost per worker Net borrowing (-) %GDP (11) Monetary and Financial Sector (12) Latest data 2013 2014(1) I.14 II.14 III.14 -2.1 -4.3 2.2 -1.6 -6.0 89.2 -2.2 -6.7 -17.5 -33.6 72.9 -1.2 -2.7 1.4 0.2 -2.9 93.2 -2.2 -1.5 -13.9 -20.7 72.5 1.2 1.9 -0.7 2.2 2.4 102.9 -0.2 1.4 -7.1 -0.3 75.9 0.7 1.2 -0.5 1.9 1.5 101.0 -0.3 1.5 -9.1 -3.2 75.6 1.3 2.2 -0.9 2.1 2.4 102.5 0.9 2.6 -8.2 -3.5 75.4 1.6 2.5 -0.9 2.4 2.2 103.7 0.3 0.7 -5.7 2.9 75.8 2.5 3.8 104.4 -1.7 0.4 -5.3 4.0 76.8 3.1 104.2 -1.1 0.9 -4.0 5.1 - 4.5 105.6 -2.5 -0.1 -5.8 2.7 - Q.3. 14 Q.3. 14 Q.3. 14 Q.4. 14 Nov. 14 Dec. 14 Dec. 14 Nov. 14 Dec. 14 Nov. 14 Q.4. 14 -7.6 -7.2 -12.1 -31.7 -13.1 -24.2 -5.5 -1.8 -3.8 4.1 -25.3 -3.5 -0.4 -9.2 7.1 0.5 18.8 -8.9 7.5 26.1 -5.6 6.9 -0.1 12.0 -11.8 10.6 29.4 -6.2 9.7 0.7 23.6 -6.1 7.7 31.3 -5.7 4.8 0.3 13.5 -7.9 4.3 15.5 -5.1 7.6 1.5 24.9 -9.6 7.9 27.4 -5.0 4.1 0.7 23.3 -11.8 2.6 17.4 -5.2 7.6 2.3 23.2 -7.1 7.9 28.9 -4.8 Oct. 14 Nov. 14 Dec. 14 Dec. 14 Oct. 14 Dec. 14 Nov. 14 3.8 1.7 -2.8 -7.1 -2563 5.2 5.4 -1.3 3.1 -1330 2.1 3.0 6.2 8.8 -2109 3.2 3.0 7.0 12.7 -2818 -2.0 -1.1 3.7 4.0 -2155 4.8 6.2 7.3 9.7 -1827 4.1 6.6 7.7 9.9 -2240 9.6 8.1 7.5 11.5 -2374 4.1 6.6 7.7 9.9 -2240 Oct. 14 Oct. 14 Oct. 14 Oct. 14 Oct. 14 0.0 -4.3 15.9 24.8 10.9 -3.4 -1.1 -2.8 4.1 26.1 2.6 -3.3 -1.3 0.8 -7.0 24.7 -5.6 1.6 -1.8 -0.5 -5.5 25.9 -4.2 0.4 -1.0 1.1 -7.0 24.5 -6.4 1.5 -1.0 1.6 -8.7 23.7 -5.9 2.0 -5.8 2.3 -6.2 2.5 -5.4 2.6 Q.3. 14 Q.3. 14 Q.3. 14 Q.3. 14 Dec. 14 Dec. 14 2.4 1.6 -0.1 3.8 1.2 -0.6 1.4 1.4 0.1 0.6 0.5 0.2 -0.1 0.0 -0.6 -1.1 -0.3 0.0 0.1 -0.7 -2.2 0.6 -0.2 0.2 0.1 -0.4 -0.1 0.5 -0.1 -0.3 0.0 -0.8 -0.9 0.6 -0.4 -0.2 -0.1 -0.7 -1.3 0.6 - -0.1 -0.1 -0.6 -1.2 0.6 - -0.4 -0.1 -0.8 -1.5 0.6 - Nov. 14 Nov. 14 Nov. 14 Nov. 14 Nov. 14 Q.3. 14 Public sector. State operations September -4.18 -4.32 -3.34 2013 -3.47 2014 -3.11 IV.14(1) Previous data 2012 October 2013 -3.48 2014 -2.90 2014 Dec. 0.05 0.08 0.33 1.78 114 1.23 3.66 Date November 2013 -3.78 2014 -3.34 Sep. Oct. Nov. 25-Dec 1-Jan 8-Jan Eurozone intervention rate (13) 0.75 0.25 0.05 0.05 0.05 0.05 0.05 0.05 0.05 3M Interbank rate.Euribor 0.57 0.22 0.21 0.10 0.08 0.08 0.01 0.08 0.07 1Y Interbank rate. Euribor 1.11 0.54 0.48 0.36 0.34 0.33 0.33 0.33 0.32 10Y Gov.Bond yield Spain 5.87 4.58 2.74 2.23 2.15 2.09 1.67 1.61 1.68 Differential Spain - Germany 430 295 150 123 128 130 108 107 117 Exchange rate ($/€) 1.29 1.33 1.33 1.29 1.27 1.25 1.22 1.21 1.18 Stock exchange Madrid IBEX-35 (14) -4.62 21.42 3.66 9.16 5.66 8.61 5.70 0.00 -1.60 Memorandum Items EE.UU Intervention rate.(13) 0.25 0.25 0.25 0.25 0.25 0.25 0.25 0.25 0.25 0.25 Brent oil Price $ per barrel 111.75 108.69 99.07 97.43 87.46 78.81 62.86 58.05 55.57 51.13 (1) Available period data. (2) Adjusted for seasonal and calendar effects; contributions in percentage points. (3) Calendar adjusted data (4) Adjusted for calendar and temperature effects. (5) Balances in %.(sa). (6) DGT estimation. (7) Monthly average. (8) CPI excluding energy and unprocessed food. (9) Difference between Spanish and Euro zone harmonized CPI. (10) Accumulated figure; annual data include the application of wage revision clauses. (11) Accumulated data since January. (12) Period averages. (13) Level at the end of the period. (14) Percentage change accumulated since the beginning of the year. (*) New methodology applied to the published data. (**)(ESA 2010 new base 2010). Source: S. G. de Análisis Coyuntural y Previsiones Económicas. from different sources. D. G. de Análisis Macroeconómico y Economía Internacional S. G. de Análisis Coyuntural y Previsiones Económicas 09/01/2015 Graph 0. SUMMARY INDICATORS 6 GDP AND COMPONENTS (Adjusted Data) y-o-y % change DOMESTIC DEMAND: COMPONENTS (Adjusted Data) y-o-y % change 17 0 0 -6 Domestic Demand (contrib.) -17 Households Cons.Exp. GDP 2009 10 GFCF Equip.and others Net exports (contrib.) -12 2010 2011 2012 2013 2014 INDUSTRY: PRODUCTION AND CONFIDENCE y-o-y % change and balances GFCF Construction -34 2009 2010 2011 2012 2013 2014 ACTIVITY INDICATORS y-o-y % change 10 110 0 90 0 -10 -20 70 -10 Large Firms Sales (left) -30 Elect.Power Con (left) ICl -40 2009 30 Econ.Sent.I.(right) IPI calendar adjusted 2010 2011 2012 50 -20 2013 2014 IMPORTS AND EXPORTS. CUSTOMS y-o-y % change (volume) 2009 2010 2011 2012 2013 2014 CONSUMER GOODS. APPARENT CONSUMPTION y-o-y % change 20 15 0 0 -20 Consumer goods (adjusted) -15 Imports Capital goods (adjusted) Exports -40 -30 2009 2010 2011 2012 2013 2014 2009 EMPLOYMENT (y-o-y % change) 4 4 2010 2011 2012 2013 2014 CONSUMER PRICES (y-o-y % change) Employment LFS Social Security covered workers 3 0 1 -4 -1 CPI Core inflation -2 -8 2009 2010 2011 2012 2013 D. G. de Análisis Macroeconómico y Economía Internacional S. G. de Análisis Coyuntural y Previsiones Económicas 2014 2009 2010 2011 2012 2013 2014 09/01/2015

© Copyright 2026