TOYOTA MOTOR CORP

February 5, 2015

NYSE: TM

TOYOTA MOTOR CORP

BUY

A+

A

A-

HOLD

B+

B

Annual Dividend Rate

$2.89

B-

C+

C

Annual Dividend Yield

2.17%

SELL

C-

D+

D

Beta

0.64

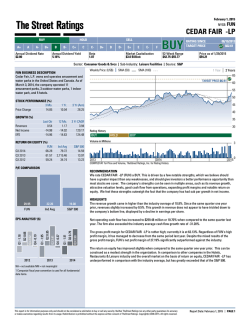

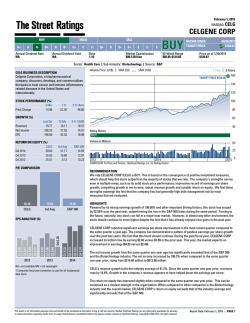

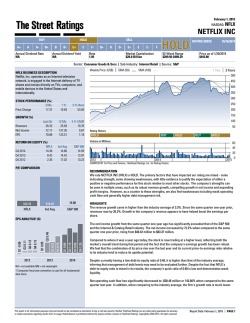

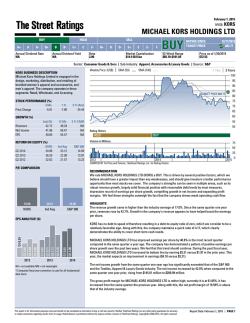

Sector: Consumer Goods & Svcs

TM BUSINESS DESCRIPTION

Toyota Motor Corporation designs, manufactures,

assembles, and sells passenger cars, minivans,

commercial vehicles, and related parts and

accessories in Japan, North America, Europe, Asia,

and internationally. It operates through Automotive,

Financial Services, and All Other segments.

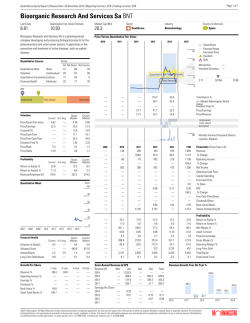

Weekly Price: (US$)

D-

E+

E

E-

F

Market Capitalization

$226.7 Billion

BUY

52-Week Range

$103.38-$134.24

Sub-Industry: Automobile Manufacturers

SMA (50)

RATING SINCE

TARGET PRICE

SMA (100)

04/02/2012

$153.25

Price as of 2/4/2015

$132.68

Source: S&P

1 Year

2 Years

160

TARGET

TARGET

TARGETPRICE

PRICE

PRICE$153.25

$153.25

$153.25

TARGET

150

140

130

120

STOCK PERFORMANCE (%)

3 Mo.

Price Change

11.12

1 Yr.

17.94

3 Yr (Ann)

20.16

12 Mo.

3.02

2.18

2.20

3 Yr CAGR

2.14

95.53

94.55

110

100

90

GROWTH (%)

Last Qtr

-8.03

-4.33

-4.05

Revenues

Net Income

EPS

80

Rating History

BUY

Volume in Millions

5

RETURN ON EQUITY (%)

TM

12.93

12.76

6.77

Q3 2014

Q3 2013

Q3 2012

Ind Avg

6.95

7.74

8.41

S&P 500

14.59

13.97

13.23

3

2013

2014

2015

0

COMPUSTAT for Price and Volume, TheStreet Ratings, Inc. for Rating History

RECOMMENDATION

We rate TOYOTA MOTOR CORP (TM) a BUY. This is based on the convergence of positive investment

measures, which should help this stock outperform the majority of stocks that we rate. The company's

strengths can be seen in multiple areas, such as its attractive valuation levels, solid stock price performance,

notable return on equity and largely solid financial position with reasonable debt levels by most measures.

We feel these strengths outweigh the fact that the company has had sub par growth in net income.

P/E COMPARISON

11.93

14.42

19.27

TM

Ind Avg

S&P 500

HIGHLIGHTS

TOYOTA MOTOR CORP' earnings per share from the most recent quarter came in slightly below the year

earlier quarter. This company has reported somewhat volatile earnings recently. But, we feel it is poised for

EPS growth in the coming year. During the past fiscal year, TOYOTA MOTOR CORP increased its bottom line

by earning $11.17 versus $6.46 in the prior year. This year, the market expects an improvement in earnings

($11.69 versus $11.17).

EPS ANALYSIS¹ ($)

2013

Q3 2.61

Q2 2.83

Q1 3.66

Q4 2.02

Q3 2.72

Q2 2.85

Q1 3.58

Q3 0.28

2012

Q4 1.73

Q2 2.15

Q1 2.30

Compared to where it was a year ago today, the stock is now trading at a higher level, regardless of the

company's weak earnings results. Turning our attention to the future direction of the stock, it goes without

saying that even the best stocks can fall in an overall down market. However, in any other environment, this

stock still has good upside potential despite the fact that it has already risen in the past year.

The return on equity has improved slightly when compared to the same quarter one year prior. This can be

construed as a modest strength in the organization. Compared to other companies in the Automobiles

industry and the overall market on the basis of return on equity, TOYOTA MOTOR CORP has outperformed in

comparison with the industry average, but has underperformed when compared to that of the S&P 500.

2014

NA = not available NM = not meaningful

1 Compustat fiscal year convention is used for all fundamental

data items.

Regardless of the drop in revenue, the company managed to outperform against the industry average of 8.9%.

Since the same quarter one year prior, revenues slightly dropped by 8.0%. Weakness in the company's

revenue seems to have hurt the bottom line, decreasing earnings per share.

This report is for information purposes only and should not be considered a solicitation to buy or sell any security. Neither TheStreet Ratings nor any other party guarantees its accuracy

or makes warranties regarding results from its usage. Redistribution is prohibited without the express written consent of TheStreet Ratings. Copyright(c) 2006-2015. All rights reserved.

Report Date: February 5, 2015

PAGE 1

February 5, 2015

NYSE: TM

TOYOTA MOTOR CORP

Sector: Consumer Goods & Svcs Automobile Manufacturers Source: S&P

Annual Dividend Rate

$2.89

Annual Dividend Yield

2.17%

PEER GROUP ANALYSIS

140%

KNDI

V

FA

AB

OR

LE

R

VO

FA

HMC

LE

AB

-20%

UN

THO WGO

TM

2%

Price as of 2/4/2015

$132.68

Huge health care and fringe benefits provided to big three employees give foreign competitors a strong

advantage. All three are negotiating new labor contracts with the United Auto Workers (UAW) union. With

these on-going negotiations, the big three hope to reduce the profit-per-vehicle gap. Reduced sales, different

platforms for parts, high raw material costs and tough exchange rates are other hurdles facing the industry.

16%

EBITDA Margin (TTM)

Companies with higher EBITDA margins and

revenue growth rates are outperforming companies

with lower EBITDA margins and revenue growth

rates. Companies for this scatter plot have a market

capitalization between $573.7 Million and $226.7

Billion. Companies with NA or NM values do not

appear.

*EBITDA – Earnings Before Interest, Taxes, Depreciation and

Amortization.

REVENUE GROWTH AND EARNINGS YIELD

Consumer choice in vehicles is more than ever being influenced by fuel efficiency. Automakers are exploring

alternate fuels such as ethanol and electric fuel cells and are delivering hybrid gasoline-electric vehicles and

pure-electric car for sale. The new cars are lighter, provide better fuel efficiency, enhanced safety features,

and many come with tax credits from the government to make costs competitive. Having an auto industry is

considered to be in the strategic interest of America and was bailed-out to help it survive the Great

Recession.

140%

V

FA

AB

OR

Manufacturers have recognized growing demand from developing economies and the opportunity to increase

auto parts sourcing from these economies.

LE

PEER GROUP: Automobiles

TSLA

UN

THO

R

VO

FA

LE

AB

-2%

US congress toughened the Corporate Average Fuel Economy (CAFE) regulations in 2007 that no longer grant

exemptions to light trucks classified as SUVs or passenger vans unless they exceed 10,000 lbs. In the near

future, the standard is to be modified to accommodate many larger vehicles.

The motorcycle industry is reeling under pressures such as volatile raw material costs, high gasoline prices

and reduced consumer spending. Harley’s heavy motorcycle sales have remained relatively flat, but light

motorcycle sales have been hurt by tough economic conditions.

KNDI

-20%

52-Week Range

$103.38-$134.24

Surging oil prices have shifted demand away from SUVs and light trucks to more fuel-efficient options. This

change in consumer preferences has supported German, Japanese and Korean manufacturers, whose

market share has consequently expanded. The big three are trying to adapt their product lines to changing

preferences.

TSLA

Revenue Growth (TTM)

Market Capitalization

$226.7 Billion

INDUSTRY ANALYSIS

The automobile industry is comprised of companies that design, manufacture, engineer, assemble and market

automobiles and motorcycles as well as provide leasing and financial services. Industry performance is

closely linked with overall economic performance. Major players include General Motors (GM), Ford Motor

Company (F) and Chrysler. This group is commonly referred to as Detroit’s big three. BMW, Daimler (DAI),

Honda (HMC), Hyundai, Mazda, Nissan, Subaru, Toyota (TM) and Harley-Davidson (HOG) are other prominent

players. There are also niche players such as Winnebago Industries (WGO) for motor- homes and Tesla

Motors (TSLA) for high-end electric cars.

REVENUE GROWTH AND EBITDA MARGIN*

Revenue Growth (TTM)

Beta

0.64

GM

F HOG

WGO

HMC

TM

10%

Earnings Yield (TTM)

Companies that exhibit both a high earnings yield

and high revenue growth are generally more

attractive than companies with low revenue growth

and low earnings yield. Companies for this scatter

plot have revenue growth rates between -1.6% and

138.8%. Companies with NA or NM values do not

appear.

Ticker

TM

KNDI

F

GM

WGO

HMC

THO

TSLA

HOG

Company Name

TOYOTA MOTOR CORP

KANDI TECHNOLOGIES GROUP

FORD MOTOR CO

GENERAL MOTORS CO

WINNEBAGO INDUSTRIES

HONDA MOTOR CO LTD

THOR INDUSTRIES INC

TESLA MOTORS INC

HARLEY-DAVIDSON INC

Recent

Price ($)

132.68

13.21

15.87

35.83

21.31

31.32

58.62

218.55

62.76

Market

Cap ($M)

226,750

611

59,954

57,699

574

56,734

3,130

27,402

13,447

Price/

Earnings

11.93

NM

20.35

21.85

13.15

10.65

17.60

NM

16.22

Net Sales

TTM ($M)

235,637.00

167.90

144,107.00

155,929.00

946.90

109,446.50

3,647.49

2,856.91

6,228.51

Net Income

TTM ($M)

17,613.00

-4.04

3,187.00

3,949.00

43.80

5,285.75

176.82

-202.68

844.61

The peer group comparison is based on Major Automobile Manufacturers companies of comparable size.

This report is for information purposes only and should not be considered a solicitation to buy or sell any security. Neither TheStreet Ratings nor any other party guarantees its accuracy

or makes warranties regarding results from its usage. Redistribution is prohibited without the express written consent of TheStreet Ratings. Copyright(c) 2006-2015. All rights reserved.

Report Date: February 5, 2015

PAGE 2

February 5, 2015

NYSE: TM

TOYOTA MOTOR CORP

Sector: Consumer Goods & Svcs Automobile Manufacturers Source: S&P

Annual Dividend Rate

$2.89

Annual Dividend Yield

2.17%

COMPANY DESCRIPTION

Toyota Motor Corporation designs, manufactures,

assembles, and sells passenger cars, minivans,

commercial vehicles, and related parts and accessories

in Japan, North America, Europe, Asia, and

internationally. It operates through Automotive, Financial

Services, and All Other segments. The company offers

hybrid cars under the Prius, Crown, Lexus RX450h,

HS250h, SAI, and CT200h brand names; conventional

engine vehicles, including subcompact and compact cars

under the Corolla, Yaris, micropremium iQ, Passo, Ractis,

Vitz, Corolla Axio/Fielder, Porte, Spade, Auris, Etios, and

Vios brand names; mini-vehicles, passenger vehicles,

commercial vehicles, and auto parts under the Toyota

brand name; mid-size cars under the Camry, REIZ,

Avensis, and Mark X brand names; luxury cars under the

Lexus and Crown brand names; Century limousines; and

sports cars under the Scion tC and Lexus brand names. It

also manufactures sport-utility vehicles under the

Sequoia, 4Runner, RAV4, Highlander, FJ Cruiser, Land

Cruiser, and Lexus brand names; pickup trucks under the

Tacoma and Tundra brand names; minivans under the

Alphard, Vellfire, Corolla Verso, Wish, Noah/Voxy,

Estima, Sienta, Isis, and the Sienna brand names; large,

medium, and small trucks; and large, small, and

micro-buses. Toyota Motor Corporation sells its products

through dealers. In addition, it provides a range of

financial services comprising retail financing, retail

leasing, wholesale financing, insurance, and credit cards.

Further, the company is involved in the design,

manufacture, and sale of prefabricated housing;

information technology related businesses, such a Web

portal for automobile information known as GAZOO.com;

and sale promotion of KDDI communication related

products, primarily the au brand. Toyota Motor

Corporation was founded in 1933 and is headquartered

in Toyota City, Japan.

TOYOTA MOTOR CORP

1 Toyota-cho

Toyota City 471-8571

JPN

Phone: 81 5 6528 2121

http://www.toyota.co.jp

Employees: 339000

Beta

0.64

Market Capitalization

$226.7 Billion

52-Week Range

$103.38-$134.24

Price as of 2/4/2015

$132.68

STOCK-AT-A-GLANCE

Below is a summary of the major fundamental and technical factors we consider when determining our

overall recommendation of TM shares. It is provided in order to give you a deeper understanding of our rating

methodology as well as to paint a more complete picture of a stock's strengths and weaknesses. It is

important to note, however, that these factors only tell part of the story. To gain an even more comprehensive

understanding of our stance on the stock, these factors must be assessed in combination with the stock’s

valuation. Please refer to our Valuation section on page 5 for further information.

FACTOR

SCORE

4.0

Growth

out of 5 stars

weak

Measures the growth of both the company's income statement and

cash flow. On this factor, TM has a growth score better than 70% of the

stocks we rate.

strong

4.5

Total Return

out of 5 stars

weak

Measures the historical price movement of the stock. The stock

performance of this company has beaten 80% of the companies we

cover.

strong

4.0

Efficiency

out of 5 stars

weak

Measures the strength and historic growth of a company's return on

invested capital. The company has generated more income per dollar of

capital than 70% of the companies we review.

strong

4.0

Price volatility

out of 5 stars

weak

Measures the volatility of the company's stock price historically. The

stock is less volatile than 70% of the stocks we monitor.

strong

3.0

Solvency

out of 5 stars

weak

Measures the solvency of the company based on several ratios. The

company is more solvent than 50% of the companies we analyze.

strong

4.0

Income

out of 5 stars

weak

Measures dividend yield and payouts to shareholders. The company's

dividend is higher than 70% of the companies we track.

strong

THESTREET RATINGS RESEARCH METHODOLOGY

TheStreet Ratings' stock model projects a stock's total return potential over a 12-month period including both

price appreciation and dividends. Our Buy, Hold or Sell ratings designate how we expect these stocks to

perform against a general benchmark of the equities market and interest rates. While our model is

quantitative, it utilizes both subjective and objective elements. For instance, subjective elements include

expected equities market returns, future interest rates, implied industry outlook and forecasted company

earnings. Objective elements include volatility of past operating revenues, financial strength, and company

cash flows.

Our model gauges the relationship between risk and reward in several ways, including: the pricing drawdown

as compared to potential profit volatility, i.e.how much one is willing to risk in order to earn profits; the level of

acceptable volatility for highly performing stocks; the current valuation as compared to projected earnings

growth; and the financial strength of the underlying company as compared to its stock's valuation as

compared to projected earnings growth; and the financial strength of the underlying company as compared

to its stock's performance. These and many more derived observations are then combined, ranked, weighted,

and scenario-tested to create a more complete analysis. The result is a systematic and disciplined method of

selecting stocks.

This report is for information purposes only and should not be considered a solicitation to buy or sell any security. Neither TheStreet Ratings nor any other party guarantees its accuracy

or makes warranties regarding results from its usage. Redistribution is prohibited without the express written consent of TheStreet Ratings. Copyright(c) 2006-2015. All rights reserved.

Report Date: February 5, 2015

PAGE 3

February 5, 2015

NYSE: TM

TOYOTA MOTOR CORP

Sector: Consumer Goods & Svcs Automobile Manufacturers Source: S&P

Annual Dividend Rate

$2.89

Annual Dividend Yield

2.17%

Consensus EPS Estimates² ($)

IBES consensus estimates are provided by Thomson Financial

NA

11.69 E

12.92 E

NA

2015(E)

2016(E)

Beta

0.64

Market Capitalization

$226.7 Billion

52-Week Range

$103.38-$134.24

Price as of 2/4/2015

$132.68

FINANCIAL ANALYSIS

TOYOTA MOTOR CORP's gross profit margin for the third quarter of its fiscal year 2014 has increased when

compared to the same period a year ago. Sales and net income have dropped, however the growth has

outpaced the average competitor within the industry. TOYOTA MOTOR CORP has weak liquidity. Currently,

the Quick Ratio is 0.83 which shows a lack of ability to cover short-term cash needs. The company's liquidity

has increased from the same period last year.

During the same period, stockholders' equity ("net worth") has remained unchanged from the same quarter

last year. Overall, the key liquidity measurements indicate that the company is in a position in which financial

difficulties could develop in the future.

STOCKS TO BUY: TheStreet Quant Ratings has identified a handful of stocks that can potentially TRIPLE in the

next 12-months. To learn more visit www.TheStreetRatings.com.

INCOME STATEMENT

Net Sales ($mil)

EBITDA ($mil)

EBIT ($mil)

Net Income ($mil)

Q3 FY14

49,788.00

7,898.00

5,318.00

4,133.00

Q3 FY13

54,131.00

7,492.00

4,860.00

4,320.00

Q3 FY14

37,886.00

389,839.00

160,619.00

136,137.00

Q3 FY13

33,948.00

384,970.00

155,563.00

135,013.00

Q3 FY14

25.47%

15.86%

10.68%

0.60

4.51%

12.93%

Q3 FY13

23.59%

13.84%

8.98%

0.59

4.47%

12.76%

Q3 FY14

1.06

0.54

54.00

98.48

Q3 FY13

1.05

0.54

47.00

103.40

Q3 FY14

1,573

0.00

2.61

86.56

NA

363,043

Q3 FY13

1,585

0.00

2.72

85.20

NA

364,719

BALANCE SHEET

Cash & Equiv. ($mil)

Total Assets ($mil)

Total Debt ($mil)

Equity ($mil)

PROFITABILITY

Gross Profit Margin

EBITDA Margin

Operating Margin

Sales Turnover

Return on Assets

Return on Equity

DEBT

Current Ratio

Debt/Capital

Interest Expense

Interest Coverage

SHARE DATA

Shares outstanding (mil)

Div / share

EPS

Book value / share

Institutional Own %

Avg Daily Volume

2 Sum of quarterly figures may not match annual estimates due to

use of median consensus estimates.

This report is for information purposes only and should not be considered a solicitation to buy or sell any security. Neither TheStreet Ratings nor any other party guarantees its accuracy

or makes warranties regarding results from its usage. Redistribution is prohibited without the express written consent of TheStreet Ratings. Copyright(c) 2006-2015. All rights reserved.

Report Date: February 5, 2015

PAGE 4

February 5, 2015

NYSE: TM

TOYOTA MOTOR CORP

Sector: Consumer Goods & Svcs Automobile Manufacturers Source: S&P

Annual Dividend Rate

$2.89

Annual Dividend Yield

2.17%

RATINGS HISTORY

Our rating for TOYOTA MOTOR CORP has not

changed since 4/2/2012. As of 2/4/2015, the stock

was trading at a price of $132.68 which is 1.2%

below its 52-week high of $134.24 and 28.3% above

its 52-week low of $103.38.

2 Year Chart

Beta

0.64

BUY: $98.13

$140

Price/Earnings

$120

$110

52-Week Range

$103.38-$134.24

1

2

3

premium

4

5

TM 11.93

Peers 14.42

• Discount. A lower P/E ratio than its peers can

signify a less expensive stock or lower growth

expectations.

• TM is trading at a discount to its peers.

Price/Projected Earnings

From

Buy

To

Buy

RATINGS DEFINITIONS &

DISTRIBUTION OF THESTREET RATINGS

3

47.33% Buy - We believe that this stock has the

opportunity to appreciate and produce a total return of

more than 10% over the next 12 months.

29.84% Hold - We do not believe this stock offers

conclusive evidence to warrant the purchase or sale of

shares at this time and that its likelihood of positive total

return is roughly in balance with the risk of loss.

22.83% Sell - We believe that this stock is likely to

decline by more than 10% over the next 12 months, with

the risk involved too great to compensate for any

possible returns.

4

5

Price/Book

1

2

3

premium

4

5

Price/Sales

1

2

premium

3

4

5

Price to Earnings/Growth

4

5

discount

1

2

3

premium

4

5

discount

TM 2.55

Peers 1.99

• Premium. The PEG ratio is the stock’s P/E divided by

the consensus estimate of long-term earnings

growth. Faster growth can justify higher price

multiples.

• TM trades at a significant premium to its peers.

Earnings Growth

1

2

3

4

lower

5

higher

TM 2.20

Peers 22.31

• Lower. Elevated earnings growth rates can lead to

capital appreciation and justify higher

price-to-earnings ratios.

• However, TM is expected to significantly trail its

peers on the basis of its earnings growth rate.

Sales Growth

discount

TM 0.89

Peers 1.24

• Discount. In the absence of P/E and P/B multiples,

the price-to-sales ratio can display the value

investors are placing on each dollar of sales.

• TM is trading at a significant discount to its

industry on this measurement.

3

TM 7.21

Peers 17.66

• Discount. The P/CF ratio, a stock’s price divided by

the company's cash flow from operations, is useful

for comparing companies with different capital

requirements or financing structures.

• TM is trading at a significant discount to its peers.

discount

TM 1.53

Peers 3.39

• Discount. A lower price-to-book ratio makes a

stock more attractive to investors seeking stocks

with lower market values per dollar of equity on the

balance sheet.

• TM is trading at a significant discount to its peers.

2

premium

discount

TM 10.27

Peers 31.32

• Discount. A lower price-to-projected earnings ratio

than its peers can signify a less expensive stock or

lower future growth expectations.

• TM is trading at a significant discount to its peers.

(as of 2/4/2015)

Research Contact: 212-321-5381

Sales Contact: 866-321-8726

2

premium

Price reflects the closing price as of the date listed, if available

TheStreet Ratings

14 Wall Street, 15th Floor

New York, NY 10005

www.thestreet.com

1

1

Price/CashFlow

discount

2014

MOST RECENT RATINGS CHANGES

Date

Price

Action

2/1/13

$98.13 No Change

Price as of 2/4/2015

$132.68

VALUATION

BUY. This stock's P/E ratio indicates a discount compared to an average of 14.42 for the Automobiles industry

and a discount compared to the S&P 500 average of 19.27. To use another comparison, its price-to-book ratio

of 1.53 indicates a discount versus the S&P 500 average of 2.72 and a significant discount versus the industry

average of 3.39. The current price-to-sales ratio is well below the S&P 500 average and is also below the

industry average, indicating a discount. Upon assessment of these and other key valuation criteria, TOYOTA

MOTOR CORP proves to trade at a discount to investment alternatives within the industry.

$130

2013

Market Capitalization

$226.7 Billion

1

2

3

lower

4

5

higher

TM 3.02

Peers 6.73

• Lower. A sales growth rate that trails the industry

implies that a company is losing market share.

• TM significantly trails its peers on the basis of sales

growth

DISCLAIMER:

The opinions and information contained herein have been obtained or derived from sources believed to be reliable, but

TheStreet Ratings cannot guarantee its accuracy and completeness, and that of the opinions based thereon. Data is provided

via the COMPUSTAT® Xpressfeed product from Standard &Poor's, a division of The McGraw-Hill Companies, Inc., as well as

other third-party data providers.

TheStreet Ratings is a division of TheStreet, Inc., which is a publisher. This research report contains opinions and is provided

for informational purposes only. You should not rely solely upon the research herein for purposes of transacting securities or

other investments, and you are encouraged to conduct your own research and due diligence, and to seek the advice of a

qualified securities professional, before you make any investment. None of the information contained in this report constitutes,

or is intended to constitute a recommendation by TheStreet Ratings of any particular security or trading strategy or a

determination by TheStreet Ratings that any security or trading strategy is suitable for any specific person. To the extent any of

the information contained herein may be deemed to be investment advice, such information is impersonal and not tailored to the

investment needs of any specific person. Your use of this report is governed by TheStreet, Inc.'s Terms of Use found at

http://www.thestreet.com/static/about/terms-of-use.html.

This report is for information purposes only and should not be considered a solicitation to buy or sell any security. Neither TheStreet Ratings nor any other party guarantees its accuracy

or makes warranties regarding results from its usage. Redistribution is prohibited without the express written consent of TheStreet Ratings. Copyright(c) 2006-2015. All rights reserved.

Report Date: February 5, 2015

PAGE 5

© Copyright 2026