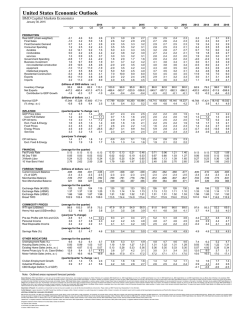

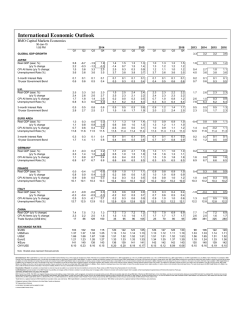

Canadian Economic Outlook

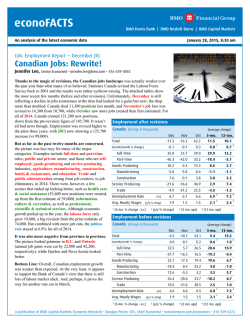

Canadian Economic Outlook BMO Capital Markets Economics January 30, 2015 Q1 PRODUCTION Real GDP (chain-weighted) Final Sales Final Domestic Demand Consumer Spending Durables Non-Durables Services Government Spending Business Investment Non-Residential Construction Machinery and Equipment Residential Construction Exports Imports Q2 Q3 2014 Q4 Q1 Q2 2015 Q4 Q3 Q1 Q2 Q3 2016 Q4 2013 2014 2015 2016 (quarter/quarter % change : a.r.) 1.0 3.6 2.8 2.0 2.0 5.8 3.6 0.7 0.1 3.3 2.8 2.0 1.5 4.4 2.8 2.7 1.6 14.9 12.6 3.0 4.0 -0.5 -0.7 2.5 1.3 3.5 2.1 2.6 -0.7 1.4 0.3 1.0 -1.9 0.8 0.5 1.7 -0.3 0.5 -1.9 1.0 -5.0 1.4 5.2 3.0 -4.2 11.4 12.5 0.0 0.9 19.0 6.9 -4.0 -4.8 9.8 4.0 0.0 1.1 0.9 -0.7 2.7 2.0 2.8 2.7 0.0 -19.3 -20.0 -18.0 1.0 2.7 -2.5 1.8 1.7 0.3 2.5 1.0 2.7 2.7 0.2 -10.7 -11.0 -10.0 1.0 4.4 0.0 2.0 2.2 1.3 2.3 1.5 2.5 2.3 0.7 -1.3 -1.8 -0.5 0.5 5.0 1.9 2.2 2.3 1.6 2.3 2.0 2.3 2.4 1.1 0.4 0.0 1.0 0.0 5.3 3.1 2.3 2.3 1.9 2.2 2.0 2.3 2.2 1.1 3.2 3.0 3.5 0.0 5.1 3.5 2.3 2.4 2.1 2.1 1.5 2.2 2.1 1.5 5.3 5.5 5.0 -0.5 4.6 3.6 2.0 2.0 2.0 1.9 1.7 1.9 2.0 1.3 5.7 6.0 5.0 -1.0 4.4 4.1 2.1 2.1 2.1 2.0 1.5 2.0 2.1 1.5 6.2 6.5 5.5 -1.0 4.1 3.9 2.0 1.8 1.5 2.5 3.8 2.3 2.3 0.1 2.6 5.0 -1.7 -0.4 2.0 1.3 2.4 2.8 1.6 2.8 5.7 2.7 2.1 -0.1 -0.4 -0.1 -1.1 2.5 5.1 1.5 2.0 1.9 1.1 2.7 4.0 2.0 2.6 0.5 -6.9 -7.7 -5.5 2.7 3.6 0.9 2.2 2.2 1.7 2.2 1.7 2.3 2.2 1.1 2.0 1.9 2.2 -0.2 4.8 3.1 (billions of chained 2007 dollars : a.r.) 13.3 4.8 0.6 6.4 -0.9 -2.0 -1.0 1.3 -29.6 -19.3 -15.6 -21.4 1.8 2.8 0.9 -1.3 7.2 0.2 -14.2 1.6 7.9 0.1 -8.1 1.3 7.1 -0.2 -3.8 0.9 6.7 -0.1 -0.8 0.6 6.4 -0.1 1.3 0.4 6.1 -0.1 2.8 0.2 6.1 0.0 3.2 0.0 6.2 0.0 3.6 0.0 12.4 0.2 -39.6 0.2 6.3 -0.4 -21.5 1.1 7.2 0.1 -6.7 0.8 6.2 -0.1 2.7 0.5 Nominal GDP (% chng : a.r.) (billions of dollars : a.r.) 1,950 1,969 1,992 6.7 3.9 4.7 1,972 -3.8 1,980 1.6 2,001 4.4 2,024 4.6 2,048 4.8 2,073 5.0 2,099 5.1 2,126 5.3 1,894 3.4 1,976 4.3 1,994 1.0 2,087 4.6 INFLATION GDP Price Index CPI All Items Excl. Food & Energy Food Prices Energy Prices Services (quarter/quarter % change : a.r.) 5.5 0.4 1.8 -2.0 2.8 3.7 1.3 0.1 2.4 2.3 2.1 1.2 2.2 5.5 1.5 3.9 11.2 11.2 -5.8 -17.5 1.6 3.6 3.3 0.2 -4.8 -1.9 1.5 2.8 -35.0 0.9 -0.2 1.8 1.8 1.6 1.9 2.1 2.4 2.2 2.1 2.2 3.0 2.0 2.4 2.3 2.0 2.6 4.4 2.1 2.5 2.1 2.0 1.7 4.4 2.1 2.6 1.9 1.6 2.1 5.0 2.3 3.0 2.2 2.0 1.9 5.2 2.0 3.1 2.4 2.4 2.1 3.4 2.2 1.4 0.9 0.9 1.2 1.5 1.4 1.9 1.9 1.6 2.3 3.5 2.1 -1.0 0.7 1.8 2.7 -12.6 1.7 2.4 2.1 1.9 2.1 4.2 2.1 CPI All Items BoC Core (year/year % change) 1.4 2.2 2.1 1.3 1.7 2.0 1.9 2.2 0.8 2.1 0.3 1.9 0.5 1.9 1.1 2.1 2.1 2.1 2.1 2.0 2.1 2.0 2.2 2.0 1.2 1.8 2.0 2.0 FINANCIAL Overnight Rate 3-Month T-Bill 90-Day BAs 10 Year Bond Yield (average for the quarter : %) 1.00 1.00 1.00 0.87 0.93 0.94 1.26 1.27 1.28 2.47 2.35 2.14 1.00 0.90 1.28 1.95 0.67 0.60 1.00 1.42 0.50 0.41 0.81 1.42 0.50 0.41 0.81 1.58 0.50 0.41 0.81 1.82 0.75 0.67 1.06 1.99 1.00 0.93 1.31 2.13 1.25 1.18 1.55 2.27 1.50 1.44 1.80 2.40 1.00 0.97 1.20 2.26 1.00 0.91 1.27 2.23 0.55 0.46 0.86 1.56 1.15 1.06 1.43 2.20 91 -36 87 -33 58 -37 39 -39 31 -39 8 -40 10 -41 13 -42 15 -43 18 -45 91 -9 88 -31 34 -39 14 -43 FOREIGN TRADE Current Account Balance (% of GDP) Merchandise Balance Non-Merchandise Balance (billions of dollars : a.r.) -45.0 -39.6 -33.6 -2.3 -2.0 -1.7 6.3 9.3 11.6 -51.4 -48.9 -45.2 -52.7 -2.6 -10.2 -42.4 -73.7 -3.7 -33.4 -40.3 -76.2 -3.8 -37.1 -39.1 -67.7 -3.4 -29.1 -38.6 -62.5 -3.1 -24.7 -37.8 -58.0 -2.8 -21.3 -36.7 -54.1 -2.6 -18.3 -35.8 -49.9 -2.4 -14.8 -35.1 -45.9 -2.2 -11.7 -34.2 -56.3 -3.0 -7.2 -49.0 -42.7 -2.2 4.2 -47.0 -70.0 -3.5 -31.1 -38.9 -52.0 -2.5 -16.5 -35.4 Exchange Rate (US¢/C$) Exchange Rate (C$/US$) Exchange Rate (¥/C$) Exchange Rate (C$/Euro) (average for the quarter) 90.6 91.7 91.8 1.103 1.090 1.089 93.1 93.6 95.5 1.51 1.50 1.44 88.1 1.135 100.8 1.42 81.6 1.226 98.1 1.39 78.9 1.267 96.0 1.45 78.7 1.271 96.8 1.45 79.5 1.257 99.1 1.42 80.5 1.242 101.3 1.40 81.4 1.229 103.4 1.37 82.2 1.217 105.5 1.35 83.0 1.204 107.6 1.33 97.1 1.030 94.7 1.37 90.6 1.105 95.8 1.47 79.7 1.255 97.5 1.43 81.8 1.223 104.5 1.36 INCOMES Corporate Profits Before Tax Corporate Profits After Tax Personal Income Real Disposable Income (year/year % change) 11.0 19.4 3.0 9.5 3.3 3.6 1.8 1.5 0.3 -0.1 3.1 1.3 -20.0 -11.4 1.7 0.2 -23.6 -15.5 1.5 0.6 -23.6 -17.0 2.1 1.0 -16.1 -10.7 2.9 1.4 1.7 1.1 4.5 2.5 7.7 4.2 5.1 3.0 9.4 5.2 4.7 2.4 11.0 6.2 4.8 2.3 0.7 7.3 3.7 2.5 10.0 5.0 3.4 1.6 -20.9 -13.7 2.1 0.8 7.4 4.2 4.8 2.6 Savings Rate (average for the quarter : %) 5.0 3.9 3.9 3.5 2.3 1.9 2.4 2.4 2.5 2.6 2.7 2.7 5.2 4.1 2.3 2.6 OTHER INDICATORS Unemployment Rate (%) Housing Starts (000s, a.r.) Existing Home Sales (y/y % ch) MLS Home Price Index (y/y % ch) Motor Vehicle Sales (mlns, a.r.) (quarter average) 7.0 7.0 176 196 1.9 6.3 5.0 5.1 1.74 1.85 6.7 185 6.2 5.4 1.96 6.7 184 0.5 3.4 1.93 6.7 177 -5.3 1.9 1.89 6.7 178 -4.6 2.1 1.88 6.6 183 -4.2 0.7 1.87 6.5 178 2.8 0.9 1.85 6.5 179 1.5 0.4 1.86 6.4 181 -2.6 -0.6 1.85 6.4 183 -1.5 -0.6 1.84 7.1 188 0.7 2.7 1.77 6.9 189 5.1 5.2 1.89 6.7 180 -3.5 2.0 1.89 6.4 180 0.0 0.0 1.85 (quarter/quarter % change : a.r.) Employment Growth 0.6 -0.0 0.7 1.6 Industrial Production 5.3 4.7 0.8 1.6 Federal Budget Balance (% of FY GDP) -0.0 -2.2 0.4 -0.6 0.9 1.3 1.0 1.3 1.4 3.2 1.0 3.8 1.0 3.3 0.9 3.0 1.4 1.8 -0.3 0.6 3.7 -0.1 0.6 0.3 0.3 1.0 2.5 0.4 Inventory Change Contribution to GDP Growth Net Exports Contribution to GDP Growth Canada/US spread: (bps) 90 day 10 year 82 -30 90 -27 10.4 7.8 3.8 2.0 7.0 199 6.0 5.3 1.99 1,991 -0.1 Note: Outlined areas represent forecast periods General Disclosure: “BMO Capital Markets” is a trade name used by the BMO Investment Banking Group, which includes the wholesale arm of Bank of Montreal and its subsidiaries BMO Nesbitt Burns Inc., BMO Capital Markets Ltd. in the U.K. and BMO Capital Markets Corp. in the U.S. BMO Nesbitt Burns Inc., BMO Capital Markets Ltd. and BMO Capital Markets Corp are affiliates. Bank of Montreal or its subsidiaries (“BMO Financial Group”) has lending arrangements with, or provide other remunerated services to, many issuers covered by BMO Capital Markets. The opinions, estimates and projections contained in this report are those of BMO Capital Markets as of the date of this report and are subject to change without notice. BMO Capital Markets endeavours to ensure that the contents have been compiled or derived from sources that we believe are reliable and contain information and opinions that are accurate and complete. However, BMO Capital Markets makes no representation or warranty, express or implied, in respect thereof, takes no responsibility for any errors and omissions contained herein and accepts no liability whatsoever for any loss arising from any use of, or reliance on, this report or its contents. Information may be available to BMO Capital Markets or its affiliates that is not reflected in this report. The information in this report is not intended to be used as the primary basis of investment decisions, and because of individual client objectives, should not be construed as advice designed to meet the particular investment needs of any investor. This material is for information purposes only and is not an offer to sell or the solicitation of an offer to buy any security. BMO Capital Markets or its affiliates will buy from or sell to customers the securities of issuers mentioned in this report on a principal basis. BMO Capital Markets or its affiliates, officers, directors or employees have a long or short position in many of the securities discussed herein, related securities or in options, futures or other derivative instruments based thereon. The reader should assume that BMO Capital Markets or its affiliates may have a conflict of interest and should not rely solely on this report in evaluating whether or not to buy or sell securities of issuers discussed herein. Dissemination of Research: Our publications are disseminated via email and may also be available via our web site http://www.bmonesbittburns.com/economics. Please contact your BMO Financial Group Representative for more information. Conflict Statement: A general description of how BMO Financial Group identifies and manages conflicts of interest is contained in our public facing policy for managing conflicts of interest in connection with investment research which is available at http://researchglobal.bmocapitalmarkets.com/Public/Conflict_Statement_Public.aspx. ADDITIONAL INFORMATION IS AVAILABLE UPON REQUEST BMO Financial Group (NYSE, TSX: BMO) is an integrated financial services provider offering a range of retail banking, wealth management, and investment and corporate banking products. BMO serves Canadian retail clients through BMO Bank of Montreal and BMO Nesbitt Burns. In the United States, personal and commercial banking clients are served by BMO Harris Bank N.A., Member FDIC. Investment and corporate banking services are provided in Canada and the US through BMO Capital Markets. BMO Capital Markets is a trade name used by BMO Financial Group for the wholesale banking businesses of Bank of Montreal, BMO Harris Bank N.A, BMO Ireland Plc, and Bank of Montreal (China) Co. Ltd. and the institutional broker dealer businesses of BMO Capital Markets Corp. (Member SIPC), BMO Nesbitt Burns Securities Limited (Member SIPC) and BMO Capital Markets GKST Inc. (Member SIPC) in the U.S., BMO Nesbitt Burns Inc. (Member Canadian Investor Protection Fund) in Canada, Europe and Asia, BMO Capital Markets Limited in Europe, Asia and Australia and BMO Advisors Private Limited in India. “Nesbitt Burns” is a registered trademark of BMO Nesbitt Burns Corporation Limited, used under license. “BMO Capital Markets” is a trademark of Bank of Montreal, used under license. "BMO (M-Bar roundel symbol)" is a registered trademark of Bank of Montreal, used under license. ® Registered trademark of Bank of Montreal in the United States, Canada and elsewhere. TM Trademark Bank of Montreal © COPYRIGHT 2015 BMO CAPITAL MARKETS CORP. A member of BMO Financial Group

© Copyright 2026