United States Economic Outlook

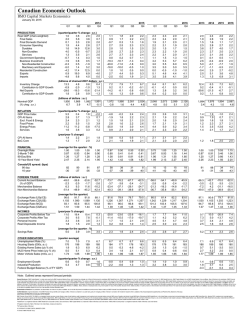

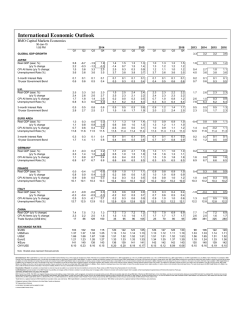

United States Economic Outlook BMO Capital Markets Economics January 30, 2015 Q1 PRODUCTION Real GDP (chain-weighted) Final Sales Final Domestic Demand Consumer Spending durables nondurables services Government Spending Business Investment non-residential construction equipment intellectual property Residential Construction Exports Imports 4.6 3.2 3.4 2.5 14.1 2.2 0.9 1.7 9.7 12.6 11.2 5.5 8.8 11.0 11.3 Q3 5.0 5.0 4.1 3.2 9.2 2.5 2.5 4.4 8.9 4.8 11.0 8.8 3.3 4.6 -0.9 2014 Q4 Q1 Q2 Q3 2015 Q4 Q1 Q2 Q3 2016 Q4 2013 2014 2015 2016 2.6 1.8 2.8 4.3 7.5 4.4 3.7 -2.2 1.9 2.6 -1.9 7.2 4.1 2.8 8.9 2.3 2.6 2.9 3.5 5.0 4.2 3.0 1.8 0.1 -2.0 -2.0 5.0 7.0 2.0 4.0 3.0 3.2 3.5 3.5 4.3 3.8 3.3 2.0 3.7 2.0 3.5 5.0 10.0 2.2 4.5 2.8 2.9 3.3 3.2 3.3 3.2 3.2 1.7 4.2 3.5 4.2 4.5 9.0 2.4 4.6 2.7 2.9 3.2 3.1 3.5 3.0 3.1 1.6 4.2 4.0 4.4 4.0 8.0 2.6 4.5 2.6 2.7 2.9 2.8 3.2 2.7 2.8 2.0 4.1 4.0 4.3 3.7 5.0 2.9 4.3 2.5 2.6 2.7 2.5 2.8 2.4 2.4 2.4 3.8 3.8 4.0 3.5 4.5 3.1 3.6 2.4 2.4 2.5 2.3 2.7 2.2 2.2 2.2 3.4 3.6 3.5 3.2 4.0 3.2 3.3 2.3 2.3 2.3 2.1 2.7 2.1 2.0 2.2 3.1 3.4 3.0 3.1 3.5 3.3 3.2 2.2 2.2 1.9 2.4 6.7 1.9 1.9 -2.0 3.0 -0.5 4.6 3.4 11.9 3.0 1.1 2.4 2.3 2.4 2.5 7.0 1.8 2.0 -0.2 6.1 8.0 6.3 4.6 1.6 3.1 3.9 3.1 3.0 3.2 3.5 6.0 3.6 3.0 1.4 3.5 2.4 2.6 5.8 7.0 3.1 4.9 2.6 2.7 2.9 2.8 3.2 2.7 2.7 2.0 3.9 3.7 4.0 3.8 6.0 2.8 4.1 (billions of 2009 dollars : a.r.) 35.2 84.8 82.2 113.1 -447.2 -460.4 -431.3 -471.5 -1.6 -0.3 0.7 -1.0 103.0 -486.4 -0.4 98.0 -503.7 -0.4 95.0 -520.9 -0.4 88.0 -536.6 -0.4 86.0 -549.7 -0.3 82.0 -557.2 -0.2 80.0 -562.3 -0.1 80.0 -566.2 -0.1 62.9 -420.5 0.2 79.2 -452.6 -0.2 96.0 -511.9 -0.4 82.0 -558.8 -0.3 Nominal GDP (% chng : a.r.) (billions of dollars : a.r.) 17,044 17,328 17,600 17,711 -0.8 6.8 6.4 2.5 17,789 18,024 18,260 18,494 1.8 5.4 5.3 5.2 INFLATION GDP Price Index Core PCE Deflator CPI All Items Excl. Food & Energy Food Prices Energy Prices Services (quarter/quarter % change : a.r.) 1.3 2.1 1.4 -0.0 1.2 2.0 1.4 1.1 1.9 3.0 1.1 -1.2 1.6 2.5 1.3 1.4 2.3 4.5 3.3 2.7 4.5 4.9 -3.7 -25.5 3.3 3.2 1.5 2.1 CPI All Items Excl. Food & Energy (year/year % change) 1.4 2.1 1.6 1.9 1.8 1.8 FINANCIAL Fed Funds Rate 90 Day T-Bill 3-Month Libor 10 Year Bond Yield Inventory Change Net Exports Contribution to GDP Growth -2.1 -1.0 0.7 1.2 3.2 0.0 1.3 -0.8 1.6 2.9 -1.0 4.7 -5.3 -9.2 2.2 Q2 18,715 18,935 19,140 19,337 4.9 4.8 4.4 4.2 -0.7 0.7 -2.9 0.9 2.6 -35.7 2.3 2.3 1.5 1.9 1.6 2.4 3.1 2.4 2.4 1.6 2.6 1.8 2.2 9.9 2.4 2.5 2.0 2.7 2.1 1.3 9.4 2.4 2.2 2.0 2.4 2.2 1.6 5.9 2.4 2.2 2.4 2.5 2.5 2.4 2.8 2.4 2.0 2.0 2.2 2.2 2.4 2.3 2.4 1.9 1.8 2.0 1.9 2.3 2.3 2.3 1.2 1.7 -0.0 1.5 -0.3 1.3 0.1 1.4 1.0 1.6 2.4 1.9 2.6 2.1 2.5 2.2 2.3 2.2 (average for the quarter) 0.13 0.13 0.13 0.05 0.03 0.03 0.24 0.23 0.23 2.76 2.62 2.50 0.13 0.02 0.24 2.28 0.13 0.02 0.25 1.79 0.13 0.02 0.25 1.80 0.21 0.10 0.34 1.97 0.46 0.33 0.60 2.22 0.71 0.57 0.86 2.40 0.96 0.80 1.13 2.55 1.21 1.03 1.39 2.70 FOREIGN TRADE Current Account Balance (% of GDP) Merchandise Balance Non-Merchandise Balance (billions of dollars : a.r.) -408 -394 -401 -2.4 -2.3 -2.3 -729 -757 -728 321 364 327 -438 -2.5 -782 344 -411 -2.3 -760 349 -408 -2.3 -761 353 -421 -2.3 -778 357 -438 -2.4 -794 356 -453 -2.4 -812 359 -462 -2.4 -826 364 Exchange Rate (¥/US$) Exchange Rate (US$/€) Exchange Rate (US$/£) Broad TWD (average for the quarter) 103 102 104 1.37 1.37 1.32 1.66 1.68 1.67 102.9 102.4 103.3 115 1.25 1.58 108.0 120 1.13 1.51 113.5 122 1.14 1.52 114.4 123 1.14 1.52 114.9 125 1.13 1.51 115.4 126 1.13 1.51 115.7 COMMODITY PRICES WTI spot (US$/bbl) Henry Hub spot (US$/mmBtu) (average for the quarter) 98.8 103.3 97.8 5.2 4.6 3.9 73.2 3.8 47.9 3.1 51.0 3.5 54.0 3.6 56.0 3.9 Pre-tax Profits with IVA and CCA Personal Income Real Disposable Income (year/year % change) -4.8 0.1 3.6 3.7 2.4 2.2 1.4 3.8 2.2 0.2 4.3 3.1 9.3 4.2 4.1 2.1 4.2 4.1 0.4 4.5 4.2 Savings Rate (%) (average for the quarter) 4.9 5.1 4.7 4.6 5.5 5.4 OTHER INDICATORS (average for the quarter) Unemployment Rate (%) 6.6 6.2 6.1 Housing Starts (mlns, a.r.) 0.93 0.99 1.03 Existing Home Sales (mlns, a.r.) 4.60 4.87 5.12 Home Prices (y/y % ch, Case-Shiller) 12.8 9.4 5.7 Motor Vehicle Sales (mlns, a.r.) 15.7 16.6 16.8 5.7 1.07 5.07 4.5 16.9 5.6 1.10 5.13 3.8 16.9 (quarter/quarter % change : a.r.) 3.5 1.4 1.5 2.4 3.9 5.7 4.1 5.6 1.4 4.2 Civilian Employment Growth Industrial Production CBO Budget Deficit (% of GDP) 16,768 17,421 18,142 19,032 3.7 3.9 4.1 4.9 1.5 1.3 1.5 1.8 1.4 -0.7 2.4 1.5 1.4 1.6 1.7 2.4 -0.5 2.6 1.0 1.3 0.2 1.5 2.7 -13.5 2.3 2.2 2.0 2.4 2.1 2.0 5.6 2.4 1.46 1.27 1.65 2.85 0.13 0.06 0.27 2.35 0.13 0.03 0.23 2.54 0.23 0.12 0.36 1.95 1.08 0.92 1.26 2.63 -468 -2.4 -837 369 -477 -2.5 -847 371 -400 -2.4 -702 301 -410 -2.4 -749 339 -420 -2.3 -773 354 -465 -2.4 -831 366 127 1.12 1.51 115.9 128 1.11 1.52 116.0 130 1.10 1.53 115.9 98 1.33 1.56 101.0 106 1.33 1.65 104.1 122 1.14 1.51 114.6 128 1.11 1.52 115.9 61.0 4.1 64.0 4.0 66.0 3.8 69.0 4.1 97.9 3.7 93.3 4.4 52.2 3.5 65.0 4.0 2.7 4.8 3.8 5.2 4.8 2.5 5.1 4.7 2.2 4.8 4.6 2.2 4.6 4.5 2.3 4.2 2.0 -0.2 -0.7 3.9 2.4 3.5 4.4 4.1 4.9 4.7 2.3 5.2 5.0 4.9 4.8 4.9 4.9 4.9 4.8 5.3 4.9 5.3 1.19 5.28 3.7 17.0 5.1 1.27 5.33 4.2 17.1 4.9 1.31 5.36 3.1 17.2 4.8 1.31 5.36 3.0 17.2 4.7 1.32 5.35 3.1 17.1 4.6 1.31 5.33 3.4 17.1 4.6 1.29 5.30 3.0 17.0 7.4 0.93 5.07 12.0 15.6 6.2 1.00 4.92 8.0 16.5 5.2 1.22 5.28 3.7 17.0 4.7 1.31 5.34 3.1 17.1 1.6 3.0 1.6 2.8 1.6 2.7 1.4 2.6 1.2 2.5 1.2 2.4 1.1 2.4 1.0 2.9 -4.1 1.6 4.3 -2.8 1.7 4.0 -2.6 1.4 2.6 -2.5 Note: Outlined areas represent forecast periods General Disclosure: “BMO Capital Markets” is a trade name used by the BMO Investment Banking Group, which includes the wholesale arm of Bank of Montreal and its subsidiaries BMO Nesbitt Burns Inc., BMO Capital Markets Ltd. in the U.K. and BMO Capital Markets Corp. in the U.S. BMO Nesbitt Burns Inc., BMO Capital Markets Ltd. and BMO Capital Markets Corp are affiliates. Bank of Montreal or its subsidiaries (“BMO Financial Group”) has lending arrangements with, or provide other remunerated services to, many issuers covered by BMO Capital Markets. The opinions, estimates and projections contained in this report are those of BMO Capital Markets as of the date of this report and are subject to change without notice. BMO Capital Markets endeavours to ensure that the contents have been compiled or derived from sources that we believe are reliable and contain information and opinions that are accurate and complete. However, BMO Capital Markets makes no representation or warranty, express or implied, in respect thereof, takes no responsibility for any errors and omissions contained herein and accepts no liability whatsoever for any loss arising from any use of, or reliance on, this report or its contents. Information may be available to BMO Capital Markets or its affiliates that is not reflected in this report. The information in this report is not intended to be used as the primary basis of investment decisions, and because of individual client objectives, should not be construed as advice designed to meet the particular investment needs of any investor. This material is for information purposes only and is not an offer to sell or the solicitation of an offer to buy any security. BMO Capital Markets or its affiliates will buy from or sell to customers the securities of issuers mentioned in this report on a principal basis. BMO Capital Markets or its affiliates, officers, directors or employees have a long or short position in many of the securities discussed herein, related securities or in options, futures or other derivative instruments based thereon. The reader should assume that BMO Capital Markets or its affiliates may have a conflict of interest and should not rely solely on this report in evaluating whether or not to buy or sell securities of issuers discussed herein. Dissemination of Research: Our publications are disseminated via email and may also be available via our web site http://www.bmonesbittburns.com/economics. Please contact your BMO Financial Group Representative for more information. Conflict Statement: A general description of how BMO Financial Group identifies and manages conflicts of interest is contained in our public facing policy for managing conflicts of interest in connection with investment research which is available at http://researchglobal.bmocapitalmarkets.com/Public/Conflict_Statement_Public.aspx. ADDITIONAL INFORMATION IS AVAILABLE UPON REQUEST BMO Financial Group (NYSE, TSX: BMO) is an integrated financial services provider offering a range of retail banking, wealth management, and investment and corporate banking products. BMO serves Canadian retail clients through BMO Bank of Montreal and BMO Nesbitt Burns. In the United States, personal and commercial banking clients are served by BMO Harris Bank N.A., Member FDIC. Investment and corporate banking services are provided in Canada and the US through BMO Capital Markets. BMO Capital Markets is a trade name used by BMO Financial Group for the wholesale banking businesses of Bank of Montreal, BMO Harris Bank N.A, BMO Ireland Plc, and Bank of Montreal (China) Co. Ltd. and the institutional broker dealer businesses of BMO Capital Markets Corp. (Member SIPC), BMO Nesbitt Burns Securities Limited (Member SIPC) and BMO Capital Markets GKST Inc. (Member SIPC) in the U.S., BMO Nesbitt Burns Inc. (Member Canadian Investor Protection Fund) in Canada, Europe and Asia, BMO Capital Markets Limited in Europe, Asia and Australia and BMO Advisors Private Limited in India. “Nesbitt Burns” is a registered trademark of BMO Nesbitt Burns Corporation Limited, used under license. “BMO Capital Markets” is a trademark of Bank of Montreal, used under license. "BMO (M-Bar roundel symbol)" is a registered trademark of Bank of Montreal, used under license. ® Registered trademark of Bank of Montreal in the United States, Canada and elsewhere. TM Trademark Bank of Montreal © COPYRIGHT 2015 BMO CAPITAL MARKETS CORP. A member of BMO Financial Group

© Copyright 2026