INSIDE AGRICULTURE

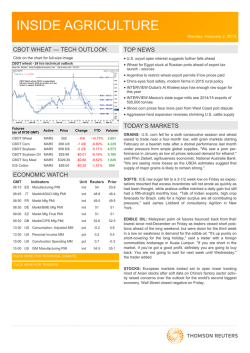

INSIDE AGRICULTURE Friday, January 30, 2015 WORLD SUGAR PRICE TOP NEWS Click on the chart for full-size image U.S. jobless claims drop sharply to near 15-year low Green Pool sees first sugar deficit after years of surpluses Rapeseed crops in Western Europe seen vulnerable to frost POLL-Global 2014/15 cocoa surplus seen weighing on prices Japan to cut beef, pork tariffs, expand rice access in TPP talks Media Potash Corp's profit beats on higher potash sales; outlook misses Washington state company issues beef recall over E. coli concerns Nigeria H5N1 bird flu spreads to four more states, total 11 TODAY’S MARKETS Futures (as of 0730 GMT) Active Price CBOT Wheat MAR5 CBOT Corn MAR5 CBOT Soybean MAR5 Change YTD Volume 508 2/8 4/8 -13.90% 2,323 370 2/8 -1 2/8 -6.42% 6,908 970 6/8 2 4/8 -5.00% 5,086 CBOT Soybean Oil MAR5 $29.73 $0.19 -7.60% 3,987 CBOT Soy Meal MAR5 $338.70 $0.80 -7.32% 1,734 ICE Cotton MAR5 $59.32 -$0.25 -1.16% 236 Asia Contracts M3 Settle Change Percent BMD Palm Oil MAR5 R2,247 -R8 -0.4% Dalian Soybean Oil MAR5 ¥5,286 -¥32 -0.6% ECONOMIC WATCH GMT Indicators Unit Reuters Prior 08:00 ES Estimated GDP QQ pct 0.6 0.5 08:00 ES HICP Flash YY pct -1.5 -1.1 09:30 GB Mortgage Lending bln 2.0 2.059 09:30 GB BOE Consumer Credit bln 1.2 1.252 09:30 GB Mortgage Approvals k 59,000 59.029 10:00 EZ Unemployment Rate pct 11.5 11.5 10:00 EZ Inflation, Flash YY pct -0.5 -0.2 13:30 US Employment Costs pct 0.6 0.7 13:30 US PCE Prices Advance Adv pct 0.8 1.2 13:30 US GDP Sales Advance Adv pct 3.3 5.0 14:45 US Chicago PMI ind 57.5 58.8 15:00 US U Mich Sentiment Final ind 98.2 98.2 GRAINS: U.S. wheat held steady after rising in the previous session, but the market is poised for its biggest monthly drop in more than three years because of ample world supplies. SOFTS: Arabica coffee futures on ICE sank more than 5 percent on Thursday, falling to a 6-1/2-month low on technical longliquidation, while raw sugar fell on talk that India could soon launch raw sugar export incentives. EDIBLE OIL: Malaysian palm oil futures decreased 0.8 percent to their lowest since mid-December as weakness in competing markets and expectations of weak monthly export figures weigh on prices that have lost more than 12 percent since mid-January. STOCKS: European stocks were set looked to open higher while Asian markets traded mixed due to persistent concerns over global growth and sagging Chinese shares. Wall Street ended positive on Thursday. CLICK HERE FOR TECHNICAL CHARTS CLICK HERE FOR TENDERS INSIDE AGRICULTURE January 30, 2015 TOP NEWS U.S. jobless claims drop sharply to near 15-year low Green Pool sees first sugar deficit after years of surpluses The number of Americans filing new claims for unemployment benefits tumbled last week to its lowest level in nearly 15 years, adding to bullish signals on the labor market. Though the decline probably exaggerates the jobs market's strength given a holiday-shortened week, Thursday's report suggested the economy was fairly healthy and weathering weakening global growth. "Claims are a welcome shot in the arm for those believing the economy is strong. The U.S. remains an oasis of prosperity in the world and will continue to do so," said Chris Rupkey, chief financial economist at MUFG Union Bank in New York. Initial claims for state unemployment benefits dropped 43,000 to a seasonally adjusted 265,000 for the week ended Jan. 24, the lowest since April 2000, the Labor Department said. It was the biggest weekly decline since November 2012. The world sugar market looks headed for its first deficit for six years, analyst Green Pool said on Thursday, predicting that more deficits could follow over several years. Green Pool, one of the first major analysts to have predicted a global sugar deficit in 2015/16, forecast a deficit of 5.0 million tonnes in 2015/16 after a surplus of 1.7 million tonnes in the prior year. A Reuters sugar poll also said on Thursday the global sugar market will shift to a deficit in 2015/16. Green Pool's annual crop production forecasts are based on crop year cycles. The key to the deficit is continued growth in consumption, combined with a small reduction in global production. POLL-Global 2014/15 cocoa surplus seen weighing on prices Rapeseed crops in Western Europe seen vulnerable to frost Cocoa prices will finish 2015 lower than last year as the market remains in surplus for a second straight year on falling demand for the key chocolate ingredient, a Reuters poll showed on Friday. A survey of 16 traders, analysts and manufacturers pegged the global cocoa market in the 2014/15 (October/September) marketing year at a 50,000-tonne surplus, with estimates ranging from a 300,000 tonne deficit to a 200,000 tonne surplus. The International Cocoa Organization (ICCO) forecast a 53,000tonne surplus in 2013/14, though said last week it may revise this in February. "The ongoing global currency crisis, deflationary wave in commodities and an ongoing erosion of consumer disposable income should conspire to not only keep cocoa in a surplus but also force speculators to flee the market completely," Shawn Hackett, of Hackett Financial Advisors in Florida. Rapeseed crops in western Europe are developing generally well but a mild autumn which boosted plant growth and bug attacks has left them vulnerable to frost damage, mainly in Germany and Britain, analysts and experts said on Thursday. French consultancy Strategie Grains on Thursday put the 2015 rapeseed crop in the 28-member European Union at 21.5 million tonnes, more than 11 percent below last year's record harvest. Rapeseed is the most widely grown oilseed crop in the EU and is used to make edible oils, biodiesel fuel and animal feed. In Germany, the bloc's largest rapeseed grower, farmers face an anxious time this winter, analysts said. "Everything is looking fine at the moment but a sudden cold snap could bring the danger of heavy damage," one said. Japan to cut beef, pork tariffs, expand rice access in TPP talks -Media Potash Corp's profit beats on higher potash sales; outlook misses Japan is prepared to cut its high import tariffs on beef and pork and slightly ease tight restrictions on rice imports for U.S. producers, in a rush to seal an ambitious Pacific trade deal, Japanese media said on Friday. Tokyo's reported concessions come as talks accelerate with Washington to strike a bilateral deal as the core of an overdue agreement in the Trans-Pacific Partnership. A bilateral agreement between the two economies, which dominate the TPP, is considered key to a deal among the 12 nations, which account for 40 percent of the world economy. Negotiators had hoped to clinch a deal by late last year. Japan and the United States are working toward an agreement to cut Japan's 38.5 percent beef tariff to about 10 percent over more than 10 years, the Nikkei newspaper said. Potash Corp of Saskatchewan, the world's biggest fertilizer company by market capitalization, reported higher-thanexpected quarterly profit on strong potash sales, but its 2015 outlook disappointed. Potash Corp sold 2.5 million tonnes of potash, the most ever in a fourth quarter and up 42 percent year over year. Its average realized potash price was $284 per tonne, up marginally from a year earlier. Prices have been slow to recover since the breakup in mid-2013 of one of the world's biggest potash traders, Belarusian Potash Company, but softer prices have stimulated demand. "We saw a balance here, and part of the reason is affordability," said Potash Corp Chief Executive Jochen Tilk in an interview. "And we expect that to be the case this year." Tilk is reviewing equity stakes in China’s Sinofert Holdings Ltd, Israel Chemicals, Jordan's Arab Potash Co Plc and Chile’s SQM, with an eye toward taking control. 2 INSIDE AGRICULTURE January 30, 2015 TOP NEWS (Continued) Washington state company issues beef recall over E. coli concerns Nigeria H5N1 bird flu spreads to four more states, total 11 An outbreak of H5N1 bird flu in Nigerian poultry farms has spread to four more states, raising the total of affected areas to 11, the agricultural and rural development minister said on Thursday. Africa's most populous country and biggest economy was the first country on the continent to detect bird flu, in 2006 when chicken farms were found to have the H5N1 strain. In 2007, Nigeria recorded its first human death from the disease. "At the time of my briefing the nation on January 21, 2015, seven states had reported cases of the bird flu. As of yesterday, a total of 11 states have reported positive cases,” Minister Akinwumi Adesina said at an emergency meeting with state agricultural commissioners in the capital Abuja. The latest bird flu outbreak was first reported in mid-January in the states of Kano and Lagos. The worst-hit state is Kano in the north where 136,905 birds were exposed with a 13 percent mortality rate. A Washington state company has voluntarily recalled 1,620 pounds of beef due to possible E. coli contamination, the U.S. Department of Agriculture said on Thursday. Washington Beef LLC, based in Toppenish in central Washington, discovered the possible E. coli bacteria in boneless beef trim during an internal records audit by the company, the USDA said in a statement. The possible contamination was in 27 bulk cases of beef sent to a single grinding facility in 2012, the USDA said. The beef was to be used in hotels, restaurants and institutions in Oregon and Washington, the agency said. There have been no reports of illnesses associated with consumption of the product. TENDER WHEAT TENDER: The lowest offer in the Lebanese government's tender to purchase 30,000 tonnes of milling wheat was $256.23 a tonne c&f free out (ciffo), European traders said on Thursday. RICE TENDER: Tunisia's state grains agency has issued an international tender to purchase up to 117,000 tonnes of soft milling wheat and 50,000 tonnes of feed barley, European traders said on Thursday. 3 INSIDE AGRICULTURE January 30, 2015 1-Month TECHNICAL CHARTS with 14 Days Moving Average CBOT Corn CBOT Wheat ICE Cocoa ICE Coffee CBOT Soybeans CBOT Soymeal (Inside Agriculture is compiled by Atiqul Habib in Bangalore) For more information: Learn more about our products and services for commodities professionals, click here Contact your local Thomson Reuters office, click here For questions and comments on Inside Agriculture, click here Your subscription: To find out more and register for our free commodities newsletters click here © 2015 Thomson Reuters. All rights reserved. This content is the intellectual property of Thomson Reuters and its affiliates. Any copying, distribution or redistribution of this content is expressly prohibited without the prior written consent of Thomson Reuters. Thomson Reuters shall not be liable for any errors or delays in content, or for any actions taken in reliance thereon. Thomson Reuters and its logo are registered trademarks or trademarks of the Thomson Reuters group of companies around the world. Privacy statement: To find out more about how we may collect, use and share your personal information please read our privacy statement here To unsubscribe to this newsletter, click here 4

© Copyright 2026