MA OP WARRANT (E) - Bank Julius Baer

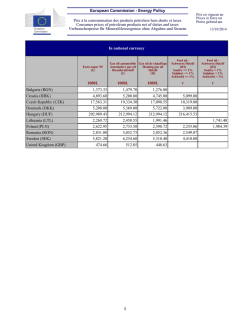

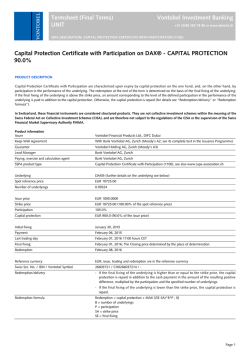

Leverage Julius Baer Warrants – Trading Calendar Start the new trading week properly informed in order to be well positioned ahead of upcoming events. · Pre-market trading 08.00 – 09.15 h · Trading hours 09.15 – 17.15 h · Listed at the SIX Swiss Exchange Underlying Information AMS 36.00 Event Consensus Tue, February 3, 2015 Year 2014 Results (Bloomberg) Est. Sales in EUR Est. Net Income in EUR Santander 5.99 Tue, February 3, 2015 Year 2014 Results Est. Sales in EUR Est. Net Income in EUR LVMH 143.90 Tue, February 3, 2015 Year 2014 Results Est. Sales in EUR Syngenta 302.00 derivatives.juliusbaer.com/newsletter Subscribe to our weekly trading calendar: +41 (0)58 888 8181 derivatives.juliusbaer.com/warrants Symbol Valor 464 Mio AMSDS 24796400 35.00 Call 20.03.15 14:1 0.19 0.20 101 Mio AMSPP 26358824 37.50 Put 19.06.15 20:1 0.23 0.24 BANJC 25302796 7.50 Call 20.03.15 3:1 0.01 0.01 LVMJC 25302790 117.00 Call 20.03.15 36:1 0.80 0.82 15’076 Mio SYNJC 26778459 300.00 Call 17.04.15 80:1 0.18 0.20 1‘725 Mio SYNPA 26419859 300.00 Put 18.12.15 100:1 0.32 0.33 42’505 Mio Ratio Bid Ask 5‘817 Mio 30.447 Mio 3‘385 Mio (Bloomberg) The prices do not constitute a solicitation or offer and are indicative only. Expiry (Bloomberg) Wed, February 4, 2015 Year 2014 Results Est. Net Income in USD Type (Bloomberg) Est. Net Income in EUR Est. Sales in USD Strike Page 1 of 2 Only for distribution in Switzerland. The information in this document is marketing material and is intended for information purposes only and contains neither an offer nor an invitation to submit an offer. The information contained herein does not represent an issue prospectus according to article 652a and article 1156 of the Swiss Code of Obligations, nor a listing notice under the terms of the listing rules of the SIX Swiss Exchange. An offer to buy or sell can only be made with complete documentation which details in particular the risks of derivative instruments, a copy of which can be obtained from Bank Julius Baer & Co. Ltd. by calling tel. +41 (0)58 888 8181, or writing to Structured Products, Hohlstrasse 604/606, 8010 Zurich, Switzerland. Investors are advised to read this documentation carefully as it contains the conditions under which investors invest in the products. Past performance is no guarantee of future results. Investments in derivative instruments entail considerable risks, including the possibility of a total loss of the capital invested. These instruments do not represent an investment in a collective investment scheme and thus are not subject to the supervision of the Swiss Financial Market Supervisory Authority (FINMA). Investors are exposed to issuer risk and - if the instrument or the underlying are denominated in other currencies than that of the country in which the investor is resident also to currency risk. Any prices indicated are subject to change without notice. Bank Julius Baer is member of the Swiss Structured Products Association (SSPA). Underlying Information ABB 17.80 Event Consensus Thu, February 5, 2015 Year 2014 Results (Bloomberg) Est. Sales in USD Est. Net Income in USD Daimler 80.11 81.52 ABBJB 26778413 18.00 Call 18.09.15 10:1 0.08 0.09 2‘794 Mio ABBPP 26152338 21.00 Put 19.06.15 8:1 0.48 0.50 DAIJC 25302784 64.00 Call 20.03.15 20:1 0.85 0.87 SANJC 25302795 80.00 Call 20.03.15 30:1 0.15 0.16 11’610 Mio SCMJK 24545653 550.00 Call 19.06.15 200:1 0.10 0.11 1’702 Mio SCMPA 26419857 540.00 Put 18.12.15 200:1 0.26 0.27 Est. Sales in EUR 128’623 Mio Thu, February 5, 2015 Year 2014 Results Est. Net Income in EUR 540.50 40’338 Mio (Bloomberg) Est. Sales in EUR Swisscom Valor Thu, February 5, 2015 Year 2014 Results Est. Net Income in EUR Sanofi Symbol Thu, February 5, 2015 Year 2014 Results Est. Sales in CHF Est. Net Income in CHF *underlying movement before change The prices do not constitute a solicitation or offer and are indicative only. Strike Type Expiry Ratio Bid Ask 6’912 Mio (Bloomberg) 33’462 Mio 6’797 Mio (Bloomberg) Page 2 of 2 Only for distribution in Switzerland. The information in this document is marketing material and is intended for information purposes only and contains neither an offer nor an invitation to submit an offer. The information contained herein does not represent an issue prospectus according to article 652a and article 1156 of the Swiss Code of Obligations respectively nor a listing notice under the terms of the listing rules of the SIX Swiss Exchange. An offer to buy or sell can only be made with complete documentation which details in particular the risks of derivative instruments, a copy of which can be obtained from Bank Julius Baer & Co. Ltd. by calling tel. +41 (0)58 888 8181, or writing to Structured Products, Hohlstrasse 604/606, CH-8010 Zurich. Investors are advised to read this documentation carefully as it contains the conditions under which investors invest in the products. Past performance is no guarantee of future results. Investments in derivative instruments entail considerable risks, including the possibility of a total loss of the capital invested. These instruments do not represent an investment in a collective investment scheme and thus are not subject to the supervision of the Swiss Financial Market Supervisory Authority (FINMA). Investors are exposed to issuer risk and - if the instrument or the underlying are denominated in other currencies than that of the country in which the investor is resident , also to currency risk. Any prices indicated are subject to change without notice. Bank Julius Baer is member of the Swiss Structured Products Association (SSPA).

© Copyright 2026