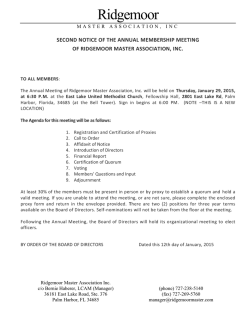

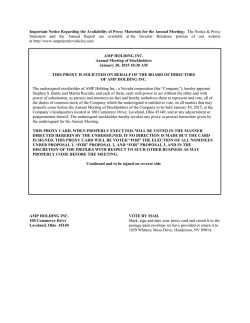

printmgr file - Investor Relations