Net income

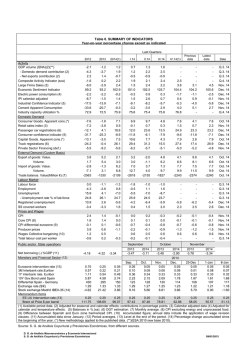

EARNINGS PRESENTATION FY 2014 FEBRUARY 2015 Disclaimer This document is not an offer of securities for sale in the United States, Canada, Australia, Japan or any other jurisdiction. Securities may not be offered or sold in the United States unless they are registered pursuant to the US Securities Act of 1933 or are exempt from such registration. Any public offering of securities in the United States, Canada, Australia or Japan would be made by means of a prospectus that will contain detailed information about the company and management, including financial statements The information in this presentation has been prepared under the scope of the International Financial Reporting Standards (‘IFRS’) of BCP Group for the purposes of the preparation of the consolidated financial statements under Regulation (CE) 1606/2002 The figures presented do not constitute any form of commitment by BCP in regard to future earnings Figures for 2014 not audited 2 Agenda Main Highlights Group • Profitability • Liquidity • Capital Portugal International operations Conclusions 3 Highlights • Recurring net income breaks-even in the 4th quarter of 2014. Profitability • Consolidated net income for the year strongly improved to -€217.9 million in 2014 from -€740.5 million in 2013. Improving trend affirmed • Excellent performance of operating net income: a more than twofold increase, reflecting a stronger net interest income (+31.6%) and lower operating costs (-11.2%). • Net new NPL entries in Portugal 14.7% down from 2013. • Increased Customers’ deposits, 2.5% up on a comparable basis. Liquidity Healthy balance sheet Capital Already reflects impacts of AQR and from Pension Fund’s revised assumptions • Narrowing commercial gap. Net loans as a percentage of deposits down to 109% (BoP criteria), compared to 117% at year-end 2013 and to the recommended 120%. Net loans down to 102% as a percentage of total balance sheet Customer funds. • ECB funding usage at €6.6 billion (€1.5 billion of which related to TLTRO), down from €10.0 billion at end-2013. Full reimbursement of State-guaranteed issues. • Common equity tier 1 ratios at 12.0% according to phased-in criteria and at 8.9% on a fullyimplemented basis (reflecting the new regime for deferred tax assets). • Focus on the early accomplishment of key commitments with DG Comp and included in the strategic plan, as €2,250 million CoCos were reimbursed in 2014. Involvement of the Portuguese state at €750 million at the end of 2014, significantly down from the initial €9 billion (inclusive of CoCos and Guarantees). 4 Highlights Net income Recurring net income reaches break-even in 4Q14 (Million euros) Contribution of the international operations (Million euros) +13.1% 201.5 178.2 -217.9 -740.5 +522.5 2013 Includes up-front effect on DTAs, influenced by the reduction of the statutory tax rate (-€83.5 million) 2013 2014 Banking income in Portugal 2014 Operating costs in Portugal* (Million euros) (Million euros) +49.5% -19.1% 1,355.9 852.9 907.0 690.2 2013 2014 * Operating costs decreased 5.9% in Portugal excluding specific non recurring items. 2013 2014 5 Highlights Net interest income per quarter New entries in NPL in Portugal, net of recoveries (Million euros) (Million euros) 325 634 295 234 179 234 236 -14.7% 541 260 201 1Q13 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 Loans to deposit ratio* Net loans to BS Customer funds 108% Dec 13 2014 Capital ratios (CET1 – CRD IV / CRR) (%) 117% 2013 -8pp (%) 12.0% 8.9% 109% 102% Dec 14 * Calculated based on Customer deposits and net loans to Customers (BoP criteria). fully implemented* phased-in * Reflecting the new regime for deferred tax assets. 6 Agenda Main Highlights Group • Profitability • Liquidity • Capital Portugal International operations Conclusions 7 Net income before income tax showing recovery… (million euros) Net interest income 2013 2014 C 848.1 1,116.2 268.1 -269.0 -192.5 -180.0 -158.1 89.0 34.4 663.0 258.2 680.9 495.4 17.9 237.2 -59.4 19.6 69.4 79.0 69.4 1,769.3 2,292.5 523.2 -767.5 -527.8 -1,295.2 -635.6 -514.0 -1,149.6 131.8 13.8 145.6 Operating net income (before impairment and provisions) 474.1 1,142.9 668.8 Loans impairment (net of recoveries) -820.8 -1,107.0 -286.2 -313.5 -313.5 Of which: costs related with hybrids instruments (CoCo's) Of which: liability management 2011 Net fees and commissions Other operating income Of which: sale of loans portfolio Of which: capital gain of insurance sale Banking income Staff costs Other administrative costs and depreciation Operating costs Of which: impairment related with capital exercise (AQR) in 3Q14 Other impairment and provisions -465.8 -209.3 256.5 Net income before income tax -812.5 -173.4 639.1 210.8 -93.7 -45.0 97.7 -110.1 -32.1 -113.1 -16.4 12.9 -740.5 -217.9 522.5 Income taxes Not-controlling interests Net income from discontinued or to be discontinued operations Net income 8 … but still affected by relevant factors (Million euros) Net income Relevant factors with impact on net income Consolidated Net of taxes* (gross) -217.9 +522.5 * Considering the marginal tax rate. Hybrids (CoCos) interest (-180.0) -111.5 Liability management 2011 (-158.1) -221.0 AQR-related impairment in 3Q14 (-313,5) -32.1 -740.5 2013 -126.9 2014 Income arising from discontinued operations -491.5 9 Recurring net income breaks-even in 4Q14 (million euros) 4Q14 Net interest income Net fees and commissions Other operating income Banking income 325.2 174.7 70.6 570.5 Staff costs Other administrative costs and depreciation Operating costs -157.6 -134.5 -292.0 Operating net income (before impairment and provisions) 278.4 Loans impairment (net of recoveries) -232.5 Of which: impact from the devaluation of listed collaterals in 4Q14 -53.8 Other impairment and provisions -66.3 Net income before income tax -20.3 Income taxes Not-controlling interests Net income from discontinued or to be discontinued operations 10.4 -28.2 1.9 Net income before impact from reduction of corporate tax rate -36.2 Net income Net impact from reduction of corporate tax rate -83.5 Net of taxes impact from listed collateral devaluation -38.0 Impact from reduction of corporate tax rate -83.5 Recurring Net income +1.8 Net income Net income excluding impact from reduction of corporate tax rate and devaluation of listed collaterals in 4Q14 -119.7 +1.8 Recurring net income before taxes:+33.5 -119.7 10 Net interest income increases, particularly in Portugal (Million euros) Portugal Net interest income Consolidated +31.6% +53.7% 1,116.2 527.0 343.0 848.1 2013 2014 International operations +16.6% 505.1 2013 2014 NIM 1.12% 1.56% NIM (excluding CoCos) 1.48% 1.81% 2013 589.1 2014 11 Increase in fees and commissions driven by international operations (Million euros) +5.9% excluding effect of regulatory changes Portugal Fees and Commissions Consolidated +0.7% 2013 2014 YoY Banking fees and commissions 538.5 545.1 1.2% Cards and transfers 181.1 193.6 6.9% Loans and guarantees 154.5 159.6 3.3% 72.5 72.7 0.3% Current account related 105.1 76.6 -27.1% State guarantee -60.1 -22.7 62.2% 85.4 65.2 -23.6% 124.4 135.7 9.1% Securities operations 91.4 97.0 6.2% Asset management 33.1 38.7 17.2% 663.0 680.9 2.7% Bancassurance Other fees and commissions Market related fees and commissions Total fees and commissions 430.3 433.2 2013 2014 International operations +6.5% 232.7 247.7 2013 2014 12 Increased net trading income in Portugal, benefiting from gains in public debt portfolio (Million euros) Portugal Net trading income Consolidated As of 31 December 2014, there are still €316 million potential gains on the investment portfolio (AFS/HTM) of Portuguese public debt +67.4% +117.4 % 343.7 158.1 442.2 Sale of loan portfolios 264.2 2013 2014 -59.4 +19.6 Internacional operations -7.1% 2013 2014 106.1 98.5 2013 2014 13 Reduction of costs in Portugal (Million euros) Portugal* Operating costs* Consolidated 1,176.2 68.1 -2.3% 1,149.6 65.5 733.8 -5.9% 690.2 -3.8% 457.5 448.5 -2.0% 2013 2014 International operations 650.6 -2.3% 635.6 +3.9% 442.4 2013 459.4 2014 Depreciation Other administrative costs Staff costs 2013 * Excluding non-recurring specific items: restructuring costs (+€126.5 M in 2013) and amendment of the mortality allowance calculation formula (-€7.5 M in 2013) . Operating costs decreased 19.1% in Portugal including specific non recurring items. 2014 14 Increased provisioning due to specific impacts (Million euros) Portugal Loan impairment (net of recoveries) Consolidated 137bp Cost of risk +37.5% 194bp 1,021.0 742.8 1,107.0 820.8 2013 2013 2014 Cost of risk evolution (basis points) 186 2011 157 2012 137 2013 130 2014 International operations Strategic plan 194 Excluding: - one-off AQR (3Q14) - Devaluation of collaterals (4Q14) 2014 ~ 100 2015 +10.5% 78.1 86.2 2013 2014 15 Higher coverage ratios, resulting from lower entries in NPL and higher provision charges (Million euros) Consolidated Net entries in NPL in Portugal Credit quality Credit ratio 634 -14.7% 541 2013 2014 Dec 13 Dec 14 NPL 11.0% 11.5% Credit at risk 11.8% 12.0% 6,586 6,580 Dec 13 Dec 14 NPL (nonperforming loans) Loan impairment provisions (balance sheet) Coverage ratio Dec 13 Dec 14 NPL 51% 53% Credit at risk 48% 51% 3,381 3,483 Net entries in NPL in Portugal decreased 14,7% year-onyear NPL ratio at 11.5% with NPL coverage at 53% at yearend 2014; Credit at risk at 12.0% with risk coverage at 51% as of the same date Coverage of credit at risk (by BS impairment and real and financial guarantees) at 106% (101% in 2013) Dec 13 Dec 14 On a comparable basis: excludes Romania and Millennium bcp Gestão de Activos (following the discontinuation processes). 16 Diversified and collateralized credit portfolio Consolidated Loan portfolio Companies 48% Loans per collateral Mortgage 45% 58% Real guarantees 35% Other guarantees 8% Unsecured LTV of mortgage in Portugal 14% 9% 0-40 40-50 12% 50-60 25% 60-75 10% 17% 13% 75-80 80-90 >90 Consumer 7% Loans to companies represent 48% of total loan portfolio. Decreased weight of construction and real estate sectors (11% at the end of 2014, compared with 12% at the end of 2013) 93% of the loan portfolio is collateralized Mortgage loans account for 45% of the total loan portfolio, with low delinquency and an average LTV of 66% On a comparable basis: excludes Romania and Millennium bcp Gestão de Activos (following the discontinuation processes). 17 Agenda Main Highlights Group • Profitability • Liquidity • Capital Portugal International operations Conclusions 18 Deposits increase both in Portugal (individuals and companies) and in international operations (Million euros) Customer funds Consolidated Individuals’ and companies’ deposits up 7% from 2013 Customer deposits in Portugal +0.7% 33,911 64,739 64,261 11,868 12,146 3,797 2,776 +1.5% 9,385 +4.1% 2,345 9,768 20,592 +8.3% 22,295 3,934 Dec 13 33,024 33,359 34,408 Individuals Dec 14 Companies Other (includes public sector) Customer deposits in international operations +2.5% +4.9% 15,236 16,793 Dec 13 Dec 14 On-demand deposits Other BS Customer funds Term deposits Off BS Customer funds On a comparable basis: excludes Romania and Millennium bcp Gestão de Activos (following the discontinuation processes). 14,684 15,409 Dec 13 Dec 14 19 No significant changes to credit performance (Million euros) Portugal Loans to Customers (gross) Consolidated New production of loans to individuals increases 21% vs 2013 -4.3% 47,251 59,734 57,168 -4.7% 1,295 45,956 43,784 26,444 25,545 Dec 13 3,493 Write-offs and Dec 13 sales comparable Dec 14 4,037 International operations 29,797 Dec 13 Mortgage +7.2% 27,586 12,483 13,385 Dec 13 Dec 14 Dec 14 Consumer Companies On a comparable basis: excludes Romania and Millennium bcp Gestão de Activos (following the discontinuation processes). 20 Continued improvement of the liquidity position. Current liquidity ratios in excess of future requirements Loans to deposit ratio** (BoP) Commercial Gap* (Billion euros) Difference between BS Customer funds and net loans Dec 13 Dec 14 -4.0 -1.1 Net loans to BS Customer funds 117% 108% -3.9 -7.8 +4.0 114% NSFR (Net stable funding ratio) 136% LCR (Liquidity coverage ratio) * Calculated based on Customer deposits and net loans to Customers. ** According to Banco of Portugal criteria. *** Estimated in accordance with CRD IV current interpretation. 109% 102% Dec 13 Liquidity ratios (CRD IV/CRR***) -8pp Dec 14 Commercial gap improved €4.0 billion in the last year Loans to deposit ratio (BoP criteria) at 109%, 102% if all BS Customer funds area included Net usage of ECB funding at €6.6 billion, compared to €10.0 billion as at the end of 2013 €14.2 billion (net of haircuts) of eligible assets available for refinancing operations with ECB, with a €7.6 billion buffer Liquidity ratios (CRD IV/CRR***) higher than the required 100% 21 Lower refinancing needs in the medium to long term. Customer deposits are the main funding source Refinancing needs of medium-long term debt (Billion euros) Already repaid 5.2 5.5 ** 4.9 3.0 2.9* 1.1 2009 2010 2011 2012 2013 2014 0.4 0.6 2015 2016 1.8 2017 0.6 >2017 Improvement of the funding structure Customer deposits 67% 75% Other financing Reduction of funding needs, reflecting a lower commercial gap Customer deposits are the main source of funding 33% 25% Dec 13 Dec 14 Includes repurchase of own debt amounting to 0.5 billion euros. ** Includes repayment of 1.6 billion euros related to liability management transactions. 22 Agenda Main Highlights Group • Profitability • Liquidity • Capital Portugal International operations Conclusions 23 Capital ratios comply with regulatory requirements CET I ratio – CRD IV/CRR (fully-implemented)* 9.3% 8.9% 1 Jan 14 Dec 14 46,757 43,261 RWA (M €) RWA (M €) Historical evolution of core tier I ratio in BCP (%) +9pp 13.7% 2004 2006 2008 * Reflecting the new regime for deferred tax assets. 2010 1 Jan 14 Dec 14 45,500 42,200 Capital ratios influenced by the following factors in 2014: − Revised pension fund assumptions as a result of lower market yields (impact: -110 basis points) Common equity tier I ratio (CRD IV/CRR) at 8.9% under fullyimplemented* principles, and at 12.0% according to phased-in criteria ≈5.0% 2002 12.0% − Increased operating results and contribution from minorities ≈6.0% 2000 12.2% − Negative effect of the AQR accounting, mitigated by the reduction of the difference between expected losses and impairment ≈9.0% 4,7% CET I ratio – CRD IV/CRR (phased-in) 2012 2014 Capital ratios at the highest levels in the history of BCP 24 Revised pension fund assumptions, resulting from lower market yields, with impact in capital ratios Revision to pension fund assumptions Pension Fund (Million euros) Shares 24% €600M 2,533 +769 -169 3,133 Loans and advances to credit inst. and others 37% Properties 10% Liabilities with pensions Dec13 Discount rate revision (from 4% to 2.5%) Revision of salary and pension growth rates, others Bonds 29% Liabilities with pensions Dec14 Pension liabilities coverage at 110% Impact in capital Impact of revised assumptions -574 Excess return over assumption +97 Total -477 Actuarial differences in 2014 penalised by the decrease in the discount rate to 2.5% (-€769 million), and benefited by fund’s performance of 8.1% and by changes to other assumptions -110 basis points in capital ratios 25 Agenda Main Highlights Group • Profitability • Liquidity • Capital Portugal International operations Conclusions 26 Portugal: deleveraging effort (Million euros) Individuals’ and companies’ deposits up 7% from 2013 Customer funds Loans to Customers (gross) New production of loans to individuals increases 21% vs 2013 -0.5% 48,128 47,881 10,528 10,800 3,689 2,673 24,880 24,334 9,031 10,074 Dec 13 Dec 14 On-demand deposits Other BS Customer funds Term deposits Off BS Customer funds -7.3% 47,251 43,784 19,916 19,142 2,162 2,502 25,173 22,139 Dec 13 Dec 14 Mortgage On a comparable basis: excludes Romania and Millennium bcp Gestão de Activos (following the discontinuation processes). Consumer Companies 27 Net income improves, as banking income increases and operating costs decrease (Million euros) Net income Improved net income, resulting from an increased banking income and a reduction in operating costs -387.3 Lower operating costs, as the implementation of the restructuring programme started at the end of 2012 yields visible savings -873.6 2013 Banking income 2014 Operating costs +49.5% 1,355.9 -19.1% 852.9 907.0 2013 The increase in banking income reflects higher net interest and trading income 690.2 2014 2013 2014 28 Net interest income in Portugal reflects the improvement in cost of deposits, although impacted by lower loan volumes Net interest income (Million euros) 176 144 106 64 77 96 97 111 4Q14 vs. 3Q14 2014 vs.2013 +7.5 +172.9 +14.9 +89.0 -5.3 -119.1 +12.3 +17.1 0.0 +34.4 +2.7 -10.2 +32.1 +184.1 Cost of deposits effect CoCos effect Performing loans volume effect NPL effect 2011 liability management effect Others 1Q13 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 Total Net interest income increased both quarter-on-quarter and year-on-year, driven by: – Cost of deposits: consistent reduction of term deposits spread, positively impacting net interest income – Lower amount of CoCos: reimbursement of 400 million euros in April and of 1,850 million euros in August 2014 – Reduction in loan volumes: still penalizes net interest income 29 Continued strong efforts to reduce the cost of deposits, in line with strategic plan Term deposits rate Credit portfolio rate (%) (%) 5.0% Companies 5.0% New Production 4.0% Portfolio 3.0% 4.0% 3.0% 2.0% 2.0% 1.0% 1.0% 0.0% Mortgage 0.0% S/11D/11M/12J/12S/12D/12M/13J/13S/13D/13M/14J/14S/14D/14 Evolution of term deposit spreads in Portugal (basis points) 2012 2013 2014 (173) 2015 ~(150) (239) (310) Strategic plan D-12 M-13 J-13 S-13 D-13 M-14 J-14 S-14 D-14 Continued effort to bring the cost of deposits down: new deposits with substantially lower rates when compared to previous years Exactly in line with strategic plan target of improving spreads on deposits Spreads on remain high loans to companies 30 Strong performance of market commissions, lower banking fees (Million euros) 2013 2014 YoY 370.0 368.0 -0.6% 92.8 103.6 11.6% 125.2 119.0 -4.9% 72.5 72.7 0.3% Current account related 105.1 76.5 -27.3% State guarantee -60.1 -22.7 62.2% Other fees and commissions 34.5 18.8 -45.5% Market related fees and commissions 60.3 65.2 8.2% Securities operations 53.8 57.7 7.3% 6.5 7.5 15.6% 430.3 433.2 0.7% Banking fees and commissions Cards and transfers Loans and guarantees Bancassurance Asset management Total fees and commissions 31 Continued reduction in costs in Portugal, on target with strategic goals (Million euros) Employees Operating costs* -5.9% 733.8 Other administrative costs Staff costs 690.2 38.2 Depreciation 8,584 -15.2% 263.0 -6.1% 432.6 -816 32.4 246.9 7,768 410.8 -5.0% Dec 13 2013 2014 Operating costs evolution* 910.4 2011 864.8 2012 Strategic Plan 7,500 690.5 ~660 2013 2014 2015 Dec 17 695 Strategic Plan 700 Dec 14 Dec 15 Branches -79 Strategic Plan 733.8 Dec 14 774 Dec 13 * Excluding the impact of specific items. Operating costs decreased 19.1% in Portugal including specific non recurring items. 32 Continued increase of core income and reduction of operating costs in Portugal Core Income* Operating costs* (Million euros) (Million euros) 288 169 189 212 204 201 224 247 185 185 183 181 173 Commissions 179 166 173 Net Interest Income 1Q13 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 1Q13 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 Core income* and operating costs* Largest banks operating in Portugal (1st quarter 2013 = 100) Operating costs cccumulated evolution 2012-2014* 170 111 125 120 119 132 +14% Core income 146 +3% +77pp -5% 100 98 97 93 96 89 93 1Q13 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 Operating costs -2% -20% BCP B1 B2 * Excludes non recurring specific items. 2014 figures were annualized based on the last interim figures reported. Figures related to the activity in Portugal were considered, whenever available. B3 B4 33 Credit quality shows signs of stabilization (Million euros) Credit quality Credit ratio Loan impairment provisions (balance sheet) Dec 13 Dec 14 NPL 13.1% 14.0% Credit at risk 13.6% 14.1% Provision coverage ratio NPL 48% 49% Credit at risk 46% 49% 6,134 2,953 3,034 Dec 13 Dec 14 Dec 13 Dec 14 Loan impairment (net of recoveries) Dec 14 vs. Dec 13 Dec14 vs. Sep 14 6,213 6,287 +/- Net entries +541 -3 - Write-offs -550 -149 -70 -0.1 6,134 6,134 NPL evolution detail Initial stock Final stock Dec 14 6,213 NPL (non performing loans) - Sales Dec13 157 bp 743 2013 Cost of risk 233 bp Excluding one-offs 150 pb 1,021 2014 34 Reduction of foreclosed assets and sale above book value, confirming appropriate coverage Foreclosed assets portfolio Number of properties sold (Million euros) Coverage -35.0% 26.5% 1,395 3,434 17.9% 2,233 1,442 258 370 2013 2014 Book value of sold properties (Million euros) 1,025 1,184 -20.9% 306 242 dec 13 dec 14 Impairments Net value Sale value 2013 2014 285 261 35 Agenda Main Highlights Group • Profitability • Liquidity • Capital Portugal International operations Conclusions 36 Significant net income growth in international operations (Million euros) 2013 International operations* C% 2014 local currency C% euros ROE 13.1% 178.2 201.5 127.8 155.2 21.5% 22.1% 12% Mozambique 82.4 88.5 7.4% 3.4% 23% Angola 40.1 51.2 27.6% 25.5% 18% -72.1 -93.4 Poland Other and non-controlling interests €295 million Note: subsidiaries’ net income presented for the 2013 at the same exchange rate as for the 2014, in order to allow comparison without exchange rate effect * Excludes Banca Millennium (Romania) 37 Poland: Customer funds and loans to Customers growth (Million euros) Loans to Customers (gross) Customer funds +4.8% 12,139 Dec 13 + 5.6% 12,719 10,648 10,081 Dec 14 6,317 +0.5% 6,351 959 + 19.0% 1,142 2,805 + 12.5% 3,155 Dec 13 Mortgage FX effect excluded. €/Zloty constant in December 2014: Income Statement 4.19291667; Balance Sheet 4.2732 Dec 14 Consumer Companies 38 Net income growth driven by higher banking income and stable operating costs (Million euros) Net income + 21.5% 155.2 127.8 Net income grows 21.5%, with ROE of 11.8% Banking income increase (+10.4%): increase of 15.3% in net interest income and 3.9% in commissions Stable operating costs (+2.0%), reflecting a strict cost control policy 2013 2014 Banking income Operating costs + 10.4% 478.5 528.4 2013 2014 FX effect excluded. €/Zloty constant in December 2014: Income Statement 4.19291667; Balance Sheet 4.2732 +2.0% 259.9 265.1 2013 2014 39 Strong increase in core income, stable operating costs (Million euros) Operating costs Net interest income* +15.3% +2.0% 349.4 259.9 265.1 129.4 134.6 130.5 130.5 2013 2014 303.1 2013 2014 Other administrative costs and depreciation Fees and commissions Staff costs +3.9% 140.4 145.9 Employees 5,881 2013 2014 Dec 13 +227 Branches 6,108 Dec 14 -16 439 423 Dec 13 Dec 14 * Pro forma data. Margin from derivative products, including those from hedging FX denominated loan portfolio, is included in net interest income, whereas in accounting terms, part of this margin (12.1M€ in 2013 and 2.6M€ in 2014) is presented in net trading income. FX effect excluded. €/Zloty constant in December 2014: Income Statement 4.19291667; Balance Sheet 4.2732 40 Stable credit quality, high coverage level (Million euros) Credit quality Loan impairment (balance sheet) Credit ratio NPL Dec 13 Dec 14 2.9% 3.0% Coverage ratio NPL Dec 13 Dec 14 106% 101% 307 318 Dec 13 Dec 14 314 289 Loan impairment (net of recoveries) 56 bp Dec 13 Dec 14 Cost of risk 61 bp 55.8 63.3 2013 2014 NPL (non performing loans) FX effect excluded. €/Zloty constant in December 2014: Income Statement 4.19291667; Balance Sheet 4.2732 41 Millennium bank’s CHF-denominated mortgage portfolio is solid; a set of risk-mitigating measures has been designed Millennium bank Comparison of CHF vs. PLN installment, in PLN The Fx-denominated mortgages portfolio of Millennium bank totalled CHF 5 billion (€4.2 billion) at year-end 2014, with an average 1.4% spread and low delinquency (impired credit below 2%) Average instalment is up by 12%. This is lower than the increases seen both in 2008 and in 2011 (+23% and +16%, respectively) +12% 1,217 1,179 1,220 +16% +23% +3% +25% 971 971 Original DTI: 35% Simulated** Current DTI: 28% 1st Instalment in CHF loan (in PLN) Instalment in CHF loan (in PLN) Wage growth in Poland over the last years has resulted in a simulated debt service to income ratio of 28%**, lower than 35% at origination A set of measures has been designed to mitigate Customers’ non-performance risk, complying with Polish supervisor authorities recommendations. These include special pricing on converting loans to local currency and a more flexible approach to Customers under risk of default 4Q06 2Q07 4Q07 2Q08 4Q08 2Q09 4Q09 2Q10 4Q10 2Q11 4Q11 2Q12 4Q12 2Q13 4Q13 2Q14 4Q14 2Q15 1st Instalment in similar PLN loan Instalment in similar PLN loan Installments to be paid from 2Q 2015 will benefit from a historically low CHF Libor, offsetting part of the exchange rate impact: the average installment is expected to increase by 3% from December 2014 * At current exchange rate and real-estate prices. ** Percentage of Customer’s income used to service loan, installment and income updated to most recent figures. 42 Mozambique: strong volume growth (Million euros) Customer funds Loans to Customers (gross) +19.2% 1,932 +17.8% 1,481 1,621 44 1,257 24 289 +6.2% 272 961 Dec 13 Dec 14 Dec 13 Mortgage FX effect excluded. €/Metical constant as at December 2014: Income Statement 41.58166667; Balance Sheet 40.4700 +19.5% 1,148 Dec 14 Consumer Companies 43 Net income benefited from increased banking income (Million euros) Net income Net income increases 7.4%, with ROE at 22.6% +7.4% 88.5 82.4 Increase of 10.3% in banking income: net interest income up by 15.6%, benefitting from business expansion, and 9.1% increase in commissions Operating costs up by 9.9% (+9 branches compared to December 13) 2013 2014 Banking income Operating costs +10.3% 202.1 +9.9% 223.0 90.0 2013 2014 FX effect excluded. €/Metical constant as at December 2014: Income Statement 41.58166667; Balance Sheet 40.4700 2013 98.9 2014 44 Consistent increase in net interest income and commissions (Million euros) Operating costs Net interest income +15.6% 121.6 +9.9% 140.6 98.9 90.0 10.8 9.0 2013 2014 +9.1% 45.3 42.8 46.5 2013 2014 2014 Branches Employees* 2,329 2013 41.5 Depreciation Staff costs Other administrative costs Fees and commissions 41.5 38.2 Dec 13 +38 2,367 Dec 14 157 Dec 13 +9 166 Dec 14 * Excludes employees from SIM (insurance company) FX effect excluded. €/Metical constant as at December 2014: Income Statement 41.58166667; Balance Sheet 40.4700 45 Credit quality and coverage (Million euros) Credit quality Loan impairment (balance sheet) Credit ratio NPL Dec 13 Dec 14 3.9% 4.1% Coverage ratio NPL Dec 13 Dec 14 151% 127% 73 78 Dec 13 Dec 14 61 49 Loan impairment (net of recoveries) 88 bp Dec 13 Dec 14 Cost of the risk 84 bp 10.7 12.0 2013 2014 NPL (non performing loans) FX effect excluded. €/Metical constant as at December 2014: Income Statement 41.58166667; Balance Sheet 40.4700 46 Angola: strong volume growth (Million euros) Customer funds Loans to Customers (gross) +10.6% 1,452 1,313 +44.9% 1,005 694 Dec 13 Dec 14 FX effect excluded. €/Kwanza constant as at December 2014: Income Statement 130.35875000; Balance Sheet 124.900 Dec 13 Dec 14 47 Net income increase driven by higher banking income (Million euros) Net income Net income increases 27.6%, with ROE at 18.4% +27.6% 51.2 40.1 Increase of 11.7% in banking income: net interest income up by 32.3%, reflecting business expansion, with commissions up by 7.6% Operating costs increased by 7.7%, as a result of network expansion (+6 branches from December 2013) 2013 Banking income 2014 Operating costs +11.7% 147.5 132.1 2013 2014 FX effect excluded. €/Kwanza constant as at December 2014: Income Statement 130.35875000; Balance Sheet 124.900 +7.7% 69.7 75.0 2013 2014 48 Strong growth in core income and operating costs in line with network expansion (Million euros) Operating costs Net interest income +32.3% 88.1 +7.7% 69.7 66.6 2013 2014 75.0 7.2 8.8 33.6 34.1 28.8 32.1 2013 2014 Depreciation Staff costs Other administrative costs Fees and commissions +7.6% 29.5 Employees 31.8 1,075 2013 2014 +68 Dec 13 FX effect excluded. €/Kwanza constant as at December 2014: Income Statement 130.35875000; Balance Sheet 124.900 Branches 1,143 82 Dec 14 Dec 13 +6 88 Dec 14 49 Credit quality and coverage (Million euros) Credit quality Credit ratio NPL Loan impairment (balance sheet) Dec 13 Dec 14 4.7% 6.4% Coverage ratio NPL Dec 13 Dec 14 114% 75% 49 37 65 dez 13 33 Loan impairment (net of recoveries) 160 bp Dec 13 dez 14 Dec 14 NPL (non performing loans) FX effect excluded. €/Kwanza constant as at December 2014: Income Statement 130.35875000; Balance Sheet 124.900 Cost of risk 102 bp 10.7 9.8 2013 2014 50 Agenda Main Highlights Group • Profitability • Liquidity • Capital Portugal International operations Conclusions 51 Progress on strategic plan metrics Phases Demanding economic environment (2012-13) Creating growth and profitability conditions (2014-15) Priorities Stronger balance sheet Recovery of profitability in Portugal 2014 2015 CET1 na 12.0% >10% (phased-in) (fully implemented) na 8.9%* LTD** 108% 102% C/I*** Oper. costs*** Continued development of business in Poland, Mozambique and Angola Sustained growth (2016-17) 2013 Sustained net income growth, greater balance between domestic and international operations … 66% €734m 52% €690m … … … Initiatives Capital ratios in excess of requirements, reflecting rights issue, insurer sale, securitisation and sale of Romanian operation <110% Deleveraging and increased Customers’ funds, leading to strengthened liquidity ≈50% Improved efficiency, stemming from increased banking income (inc. gain on sale of sovereign debt portfolio) and cost reduction ≈€660m Restructuring programme from end-2012. Savings already clearly visible Cost of risk (bps) 137 194 … ≈100 Increased cost of risk due to AQR impact. Goal for 2015 not at risk, as new NPL entries still going down ROE**** -26% -6% … ≈7% Increased contribution from international operations, recovery in Portugal Positive earnings trend affirmed, aligned with strategic plan of creating conditions for profitability in Portugal and sustained growth in Poland, Mozambique and Angola, as specific items do not risk a solid capital position * Reflecting the new regime for deferred tax assets.| ** Loans to deposits ratio calculated based on net loans to Customers and on balance sheet Customer funds. *** On a comparable basis. | **** 2015 adjusted for excess capital vs 10%. 52 Appendixes 53 Sovereign debt portfolio (Million euros) Sovereign debt portfolio Total sovereign debt maturity Dez 13 Sep 14 Dez 14 C% annually Portugal 5,879 5,133 4,688 -20% -9% T-bills 2,178 1,055 815 -63% -23% Bonds 3,701 4,078 3,873 5% -5% Poland 1,366 1,568 1,820 33% 16% Mozambique 393 470 587 49% 25% Angola 319 412 367 15% -11% Others 375 192 130 -65% -32% 8,332 7,776 7,592 -9% -2% Total <1 year 23% C% quarterly >3 years 50% >1 year and <2 years 9% >2 years and <3 years 18% Total sovereign debt at 7.6 billion euros, of which 1.7 billion euros maturing up to one year Portuguese sovereign debt decreased, whereas exposure to Polish, Mozambican and Angolan have increased from December 2013 54 Sovereign debt portfolio details (Milhões de euros) Portugal Poland Trading book < 1 year > 1 year and <2 years > 2 year and <3 years > 3 years 194 4 10 0 180 218 1 61 40 117 AFS book < 1 year > 1 year and <2 years > 2 year and <3 years > 3 years 2,627 893 160 681 893 1,601 39 426 442 694 HTM book < 1 year > 1 year and <2 years > 2 year and <3 years > 3 years 1,867 83 0 0 1,784 0 0 0 0 Total < 1 year > 1 year and <2 years > 2 year and <3 years > 3 years 4,688 981 170 681 2,856 1,820 39 487 483 811 Mozambique Angola Others Total 0 0 0 0 0 0 0 0 73 0 0 73 0.0047 486 5 71 114 296 587 472 4 110 0 367 217 58 30 61 7 5 0 0 1 5,189 1,627 648 1,264 1,650 0 0 0 0 50 0 0 0 50 1,917 83 0 0 1,834 367 217 58 30 61 130 5 0 73 52 7,592 1,715 719 1,378 3,780 0 0 0 0 0 587 472 4 110 0 55 Pension Fund Assumptions Discount rate Dec 13 Jun 14 Dec 14 4.00% 3.50% 2.50% 1.00% until 2016 0.75% until 2017 1.75% after 2016 1.00% after 2017 0.00% until 2016 0.00% until 2017 0.75% after 2016 0.50% after 2017 Salary growth rate Pensions growth rate Projected rate of return of fund assets 4.00% 3.50% 2.50% Mortality Tables Men TV 73/77 -1 year TV 73/77 -2 years Women Tv 88/90 -2 years Tv 88/90 -3 years 56 The Angolan economy is increasingly diversified; BMA’s exposure to the oil industry is immaterial The fiscal and budget mechanisms implemented by the Angolan Government during the last oil crisis (2009) allowed GDP growth not do drop below reasonable levels and permitted roughly stable exchange rates; Main macroeconomic indicators 2008 2009 Ch.% 2014f Oil price (USD/barrell) 96.8 62.7 -35% 98.9 Real GDP (percent change) 13.8 2.4 -11.4 3.9 5.9 Exports (percent change) 10.1 -2.6 -12.7 -2.9 2.8 Investment (% of GDP) 16.2 15.2 -1.0 14.8 14.6 Official exchange rate (average, kwanzas per U.S. dollar) 75.0 79.3 -6% 98.3 Consumer prices (annual avg %) 12.4 13.7 +1.3 7.3 7.3 Overall fiscal balance (% of GDP) -4.5 -7.4 -2.9 -4.1 -4.2 16,186 13,617 -16% 27,346 35,113 Gross international reserves (end of period, USD mln) Breakdown of Angola’s GDP 11,984 42% 44% 56% 2007 The weight of the oil industry has decreased, and should account for 35% of Angola’s GDP in 2015 (compared to 58% in 2008); BMA’s exposure to the oil industry accounts for less than 1% of its highly-diversified loan portfolio; BMA’s delinquency levels are significantly below Angolan banking industry average. 12.917 58% 2008 5,989 59% 63% 14.167 Mining Oil/Gas 65% 15% Other 33% … 44% 46% 2009 … 37% Trade Food industry 35% 3% 1% 11% 2013E 2014P 2015P Individuals Source: International Monetary Fund – September 2014; National Bank of Angola; Business Monitor BMA Peso no Grupo Total assets 1,950 2.5% Gross loans 1,005 1.8% Deposits 1,452 2.9% Sh. Equity 315 3.7%* 3% Construction 15% 41% BMA’s weight in BCP Group (Million euros) 0% 6,316 4,637 Angola has today international currencies’ reserves in excess of USD 27 bln, well above 2008; BMA’s loans portfolio per sector (Billion Kwanzas) Oil Non-oil 2015f 19% Transport *BCP’s stake: 50.1% Services 57 Financial Statements 58 Consolidated Balance Sheet and Income Statement 2014 2014 2013 2013 (Thousands of Euros) (T housands of Euros) Assets Cash and deposits at central banks Loans and advances to credit institutions Repayable on demand Other loans and advances Loans and advances to customers Financial assets held for trading Financial assets available for sale Assets with repurchase agreement Hedging derivatives Financial assets held to maturity Investments in associated companies Non current assets held for sale Investment property Property and equipment Goodwill and intangible assets Current tax assets Deferred tax assets Other assets 1,707,447 2,939,663 795,774 1,456,026 53,685,648 1,674,240 8,263,225 36,423 75,325 2,311,181 323,466 1,622,016 176,519 755,451 252,789 41,895 2,398,562 784,929 1,054,030 1,240,628 56,802,197 1,290,079 9,327,120 58,268 104,503 3,110,330 578,890 1,506,431 195,599 732,563 250,915 41,051 2,181,405 593,361 76,360,916 82,007,033 Liabilities Amounts owed to credit institutions Amounts owed to customers Debt securities Financial liabilities held for trading Hedging derivatives Provisions for liabilities and charges Subordinated debt Current income tax liabilities Deferred income tax liabilities Other liabilities Total Liabilities 10,966,155 49,816,736 5,709,569 952,969 352,543 460,293 2,025,672 31,794 6,686 1,051,592 13,492,536 48,959,752 9,411,227 869,530 243,373 365,960 4,361,338 24,684 6,301 996,524 71,374,009 78,731,225 Equity Share capital Treasury stock Preference shares Other capital instruments Fair value reserves Reserves and retained earnings Net income for the year attributable to Shareholders Total Equity attributable to Shareholders of the Bank Non-controlling interests Total Equity 3,706,690 (13,547) 171,175 9,853 106,898 449,381 (217,914) 3,500,000 (22,745) 171,175 9,853 22,311 (356,937) (740,450) 4,212,536 2,583,207 774,371 692,601 4,986,907 3,275,808 76,360,916 82,007,033 Interest and similar income Interest expense and similar charges Net interest income Dividends from equity instruments Net fees and commission income Net gains / losses arising from trading and hedging activities Net gains / losses arising from available for sale financial assets Net gains / (losses) arising from financial assets held to maturity Other operating income Other net income from non banking activity 2,652,638 (1,536,487) 2,832,912 (1,984,825) 1,116,151 848,087 5,888 680,885 3,680 662,974 154,247 80,385 302,407 184,065 (14,492) (53,299) (278) (55,627) 2,191,787 1,723,286 19,278 20,502 2,211,065 1,743,788 635,616 448,451 65,543 767,463 459,653 68,123 Operating costs 1,149,610 1,295,239 Operating net income before provisions and impairments 1,061,455 448,549 (1,106,990) (91,345) (36,311) (145) (81,473) (820,827) (102,193) (210,471) (3,043) (150,059) (254,809) (838,044) 35,960 45,445 62,260 (36,759) (173,404) (812,543) (100,995) 198,670 (75,729) (115,635) 326,434 (601,744) Total operating income Staff costs Other administrative costs Depreciation Loans impairment Other financial assets impairment Other assets impairment Goodwill impairment Other provisions Operating net income Share of profit of associates under the equity method Gains / (losses) from the sale of subsidiaries and other assets Net (loss) / income before income tax Income tax Current Deferred Net (loss) / income after income tax from continuing operations Income arising from discontinued operations Net income after income tax Attributable to: Shareholders of the Bank Non-controlling interests Net income for the year Earnings per share (in euros) Basic Diluted (32,125) (45,004) (107,854) (646,748) (217,914) 110,060 (740,450) 93,702 (107,854) (646,748) (0.005) (0.005) (0.022) (0.022) 59 Consolidated Income Statement Quarterly evolution (Million euros) Quarterly 4Q 13 1Q 14 2Q 14 Year-to-date 3Q 14 4Q 14 Dec 13 Dec 14 C% 14 / 13 Net interest income 234.3 236.4 259.6 295.0 325.2 848.1 1,116.2 31.6% Dividends from equity instruments Net fees and commission income Other operating income Net trading income Equity accounted earnings Banking income 2.0 168.2 -23.2 114.8 15.8 512.0 3.3 164.6 -15.0 111.9 13.1 514.3 2.5 176.5 62.4 63.3 9.9 574.2 0.1 165.0 -13.8 182.0 5.2 633.6 0.1 174.7 -22.2 85.0 7.7 570.5 3.7 663.0 -71.9 264.2 62.3 1,769.3 5.9 680.9 11.4 442.2 36.0 2,292.5 60.0% 2.7% >100% 67.4% -42.2% 29.6% Staff costs Other administrative costs Depreciation Operating costs 263.5 124.3 19.4 407.2 160.2 107.6 15.9 283.6 163.2 113.9 15.9 293.1 154.6 109.7 16.5 280.9 157.6 117.3 17.2 292.0 767.5 459.7 68.1 1,295.2 635.6 448.5 65.5 1,149.6 -17.2% -2.4% -3.8% -11.2% Operating net income bef. imp. 104.8 230.7 281.1 352.7 278.4 474.1 1,142.9 >100% Loans impairment (net of recoveries) Other impairm. and provisions Net income before income tax 202.2 90.3 -187.7 191.7 59.4 -20.4 179.9 54.6 46.6 502.9 29.0 -179.2 232.5 66.3 -20.3 820.8 465.8 -812.5 1,107.0 209.3 -173.4 34.9% -55.1% 78.7% Income tax Non-controlling interests Net income (before disc. oper.) -72.4 26.4 -141.7 -5.4 25.4 -40.4 7.6 27.2 11.7 -173.0 29.3 -35.5 73.1 28.2 -121.6 -210.8 93.7 -695.4 -97.7 110.1 -185.8 53.7% 17.5% 73.3% -1.4 -0.3 -33.3 -0.5 1.9 -45.0 -32.1 28.6% -143.1 -40.7 -21.5 -36.0 -119.7 -740.5 -217.9 70.6% Net income arising from discont. operations Net income 60 Consolidated Income Statement (Portugal and International Operations) For the 12 months period ended 31th December, 2013 and 2014 (Million euros) Int e rna t io na l o pe ra t io ns Gro up D ec 13 D ec 14 P o rt uga l ∆ % D ec 13 D ec 14 T o tal ∆ % D ec 13 D ec 14 B a nk M ille nnium ( P o la nd) ∆ % D ec 13 D ec 14 ∆ % M ille nnium bim ( M o z.) D ec 13 D ec 14 M ille nnium A ngo la ∆ % D ec 13 D ec 14 O t he r int . o pe ra t io ns ∆ % D ec 13 D ec 14 ∆ % Interest inco me 2,833 2,653 -6.4% 1,914 1,699 -11.2% 919 953 3.8% 634 616 -2.8% 183 207 12.7% 92 124 35.3% 9 6 Interest expense 1,985 1,536 -22.6% 1,571 1,172 -25.4% 413 364 -11.9% 345 269 -21.8% 57 66 15.8% 24 36 49.5% -12 -8 38.6% N e t int e re s t inc o m e 848 1,116 3 1.6 % 343 527 5 3 .7 % 505 589 16 .6 % 289 347 19 .8 % 12 6 14 1 11.3 % 68 88 3 0 .1% 22 14 - 3 7 .1% Dividends fro m equity instruments Int e rm e dia t io n m a rgin 1 -35.0% 4 6 60.0% 2 84.8% 2 4 47.4% 0 0 13.4% 0 0 -11.2% 2 3 55.4% 0 0 <-100% 852 1,12 2 3 1.7 % 344 529 5 3 .8 % 508 593 16 .8 % 290 347 19 .8 % 12 6 14 1 11.3 % 70 91 3 0 .9 % 22 14 - 3 7 .1% Net fees and co mmissio n inco me 663 681 2.7% 430 433 0.7% 233 248 6.5% 140 146 4.4% 43 45 5.1% 30 32 5.9% 20 25 24.4% Other o perating inco me -72 11 >100% -88 14 >100% 16 -2 <-100% -4 -14 <-100% 19 14 -28.3% 1 -1 <-100% 0 -1 <-100% 2 5 .7 % 687 976 4 2 .1% 756 838 10 .9 % 425 479 12 .5 % 18 9 200 5 .8 % 10 0 12 2 2 1.5 % 41 B a s ic inc o m e 1,4 4 3 1,8 14 264 442 67.4% 158 344 >100% 106 99 -7.1% 49 48 -1.4% 21 23 10.3% 34 26 -24.3% 62 36 -42.2% 62 36 -41.9% 0 0 <-100% 0 0 <-100% 0 0 -- 0 0 -- 1,7 6 9 2 ,2 9 2 2 9 .6 % 907 1,3 5 6 4 9 .5 % 862 937 8 .6 % 474 527 11.0 % 2 10 223 6 .3 % 13 4 14 8 9 .9 % Staff co sts 767 636 -17.2% 549 411 -25.2% 218 225 3.1% 130 130 0.5% 44 47 4.7% 29 32 Other administrative co sts 460 448 -2.4% 265 247 -6.9% 194 202 3.6% 115 120 4.4% 40 42 4.9% 34 34 Net trading inco me Equity acco unted earnings B a nk ing inc o m e Depreciatio n 38 - 8 .7 % 2 2 -32.8% 0 0 69.6% 44 39 - 10 .0 % 9.7% 14 16 7.9% -0.2% 6 6 2.2% 68 66 -3.8% 38 32 -15.2% 30 33 10.8% 13 13 2.4% 9 11 15.8% 7 9 19.8% 0 0 -0.1% Ope ra t ing c o s t s 1,295 1,150 -11.2% 853 690 -19.1% 442 459 3.9% 257 263 2.3% 93 99 5.9% 71 75 6.0% 21 22 6.1% Ope ra t ing ne t inc o m e be f . im p. 474 1,14 3 >10 0 % 54 666 >10 0 % 420 477 13 .6 % 2 17 263 2 1.3 % 116 12 4 6 .6 % 72 14 .2 % 23 17 - 2 4 .6 % <-100% 63 Lo ans impairment (net o f reco veries) 821 1,107 34.9% 743 1,021 37.4% 78 86 10.4% 53 65 23.2% 11 12 8.1% 11 10 -9.6% 4 0 Other impairm. and pro visio ns 466 209 -55.1% 463 208 -55.1% 3 2 -46.7% 3 -1 <-100% 1 2 >100% -1 1 >100% 0 0 >100% - 8 13 - 17 3 7 8 .7 % - 1,15 2 -563 5 1.1% 339 389 14 .9 % 16 1 200 2 3 .9 % 10 5 110 5 .0 % 53 16 .2 % 19 17 - 10 .1% -211 -98 53.7% -278 -176 36.7% 67 78 16.6% 34 45 30.2% 18 20 11.7% 13 11 -13.8% 2 2 18.5% 94 110 17.5% 0 0 >100% 94 110 17.1% 0 0 -- 1 1 17.7% 0 0 -- 93 109 17.1% -695 - 18 6 7 3 .3 % -874 -387 5 5 .7 % 17 8 201 13 .1% 12 7 15 5 2 2 .1% 3 .4 % 41 51 2 5 .5 % -75 -93 - 2 4 .2 % N e t inc o m e be f o re inc o m e t a x Inco me tax No n-co ntro lling interests N e t inc o m e ( be f o re dis c . o pe r.) Net inco me arising fro m disco nt. o peratio ns N e t inc o m e -45 -32 28.6% -740 - 2 18 7 0 .6 % 86 88 62 61 Investor Relations Division Rui Coimbra, Head of Investor Relations Investor Relations Reporting and Ratings Luís Pedro Monteiro Luís Morais Paula Dantas Henriques Lina Fernandes Tl: +351 21 1131 084 Tl: + 351 21 1131 337 Email: [email protected] Banco Comercial Português. S.A., a public company (sociedade aberta) having its registered office at Praça D. João I. 28, Oporto, registered at the Commercial Registry of Oporto, with the single commercial and tax identification number 501 525 882 and the share capital of EUR 3,706,690,253.08 62

© Copyright 2026

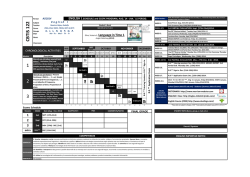

!["Minho - Le Nord" [no. 1 "Old Land Portugal"] - Free](http://s2.esdocs.com/store/data/000459019_1-763f6c95acdaf20bb3a9381d878beb51-250x500.png)