Crescent Mortgage Company

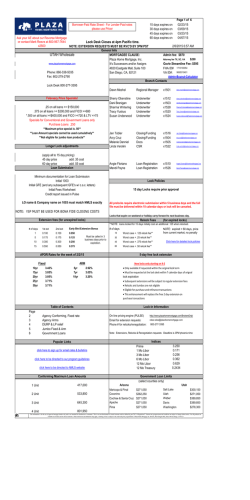

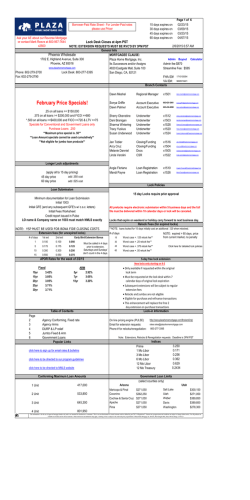

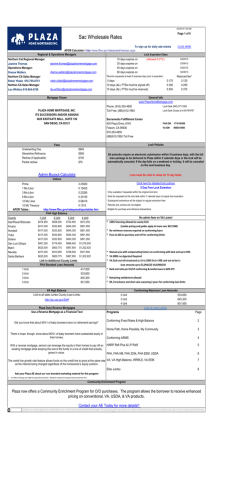

Thursday, February 05, 2015 4:15 PM EDT Crescent Mortgage Company 5901 Peachtree Dunwoody Road NE, Bldg C, Suite 250 Atlanta, GA 30328 (800) 851-0263 www.crescentmortgage.com Market Update: 2/5/2015 Price Improvement Effective 4:15 P. M. ET 30Yr Bond Yield 2.416, 10 Yr. Bond Yield 1.807 as of 4:15pm ET Marketing Department Information Table Of Contents [email protected] Email: FAX: 770-677-7992 Locks Only 10:30AM the following business day Rates are good through: *** RATES SUBJECT TO CHANGE WITHOUT NOTICE. Lock Periods: 15 Day - Approved Loans Only * Refinance Transactions limited to a Maximum 45 Day Lock * 30 Day , 45 Day 60 Day for Purchase Transactions or Construction Perm Refi ONLY Not Allowed: (1) Ground Leases in all states, (2) and ONLY in Cook County, IL if you are a bank or credit union. NO locks on TBD addresses. Page 2 Page 3 Page 4 Page 5 Page 6 Page 7 & 8 Conventional Fixed and ARM DU Refi Plus LP Open Access DU High Balance & LP Super Conforming FHA / VA and USDA Jumbo Fixed and ARM - Option I & II Announcements VA price adjusters have changed. See Govt rate sheet for details Marketing and Rate Lock Extension Policy **** 3 day right-of rescission not counted in lock, loan must close by expiration date. *** Crescent Mortgage offers overnight price protection until 10:30 am Eastern time for NEW locks only, unless pricing suspended / changed. Locks that expire on weekend or holiday automatically are extended to following business day. Crescent Mortgage closely monitors lock fall out and pull through. Once expired, relocks are based on worse of original price or current market. Extension requests on expiring locks MUST be received by 6:00 PM ET on the expiration date. NO EXCEPTIONS These fees are incurred regardless if current market is better or worse than original lock price. *** 1) 2) 3) 4) 5) There is no fee for a 1 time only 1 day extension if no other extensions have been made. The fee is 0.10 (10 bps) for a 5 calendar day extension. The fee is 0.20 (20 bps) for a 10 calendar day extension. The fee is 0.30 (30 bps) for a 15 calendar day extension. Once a loan has been extended a TOTAL of 15 days (Including the 1 Day free extension), then any additional extensions will be worse case price. Re-Locking Expired Locks Locks that expire can be re-locked for a maximum of 15 days. Such loans must be re-locked off of worse case pricing when comparing original market to current market. All re-locks will cost at least .30pt, but could be more depending on current market. Locks that have been expired for 60 days or more will be relocked at current market. Fees: Wholesale Correspondent 1x CP Modification $725 Conventional Conforming $600 $250 $725 FHA $600 $725 VA $600 VA IRRRL No Separate Admin Fee on VA IRRRL (See Rate Sheet for price adjustment) $725 Rural Housing $600 $725 Jumbo Option I & II $600 $10 Flood Cert $10 In House Appraisal Admin Fee $75 $75 CRESCENT ACCOUNT EXECUTIVES Alex Williams Alex Williams Ashli Matson Bob Capodieci Bob Shellenberger Bryan Rivas Bryan Sherrill Dawn Cooley Drais Von Hagen Greg Reynolds Jill Levine Peggy Tyre Rick McKinley Sherry Orton Shy Tittlebaum SVP Sales & Marketing IL, KS, MO, OH, PA, South Texas GA CT, MA, ME, NH, VT, RI FL WA, OR, ID IN, KY, WV CO, UT, WY, MT TN North TX, OK NC, SC DC, VA, DE, MD IA, MI, MN, ND, SD, WI AL LA, MS, AR 770-846-8545 770-846-8545 770-714-5417 603-930-5989 727-638-1583 425-802-9790 502-435-6666 970-278-9328 865-607-5626 817-917-0261 703-819-6170 804-836-6424 763-458-4051 205-532-0596 225-810-6085 THIS RATE SHEET IS FOR MORTGAGE PROFESSIONALS ONLY, NOT FOR PUBLIC CONSUMPTION. CMC Rates are price indications only and are subject to change without notice DATE: Conventional Conforming Fixed / ARM Effective 02/05/15 4:15 PM EDT EXPIRATION DATES (Must close by expiration date) 15 DAY 02/20/15 45 DAY 03/22/15 30 DAY 03/07/15 60 DAY 04/06/15 15 Day Lock for Approved Loans only. 60 Day Locks for Purchase or Const/Refi only. LIBOR 12 MONTH FNMA 30 Day Yield 0.618 3.187 * Refinance Transactions limited to a Maximum 45 Day Lock * Fannie Mae Fixed Rate (DU) 30 Year FNMA 15 Days 105.313 4.625 105.065 4.500 104.818 4.375 104.505 4.250 104.245 4.125 103.796 4.000 103.679 3.990 103.407 3.875 102.813 3.750 102.088 3.625 101.107 3.500 100.955 3.490 100.265 3.375 99.543 3.250 30 Days 45 Days 60 Days 105.163 104.915 104.668 104.355 104.095 103.646 103.529 103.257 102.663 101.938 100.957 100.805 100.115 99.393 105.013 104.765 104.518 104.205 103.945 103.496 103.379 103.107 102.513 101.788 100.807 100.655 99.965 99.243 104.763 104.515 104.268 103.955 103.695 103.246 103.129 102.857 102.263 101.538 100.557 100.405 99.715 98.993 20 Year FNMA 15 Days 104.523 4.250 104.290 4.125 103.870 4.000 103.768 3.990 103.514 3.875 102.934 3.750 102.409 3.625 101.451 3.500 101.319 3.490 100.652 3.375 99.944 3.250 30 Days 45 Days 60 Days 104.373 104.140 103.720 103.618 103.364 102.784 102.259 101.301 101.169 100.502 99.794 104.223 103.990 103.570 103.468 103.214 102.634 102.109 101.151 101.019 100.352 99.644 103.973 103.740 103.320 103.218 102.964 102.384 101.859 100.901 100.769 100.102 99.394 30 Days 45 Days 60 Days 104.123 103.790 103.320 103.328 103.039 102.509 101.959 101.026 100.919 100.302 99.494 103.973 103.640 103.170 103.178 102.889 102.359 101.809 100.876 100.769 100.152 99.344 103.723 103.390 102.920 102.928 102.639 102.109 101.559 100.626 100.519 99.902 99.094 15 Year FNMA 15 Days 30 Days 45 Days 60 Days 103.944 103.794 103.644 103.394 3.875 103.873 103.723 103.573 103.323 3.750 103.802 103.652 103.502 103.252 3.625 103.706 103.556 103.406 103.156 3.500 103.363 103.213 103.063 102.813 3.375 103.045 102.895 102.745 102.495 3.250 102.771 102.621 102.471 102.221 3.125 102.307 102.157 102.007 101.757 3.000 102.165 102.015 101.865 101.615 2.990 101.616 101.466 101.316 101.066 2.875 100.974 100.824 100.674 100.424 2.750 10 Year FNMA See Scenario Pricer for 10yr price improvement Freddie Mac Fixed Rates (LP) 30 Year FHLMC 15 Days 104.963 4.625 104.765 4.500 104.518 4.375 104.205 4.250 103.945 4.125 103.496 4.000 103.379 3.990 103.107 3.875 102.513 3.750 101.788 3.625 100.797 3.500 100.655 3.490 99.940 3.375 99.218 3.250 30 Days 45 Days 60 Days 104.813 104.615 104.368 104.055 103.795 103.346 103.229 102.957 102.363 101.638 100.647 100.505 99.790 99.068 104.663 104.465 104.218 103.905 103.645 103.196 103.079 102.807 102.213 101.488 100.497 100.355 99.640 98.918 104.413 104.215 103.968 103.655 103.395 102.946 102.829 102.557 101.963 101.238 100.247 100.105 99.390 98.668 20 Year FHLMC 15 Days 104.273 4.250 103.940 4.125 103.470 4.000 103.478 3.990 103.189 3.875 102.659 3.750 102.109 3.625 101.176 3.500 101.069 3.490 100.452 3.375 99.644 3.250 30 Days 45 Days 60 Days 103.544 103.448 103.377 103.306 102.963 102.645 102.321 101.857 101.715 101.141 100.549 103.394 103.298 103.227 103.156 102.813 102.495 102.171 101.707 101.565 100.991 100.399 103.144 103.048 102.977 102.906 102.563 102.245 101.921 101.457 101.315 100.741 100.149 No FHLMC 10 Yr Product available at this time LIBOR ARM 5/1 LIBOR ARM 15 Year FHLMC 15 Days 103.694 3.875 103.598 3.750 103.527 3.625 103.456 3.500 103.113 3.375 102.795 3.250 102.471 3.125 102.007 3.000 101.865 2.990 101.291 2.875 100.699 2.750 Adjustments for NO ADMIN FEE Program Only 7/1 LIBOR ARM 10/1 LIBOR ARM Rate 30 Days Rate 30 Days Rate 30 Days 4.000 3.875 3.750 3.625 3.500 3.375 3.250 3.125 3.000 2.875 103.225 103.000 102.800 102.550 102.275 102.000 101.725 101.325 100.925 100.475 4.250 4.125 4.000 3.875 3.750 3.625 3.500 3.375 3.250 3.125 103.650 103.525 103.400 103.175 102.875 102.525 102.150 101.750 101.325 100.825 4.750 4.625 4.500 4.375 4.250 4.125 4.000 3.875 3.750 3.625 103.725 103.775 103.850 103.800 103.750 103.425 103.050 102.600 102.150 101.600 1 YR LIBOR 0.618 Margin 2.25 Non-Convertible Loan Amt Price Adjustments for No Admin Fee FNMA/FHLMC 30YR Fixed Programs Only -3.800 -1.450 -1.200 -0.700 -0.550 -0.450 -0.400 -0.250 -0.200 -0.200 -0.150 Loan Amount $25,000 to $59,999 Loan Amount $60,000 to $74,999 Loan Amount $75,000 to $99,999 Loan Amount $100,000 to $124,999 Loan Amount $125,000 to $149,999 Loan Amount $150,000 to $174,999 Loan Amount $175,000 to $199,999 Loan Amount $200,000 to $224,999 Loan Amount $225,000 to $249,999 Loan Amount $250,000 to $274,999 Loan Amount $275,000 to Limit 5/1, 7/1 & 10/1 LIBOR ARM NOTES : 45 Day Lock subtract 0.150 pt 30 Year FNMA No Admin Fee 5/1 Caps 2/2/5 , 1 Yr LIBOR, 2.25 Margin. 60 Day Lock subtract 0.400 pt 30 Year FHLMC No Admin Fee 7/1 & 10/1 Caps 5/2/5, 1 Yr LIBOR, 2.25 Margin. *LP Approved - subtract .50pt from price Risk Based Pricing Credit Score >= 740 LTV / Credit Score Grid < = 60 Cash Out Refinances LTV > 60 <= 70 >70 < = 75 >75 < = 80 >80 < = 90 >90 < = 97 LTV / Credit Score Grid < = 60 > 60 <= 70 LTV >70 < = 75 0.000 -0.250 -0.250 >75 < = 80 >80 < = 85 0.250 0.000 0.000 -0.250 -0.250 -0.250 Credit Score => 740 -0.500 -0.625 720 & <= 739 0.250 0.000 -0.250 -0.500 -0.500 -0.500 >= 720 & <= 739 0.000 -0.625 -0.625 -0.750 -1.500 700 & <= 719 0.250 -0.500 -0.750 -1.000 -1.000 -1.000 >= 700 & <= 719 0.000 -0.625 -0.625 -0.750 -1.500 680 & <= 699 0.000 -0.500 -1.250 -1.750 -1.500 -1.250 >= 680 & <= 699 0.000 -0.750 -0.750 -1.375 -2.500 660 & <= 679 0.000 -1.000 -2.250 -2.750 -2.750 -2.250 >= 660 & <= 679 -0.250 -0.750 -0.750 -1.500 -2.500 640 & <= 659 -0.500 -1.250 -2.750 -3.000 -3.250 -2.750 >= 640 & <= 659 -0.250 -1.250 -1.250 -2.250 -3.000 620 & <= 639 -0.500 -1.500 -3.000 -3.000 -3.250 -3.250 >= 620 & <= 639 -0.250 -1.250 -1.250 NA NA < 620 N/A N/A N/A N/A N/A N/A NA NA NA NA NA < 620 Risk based pricing adjustments apply to all conventional conforming loans except Cash Out adjustments apply to all conventional loans. loans with terms of 180 months or less. ** Texas Cash-Out under $100,000 Other Adjustments additional price adj = -.50pt Subordinate Financing LTV Range CLTV Range Score <720 Score >=720 <=65% >80% <=95% -0.500 -0.250 0.100 >65% <=75% >80% <=95% -0.750 -0.500 $50,000 to $99,999 -0.250 >75% <=95% >90% <=95% -1.000 -0.750 $25,000 to $49,999 -1.000 >75% <=90% >76% <=90% -1.000 -0.750 < $25,000 -2.000 <=95 >95% <=97% -1.500 -1.500 High LTV (97% LTV) >95 and <=97 Purchase and R/T Fixed DU 9.2 Only -0.500 Escrow Waiver Owner Occp with Score >= 660 & LTV <= 80% Add to Price Loan Amount (adjusters do not apply if NO ADMIN FEE program selected) >= $200,000 -0.250 LPMI 30,25,20 Yr 15 & 10 Yr State Adjusters (Fixed Rate Only) 80.01-85 85.01-90 90.01-95 Primary - Purchase/Rate/Term >=740 (0.990) (1.370) (2.150) TX 0.200 0.100 Primary - Purchase/Rate/Term 720-739 (1.120) (1.720) (2.350) SC 0.100 0.000 Primary - Purchase Only 680-719 (1.330) (2.170) (3.290) CO, CT, FL, ID, LA, MA, ME, MS, NC, NH, RI, SD, TN, UT, VT, WA, WY -0.100 -0.100 Primary - Cash-Out >=740 (1.490) n/a n/a AL, AR, DE, IL, IN, KY, MD, MN, NE, NM, OH, VA, WI -0.150 -0.100 Primary - Cash-Out 720-739 (1.820) n/a n/a AZ, DC, IA, MI, MT, NV, WV -0.200 -0.150 SecondHome Purch/RateTerm >=740 (1.240) (1.620) n/a CA -0.375 -0.250 SecondHome Purch/RateTerm 720-739 (1.610) (2.210) n/a -1.000 2 - 4 Units Investment Property No Condos - Minimum $50,000 Loan Amt Purchase Only >> Condos 1 Unit -1.750 Multiple Financed Properties - INVESTOR and Second Home loans with To MAX 80 LTV 1 Unit -3.000 5 to 10 financed properties - Adjust pricing by -2.00 pt To MAX 75 LTV 2 - 4 Units -1.750 Primary Owner Occupied Only FNMA 30 yr fixed My Community FHLMC 30 yr fixed Home Possible Fannie Mae ONLY To 75 LTV LTV > 75% -0.750 -2.000 -3.000 Date: 2/5/2015 Fannie Mae DU Refi Plus Effective: 4:15 PM EXPIRATION DATES (Must close by expiration date) 15 DAY 02/20/15 45 DAY 03/22/15 30 DAY 03/07/15 60 DAY 04/06/15 Fannie Mae DU Refi Plus 30 yr FNMA DU Refi Plus 4.625 4.500 4.375 4.250 4.125 4.000 3.990 3.875 3.750 3.625 3.500 3.490 3.375 3.250 20 yr FNMA DU Refi Plus 15 Days 30 Days 45 Days 104.888 104.665 104.393 104.105 103.645 102.996 102.854 102.507 101.913 100.688 99.672 99.405 98.640 97.868 104.738 104.515 104.243 103.955 103.495 102.846 102.704 102.357 101.763 100.538 99.522 99.255 98.490 97.718 104.588 104.365 104.093 103.805 103.345 102.696 102.554 102.207 101.613 100.388 99.372 99.105 98.340 97.568 4.250 4.125 4.000 3.990 3.875 3.750 3.625 3.500 3.490 3.375 3.250 15 yr FNMA DU Refi Plus 15 Days 30 Days 45 Days 104.148 103.690 103.070 102.953 102.614 102.009 100.759 99.751 99.494 98.752 97.944 103.998 103.540 102.920 102.803 102.464 101.859 100.609 99.601 99.344 98.602 97.794 103.848 103.390 102.770 102.653 102.314 101.709 100.459 99.451 99.194 98.452 97.644 3.875 3.750 3.625 3.500 3.375 3.250 3.125 3.000 2.990 15 Days 30 Days 45 Days 103.519 103.423 103.402 103.256 102.913 102.520 102.221 101.682 101.490 103.369 103.273 103.252 103.106 102.763 102.370 102.071 101.532 101.340 103.219 103.123 103.102 102.956 102.613 102.220 101.921 101.382 101.190 10 YR FNMA DU Refi Plus Same price as 15 Year FNMA DU Refi. 10yr adjustment is subject to change without notice Price Cap for FNMA Fees DU Refi Plus Agency Price Adjusters DU Refi Plus loans will have a cumulative delivery fee cap. Other CMC fees may still apply. Price CAP Primary Residence LTV >80% / Amort Term > 240 Primary Residence LTV >80% / Amort Term <= 240 All other transactions 0.500 0.000 1.750 Risk based pricing adjustments apply to all conventional conforming loans except with terms of 180 months or less. Risk Based Pricing LTV / Credit Score Grid Other Adjustments Credit Score < = 60 > 60 <= 70 LTV >70 < = 75 >= 740 >= 720 & <= 739 >= 700 & <= 719 >= 680 & <= 699 >= 660 & <= 679 >= 640 & <= 659 >= 620 & <= 639 < 620 0.250 0.250 0.250 0.000 0.000 -0.500 -0.500 n/a 0.000 0.000 -0.500 -0.500 -1.000 -1.250 -1.500 n/a 0.000 0.000 -0.500 -0.750 -1.500 -1.750 -1.750 n/a CLTV Range Score <720 Score >=720 -0.500 -0.500 -0.250 -1.500 -0.250 -0.250 0.000 -1.500 >75 < = 95 >95 < = 150 0.000 0.000 -0.500 -0.750 -1.750 -1.750 -1.750 n/a 2-4 Units 0.000 0.000 -0.500 -0.500 -1.250 -1.750 -1.750 n/a -1.000 Investment Property Minimum $50,000 Loan Amt LTV <= 75 LTV <= 80 LTV <= 90 -1.750 -1.750 -1.750 Condos LTV > 75% -0.750 High LTV: 95.00 < LTV <= 97.00 High LTV: 97.00 < LTV <= 150.00 Subordinate Financing LTV Range Add to Price >65 <=75 >90 <=95 >75 <=95 >90 <=95 >75 <=90 >76 <=90 All CLTV > 95% Other Non-Capped Price Adjusters for DU Refi Plus Multiple Financed Properties - INVESTOR and Second Home loans with 5 to 10 financed properties - Adjust pricing by -1.50pt Loan Amount Escrow Waiver State Adjusters >= $200,000 $50,000 to $99,999 $25,000 to $49,999 < $25,000 Owner Occp with Score >= 660 & LTV <= 80% 0.100 -0.250 -1.000 -2.000 -0.250 30,25,20 Yr SC, TX CO, CT, FL, ID, LA, MA, ME, MS, NC, NH, RI, SD, TN, UT, VT, WA, WY AL, AR, DE, IL, IN, KY, MD, MN, NE, NM, OH, VA, WI AZ, DC, IA, MI, MT, NV, WV CA 0.100 -0.100 -0.150 -0.200 -0.375 High LTV (Not price capped) 15 & 10 Yr 0.000 -0.100 -0.100 -0.150 -0.250 LTV % >=105 < 125% -0.625 LTV% >= 125% -1.250 -0.500 -1.000 Date: 2/5/2015 Freddie Mac Open Access Effective: 4:15 PM EXPIRATION DATES (Must close by expiration date) 15 DAY 02/20/15 45 DAY 03/22/15 30 DAY 03/07/15 60 DAY 04/06/15 Freddie Mac Open Access 30 yr FHLMC LP Open Access 4.625 4.500 4.375 4.250 4.125 4.000 3.990 3.875 3.750 3.625 3.500 3.490 3.375 3.250 20 yr FHLMC LP Open Access 15 Days 30 Days 45 Days 104.388 104.190 103.918 103.530 102.795 102.396 102.279 101.857 101.188 100.338 99.322 99.105 98.340 97.618 104.238 104.040 103.768 103.380 102.645 102.246 102.129 101.707 101.038 100.188 99.172 98.955 98.190 97.468 104.088 103.890 103.618 103.230 102.495 102.096 101.979 101.557 100.888 100.038 99.022 98.805 98.040 97.318 4.250 4.125 4.000 3.990 3.875 3.750 3.625 3.500 3.490 3.375 3.250 15 yr FHLMC LP Open Access 15 Days 30 Days 45 Days 103.448 102.840 102.470 102.303 101.914 101.234 100.409 99.401 99.244 98.477 97.694 103.298 102.690 102.320 102.153 101.764 101.084 100.259 99.251 99.094 98.327 97.544 103.148 102.540 102.170 102.003 101.614 100.934 100.109 99.101 98.944 98.177 97.394 3.875 3.750 3.625 3.500 3.375 3.250 3.125 3.000 2.990 15 Days 30 Days 45 Days 103.269 103.148 103.177 103.031 102.713 102.345 102.046 101.557 101.415 103.119 102.998 103.027 102.881 102.563 102.195 101.896 101.407 101.265 102.969 102.848 102.877 102.731 102.413 102.045 101.746 101.257 101.115 10 YR FHLMC LP Open Access - NOT OFFERED Price Cap for FHLMC Fees LP Open Access Agency Price Adjusters Price CAP Primary Residence / LTV >80% / Amort Term > 240: LP Open Access loans will have a cumulative delivery fee cap. Other CMC fees may still apply. LTV > 80% <= 105% 0.50 1.00 Risk based pricing adjustments apply to all conventional conforming loans except with terms of 180 months or less. LTV > 105% Primary Residence / LTV >80% / Amort Term <= 240: LTV > 80% <= 105% LTV > 105% All other transactions 0.50 1.75 Risk Based Pricing LTV / Credit Score Grid LTV Credit Score < = 60 > 60 <= 70 >70 < = 75 >75 < = 80 >80 < = 85 >85 < = 125 >= 740 >= 720 & <= 739 >= 700 & <= 719 >= 680 & <= 699 >= 660 & <= 679 >= 640 & <= 659 >= 620 & <= 639 < 620 0.250 0.250 0.250 0.000 0.000 -0.500 -0.500 n/a 0.000 0.000 -0.500 -0.500 -1.000 -1.250 -1.500 n/a 0.000 -0.250 -0.750 -1.250 -1.750 -1.750 -1.750 n/a -0.250 -0.500 -1.000 -1.750 -1.750 -1.750 -1.750 n/a 0.000 0.000 -0.500 -1.000 -1.750 -1.750 -1.750 n/a 0.000 0.000 -0.500 -0.750 -1.750 -1.750 -1.750 n/a 0.00 Other Adjustments Add to Price 2-4 Units Investment Property Minimum $50,000 Loan Amt Condos -1.000 LTV <= 75 LTV <= 80 LTV <= 90 LTV > 75% -1.750 -1.750 -1.750 -0.750 Subordinate Financing LTV Range CLTV Range <=65 >80 <=95 >65 <=75 >80 <=95 >75 <=80 >76 <=95 >80 <=90 >81 <=95 >90 <=95 >90 <=95 All CLTV > 95% Score <720 -0.500 -0.750 -1.000 -1.000 -0.500 -1.500 Score >=720 -0.250 -0.500 -0.750 -0.500 -0.250 -1.500 High LTV: 95.00 < LTV <= 97.00 High LTV: 97.00 < LTV <= 105.00 High LTV: > 105 -0.500 -1.000 -2.000 All LP Open Access loans with LTV over 105% This is a non-capped price adjuster -0.625 Other Non-Capped Price Adjusters for LP Open Access Loan Amount Escrow Waiver State Adjusters >= $200,000 $50,000 to $99,999 $25,000 to $49,999 < $25,000 Owner Occp with Score >= 660 & LTV <= 80% 0.100 -0.250 -1.000 -2.000 -0.250 30,25,20 Yr SC, TX CO, CT, FL, ID, LA, MA, ME, MS, NC, NH, RI, SD, TN, UT, VT, WA, WY AL, AR, DE, IL, IN, KY, MD, MN, NE, NM, OH, VA, WI AZ, DC, IA, MI, MT, NV, WV CA 0.100 -0.100 -0.150 -0.200 -0.375 15 & 10 Yr 0.000 -0.100 -0.100 -0.150 -0.250 Date: 2/5/2015 FNMA High Balance / FHLMC Super Conforming Effective: 4:15 PM EXPIRATION DATES (Must close by expiration date) 15 DAY 02/20/15 45 DAY 03/22/15 30 DAY 03/07/15 60 DAY 04/06/15 Fannie Mae High Balance See www.fhfa.gov for High Cost Areas 30 yr FNMA High Balance 5.375 5.250 5.125 5.000 4.875 4.750 4.625 4.500 4.375 4.250 4.125 4.000 3.875 3.750 15 yr FNMA High Balance 15 Days 30 Days 45 Days 60 Days 103.975 104.172 104.339 104.230 104.046 103.938 103.881 103.655 103.329 103.153 102.889 102.371 101.926 101.356 103.825 104.022 104.189 104.080 103.896 103.788 103.731 103.505 103.179 103.003 102.739 102.221 101.776 101.206 103.675 103.872 104.039 103.930 103.746 103.638 103.581 103.355 103.029 102.853 102.589 102.071 101.626 101.056 103.425 103.622 103.789 103.680 103.496 103.388 103.331 103.105 102.779 102.603 102.339 101.821 101.376 100.806 4.750 4.625 4.500 4.375 4.250 4.125 4.000 3.875 3.750 3.625 3.500 15 Days 30 Days 45 Days 60 Days 101.675 101.759 101.918 102.076 102.235 102.493 102.488 102.511 102.434 102.432 102.375 101.525 101.609 101.768 101.926 102.085 102.343 102.338 102.361 102.284 102.282 102.225 101.375 101.459 101.618 101.776 101.935 102.193 102.188 102.211 102.134 102.132 102.075 101.125 101.209 101.368 101.526 101.685 101.943 101.938 101.961 101.884 101.882 101.825 Loan Amounts from $417,001 to $625,000 SFD , 1 Unit Primary Residence and Second Home Fannie Mae High Balance Price Adjusters The Following Adjustments Apply and are Cumulative: Risk Based Pricing LTV / Credit Score Grid Subordinate Financing LTV Range CLTV Range Score <720 Score >=720 >75 <=90 >76 <=90 -1.000 -0.750 Loans with terms of 180 months will not be adjusted with LTV/Score price adjusters LTV Credit Score < = 60 > 60 <= 70 >70 < = 75 >75 < = 90 >95 < = 150 >= 740 >= 720 & <= 739 >= 700 & <= 719 >= 680 & <= 699 >= 660 & <= 679 >= 640 & <= 659 0.250 0.250 0.250 0.000 0.000 -0.500 0.000 0.000 -0.500 -0.500 -1.000 -1.250 0.000 0.000 -0.500 -0.750 -1.500 -1.750 0.000 0.000 -0.500 -0.750 n/a n/a n/a n/a n/a n/a n/a n/a Escrow Waiver Owner Occp with Score >= 660 & LTV <= 80% State Adjusters (if applicable) SC, TX CO, CT, FL, ID, LA, MA, ME, MS, NC, NH, RI, SD, TN, UT, VT, WA, WY AL, AR, DE, IL, IN, KY, MD, MN, NE, OH, VA, WI DC, IA, MI, MT, NV, WV Cash Out Refinances Credit Score => 700 -0.250 30 Yr 15 Yr 0.100 -0.100 -0.150 -0.200 0.000 -0.100 -0.100 -0.150 Freddie Mac Super Conforming The Following Adjustments Apply and are Cumulative: 30 yr FHLMC Super Conforming Risk Based Pricing LTV / Credit Score Grid 4.625 4.500 4.375 4.250 4.125 4.000 3.990 3.875 3.750 15 Days 30 Days 45 Days 60 Days 103.938 103.740 103.468 103.130 102.820 102.371 102.179 101.957 101.338 103.788 103.590 103.318 102.980 102.670 102.221 102.029 101.807 101.188 103.638 103.440 103.168 102.830 102.520 102.071 101.879 101.657 101.038 103.388 103.190 102.918 102.580 102.270 101.821 101.629 101.407 100.788 Cash Out Refinances Credit Score => 740 >= 720 & <= 739 >= 700 & <= 719 LTV / Credit Score Grid LTV < = 60 > 60 <= 70 -1.000 -1.250 -1.000 -1.625 -1.000 -1.625 Credit Score >= 740 720 <= 739 700 <= 719 680 <= 699 660 <= 679 640 <= 659 <= 60 0.250 0.250 0.250 0.000 0.000 -0.500 > 60 & <= 70 0.000 0.000 -0.500 -0.500 -1.000 -1.250 Subordinate Financing LTV CLTV 75.01 <= 90 75.01-90.00 < 720 -1.000 => 720 -0.750 > 70 & <= 75 0.000 -0.250 -0.750 -1.250 -2.250 -2.750 LTV / Credit Score Grid LTV < = 60 -1.000 > 75 & <= 80 -0.250 -0.500 -1.000 -1.750 n/a n/a Escrow Waiver Owner Occp with Score >= 660 & LTV <= 80% State Adjusters (if applicable) > 80 & <= 85 -0.250 -0.500 -1.000 -1.500 n/a n/a > 85 & <= 90 -0.250 -0.500 -1.000 -1.250 n/a n/a -0.250 30,25,20 Yr 15 & 10 Yr SC CO, CT, FL, ID, LA, MA, ME, MS, NC, NH, RI, SD, TN, UT, VT, WA, WY AL, AR, DE, IL, IN, KY, MD, MN, NE, NM, OH, VA, WI AZ, DC, IA, MT, NV, WV CA 0.100 -0.100 -0.150 -0.200 -0.375 0.000 -0.100 -0.100 -0.150 -0.250 Date: Effective Government 15 DAY EXPIRATION DATE 02/20/15 30 DAY EXPIRATION DATE 03/07/15 15 day Locks For Approved Loans Only. 45 DAY EXPIRATION DATE 03/22/15 60 day Locks for Purchase or Const/refi only. 45 Day max for Refinance 60 DAY EXPIRATION DATE 04/06/15 2/5/2015 4:15 PM FHA/VA 30 Yr, 25 Yr, 20 Yr 4.375 4.250 4.125 4.000 3.875 3.750 3.625 3.500 3.375 3.250 3.125 15 Days 30 Days 45 Days 60 Days 106.011 105.861 105.711 105.361 105.676 105.526 105.376 105.026 105.520 105.370 105.220 104.870 105.306 105.156 105.006 104.656 104.985 104.835 104.685 104.335 104.645 104.495 104.345 103.995 104.382 104.232 104.082 103.732 104.028 103.878 103.728 103.378 103.449 103.299 103.149 102.799 102.877 102.727 102.577 102.227 98.360 98.210 98.060 97.710 FHA/VA 5/1 ARM - Caps 1/5 - Margin 2.00 3.625 3.500 3.375 3.250 3.125 3.000 2.875 FHA/VA 15 Yr 3.250 3.125 3.000 2.875 2.750 15 Days 30 Days 45 Days 60 Days 101.450 101.300 101.150 100.800 101.172 101.022 100.872 100.522 100.893 100.743 100.593 100.243 100.615 100.465 100.315 99.965 99.861 99.711 99.561 99.211 99.582 99.432 99.282 98.932 98.303 98.153 98.003 97.653 15 Days 30 Days 45 Days 60 Days 103.618 103.468 103.318 102.968 103.004 102.854 102.704 102.354 102.596 102.446 102.296 101.946 102.173 102.023 101.873 101.523 INDEX : 1 YR Treas : 101.743 101.593 101.443 101.093 VA IRRRL not allowed on VA 5/1 ARM Price Tiers by State: For Fixed Only Add to Price: 0.170 All Borrowers Must Have a Credit Score. RI TX 0.150 Adjustments Based on All Borrowers Mid Score : AL AR AZ DC ID IN KY MS OR TN VA WA WV -0.050 VA CA CO DE GA MD OH -0.100 FHA FL MI NV UT WI -0.150 FHA/VA Score 640-679 -0.500 FHA/VA Score => 720 0.250 Loan Amount Price Adjuster Score 620-639 -1.500 Score 620-639 -2.000 VA Loans - Purchase or Non Streamline Refinance -0.550 Total Loan Amount => $200,000 0.100 VA Cash Out over 90% LTV -0.500 Total Ln Amt $75,000 to $99,999 -0.250 VA IRRRL (Streamline Refi) - No Admin Fee Charged on IRRRL -0.700 Total Ln Amt $60,000 to $74,999 -0.375 FHA Streamline Refinance with CLTV over 100% -1.500 Total Ln Amt $25,000 to $59,999 -1.000 20 Yr Term (Deduct from 30 Yr Price) -0.600 Total Ln Amt < $25,000 -2.000 FHA High Balance to $625,000 (total ln amt) : 30 YR Fix ONLY -2.000 VA High Balance Loans to $625,000 (total ln amt): -2.000 30 YEAR FHA/VA/RD - No Admin Fee Program Program Codes: Loan Amt Price Adjustments for No Admin Fee FHA/VA/RH Program Only Loan Amount $25,000 to $59,999 -3.800 30 Year Fixed FHA No Admin Fee Loan Amount $60,000 to $74,999 -1.450 30 Year Fixed FHA $100 Down No Admin Fee Loan Amount $75,000 to $99,999 -1.200 30 Year Fixed VA No Admin Fee Loan Amount $100,000 to $124,999 -0.700 Rural Housing 30 YR No Admin Fee Loan Amount $125,000 to $149,999 -0.550 Loan Amount $150,000 to $174,999 -0.450 Loan Amount $175,000 to $199,999 -0.400 Loan Amount $200,000 to $224,999 -0.250 Loan Amount $225,000 to $249,999 -0.200 Loan Amount $250,000 to $274,999 -0.200 Loan Amount $275,000 to Limit -0.150 Crescent Mortgage Company FHA # 2084000006. CMC offers the ability to waive the Admin Fee on FHA or VA fixed rate loans by reducing the price with the adjustments located to the left. All other FHA/VA adjustments shown above will apply with the exception of the additional loan amt adjustments above this program. ** NOT For VA IRRRL loans - see price adjustment above Crescent Mortgage Company VA # 6402350000. Please see website for FHA & VA Product Profiles. www.mycrescent.net/CMCDocs/ RURAL HOUSING LOANS RH 30 and RH 30 Refi Pilot 4.000 3.875 3.750 3.625 3.500 3.375 3.250 Minimum Score 640 *** Homebuyer education maybe required for first time homebuyers by the USDA office 30 Days 45 Days 60 Days Price Tiers by State 104.971 104.650 104.310 104.047 103.693 103.114 102.542 98.025 104.821 104.500 104.160 103.897 103.543 102.964 102.392 97.875 104.471 104.150 103.810 103.547 103.193 102.614 102.042 97.525 AR, AZ, GA, IN, MN, NC, NM, OK, PA, RI, VT, WI AL, CA, CT, FL, IA, IL, KS, KY, LA, ME, MO, 0.100 0.000 MS, NE, NH, OH, SC, SD, TN, TX & WV. 0.000 CO, DE, MA, MD, MT, ND, VA & WY. -0.150 ID, MI, NV, OR, UT, WA. Loan Amount -0.250 Price Adjustment $55,001 to $95,000 -0.500 $35,000 - $55,000 -1.000 Standard Streamline Refinance -0.500 REMINDER: RH 30 REFI PILOT Program adjustment -1.000 Crescent Mortgage will not close or purchase RD loans with the following commitment language: Score "subject to the availability of Congressionally appropriated funds" Credit Score 640-679 3.125 *** RH 30 Refi Pilot program not available in all states. LPO Comp not allowed THIS RATE SHEET IS FOR MORTGAGE PROFESSIONALS ONLY, NOT FOR PUBLIC CONSUMPTION. -0.500 Date: Jumbo Option I Effective 15 DAY 30 DAY 0.618 LIBOR 12 MONTH 5/1 Jumbo ARM 2/2/5 Caps 2/5/2015 4:15 PM EXPIRATION DATES : 02/20/15 45 DAY 03/07/15 60 DAY 03/22/15 04/06/15 15 Yr Jumbo Rate 30 Day 45 Day Rate 3.125 3.000 2.875 2.750 2.625 2.500 2.375 101.835 101.535 101.215 100.875 100.515 100.135 99.715 101.535 101.235 100.915 100.575 100.215 99.835 99.415 3.625 3.500 3.375 3.250 3.125 3.000 2.875 15 Day 102.125 101.765 101.385 100.905 100.445 100.365 99.835 30 Day 45 Day 102.025 101.665 101.285 100.805 100.345 100.265 99.735 101.725 101.365 100.985 100.505 100.045 99.965 99.435 7/1 Jumbo ARM 5/2/5 Caps Rate 30 Day 45 Day 3.250 3.125 3.000 2.875 2.750 2.625 2.500 101.685 101.345 101.005 100.865 100.475 100.195 99.635 101.385 101.045 100.705 100.565 100.175 99.895 99.335 10/1 Jumbo ARM 5/2/5 Caps Rate 30 Day 45 Day 3.625 3.500 3.375 3.250 3.125 3.000 2.875 102.165 101.835 101.485 101.095 100.535 100.075 99.575 101.865 101.535 101.185 100.795 100.235 99.775 99.275 Available lock periods** : Fixed Rate : 15, 30 & 45 days. ARMs : 30 & 45 days only. All ARMs Margin 2.25 , Index 1 Yr Libor Maximum Loan Amount = $1,000,000 U/W Note: Reduce LTV by 5% for the following state: MI Adjustments for All Jumbo Products : Note - All loans that close with Crescent's funds Must close in name Crescent Mortgage Company. Interest Credit is not allowed. Escrow Waiver -0.250 LTV >70% -0.375 All Jumbo Loans Must be Run DU 0.250 Please see website for JUMBO parameters. State Adjuster Texas Property With Escrows No price improvement for Texas loans if escrows waived. For Primary Residence Only. THIS RATE SHEET IS FOR MORTGAGE PROFESSIONALS ONLY, NOT FOR PUBLIC CONSUMPTION. Date: Jumbo Option II Effective 15 DAY 30 DAY 0.618 LIBOR 12 MONTH 5/1 Jumbo LIBOR ARM 2/2/5 Caps 2.50 Margin 2/5/2015 4:15 PM EXPIRATION DATES : 02/20/15 45 DAY 03/07/15 60 DAY 03/22/15 04/06/15 30 Yr Jumbo Rate 30 Day 45 Day 60 Day Rate 3.750 3.625 3.500 3.375 3.250 3.125 3.000 101.331 101.242 101.121 100.938 100.692 100.446 100.138 101.131 101.042 100.921 100.738 100.492 100.246 99.938 100.931 100.842 100.721 100.538 100.292 100.046 99.738 4.750 4.625 4.500 4.375 4.250 4.125 4.000 7/1 Jumbo LIBOR ARM 5/2/5 Caps 2.50 Margin 30 Day 102.221 102.132 101.917 101.609 101.207 100.773 100.278 45 Day 60 Day 102.021 101.932 101.717 101.409 101.007 100.573 100.078 101.821 101.732 101.517 101.209 100.807 100.373 99.878 45 Day 60 Day 101.220 101.192 101.134 101.013 100.830 100.584 100.307 101.020 100.992 100.934 100.813 100.630 100.384 100.107 15 Yr Jumbo Rate 30 Day 45 Day 60 Day Rate 30 Day 4.000 3.875 3.750 3.625 3.500 3.375 3.250 101.681 101.560 101.408 101.225 100.916 100.608 100.268 101.481 101.360 101.208 101.025 100.716 100.408 100.068 101.281 101.160 101.008 100.825 100.516 100.208 99.868 4.250 4.125 4.000 3.875 3.750 3.625 3.500 101.420 101.392 101.334 101.213 101.030 100.784 100.507 Escrow Waiver -0.250 10/1 Jumbo LIBOR ARM 5/2/5 Caps 2.50 Margin Rate 30 Day 45 Day 60 Day 4.500 4.375 4.250 4.125 4.000 3.875 3.750 101.753 101.570 101.324 101.016 100.645 100.274 99.872 101.553 101.370 101.124 100.816 100.445 100.074 99.672 101.353 101.170 100.924 100.616 100.245 99.874 99.472 Pricing Adjustments: FICO >= 760 FIXED RATE LTV <=60% 0.625 60.01-65.00% 0.375 65.01-70.00% 0.125 70.01-75.00% 0.000 75.01-80.00% -0.250 740-759 0.500 0.250 0.000 0.000 -0.375 720-739 0.500 0.250 0.000 -0.125 -0.625 700-719 0.500 0.250 0.000 -0.250 N/A Purchase 0.250 0.250 0.125 0.125 0.000 CashOut Refi -0.250 -0.500 -0.625 -1.000 N/A 2nd Home -0.250 -0.500 -0.500 -0.500 N/A Pricing Adjustments: FICO >= 760 FIXED RATE MAX Net Price after all adjustments = 102.000 (Net Price plus your LPO agreement can't exceed 102.000) Hybrid ARM LTV <=60% 0.375 60.01-65.00% 0.250 65.01-70.00% 0.000 70.01-75.00% 0.000 75.01-80.00% -0.375 740-759 0.250 0.125 0.000 -0.125 -0.500 720-739 0.125 0.000 0.000 -0.250 -0.625 700-719 0.000 0.000 -0.125 -0.375 N/A Purchase 0.250 0.250 0.250 0.250 0.000 CashOut Refi -0.250 -0.500 -0.625 -1.000 N/A 2nd Home -0.500 -0.500 -0.500 -0.500 N/A Escrow Waiver -0.250 Hybrid ARM MAX Net Price after all adjustments = 101.750 (Net Price plus your LPO agreement can't exceed 101.750) THIS RATE SHEET IS FOR MORTGAGE PROFESSIONALS ONLY, NOT FOR PUBLIC CONSUMPTION.

© Copyright 2026