February Price Specials!

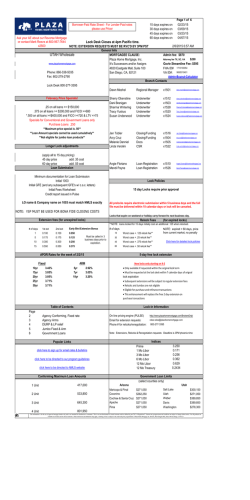

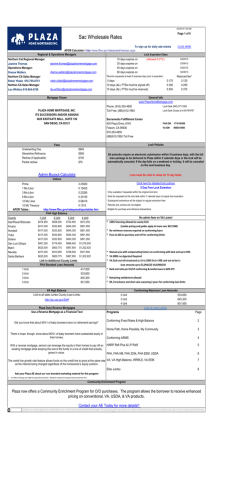

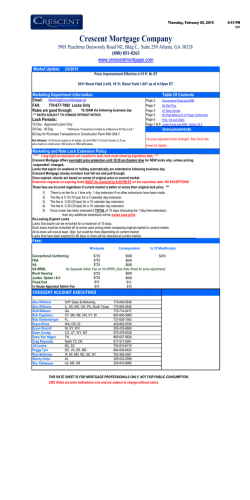

Borrower-Paid Rate Sheet - For Lender-Paid rates please use Pricer Ask your AE about our Reverse Mortgage or contact Mark Reeve at 800-957-7644 Lock Desk Closes at 4pm PST x2500 NOTE: EXTENSION REQUESTS MUST BE RVC'D BY 3PM PST General Info Phoenix Wholesale MORTGAGEE CLAUSE: 1702 E. Highland Avenue, Suite 300 Plaza Home Mortgage, Inc. Phoenix, AZ 85016 Its Successors and/or Assigns www.plazahomemortgage.com 4820 Eastgate Mall, Suite 100 Phone: 602-279-2700 Lock Desk: 800-277-3395 San Diego, CA, 92121 Fax: 602-279-2790 15 days expires on 30 days expires on 45 days expires on 60 days expires on 2/6/2015 6:57 AM Admin .25 on all loans >= $150,000 .375 on all loans >= $200,000 and FICO >=680 *.500 on all loans >=$400,000 and FICO >=720 & LTV <=75 Specials for Conventional and Government Loans only Purchase Loans .250 **Maximum price special is .50** **Loan Amount specials cannot be used cumulatively** **Not eligible for jumbo loan products** Buyout Calculator Admin fee $870 Streamline Fee: $595 FHA ID# VA ID#: Branch Contacts February Price Specials! Page 1 of 6 02/23/15 03/09/15 03/23/15 04/07/15 1710100054 9065310401 Dawn Meshel Regional Manager x1501 [email protected] Sonya Griffin Dawn Palmer Account Executive Account Executive 602-625-3981 [email protected] 602-430-6898 [email protected] Sherry Obenstine Dani Branigan Sharma Wintering Tracy Yuskus Susan Underwood Underwriter Underwriter Underwriter Underwriter Underwriter x1512 x1503 x1528 x1520 x1524 [email protected] Jen Tobler Arcy Cruz Melanie Danniel Linda Verolini Closing/Funding Closing/Funding Docs CSR x1516 x1504 x1505 x1522 [email protected] Angie Floriano Mandi Payne Loan Registration Loan Registration x1510 x1526 [email protected] [email protected] [email protected] [email protected] [email protected] [email protected] [email protected] [email protected] Longer Lock adjustments (apply all to 15 day pricing) add .350 cost 45 day price add .525 cost 60 day price [email protected] Lock Policies Loan Submission 15 day Locks require prior approval Minimum documentation for Loan Submission Initial 1003 Initial GFE (and any subsequent GFE's w/ c.o.c. letters) Initial Fees Worksheet Credit report issued in Pulse LO name & Company name on 1003 must match NMLS exactly All prelocks require electronic submission within 5 business days and the full file must be delivered within 10 calendar days or lock will be canceled. Locks that expire on weekend or holiday carry forward to next business day. Relock Fees (for expired locks) NOTE: YSP MUST BE USED FOR BONA FIDE CLOSING COSTS Extension fees (for unexpired locks) # of days Early Bird Extension Bonus 1st ext 2nd ext 1 0.100 0.100 0.050 5 0.175 0.175 0.125 10 0.300 0.300 0.250 0.550 0.550 0.375 15 Must be called in 4 days prior to extension, Saturdays and Sundays’ don’t count in the 4 days. **NOTE: loans locked for 15 days initially cost an additional .125 when relocked. # of days 15 Worst case + .125 relock fee** 30 Worst case + .25 relock fee** 45 Worst case + .375 relock fee** 60 Worst case + .50 relock fee** APOR Rates for the week of 2/2/15 Fixed 10yr 15yr 20yr 25yr 30yr 5yr 7yr 10yr Only available if requested within the original lock term Must be requested at the lock desk within 7 calendar days of original lock expiration Subsequent extensions will be subject to regular extension fees Relocks and Jumbos are not eligible Eligible for purchase and refinance transactions This enhancement will replace the free 2 day extension on purchase transactions Lock-in Information 2.92% 3.05% 3.20% Table of Contents Page 2 3 4 5 6 Agency Conforming, Fixed rate Agency Arms DURP & LP relief Jumbo Fixed & Arm Government Loans Popular Links On line pricing engine (PULSE) Email for extension requests: Phone # for relocks/renegotiation: [email protected] 800-277-3395 Indices Prime 1 Mo Libor 3 Mo Libor 6 Mo Libor 12 Mo Libor 12 Mo Treasury click here to be directed to our program guidelines click here to be directed to NMLS website Conforming Maximum Loan Amounts 3.250 0.171 0.256 0.362 0.629 0.2434 Government Loan Limits (select counties only) 417,000 Arizona 2 Unit 533,850 Maricopa & Pinal Coconino 3 Unit 645,300 Cochise & Santa Cruz Apache Pima 4 Unit http://www.plazahomemortgage.com/BrokersOnly/ Note: Extensions, Relocks & Renegotiation requests: Deadline is 3PM PST click here to sign up for email rates & bulletins 1 Unit Click here for detailed lock policies 5-day free lock extension New locks only starting on 9-2 ARM 3.42% 3.05% 3.05% 3.71% 3.71% NOTE: expired > 60 days, price from current market, no penalty Utah $271,050 $362,250 $271,050 $271,050 $271,050 Salt Lake Utah Weber Davis Washington $300,150 $271,050 $389,850 $389,850 $278,300 801,950 This information is for the use of approved mortgage lenders only and is not intended for distribution to consumers. This is not an advertisement to extend customer credit as defined by part 226.2 of Regulation Z. Interest rate, program terms and conditions are subject to change without notice. Not all products are available in all states and for all loan amounts. Other restrictions and limitations may apply. Granting of loan is subject to the credit and policy requirements of Plaza Home Mortgage, Inc. ISAOA, 4820 Eastgate Mall, Suite 100 San Diego, CA 92121 PLAZA HOME MORTGAGE, INC. Phoenix Wholesale 1702 East Highland Ave., Suite 300 Phoenix, AZ 85016 Phone: 866-338-5035 Page 2 of 6 On borrower-paid transactions Plaza's maximum broker compensation is the lesser of 4.5% or $20,000 on all products. 2/6/2015 6:57 AM NEW: Great Resources On-Line ► ► ► ► Plaza no longer has a hit for condos >75 LTV on terms of 15 years and less! Lock Submit Manage Pipeline View Guidelines www.PlazaHomeMortgage.com 15 days expires on 30 days expires on 45 days expires on 60 days expires on 02/23/15 03/09/15 03/23/15 04/07/15 1-Day Extension 5-Day Extension 10-Day Extension 15-Day Extension 0.100 0.175 0.300 0.550 Contact lock desk for longer lock terms Lock Desk (800) 277-3395 CONFORMING FIXED RATES 30 Year Fixed 20 Year Fixed 15 Year Fixed CF300 CF200 CF150 Rate 15 Day 30 Day Rate 15 Day 30 Day Rate 15 Day 30 Day 4.375 4.375 4.125 (4.909) (4.734) (4.656) (4.481) (4.703) (4.528) 4.250 4.250 4.000 (4.405) (4.230) (4.248) (4.073) (4.624) (4.449) 4.125 4.125 3.875 (3.669) (3.494) (3.608) (3.433) (4.416) (4.241) 4.000 4.000 3.750 (3.094) (2.919) (3.186) (3.011) (4.240) (4.065) 3.875 3.875 3.625 (2.616) (2.441) (2.721) (2.546) (4.034) (3.859) 3.750 3.750 3.500 (1.915) (1.740) (2.248) (2.073) (3.668) (3.493) 3.625 3.625 3.375 (1.160) (0.985) (1.587) (1.412) (3.122) (2.947) 3.500 3.500 3.250 (0.067) 0.108 (0.768) (0.593) (2.643) (2.468) 3.375 3.375 3.125 0.779 0.954 0.069 0.244 (2.207) (2.032) 30 Yr Fixed Retained (HB) 30 Year Fixed 20 Year Fixed 15 Year Fixed RCF30 RCF300HB RCF20 RCF15 Rate 15 Day Rate 15 Day Rate 15 Day Rate 15 Day 30 Day 4.375 4.750 4.500 4.125 (4.367) (3.178) (4.595) (4.453) (4.278) 4.250 4.625 4.375 4.000 (3.960) (2.899) (4.184) (4.374) (4.199) 4.125 4.500 4.250 3.875 (3.419) (2.671) (3.777) (4.166) (3.991) 4.000 4.375 4.125 3.750 (2.844) (2.409) (3.347) (3.990) (3.815) 3.875 4.250 4.000 3.625 (2.241) (2.151) (2.936) (3.784) (3.609) 3.750 4.125 3.875 3.500 (1.656) (1.735) (2.471) (3.418) (3.243) Rate 4.000 3.875 3.750 3.625 3.500 3.375 3.250 3.125 3.000 10 Year Fixed CF100 15 Day 30 Day (4.267) (4.092) (4.060) (3.885) (3.884) (3.709) (3.678) (3.503) (3.381) (3.206) (2.922) (2.747) (2.470) (2.295) (2.001) (1.826) (1.498) (1.323) 30 Year Fixed High Balance CF300HB Rate 15 Day 4.625 (3.904) 4.500 (3.527) 4.375 (3.409) 4.250 (2.905) 4.125 (2.169) 4.000 (1.594) 3.875 (1.116) 3.750 (0.415) 3.625 0.340 30 Year Fixed Super Conforming 30 Year Fixed Split MI CF300SC 15 Day (4.932) (4.480) (3.875) (3.213) (3.409) (2.905) CF300SMI Rate 15 Day 4.375 (4.909) 4.250 (4.405) 4.125 (3.669) 4.000 (3.094) 3.875 (2.616) 3.750 (1.915) Rate 4.875 4.750 4.625 4.500 4.375 4.250 30 Day (4.757) (4.305) (3.700) (3.038) (3.234) (2.730) All adjustments apply to all conventional programs and are cumulative unless otherwise stated. Plaza does not allow manufactured homes on agency products. 2 units 3-4 units Condo LTV > 75% & Loan Term >15yrs; (Excludes Detached Condo w/ DU) Investment LTV <= 75% Property: LTV > 75% - 80% LTV > 80% - 85% Subordinate Financing LTV<=65, CLTV/HCLTV >80<=95, FICO <720 LTV<=65, CLTV/HCLTV >80<=95, FICO >=720 LTV >65<=75, CLTV/HCLTV >80<=95, FICO <720 LTV >65<=75, CLTV/HCLTV >80<=95, FICO >=720 LTV >75<=95, CLTV/HCLTV >90<=95, FICO <720 LTV >75<=95, CLTV/HCLTV >90<=95, FICO >=720 LTV >75<=90, CLTV/HCLTV >76<=90, FICO <720 LTV >75<=90, CLTV/HCLTV >76<=90, FICO >=720 LTV <=95, CLTV/HCLTV >95<=97 Risk-Based Adjustments Credit Score 620 640 660 < 620 639 659 679 LTV% <= 60 N/A 0.500 0.500 0.000 60.01-70 N/A 1.500 1.250 1.000 70.01-75 N/A 3.000 2.500 2.000 75.01-80 N/A 3.000 3.000 2.500 80.01-85 N/A 3.250 3.250 2.750 85.01-90 N/A 3.250 2.750 2.250 90.01-95 N/A 3.250 2.750 2.250 95.01-97 N/A 3.250 2.750 2.250 >97 N/A N/A N/A N/A 1.000 1.000 0.750 1.750 3.000 3.750 0.500 0.250 0.750 0.500 1.000 0.750 1.000 0.750 1.500 680 699 0.000 0.500 1.250 1.750 1.500 1.250 1.250 1.250 N/A 700 719 (0.250) 0.500 0.750 1.000 1.000 1.000 1.000 1.000 N/A My Community My Community 97 0.750 Loan Amounts Loan Amount <$140k Loan Amount <$100k Loan Amount <$75k 0.125 0.250 0.500 High Balance/Super Conforming Cash Out 1.000 LTV >95<=97 0.500 Super Conforming ARMs - Purch, R/T >75% LTV/CLTV 0.750 Community Enrichment (O/O only) 720 739 (0.250) 0.000 0.250 0.500 0.500 0.500 0.500 0.500 N/A (0.500) >= 740 (0.250) 0.000 0.000 0.250 0.250 0.250 0.250 0.250 N/A Use the above matrix for all programs excluding My Community and Home Possible programs. Risk-Based Adjustments do not apply to loans with amortization terms <=180 months, if both LTV<=95 & FICO >=620 Expanded Approval Programs (in addition to the risk-based adjustments above) Credit Score 620 640 660 680 700 720 < 620 639 659 679 699 719 739 LTV% <95 N/A 0.750 0.750 0.500 0.500 0.250 0.250 95.01 - 97 N/A N/A N/A N/A N/A N/A N/A Cash Out Credit Score 620 640 660 680 700 720 < 620 639 659 679 699 719 739 LTV% <= 60 0.250 0.250 0.250 0.000 0.000 0.000 N/A 60.01-75 1.250 1.250 0.750 0.750 0.625 0.625 N/A 2.750 2.250 1.500 1.375 0.750 0.750 75.01-80 N/A 80.01-85 N/A 3.000 3.000 2.500 2.500 1.500 1.500 LTV > 85 N/A N/A N/A N/A N/A N/A N/A >= 740 0.000 N/A >= 740 0.000 0.250 0.500 0.625 N/A Lender Paid Mortgage Insurance (LPMI) Options Lender-Paid MI 25yr & 30yr (CF300MIR, CF250MIR, CF30HBMIR, CF300SCMI and all ARMs) MI Coverage LTV 760 740-759 720-739 680-719 660-679 640-659 95.01 - 97 35 2.8 3.08 3.08 3.85 6.84 7.09 90.01 - 95 30 1.6 1.9 2.23 3.29 4.93 5.12 85.01 - 90 25 1.1 1.33 1.6 2.17 3.28 3.53 80.01 - 85 12 0.7 0.87 1.12 1.33 1.54 1.73 Lender-Paid MI 15yr & 20yr (CF200MIR, CF150MIR, CF150SCMI) 620-639 7.38 5.79 4.08 1.97 MI Coverage LTV 95.01 - 97 35 90.01 - 95 25 85.01 - 90 12 80.01 - 85 6 620-639 6.99 4.52 1.81 1.17 760 2.62 1.25 0.87 0.55 740-759 2.9 1.46 0.91 0.6 720-739 2.9 1.88 1.19 0.87 680-719 3.57 2.66 1.26 0.91 660-679 6.45 3.79 1.42 1.09 640-659 6.7 3.96 1.54 1.13 Lender Paid MI Adjustments Rate-and-Term Refinance Cash Out Second Home Investment Property Loan Amounts > $417,000 Loan Term = 25yr Rate-and-Term Refinance Cash Out Second Home Investment Property Loan Amounts > $417,000 Loan Term = 25yr FICO 740+ 0.00 0.50 0.25 1.19 0.40 (0.18) 680-719 0.53 1.00 0.70 1.75 1.40 (0.28) 720-739 0.00 0.70 0.49 1.33 0.88 (0.18) 620-679 1.05 1.30 1.23 0.00 2.10 (0.39) Note: Minimum single rate is .54 This information is for the use of approved mortgage lenders only and is not intended for distribution to consumers. This is not an advertisement to extend customer credit as defined by part 226.2 of Regulation Z. Interest rate, program terms and conditions are subject to change without notice. Not all products are available in all states and for all loan amounts. Other restrictions and limitations may apply. Granting of loan is subject to the credit and policy requirements of Plaza Home Mortgage, Inc. ISAOA, 4820 Eastgate Mall, Suite 100 San Diego, CA 92121 PLAZA HOME MORTGAGE, INC. Phoenix Wholesale 1702 East Highland Ave., Suite 300 Phoenix, AZ 85016 Phone: 866-338-5035 Page 3 of 6 2/6/2015 6:57 AM CA1012L 10/1 ARM 2.25 Margin 2/2/5 caps Rate 4.625 4.500 4.375 4.250 4.125 4.000 3.875 3.750 3.625 15 Day (4.671) (4.439) (4.237) (4.075) (3.775) (3.271) (2.741) (2.189) (1.545) 30 Day (4.496) (4.264) (4.062) (3.900) (3.600) (3.096) (2.566) (2.014) (1.370) CA512L 5/1 ARM 2.25 Margin 2/2/5 caps CA51LHB 5/1 ARM Adjustments Link 2.25 Margin MANUFACTURED HOMES are not allowed. High Balance 2/2/5 caps 2 units 3-4 units Condo LTV > 75% & Loan Term >15yrs N/O/O: LTV <= 75% LTV > 75% - 80% Rate 4.500 4.375 4.250 4.125 4.000 3.875 3.750 3.625 3.500 Rate 4.500 4.375 4.250 4.125 4.000 3.875 3.750 3.625 3.500 3.375 1.000 1.000 0.750 1.750 3.000 15 Day 30 Day Rate CA712L (4.989) (4.814) 4.500 7/1 ARM (4.739) (4.564) 4.375 (4.297) (4.472) 4.250 2.25 Margin (4.031) (4.206) 4.125 (3.828) (4.003) 4.000 5/2/5 caps (3.609) (3.784) 3.875 (3.302) (3.477) 3.750 (3.004) (3.179) 3.625 (2.625) (2.800) 3.500 15 Day 30 Day Rate (4.239) (4.064) CA71LHB 4.625 (3.989) (3.814) 7/1 ARM 4.500 (3.722) (3.547) 4.375 2.25 Margin (3.456) (3.281) 4.250 (3.253) (3.078) 4.125 High (3.034) (2.859) 4.000 Balance (2.727) (2.552) 3.875 (2.429) (2.254) 3.750 5/2/5 caps (2.050) (1.875) 3.625 (1.668) (1.493) 3.500 Loan Amounts Loan Amount <$140k Loan Amount <$100k Loan Amount <$75k Subordinate Financing LTV<=65, CLTV/HCLTV >80<=95, FICO <720 LTV<=65, CLTV/HCLTV >80<=95, FICO >=720 LTV >65<=75, CLTV/HCLTV >80<=95, FICO <720 LTV >65<=75, CLTV/HCLTV >80<=95, FICO >=720 LTV >75<=95, CLTV/HCLTV >90<=95, FICO <720 LTV >75<=95, CLTV/HCLTV >90<=95, FICO >=720 LTV >75<=90, CLTV/HCLTV >76<=90, FICO <720 LTV >75<=90, CLTV/HCLTV >76<=90, FICO >=720 LTV <=95, CLTV/HCLTV >95<=97 15 Day (4.937) (4.724) (4.509) (4.307) (4.047) (3.782) (3.427) (3.051) (2.571) 15 Day (4.401) (4.187) (3.974) (3.759) (3.557) (3.297) (3.032) (2.677) (2.301) (1.821) 30 Day (4.762) (4.549) (4.334) (4.132) (3.872) (3.607) (3.252) (2.876) (2.396) 30 Day (4.226) (4.012) (3.799) (3.584) (3.382) (3.122) (2.857) (2.502) (2.126) (1.646) 0.125 0.250 0.500 0.500 0.250 0.750 0.500 1.000 0.750 1.000 0.750 1.500 Risk-Based Adjustments LTV% <= 60 60.01-70 70.01-75 75.01-80 80.01-85 85.01-90 90.01-95 95.01-97 >97 No FICO or < 620 N/A N/A N/A N/A N/A N/A N/A N/A N/A 620 639 0.500 1.500 3.000 3.000 3.250 3.250 3.250 3.250 N/A 640 659 0.500 1.250 2.500 3.000 3.250 2.750 2.750 2.750 N/A Credit Score 660 679 0.000 1.000 2.000 2.500 2.750 2.250 2.250 2.250 N/A 680 699 0.000 0.500 1.250 1.750 1.500 1.250 1.250 1.250 N/A 700 719 (0.250) 0.500 0.750 1.000 1.000 1.000 1.000 1.000 N/A 720 739 (0.250) 0.000 0.250 0.500 0.500 0.500 0.500 0.500 N/A >= 740 (0.250) 0.000 0.000 0.250 0.250 0.250 0.250 0.250 N/A Use the above matrix for all programs excluding My Community and Home Possible programs Loans with FICOs less than 620 must have DU or LP approval. Risk-Based Adjustments do not apply to loans with amortization terms <=180 months, if both LTV<=95 & FICO >=620 Cash Out LTV% <= 60 60.01-75 75.01-80 80.01-85 LTV > 85 No FICO or <620 N/A N/A N/A N/A N/A 620 639 0.250 1.250 2.750 3.000 N/A 640 659 0.250 1.250 2.250 3.000 N/A Credit Score 660 679 0.250 0.750 1.500 2.500 N/A 680 699 0.000 0.750 1.375 2.500 N/A 700 719 0.000 0.625 0.750 1.500 N/A 720 739 0.000 0.625 0.750 1.500 N/A >= 740 0.000 0.250 0.500 0.625 N/A This information is for the use of approved mortgage lenders only and is not intended for distribution to consumers. This is not an advertisement to extend customer credit as defined by part 226.2 of Regulation Z. Interest rate, program terms and conditions are subject to change without notice. Not all products are available in all states and for all loan amounts. Other restrictions and limitations may apply. Granting of loan is subject to the credit and policy requirements of Plaza Home Mortgage, Inc. ISAOA, 4820 Eastgate Mall, Suite 100 San Diego, CA 92121 PLAZA HOME MORTGAGE, INC. Phoenix Wholesale 1702 East Highland Ave., Suite 300 Phoenix, AZ 85016 Phone: 866-338-5035 Rate 4.500 4.375 4.250 4.125 4.000 3.875 3.750 3.625 3.500 3.375 3.250 30 Year Fixed RCF30DURP 15 Day 30 Day (4.902) (4.727) (4.492) (4.317) (4.085) (3.910) (3.544) (3.369) (2.969) (2.794) (2.366) (2.191) (1.781) (1.606) (0.910) (0.735) 0.058 0.233 0.904 1.079 1.615 1.790 Page 4 of 6 2/6/2015 6:57 AM CONFORMING FIXED RATES - DU Refi Plus 30yr Fixed High Balance 20 Year Fixed 15 Year Fixed RCF30DURPH RCF20DURP RCF15DURP Rate 15 Day 30 Day Rate 15 Day Rate 15 Day 30 Day 4.750 4.625 4.125 (4.178) (4.003) (5.096) (4.578) (4.403) 4.625 4.500 4.000 (3.779) (3.604) (4.720) (4.499) (4.324) 4.500 4.375 3.875 (3.402) (3.227) (4.309) (4.291) (4.116) 4.375 4.250 3.750 (2.992) (2.817) (3.902) (4.115) (3.940) 4.250 4.125 3.625 (2.585) (2.410) (3.472) (3.909) (3.734) 4.125 4.000 3.500 (2.044) (1.869) (3.061) (3.543) (3.368) 4.000 3.875 3.375 (1.469) (1.294) (2.596) (2.997) (2.822) 3.875 3.750 3.250 (0.866) (0.691) (2.123) (2.518) (2.343) 3.750 3.625 3.125 (0.281) (0.106) (1.462) (2.082) (1.907) 3.625 3.500 3.000 0.590 0.765 (0.643) (1.509) (1.334) 3.500 3.375 2.875 1.558 1.733 0.194 (0.772) (0.597) Loan Amount <$140k Loan Amount <$100k Loan Amount <$75k 2 units 3-4 units Condo LTV > 75% & Loan Term >15yrs; (Excludes Detached Condo w/ DU) DURP w/ MI 0.125 0.250 0.500 1.000 1.500 0.750 0.375 Investment LTV <= 75% Property: LTV > 75% - 80% 1.750 1.750 1.750 LTV > 80% Risk-Based Adjustments 30yr Fixed >105 LTV RCF30DURPX Rate 15 Day 30 Day 4.500 (5.353) (5.178) 4.375 (4.676) (4.501) 4.250 (4.004) (3.829) 4.125 (3.178) (3.003) 4.000 (2.306) (2.131) 3.875 (1.407) (1.232) 3.750 (0.525) (0.350) 3.625 0.653 0.828 3.500 1.933 2.108 3.375 3.092 3.267 3.250 4.115 4.290 Subordinate Financing LTV<=65, CLTV/HCLTV >80<=95, FICO <720 LTV<=65, CLTV/HCLTV >80<=95, FICO >=720 LTV >65<=75, CLTV/HCLTV >80<=95, FICO <720 LTV >65<=75, CLTV/HCLTV >80<=95, FICO >=720 LTV >75<=95, CLTV/HCLTV >90<=95, FICO <720 LTV >75<=95, CLTV/HCLTV >90<=95, FICO >=720 LTV >75<=90, CLTV/HCLTV >76<=90, FICO <720 LTV >75<=90, CLTV/HCLTV >76<=90, FICO >=720 LTV <=95, CLTV/HCLTV >95<=97 0.500 0.250 0.750 0.500 1.000 0.750 1.000 0.750 1.500 Credit Score 620 640 Maximum Cumulative Adjustments 660 680 700 720 LTV% < 620 639 659 679 699 719 739 >= 740 (excludes lock term, loan amts, MI transfer & state adjustments) <= 60 N/A 0.750 0.500 0.000 0.000 (0.250) (0.250) (0.250) LTV >80, Owner Occupied, Loan Term <=20yrs 60.01-70 N/A 1.500 1.250 1.000 0.500 0.500 0.000 0.000 LTV >80, Owner Occupied, Loan Term >20yrs 70.01-75 N/A 1.750 1.750 1.500 0.750 0.500 0.000 0.000 2nd Home or N/O/O 75.01-80 N/A 1.750 1.750 1.750 0.750 0.500 0.000 0.000 LTV <=80% 80.01-85 N/A 1.750 1.750 1.750 0.750 0.500 0.000 0.000 85.01-90 N/A 1.750 1.750 1.750 0.750 0.500 0.000 0.000 90.01-95 N/A 1.750 1.750 1.750 0.750 0.500 0.000 0.000 95.01-97 N/A 1.750 1.750 1.750 1.250 1.000 0.500 0.500 97.01-105 N/A 3.500 2.500 2.000 1.750 1.500 1.000 1.000 105.01-125 N/A 3.500 2.500 2.000 1.750 1.500 1.000 1.000 0.000 0.750 1.750 1.750 Risk-Based Adjustments do not apply to loans with amortization terms <=180 months. Rate 4.375 4.250 4.125 4.000 3.875 3.750 3.625 3.500 3.375 3.250 30 Year Fixed CF300LPRR 15 Day 30 Day (4.685) (4.510) (4.231) (4.056) (3.681) (3.506) (2.963) (2.788) (2.211) (2.036) (1.697) (1.522) (1.056) (0.881) (0.222) (0.047) 0.683 0.858 1.564 1.739 CONFORMING FIXED RATES - LP Relief Refinance 15 Year Fixed 30yr Fixed High Balance CF150LPRR CF300LPRRH Rate 15 Day 30 Day Rate 15 Day 30 Day 3.875 4.750 (4.900) (4.725) (4.515) (4.340) Closing costs, financing 3.750 4.625 (4.487) (4.312) (4.000) (3.825) costs (including discount costs) and 3.625 4.500 (4.065) (3.890) (3.338) (3.163) prepaids/escrows, are 3.500 4.375 (3.578) (3.403) (3.185) (3.010) limited to the lesser of 4% of the current unpaid 3.375 4.250 (2.957) (2.782) (2.731) (2.556) balance of the mortgage 3.250 4.125 (2.474) (2.299) (2.181) (2.006) being refinanced or $5,000. 3.125 4.000 (2.043) (1.868) (1.463) (1.288) 3.000 3.875 (1.513) (1.338) (0.711) (0.536) 2.875 3.750 (0.804) (0.629) (0.197) (0.022) 2.750 3.625 (0.148) 0.027 0.444 0.619 Loan Amounts Loan Amount <$140k Loan Amount <$100k Loan Amount <$75k LPRR w/ MI LTV >105 Subordinate Financing CLTV/HCLTV >95, FICO >=720 CLTV/HCLTV >95, FICO <720 LTV >65<=75, CLTV/HCLTV >90<=95, FICO >=720 LTV >65<=75, CLTV/HCLTV >90<=95, FICO <720 LTV >75<=80, CLTV/HCLTV >75<=90, FICO >=720 LTV >75<=80, CLTV/HCLTV >75<=90, FICO <720 LTV >75<=80, CLTV/HCLTV >90<=95, FICO >=720 LTV >75<=80, CLTV/HCLTV >90<=95, FICO <720 LTV >80<=90, CLTV/HCLTV >80<=95, FICO >=720 LTV >80<=90, CLTV/HCLTV >80<=95, FICO <720 LTV >90, CLTV/HCLTV >90, FICO >=720 LTV >90, CLTV/HCLTV >90, FICO <720 0.125 0.250 0.500 0.375 Condo LTV > 75% & Loan Term >15yrs 2 units 3-4 units <=80 LTV 3-4 units >80<=85 LTV 3-4 units >85 LTV Investment Property LTV >95<=97 LTV >97<=105 Risk-Based Adjustments 30yr Fixed >105 LTV RCF30LPRRX Rate 15 Day 30 Day 4.000 (2.213) (2.038) 3.875 (1.461) (1.286) 3.750 (0.947) (0.772) 3.625 (0.306) (0.131) 3.500 0.528 0.703 3.375 1.433 1.608 3.250 2.314 2.489 0.750 1.000 1.000 1.500 2.000 1.750 0.500 1.000 2.000 1.500 1.500 0.250 0.500 0.750 1.000 0.750 1.000 0.750 1.000 0.250 0.500 Credit Score 620 640 Maximum Cumulative Adjustments 660 680 700 720 LTV% < 620 639 659 679 699 719 739 >= 740 (excludes lock term, loan amts, MI transfer & state adjustments) <= 60 N/A 0.500 0.500 0.000 0.000 (0.250) (0.250) (0.250) LTV >80, O/O & 2nd Home, Loan Term <=20yrs 60.01 - 70 N/A 1.500 1.250 1.000 0.500 0.500 0.000 0.000 LTV >80, O/O & 2nd Home, Loan Term >20yrs 70.01 - 75 N/A 3.000 2.750 2.250 1.250 0.750 0.250 0.000 N/O/O 75.01 - 80 80.01 - 85 N/A N/A 3.000 3.250 3.000 3.250 2.750 2.750 1.750 1.500 1.000 1.000 0.500 0.500 0.250 0.250 LTV <=80% 85.01 - 90 N/A 3.250 2.750 2.250 1.250 1.000 0.500 0.250 90.01 - 95 N/A 3.250 2.750 2.250 1.250 1.000 0.500 0.250 95.01 - 97 >97 N/A N/A 3.250 3.250 2.750 2.750 2.250 2.250 1.250 1.250 1.000 1.000 0.500 0.500 0.250 0.250 0.000 0.750 1.750 1.750 Risk-Based Adjustments do not apply to loans with amortization terms <=180 months. This information is for the use of approved mortgage lenders only and is not intended for distribution to consumers. This is not an advertisement to extend customer credit as defined by part 226.2 of Regulation Z. Interest rate, program terms and conditions are subject to change without notice. Not all products are available in all states and for all loan amounts. Other restrictions and limitations may apply. Granting of loan is subject to the credit and policy requirements of Plaza Home Mortgage, Inc. ISAOA, 4820 Eastgate Mall, Suite 100 San Diego, CA 92121 PLAZA HOME MORTGAGE, INC. Phoenix Wholesale 1702 East Highland Ave., Suite 300 Phoenix, AZ 85016 Phone: 866-338-5035 Page 5 of 6 2/6/2015 6:57 AM ELITE JUMBO 30yr Fixed Jumbo EJF30 15yr Fixed Jumbo EJF15 Rate 15 Day 30 Day Rate 15 Day 30 Day 4.375 4.250 4.125 4.000 3.875 3.750 3.625 (1.990) (1.577) (1.160) (0.718) (0.189) 0.416 1.162 (1.815) (1.402) (0.985) (0.543) (0.014) 0.591 1.337 4.125 4.000 3.875 3.750 3.625 3.500 3.375 3.250 3.125 3.000 2.875 (1.515) (1.325) (1.144) (1.012) (0.807) (0.542) (0.232) 0.132 0.513 0.970 1.485 (1.340) (1.150) (0.969) (0.837) (0.632) (0.367) (0.057) 0.307 0.688 1.145 1.660 Adjustments LTV/CLTV/HCLTV <= 60% 60.01 - 65% 65.01 - 70% 70.01 - 75% FICO 700-719 (0.125) 0.375 0.625 N/A 75.01 - 80% N/A FICO 720-739 (0.250) 0.125 0.375 0.625 1.000 FICO 740-759 (0.375) (0.125) 0.000 0.375 0.625 FICO >=760 (0.500) (0.375) (0.250) 0.000 0.250 LTV <= 60% 60.01 - 65% 65.01 - 70% 70.01 - 75% 75.01 - 80% <= $1.0M (0.250) (0.250) (0.125) 0.000 0.000 > $1.0M to $1.5M (0.250) 0.000 0.125 0.250 0.375 > $1.5M to $2.0M (0.125) 0.000 0.250 0.375 N/A > $2.0M to $2.5M 0.000 0.125 0.250 N/A N/A C/O Refinance 0.250 0.250 0.250 N/A N/A 2 unit 0.250 0.250 N/A N/A N/A 2nd Home 0.125 0.250 0.375 0.750 N/A No Escrows (NY excluded) 0.125 0.125 0.125 0.125 0.125 15yr Fixed 0.000 0.000 0.000 0.000 0.000 Fixed Max Rebate 30 yr - Loan Amounts <= $1,000,000 (2.125) FL, NV 0.000 0.000 0.000 0.000 0.375 Fixed Max Rebate 15 yr - Loan Amounts <= $1,000,000 (1.750) ARM 0.000 0.000 0.000 0.000 0.250 Fixed Max Rebate 30 yr - Loan Amounts > $1,000,000 (1.750) Purchase (0.375) (0.375) (0.375) (0.375) (0.375) Fixed Max Rebate 15 yr - Loan Amounts > $1,000,000 (1.500) 30 yr Fixed, Non CA (0.375) (0.375) (0.375) (0.375) (0.375) ARM Max Rebate - Loan Amounts <= $1,000,000 (1.125) Texas A6 0.500 0.500 0.500 0.500 0.500 ARM Max Rebate - Loan Amounts > $1,000,000 (1.000) 30 yr Fixed, CA (0.250) (0.250) (0.250) (0.125) 0.000 7yr ARM Jumbo EJA71 10yr ARM Jumbo EJA101 5yr ARM Jumbo EJA51 2/2/5 caps Rate 3.750 3.625 3.500 3.375 3.250 3.125 3.000 2.875 2.750 2.25 margin 15 Day (1.413) (1.291) (1.146) (0.968) (0.760) (0.519) (0.281) (0.029) 0.274 30 Day (1.238) (1.116) (0.971) (0.793) (0.585) (0.344) (0.106) 0.146 0.449 2/2/5 caps Rate 3.875 3.750 3.625 3.500 3.375 3.250 3.125 3.000 2.875 2.25 margin 15 Day (1.512) (1.386) (1.193) (0.970) (0.744) (0.516) (0.201) 0.202 0.639 30 Day (1.337) (1.211) (1.018) (0.795) (0.569) (0.341) (0.026) 0.377 0.814 2/2/5 caps Rate 4.375 4.250 4.125 4.000 3.875 3.750 3.625 3.500 3.375 2.25 margin 15 Day (2.080) (1.880) (1.634) (1.357) (1.083) (0.734) (0.284) 0.188 0.635 30 Day (1.905) (1.705) (1.459) (1.182) (0.908) (0.559) (0.109) 0.363 0.810 Elite Jumbo Restrictions 1. Only 1 extension allowed Lock Cutoff - 4:00 PM - PST This information is for the use of approved mortgage lenders only and is not intended for distribution to consumers. This is not an advertisement to extend customer credit as defined by part 226.2 of Regulation Z. Interest rate, program terms and conditions are subject to change without notice. Not all products are available in all states and for all loan amounts. Other restrictions and limitations may apply. Granting of loan is subject to the credit and policy requirements of Plaza Home Mortgage, Inc. ISAOA, 4820 Eastgate Mall, Suite 100 San Diego, CA 92121 Page 6 of 6 PLAZA HOME MORTGAGE, INC. Phoenix Wholesale 1702 East Highland Ave., Suite 300 Phoenix, AZ 85016 Phone: 866-338-5035 2/6/2015 6:57 AM Rate 4.500 4.375 4.250 4.125 4.000 3.875 3.750 3.625 3.500 3.375 3.250 Rate 4.500 4.375 4.250 4.125 4.000 3.875 3.750 3.625 3.500 3.375 Rate 3.750 3.625 3.500 3.375 3.250 3.125 3.000 2.875 2.750 Rate 4.000 3.875 3.750 3.625 3.500 3.375 30 Year Fixed FHA300 15 Day 30 Day (5.975) (5.800) (5.486) (5.311) (5.527) (5.352) (5.101) (4.926) (4.725) (4.550) (4.216) (4.041) (3.772) (3.597) (3.118) (2.943) (3.194) (3.019) (2.634) (2.459) (1.706) (1.531) 30 Year Fixed VA300 15 Day 30 Day (5.725) (5.550) (5.236) (5.061) (5.277) (5.102) (4.851) (4.676) (4.475) (4.300) (3.966) (3.791) (3.522) (3.347) (2.868) (2.693) (2.944) (2.769) (2.384) (2.209) 15 Year Fixed FHA150 15 Day 30 Day (4.107) (3.932) (4.015) (3.840) (3.679) (3.504) (3.345) (3.170) (2.954) (2.779) (2.255) (2.080) (1.863) (1.688) (1.470) (1.295) (1.028) (0.853) 5 Year ARM FHA51T 15 Day 30 Day (3.829) (3.654) (3.641) (3.466) (3.388) (3.213) (3.076) (2.901) (2.752) (2.577) (2.427) (2.252) GOVERNMENT RATES - FHA & VA 30 Year Fixed FHA300HB/FHA300HBS Rate 15 Day 30 Day 4.625 (4.818) (4.643) 4.500 (4.475) (4.300) 4.375 (3.986) (3.811) 4.250 (4.027) (3.852) 4.125 (3.601) (3.426) 4.000 (3.225) (3.050) 3.875 (2.716) (2.541) 3.750 (2.272) (2.097) 3.625 (1.618) (1.443) 3.500 (1.694) (1.519) 3.375 (1.134) (0.959) Rate 4.500 4.375 4.250 4.125 4.000 3.875 3.750 3.625 3.500 3.375 30 Year Fixed RFHA30BTW 15 Day 30 Day (5.105) (4.930) (4.803) (4.628) (4.432) (4.257) (4.322) (4.147) (3.954) (3.779) (3.591) (3.416) (3.147) (2.972) (2.493) (2.318) (2.049) (1.874) (1.604) (1.429) 15 Year Fixed VA15IRRRLA Rate 15 Day 30 Day 4.500 (3.911) (3.736) 4.000 (4.301) (4.126) 3.500 (3.176) (3.001) 3.000 (1.286) (1.111) 30 Year Jumbo Fixed VA30JIRRLA Rate 4.750 4.625 4.500 4.375 4.250 4.125 4.000 3.875 3.750 15 Day (5.074) (4.285) (3.980) (3.678) (3.307) (3.197) (2.829) (2.466) (2.022) 30 Day (4.899) (4.110) (3.805) (3.503) (3.132) (3.022) (2.654) (2.291) (1.847) 30 Year Fixed VAJ30IRRRL 30 Year Fixed VA300IRRRL Rate 4.625 4.500 4.375 4.250 4.125 4.000 3.875 3.750 3.625 3.500 Rate 3.750 3.625 3.500 3.375 3.250 3.125 3.000 2.875 15 Day 30 Day (5.535) (5.360) (5.230) (5.055) (4.928) (4.753) (4.557) (4.382) (4.447) (4.272) (4.079) (3.904) (3.716) (3.541) (3.272) (3.097) (2.618) (2.443) (2.174) (1.999) 15 Year Fixed VA150 15 Day 30 Day (4.107) (3.932) (4.015) (3.840) (3.679) (3.504) (3.345) (3.170) (2.954) (2.779) (2.255) (2.080) (1.863) (1.688) (1.470) (1.295) Rate 4.750 4.625 4.500 4.375 4.250 4.125 4.000 3.875 3.750 3.625 15 Day (5.074) (4.285) (3.980) (3.678) (3.307) (3.197) (2.829) (2.466) (2.022) (1.368) 15 Year Fixed VA150IRRRL Rural Housing Full Doc & Rural Refinance Pilot USDA RH 30 Yr (USDARH30 & USDARH30P) Rate 15 Day 30 Day 4.500 (5.725) (5.550) 4.375 (5.236) (5.061) 4.250 (5.277) (5.102) 4.125 (4.851) (4.676) 4.000 (4.475) (4.300) 3.875 (3.966) (3.791) 3.750 (3.522) (3.347) 3.625 (2.868) (2.693) 30Yr Fixed - FHA Streamline FHA30S Rate 15 Day 30 Day 4.500 (5.725) (5.550) 4.375 (5.236) (5.061) 4.250 (5.277) (5.102) 4.125 (4.851) (4.676) 4.000 (4.475) (4.300) 3.875 (3.966) (3.791) 3.750 (3.522) (3.347) 3.625 (2.868) (2.693) 3.500 (2.944) (2.769) 3.375 (2.384) (2.209) Rate 3.625 3.500 3.375 3.250 3.125 3.000 2.875 15 Day (3.515) (3.179) (2.845) (2.454) (1.755) (1.363) (0.970) 30 Day (3.340) (3.004) (2.670) (2.279) (1.580) (1.188) (0.795) 30 Year Fixed (203K Streamline & Full) Rate 4.750 4.625 4.500 4.375 4.250 4.125 FHA30KS & FHA30K 15 Day 30 Day (3.524) (3.699) (2.735) (2.910) (2.430) (2.605) (2.128) (2.303) (1.757) (1.932) (1.647) (1.822) 45 Day (3.349) (2.560) (2.255) (1.953) (1.582) (1.472) FHA ID# 1710100054 VA ID# 9065310401 Adjustments 25 Year FHA & VA 20 Year FHA & VA VA Streamline: FICO 620-659 VA Streamline: FICO 660-699 FHA Streamline: FICO 640-679 FHA Streamline: FICO 620-639 FHA/VA Full Doc & USDA: FICO 640-679 FHA/VA Full Doc & USDA: FICO 620-639 FHA Full Doc: FICO 600-619 FHA Full Doc: FICO 580-599 FHA/VA Full Doc, FHA Streamline & USDA: FICO 680-719 For FHA's Back to Work use code RFHA30BTW 0.125 0.500 1.125 0.125 0.500 1.000 0.500 1.000 1.250 1.750 0.250 Loan Amounts >= $125,000 $100,000 - $124,999 $75,000 - $99,999 $50,000 - $74,999 $25,000 - $49,999 Min FICO of 620 required for VA Base 0.125 0.250 0.375 0.750 2nd Home or Non-owner Streamline Community Enrichment (O/O only) Min FICO of 620 required for FHA Streamline Use FHA High Balance for base loan amts >417,000 Manufactured Homes are not allowed 0.500 (0.750) This information is for the use of approved mortgage lenders only and is not intended for distribution to consumers. This is not an advertisement to extend customer credit as defined by part 226.2 of Regulation Z. Interest rate, program terms and conditions are subject to change without notice. Not all products are available in all states and for all loan amounts. Other restrictions and limitations may apply. Granting of loan is subject to the credit and policy requirements of Plaza Home Mortgage, Inc. ISAOA, 4820 Eastgate Mall, Suite 100 San Diego, CA 92121

© Copyright 2026