New Neutrals, Fat Tails and Distorted Markets

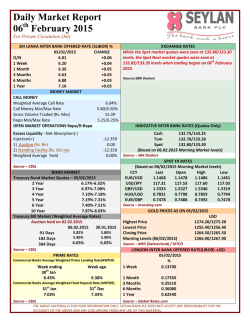

Viewpoint February 2015 Your Global Investment Authority New Neutrals, Fat Tails and Distorted Markets This article originally appeared on institutionalinvestor.com on 27 January 2015. Vineer Bhansali, Ph.D. Managing Director Portfolio Manager Dr. Bhansali is a managing director and portfolio manager in the Newport Beach office. He currently oversees PIMCO's quantitative investment portfolios. From 2000, he also headed PIMCO's firmwide analytics department. Prior to joining PIMCO in 2000, he was a proprietary trader in the fixed income trading group at Credit Suisse First Boston and in the fixed income arbitrage group at Salomon Brothers in New York. Previously, he was head of the exotic and hybrid options trading desk at Citibank in New York. He is the author of numerous scientific and financial papers and of the books "Bond Portfolio Investing and Risk Management," "Pricing and Managing Exotic and Hybrid Options," "Fixed Income Finance: A Quantitative Approach" and the most recent book, "Tail Risk Hedging." He also holds the ATP (Airline Transport Pilot) certificate, the highest civil aviation license in the U.S. He has 24 years of investment experience and holds a Ph.D. in theoretical particle physics from Harvard University. He has a master's degree in physics and an undergraduate degree from the California Institute of Technology. PIMCO identified a secular investment theme a few years ago, and the logical progression of events is playing out close to the script. Circa 2007 we identified “stable disequilibrium,” which preceded the financial crisis of 2008. The New Normal of subdued growth and central bank action followed naturally from this. And finally, the New Normal morphed into The New Neutral, which is characterized by lower-thanhistorical growth rates and, consequently, lower-than-normal policy rates. The next logical step is a natural market ecology that consists of large market movements from improperly positioned participants and even more radical policy responses. Policy responses emanating from the willingness and the ability of central bankers to try to support their local markets and hopefully their real economies can best be characterized as a culture of “credible irresponsibility” (which we discussed in a forum a few years ago and which follows a period of precommitment to accommodative policy). Credible because they can do it – they have the ability, at least in the short term, to follow up on their promises to deliver even more massive doses of stimulus (witness the well-anticipated quantitative easing announcement by the European Central Bank), and subsequent off-cycle responses from other central banks (Singapore and Denmark to name two more). Irresponsible because in a game of stare down (or “chicken”), the unpredictable actor, who appears to be acting irresponsibly in the short term, has the better chance of being the winner. From the perspective of market participants, credible irresponsibility was best illustrated by the decision of the Swiss National Bank (SNB) to suddenly, and without warning, drop the floor they had put in place for the Swiss franc versus the euro. The SNB on January 15th despite previous guidance to the contrary, and facing increasing upward pressure on the franc did a shock 180° and dropped the 1.20 franc-per-euro cap on their currency. This led to widespread market disruption as foreign exchange risk became unhedgeable, dealers got hit with forward, option and volatility spikes, and risk-reversals exploded as demand for Swiss franc call overwhelmed available supply. The following night massive FX forward positions were unwound with anecdotes indicating that overnight implied rates plummeted to -9%, and the risk continued to percolate out sending 10-year yields well into negative territory: a cycle of dislocation courtesy of central bank policy. FIGURE 1: SWISS FRANC SOARS VERSUS EURO AFTER SNB LETS IT FLOAT 1.05 FIGURE 2: SWISS 10-YEAR RATES FALL INTO NEGATIVE TERRITORY 0.95 0.9 Percent 23-Jan-15 21-Jan-15 19-Jan-15 17-Jan-15 15-Jan-15 13-Jan-15 9-Jan-15 11-Jan-15 0.2 7-Jan-15 0.7 5-Jan-15 0.3 3-Jan-15 0.75 1-Jan-15 0.4 30-Dec-14 0.8 28-Dec-14 0.5 26-Dec-14 0.85 24-Dec-14 Euros per franc 1 As mentioned, the greatest distortions are evident in the interest rate markets. Swiss yields (both government bonds and swaps) are negative out to 10 years. In other words, you have to pay money to lend them money. There is a rational (relatively speaking) explanation for this: Swiss short rates are negative – Swiss target rates are -0.75% and one month deposit rates quoted at -1.625% on Monday traded at -3% just a week ago. (One would naturally trace the highly volatile movement in the deposit rate to the unwind of currency forward positions that were not prepared for such a surprise, though evidence of this smoking gun will probably only emerge in the weeks and months to follow.) Since long-term rates are nothing but an average of short-term rates in the future, if we assume negative short-term rates out into the future, the negative longer-term yield follows arithmetically. Collateral damage is being felt by modelers of interest rate derivatives, where much of the accumulated knowledge over multiple decades was designed to preclude negative nominal interest rates, which are simply the norm in many developed European nations. This has resulted in many derivatives markets freezing up (for instance, in the Swiss swaptions markets liquidity has essentially evaporated). 0.1 0 -0.1 -0.2 23-Jan-15 21-Jan-15 19-Jan-15 17-Jan-15 15-Jan-15 13-Jan-15 11-Jan-15 9-Jan-15 7-Jan-15 5-Jan-15 3-Jan-15 1-Jan-15 30-Dec-14 28-Dec-14 26-Dec-14 The massive currency swings that this created resulted in irrecoverable damage to many large and small investors, but consistent with our theme this was nothing but a continuation of the natural evolution of the interaction of policy and markets that will result in fatter tail events and market distortions. -0.3 24-Dec-14 Source: Bloomberg as of 23 January 2015 Source: Bloomberg as of 23 January 2015 Relatively speaking there is nothing wrong with negative rates, and in many cases they might even be required to FEBRUARY 2015 | VIEWPOINT 2 extract an exorbitant price for insurance so that taking risk becomes the only choice. But we should step back and reflect on whether as investors we should be willing to pay for the privilege of lending (in absolute terms) for the next ten years to an economy that depends on banking and exports (both of which suffer under perpetual negative rates) and that willfully allowed a 30% strengthening of its currency against its trading partners after promising the opposite. Whatever the answer to the question, one cannot ignore that this type of market distortion is a natural aftermath of fluid policy action and opens the door to unforeseen risks and fat tails. While it might not be easy to protect against unforeseen events (please see PIMCO’s October 2014 Viewpoint, “Can Anything Go Wrong for the Markets?”), one can easily see that the logical aftermath of The New Neutral is an environment of unpredictability, market distortions and fat tails. The theme for portfolio construction that works in such environments is one of opportunistic strategies combined with tactical allocation and well-protected exposure to risk assets. Hanging your hat on the “central bank put” is becoming fraught with dangers like none of us have seen – ever. Good luck. FEBRUARY 2015 | VIEWPOINT 3 All investments contain risk and may lose value. This material contains the opinions of the author but not necessarily those of PIMCO and such opinions are subject to change without notice. This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed. PIMCO provides services only to qualified institutions and investors. This is not an offer to any person in any jurisdiction where unlawful or unauthorized. | Pacific Investment Management Company LLC, 650 Newport Center Drive, Newport Beach, CA 92660 is regulated by the United States Securities and Exchange Commission. | PIMCO Europe Ltd (Company No. 2604517), PIMCO Europe, Ltd Amsterdam Branch (Company No. 24319743), and PIMCO Europe Ltd - Italy (Company No. 07533910969) are authorised and regulated by the Financial Conduct Authority (25 The North Colonnade, Canary Wharf, London E14 5HS) in the UK. The Amsterdam and Italy Branches are additionally regulated by the AFM and CONSOB in accordance with Article 27 of the Italian Consolidated Financial Act, respectively. PIMCO Europe Ltd services and products are available only to professional clients as defined in the Financial Conduct Authority’s Handbook and are not available to individual investors, who should not rely on this communication. | PIMCO Deutschland GmbH (Company No. 192083, Seidlstr. 24-24a, 80335 Munich, Germany) is authorised and regulated by the German Federal Financial Supervisory Authority (BaFin) (Marie- Curie-Str. 24-28, 60439 Frankfurt am Main) in Germany in accordance with Section 32 of the German Banking Act (KWG). The services and products provided by PIMCO Deutschland GmbH are available only to professional clients as defined in Section 31a para. 2 German Securities Trading Act (WpHG). They are not available to individual investors, who should not rely on this communication. | PIMCO Asia Pte Ltd (501 Orchard Road #09-03, Wheelock Place, Singapore 238880, Registration No. 199804652K) is regulated by the Monetary Authority of Singapore as a holder of a capital markets services licence and an exempt financial adviser. The asset management services and investment products are not available to persons where provision of such services and products is unauthorised. | PIMCO Asia Limited (Suite 2201, 22nd Floor, Two International Finance Centre, No. 8 Finance Street, Central, Hong Kong) is licensed by the Securities and Futures Commission for Types 1, 4 and 9 regulated activities under the Securities and Futures Ordinance. The asset management services and investment products are not available to persons where provision of such services and products is unauthorised. | PIMCO Australia Pty Ltd (Level 19, 363 George Street, Sydney, NSW 2000, Australia), AFSL 246862 and ABN 54084280508, offers services to wholesale clients as defined in the Corporations Act 2001. | PIMCO Japan Ltd (Toranomon Towers Office 18F, 41-28, Toranomon, Minato-ku, Tokyo, Japan 105-0001) Financial Instruments Business Registration Number is Director of Kanto Local Finance Bureau (Financial Instruments Firm) No.382. PIMCO Japan Ltd is a member of Japan Investment Advisers Association and The Investment Trusts Association, Japan. Investment management products and services offered by PIMCO Japan Ltd are offered only to persons within its respective jurisdiction, and are not available to persons where provision of such products or services is unauthorized. Valuations of assets will fluctuate based upon prices of securities and values of derivative transactions in the portfolio, market conditions, interest rates, and credit risk, among others. Investments in foreign currency denominated assets will be affected by foreign exchange rates. There is no guarantee that the principal amount of the investment will be preserved, or that a certain return will be realized; the investment could suffer a loss. All profits and losses incur to the investor. The amounts, maximum amounts and calculation methodologies of each type of fee and expense and their total amounts will vary depending on the investment strategy, the status of investment performance, period of management and outstanding balance of assets and thus such fees and expenses cannot be set forth herein. | PIMCO Canada Corp. (199 Bay Street, Suite 2050, Commerce Court Station, P.O. Box 363, Toronto, ON, M5L 1G2) services and products may only be available in certain provinces or territories of Canada and only through dealers authorized for that purpose. | PIMCO Latin America Edifício Internacional Rio Praia do Flamengo, 154 1o andar, Rio de Janeiro – RJ Brasil 22210-906. | No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission. PIMCO is a trademark or registered trademark of Allianz Asset Management of America L.P. in the United States and throughout the world. THE NEW NEUTRAL and YOUR GLOBAL INVESTMENT AUTHORITY are trademarks or registered trademarks of Pacific Investment Management Company LLC in the United States and throughout the world. ©2015, PIMCO. Newport Beach Headquarters 650 Newport Center Drive Newport Beach, CA 92660 +1 949.720.6000 Amsterdam Hong Kong London Milan Munich New York Rio de Janeiro Singapore Sydney Tokyo Toronto Zurich pimco.com

© Copyright 2026