DAILY MARKET REPORT 01012013

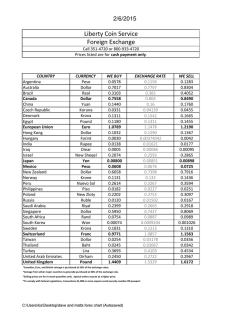

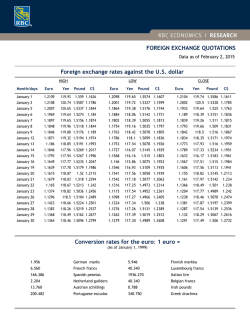

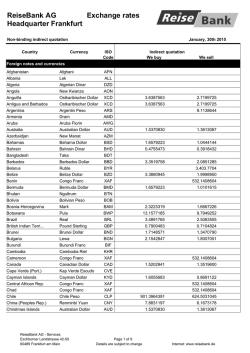

Daily Market Report 06th February 2015 For Private Circulation Only SRI LANKA INTER BANK OFFERED RATE (SLIBOR) % 05/02/2015 CHANGE O/N 6.01 +0.06 1 Week 6.20 +0.04 1 Month 6.36 +0.05 3 Months 6.63 +0.03 6 Months 6.88 +0.03 1 Year 7.16 +0.03 MONEY MARKET CALL MONEY Weighted Average Call Rate 6.04% Call Money Min/Max Rate 5.80/6.50% Gross Volume Traded (Rs. Mio) 15.39 Repo Min/Max Rate 5.25/6.25% OPEN MARKET OPERATIONS Repo/R-Repo Excess Liquidity - Net Absorption(-) Injection(+) 1) Auction (Rs. Bn) 2) Standing Facility (Rs. Bn) net Weighted Average Yield -12.359 0.00 -12.359 0.00% Source – CBSL BOND MARKET Treasury Bond Market Quotes – 05/02/2015 2 Year 6.17%-6.32% 3 Year 6.97%-7.08% 4 Year 7.10%-7.18% 5 Year 7.19%-7.31% 6 Year 7.40%-7.51% 10 Year 7.87%-8.03% Treasury Bill Market (Weighted Average Rates) Auction held on 02.02.2015 06.02.2015 30.01.2015 5.82% 5.80% 91 Days 5.90% 5.90% 182 Days 6.05% 6.05% 364 Days Source – CBSL PRIME RATES Commercial Banks Average Weighted Prime Lending Rate(AWPLR) Week ending 30th Jan 6.43% Week ago 6.38% Commercial Banks Average Weighted Fixed Deposit Rate (AWFDR) 31st Jan 7.02% Source – CBSL 31st Dec 7.33% EXCHANGE RATES While the Spot market quotes were seen at 132.80/133.30 levels, the Spot Next market quotes were seen at 132.85/133.35 levels when trading began on 06th February 2015 Source:SBK Dealers INDICATIVE INTER BANK RATES (Quotes Only) Cash 132.75/133.25 Tom 132.78/133.28 Spot 132.80/133.30 (Based on 06.02.2015 Morning Market levels) Source – SBK Dealers SPOT FX RATES (Based on 06/02/2015 Morning Market levels) CCY Last Open High Low EUR/USD 1.1468 1.1478 1.1486 1.1461 USD/JPY 117.31 117.53 117.60 117.03 GBP/USD 1.5333 1.5327 1.5340 1.5319 AUD/USD 0.7831 0.7798 0.7859 0.7794 EUR/GBP 0.7478 0.7488 0.7492 0.7478 Source – Investing.com GOLD PRICES AS ON 05/02/2015 Highest Price Lowest Price Closing Price Morning Levels (06/02/2015) USD 1274.20/1275.20 1255.40/1256.40 1264.50/1265.50 1266.90/1267.90 Source – MKS (Switzerland) / KITCO LONDON INTER BANK OFFERED RATE(LIBOR) -USD 05/02/2015 % 1 Week 0.13700 1 Month 3 Months 6 Months 1 Year 0.17350 0.25510 0.36080 0.62540 Source – Global Rates.com THE ABOVE MATERIAL IS FOR YOUR INFORMATION ONLY. SEYLAN BANK PLC DOES NOT ACCEPT ANY RESPONSIBILITY FOR THE ACCURACY OF THE ABOVE AND ANY LOSS ARISING FROM ANY USE OF THIS MATERIAL. Market Updates T/BILL AUCTION Sri Lanka Treasury bill yields flat: Central Bank 02 Feb, 2015 14:30:21 (LBO) – Sri Lanka's Treasury bill yields were flat on Monday’s auction with the 12-month yield unchanged at 6.05 percent, data from the state debt office showed. 6-month yield was also frozen at 5.90 percent and 1,325 million rupees were accepted from 5,660 million rupees. The debt office offered 12,000 million rupees of maturing debt and the auction was oversubscribed with bids amounting to 31,749 million rupees being received. It was decided to accept 9,869 million rupees from the auction. The debt office which is part of the island's central bank offered 3-month short term bills for the auction at 5.82 percent and 5,103 million rupees were accepted from 12,028 million rupees. FX TRADING FOREX-Dollar falls vs euro on Swiss bank speculation, optimism on Greece NEW YORK, Feb 5 (Reuters) - The U.S. dollar tumbled against the euro while the euro rose against the Swiss franc on Thursday on speculation the Swiss National Bank was buying euros and as traders took a sanguine view on developments surrounding Greece. The view that the Swiss central bank was buying euros to weaken the franc boosted the euro broadly and helped the currency reverse losses it posted on Wednesday when the European Central Bank said it would no longer accept Greek bonds in return for funding. "If the SNB has a new policy of intervening to change the value of the euro/Swiss ... it will tend to push the euro higher," said Joseph Trevisani, chief market strategist at WorldWideMarkets in Woodcliff Lake, New Jersey. The euro was up 1.21 percent against the dollar at $1.14835 after hitting a low of $1.13040. The euro hit 1.06425 franc, its highest against the franc since Jan. 15, when the Swiss central bank stunned markets by scrapping the three-year-old cap on its currency. Analysts said traders brushed off Wednesday's announcement from the ECB regarding Greek funding and took the view the consequences may not be dramatic in the near term. "Greece's problems are not spilling over to the rest of the world because Greek bonds are no longer owned by banks outside of Greece that would be vulnerable if Greece were to default," said Axel Merk, president and chief investment officer of Palo Alto, California-based Merk Investments. The greenback was hurt after data showed the U.S. trade deficit in December widened to its biggest since 2012 as the dollar's recent strength appeared to suck in imports and weigh on exports, while a report showing a surge in German industrial orders for December helped the euro. The Swiss franc, meanwhile, benefited from the dollar's weakness. The greenback was last down 0.35 percent against the franc at 0.92245 franc. The dollar rose modestly against the safe-haven Japanese yen, however, with analysts citing greater risk appetite in response to a rebound in oil prices and strength in U.S. equities. The dollar was last up 0.23 percent against the yen at 117.55 yen. The dollar index, which measures the greenback against a basket of six major currencies, was last down 0.49 percent at 93.524. GOLD TRADING Gold prices steady to higher in Asia with Greece, U.S. jobs in focus Investing.com - Commodities - Feb 05, 2015 11:04PM GMT - Gold prices held steady to higher in early Asia on Friday as investors awaited U.S. non-farm payroll data and the latest twist in Greece's efforts to renegotiate with creditors. On the Comex division of the New York Mercantile Exchange, gold futures for April delivery inched up 0.06% to trade at $1,266.50 a troy ounce during U.S. morning hours. Also on the Comex, silver futures for March delivery rose 0.09% at $17.285 a troy ounce. Elsewhere in metals trading, copper for March delivery fell 0.07% to trade at $2.596 a pound. Market sentiment remained subdued despite a surprise move by China's central bank to cut bank reserve requirements on Wednesday, in a bid to boost lending and spur growth. Overnight, gold held on to small losses on Thursday, as investors digested a mixed bag of U.S. economic data while monitoring developments surrounding Greece's debt. The U.S. Department of Labor said the number of individuals filing for initial jobless benefits in the week ending January 31 increased by 11,000 to 278,000 from the previous week’s revised total of 267,000. Analysts had expected initial jobless claims to rise by 23,000 to 290,000 last week. A separate report showed that the U.S. trade deficit widened to $46.56 billion in December from $39.75 billion in November, whose figure was revised from a previously estimated deficit of $39.00 billion. Analysts had expected the trade deficit to narrow to $38.00 billion in December. Market analysts expect the data to show that the U.S. economy added 234,000 jobs in January, slowing from a gain of 252,000 in December, while the unemployment rate was forecast to hold steady at 5.6%. A strong U.S. nonfarm payrolls report was likely to add to speculation over when the Federal Reserve will begin to raise interest rates, while a weak number could boost gold by undermining the argument for an early rate hike. Meanwhile, investors remained wary of developments in Greece, after the European Central Bank said it would no longer accept Greek bonds as collateral for lending, shifting the burden on to Greece’s central bank to provide additional liquidity for its lenders and increasing pressure on Athens. Greece’s government is seeking debt relief on its current €240 billion bailout, which has fuelled fears over a clash with its creditors that could bring about its eventual exit from the euro zone. Athens main stock index plunged on Thursday, while the yield on Greek 10-Year bonds rose sharply to hover just below the 11%-level. THE VIEWS EXPRESSED IN THIS REPORT IS THE VIEW OF THE WRITER AND NOT THE VIEW OF SEYLAN BANK PLC. RELIANCE ON THIS INFORMATION FOR TRANSACTIONS WILL BE AT ONE’S OWN RISK.

© Copyright 2026