Report - CREDICORP capital

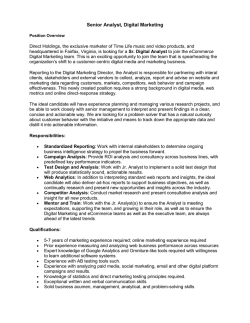

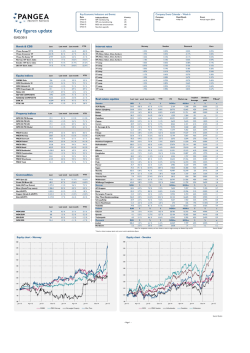

February 2nd 2015 Credicorp Capital Research Andean Daily Report CREDICORP CAPITAL RESEARCH Chile: +(562) 2450 1600 Colombia: +(571) 339 4400 Ext. 1505 Peru: +(511) 205 9190 Ext. 36070 V a lua tions REGIONAL Andean Economies: Impact from lower copper and oil prices (Full report attached) P / E EV / EBITDA P / BV 2 0 14 E 2 0 15 E 2 0 14 E 2 0 15 E LTM Country Chile 18.7x 16.1x 9.3x 8.6x 1.7x Colombia 19.2x 22.0x 8.1x 8.4x 1.4x CHILE Peru 15.3x 13.9x 8.0x 7.3x 1.3x Colbun 4Q14 Results: strong EBITDA growth, in line with estimates; EPS impacted by provision for HidroAysen’s write-off Index Last S&P MILA 40 S&P INDEX Chile Colombia Peru Mex ico Brazil Equities Latam 591 1,995 3,837 1,389 13,670 40,951 46,908 2,555 Fx Rates Last CLP / US$ UF / CLP Peru / US$ Colombia / US$ Brazil / US$ CLP / Euro Euro / US$ 633 24,560 3.06 2,440 2.68 714 1.13 PERU Commodities Last Volcan discloses expectations about its 2015 production and 4Q14 results for the first time Copper (US$/lb) Gold (US$/oz) Silv er (US$/oz) Brent (US$/bbl) Pulp (US$/MT) WTI (US$/bbl) 249 1,279 17.2 51 930 48 Cencosud – 2015 Capex guidance released; upgrading to Hold after sharp correction; company evaluating potential spin off of Real Estate business (Company Alert attached) Banmedica raises its participation in Empremedica to 100% COLOMBIA Monetary policy decision and growth projections update by BanRep came in line with our expectations Cement production increased 12.2% y/y in Dec-14 Davivienda will charge equity tax for 2015-2017 through equity accounts Nutresa to guarantee debt from subsidiaries EEB: BoD authorized the participation in two power transmission projects in Colombia Buenaventura evaluates bond issue in order to expand operations D/D % YTD% Local USD Local USD -1.1% -1.1% -7.2% -7.2% -1.3% -1.3% -3.1% -3.1% -0.1% -1.0% -0.4% -4.6% -1.3% -2.5% -8.2% -10.5% 1.5% 0.4% -7.6% -10.0% -2.2% -3.0% -5.1% -6.6% -1.8% -4.4% -6.2% -7.5% -3.6% -3.6% -6.3% -6.3% D/D % YTD% 0.8% 0.0% 1.3% 1.2% 2.9% 0.6% -0.3% 4.3% -0.3% 2.8% 2.7% 1.3% -2.5% -6.7% D/D % Local USD 1.8% 1.9% 2.6% 8.4% 0.0% 8.3% YTD% Local USD -11.7% 8.0% 10.3% -8.9% -0.2% -9.4% This report is property of IM Trust S.A. and/or Credicorp Capital Colombia S.A Sociedad Comisionista de Bolsa and/or Credicorp Capital S.A.A. and/or its subsidiaries (hereinafter jointly called “Credicorp Capital”), therefore, no part of this the material or its content, nor any copy of it may altered in any way, transmitted, copied or distributed to any third party without prior and express written consent of Credicorp Capital. In making this report, Credicorp Capital has relied on information from public sources. Credicorp Capital has not verified the truthfulness, completeness or accuracy of the information accessed, nor has audit the information in any way. Accordingly, this report does not constitute a statement, assertion or guarantee (express or implied) as to the truth, accuracy or completeness of the information contained herein or any other written or oral information furnished to any person and/or their advisors. Regional Andean Economies: Impact from lower copper and oil prices (Full report attached) The sharp reduction in commodity prices during the last months have impacted the terms of trade of the Andean economies and therefore, their national income. Particularly, the fall in copper prices entails risks on the expected recovery of Chile and Peru’s economic activity, while lower crude prices will negatively affect Colombian growth. This report analyzes the expected impact of the recent strong reduction in both copper and oil prices on Chile, Colombia and Peru’s economies. Chile Company News Colbun 4Q14 Results: strong EBITDA growth, in line with estimates; EPS impacted by provision for HidroAysen’s write-off (COLBUN: BUY; T.P.: CLP 196) Colbun (USDm) 4Q14A 4Q13A 4Q14E Y/Y A/E (%) (%) Colbun 2014 2015E Rev enues 330.1 349.6 320.6 -5.6% 3.0% P/E 79.8x 18.0x EBIT 111.1 64.1 115.5 73.2% -3.8% FV/EBITDA 13.7x 9.8x EBITDA 159.0 106.8 161.0 48.9% -1.2% P/BV 1.5x 1.2x Net Income -61.8 6.9 74.9 nm nm Div . Yield 0.4% 1.3% EBITDA Mg. 48.2% 30.5% 50.2% Net Mg. 2.0% 23.4% -18.7% Colbun posted a strong quarter, with EBITDA growth of 49%, in line with our forecast. Hydro generation increased 46% when compared to 4Q13, driven by a better snow melting season and by the entry of Angostura during the year. The latter drove a strong reduction in costs, which largely explains the positive results. Spot market purchases decreased from USD 59 mn in 4Q13 to USD 29 mn in 4Q14, while fuel costs declined 58% y/y, to USD 41 mn during the period. EPS came in below our estimates, largely due to an impairment provision of USD 102mn associated with the HidroAysen project. We highlight that this impartment does not change our positive view towards Colbun, as HidroAysen was not included in our projections. We remain bullish on the name and reiterate our BUY rating on Colbun. 2 Company Alert: Cencosud – Hold (Upgraded from Underperform) (Company Alert attached) 2015 Capex guidance released; upgrading to Hold after sharp correction; company evaluating potential spin off of Real Estate business Price: CLP 1,500; Target Price: CLP 1,765 Cencosud released it annual Capex guidance for 2015, implying sales growth of 11% - 20% and a range of EBITDA growth of 16% - 33%. Overall, operational expectations are slightly better than what we are expecting while capex comes in line with our current assumptions. The company also mentioned that it was evaluating a potential spin off and IPO of its Real Estate business, a move which could unlock value for shareholders. After an 18% USD decline in shares since our last model update (October 2014), we are upgrading our recommendation to Hold. Banmedica raises its participation in Empremedica to 100% (BANMEDICA: BUY; T.P.: CLP 1,170) Through a public release to the local regulatory, Banmedica announced the acquisition of the remaining shares of Empremedica S.A in Peru, raising its participation from 75% to 100%. The acquisition implied an investment of USD 19.3mn. Empremedica S.A is the controlling society of Clinic San Felipe and ROE Laboratory through which Banmedica participates in the health provision services in Peru. This acquisition looks to complete the participation of Banmedica in the 50-50 joint venture formed with Pacifico to participate in health provision, health insurance and medical assistance insurances services in Peru. In the last material fact, Banmedica announced a total investment in this joint venture of USD 57mn, approximately. Colombia Economics and Politics Monetary policy decision and growth projections update by BanRep came in line with our expectations The BanRep decided to keep the repo rate unchanged at 4.50% for a fifth month in a row, in line with both market consensus and our expectations. The language of the statement remained balanced between: i) risks on activity from low oil prices and a low dynamism of the main trading partners, and ii) an inflation and inflation expectations that stand close to the ceiling of the BanRep’s target range, amid a domestic demand that continues growing at a healthy pace. Importantly, the BanRep revised its 2015 GDP growth forecast from 4.3% to 3.6% as the most likely figure, similar to our estimate of 3.7%. The high level of uncertainty currently, jointly with the recent upward trend in inflation, which is expected to continue in the upcoming months, continue to support our expectation of a stable repo rate at 4.50% for several months. In any case, we expect the BanRep´s next move to be on the downside, which might happen in 4Q15 as risks on the economic activity will be higher in 2016, a year in which the government will be required to carry out a significant fiscal adjustment as a result of current oil prices. Thus, we expect a repo rate at 4.0% by Dec-15. Cement production increased 12.2% y/y in Dec-14 According to DANE, cement production advanced 12.2% in Dec-14 (Nov-14:4.8%). At the same time, cement deliveries grew by 10.0% y/y after climbing 6.3% y/y in Nov-14. In addition, we highlight that cement production increased 10.2% during 2014, while deliveries did it by 10.3%. These results suggest that the construction dynamics should remain solid, as the sector continues to stand out in the local economy. 3 Company News Nutresa to guarantee debt from subsidiaries (NUTRESA: BUY; T.P.: COP 32,000) The BoD authorized Grupo Nutresa to guarantee debt from subsidiaries Noel, Doria, Means and Colcafe up to COP 690 bn. This debt will be used to fund the acquisition of Grupo El Corral. Davivienda will charge equity tax for 2015-2017 through equity accounts (PFDAVIVIENDA: BUY; T.P.: COP 35,300) The shareholders decided to charge the equity tax for 2015-2017 through equity accounts, according to Article 10 of Law 1739 of 2014 (the tax bill). This procedure, which does not comply with IFRS, will pressure ROAE to the upside, but will contract capital adequacy ratios a few basis points. Recall that Grupo Aval reached the same decision in previous weeks. EEB: BoD authorized the participation in two power transmission projects in Colombia (EEB: BUY, T.P.: COP 1,930) The BoD authorized the management of EEB to participate in the following transmission projects that will be awarded by UPME: 500 kV Refuerzo Costa Caribe and Refuerzo 500 kV Suroccidental. Peru Company News Volcan discloses expectations about its 2015 production and 4Q14 results for the first time (VOLCAN: BUY; T.P.: PEN1.10) Volcan, the mining company, expects an increase in the production of zinc (5%) and lead (8%), which will reach 295,000 MT and 62,000 MT, respectively. The firm is also looking for a 9% increase in silver output. For its part, Ignacio Rosado, said in the company report, that the cost reduction and operating efficiency policies will continue. In a related note, Volcan disclosed its 4Q14 production results for the first time. The results were higher than our estimates for the main metals that Volcan produces, including production numbers of 73,100 MT Zn (+7% A/E) and 6.1mn oz Ag (+5% A/E). Buenaventura evaluates bond issue in order to expand operations (BUENAVENTURA: HOLD; T.P.: USD 12.90) Roque Benavides, CEO of Buenaventura, commented during the Bloomberg’s 2015 Summit event, that the firm could issue bonds this year (considered previously). However, this issuance will not likely happen in the short term due to challenged market conditions. It was also informed that Buenaventura’s capex of USD 220mn will be financed mainly by the company’s cash generation and the future cash flow of the Cerro Verde’s expansion, which is expected to be completed by year-end. 4 Trading Information Traded Volume Country Vol. (USDmn) Best sector Worst Sector Chile 86.2 Retail / +3.73% Consumption / -1.30% Colombia 170.6 - - 6.8 Mining / +2.92% Agribusiness / -2.38% Peru Volume Leaders Chile USD Th. Enersis $ 9,107.2 Falabella Latam Colombia Clp. % USD Th. 0.71% Bancolombia $ 43,487.5 $ 6,172.2 0.51% Grupo Av al $ 6,025.8 -1.68% Ecopetrol Peru Cop. % USD Th. Pen % 1.62% Credicorp $ 862 -0.82% $ 21,581.9 2.39% In Retail $ 807 0.61% $ 20,124.2 -0.51% Volcan-B $ 735 6.67% Top Winners & Losers Chile Top Winners Cencosud CLP Colombia Clp.% Top Winners Peru COP Cop.% Top Winners PEN / USD % Rio Alto Mining $ 2.87 8.30% $ 1,551 10.70% Canacol $ 6,900 10.40% Ripley $ 261 2.81% Grupo Av al $ 1,285 2.39% Volcan-B $ 0.48 6.67% Embonor-B $ 844 1.69% Bancolombia $ 28,880 1.62% BVN $ 11.47 5.23% Top Losers CLP Top Losers COP Cop.% Top Losers PEN / USD Clp.% % Forus $ 2,249.5 -3.33% PFCemargos $ 8,600 -5.49% Atacocha-B $ 0.19 -5.00% CAP $ 1,552.4 -2.86% Éx ito $ 25,000 -4.94% Casa Grande $ 6.45 -3.01% CCU $ 5,798.2 -2.54% BVC $ 19 -4.15% Bco. Continental $ 4.11 -2.14% Sources: Bloomberg & Credicorp Capital 5 Economic Calendar Chile Date 30-Jan 5-Feb 5-Feb 6-Feb 6-Feb Time 9:00 8:30 8:30 8:00 8:00 Indicator / Event Unemployment Rate Economic Activity Index YoY Economic Activity Index MoM CPI YoY CPI MoM Period Dec-14 Dec-14 Dec-14 Jan-15 Jan-15 Consensus 6.0% 1.9% 4.3% -0.3% Credicorp Capital - - Actual Previous 6.0% - 6.1% 1.3% 0.2% 4.6% -0.4% Actual Previous 4.50% - 4.50% 3.66% 0.27% Actual Previous 0.17% 3.07% -0.31% 0.23% 3.22% -0.31% Colombia Date 30-Jan 5-Feb 5-Feb Time 21:00 21:00 Indicator / Event Reference Rate CPI YoY CPI MoM Period Jan-15 Jan-15 Jan-15 Consensus 4.50% 3.79% 0.58% Credicorp Capital - Peru Date 1-Feb 1-Feb 1-Feb Time 2:00 2:00 2:00 Indicator / Event CPI MoM CPI YoY Wholesale Price Index MoM Period Jan-15 Jan-15 Jan-15 Consensus 0.12% 3.05% - Credicorp Capital - Sources: Bloomberg & Credicorp Capital 6 Important Disclosures This report is property of IM Trust S.A. and/or Credicorp Capital Colombia S.A. Sociedad Comisionista de Bolsa and/or Credicorp Capital Perú S.A.A. and/or its subsidiaries (hereinafter jointly referred to as “Credicorp Capital”), therefore, no part of this the material or its content, nor any copy of it, may be altered in any way, transmitted, copied or distributed to any third party without prior and express written consent of Credicorp Capital. In making this report, Credicorp Capital has relied on public information. Credicorp Capital has not verified the truthfulness, completeness or accuracy of the information accessed, nor has audited the information in any way. Accordingly, this report does not constitute a statement, assertion or guarantee (express or implied) as to the truth, accuracy or completeness of the information contained herein or any other written or oral information furnished to any person and/or their advisors. Unless otherwise stated, the information used in this report is not confidential, nor constitutes privileged information that may mean the violation of the rules of the stock market, or that could mean failure to comply with copyright legislation. This report is not intended and shall not be understood in any way as to: a) predict the future or guarantee a specific financial result; b) ensure the fulfillment of the scenarios described in it; c) be an investment advice or opinion that could be considered as Credicorp Capital recommendations. The information contained in this report is only for referential purposes. While reading it, you should consider that the information contained in this report may be oriented to a specific segment of clients or investors, with a certain risk profile that may not be yours. Unless otherwise stated, this report does not contain investment recommendations or other suggestions that may be understood to be given under the stock market intermediaries’ special duty to clients classified as investors. When recommendations are made, the report will clearly specify the investors risk profile to which the recommendation is intended. Credicorp Capital can seek and/or conduct business with companies that are mentioned in the report, and they can also execute buying and selling transactions of shares that are mentioned. It is important to state that the fluctuation in exchange rates can have adverse effects on investments values. It is client responsibility to determine how to use the information contained in this report. Hence, the client is the sole responsible for investment decisions or any other operation he/she might perform in the stock market based on this report. In other words, the investment or operation result made by the client using the information contained in this report is of her/his sole responsibility. Credicorp Capital does not assume any responsibility, obligation or duty for any action or omission derived from the use of this document. Credicorp Capital recommends to their clients to ask for professional advice from financial, legal, accounting, tax experts before adopting an investment decision. Under no circumstances the information contained in this report may be considered as a financial, legal, accounting or taxation opinion, neither as a recommendation or investment advice. Rating System N° of Companies Companies covered covered with this rating with this rating (% ) Rating Definition Buy Expected returns of 5 percentage points or more in excess over the expected return of the local index, over the next 12-18 months. 35 43% Hold Expected returns of +/- 5% in excess/below the expected return of the local index over the next 12-18 months. 36 44% Underperform Expected to underperform the local index by 5 percentage points or more over the next 12-18 months. 9 11% Under Review / Restricted Company coverage is under review or restricted. 2 3% 82 100% Total CONTACT LIST ANDEAN RESEARCH TEAM SALES & TRADING Heinrich Lessau Hugo Horta Director of Research [email protected] Director of Sales & Trading [email protected] EQUITY RESEARCH EQUITY SALES & TRADING CHILE COLOMBIA PERU Hernán Arellano Francisca Manuschevich César Cuervo Héctor Collantes Head of Equities [email protected] Head of Equity Research [email protected] # (562) 2446 1798 Head of North Andean Equity Research [email protected] # (571) 339 4400 Ext 1012 Head of Equity Research [email protected] # (511) 205 9190 Ext 33052 Javier Günther Marilyn Macdonald Cristián Castillo Christopher DiSalvatore Jaime Pedroza Fernando Pereda Associate: Retail & Financials [email protected] # (562) 2446 1724 Senior Analyst: Utilities [email protected] # (571) 339 4400 Ext 1025 Senior Analyst: Cement & Utilities [email protected] # (511) 205 9190 Ext 37856 International Equity Sales [email protected] # (562) 2450 1695 International Equity Sales [email protected] # (4477) 7151 5855 International Sales Trader [email protected] # (786) 999 1633 CHILE PERU COLOMBIA Arturo Prado Juan C. Domínguez Iván Bogarín René Ossa Rodrigo Zavala Juan A. Jiménez Senior Analyst: Natural Resources [email protected] # (562) 2450 1688 Senior Analyst: Banks [email protected] # (571) 339 4400 Ext 1026 Senior Analyst: Retail & Others [email protected] # (511) 416 3333 Ext 33055 International Equity Sales [email protected] # (562) 2651 9324 Head of Equity - Peru [email protected] # (511) 313 2918 Ext 36044 Head of International Equity Sales [email protected] # (571) 339 4400 Ext 1701 Andrés Ossa Sebastián Gallego Tamara Vasquez Christian Munchmeyer Ursula Mitterhofer Santiago Castro Analyst: Utilities, Telecom & I.T. [email protected] # (562) 2651 9332 Analyst: Oil & Gas [email protected] # (571) 339 4400 Ext 1594 Research Assistant [email protected] # (511) 416 3333 Ext 37946 International Sales & Trading [email protected] # (562) 2450 1613 Sales & Trading [email protected] # (511) 313 2918 Ext 32922 International Sales & Trading [email protected] # (571) 339 4400 Ext 1344 Tomás Sanhueza Carlos E. Rodriguez Analyst: Food & Beverages, Healthcare [email protected] # (562) 2446 1751 Analyst: GEA & infrastructure [email protected] # (571) 339 4400 Ext 1365 Pilar González FIXED INCOME SALES & TRADING Analyst: Transport [email protected] # (562) 2446 1768 Felipe García Lourdes Alamos Head of Fixed Income [email protected] Research Coordinator & Holdings Analyst [email protected] # (562) 2450 1609 FIXED INCOME & ECONOMICS RESEARCH CHILE COLOMBIA PERU Gonzalo Covarrubias Carlos Sanchez Alfredo Bejar Head of Capital Markets [email protected] Head of Fixed Income [email protected] Head of Fixed Income / FX Trading [email protected] CHILE COLOMBIA PERU # (562) 2450 1635 # (571) 323 9154 # (511) 205 9190 Ext 36148 Paulina Yazigi Daniel Velandia Irvin León Guido Riquelme Christian Jarrin Vallerie Yong Head of Research & Chief Economist [email protected] # (562) 2450 1637 Head of Research & Chief Economist [email protected] # (571) 339 4400 Ext 1505 Senior Fixed Income Analyst [email protected] # (511) 416 3333 Ext 37854 Head of Sales [email protected] # (562) 2446 1712 RM Fixed Income Offshore [email protected] # (571) 340 2591 Local FI Senior Trader [email protected] # (511) 313 2902 - # (511) 313 2908 Felipe Lubiano Sergio Ferro Alberto Zapata Belén Larraín Andrés Valderrama Evangeline Arapoglou Senior Fixed Income Analyst [email protected] # (562) 2651 9308 Fixed Income Analyst [email protected] # (571) 339 4400 Ext 1609 Fixed Income Analyst [email protected] # (511) 205 9190 Ext 36018 Head of International FI Sales [email protected] # (562) 2446 1720 Fixed Income Trader [email protected] # (571) 323 9163 Senior International FI Trader [email protected] # (511) 313 2902 - # (511) 313 2908 Paulina Valdivieso Camilo A. Durán Paz Stepke José Andrés Riveros Lizeth Espíritu Fixed Income Analyst [email protected] # (562) 2651 9337 Macro Analyst [email protected] # (5511) 339 4400 Ext. 1383 International Fixed Income Sales [email protected] # (562) 2651 9336 Fixed Income Trader [email protected] # (571) 339 4400 Ext 1180 Fixed Income Trader [email protected] # (511) 313 2902 - # (511) 313 2908 Andrés Osorio Benjamín Diaz Economist [email protected] # (562) 2446 1760 Local Fixed Income Sales [email protected] # (562) 2446 1738

© Copyright 2026