Market Synopsis 29012015

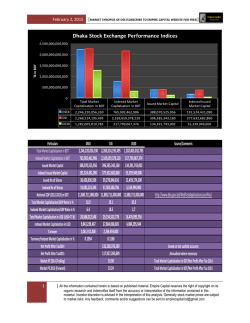

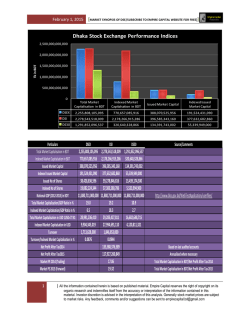

January 29, 2015 [MARKET SYNOPSIS OF DSE/SUBSCRIBE TO EMPIRE CAPITAL WEBSITE FOR FREE]] Dhaka Stock Exchange Performance Indices 2,500,000,000,000 Tk in BDT 2,000,000,000,000 1,500,000,000,000 1,000,000,000,000 500,000,000,000 0 Total Market Capitalisation in BDT Issued Market Capital Indexed Issued Market Capital DSEX 2,283,567,723,878 780,479,932,847 388,070,525,956 191,524,431,090 DSI 2,306,933,576,116 2,203,839,271,695 396,585,343,160 377,632,682,860 DS30 1,305,667,197,409 324,607,685,157 134,391,743,002 55,339,949,000 Particulars Total Market Capitalisation in BDT Indexed Market Capitalsation in BDT Issued Market Capital Indexed Issued Market Capital Issued No of Shares Indexed No of Shares National GDP (2012-2013) in BDT Total Market Capitalisation/GDP Ratio in % Indexed Market Capitalsation/GDP Ratio in % Total Market Capitalisation in USD 1USD=78.34 Indexed Market Capitalsation in USD Turnover Turnover/Indexed Market Capitalisation in % Net Profit After Tax2014 Net Profit After Tax2015 Market PE 2014 (Trailing) Market PE 2015 (Forward) 1 Indexed Market Capitalsation in BDT DSEX DSI DS30 2,283,567,723,878 780,479,932,847 388,070,525,956 191,524,431,090 38,428,836,596 19,082,224,344 11,880,711,000,000 19.2 6.6 29,149,447,586 9,962,725,719 1,956,768,000 0.1000 2,306,933,576,116 2,203,839,271,695 396,585,343,160 377,632,682,860 39,278,846,816 37,383,580,786 11,880,711,000,000 19.4 18.5 29,447,709,677 28,131,724,173 2,065,740,000 0.1056 133,588,376,589 117,927,260,849 17.27 19.56 1,305,667,197,409 324,607,685,157 134,391,743,002 55,339,949,000 13,439,174,300 5,533,994,900 11,880,711,000,000 11.0 2.7 16,666,673,442 4,143,575,251 Source/Comments http://www.bbs.gov.bd/WebTestApplication/userfiles/ Based on last audited accounts Annualised where necessary Total Market Capitalisation in BDT/Net Profit After Tax 2014 Total Market Capitalisation in BDT/Net Profit After Tax 2015 | All the information contained herein is based on published material. Empire Capital reserves the right of copyright on its organic research and indemnifies itself from the accuracy or interpretation of the information contained in this material. Investor discretion is advised in the interpretation of this analysis. Generally stock market prices are subject to market risks. Any feedback, comments and/or suggestions can be sent to [email protected] January 29, 2015 SECTOR YDAY MARKET CAP Bank Cement Ceramic Engineering Financial Institutions Food & Allied Fuel and Power Insurance IT Sector Jute Miscellaneous Pharma & Chemicals Service & Real Estate Tannery Telecommunication Textile Travel & Leisure Paper and Printing TOTAL EQUITY MARKET CAP MARKET CAP 404,090,284,834 198,460,743,300 23,331,154,698 102,145,087,333 139,291,476,843 234,256,940,851 317,510,948,103 80,402,540,370 5,830,051,396 814,207,600 60,392,481,337 323,295,493,736 20,421,202,357 23,438,959,485 464,085,883,971 80,069,440,007 26,928,851,801 484,500,000 2,505,250,248,023 INDEX DSEX DSES DS30 TOTAL MARKET CAPITALIZATION 2 [MARKET SYNOPSIS OF DSE/SUBSCRIBE TO EMPIRE CAPITAL WEBSITE FOR FREE]] 403,094,677,831 197,832,526,832 22,435,286,524 100,536,197,238 137,619,329,627 240,418,839,865 313,278,675,824 79,321,205,009 5,849,757,247 802,874,300 59,878,196,530 322,074,787,421 19,868,967,241 23,666,829,732 461,024,416,965 81,838,640,394 26,814,327,721 476,900,000 2,496,832,436,301 % CHANGE MARKET CAP% OF TOTAL MARKET CAPYDAY TURNOVER(in mn) TURNOVER(in mn) -0.25% -0.32% -3.84% -1.58% -1.20% 2.63% -1.33% -1.34% 0.34% -1.39% -0.85% -0.38% -2.70% 0.97% -0.66% 2.21% -0.43% -1.57% -0.34% 16.14% 7.92% 0.90% 4.03% 5.51% 9.63% 12.55% 3.18% 0.23% 0.03% 2.40% 12.90% 0.80% 0.95% 18.46% 3.28% 1.07% 0.02% 100.00% 162.719 54.986 41.097 265.937 136.414 61.013 316.273 37.19 143.596 2.003 95.29 245.686 101.294 6.116 109.282 393.786 15.45 8.359 2196.491 186.309 94.414 37.608 235.89 134.481 91.084 308.761 43.536 72.517 1.722 76.113 163.598 64.598 7.32 114.96 317.006 21.094 6.851 1977.862 % CHANGE TURNOVER 14.50% 71.71% -8.49% -11.30% -1.42% 49.29% -2.38% 17.06% -49.50% -14.03% -20.12% -33.41% -36.23% 19.69% 5.20% -19.50% 36.53% -18.04% -9.95% YESTERDAY TODAY % CHANGE 4747.63694 4724.04933 -0.4968% 1122.32489 1115.69606 -0.5906% 1756.80991 1747.75509 -0.5154% 3190599.23 3177697.796 -0.40% | All the information contained herein is based on published material. Empire Capital reserves the right of copyright on its organic research and indemnifies itself from the accuracy or interpretation of the information contained in this material. Investor discretion is advised in the interpretation of this analysis. Generally stock market prices are subject to market risks. Any feedback, comments and/or suggestions can be sent to [email protected] January 29, 2015 [MARKET SYNOPSIS OF DSE/SUBSCRIBE TO EMPIRE CAPITAL WEBSITE FOR FREE]] Market Capitalisation Composition Market Turnover Composition 3 | All the information contained herein is based on published material. Empire Capital reserves the right of copyright on its organic research and indemnifies itself from the accuracy or interpretation of the information contained in this material. Investor discretion is advised in the interpretation of this analysis. Generally stock market prices are subject to market risks. Any feedback, comments and/or suggestions can be sent to [email protected] January 29, 2015 [MARKET SYNOPSIS OF DSE/SUBSCRIBE TO EMPIRE CAPITAL WEBSITE FOR FREE]] Sector Bank Cement Ceramic Engineering Financial Institutions Food & Allied Fuel and Power Insurance IT Sector Jute Miscellaneous Pharma & Chemicals Service & Real Estate Tannery Telecommunication Textile Travel & Leisure Paper and Printing Total Market Cap.(DSEX) Total Market Cap.(DSI) Total Market Cap.(DS30) Turnover 375,255,665,413 375,255,665,105 94,063,595,346 197,832,531,743 197,832,531,743 172,339,908,888 20,292,728,655 20,539,525,437 83,198,649,161 83,567,793,535 32,282,637,975 137,038,601,275 137,922,575,755 16,347,843,320 207,346,552,288 217,607,959,328 203,557,074,385 262,163,927,566 262,533,496,634 197,167,927,238 75,265,041,189 76,537,008,265 24,885,853,718 5,135,550,649 5,135,550,621 262,792,800 781,462,800 59,694,590,943 59,761,305,994 16,149,107,685 281,475,317,060 288,677,757,463 45,397,929,017 14,154,112,354 14,154,112,322 23,448,987,840 23,655,387,840 461,024,416,970 461,024,416,970 461,024,416,970 56,208,172,372 57,711,103,158 19,157,717,269 23,293,185,600 23,759,023,148 23,293,185,600 476,900,000 476,900,000 - % Turnover of TMC(DSEX) % Turnover of TMC(DSI) % Turnover of TMC(DS30) 186.309 0.0496% 0.0496% 0.1981% 94.414 0.0477% 0.0477% 0.0548% 37.608 0.1853% 0.1831% 0.0000% 235.89 0.2835% 0.2823% 0.7307% 134.481 0.0981% 0.0975% 0.8226% 91.084 0.0439% 0.0419% 0.0447% 308.761 0.1178% 0.1176% 0.1566% 43.536 0.0578% 0.0569% 0.1749% 72.517 1.4121% 1.4121% 0.0000% 1.722 0.6553% 0.2204% 0.0000% 76.113 0.1275% 0.1274% 0.4713% 163.598 0.0581% 0.0567% 0.3604% 64.598 0.4564% 0.4564% 0.0000% 7.32 0.0312% 0.0309% 0.0000% 114.96 0.0249% 0.0249% 0.0249% 317.006 0.5640% 0.5493% 1.6547% 21.094 0.0906% 0.0888% 0.0906% 6.851 1.4366% 1.4366% 0.0000% Sector Bank Cement Ceramic Engineering Financial Institutions Food & Allied Fuel and Power Insurance IT Sector Jute Miscellaneous Pharma & Chemicals Service & Real Estate Tannery Telecommunication Textile Travel & Leisure Paper and Printing Indexed Market Cap.(DSEX) Indexed Market Cap.(DSI) Indexed Market Cap.(DS30) Turnover 197,322,130,003 375,115,156,495 45,762,973,885 84,276,981,003 186,199,336,743 75,463,943,297 5,367,499,885 20,539,525,437 31,321,308,044 69,364,643,184 11,515,945,455 59,374,677,511 133,745,726,787 5,223,525,177 43,963,612,950 216,832,861,490 36,490,391,076 74,068,979,918 241,686,793,199 57,996,162,098 33,439,962,369 61,929,235,839 8,640,632,325 3,779,957,874 4,660,041,287 97,233,336 781,462,800 18,040,566,892 56,854,531,410 12,757,795,043 107,511,217,111 282,474,940,960 6,072,085,146 5,148,746,093 14,154,112,322 8,807,358,689 23,655,387,840 48,721,740,786 451,468,415,601 48,721,740,786 25,478,009,801 47,322,634,132 8,928,687,174 7,033,803,696 10,712,137,418 7,033,803,696 163,052,110 476,900,000 - % Turnover of IMC(DSEX) % Turnover of IMC(DSI) % Turnover of IMC(DS30) 186.309 0.0944% 0.0497% 0.4071% 94.414 0.1120% 0.0507% 0.1251% 37.608 0.7007% 0.1831% 0.0000% 235.89 0.7531% 0.3401% 2.0484% 134.481 0.2265% 0.1005% 2.5745% 91.084 0.2072% 0.0420% 0.2496% 308.761 0.4169% 0.1278% 0.5324% 43.536 0.1302% 0.0703% 0.5039% 72.517 1.9185% 1.5561% 0.0000% 1.722 1.7710% 0.2204% 0.0000% 76.113 0.4219% 0.1339% 0.5966% 163.598 0.1522% 0.0579% 2.6943% 64.598 1.2546% 0.4564% 0.0000% 7.32 0.0831% 0.0309% 0.0000% 114.96 0.2360% 0.0255% 0.2360% 317.006 1.2442% 0.6699% 3.5504% 21.094 0.2999% 0.1969% 0.2999% 6.851 4.2017% 1.4366% 0.0000% 4 | All the information contained herein is based on published material. Empire Capital reserves the right of copyright on its organic research and indemnifies itself from the accuracy or interpretation of the information contained in this material. Investor discretion is advised in the interpretation of this analysis. Generally stock market prices are subject to market risks. Any feedback, comments and/or suggestions can be sent to [email protected] January 29, 2015 Sector Bank Cement Ceramic Engineering Financial Institutions Food & Allied Fuel and Power General Insurance IT Sector Jute Miscellaneous Pharma & Chemicals Service & Real Estate Tannery Telecommunication Textile Travel & Leisure [MARKET SYNOPSIS OF DSE/SUBSCRIBE TO EMPIRE CAPITAL WEBSITE FOR FREE]] Sectoral PE 10.08 35.15 33.35 25.58 14.80 31.30 10.84 11.31 19.11 208.31 29.52 22.35 39.57 23.70 21.35 13.32 14.90 Market Capitalisation Negative Earnings excluded 403,094,677,831 ICBIBNK 197,832,526,832 22,435,286,524 SPCERAMICS, 100,536,197,238 AZIZ PIPES, KAY&QUE, 137,619,329,627 ILFSL, MIDASFIN 240,418,839,865 CVOPRL, FINEFOODS, GEMINISEA, MEGHCONMILK, RAHIMAFOOD, ZEAL BANGLA 313,278,675,824 35,720,809,628 5,849,757,247 INTECH 802,874,300 JUTESPIN 59,878,196,530 322,074,787,421 IMAMBUTTON 19,868,967,241 23,666,829,732 461,024,416,965 81,838,640,394 DULAMIACOT, SONARGAON, MODERNDYE 26,814,327,721 TOP 10 GAINERS BASED ON YCP AND CLOSE PRICE Instr Code NPOLYMAR BSCCL BATBC ISLAMIINS RANFOUNDRY BGIC KOHINOOR MONNOSTAF AMCL(PRAN) PRIMEBANK YCP TOP 10 LOSERS BASED ON YCP AND CLOSE PRICE Instr Code EXIM1STMF SPCL HFL NTLTUBES METROSPIN BDAUTOCA KEYACOSMET GEMINISEA GSPFINANCE RAKCERAMIC YCP 5 High 64.2 102.6 2816.6 18.2 96.3 20.1 339 294.5 195.2 18.8 Low 70.4 112.1 2957.3 19.2 100.3 21.3 359 306.8 201 19.5 High 6.6 233.5 31.7 103.5 12.9 22.5 21.7 251.6 29.2 56.7 CLOSE 65 104 2780 18 95.2 19.5 337.5 294 193 18.7 Low 6 234 31.4 99.7 12.7 22.5 22 255 28.9 56.6 69.3 109.2 2934.4 18.9 99.9 20.8 348.9 302.5 200.5 19.3 CLOSE 6 213.1 28.8 93.2 12 20.7 20.3 234 27.4 53.6 6 213.9 29.1 95.2 12.1 21.2 20.5 238 27.7 54.1 %CHG 7.944 6.433 4.182 3.846 3.738 3.483 2.92 2.716 2.715 2.66 %CHG -9.091 -8.394 -8.202 -8.019 -6.202 -5.778 -5.53 -5.405 -5.137 -4.585 | All the information contained herein is based on published material. Empire Capital reserves the right of copyright on its organic research and indemnifies itself from the accuracy or interpretation of the information contained in this material. Investor discretion is advised in the interpretation of this analysis. Generally stock market prices are subject to market risks. Any feedback, comments and/or suggestions can be sent to [email protected] January 29, 2015 [MARKET SYNOPSIS OF DSE/SUBSCRIBE TO EMPIRE CAPITAL WEBSITE FOR FREE]] Lowest Forward PE Companies Forward PE GENNEXT( Generation Next Fashions Limited 5.51 SOUTHEASTB( Southeast Bank ) 5.97 FAMILYTEX( Familytex (BD) Limited ) 6.13 TRUSTBANK( Trust Bank Limited ) 6.48 ABBANK( AB Bank Limited ) 7.10 UNITEDAIR( United Airways (BD) Ltd. 7.18 ASIAPACINS( Asia Pacific General Insurance Co. Ltd. ) 7.44 IFIC( IFIC Bank ) 7.58 CONTININS( Continental Insurance Ltd. ) 7.58 UTTARAFIN( Uttara Finance ) 7.67 Highest Forward PE Comapnies ECABLES( Eastern Cables ) Forward PE 1736.76 ATLASBANG( Atlas Bangladesh ) 580.10 MONNOSTAF( Monno Jute Stafflers ) 259.29 BAYLEASING( Bay Leasing & Investment Limited ) 244.22 GEMINISEA( Gemini Sea Food ) 171.11 BEACONPHAR( Beacon Pharmaceuticals Limited ) 166.90 SONALIANSH( Sonali Aansh ) 162.22 BXSYNTH( Beximco Synthetics ) 143.48 RENWICKJA( Renwick Jajneswar & Co (Bd) ) 124.57 BDAUTOCA( BD.Autocars ) 113.51 Highest Dividend Yield Companies Dividend Yield RSRMSTEEL( Ratanpur Steel Re-Rolling Mills Limited ) 9.23% FIRSTSBANK( First Security Islami Bank Limited ) 9.09% SIBL( Social Islami Bank Limited ) 8.63% DHAKAINS( Dhaka Insurance Limited ) 8.30% SOUTHEASTB( Southeast Bank ) 8.16% DHAKABANK 8.10% STANDBANKL( Standard Bank Limited ) 8.00% PHOENIXFIN( Phoenix Finance and Investments Ltd. ) 7.97% HEIDELBCEM( Heidelberg Cement Bd. ) 7.74% DELTASPINN( Delta Spinners Ltd. ) 7.52% 6 | All the information contained herein is based on published material. Empire Capital reserves the right of copyright on its organic research and indemnifies itself from the accuracy or interpretation of the information contained in this material. Investor discretion is advised in the interpretation of this analysis. Generally stock market prices are subject to market risks. Any feedback, comments and/or suggestions can be sent to [email protected] January 29, 2015 [MARKET SYNOPSIS OF DSE/SUBSCRIBE TO EMPIRE CAPITAL WEBSITE FOR FREE]] TOP TEN CHEAPEST STOCK BASED ON FORWARD PE RELATIVE TO SECTORAL PE NAME OF THE COMPANY CMCKAMAL( CMC Kamal ) QSMDRYCELL( Quasem Drycells ) BATBC( BATBC ) ORIONINFU( Orion Infusion Ltd. ) PADMAOIL( Padma Oil Co. ) METROSPIN( Metro Spinning GP( Grameenphone Ltd. ) BATASHOE( Bata Shoe ) PRIMEINSUR( PRIME INSURACE ) NPOLYMAR( National Polymer ) Realtive to Sector PE most undervalued stocks Column1 BANK CEMENT EBL( Eastern Bank ) PREMIERCEM( Premier Cement Mills Limited ) EXIMBANK( Export Import (Exim) Bank of Bangladesh ) HEIDELBCEM( Heidelberg Cement Bd. ) FIRSTSBANK( First Security Islami Bank Limited ) MEGHNACEM( Meghna Cement ) CERAMIC ENGINEERING RAKCERAMIC( RAK Ceramics (Bangladesh) Limited ) NPOLYMAR( National Polymer ) FUWANGCER( Fu-Wang Ceramic ) BSRMSTEEL( BSRM Steels Limited ) GOLDENSON( Golden Son Ltd. ) FINANCIAL INSTITUITION FOOD AND ALLIED ISLAMICFIN( Islamic Finance & Investment Ltd. ) BATBC( BATBC ) BDFINANCE( Bangladesh Finance and Investment Co.Ltd ) APEXFOODS( Apex Foods ) FASFIN( FAS Finance & Investment Limited ) RDFOOD( Rangpur Dairy & Food Products Ltd. ) FUEL AND POWER GENERAL INSURANCE PADMAOIL( Padma Oil Co. ) PRIMEINSUR( PRIME INSURACE ) SPPCL (Summit Purbanchol Power Company Limited ) MERCINS( Mercantile Insurance Co. Ltd. ) BEDL( Barakatullah Electro Dynamics Ltd. ) SONARBAINS( Sonar Bangla Insurance Ltd. ) IT SECTOR MISCELLANEOUS BDCOM( BDCOM Online Ltd. ) BERGERPBL( Berger Paints Bangladesh Ltd. ) DAFODILCOM( Daffodil Computers Ltd. ) SINOBANGLA( Sinobangla Industries ) INTECH( In Tech Online Ltd. ) ARAMIT( Aramit ) PHARMA AND CHEMICALS SERVICE AND REAL ESTATE MARICO( Marico Bangladesh Limited ) SAMORITA( Samorita Hospital ) ACTIVEFINE( Active Fine Chemicals Limited ) EHL( Eastern Housing ) SALVOCHEM( Salvo Chemical Industry Limited ) TANNERY TELECOMMUNICATION APEXADELFT( Apex Adelchi Footwear Ltd. ) GP( Grameenphone Ltd. ) BATASHOE( Bata Shoe ) TEXTILE TRAVEL AND LEISURE RNSPIN( R.N. Spinning Mills Limited ) BDSERVICE( Bangladesh Services Ltd. ) SAIHAMCOT( Saiham Cotton Mills Limited ) UNITEDAIR( United Airways (BD) Ltd. PTL( Paramount Textile Limited ) 7 | All the information contained herein is based on published material. Empire Capital reserves the right of copyright on its organic research and indemnifies itself from the accuracy or interpretation of the information contained in this material. Investor discretion is advised in the interpretation of this analysis. Generally stock market prices are subject to market risks. Any feedback, comments and/or suggestions can be sent to [email protected] January 29, 2015 [MARKET SYNOPSIS OF DSE/SUBSCRIBE TO EMPIRE CAPITAL WEBSITE FOR FREE]] NOTES DSE Indices as per „DSE Bangladesh Index Methodology‟ designed and developed by S&P Dow Jones Indices Dhaka Stock Exchange Indices The Dhaka Stock Exchange presently computes two indices, DSE Broad Index (DSEX) and DSE 30 Index (DS30). None of the DSE Indi ces include mutual funds, debentures and bonds. DSEX and DS30 Index Introduction of DSE Indices The Dhaka Stock Exchange Limited introduced DSE Broad Index (“DSEX”) and DSE 30 Index (“DS30”) as per „DSE Bangladesh Index Methodology‟ designed and developed by S&P Dow Jones Indices with effect from January 28, 2013.” DSEX” is the Broad Index of the Exchange (Benchmark Index) which reflects around 97% of the total equity market capitalization.DS30 constructed with 30 leading companies which can be said as investable Index of the Exchange. “DS30” reflects around 51% of the total equity market capitalization. The criteria taken into consideration in construction of these Indices are: Market Capitalization DS30 - Eligible stocks must have a float-adjusted market capitalization above 500 million BDT as of the rebalancing reference date. DSEX - Eligible stocks must have a float-adjusted market capitalization above 100 million BDT. Additionally, if a current index constituent falls below the 100 million BDT threshold, but is no less than 70 million BDT, then the stock remains in the index provided it also meets the other inclusion criteria. Float-Adjustment: A stock‟s weight in an index is determined by its float-adjusted market capitalization. Liquidity DS30- Stocks must have a minimum three-month average daily value traded (ADVT) of 5 million BDT as of the rebalancing reference date. Liquidity criteria can be reduced to 3 million BDT in certain circumstance to ensure there are enough constituents in the ind ex. At each semiannual rebalancing, if a current index constituent falls below 5 million BDT but is no less than 3 million BDT then the stock remains in the index provided it also meets the other eligibility criteria. DSEX - Stocks must have a minimum six-month ADVT of 1 million BDT as of the rebalancing reference date. At each annual rebalancing, if a current index constituent falls below 1 million BDT, but is no less than 0.7 million BDT, then the stock remains in the index provided it also meets the other eligibility criteria. In addition, all eligible stocks for the DSE indices are required to trade at least half of normal trading days each month for the three months prior to the rebalancing reference date. Financial Viability DS30 - Stocks must be profitable as measured by positive net income over the latest 12-month period, as of the rebalancing reference date. The figure is calculated by adding the latest four quarters of net income reported for the company. DSEX - Financial viability is not required for index membership. Sector Classification All listed DSE stocks are classified according to the DSE Industry Classification system. The number of constituents in Banks, Financial Institutions, Insurance sector and Real Estate Sub-sector of Service & Real Estate sector is capped at 5 each and 10 combined for the DS30 Index. Sector diversification rule is not applied to the DSEX. Base Date The base dates of the DSE 30 Index (DS30) and The DSE Broad Index (DSEX) are January 17, 2008. Base Value DSE 30 Index (DS30): The base value is 1000 for DS30 Index. The DSE Broad Index (DSEX): The DSE Broad index has a base value of 2951.91 on Jan 17th 2008 which was the index value of the DSE General Index on this date. The new index is a broad market index and is d esigned to refect the broad market performance. Starting the base value at 2951.91 the performance of the two indices has been linked and we maintain the continuity of the performance of the benchmark. The two indices are very close in design and we can build on the history of the older index which goes back to 2001. “Interim IPO additions to the DSE Broad Index 8 | All the information contained herein is based on published material. Empire Capital reserves the right of copyright on its organic research and indemnifies itself from the accuracy or interpretation of the information contained in this material. Investor discretion is advised in the interpretation of this analysis. Generally stock market prices are subject to market risks. Any feedback, comments and/or suggestions can be sent to [email protected] January 29, 2015 [MARKET SYNOPSIS OF DSE/SUBSCRIBE TO EMPIRE CAPITAL WEBSITE FOR FREE]] (DSEX) take place quarterly on the third Thursday of April, July and October. To be considered eligible for inclusion, an IPO must fall within the top half of the ranked companies, by float-adjusted market capitalization and have at least one month of sufficient liquidity at each quarterly observation date”. After ranking the companies in accordance with “DSE Bangladesh Index Methodology” designed &developed by S&P Dow Jones Indices, following one (1) company was qualified for inclusion in the DSEX with effect from October 20, 2013. 1 Familytex (BD) Limited As a result, the total numbers of constituents in DSEX stands at 207 (Two Hundred and Seven). On January 16, 2014 new 23 companies were included to the DSEX and existing 4 companies were excluded. The new 23 companies that were included to the DSEX are Fareast Finance, Eastern Cables, Renwick Jajneswar, National Tubes, Bengal Windsor Thermoplastics, Bangladesh Building Systems, AMCL (Pran), Rahim Textile, Ambee Pharma, The Ibn Sina, Libra Infusions, Global Heavy Chemicals, JMI Syring es & Medical Devices, Central Pharmaceuticals, Hakkani Pulp & Paper, Samorita Hospital, Information Services Network, Purabi General Insurance, Pragati Insurance, Prime Insurance, Sunlife Insurance, Usmania Glass and Berger Paints. On the other hand, existing four companies th at lost their eligibility to retain their position in the index are Kay & Que, Midas Finance, CVO Petrochemical and Rahima Food. As a result, the total numbers of constituents in DSEX stands at 226 (Two Hundred and twenty Six). Similarly on January 16, 2014 in the DS30, four new companies were added to the index. They are United Commercial Bank Ltd., Delta Life Insurance Ltd, Orion Pharma Ltd and Renata Ltd. The existing four companies that were excluded from the index are Beximco Ltd, Khulna Power Company Ltd, Square Textiles Ltd and Southeast Bank Ltd as they failed to meet their criteria to stay in the index. 9 | All the information contained herein is based on published material. Empire Capital reserves the right of copyright on its organic research and indemnifies itself from the accuracy or interpretation of the information contained in this material. Investor discretion is advised in the interpretation of this analysis. Generally stock market prices are subject to market risks. Any feedback, comments and/or suggestions can be sent to [email protected]

© Copyright 2026