AIC - Department of Human Services

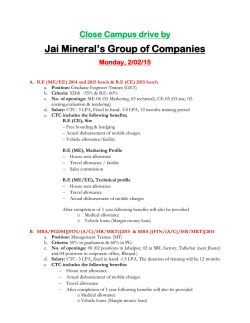

Information you need to know about your claim for Assistance for Isolated Children (AIC) The Assistance for Isolated Children (AIC) Scheme helps the families of the following types of students who are unable to attend an appropriate state school on a daily basis, mainly because of geographic isolation: • primary and secondary students • tertiary students who are either under the minimum education or training participation age in their state or territory or under 16 years of age (whichever is the greater). Information you need to know about your claim for Assistance for Isolated Children (AIC) will be referred to as the Notes Booklet. Online Services You can access your Centrelink, Medicare and Child Support Online Services through myGov. myGov is a fast, simple way to access a range of government services online with one username, one password, all from one secure location. To create a myGov account, go to my.gov.au www. For more information Go to our website humanservices.gov.au/isolatedchildren or call us on 132 318 or visit one of our Service Centres. www. If you need a translation of any documents for our business, we can arrange this for you free of charge. To speak to us in languages other than English, call us on 131 202. Note: Call charges apply – calls from mobile phones may be charged at a higher rate. If you have a hearing or speech impairment, you can contact the TTY service on Freecall™ 1800 810 586. A TTY phone is required to use this service. SY040.1501 Please keep this Notes Booklet (pages 1 to 16) for your information. Notes—1 of 16 Information in other languages SY040.1501 Notes—2 of 16 Contents AIC claim 4 AIC Allowances 4 Reason for applying for AIC 4 Australian residence requirements 8 Applicant details 9 Principal family home 9 Full-time education/training requirement 9 Student details 9 School term living arrangements Parental income 12 Payment details 14 Tax file number details 14 Changes you must tell us about 15 Other payments, concessions and help 16 Family Tax Benefit SY040.1501 11 16 Notes—3 of 16 AIC Claim The claim To qualify for payment for the year of study, you should lodge your claim by 31 December of that year. Alternatively you can register your intent to claim by contacting us in person or calling us on 132 318 by 31 December in the year of study but you should lodge the claim within 13 weeks of the date the intent to claim was registered, or by 31 December, whichever is the later. Claims received after this date will not be approved for payment of AIC. Return this claim as soon as you have completed it. The sooner you apply, the sooner you can be paid. AIC Allowances There are 4 types of AIC allowances which are paid direct to the applicant or his/her agent (e.g. the board provider or the student): Boarding for families with students who must board away from home to study. (Board can be at a boarding school, hostel or private residence. See ‘boarding fees’ on page 11 of the Notes Booklet.) Distance Education for families with students who are enrolled in an approved distance education course. Second Home for families that maintain a second home to allow their children to attend school daily. Maintaining a second home includes paying or contributing to rent, utilities charges such as electricity, water and/or gas consumption. Maintaining a second home where it is owned, or being bought, includes paying or contributing to council rates, water rates, land tax and/or mortgage as well as utilities charges mentioned above. (See ‘Students living in a second home’ and ‘Both parents living in a second home’ on page 11 of the Notes Booklet.) Pensioner Education Supplement for families with students on a Disability Support Pension or Parenting Payment (Single) and studying at primary or equivalent ungraded level. If a dependent student is 16 years or older and needs to live away from home in order to study he/she may be eligible for Youth Allowance (that is means-tested) instead of AIC. (See page 10 of the Notes Booklet.) If the student is an Australian Aboriginal or a Torres Strait Islander undertaking approved study he/she (or their parent/guardian, if the student is aged under 16) can claim ABSTUDY instead of AIC. ABSTUDY is available for students undertaking secondary studies (as well as for certain primary school students aged 14 years or over at 1 January in the year of study or who need to repeat their final year of primary school at another location). Reason for applying for AIC To be eligible for AIC the reason the student: • boards away from home to study, or • is enrolled in an approved distance education course (or undertaking other approved education while living at home), or • lives in the family’s second home that was set up to provide them with daily access to schooling must be in accordance with the AIC policy. The student is geographically isolated (Geographic Isolation Rules 1 and 2) A student may be regarded as geographically isolated from appropriate schooling if one of the following rules are met: • Rule 1—The distance between the principal family home and the nearest appropriate state school is at least 56 kilometres via the shortest practical route, or SY040.1501 Notes—4 of 16 AIC Claim • continued • Rule 2—The distance between the principal family home and the nearest appropriate state school via the shortest practical route is at least 16 kilometres AND the distance between the principal family home and the nearest available transport service to the nearest appropriate state school is at least 4.5 kilometres via the shortest practical route or there is no available transport service to that school (and this will not be provided if requested). Shortest practical route—Where a transport service is available or could be made available if requested, the shortest practical route is: • the distance from home to the nearest available transport service by the shortest practical route, PLUS • the distance from the transport service to the school by the route used by the service (or connecting services). Available transport service—The transport service(s) may not necessarily take the student direct to his/her local state school but may connect with others that do. Alternating bus routes—If the school transport service, route or pickup point varies on a daily, weekly or monthly basis then provide details of all routes. Where morning and afternoon transport services differ in length, the average of the two is taken. Transport which would be made available—A family cannot be considered isolated if the state or territory school transport authority or its contractor would provide a service close to the student’s home if requested. We may check the availability of transport with the relevant state or territory school transport authority. www. Most families claiming AIC due to geographical isolation do not normally need to provide evidence. However, where the distance(s) from the principal family home to the nearest state school(s) and/or any transport services to those schools that are being claimed are just over the minimum AIC geographical isolation criteria, evidence will normally be required. In such cases we will ask you to get the Assistance for Isolated Children (AIC) Marginal Distance Confirmation form (SY069) completed by your local bus company proprietor and/or local government (e.g. shire clerk/engineer or other authority). If you do not have this form, go to our website humanservices.gov.au/isolatedchildren If you feel it would be useful, provide a copy of a local map or a sketch with relevant locations, routes marked. Other circumstances that adversely affect the student’s access to school (Geographic Isolation Rule 3) If Geographic Isolation Rules 1 or 2 do not apply but there are other circumstances that make it impracticable for the student to travel between the family home and the nearest state school on at least 20 school days of the year then Geographic Isolation Rule 3 may apply. Evidence must be provided. The table on page 7 of the Notes Booklet sets out examples of claims for this reason and the evidence required. For AIC purposes travel between home and school is impracticable if: • the student is unable to get to school, or • the travel time for the return journey between home and school is at least 3 hours, or • one of the distance conditions above are met (for at least 20 school days in a year). In measuring travel time, we will take into account 10 minutes waiting time at the initial transport pick-up point and 10 minutes waiting time for any connecting transport. Claims on this basis must be supported by independent evidence. In such cases we will ask you to get the Assistance for Isolated Children (AIC) Marginal Distance Confirmation form (SY069) completed by your local bus company proprietor and/or local government (e.g. shire clerk/engineer or other authority). If you do not have this form, go to our website humanservices.gov.au/isolatedchildren. As other evidence may be required, call us on 132 318 for details. www. The following information sets out what evidence may be required for families claiming AIC for other reasons. The student has a disability or other health-related condition This includes students who have a physical or intellectual disability, a psychological, emotional or behavioural problem, a medical condition or are pregnant. SY040.1501 Notes—5 of 16 AIC Claim • continued The student requires a special school program or special facilities The table below gives acceptable reasons for approval of AIC for a student with disabilities, other health-related condition(s) or special education need(s), and lists the documentation you will need to provide in support of a claim based on one or more of these reasons. Basis of Claim Evidence required Student needs to attend a special school which specifically caters for students with disabilities, other health-related conditions or learning difficulties. No evidence required. Student needs access to special facilities for a health-related condition. Medical evidence* to establish the nature of the condition AND a statement from facility outlining how it will assist in treatment of the student’s condition. Student needs to live in a different environment for health reasons (e.g. needs to live in a different climate or needs to avoid lengthy travel). Medical evidence* to establish the nature of the condition including (where necessary) confirmation that the environment will assist in treatment of the student’s condition. Student needs to be removed from local school environment. A statement from state or territory education authority (not local school) supporting the request for the student to bypass the local school, AND where applicable, medical evidence* to establish the nature of the condition and establish linkage between the condition and local school environment. Student needs to study from home for health related reasons. Medical evidence* to establish the nature of the condition including, where necessary, statement about why study in the home environment is required. Student requires diagnostic testing and/or specialist support/remedial tuition for a diagnosed learning need or disability. Statement from state or territory education authorities supporting the need for testing/remedial program. Student’s education would be seriously disadvantaged if he/she were to attend the local state school. Statement from state or territory education authorities (or specialist assessment service used by those authorities) supporting the need for testing/learning support or remedial program and that it is not available locally. Where the student needs diagnostic testing or support for a learning disability, the statement should also advise the period for which the testing/ support is required. Where the student needs learning support provided by a specialist teacher or facility for at least one and a half hours a week, evidence from the school principal/director of the facility is also required giving details of the program. Student received AIC in Year 11 and is continuing in Year 12 at the same school. No evidence is required. Centrelink will verify eligibility from previous AIC records. * The form of medical evidence will vary depending on the condition(s). Evidence from a specialist is necessary for conditions requiring specialist treatment. Evidence must include an estimate of the duration of the condition or circumstance. If an estimate is not possible, it must be dated no earlier than 1 July of the previous year to which the AIC claim relates. Call us on 132 318 for details. You will need to get the Assistance for Isolated Children Medical Statement – Student Special Needs form (SY099) completed by yourself and the Medical Practitioner/Specialist and attached it to the Claim for Assistance for Isolated Children (AIC). If you do not have this form, go to our website humanservices.gov.au/isolatedchildren www. SY040.1501 Notes—6 of 16 AIC Claim • continued State school offers tuition at the student’s level Generally, a state school is regarded as offering tuition at the student’s level even if some or all of the subjects are delivered by distance education methods rather than by face-to-face teaching methods. If the student has a disability, other health-related condition or a learning difficulty, give the name and address of the nearest state school or institution that can meet the student’s needs. If a state selective or specialist school is the nearest state school to the student's principal family home, it will not be relevant in deciding whether the student is geographically isolated unless the student attends that school. If the student is under the minimum education or training participation age in their state or territory and undertaking tertiary study (e.g. a TAFE course), give details of the nearest state secondary school offering tuition in the grade or year appropriate for the student’s age. Basis of Claim Evidence required Special weather conditions regularly make road or waterways impassable. If the student is continuing study and was assessed as eligible on this basis and there has been no significant change in circumstances, no evidence is required. All other applicants should provide a statement from the school showing actual dates of absences due to special conditions in previous years for either the student, a sibling or a neighbouring student. If this is not available, the applicant must provide sufficient documentation from the appropriate authorities to clearly demonstrate that the road in question has previously been impassable and the duration of this situation. Only school days can be considered. It will be necessary to supply a report stating that the road or waterway in question was impassable on particular dates and has not been significantly upgraded since that time. The reports will be accepted from either the shire engineer/clerk, the bus company proprietor or the local/state/national roads, water, and/or land management authority. Parents are unable to transport children to and from school (e.g. medically unfit to drive, do not have a vehicle or a driving license). Documentation confirming that parent(s) is/are medically unfit or legally unable to drive for medical reasons and the period this will be the case. Documentation from the relevant state or territory authorities that the parent(s) do not have a registered vehicle or a driving licence. Evidence that a person does not have a registered vehicle or a driving licence will not be accepted if the person’s access to a vehicle or licence has been removed by a court (i.e. due to conviction) or other legal authority (i.e. police officer). AIC cannot be approved where factors within the family’s control (e.g. choice of lifestyle, work commitments or child care arrangements) make it inconvenient or difficult to transport the student to and from school each day. If there is more than one transport pick-up point, provide details of the shortest practicable route. SY040.1501 Notes—7 of 16 AIC Claim • continued Work of parent(s) requires frequent moves The following evidence will need to be provided to support a claim on the basis of frequent moves: Basis of Claim Evidence required The parent(s)/guardian(s) has work where an itinerant lifestyle is a necessary requirement for their livelihood, the work requires the parent(s)/guardian(s) to perform the skill onsite, the work necessitates the relocation of the family, AND the parent(s)/guardian(s) relocates at least 5 times a year for work purposes. A statement from the applicant showing details of travel movements for the past 12 months (including dates and locations of work/employment) and planned travel movements in the year of study (including dates and locations of proposed work/employment) AND supporting evidence from employer(s) or other authorities. If the relocation of the family involves the placement of the majority of their belongings in storage, a statement from the storage company verifying this will be required. It should be noted that this provision does not apply to a student whose parent(s)/guardian(s) are unemployed and travel widely and frequently in search of suitable employment. Australian residence requirements To be eligible for Assistance for Isolated Children (AIC) you and the student you are claiming for, must satisfy residence requirements. You and the student you are claiming for must be living in Australia and be: • an Australian citizen • the holder of a permanent residence visa, or • a New Zealand citizen who has permanently settled in Australia (a waiting period may also apply). You are ‘living in Australia’ if Australia is your usual place of residence. That is, Australia is where you make your home. When we are deciding whether you are living in Australia we will look at: • the nature of your accommodation, and • the nature and extent of your family relationships in Australia, and • the nature and extent of your employment, business or financial ties with Australia, and • the frequency and duration of your travel outside Australia, and • any other matter we think is relevant. Where a New Zealand citizen has a partner living in New Zealand they must be moving to Australia within 6 months. Evidence of permanent residence status must be provided for you and the student you are claiming for: • Permanent residence visa holders – provide your passport with an Australian visa. • New Zealand citizens – provide your New Zealand passport. We may also request evidence of permanent settlement in Australia. For information about the conditions for payment outside Australia go to humanservices.gov.au/paymentsoverseas SY040.1501 Notes—8 of 16 www. AIC Claim • continued Applicant details Approved applicant The person applying for AIC must be one of the student’s natural or adoptive parents or a person having prime (or joint) responsibility for the student’s care and financial support (e.g. a step-parent, guardian). The applicant must sign the declaration at the end of the claim, give his/her tax file number (unless an exemption applies) and is responsible for repaying any debt incurred in respect of the claim. The only circumstances where a claim may be accepted from an organisation is where the student lives under the care of a non-government organisation which has full responsibility for the upkeep of the student. If this is the case, the organisation should complete questions 1 to 5 on the claim form and then follow the prompts from question 28 onwards. Organisations should also complete the Organisation Details form (SY067) that can be obtained from one of our Service Centres. Forward both forms together to the address listed on the cover of the claim. Principal family home The principal family home is the family’s usual place of residence. It is the home where at least one parent/guardian lives for more than half the period for which AIC is being claimed. It is also the home where the student would normally live so they can attend school and where they would normally live during school holidays. Full-time education/training requirement Students must be enrolled in, and be undertaking, full-time education or training to be eligible for AIC. Approved courses for AIC include primary and secondary level or equivalent ungraded courses as well as some tertiary vocational educational and training (e.g. TAFE) certificate courses. For a student at a school, distance education centre or other institution (including students with health related condition or disability) a full-time study load is the amount of education or training that the school or other institution regards as a full-time amount for that student. We check with the school or other institution whether the student is enrolled in, and undertaking, full-time education or training. Student details Proof of age Where no previous payments, such as Family Tax Benefit or Child Care Benefit, have been paid for the student, proof of their age is required before AIC benefits can commence, where this is the first claim for that student. The normal requirement is for either: • the student’s birth certificate or birth certificate extract, or • a current Australian passport which shows the student’s date of birth. If neither is available, acceptable alternatives include: • official citizenship or residence papers which show the student’s date of birth, or • the student’s registration of birth receipt. Note: Refer to Supporting Documentation for more details. Supporting documentation Evidence is often required to support an AIC claim. Normally original documents or copies that have been certified by a Justice of the Peace or Commissioner of Declarations are required. Applicants living in isolated areas, however, may have their original documents copied and endorsed by an official of the local court, police station or other government office. The copies must be stamped (if an office stamp is used), signed and dated by the official viewing the original documents. SY040.1501 Notes—9 of 16 AIC Claim • continued Other Australian Government assistance Education or training assistance –The student cannot be assisted by more than one Australian Government education or training scheme at the same time. You should compare entitlements available under the different schemes, so you can choose the one that will assist your family the best. For example, at age 16, some families have the choice of continuing to receive assistance for the student under AIC and Family Tax Benefit or receive assistance under Youth Allowance or ABSTUDY, that are means tested on parental income, assets and in certain circumstances actual means. See below and page 11 of the Notes Booklet about the different assistance that may be available. If you are eligible for AIC term in advance payments (see ‘Payment details’ on page 14 of the Notes Booklet.) and the student turns 16 years of age during the year, we may contact you about paying AIC only to the day before the student’s 16th birthday. We can help your family decide whether it may be more beneficial to keep receiving AIC for the student or for them to claim Youth Allowance or another payment in their own right. Paying AIC only to that day will reduce the chance of an AIC overpayment if the student receives another payment from their 16th birthday. Both the family and the student’s circumstances need to be considered carefully. To help with that decision see ‘Other Australian Government payments’, on page 11 of the Notes Booklet. You should also note that: • Family Tax Benefit is not payable when a student turns 16 years and receives payments such as Youth Allowance, ABSTUDY, Veterans’ Children Education Scheme or the Military Rehabilitation and Compensation Act Education and Training Scheme allowances or Disability Support Pension. • Family Tax Benefit continues to be payable for dependent students aged 16 and 17 studying towards a year 12 or equivalent qualification, who do not need to live away from home in order to study. • Family Tax Benefit is also payable for a student aged 16 years or over who continues to qualify for Assistance for Isolated Children (AIC) payments. It may also be more beneficial for Family Tax Benefit and AIC payments to be claimed, or continue, for a student living away from home when he or she turns 16 years of age, instead of them claiming Youth Allowance. • Boarding or other assistance from a state or territory government may also be payable to eligible isolated families in addition to AIC. For more information about the factors that need to be considered, see the AIC brochure by going to our website humanservices.gov.au/isolatedchildren or call us on 132 318. www. Important: If there is a change of mind and the student decides to claim Youth Allowance (or another payment), you may incur an AIC overpayment where AIC payments are made a term in advance. To reduce the chance of an AIC overpayment, you should advise us at least 2 days before the date of the advance payment that covers the period the student will be making his or her claim. SY040.1501 Notes—10 of 16 AIC Claim • continued Other Australian Government payments – The relationship between AIC and other forms of Australian Government benefits is set out below: School term living arrangements If the student/young person (for whom AIC is claimed) receives or qualifies for: AIC is affected in this way Disability Support Pension, Parenting Payment (single) Families of students receiving one of these payments may qualify for an AIC Pensioner Education Supplement if studying at primary or ungraded level. Youth Allowance, ABSTUDY, Community Development Employment Projects (CDEP) wages, Farm Household Allowance or another Australian Government Income Support payment AIC is not payable from the date the young person (for whom AIC is claimed) receives one of these payments. Family Tax Benefit This payment is normally paid to the student’s parent or guardian and does not affect AIC benefits. Family Tax Benefit A and B is payable for the same child or when a full-time student aged 16 years or older continues to qualify for AIC. If the applicant or applicant’s partner receives, or has received: AIC Second Home Allowance is affected in this way Rent Assistance, the First Home Owners Grant or state/territory government first home owner assistance or financial concession (e.g. stamp-duty concession) for a residence being claimed as a second home The allowance is not payable from the date the applicant or the applicant’s partner receives Rent Assistance. The allowance is not payable if the applicant or the applicant’s partner has ever received the First Home Owners Grant or state/territory government first home owner assistance for that residence. Boarding fees Boarding fees are the actual boarding charges levied per annum by the institution or person providing board for the student. This includes charges for items associated with boarding such as laundry and linen costs. If the charges are reduced (e.g. because of a subsidy, refund or scholarship), then the reduced boarding charge should be provided. Do not include fees associated with the student’s tuition or the supply of school or stationery materials. Students living in a second home To qualify for Second Home Allowance at least one parent/guardian must live in the principal family home for more than half the period for which AIC is being claimed. A family can receive Second Home Allowance for up to 3 children living in the second home and attending school daily. At least one of the children must satisfy the criteria set out in question 61. A claim must be submitted for each child. Both parents living in second home To qualify for Second Home Allowance at least one parent/guardian must live in the principal family home for more than half the period for which AIC is being claimed. However, if an applicant has received Second Home Allowance in 2005 for a student (on the basis that both parents/guardians are living in the second home) that student will continue to be deemed as geographically isolated until the completion or discontinuation of their course, or arrangements for their principal family home change. SY040.1501 Notes—11 of 16 Parental income Applying for Additional Boarding Allowance Additional Boarding Allowance (ABA) may be paid depending on the level of family income and the actual boarding fees paid for the student. If the parent or guardian receives certain forms of income support from the Australian Government or holds a Health Care Card, we will, subject to the student’s actual boarding fees (provided at question 52), automatically pay eligible applicants the Additional Boarding Allowance. Where the parent(s)/guardian(s) income support payments cease and the applicant wishes to continue to receive ABA, ensure that all of the questions (76 to 83) are completed. You DO NOT need to answer questions 76 to 83, unless you are applying for the income-tested ABA. Student in state/substitute care If a student in state/substitute care needs to board away from the home of their officially approved carer in order to attend school, the carer may qualify for Additional Boarding Allowance only if he/she does not receive a state or territory government allowance for the student. If a foster care or similar allowance is received by: • an organisation (applying on behalf of a student) then AIC is not payable • an applicant, then Additional Boarding Allowance is not payable. If a foster care or similar allowance is not received, the income test is waived. The carer must attach an original statement from the relevant government agency outlining the care arrangements and confirming that an allowance is not being paid for the student. Exemption from the parental income test Subject to the level of boarding fees involved, maximum Additional Boarding Allowance is payable while the applicant or applicant’s partner is in receipt of certain forms of income support or Community Development Employment Projects (CDEP) wages from the Australian Government or holds a current Health Care Card. This does not include a Health Care Card issued to a person receiving Mobility Allowance or on behalf of a child with a disability. Australian taxable income Australian taxable income includes: • taxable income shown on an Australian Taxation Office – Notice of Assessment • any taxable pensions, allowances, payments or benefits received from the Department of Human Services or the Department of Veterans’ Affairs (DVA), and • income received below the tax threshold, less any deductions allowable for taxation purposes. The Base Tax Year for an Assistance for Isolated Children payment is the financial year ending before 1 January of the year of study. Acceptable evidence of income If you have an Australian Taxation Office – Notice of Assessment for the Base Tax Year, a copy of this must be provided as proof of income. If you (or your partner) do not have an Australian Taxation Office – Notice of Assessment for the Base Tax Year, the following evidence is acceptable: • a copy of your (or your partner’s) tax return for the Base Tax Year, or • a letter from your accountant/tax agent stating that ‘Income received by you (and/or your partner), is not expected to exceed $xxxx’, or • if you (or your partner) received a taxable pension from DVA for the full Base Tax Year (and no longer receive it), a statement of benefit from that department, or • payment summary and/or statements of benefit supported by a statutory declaration (or accountant certification) confirming that these show the full amount of taxable income received by you (or your partner) during the Base Tax Year. Note: Where proof of income, other than an Australian Taxation Office – Notice of Assessment, is supplied, it is accepted on an interim basis. However, actual (or certified copy) Australian Taxation Office – Notice of Assessment must be supplied as soon as they are available. SY040.1501 Notes—12 of 16 Parental income • continued Income outside Australia Gross income earned or received outside Australia must be included under the parental income test. The evidence required is the same as for Australian taxable income, as applicable to the country outside Australia in which the income was earned. The evidence, or an attached explanatory statement, must clearly show the total amount in the currency of the country outside Australia. We will convert the amount into Australian currency. Net investment losses Net investment losses include net losses from rental property (negative gearing) and non-property income investments such as shares. Investment earnings include taxable and tax-exempt interest, dividends and rental income. The value of such losses is added back to income for AIC. Rental property for AIC purposes includes a house, a home unit, a room in your home, an on-site caravan, a house boat and any other similar rental property (including rental property outside Australia) for which rent or premiums were received. Reportable Superannuation Contributions Reportable superannuation contributions are counted as part of parental income and include discretionary employer superannuation contributions (such as voluntary salary sacrificed amounts) paid by you or on your behalf and, for the self-employed, total superannuation contributions which will be claimed as a tax deduction. If you (or your partner) are affected, you (or your partner) must provide your Payment Summary or personal income tax return that shows the contribution. Contact us about what evidence is required if you (or your partner) have salary sacrificed to the benefit of your partner’s superannuation or you (or your partner) are between Age Pension age and 70 years. Fringe benefits Fringe benefits include the value of any employer provided benefits received during the Base Tax Year. An employer provided benefit is any right, privilege, service, in-kind payment or facility that an employee receives, or assigns to someone else, from their employment. The total amount of employer provided benefits will be shown in the payment summary from the employer. Change in Income The income test is normally based on the Base Tax Year income, but if there has been a decrease or an increase in income since that time, entitlement to the Additional Boarding Allowance may be affected. Decrease in income: If there has been a substantial and lasting drop in income, you may apply for a Current Income Assessment by contacting us. If the concession is granted, you will be assessed on the basis of estimated (or actual) income for the financial year following the Base Tax Year, effective from the date of the decrease or 1 January in the year of study, whichever is the later. If entitlement is calculated on the basis of estimated income, you will be asked to provide an Income Tax Notice of Assessment when available. Entitlement will then be reassessed on the basis of the actual income details. Note: Claims based on seasonal or short term market fluctuations may not be approved unless special circumstances exist. Increase in income: If parental income for the financial year following the Base Tax Year increases by more than 25 per cent from the Base Tax Year parental income, you must inform us as soon as possible (after the end of the current financial year). Your Additional Boarding Allowance entitlement may be reassessed on the higher income with effect from 1 October. If parental income for the Current Tax Year has decreased substantially or increased by more than 25 percent compared to the Base Tax Year income, you should complete the Assistance for Isolated Children (AIC) Current Tax Year Assessment form (SY042). If you do not have this form, go to our website humanservices.gov.au/isolatedchildren. See 'Returning your form' on page 1 of the claim form about how to return the completed form. www. SY040.1501 Notes—13 of 16 Payment details Payments are normally made to the applicant. However, an applicant can decide to direct payment to another person or organisation if they wish. Applicants who direct payments to a school or boarding institution do not need to provide the institution’s account details. We will obtain this information direct from the school or boarding institution. If the amount of AIC allowance paid direct to a school or boarding institution is greater than fees due, the applicant should claim a refund on the difference from the institution. Any AIC debt that occurs, even though payment was made to another person or an organisation, is still the responsibility of the applicant. The following payments are made a term in advance: • Boarding Allowance for students at a boarding school, hostel, other residential institution, or boarding under the ‘homestay trial’ in Queensland • Distance Education Allowance, and • Pensioner Education Supplement for students at a boarding school, hostel or other residential institution. The following payments are made fortnightly in arrears: • Boarding Allowance for students boarding privately • Second Home Allowance, and • Pensioner Education Supplement for students boarding privately. Tax file number details How to get a tax file number (TFN) If you are applying for AIC for the first time and you do not know your TFN or have never had one, you will need to apply for a TFN at the Australian Taxation Office or one of our Service Centres by completing the Tax file number application or enquiry for an individual form. If you have a partner, their TFN is only required to be provided if Additional Boarding Allowance is being claimed. Exemptions An applicant for AIC or his/her partner do not have to give us their TFN if: • he/she receives a social security pension or Special Benefit from Centrelink or certain pensions from DVA • he/she is temporarily outside Australia • he/she is an Aboriginal or Torres Strait Islander person and is required to attend traditional ceremonies at the time the form is lodged • his/her physical safety is at risk from another person and the risk would be increased by disclosure of a TFN • he/she has lost all records of his/her TFN because of fire or flood damage to his/her home within 6 months preceding the application for AIC. If you think any of these situations applies to you and/or your partner, attach a note to the form. But remember, you must give your TFN when you return from outside Australia or after attending the traditional ceremony. SY040.1501 Notes—14 of 16 Changes you must tell us about If you do not tell us about changes, you could have a debt. If you have a debt, even though the payment was made to another person or organisation, you may have to pay all or some of the money back. After claiming Assistance for Isolated Children, you must tell us within 14 days if any of the following happens. To advise us of changes, call us on 132 318. Change of address • If the principal family home address of the applicant, their partner or the student changes • If the student’s term address or term living arrangements change • If the student ceases to board away from home, or live in a second family home, while undertaking study. Change in family’s geographic isolation • If the geographic isolation or other reason for which Assistance for Isolated Children Scheme was granted ceases. If the student: • does not enrol at the school, in the distance education course or other education or training course • does not begin school within the first 2 weeks after the first day on which the course is offered or on the day on which the student commences boarding • does not begin their distance education course within the first 2 weeks • discontinues their course, education or training or discontinues full-time education, study or training • has his or her enrolment cancelled by the education institution • starts to receive an education or vocational training assistance from the Australian Government • starts to receive ABSTUDY, Youth Allowance, Sickness Allowance, Special Benefit or other Australian Government income support payment, pension or allowance • begins a full-time apprenticeship or traineeship • is taken into lawful custody • changes their foster or state care arrangements • moves from one parent/guardian residence to the other parent/guardian residence as a result of the parent/guardian divorce or separation • is now the financial or legal responsibility, or in the care and custody, of another person • changes their arrangements for travel to and from the principal family home to the school • ceases to be an Australian citizen or an Australian permanent resident • as a New Zealand citizen, ceases to be the holder of a special category or special purpose visa or ceases to be permanently settled in Australia • is boarding and their boarding fees or costs change, or • is deceased. If the applicant (usually the parent or guardian): • ceases to have financial or legal responsibility or care and custody of the student • marries, is in or commences a registered or de facto relationship (either opposite-sex or same-sex) or reconciles with a former partner • separates from their partner • has a partner who dies • is taken into lawful custody • is admitted to a psychiatric institution • ceases to be an Australian citizen or an Australian permanent resident Continued SY040.1501 Notes—15 of 16 Changes you must tell us about • continued • as a New Zealand citizen, ceases to be the holder of a special category or special purpose visa or ceases to be permanently settled in Australia • receives Second Home Allowance and begins to be paid Rent Assistance from us or another Australian Government agency for their second home • receives Second Home Allowance and has been paid a First Home Owners Grant or state/territory first home owner assistance for their second home • receives Additional Boarding Allowance and the income he or she or their partner earns or receives varies from the last estimate of income given to us • receives Additional Boarding Allowance and there are changes in the circumstances of any dependent children in the family receiving or eligible for: – Assistance for Isolated Children (Additional Boarding Allowance), or – Youth Allowance, or – ABSTUDY (living or boarding related allowances), or – attracting Family Tax Benefit as a child aged 16 years or over in full-time secondary study, or • receives Additional Boarding Allowance and their and their partner’s income for the financial year ending in the year, for which the allowance is being received, increases by more than 25 per cent from the previous financial year • receives Additional Boarding Allowance and ceases to be paid an Australian Government income support payment, pension, allowance, ABSTUDY or Community Development Employment Projects (CDEP) wages • receives Additional Boarding Allowance and ceases to be entitled to a Health Care Card • receives Additional Boarding Allowance and a child ceases to be in their care, or the number of dependent children in their care changes. Other payments, concessions and help If you receive Assistance for Isolated Children, there are other payments, concessions and help you may be eligible for. Family Tax Benefit Family Tax Benefit helps with the cost of raising children. It is made up of 2 parts: • Family Tax Benefit Part A, and • Family Tax Benefit Part B. Family Tax Benefit Part A is paid for each child. The amount you get is based on your family’s circumstances. If your child is born or adopted on or after 1 March 2014, you may receive an increase to your Family Tax Benefit Part A called Newborn Upfront Payment and Newborn Supplement. Family Tax Benefit Part B gives extra help to single parents and families with one main income, where one parent stays at home to care for children full-time, or balances some paid work with caring for children. Child support and family assistance are closely linked. If you receive child support and Family Tax Benefit, the child support you receive will be considered when we calculate your Family Tax Benefit payment. Family Tax Benefit is income tested. For more information, go to our website humanservices.gov.au/families www. SY040.1501 Notes—16 of 16 Claim for Assistance for Isolated Children (AIC) When to use this form This claim is to be completed by the parent/guardian who cares for the student. A separate form is needed for each student. You should have received the booklet Information you need to know about your claim for Assistance for Isolated Children (AIC) with this form. In this claim, this booklet will be referred to as the Notes Booklet. If you do not have this booklet, go to our website humanservices.gov.au/isolatedchildren or call us on 132 318. www. Please READ the Notes before you complete this form. What else you will need to provide The applicant may need to provide proof of age for the student. The Notes Booklet advises what evidence may be needed depending on the reason for claiming AIC. Filling in this form • • • • Returning your form Check that all required questions are answered and that the form is signed and dated. Please use black or blue pen. Print in BLOCK LETTERS. Mark boxes like this with a ✔ or ✘. Go to 5 skip to the question number shown. You do not Where you see a box like this need to answer the questions in between. You can return this form and any supporting documents: • online – submit your documents online. For more information about how to access an Online Account or how to lodge documents online, go to humanservices.gov.au/submitdocumentsonline • by post – return your documents by sending them to: Department of Human Services Student Services Reply Paid 7804 CANBERRA BC ACT 2610 • in person – if you are unable to submit this form and any supporting documents online or by post, you can provide them in person to one of our Service Centres. www. To lodge by fax For applicants living in Queensland, New South Wales, the Australian Capital Territory, Victoria or Tasmania Fax number 1300 786 102 (Lismore) For applicants living in Western Australia, the Northern Territory or South Australia Fax number 1300 786 102 (Perth) To establish your identity, you may be required to attend one of our Service Centres to provide original documents. SY040.1501 1 of 14 For more information Go to our website humanservices.gov.au/isolatedchildren or call us on 132 318 or visit one of our Service Centres. www. If you need a translation of any documents for our business, we can arrange this for you free of charge. To speak to us in languages other than English, call 131 202. Note: Call charges apply – calls from mobile phones may be charged at a higher rate. If you have a hearing or speech impairment, you can contact the TTY service on Freecall™ 1800 810 586. A TTY phone is required to use this service. SY040.1501 2 of 14 1 2 3 4 Mrs Miss Ms Your name Mr Other Mrs Miss Family name Family name First given name First given name Second given name Second given name Has the student ever used or been known by any other name (e.g. name at birth, maiden name, previous married name, Aboriginal or tribal name, alias, adoptive name, foster name)? 7 Ms Other Have you ever used or been known by any other name (e.g. name at birth, maiden name, previous married name, Aboriginal or tribal name, alias, adoptive name, foster name)? No Go to next question No Go to next question Yes Give details below Yes Give details below 1 Other name 1 Other name Type of name (e.g. name at birth) Type of name (e.g. name at birth) 2 Other name 2 Other name Type of name (e.g. maiden name) Type of name (e.g. maiden name) If the student has more than 2 other names, attach a separate sheet with details. If you have more than 2 other names, attach a separate sheet with details. 8 Student’s sex Your sex Male Male Female Female 9 Student’s date of birth / 5 6 Student’s name Mr / Are you: • a person who is a parent or guardian of the student • claiming on behalf of a non-government organisation that has full responsibility for the upkeep of the student (e.g. the student has been placed in the care of an organisation by a state or territory authority or a court) Your date of birth / / Go to next question Go to 28 Refer to Applicant details in the Notes Booklet. CLK0SY040 1501 SY040.1501 3 of 14 10 The address of your principal family home 18 What is your country of citizenship? 19 Are you a person who has been granted and continues to hold Postcode Australian Permanent Residence status? No 11 Your postal address (if different to above) Go to next question Yes Postcode You must provide evidence. Refer to Australian residence requirements in the Notes Booklet. Go to 21 20 Are you a New Zealand citizen settled permanently in Australia? No 12 Has your principal family home address changed since 1 January You may not be eligible for an AIC allowance. Refer to Australian residence requirements in the Notes Booklet or call us on 132 318. of the year of study? No Go to next question Yes Date your address changed / Yes Date of last arrival / / / You must provide evidence. Refer to Australian residence requirements in the Notes Booklet. 13 Is the student’s principal family home the same as the address at question 10? No Yes You may not be eligible for an AIC allowance as the student does not normally live with you. Call us on 132 318. Go to next question 21 What is the student’s country of birth? 22 Is the student an Australian citizen? 14 Is your principal family home on a property? No Go to 16 Yes Go to next question No Go to next question Yes Go to 26 23 What is the student’s country of citizenship? 15 What is the legal description of the property (e.g. lot, section, parish, etc – this may appear on your rates notice)? 24 Is the student a person who has been granted and continues to hold Australian Permanent Residence status? No Go to next question Yes You must provide evidence. Refer to Australian residence requirements in the Notes Booklet. Go to 26 Attach a copy of your current rates notice or Livestock Health and Pest Authority notice (NSW only). 25 Is the student a New Zealand citizen settled permanently in 16 What is your country of birth? Australia? No 17 Are you an Australian citizen? No Go to next question Yes Go to 21 Yes You may not be eligible for an AIC allowance. Refer to Australian residence requirements in the Notes Booklet or call us on 132 318. Date of last arrival / / You must provide evidence. Refer to Australian residence requirements in the Notes Booklet. SY040.1501 4 of 14 26 Please read this before answering the following question. 29 Do you have primary care and responsibility for the student? No If you provide an email address or mobile phone number, you may receive electronic messages (SMS or email) from us. To read the Terms and Conditions, go to our website humanservices.gov.au/em or visit one of our Service Centres. Attach a statement describing why the person with primary care and responsibility for the student cannot apply. www. Go to next question Yes Your contact details Home phone number ( 30 Please read this before answering the following question. ) Is this a silent number? No We recognise both opposite-sex and same-sex relationships. This includes de facto relationships and relationships registered under state or territory law. Select ONE option below that best describes your current relationship status. Yes Mobile phone number Fax number ( ) Work phone number ( ) What is your CURRENT relationship status? Alternative phone number ( ) Married Go to 32 Email Registered relationship (opposite-sex or same-sex relationship registered under state or territory law) Go to 32 @ Partnered (living together in an opposite-sex or same-sex relationship, including de facto) Go to 32 Separated (previously lived with an opposite-sex or same-sex partner, including in a marriage, registered or de facto relationship) Go to 31 Divorced Go to 31 Widowed (previously partnered with an opposite-sex or same-sex partner, including in a marriage, registered or de facto relationship) Go to 31 Never married or lived with a partner Go to 35 27 Please read this before answering the following questions. Question 27 is optional and will not affect your payment. If you do answer, the information will help us to continue to improve services to Aboriginal and Torres Strait Islander Australian and Australian South Sea Islanders. Australian South Sea Islanders are the descendents of Pacific Islander labourers brought from the Western Pacific in the 19th Century. Are you of Aboriginal or Torres Strait Islander Australian origin? If you are of both Aboriginal and Torres Strait Islander Australian origin, please tick both ‘Yes’ boxes. No Yes – Aboriginal Australian Yes – Torres Strait Islander Australian 31 Give the date of your separation, divorce or becoming widowed, if after 1 January in the year of study 28 What is your relationship to the student? Parent Go to next question Grandparent Go to next question Step-parent Go to next question Foster parent Go to next question Organisation Go to 35 Other/guardian SY040.1501 / / Go to 35 32 Give the date of your marriage, date of registration or becoming a member of a couple, if after 1 January in the year of study / Attach a statement describing your relationship to the student and explaining why this student’s parent(s) cannot apply. 5 of 14 / 33 Your partner’s name Mr Mrs Miss 37 Details of parent/guardian or other person. Ms This will assist us to identify the person to whom you allow information to be given. Other Family name Person’s name First given name Relationship to you (e.g. mother, father, friend) Second given name Phone number ( Date of birth / ) / Permanent address 34 The address of your partner’s principal family home (if different to question 10) Postcode Postcode 38 Has Assistance for Isolated Children (AIC), Family Tax Benefit, Child Care Benefit or Baby Bonus ever been paid before for this student? 35 Do you allow us to give information about your claim or payments to another person or organisation? No For example: We may give information to relevant state or territory governments who provide other benefits for isolated children. You can change this authorisation at any time. No Go to 38 Yes Give details below To the Department of Education, Western Australia or to the Department for Education and Child Development, South Australia To your partner To a parent/guardian or another person Yes Not sure Provide proof of age. Student’s Centrelink Reference Number (if known) Give details below Go to next question Go to 38 39 Please read this before answering the following question. Go to 37 Question 39 is optional and will not affect your payment. If you do answer, the information will help us to continue to improve services to Aboriginal and Torres Strait Islander Australian and Australian South Sea Islanders. Australian South Sea Islanders are the descendents of Pacific Islander labourers brought from the Western Pacific in the 19th Century. 36 Do you authorise the Department of Human Services to disclose your personal information, depending on the state you reside in, to the Department of Education, Western Australia or the Department for Education and Child Development, South Australia? Is the student of Aboriginal or Torres Strait Islander Australian origin? If the student is of both Aboriginal and Torres Strait Islander Australian origin, please tick both ‘Yes’ boxes. If you authorise the disclosure we may provide the relevant Department mentioned above with your name and address, so if you are granted AIC, they can send you a claim form for their state allowance for students boarding away from home and (in the case of WA) living in a second home to attend school in the state. You can change this authorisation at any time. No Yes – Aboriginal Australian Yes – Torres Strait Islander Australian No Go to 38 Yes Go to 38 40 Is the student in state care or living under a government or court approved substitute care arrangement? Does not normally include students living away from home in a boarding school or hostel. SY040.1501 6 of 14 No Go to next question Yes Give details below – Type of care 41 Is the student going to receive Australian Government education 45 Give details of the school/institution, year and level of study the or training assistance other than AIC in the year of study? student is enrolled with/will enrol with in the year of study. Name of school/institution For example: Youth Allowance, ABSTUDY, Community Development Employment Projects (CDEP) wages or Veterans’ Children Education Scheme or the Military Rehabilitation and Compensation Act Education and Training Scheme. Note: If you are entitled to the higher rate of Family Tax Benefit for dependent students aged 16 to 19, it should normally be more beneficial for you to receive Family Tax Benefit in addition to AIC for the student, instead of them claiming Youth Allowance. However, should the student later decide to claim Youth Allowance or another Australian Government payment, you must advise us within 14 days. To reduce the chance of an overpayment (where you receive AIC term in advance payments), you should advise us at least 2 days before the date of the advance payment that covers the period the student will be making his or her claim. Refer to Student details – Other Australian Government payments in the Notes Booklet. No Go to 43 Yes Go to next question Not sure Address of school/institution Postcode OFFICE USE ONLY –School code Grade or year (e.g. 1st grade, Year 10, 1st year) ungraded Level: primary Go to next question secondary tertiary Give details below Give details below Exact course title (e.g. Certificate of Office Studies) Course code number Go to 43 42 Please read this before answering the following question. 46 What is the period the student is going to study, or is studying, full-time at the school/institution nominated in question 44 and for the year you are claiming in question 43: AIC benefits will be paid to the day before the student starts receiving Youth Allowance or other payment (usually their 16th birthday). From / What Australian Government education or training assistance other than AIC in the year of study will the student receive? Youth Allowance Go to next question Other Name of assistance To / / / If the student is only studying full-time for part of the year, give reason 43 Is the student going to receive a Disability Support Pension or 47 If you are: Parenting Payment (Single)? • a person who is a parent or guardian of the student No Yes • claiming on behalf of a non-government organisation (e.g. the student has been placed in the care of an organisation by a state or territory authority or a court) 44 What year are you claiming AIC for? Go to next question You will need to complete and attach an Assistance for Isolated Children (AIC) Organisation Details form (SY067) and return both forms to us. Go to 91 Refer to Applicant details in the Notes Booklet. SY040.1501 7 of 14 48 Tick the box which best describes the student’s living 55 Is the address in question 53 a second family home? arrangements during the school term. Go to 61 Living at the principal family home and studying by distance education or other approved education Boarding at a residential institution (e.g. boarding school or hostel) Go to 50 Living at a second home maintained by the family Go to 53 Yes Go to next question home and attend school daily or study by distance education in the year of study? You may not be eligible for an AIC allowance. Call us on 132 318. None of the above Go to 61 56 Are any other dependent children going to live in the second Go to next question Boarding at a private residence No No Go to next question Yes Give details below 1 Family name First name 49 What is the name of the person providing board and the relationship between this person and the student? Name of person providing board Date of birth Relationship to student 2 Family name / / Go to 51 First name 50 What is the name of the residential institution where the student is/will be boarding? Date of birth / / 3 Family name 51 How many nights per week does/will the student board? First name 52 How much are the boarding fees paid for the student? Date of birth Do not include tuition fees paid to the school. $ / per year / 4 Family name 53 Give the address details of the board location or second family home. First name Date of birth Postcode / 54 Will the student be living at the location given in question 53 for the full school year? No Period From / 5 Family name First name To / / / / / / / / Date of birth / Attach details if more than 2 periods. Yes SY040.1501 / If you have more than 5 dependent children, attach a separate sheet with details. Go to next question 8 of 14 57 Who is/will be living with the student at the second home? 61 Why does the student need to board away from home, live in a second home or study by distance education? Refer to School term living arrangements – Both parents living in second home in the Notes Booklet. Geographic location You (the person named in question 6) Your partner (named in question 33) Go to 59 Both you and your partner Another person Go to next question 58 Who is the other person? Name of person Relationship to student 59 Please read this before answering the following question. You cannot receive AIC Second Home Allowance from the date you or your partner receive Australian Government Rent Assistance for that residence. Refer to Student details – Other Australian Government payments in the Notes Booklet. Go to next question Yes Give details below The student has a disability, other health-related condition or special education need, which requires a special school program or special facilities that cannot be catered for at a local state school, or in the vicinity of the home. Evidence may be required to support the claim. Refer to Reason for applying for AIC in the Notes Booklet. Go to next question Work of parent(s) requires frequent moves. Evidence is required to support the claim. Refer to Reason for applying for AIC in the Notes Booklet. Go to 71 The student lives in a second family home with a brother/sister (named in question 56) who has qualified for AIC under one of the above criteria. Go to 72 62 Does the student need to live full-time (including periods of short term board) at a special institution (named in question 50) that caters specifically for students with disabilities or other health-related conditions? Will/did you (and/or your partner) receive Australian Government housing assistance (e.g. Rent Assistance) for the second family home address (provided in question 53) during the year of study? No Go to 63 No Please give details of the reason for your claim. For acceptable reasons and evidence required, refer to Reason for applying for AIC in the Notes Booklet. Yes Go to 74 Type of assistance Full name of department or agency providing assistance 63 Please read this before answering the following question. 60 Please read this before answering the following question. You cannot claim AIC Second Home Allowance if you or your partner are receiving, or have previously received, a First Home Owners Grant or state/territory government first home owner assistance for that residence. Refer to Student details – Other Australian Government payments in the Notes Booklet. Have you (and/or your partner) received, or will you (and/or your partner) receive either: • First Home Owners Grant or • state/territory government first home owner assistance or financial concession (e.g. stamp-duty concession) for the home/property being claimed as your second home? No Yes If there is more than one state school within 56 kms, give details of the school with a transport pick-up point nearest to the principal family home. Where there is more than one state school, also attach a copy of a scale map of the area showing the location of each school, any bus pick-up points and school bus routes. Refer to Reason for applying for AIC – The student is geographically isolated in the Notes Booklet. Give the name(s) and address(es) of the state school(s) nearest to the principal family home (given in question 10) which offer tuition at the student’s level. Name of school Address of school (not PO Box number) Go to next question You may not be eligible for an AIC Second Home Allowance. Refer to Student details – Other Australian Government payments in the Notes Booklet. Postcode OFFICE USE ONLY –School code SY040.1501 9 of 14 64 What is the distance one way from the principal family home 70 Is there any reason (other than distance, travel time or a condition (given at question 10) to the state school (named in question 63) by the shortest practical route? See definition of 'Shortest practical route' in Reason for applying for AIC – The student is geographically isolated in the Notes Booklet. You may be asked to provide evidence to confirm the distances provided below. Give distance to the nearest tenth of a kilometre • described in question 62) that affects the student’s ability to travel from the principal family home to the state school(s) nearest the principal family home on at least 20 school days of the year (e.g. roads frequently impassable)? No Go to 74 Yes Give details below kms 65 At question 64, is the stated distance 56 kms or greater? No Go to next question Yes Go to 74 You may need to provide more information. Go to 74 66 Is there a transport service to the state school(s) nearest the principal family home? 71 Give details of the type of work undertaken that requires frequent moves. This includes transport which would be made available on request. No Go to 69 Yes Go to next question 67 What is the distance from the principal family home (given at question 10) to the nearest transport pick-up point (e.g. bus stop), going to the state school(s) nearest the principal family home, by the shortest practical route? This includes transport which would be made available on request. You may need to provide more information. Go to 74 72 Give the name of the student for whom the second home was Give distance to the nearest tenth of a kilometre • established. kms 68 What is the distance from the transport pick-up point to the state 73 Has an AIC form been lodged for the student in the year of study? school(s) nearest the principal family home, by the transport service route? Give distance to the nearest tenth of a kilometre • No kms Yes Attach a statement explaining why this student must live in the second home to access school daily. Student’s Centrelink Reference Number (if known) 69 How long does a return journey by public, private or school transport take from the principal family home (given in question 10) to the state school(s) nearest the principal family home? hours 74 Are you applying for Boarding Allowance? minutes No Go to 84 Yes Go to next question 75 Do you wish to apply for the Additional Boarding Allowance which is income-tested? No Go to 84 Yes Go to next question 76 Will you or do you (or your partner) receive foster care or similar allowance for the student? SY040.1501 10 of 14 No Go to 79 Yes Go to next question 77 Will you or do you (or your partner) receive foster care or similar 81 Please read this before answering the following questions. allowance for the student for the whole calendar year? No Go to next question Yes Go to 84 78 Period(s) you (and/or your partner) will receive foster care or similar allowance for the student. From To / / / / / / / / / / / / All boxes in questions 81 and 82 MUST be completed. The Base Tax Year for an Assistance for Isolated Children payment is the financial year ending before 1 January of the year of study. If you have had a large increase or decrease in income, refer to Parental income in the Notes Booklet. If you (and/or you partner) did not receive income from any of the following sources, write ‘Nil’ in the appropriate boxes. Give your (and your partner’s) income for the Base Tax Year. A Australian taxable income even if below the threshold You Your partner $ $ Attach details if more than 3 periods. 79 Other than Family Tax Benefit do you (and/or your partner) receive any of the following: • a pension, benefit, allowance or payment from the Department of Human Services • an income and assets tested pension from the Department of Veterans’ Affairs (DVA) • Farm Household Allowance • Community Development Employment Projects (CDEP) wages. No Go to next question Yes Give details below last financial year You Your partner Type of currency Type of currency C Net investment losses (include losses on investments/shares and rental properties, i.e. negative gearing) Date payments started / B All income from outside Australia received in that country’s / Type of assistance You Your partner $ $ D Reportable superannuation contributions paid by you (or your partner) or on your (or your partner’s) behalf (e.g. voluntary salary sacrificed amounts). Centrelink Reference Number/ Department of Veterans’ Affairs number Go to 84 You Your partner $ $ 80 Do you (and/or your partner) have a current Health Care Card from Centrelink? Not a card held on behalf of a child eligible for Carer Allowance or a card held by a person receiving Mobility Allowance. No Go to next question Yes Dates on card From / To / / E All child support and partner maintenance payments you (and your partner) received, do not include Family Tax Benefit You Your partner $ $ F All child support and partner maintenance payments you / (and your partner) paid out You Your partner $ $ You must attach proof of your (and your partner’s) income. SY040.1501 11 of 14 82 Give the total of any fringe benefits shown on any payment 83 Continued 4 Family name summaries for the Base Tax Year. You Your partner $ $ First given name You must attach proof of your (and your partner’s) income. Date of birth / 83 Are there any other dependent children in your family (apart from the student named in question 1 of this claim) for whom one of these payments is being, or will be, claimed: • Assistance for Isolated Children (AIC) (Additional Boarding Allowance) • Youth Allowance (YA) • ABSTUDY (living or boarding related allowances) • Family Tax Benefit (FTB) (for child aged 16 years or over in full-time secondary study who are attracting Family Tax Benefit or may attract Family Tax Benefit in the future as part of a lump sum claim)? No Go to next question Yes Give details below / Receiving (or recently claimed) AIC ABSTUDY FTB YA FTB YA FTB 5 Family name First given name Date of birth / / Receiving (or recently claimed) AIC ABSTUDY 1 Family name YA 6 Family name First given name First given name Date of birth / / Receiving (or recently claimed) AIC ABSTUDY Date of birth / YA FTB Receiving (or recently claimed) AIC ABSTUDY 2 Family name If you have more than 6 dependent children, attach a separate sheet with details. First given name Date of birth / / Receiving (or recently claimed) AIC ABSTUDY YA FTB YA FTB 3 Family name First given name Date of birth / / Receiving (or recently claimed) AIC ABSTUDY SY040.1501 / 12 of 14 84 Who are payments to go to: 88 Please read this before answering the following question. It is your responsibility to give the correct numbers. Please check that the Branch and Account numbers are correct. Incorrect numbers will delay payments. If you are directing your AIC payments to a school or boarding institution, you do not need to provide their account details as we will obtain this information direct from the school or boarding institution. Payments will be made to the applicant OR to an agent authorised by the applicant. The applicant Go to 88 The boarding institution (named in question 50) Go to 89 The school (named in question 45) Go to 89 Another agent Where do you want your payment made? The bank, building society or credit union account can be in your name or your Agent’s name. A joint account is acceptable. Go to next question 85 Agent’s name Mr Mrs Miss Ms Name of bank, building society or credit union Other Branch where the account is held Family name Branch number (BSB) First given name Account number (this may not be your card number) Account held in the name(s) of Second given name 86 Agent’s address 89 Please read this before answering the following questions. You are not breaking the law if you do not give us your (and your partner’s) tax file number(s), but if you (and your partner) do not provide them to us, or authorise us to get them from the Australian Taxation Office, you may not be paid. Postcode In giving us your (and your partner’s) tax file number in relation to this claim you authorise us to use your (and your partner’s) tax file number for other family assistance payments or social security payments and services in future where necessary. 87 Agent’s contact details Daytime phone number ( ) Mobile phone number After hours phone number ( Have you (and your partner) given us your tax file number(s) before? No Go to next question ) Not sure Yes Go to next question Go to 91 90 Do you (and your partner) have a tax file number(s)? Note: If you have a partner, their TFN is only required to be provided if Additional Boarding Allowance is being claimed. You No Yes Please call us on 132 318. Your tax file number Your partner No Yes SY040.1501 13 of 14 Please call us on 132 318. Your partner’s tax file number 91 Which of the following forms, documents and other attachments are you (and/or your partner) providing with this form? If you are not sure, check the question to see if you should attach the documents. 92 Privacy and your personal information Your personal information is protected by law, including the Privacy Act 1988, and is collected by the Australian Government Department of Human Services for the assessment and administration of payments and services. This information is required to process your application or claim. Your information may be used by the department or given to other parties for the purposes of research, investigation or where you have agreed or it is required or authorised by law. You can get more information about the way in which the Department of Human Services will manage your personal information, including our privacy policy at humanservices.gov.au/privacy or by requesting a copy from the department. Where you are asked to supply documents, please attach original documents. A copy of the current rates notice (if you answered Yes at questions 15) Proof of Australian Permanent Residence status (if you answered Yes at questions 19 and 24) Proof of being a New Zealand citizen (if you answered Yes at questions 20 and 25) www. Statement describing your relationship to student (if you answered ‘Other/guardian’ at question 28) Statement describing why the person with primary care and responsibility for the student cannot apply (if you answered No at question 29) IMPORTANT INFORMATION 93 Statement Proof of age (if you answered No at question 38) I declare that: • the information I have provided in this form is complete and correct. • I have read and understand the list of events provided on pages 15 and 16 of the Notes Booklet. Assistance for Isolated Children (AIC) Organisation Details form (SY067) (if required for question 47) Details of more than 2 periods of living at board location or second home (if required for question 54) I understand that: • giving false or misleading information is a serious offence. • the Australian Government Department of Human Services can make relevant enquiries to make sure I receive the correct entitlement. • I must notify the Australian Government Department of Human Services of any change(s) to this information, within 14 days of the occurrence of any event listed on pages 15 and 16 of the Notes Booklet. More evidence (if required at question 70) More evidence (if required at question 71) Statement why student must live in second home to access school daily (if required for question 73) Your signature Details of more than 3 periods you (or your partner) received foster care of similar allowance for the student (if required for question 78) Proof of income (if required for question 81) Date Proof of income (if required for question 82) / / Your partner’s signature (only if applying for income tested Additional Boarding Allowance) Date / / AIC payments cannot start until this statement is signed and the form is returned to us. An important note for Applicants Any AIC debt will usually be recovered by reducing any remaining payments you may receive. If you are no longer receiving AIC, you will have to arrange to repay the debt directly to us. The debt is always recovered from the applicant, not from the agent/student who receives AIC. SY040.1501 14 of 14

© Copyright 2026