Urbas Grupo Financiero SA UBS

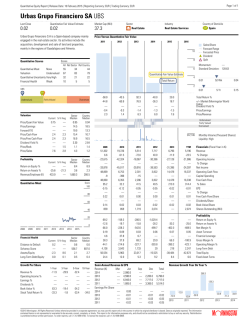

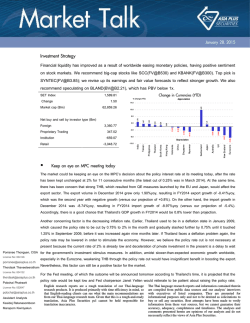

Page 1 of 1 Quantitative Equity Report | Release Date: 05 February 2015 | Reporting Currency: EUR | Trading Currency: EUR Urbas Grupo Financiero SA UBS Last Close Quantitative Fair Value Estimate Market Cap (Mil) Sector Industry 0.02 0.03 35.3 u Real Estate Real Estate Services Urbas Grupo Financiero S.A is a Spain-based company mainly engaged in the real estate sector. Its activities include the acquisition, development and sale of land and properties, mainly in the regions of Guadalajara and Almeria. Quantitative Scores Country of Domicile ESP Spain Price Versus Quantitative Fair Value 2011 2012 2013 2014 2015 2016 Sales/Share Forecast Range Forcasted Price Dividend Split 10 8 Scores Momentum: — Standard Deviation: 128.63 All Rel Sector Rel Country Quantitative Moat None Valuation Undervalued Quantitative Uncertainty Extreme Financial Health Moderate 53 77 20 11 29 91 8 5 6 41 92 8 6 Quantitative Fair Value Estimate 4 Total Return 0.01 52-Wk 0.04 0.01 5-Yr 0.15 2 UBS ESP u Undervalued Fairly Valued Overvalued Valuation Sector Median Country Median — — — 2.3 2.3 — 1.5 2.8 0.95 14.5 19.2 15.4 16.9 3.29 1.1 4.3 0.93 18.4 13.1 10.5 16.7 2.77 1.4 1.2 Current 5-Yr Avg Sector Median Country Median 8.4 3.6 1,659.2 8.9 2.3 268.7 Current 5-Yr Avg Price/Quant Fair Value Price/Earnings Forward P/E Price/Cash Flow Price/Free Cash Flow Dividend Yield % Price/Book Price/Sales 0.66 — — 2.3 2.3 — — 7.2 Profitability Return on Equity % Return on Assets % Revenue/Employee (K) — -25.6 433.0 — -21.3 — Score 100 Quantitative Moat 80 60 40 20 0 2008 2009 2010 2011 2012 2013 2014 Financial Health Current 5-Yr Avg Distance to Default Solvency Score Assets/Equity Long-Term Debt/Equity 2015 Sector Median Country Median 0.6 556.7 2.1 0.5 0.6 807.0 2.6 0.4 0.2 — -2.3 0.0 — — 8.6 0.1 1-Year 3-Year 5-Year 10-Year -11.9 — — — 63.3 -37.0 -29.9 — — — -19.4 -3.6 -32.4 — — — -34.2 -34.2 — — — — — -32.0 Growth Per Share Revenue % Operating Income % Earnings % Dividends % Book Value % Stock Total Return % -58.9 -44.8 -43.5 -60.9 92.3 76.9 -40.0 -36.3 13.3 11.2 — -0.4 2.3 — -0.3 1.4 — -1.4 6.3 — -1.3 6.0 — -1.4 7.2 Total Return % +/– Market (Morningstar World Index) Dividend Yield % Price/Earnings Price/Revenue Undervalued Fairly Valued Overvalued Monthly Volume (Million Shares) Liquidity: High 248 Financials (Fiscal Year in K) Revenue % Change 2009 2010 2011 2012 2013 TTM 51,302 6.6 19,726 -61.5 5,514 -72.0 7,717 40.0 6,796 -11.9 5,196 -23.5 -22,615 — -33,878 -42,324 — -45,017 -18,067 — -29,916 -30,386 — -38,563 -27,128 — -31,396 -21,986 — -24,397 Operating Income % Change Net Income 48,869 -9 48,860 95.2 6,753 -398 6,355 32.2 2,301 -15 2,286 41.5 3,822 — 3,822 49.5 14,478 — 14,478 213.0 16,337 — 16,338 314.4 Operating Cash Flow Capital Spending Free Cash Flow % Sales -0.15 — 0.22 -0.12 — 0.01 -0.05 — 0.00 -0.05 — 0.00 -0.02 — 0.01 -0.01 — 0.01 EPS % Change Free Cash Flow/Share — 0.14 859 — 0.02 859 — 0.03 1,719 — -0.02 2,074 — -0.02 — — -0.02 2,074 Dividends/Share Book Value/Share Shares Outstanding (Mil) -69.2 -12.6 -66.0 0.19 4.6 -159.3 -19.7 -228.2 0.09 37.8 -206.5 -15.8 -542.6 0.03 6.7 -1,029.4 -28.2 -499.7 0.06 — — -30.2 -462.0 0.07 — — -25.6 -469.5 0.05 — Profitability Return on Equity % Return on Assets % Net Margin % Asset Turnover Financial Leverage 38.3 -44.1 4,138 37.9 -214.6 3,043 69.2 -327.7 1,733 29.9 -393.8 29 -56.3 -399.2 218 -100.9 -423.1 2,247 Gross Margin % Operating Margin % Long-Term Debt 50,554 24.4 5,963 12.0 23,017 5.3 -15,525 9.2 -38,484 8.4 -42,673 6.6 Semi-Annual Revenue & EPS Revenue (K) Mar Jun 2014 — 2,990.0 2013 — 4,590.0 2012 — 6,943.0 2011 — 1,885.0 Earnings Per Share 2014 — 0.00 2013 — -0.01 2012 — -0.01 2011 — -0.02 Total Equity Fixed Asset Turns Revenue Growth Year On Year % Sep — — — — Dec — 2,206.0 7,717.0 3,366.0 Total — 6,796.0 7,717.0 5,514.0 — — — — — -0.01 -0.03 -0.03 — -0.02 -0.05 -0.05 268.3 129.3 -12.8 -72.8 2010 -83.4 2011 -33.9 -59.9 2012 ©2015 Morningstar. All Rights Reserved. Unless otherwise provided in a separate agreement, you may use this report only in the country in which its original distributor is based. Data as originally reported. The information contained herein is not represented or warranted to be accurate, correct, complete, or timely. This report is for information purposes only, and should not be considered a solicitation to buy or sell any security. Redistribution is prohibited without written permission. To order reprints, call +1 312-696-6100. To license the research, call +1 312-696-6869. 2013 -71.4 -34.9 2014 ® ß

© Copyright 2026