To Complete the New Group Enrollment

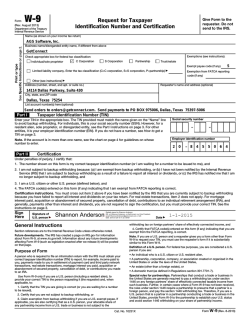

Small Group Enrollment Checklist AETNA Employer Application Please read fully and complete all sections; must be dated prior to the requested effective date. Employer signature must be an owner or corporate officer. Signature may not be more than 60 days old. Complete COBRA/Cal COBRA Questionnaire and include qualifying event and date. Employer Statement of Understanding Must be completed by every group, regardless of plan selection. Must be signed by both the employer and broker. Reconciled DE-9C / Quarterly Wage Report Every employee must be accounted for: Part-time, terminated, seasonal or temporary must be indicated. New hires not showing on the DE-9C: provide 2 weeks of payroll records showing wages earned and taxes withheld. If a DE-9C is not available: 6 weeks of payroll records must include, for every eligible employee enrolling, taxes withheld, check number and wages earned. DE-9C requirement is waived for groups with prior coverage that have at least 10 enrolling employees; 75% of enrolling employees must appear on the prior carrier billing statement or a DE-9C will be required. Proof of Eligibility Form Required for each Sole Proprietor, Partner(s) or Corporate Officer not listed on the DE-9C in addition to the following: Must submit one of the following C-Corporation, Limited Liability Company (operating as C Corp), Personal Service Corporation, S-Corporation Partnership, Limited Liability Partnership IRS Form 1065 schedule K-1 IRS Form 1120S Schedule K1 along with Schedule E (Form 1040) Partnership agreement if established within 2 years - eligible partners must be listed on agreement. Be sure and include the signature page. Sole Proprietor, Limited Liability Company (operating as a sole proprietor), Franchise IRS Form 1120 IRS Form 1120W (C-Corp and Personal Service Corp) IRS Form 1120 S Schedule K1 along with Schedule E (Form 1040) 1040 ES (Estimated Tax) (S-Corp) IRS Form 8832 (Entity classification as a corporation) W2 Article of Incorporation if established within 2 years - corporate officers must be listed. Be sure and include the signature page. IRS IRS IRS IRS Form 1040 Form Form 1040 along with Schedule F (Form 1040) along with Schedule K1 (Form 1065) 1040 along with Schedule C (Form 1040) 1040 along with Schedule SE (Form1040) Copy of Current/Prior Carrier Bill Bill must be the latest available with employee roster and premium summary page. Premium Check Submit a company check for the initial first month’s premium made payable to ‘Aetna’. Include a separate check for any Cal-COBRA enrollees. JAN 2015 Small Group Enrollment Checklist Payment for the first month’s premium may be processed via electronic funds transfer; complete the ACH New Business Request form. Effective Dates 1st of the month effective date 15th of the month effective date available for groups losing prior coverage mid-month or for virgin groups upon request. Employee Enrollment Forms All information must be fully completed; must be dated prior to the requested effective date. Alterations must be initialed and dated by the employee. If waiving for self or dependents, employee must specify who is being declined and provide a reason why. If employee is declining for spousal or other group coverage then a copy of the ID card must be provided. Summary of Benefits and Coverage (SBC) A Summary of Benefits and Coverage (SBC) must be provided to each employee and beneficiary who is eligible to participate. Agent Appointment Application for appointment must be completed prior to the submission of a group. If not completed, no commission payment will be made until after the appointment is completed. All appointment paperwork must be submitted online via Aetna’s Producer World. Hardcopies (paper agreements) will not be accepted. The following link should be used to access online applications: https://pangea.geninfo.com/Aetna/Apply/ Please call your LISI Regional Sales Manager or LISI Broker Sales Representative for more information, or submit your case to: Fresno: 30 River Park Place W est, Suite 100 Fresno, CA 93720 (866) 570-5474 Los Angeles: 21700 Oxnard Street, Suite 440 Woodland Hills, CA 91367 (866) 570-5474 Orange: 2677 N. Main Street, Suit e 350 Santa Ana, CA 92705 (866) 570-5474 Sacramento: 3100 Zinfandel Drive, Suite 325 Rancho Cordova, CA 95670 (866) 570-5474 San Diego: 9095 Rio San Diego Drive, Suite 220 San Diego, CA 92108 (866) 570-5474 San Mateo: 1600 W . Hillsdale Boulevard San Mateo, CA 94402 (866) 570-5474 JAN 2015

© Copyright 2026