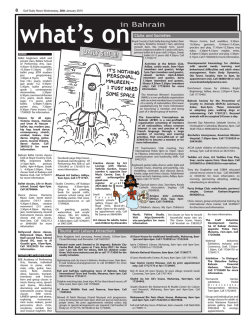

Total awarded stake in new oil concession

Gulf Daily News Friday, 30th January 2015 19 RBS to exit corporate debt business in Mideast-Africa DUBAI: Royal Bank of Scotland (RBS) plans to sell or close its corporate debt and debt capital markets business in the Middle East and Africa, the latest pullback by the state-controlled lender from emerging markets to focus on its domestic business. The lender, 81 per cent owned by the British government, has been reviewing its global footprint as it seeks to rebuild its reputation after one of the biggest bailouts in British history during the global financial crisis. Earlier this month, media reports indicated most of its Asian corporate banking business was up for sale. This came on top of confirmation in November that it was reviewing its options across its Central and Eastern Europe, Middle East and Africa network. “Part of the strategy set out by chief executive Ross McEwan in February 2014 was to make RBS a smaller, more focused bank. As part of that strategy, we have taken the decision to exit our corporate debt and debt capital markets business in the Middle East and Africa,” RBS said in a statement yesterday. Banking sources said that RBS was attempting to sell its corporate bank- ing business across the Middle East but had been unable to offload it in one chunk. Two of the sources, speaking on condition of anonymity as the information isn’t public, said the bank was now selling off its assets piecemeal to different buyers. RBS’s credit exposure to the region, as well as Central Asia and supranationals such as the World Bank, was £19.1 billion in 2013, representing 3.4pc of its £573bn of credit risk assets, its annual report said. In the Middle East, RBS has offices in Qatar and UAE, offering services to corporate and institutional clients such as financing, risk management and transactions. As recently as last year, RBS had around 200 staff across eight countries in the Middle East and Africa. Investcorp to acquire key Spanish company MANAMA: Investcorp yesterday announced it is buying Fritta, a specialist producer of intermediates for the ceramic industry, from financial investor Nazca Private Equity. Established in 1973 in Onda, Spain, Fritta produces ceramic frits and glazes as well as ceramic colours and inkjet inks, used in the manufacturing of ceramic tiles. The company’s global activities are supported by two frits manufacturing plants in Spain and Vietnam and two glaze mixing units in Italy and Mexico. Fritta employs around 300 people and following the acquisition of Grupo Esmalglass-Itaca in July 2012. “Fritta is an efficient producer of ceramic frits and glazes with a valuable business proposition and a consistent The acquisition is subject to Spanish go-to-market strategy,” Investcorp’s competition authorities clearance. Gulf Business president Mohammed Al Investcorp is an alternative investShroogi said. ment manager listed on the Bahrain “It also leverages its expanding inkjet Bourse, ink business, which allows the company to cross-sell from its traditional frits and glazes product offering.” Mr Al Shroogi said Fritta’s management team has been able to more than double the size of the business over the last five years. “Fritta and Esmalglass-Itaca successfully target different segments of the market by offering distinct approaches to product quality, design and technical assistance. “Given this, the two businesses will continue to be run DUBAI: Total became the first oil major to renew a 40-year onautonomously,” he added. shore concession in Abu Dhabi, putting its peers under pressure Nazca Capital chief executo improve terms after the local partner said the French firm made tive Carlos Carbó said Fritta the best offer. represented its first exit in The state-run Abu Dhabi National Oil Company (ADNOC) Nazca Fund III with “excellent signed an agreement yesterday with Total giving the firm a 10 returns to our investors”. per cent stake in the new concession to help operate the UAE’s “Since our entry in December biggest oilfields. “What’s this about my wealth trickling down to poor people.” 2013, Fritta has experienced Nine Asian and Western firms bid for stakes in the Abu Dhabi double-digit growth as a result Company for Onshore Oil of international expansion and Operations (ADCO) concessuccessful development of the sion after a deal with Western inkjet ink strategy. oil majors dating back to the “We are delighted with the 1970s expired in January 2014. outcome of this transaction, Four oil majors – which represents a significant ExxonMobil, Royal Dutch step for the development of the Shell , Total and BP – had each company,” Mr Carbó added. held 9.5pc equity stakes in the Fritta chief executive ADCO concession since the Pascual Parra said support from 1970s. Nazca allowed the company to After the deal expired last become one of the reference year, ADNOC took 100pc players in the industry. of the concession as political “We see a significant interleaders in Abu Dhabi weighed national expansion opportunity up whether to bring in Asian at Fritta and view Investcorp firms or stick with old partners, as ideally suited to back and sources said. support our growth aspirations. Shell, Total and BP have “Investcorp has a three-decmade new bids, while Exxon ade track record of assisting its has decided against bidding, n Slingtek, a Bahrain-based provider of products for the lifting and rigging industry, received portfolio companies in reachsources said. an ISO 9001:2008 Quality Certification for its management and operations departments. The ing their full potential. The concession signed certification was awarded by Germany-based certifying body TÜV Nord’s Bahrain office. “Besides access to capital to with Total was effective from Slingtek is engaged in the production of lifting accessories, fall protection systems and support our business plan, this January 1 and covers Abu industrial inspection and testing services, catering to the oil and gas, shipping, marine, transaction provides us with an Dhabi’s 15 principal onshore dredging and construction industries. Slingtek says it is the only manufacturer in Bahrain to experienced partner who has oilfields that represent more achieve full membership of the Lifting Equipment Engineers Association, UK. At the event are, already invested in a similar than half of the emirate’s pro- TÜV Nord Bahrain country manager Ramakumar, second from left, and Slingtek managing company and thus knows our duction. director Hemant Bhatia, second from right, with officials. sector very well,” he added. Total awarded stake in new oil concession its products are sold to approximately 200 customers worldwide. Last year, Fritta is expected to have generated sales and EBITDA of around 100 million euros and 16m euros, respectively. More than 50 per cent of Fritta’s sales are generated outside of Spain. Fritta will be the second company to be owned by Investcorp in Spain Shell misses forecasts on forex losses LONDON: Royal Dutch Shell blamed writedowns and forex losses for making almost no money in oil production, its most powerful division, in the last quarter of 2014, causing the company to miss profit forecasts by more than 20 per cent. Shell, the largest of the European energy majors, also announced a relatively modest three-year, $15 billion cut in spending to help it weather the plunge in oil prices. “We are taking a prudent approach here and we must be careful not to over-react to the recent fall in oil prices,” chief executive Ben van Beurden said. The company also kept dividends unchanged to soothe investors but its shares fell four percent, hit by the earnings shortfall. The company’s fourth-quarter 2014 adjusted net income of $3.3bn was weighed down by weaker than expected earnings from oil and gas production, known as upstream. “Upstream earnings of $1.7bn were well below our and consensus expectations of $2.8bn,” Morgan Stanley analysts said. “Integrated gas accounted for $1.6bn of this profits, implying that Shell’s remaining upstream activities were generating almost no earnings with Brent still averaging $75 per barrel in the fourth quarter.” Chief financial officer Simon Henry blamed the miss on a number of one-off items, including forex losses, exploration write-offs in North America and increased estimates of future decommissioning liabilities worldwide. He said those oneoffs were unlikely to be repeated in future quarters. The $15bn spending cut, which will involve cancelling and deferring projects through 2017, represents a 14pc cut per year from 2014 capital investment of $35bn. It is a change of course after Shell said in October it would keep its 2015 spending unchanged. “Shell is considering further reductions to capital spending should the evolving market outlook warrant that step, but is aiming to retain growth potential for the medium term,” it said. Shell maintained its fourth-quarter dividend unchanged from the previous quarter at $0.47 per share and in a rare move pledged to pay the same amount in the first quarter of 2015.

© Copyright 2026