2013.05050 - Support

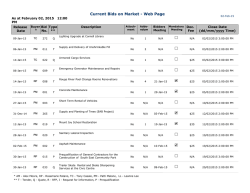

2013.05050 Contact and Support Information 2 Release Highlights 3 Product Updates 4 Release Notes February 1, 2015 Individual (1040) Product Updates 4 Partnership (1065) Product Updates 5 Corporation (1120) Product Updates 6 S Corporation (1120S) Product Updates 7 Fiduciary (1041) Product Updates 8 Contents • 1 Contact and Support Information Product and account information can be accessed by visiting Customer Support online at Support.CCH.com. In addition to product and account information, the Customer Support site offers answers to our most frequently asked questions, forms release status, Knowledge Base articles, training videos, and operating systems compatibility. Access to these features is available 24/7. The following Web site provides important information about the features and updates included in all ProSystem fx Tax releases: Release Notes Visit the Application Status Web page to view the current status of our CCH applications. The Application Status Web page is updated every 15 minutes. Go to Contact Us to find Support calendars, as well as options to enter Web tickets for assistance. Contact and Support Information • 2 Release Highlights Return to Table of Contents. Tax Updates Arizona On Tuesday, January 13, 2015, the Arizona Department of Revenue posted an update to their electronic filing specification that affected 2012 and 2013 returns. The updates added the option to include PDF attachments and are available with this release. Prior schema versions are no longer accepted, so Arizona electronically filed returns must be recalculated, re-exported, and resubmitted on Release 2013.05050. The 2012 schema is not available in ProSystem fx Tax and Arizona Individual Income tax returns should be filed on paper. Release Highlights • 3 Product Updates Individual (1040) Product Updates Return to Table of Contents. Oklahoma Interest and penalties calculate on amended returns. Product Updates • 4 Partnership (1065) Product Updates Return to Table of Contents. Pro Forma Federal Worksheet Federal > Income/Deductions > Rent and Royalty > Disallowed Rental Expense Carryover > Other Expenses > Description (Interview Form E1A, Box 60) is no longer populating with duplicate Pro Forma data that is included on Worksheet Federal > Income/Deductions > Rent and Royalty > Expenses > Other Expenses > Description (Interview Form E1, Box 160) when the rental is not a vacation home. Pro Forma of Partnership Federal returns with Form 8825 rental input present may include unnecessary descriptions for Other Expenses related to Disallowed Rental Expense Carryover. This occurs for prior year Federal returns that have rentals that are not vacation homes and other expenses are present. Do one of the following: Rerun Pro Forma to update this input for affected returns. Changes can be made manually in the 2014 software on Federal > Income/Deductions > Rent and Royalty > Disallowed Rental Expense Carryover > Other Expenses (Interview Form E1A). Minnesota Program will no longer populate 2014 Interview Form MN15, Box 60 (Minnesota Taxes and Credits Credit for Increasing Research Activities, Schedule RD, Line 13) with the amount from the 2013 MN Form M3A, Line 5A. New York City Federal Pro Forma of Partnership New York City returns with amounts credited to next year's tax is not including the amount in Pro Forma data. Also, prior year tax is not being included in Pro Forma. This occurs for prior year New York City returns that have amounts present on Form NYC204, Line 32b or Form NYC-204, Line 25. Do one of the following: Rerun Pro Forma to update this input for affected returns. Changes can be made manually in the 2014 software on Worksheet View Federal > Income / Deductions > Rent and Royalty > Disallowed Rental Expense Carryover > Other Expenses (Interview Form E1A). Michigan Form 807. 2014 Composite Income Tax Return and accompanying schedules are now available for fiscal year return processing. Product Updates • 5 Corporation (1120) Product Updates Return to Table of Contents. California The late payment penalty calculation will now properly accounting for the number of months the payment was late in computing the penalty. Michigan - Electronic Filing Input on Worksheet View Michigan > Corporate Income Tax > UBG > CIT UBG Form 4897(Interview Form CIT52, Box 46 and 47 ) for Form 4897, Gross Receipts, Line 19a, will now allow negative amounts. New Jersey 2013 Electronic Filing. New Jersey Form CBT-100 and associated schedules, for taxable year ending after June 30, 2014, are now available for processing. South Carolina South Carolina 1120, Schedule M will now use Schedule H-3 apportionment percentage when the Schedule H-3 is present in the return. Product Updates • 6 S Corporation (1120S) Product Updates Return to Table of Contents. Michigan Form 807. 2014 Composite Income Tax Return and accompanying schedules are now available for fiscal year return processing. Product Updates • 7 Fiduciary (1041) Product Updates Return to Table of Contents. Maine - Electronic Filing The State of Maine stopped accepting 2013 electronically filed fiduciary returns on December 26, 2014. Product Updates • 8

© Copyright 2026