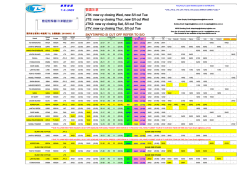

Three-Year Energy Efficiency Plan