Estate Planning – The importance of Wills & Trusts

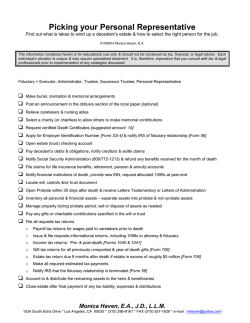

Estate planning may seem like an overwhelming and unnecessary undertaking for those with modest income and assets, but it does not have to be. On first blush, the term itself seems to be more appropriate for wealthy individuals who have large bank accounts, high value property, businesses or other substantial assets. However, estate planning including a will or trust is very important to everyone of all income levels. If you do not plan the transfer of your property in advance, the state will distribute the property for you. You should control the ownership of your assets after death (or other key life event) by means of a will or trust so that you can ensure your assets are in the hands of the people you choose. For those of us with children, far more important than your assets, you need to plan for the ongoing care and custody of your children if you should come to an untimely demise. A will is a written legal document that ensures the distribution of property and assets among the people named as beneficiaries as well as addressing many other issues such as guardianship for minor children or others needing ongoing care. While creating or updating a will, it is essential to involve an experienced estate planning attorney such as David R. Brewer. If one does not have a will, the state will distribute the assets to heirs according to its laws, and custody of children will be decided by a judge whom you do not know, if it is not planned in advance by you. A will names beneficiaries for assets such as bank accounts not already made joint with right of survivor ship, real estate, and personal property, as well as other assets. When a will undergoes probate, it will be in public domain so it is important to draft it carefully with the help of a knowledgeable estate planning attorney. If you already have a will it should be reviewed after any significant life event that may impact beneficiaries, the persons you appoint as decision makers, or the assets which are to be distributed. Additionally, your named beneficiaries and decision makers should be reviewed periodically not only in your will but also for assets such as IRA’s and other investment plans. A trust is frequently used to reduce large estate taxes and to shield the transfer of assets from being part of public record as an estate goes through the probate process. The formation of the trust allows you to give your assets or property rights to a trustee for the benefit of a third party beneficiary. These beneficiaries can be family, friends or even a charitable organization. There are numerous types of trusts that can be utilized to protect you and your beneficiaries. Among these trusts are a Special Needs Trust, an Irrevocable Life Insurance Trust, a Living Trust. Each trust is built to address specific circumstances and you must look carefully at your needs to determine the proper trust to be formed. When choosing a trust you want an experienced estate planning attorney such as David R. Brewer to help you ensure the best choice for you and your loved ones. A trust can serve many purposes: Your property can be transferred without the need for probate to family members and/or others after your death. Trust assets may be protected from creditors, divorce, and bankruptcy. A trust can provide for the care of children from a previous marriage. A trust is capable of managing your money and assets after your death and ensuring your family’s financial needs are met. A trust can allow you to donate to charity, all or part of an estate. A trust can provide for the care of a disabled child or spouse. A trust can provide for the financial needs of minor beneficiaries like grandchildren in their younger years and subsequently distributing the assets once they are a specific age. Regardless of your income level, estate planning is as important as having health insurance or filing your taxes. Choosing the proper type of will or trust depends upon your individual needs and choosing an experienced and knowledgeable estate planning attorney is very important to meeting those needs. David R. Brewer and his team are experienced, knowledgeable and will help you meet your needs and prepare for the future. Disclaimer – The materials available within this article are for informational purposes only and not for the purpose of providing legal advice. You should contact an attorney to obtain advice with respect to any particular issue or problem. Use of and access to this Web site or any of the e-mails or links contained within the website or article do not create an attorney-client relationship between brewer law and the user or browser. Article Resource:- https://brewerlaw.tumblr.com/post/159823705825/estateplanning-the-importance-of-wills-trusts

© Copyright 2026