Que contenido debe tener un manual de

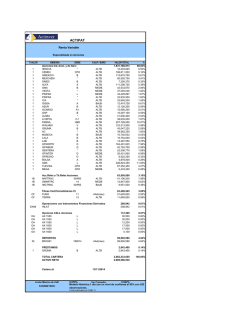

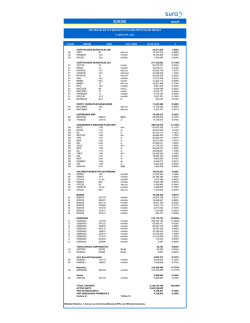

ALTERNA AA/5HR HR Ratings de México, S.A. De C.V. Deuda Sociedad Discrecional T.VALOR 90 EMISORA SERIE Cert.Bursatiles Municipales CBPF 48 91 91 91 91 91 91 91 91 91 91 91 91 91 91 91 91 91 91 91 91 91 91 91 91 91 91 91 91 91 91 91 91 AAA(mex) VALOR TOTAL 48,729,307 48,729,307 % 0.41% 0.41% Cert.Bursatiles Corporativos MFRISCO 13 INCARSO 13 AERMXCB 13 ELEKTRA 14 VWLEASE 12 FUNO 13 FIDEPCB 14 ELEKTRA 14-2 FORD 14 ELEKTRA 13 HOLCIM 14 VWLEASE 13 KUO 10 KUO 12 NRF 12 DINEXCB 12 CULTIBA 13 LAB 13 ALSEA 13 DAIMLER 14-3 NEMAK 07 INCARSO 12 GCARSO 12 SCRECB 12 VWLEASE 13-2 NRF 13 CADU 14 IDEAL 11-2 BIMBO 12 GDINIZ 12 LOMCB 12 CATFIN 12 AA-(mex) AA(mex) HRAA+ A(mex) Aaa.mx AAA(mex) AA(mex) A(mex) AA(mex) A(mex) AAA(mex) Aaa.mx A(mex) A(mex) Aaa.mx AA-(mex) AA(mex) AA(mex) AA-(mex) AAA(mex) AA-(mex) AA(mex) AA+(mex) AAA(mex) Aaa.mx Aaa.mx A+(mex) Aa2.mx AA+(mex) HRAmxBAaa.mx 4,047,101,044 297,409,851 295,439,496 269,796,219 214,553,242 212,714,707 203,972,058 203,948,850 200,213,115 199,072,157 193,177,796 170,999,119 164,894,939 134,944,437 132,386,716 130,463,048 127,051,276 120,239,441 97,055,758 87,442,820 84,124,549 82,757,449 80,764,538 68,591,902 66,408,824 50,223,965 50,201,109 50,111,468 30,108,168 10,764,639 7,945,480 8,390,339 933,569 34.00% 2.50% 2.48% 2.27% 1.80% 1.79% 1.71% 1.71% 1.68% 1.67% 1.62% 1.44% 1.39% 1.13% 1.11% 1.10% 1.07% 1.01% 0.82% 0.74% 0.71% 0.70% 0.68% 0.58% 0.56% 0.42% 0.42% 0.42% 0.25% 0.09% 0.07% 0.07% 0.01% 93 93 Cert.Bursa.Ref.a Papel Comercial SICREA 00114 GDINIZ 00114 F2(mex) HR3 62,133,651 50,131,509 12,002,142 0.52% 0.42% 0.10% 94 94 94 Certif. Bursatiles Bancarios COMPART 12 VWBANK 12 BINTER 14-4 AA+(mex) Aaa.mx A(mex) 139,851,934 50,705,244 48,904,279 40,242,411 1.18% 0.43% 0.41% 0.34% 95 95 95 Cer.Bur.Emit.Ent.o Ins.Gob.Fed IFCOTCB 13 TFOVIS 10-2U CDVITOT 14U AAA(mex) AAA(mex) AAA(mex) 89,753,407 40,207,378 28,763,404 20,782,625 0.76% 0.34% 0.24% 0.18% BI Cetes con Impuesto CETES AAA(mex) 2,728,324 2,728,324 0.02% 0.02% CHD Chequera Dolares 40-012 CHE Chequera Euros 40-012 150723 CALIF / BURS 1148427 483,372 483,372 0.00% 0.00% 5514622 12,144 12,144 0.00% 0.00% A 150,957,437 150,957,437 1.27% 1.27% AAA(mex) 59,129,950 59,129,950 0.50% 0.50% EAIM Operaciones con Instrumentos Financieros Derivados INLAT 11,811,512 11,811,512 0.10% 0.10% FWD Forward de Divisas MXPEUR -53,583 -53,583 0.00% 0.00% D2 Eurobonos Empresas Priv.(Fix) AMXL764 150116 D8 Titulos Emisoras Extranje.SIC MLMXN 1-07 141212 IM IM IM IM IM IM Bonos Prot.Ahorro (BPAG28) BPAG28 170223 BPAG28 161020 BPAG28 151112 BPAG28 160616 BPAG28 170518 BPAG28 161222 AAA(mex) AAA(mex) AAA(mex) AAA(mex) AAA(mex) AAA(mex) 1,102,615,630 547,840,596 205,687,970 99,884,601 99,784,151 99,568,790 49,849,522 9.26% 4.60% 1.73% 0.84% 0.84% 0.84% 0.42% IS IS Bonos Prot.al Ahorro Pago Sem. BPA182 180104 BPA182 151210 AAA(mex) AAA(mex) 121,672,895 70,926,268 50,746,627 1.02% 0.60% 0.43% JE Nota Estructurada sin Garantia AMX 0619 AAA(mex) 93,779,077 93,779,077 0.79% 0.79% JI JI Tit.Org.Financ.Multilaterales CABEI 1-14 CABEI 1-13 Aaa.mx Aaa.mx 381,153,680 280,704,026 100,449,654 3.20% 2.36% 0.84% LD LD LD LD LD Bondes D BONDESD BONDESD BONDESD BONDESD BONDESD 170223 170622 170427 161229 161027 AAA(mex) AAA(mex) AAA(mex) AAA(mex) AAA(mex) 1,718,400,195 423,826,755 397,950,148 398,082,276 299,019,270 199,521,746 14.44% 3.56% 3.34% 3.34% 2.51% 1.68% M M M Bonos Gob. Fed. Tasa fija (20) BONOS 241205 BONOS 181213 BONOS 191211 AAA(mex) AAA(mex) AAA(mex) 1,029,908,244 546,819,441 305,517,631 177,571,172 8.65% 4.59% 2.57% 1.49% Q Q Q Obligaciones Subordinadas(FIX) BAZTECA 08 BANORTE 08 BANORTE 08-2 BBB(mex) Aa2.mx Aa1.mx 297,856,097 200,587,098 95,413,720 1,855,279 2.50% 1.69% 0.80% 0.02% S S S Udibonos UDIBONO UDIBONO UDIBONO 141218 160616 190613 AAA(mex) AAA(mex) AAA(mex) 1,457,636,928 764,336,629 493,090,432 200,209,867 12.24% 6.42% 4.14% 1.68% Swaps Entregables 1MXPTIE 1MXPTIE 1MXPTIE 1MXPTIE 1MXPTIE 1MXPTIE 1MXPTIE 1MXPTIE 1MXPTIE 181015 241007 241008 241028 190610 241031 241031 180912 181015 -2,391,620 -157,500 -93,250 54,750 -6,800 -368,820 -380,100 -264,000 -577,500 -598,400 -0.02% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% -0.01% -0.01% REPORTOS BONDESD BONDESD BONDESD 160505 191003 190207 1,091,648,318 987,068,405 100,008,357 4,571,556 9.17% 8.29% 0.84% 0.04% 11,904,917,943 11,358,739,727 100.00% SWP SWP SWP SWP SWP SWP SWP SWP SWP LD LD LD AAA(mex) AAA(mex) AAA(mex) TOTAL CARTERA ACTIVO NETO Cartera al: Límite Máximo de VaR: PARÁMETROS: 13/11/2014 0.492% Var Promedio: 0.015% Modelo Histórico,1 día con un nivel de confianza al 95% con 252 observaciones. Límite autorizado por CNBV %

© Copyright 2026