Small Business Weekly* (opens new window)

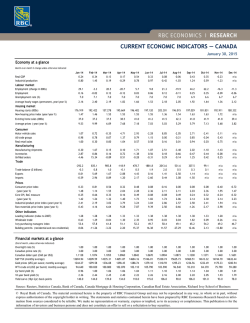

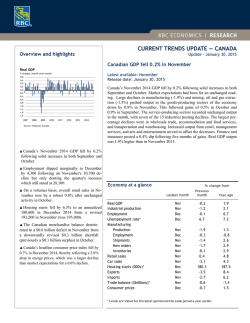

SMALL BUSINESS WEEKLY TD Economics February 2, 2015 HIGHLIGHTS OF THE WEEK • The Canadian dollar hit a new low this week, ending the week a little under US$0.79, as financial markets continue to price in a further rate cut by the Bank of Canada, just as the Fed is getting ready to lift rates. • The data this week continued to feed pessimism. Real economic output fell 0.2% in November and the decline was broad based across most sectors. Meanwhile, Statistics Canada released revisions the labour force data, which showed job creation was much slower in 2014 than previously thought. • Going forward, TD Economics estimates that Canadian economic growth will decelerate sharply in the first half of the year as the recent plunge in oil prices hurts commodity producing regions. However, as the year progresses, a depreciating Canadian dollar, robust U.S. economic growth and the recent plunge in interest rates will offer positive offsets to economies and housing markets elsewhere. FINANCIAL MARKETS 52-Week 52-Week High Low INDUSTRY CONTRIBUTION TO REAL GDP DECLINE IN NOVEMBER, % Current* Week Ago S&P500 2,021 2,052 2,091 1,742 S&P/TSXComp. 14,637 14,779 15,658 13,486 BoC(OvernightRate) 0.75 0.75 1.00 0.75 Retail TDBankPrimeRate 3.00 3.00 3.00 3.00 Wholesale 0-0.25 0-0.25 0-0.25 0-0.25 Stock Market Indexes Cash Rates FedFundsTargetRate U.S.5-yrTreasury Financeandinsurance Transportationandwarehousing Manufacturing Construction Fixed Income Yields Canada5-yrBond Others Publicsector 0.63 1.19 0.79 1.79 0.63 1.31 1.83 1.16 Foreign Exchange Cross Rates C$(USDperCAD) 0.78 0.80 0.94 0.78 Euro(CADperEUR) 1.46 1.44 1.46 1.28 Pound(CADperGBP) 1.92 1.86 1.92 1.76 Yen(JPYperCAD) 92.0 94.8 106.2 90.8 CrudeOil($US/bbl) 44.6 45.2 107.6 44.5 NaturalGas($US/MMBtu) 2.88 2.96 7.92 2.75 Copper($US/met.tonne) 5433.0 5549.0 7235.0 5433.0 Gold($US/troyoz.) 1262.6 1294.1 1383.1 1140.7 Commodity Spot Prices** *asof9:15amonFriday**Oil-WTI,Cushing,Nat.Gas-HenryHub,LA (Thursdaycloseprice),Copper-LMEGradeA,Gold-LondonGold Bullion;Source:Bloomberg Utilities Miningandoilandgasextraction Agricultureandforestry -0.3 -0.2 -0.1 0.0 0.1 Source:StatisticsCanada KEY ECONOMIC INDICATORS Current RealGDPGrowth(q/q,annualized) 2.8 Q3-14 MonthlyRealGDP(m/m,%) -0.2 Nov-14 NetChangeinEmployment(000s) -11.3 Dec-14 UnemploymentRate(%) 6.7 Dec-14 AverageHourlyWageRate(y/y,%)* 2.1 Dec-14 CPIInflation(y/y,%) 1.5 Dec-14 RetailSales(m/m,%) 0.4 Nov-14 Source:StatisticsCanada,Bloomberg.*Permanentjob. This report is provided by TD Economics. It is for informational and educational purposes only as of the date of writing, and may not be appropriate for other purposes. The views and opinions expressed may change at any time based on market or other conditions and may not come to pass. This material is not intended to be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this report has been drawn from sources believed to be reliable, but is not guaranteed to be accurate or complete. This report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors, and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise the TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered. TD Economics | www.td.com/economics CANADA - SEARCHING FOR A BOTTOM Another week, another dip in Canadian dollar. The loonie ended the week a little under US$0.79. The impetus behind this week’s depreciation was the combination of a further decline in the WTI price of oil and diverging trends in monetary policy expectations between the U.S. and Canada. Following the Federal Reserve Statement this week, markets continued to price in a rate hike by year end, while pricing in further rate cuts by the Bank of Canada in early 2015. The Bank of Canada and financial markets are concerned about the negative economic consequences of falling oil prices on the Canadian economy – and with good reason. This week, Statistics Canada released revisions to its labour force survey, which showed that 65K fewer jobs were created in 2014 than previously anticipated – making it the slowest year for job creation since the recession. The release of Canadian monthly real GDP Friday morning showed that economic output fell 0.2% in November. The weakness was broad based and not just an oil production story. Output in most sectors declined, with the exception of retail trade and industries tied to the public sector. So far, the data has been consistent with our view that real GDP growth will decelerate sharply through the first half of this year as falling oil prices weigh on growth in oil producing regions. Real GDP is estimated to grow by just 1.4% annualized over the first two quarters of the year. However, as the year progress, a depreciating Canadian dollar, robust U.S. economic growth and the recent plunge in interest rates will offer positive offsets. Indeed, the CFIB business barometer released this week confirmed just that. The index 5-YEAR GOVERNMENT BOND YIELDS Level,% 2.5 2.0 1.5 1.0 Canada U.S. 0.5 0.0 1-Jan 1-Apr 1-Jul Source:Reuters February 2, 2015 1-Oct 1-Jan 1-Apr 1-Jul 1-Oct CANADIAN S&P/TSX REIT PRICE INDEX Level 180.0 175.0 170.0 165.0 160.0 155.0 150.0 145.0 140.0 135.0 31-Dec 31-Mar 30-Jun 30-Sep 31-Dec Source:Reuters showed modest improvements in sentiment among business in most provinces outside of Alberta, Newfoundland and Saskatchewan. Overall, we continue to expect real GDP to grow by a decent 2.0% for 2015 as a whole. As preliminary data on resale housing activity in January is released by some of the big cities next week, we expect to see that some of December’s sharp drop in home sales will be reversed. Some of the decline in December was likely due to a knee-jerk reaction to falling oil prices. But, if investments tied to housing, like REITs, are any indication, confidence in Canadian housing has since improved. Prices of REITs had also plummeted in December, but have since rebounded. With the big Banks announcing that they will lower their prime rate by 15 basis points this week, the housing market (outside oil producing economies) is likely to pick up more traction as the year progresses. Calgary and Edmonton, however, are likely to endure their second housing correction since 2009. It can take up to two quarters for lower oil prices to hit real GDP growth, and as such we will have to wait for Q1 2015 data to have a complete picture of the full impact of falling oil prices on the Canadian economy. We will not have this information by the time the Bank of Canada meets next in March. At that point, oil prices will likely be lower than they are today and risks to the outlook will remain elevated. As such, the Bank of Canada is likely to take out more insurance and cut the overnight rate by a further 25 basis points. 1-Jan Diana Petramala, Economist 416-982-6420 2

© Copyright 2026