Download a Brochure - Hfma

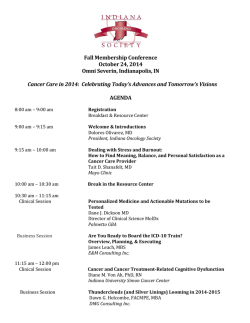

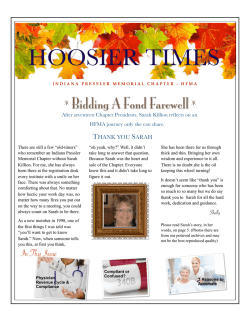

INSTITUTE INFORMATION & REGISTRATION - INDIANA PRESSLER MEMORIAL CHAPTER - 2015 WINTER INSTITUTE JANUARY 29-30, 2015 RENAISSANCE HOTEL CARMEL, INDIANA WINTER INSTITUTE LOCATION Institute Highlights... The 2015 Winter Institute will be held at the Renaissance Hotel, Carmel, Indiana and will feature a variety of educational and networking opportunities including a new offering called Consultants One Call. LATE NIGHT EUCHRE Consultants On Call is for those hats, etc. and at this time of year, who want to have one-on-one who couldn’t use a warm blanket! experience with specific vendors. There will be a Reception after the All this plus National and Local first day sessions. Healthcare Speakers and a “late night Euchre party”! For our Chapter “give-back” we will accept donations of coats, gloves, DONATIONS CONSULTANTS ON CALL General Information HIGHLIGHTED SPEAKERS Educational Credit Programming is approved for 9.5 CPE. Cancellation Policy Refunds are made on cancellations received four (4) business days prior to the meeting date. Please fax cancellations to 317-300-7059. Early Bird Registration There will be a discount for registrations received by January 14, 2015. Hotel Reservations CHAD MULVAN Y - A block of rooms has been reserved at the Renaissance Hotel, 11925 N. Meridian St., Carmel, Indiana 46032. The conference rate is $129.00, plus tax. Reservations must be made by January 7, 2015. After that date, reservations will be accepted on a space and rate available basis. Call Marriott reservations at (866) 905-9619, the name of the event is “Indiana Chapter - Healthcare Financial Management Association. NATIONAL HFMA Registration Fees Early Bird Registration forms must be received by January 14, 2015. MEMBER NON-MEMBER By January 14 By January 14 DOUG LEONARD IN DIA N A HO SP ITAL A SSO CIAT IO N One Day $175 One Day $195 Two Days $240 Two Days $275 After January 14 After January 14 One Day $190 One Day $210 Two Days $255 Two Days $290 Students - Flat Fee $ 25.00 Attire REPRESENTATIVE ROBIN SHAC KL EFORD Casual attire is welcome. Rooms may be cooler so bring a sweater or jacket. Information Indiana Pressler Memorial Chapter - 317-643-2520 - [email protected] Shelly Haggard - Chapter Administrative Assistant BRIAN TABOR Institute Schedule Thursday, January 29, 2015 7:30-8:00 am 8:00-9:15 am Registration & Breakfast Welcome & Keynote Address from Chad Mulvany - National HFMA An Overview of Regulatory and Market Events and Their Implications for Health Systems Coverage expansion, the federal fiscal situation, and the transition to value based reimbursement for both public and private payers pose both opportunities and challenges to health systems. This session will discuss key health policy issues that will impact providers and offer strategies to manage anticipated risk. Presentation Level: Strategic Target Audience: CFOs, Directors of Revenue Cycle, Directors of Reimbursement. 9:15-10:15 am General Session - Doug Leonard - Indiana Hospital Association| 10:15-10:30 am Break - morning break; restrooms are located to the right as you leave the Main Ballroom. 10:30-11:30 am General Session - Adam Plotkin - Adam Plotkin, PC 11:45-12:45 pm Lunch 12:45- 1:45 pm Break Out Sessions Track #1 - Jeff Heaphy - Plante Moran Population health strategies and payer reforms are radically changing how providers are paid. Traditional fee for service arrangements are increasingly being replaced with partial or full risk contracts. To achieve success under these models of care, providers will need enhanced data analytic capabilities that assist with evaluating payer contracts, monitoring patient utilization, calculating the cost of care, and predicting future trends. This information will be essential in cultivating successful new payer relationships. This session will guide participants in how to transform your existing fee for service oriented financial and data analysis into effective tools for thriving under new models of care. At the end of this session... Participants will understand that risk based contracting (with Medicare Advantage Plans, Managed Care for Dual Eligibles, ACO participation or bundled payments, for example) requires a deeper level of financial and data analysis than previously needed to participate in fee for service contracts. You will learn about the specific data and financial analysis needed to support risk based contracts. We will provide guidance on analyzing the financial feasibility of various payer contracts, developing tools for calculating the cost of care and for predicting patient/resident service utilization. Participants will understand that expanded financial and data analysis capabilities will be critical in supporting relationships with managed care organizations, ACOs and other provider networks throughout the healthcare continuum. At the end of this session... Participants will receive a basic overview of the CFPB, its purpose, what it has focused on in the past, and what it will focus on in the future that will impact the Health Care Industry. Target Audience: Any Manager or Attorney with a Health Care Organization that deals with issues of consumer finance. Presentation Level: Technical details will be discussed. Target Audience: Nursing Home Administrators, CEOs, CFOs, COOs, and CNOs of senior care and hospital systems. Presentation Level: Intermediate Track # 2 - Albert Lin & Steve Forry - Ice Miller This presentation will give a basic overview of the CFPB, its regulatory functions, and its enforcement actions. It will then discuss how the Bureau’s activities may relate to the Health Care Industry 1:45-2:45 pm 2:45-3:45 pm Consultants On Call - General Session Area - Main Ballroom General Session - Allison Taylor 3:45-4:00 pm Break 4:00-5:15 pm General Session - Gregg Wallander & Alyssa James - Hall Render 5:15-6:30 pm Reception - Just outside the Main Ballroom; join us for cocktails and Hors d’oeuvre. 8:30-?? pm Euchre - Return from dinner, put your comfies on and play some cards! There will be some snacks and drinks and a few prizes. Friday, January 30, 2015 8:30-9:00 am Registration & Breakfast 9:00-10:15 am Legislative Panel - Brian Tabor - Indiana Hospital Association 10:15-10:30 am This legislative Panel will include: Break 10:30-11:30 am General Session - Tom Blair - Fifth Third Bank General Economic Update IN S TITUTE S P E C I A L E V E NT S L ATE NIG HT EUCHR E Be sure to check the appropriate boxes on the Registration Form for any events you plan to attend. RECEPTION CONSULTANTS ON C AL L DONATIONS Institute Faculty Chad Mulvany, with HFMA National will open the Winter Institute with a National Healthcare Update. Based out of Washington, DC he is responsible for analyzing the implications of legislative and regulatory developments on healthcare providers and is also a contributor to HFMA’s Value Project research. Chad is a regular columnist in HFM, the HFMA magazine and speaks frequently on issues related to health reform. Chad is also a Fellow of the HFMA and holds a Masters of Business Administration from the University of Maryland. He is active with the Virginia Chapter of HFMA where he has served as a past board member. CHAD MULVANY THURSDAY OPENING SESSION CHAD IS A HEALTHCARE FINANCE POLICY DIRECTOR FOR THE HEALTHCARE FINANCIAL MANAGEMENT ASSOCIATION. “WINTER INSTITUTE ALWAYS CONTAINS GREAT UPDATES ON NATIONAL & LOCAL HEALTHCARE POLICY” Doug Leonard serves as president of the Indiana Hospital Association, which is the chief advocate of Indiana hospitals, representing their interests with the state and federal governments, the business community, regulatory agencies, accrediting bodies, and others who have interest in the work of hospitals. Leonard has almost 40 years of experience in health care. Before joining the IHA in 2007, he spent 30 years in administration at Columbus Regional Hospital, the last 10 as CEO. During his tenure as CEO the hospital became the first Magnet Hospital for Nursing in Indiana and was awarded the AHA Quest for Quality Prize. DOUG LEONARD THURSDAY GENERAL SESSION DOUG LEONARD IS THE PRESIDENT OF THE INDIANA HOSPITAL ASSOCIATION, WHICH REPRESENTS THE INTERESTS OF APPROXIMATELY 172 INDIANA HOSPITALS. I N ST IT U T E FACULTY JEFF HEAPHY, NHA PARTNER, PLANTE MORAN SENIOR CARE PRACTICE LEADER Jeff Heaphy: Jeff has more than 30 years of experience in the senior care and living industry. He devotes 100 percent of his time to clients in the senior care and living industry. Jeff is a nursing home administrator (NHA) and concentrates his practice by overseeing Medicaid and Medicare cost report preparation, projecting and negotiating final settlements, reviewing rate settings, presenting rate appeals, developing and monitoring operating budgets and financial reports, as well as negotiating the sale and/or acquisition of facilities and related financing. He is active in a number of senior care trade associations and presents numerous educational programs throughout the country. Steve Forry: Steve is a partner in Ice Miller's litigation practice group. Over the course of his career, Steve has advised clients how to avoid litigation and, when necessary, has represented clients in prosecution and in defense of lawsuits. Steve has tried cases in the courts of numerous states and federal circuits. Steve practices all manner of commercial litigation, with focuses on financial services litigation and construction litigation. Albert Lin: Albert Lin is a partner in Ice Miller’s litigation group. His practice focuses on complex litigation relating to consumer financial services, securities and investments or other banking or finance matters. Albert has also litigated numerous regulatory, commercial, or civil disputes involving federal, state, or local agencies, representing both the government and private companies in those settings. STEVE FORRY ALBERT LIN ALLISO N TAYLOR Allison Taylor: Allison's practice focuses on general health law, regulatory compliance and contracting and reimbursement issues, as well as government relations. Allison has over nine years of experience representing health care clients before Indiana's legislative and administrative bodies. Before joining Hall Render, Allison was a government affairs consultant for a law firm and then served as the Legislative and Regional Affairs Director for the Indiana Academy of Family Physicians. Allison graduated from DePauw University in 2003 and from Indiana University Robert H. McKinney School of Law in 2008. Allison routinely speaks to health care organizations on health law and legislative matters. She is a member of the American Bar Association, Indiana State Bar Association, Indianapolis Bar Association, American Health Lawyers Association, Governmental Affairs Society of Indiana, Indiana Society of Association Executives and Executive Women in HealthCare. Gregg Wallander: Mr. Wallander counsels clients in numerous aspects of health care law. His work involves day-to-day counsel regarding hospital and health system initiatives, physician alignment, joint venture and other affiliation arrangements, governance and board of director/trustee organization, Fraud and Abuse/Stark analysis, preparation and review of physician/hospital and other provider contracts, corporate compliance, physician recruitment, medical staff and peer review, tax exemption and Medicare reimbursement. Mr. Wallander has made national and regional presentations on the Stark and Fraud and Abuse Laws for the American Health Lawyers Association, Indiana Hospital Association, Kentucky Hospital Association, Wisconsin Hospital Association, Healthcare Financial Management Association and Idianna State Medical Association. Mr. Wallander has been named in Best Lawyers in America and Indiana Super Lawyers. Alyssa James: Alyssa practices in the area of health care law with a focus on fraud and abuse, hospital and health system matters, regulatory and compliance issues, corporate transactions and hospital/physician alignment. Alyssa received her law degree and Graduate Certificate in Health Law from Indiana University Robert H. McKinney School of Law, where she also served as Executive Articles Editor for the Indiana Health Law Review. GREGG WALLANDER ALYSSA JA MES I N ST IT U T E FACULTY Brian Tabor: Brian C. Tabor is vice president of government relations at Indiana Hospital Association. As such, he oversees all of IHA's state and federal legislative initiatives and health policy development. Prior to joining IHA in 2008, Brian worked at the Indiana House of Representatives, where he served as the majority caucus policy director. He has worked for and around the Indiana General Assembly for almost 15 years, also serving as a fiscal analyst for the Indiana State Senate. He earned a bachelor's degree in political science and a master's degree in agricultural economics from Purdue University. B RIAN TABO R Representative Robin Shackleford: Robin has extensive experience in governmental, community and diversity affairs coupled with a strong background in business management, supervision, training, and budgeting. First elected to the Indiana House of Representatives in 2012, Robin represents the citizens of Indiana House District 98 in the state legislature as it meets at the Statehouse in Indianapolis. She has also served as a Precinct Committee Chairwoman for more than 10 years. Robin serves on the following standing committees of the Indiana House: • • • • RE PRES ENTATIVE ROBIN S HACKLEFO RD TO M B L A I R Public Health Commerce, Small Business & Economic Development Financial Institutions Government Reduction (Ranking Minority Member) Tom Blair: Tom is a Senior Portfolio Manager and Vice President at Fifth Third Investment Advisors based in Indianapolis. Tom's experience includes institutional and private bank investment management; financial services mergers and acquisitions; public and secondary equity offerings; corporate finance and accounting; implementation and interpretation of financial accounting standards and government regulations; and bank asset and liability management. Tom began his career during the savings and loan crisis of the 1980's acquiring failed banks, assisting formation of a new investment bank and investment advisor. Tom began his not-for-profit and government experience while advising Rockefeller & Co. in the early 1990's as investment manager and blind trustee to elected officials. Tom has advised numerous community foundations, universities, corporations, pensions and private foundations including de novo start-ups. Tom is a frequent continuing education and industry speaker. A graduate in finance and accounting from Virginia Polytechnic Institute & State University, Tom is a member of the North Carolina CPA's and Chartered Financial Analyst Institute. He serves on the national investment committee and audit committee for the American Heart Association as well as a number of past and present board associations. Consultants On Call These are the Sponsors that will be available for Consultants On Call. If you would like to meet with any of these please check the box next to their name. Five 10 minutes time Slots: 1:45, 1:57, 2:09, 2:21 and 2:33 (with 2 minute table switches) President Sponsors BKD: Bob Brandenburg Long time Presidential Sponsor. Please don’t miss a chance to visit with them. RevOne Companies: Joe Huff, Joe Keller and Jennifer Taylor Long time Presidential Sponsor. Please don’t miss a chance to visit with them. Gold Sponsors CIPROMS Medical Billing: Casandra Graham and Cheryl Louks CIPROMS specializes in revenue cycle management for hospital-based groups including anesthesiologists, hospitalists, and emergency physicians as well as ASC and office-based practices. We provide full service or stand-alone billing options that are customized based on an initial needs analysis consultation. Our services include the following: Full service, stand-alone and ASP solutions ·∙ Provider enrollment and credentialing ·∙ Certified medical coding which includes education with physicians ·∙ Coding audits ·∙ ClaimAid: Brad Willkie and J Hopkins 25 years of eligibility experience and patient advocacy. Looking for Provider partners that want a comprehensive enrollment program, helping all of your un and under insured self-pay patients… not just high dollar in patient accounts. Comprehensive Patient Enrollment at every patient entry point you desire ·∙ New technology that offers a plethora of registration tools ·∙ Stake Holder with FSSA on the HIP 2.0 Roll Out (Ask us about the Road Show) ·∙ SSI and SSDI filings and appeals ·∙ Project flow into our sister company, ClaimAid Self-Pay Solutions, offering Early Out processes for unqualified ·∙ patients Navigator Training and Application Organization services ·∙ Cleverley + Associates: Bryan Gordon Cleverley + Associates has a staff of consultants, researchers, and experts dedicated to one thing; transforming data into meaningful and actionable solutions. A variety of backgrounds in education, hospital finance, billing & coding, cost management, and regulatory affairs provides the experience necessary to create custom solutions for our clients. We understand that no two hospitals are alike so we do not utilize cookie-cutter solutions. Our staff tailors the scope of each project around the specific client needs. This starts prior to engagement with a thorough needs analysis conducted by our Account Management staff and continues throughout the process to final results and custom action plans. Transformational Pricing Strategies and Transparency Policy Reviews Cost Containment Strategies Revenue Enhancement Opportunities Coding and Billing Reviews Commerce Bank: Chris Comerford Cutting-edge patient loan financing program from Commerce Bank The Affordable Care Act and high-deductible insurance plans have expanded the need for patient payment solutions. Commerce Bank’s Health Services Financing (HSF) program features a line of credit that can be presented to patients, or the financially responsible party, upfront at the point of service, or during the backend billing cycle via the phone. Commerce Bank’s Health Services Financing (HSF) allows Providers to offer patients, regardless of credit history, up to a $50,000 Commerce Bank line of credit that can be offered in person or over the phone at any point in the revenue cycle, or even by your existing revenue cycle outsource partners. Health Services Financing (HSF) is a completely paperless solution and enrollment is fast and easy. All you need is web access and anyone in your revenue cycle team can electronically enroll a patient through our HSF web portal. Fifth Third Bank: Teresa Kimberlee Ray Fifth Third Bank Healthcare is committed to helping your organization find opportunities to operate more efficiently and profitably. Our deep involvement in the operational, policy and regulatory aspects of the healthcare industry, combined with our experience in financial services gives us a unique level of understanding. Using a consultative approach, our dedicated healthcare teams leverage this knowledge to deliver practical advice and guidance that helps you meet all of your business needs, from corporate solutions to personal financial services for your employees. McGladrey: Chris Burke McGladrey is a leading provider of assurance, tax and consulting services focused on the middle market. We help guide health care organizations through complex business challenges by understanding their needs and bringing together the right team to address them. With our depth of experience and breadth of resources, we help address these industry challenges to meet our clients' unique needs. From accounting and tax to reimbursement and health care information technology, our specialists deliver effective and affordable solutions to nearly 3,000 health care institutions across the nation. With more than 6,700 professionals in 75 U.S. cities and access to more than 32,000 people in 100 countries through our membership in RSM International, we can meet your needs wherever in the world you do business. Plante Moran: Jean Young Plante Moran is the nation’s 13th largest public accounting, tax and consulting firm. We were founded 90 years ago and while we serve clients in every state, our offices and our roots are in the Midwest. The Plante Moran healthcare industry practice is made up of more than 200 specialists that understand and serve the entire care continuum, including community hospitals; health systems; critical access hospitals; skilled nursing, assisted living, and continuing care retirement communities; and home and community based services. We help providers understand and implement strategies that will ensure their long-term success in a post-reform world. Our advisors at the conference will be happy to discuss any of these topics with you as well as our related services: Getting more value from your audit ·∙ Tax compliance strategies that protect your community benefit status ·∙ The most often missed opportunities for reimbursement optimization ·∙ Bundled payments and managed care contracting best practices ·∙ Data analytics you’ll need to thrive under at-risk models of care ·∙ Post-acute collaboration strategies ·∙ Rycan: Nick Kuzera Having been a leader in healthcare revenue cycle software solutions for over twenty-seven years, Rycan has built its reputation by providing best-of-breed solutions to hospitals and healthcare systems, maximizing their reimbursement while increasing productivity. Denial Management: Improve efficiency by identifying, automating and resolving denied claims in a single system. ·∙ Claim Submission: Maximize claim acceptance and correct payment on the first submission. ·∙ Patient Liability Estimates: Equip your staff to provide your community defensible and transparent pricing. ·∙ Contract Management: Manage complex contracts and automatically validate reimbursement. ·∙ ·∙ VHC Vaughan Holland Consulting : Frank Morelli Today a complete retrospective Medicare claims review must be considered a best practice. VHC, Inc. has been in business for 18 years, making sure hospitals receive all the revenue they deserve while improving your internal processes which helps in preventing future losses. ·∙ ·∙ ·∙ ·∙ Focused Revenue Recovery for Medicare Inpatient, Outpatient, Medicare Advantage, Commercial Inpatient & Commercial Outpatient We go back 4 years to recover revenue from zero-balance paid claims, which can create a substantial revenue stream for your hospital We work on a contingency fee basis and also offer a complete CDM Review Our goal is to make certain hospitals receive all the revenue they deserve while making sure they remain compliant Silver Sponsors Allied Business Solutions: Brian Siebers Have you decided how you will implement 501r when it becomes mandatory? ·∙ What steps have you taken toward preparing for 501r? If an Early Out or Bad Debt partner could assist with 501r compliance, would you be interested in discussing how? ·∙ Can your patients with Early Out balances currently make payments over the phone 24 hours a day? ·∙ Can your patients with Bad Debt balances currently make payments over the phone 24 hours a day? ·∙ Can your patients currently make any payments on an account on a website 24 hours a day? ·∙ Americollect: Nick McLaughlin Established in 1964, The Ridiculously Nice Collection Agency is looking for hospitals that care both about maximizing cash recovery and patient happiness. Our Bad Debt and Extended Business Office programs collect more because: We treat Patients Ridiculously Nice. ·∙ Happy people collect more, and Americollect is the Best Place to Work in Collections according to InsideARM.com. ·∙ Our sophisticated predictive dialer technology, along with a large workforce (150 representatives), allows us to connect ·∙ with more patients when they have the ability to pay. Blue and Co.: Megan Iemma, Maddie Gookins and Lynette Thom, RHIT, CDIP, AHIMA-Approved ICD-10-CM/ PCS Trainer We are ranked the 53rd largest CPA firm in the U.S. by Accounting Today, has grown from a startup in 1970 to eight offices in three states (IN, KY and OH), by developing a culture of responsive solutions for our clients. We have a solid reputation for providing candid, accurate business advice that helps our clients succeed. Our long and concentrated involvement in the healthcare industry has imparted our professional staff with an acute awareness of administrative, organizational, and financial needs enabling us to consistently exceed our client’s expectations. As our commercial healthcare practice leader, Megan Iemma will be able to Clarify commercial managed care language ·∙ Offer solutions to problematic claim denials from commercial carriers ·∙ Assist in identifying the root cause of inconsistent/incorrect payments from commercial carriers ·∙ Capio Partners – Joshua White Capio Partners provides revenue cycle solutions for some of the nation’s leading healthcare providers and hospital systems, converting uncollected receivables into cash. Capio's Complaintless Collections™ model helps optimize healthcare revenue cycles through best practices that focus on educating and advocating for patients, while remaining fully compliant with industry regulations. ·∙ Leading buyer of healthcare debt ·∙ Non-recourse with seller buy-back rights ·∙ Ongoing data & analytic feedback ·∙ Over 500 hospital clients ·∙ Over 16 million patient accounts ·∙ Selected Best Places to Work in Collections 2012, 2013 & 2014 Enablecomp We focus exclusively on Workers’ Compensation reimbursement for over 465 hospitals nationwide. As a best practice focused company we use data analytics and proprietary technology to achieve optimal results for our clients better than anyone and built our entire business on that premise. Our proprietary technology, combined with our experienced staff, provides a distinguishable advantage that ensures our clients receive what they are owed and are paid promptly. We remove the complexity and payer challenges associated with WC and can help accelerate your cash flow. Day 1 ·∙ Aged Accounts ·∙ Zero-Balance Recovery ·∙ Individual prompt-pay settlements ·∙ Hardamon and Associates: Tom Quellhorst LEGAL ISSUES Hospital Liens ·∙ Estate Claims ·∙ Bankruptcy Proof of Claims ·∙ REVENUE CYCLE ENHANCEMENT Workers Compensation follow-up and review ·∙ MVA/3rd Party Program ·∙ UNINSURED/CHARITY SUPPORT Financial Assistance high-dollar reviews ·∙ Financial Assistance large volume reviews ---COMMERCIAL INSURANCE ·∙ Healthcare Insights LLC: Farrah Mahoney Healthcare Insights, LLC’s INSIGHTS® gives managers access to critical information and processes linking daily, biweekly, and monthly operations with budgets. INSIGHTS is the powerful, user-friendly software application, service, and support suite ranked Best by KLAS for 2011, 2012 and 2013. INSIGHTS integrates strategic financial planning, budgeting, rolling forecasts, labor productivity, supply chain management, cost accounting, service-line reporting and patient analytics to enable decision makers to control costs, allocate resources, identify opportunities, and improve results. IMC Credit Services: Angie Wells Offering comprehensive receivables management services for the healthcare industry including Early-out (1st and 3rd party), Payment Monitoring and Bad Debt (Primary and Secondary) Qualified, experienced and professional staff, specializing in healthcare collections and focusing on a positive ·∙ patient experience State-of-the-art technology, enabling clients compliant and secure online access, including electronic account ·∙ placement Insurance verification and troubleshooting, as well as electronic insurance billing on accounts placed ·∙ Dedicated Litigation Support Department that provide investigation, verification and preparation of client ·∙ approved lawsuits Magnet Solutions/ Accelerated Receivables Solutions: Darren Cook Magnet Solutions and Accelerated Receivables Solutions(ARS) provide healthcare receivable management services designed to drive down the COST OF RECOVERY and increase CASH FLOW. We offer CUSTOMIZED SOLUTIONS tailored to the needs of each individual client. Our CERTIFIED patient accounts representatives strive to be the caring face of your healthcare facility. Services: Magnet: Early Out Self-Pay Recovery, Presumptive Charity Scoring, Point of Service Collections training ARS: Pre-Collect, Third Party Bad Debt, Legal Recovery, Credit Reporting Medical Protective: Jennifer Wiggins Indiana’s largest and most experienced healthcare malpractice insurance company, Medical Protective is a national leader in insurance and risk solutions for physicians, dentists, allied providers, facilities, hospitals and healthcare systems. With over $800 million in annual premium, MedPro has been protecting the assets and reputations of healthcare providers for more than 110 years and is rated A++ (Superior) by A.M. Best. MedPro is a Berkshire Hathaway business. More information about MedPro is available at www.medpro.com. MMIC: AJ Beck MMIC (the largest insurer of medical liability insurance in the Midwest) provides physicians, clinics, hospitals and care facilities with medical professional liability insurance, exceptional risk management, claim management and health IT services. We empower caregivers to provide the best medical care possible while promoting safety and minimizing risk. Our full-service organization has been partnering with medical professionals for more than 31 years with the goal of protecting and promoting the practice of good medicine. Client retention rate of 99% over the past six years. Net Revenue Associates: Bill Bauza Net Revenue is a revenue enhancement company that offers a GUARANTEED ROI! ·∙ We have a proprietary process to find lost revenue, recover said revenue, and then implement training & education of the staff to continue to keep revenue from being lost again! ·∙ We work on a contingency fee basis, which equals a GUARANTEED ROI! Performance Services: Jim Christie We are an engineering and construction company with expertise focused around delivering precise environments (temperature, humidity, pressure, filtration, etc.) in your most critical spaces (ORs, Labs, ICUs, ERs) while also guaranteeing energy savings as part of the project delivery. Happy surgeons, staff, and patients because of the guaranteed Indoor Environmental Quality (IEQ), thus helping ·∙ HCAHPS scores. Improved infection control through your precise and guaranteed IEQ, again helping HCAHPS scores. ·∙ No budget overruns because Performance Services, Inc. has a “no change order” project guarantee. ·∙ Guaranteed 15-20% energy savings with no required upfront capital expenditure through our Energy Leadership ·∙ Program. PNC Healthcare Services: PNC Healthcare supports clients with solutions including revenue cycle automation, treasury management, credit, capital markets, equipment financing, and institutional investments services. We have developed a full array of integrated solutions for the healthcare industry, including registration, eligibility, verification, estimation, denial prevention workflow, revenue consulting, clearinghouse services, banking and treasury management services. Our goal is to not just provide products, but rather to develop total client relationships for the long-term and deliver solutions that add value to organizations. ·∙ ·∙ ·∙ ·∙ ·∙ ·∙ ·∙ Receivable Recovery Partners: Tom Loughery People helping people reach a higher outcome of success, for your patient and your Hospital. Two Companies, Many solutions: Receivable Recovery Partners and Outsource Billing Services believe experience counts most in Healthcare Receivables Management. Our companies are designed to show you possibilities , whether it's incorporating new strategies, or giving a fresh take on a current process for improvement. Pre-Collect Bad Debt Resolution EBO (Extended Business Office) Insurance Billing and Follow-up Insurance Clean-up First Party Liability Resolution Recondo Technology Ensure prompt and proper payment with our intelligent “no-touch” technology fueled by Recondo’s proprietary Reconbot technology. Integrated Payer Authorization Management ·∙ Real-Time, Accurate Patient Estimation ·∙ Enriched Eligibility and Benefit Data ·∙ Analytics Driven Denial Avoidance ·∙ Exception Based Automated Claims Management ·∙ Enriches, Actionable Claim Status Data ·∙ Extended Business Office Services ·∙ Craneware: Drake Alldaffer · Optimizing reimbursement. · Minimizing compliance risk. · Increasing operational efficiency. Download your free Revenue Integrity Survival Guide onto your smartphone by scanning the QR code or visiting www.craneware.com/survival REVENUE INTEGRITY SOLUTIONS® · Revenue Cycle · Supply Management · Audit & Revenue Recovery · Access Management & · Strategic Pricing Winter Institute Registration Form HFMA Member ______ Non-Member ______ Student Member ________ Name: __________________________________________ Name Badge Name: ________________________________ Title: ___________________________________________ Email: __________________________________________ Organization: _____________________________________________ Phone: _________________________________ Address: _____________________________________ City/State/Zip: _______________________________________ _____ Officer _____ Board Member ______ Sponsor ______ Vendor ______ Speaker ______ New Member REGISTRATION FEES: By January 14 Member: _____ One Day - $175 Fee Summary: _____ Both Days - $240 Non-Member: _____ One Day - $195 _____ Both Days - $275 After January 14 Registration Fees $ ________ Reception (Guest charge) TOTAL DUE $ ________ $ ________ Member: _____One Day - $190 _____ Both Days - $255 Non-Member: _____ One Day - $210 Student: I would like to participate in Consultants On Call and have indicated the five (5) groups I would like to meet with on the previous page Yes No _____ Both Days - $290 I will attend the Thursday Reception: Yes No _____ Flat Fee - I will attend the Late Night Euchre Party: Yes No I will bring a Winter Outerwear Donation: Yes No $ 25.00 Thursday Reception: No Charge To Member/$ 25.00 per guest. Special Requests: ____ Opt Out of receiving emails/other institute details. Other: ____________________________ Indicate any dietary or other restrictions: ______________________________________________________________ Break-out Session: I plan to attend: _____ Session # 1: Jeff Heaphy-Plante Moran - OR - _____ Session # 2: Albert Lin & Steve Forry - Ice Miller PAYMENT METHOD: ____ CHECK - Payable to: HFMA - Pressler Memorial Chapter _____ CREDIT CARD Card Number: ___________________________________ Exp. Date: ____________________ Security Code: _________ Name on Card: ______________________________________________ Total Amount To Be Charged: $______________ Billing Address (if different than above): __________________________________________________________________ _______________________________________________________________________________________________ Email Receipt To: _________________________________ Office Use Only: Date: ______________ Recpt Sent _________ Trans. # ____________________ Ck# ______________ RETURN COMPLETED FORM TO: HFMA - Indiana 2106 Remington Drive - Indianapolis, IN 46227 Email: [email protected] Fax: 317-300-7059 Attn: Shelly Haggard

© Copyright 2026