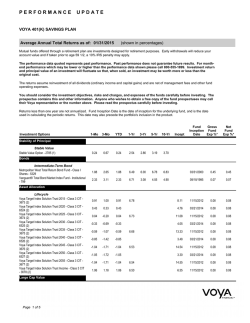

Display monthly fund performance

PERFORMANCE UPDATE Voya Retirement Insurance and Annuity Company OPPORTUNITY PLUS Variable Annuity Account C, Non-Standardized Returns without a Deferred Sales Charge Average Annual Total Returns as of: 01/31/2015 (shown in percentages) Variable annuities are long-term investment vehicles designed for retirement purposes which allow you to allocate contributions among variable investment options that have the potential to grow tax-deferred with an option to receive a stream of income at a later date. Early withdrawals from variable annuities may be subject to surrender charges, and if taken prior to age 59 1/2, a 10% IRS penalty may apply. Withdrawals will also reduce the applicable death benefit and cash surrender value/account value. The performance data quoted represents past performance. Past performance does not guarantee future results. For monthend performance which may be lower or higher than the performance data shown please call 800-677-4636. Investment return and principal value of an investment will fluctuate so that, when sold, an investment may be worth more or less than the original cost. These numbers reflect annual deductions from the Separate Account as follows: for Voya Money Market Portfolio, a 1.25% annual deduction prior to February 15, 2000, a 0.35% annual deduction between February 16, 2000 and January 31, 2012, and 0.45% annual from February 1, 2012 through April 30, 2013, and a 0.55% annual deduction thereafter; and for all other sub accounts, a 1.25% annual deduction prior to February 15, 2000, a 1.10% annual deduction from February 15, 2000 through February 14, 2001, a 1.05% annual deduction from February 15, 2001 through February 14, 2002, a 1.00% annual deduction from February 15, 2002 through January 31, 2012, and a 1.10% annual deduction thereafter from February 1, 2012 through April 30, 2013, and a 1.20% annual deduction thereafter. They also assume reinvestment of all dividends (ordinary income and capital gains) and are net of management fees and other fund operating expenses. Depending upon the type of contract in which you participate, you have either received prospectuses and/or prospectus summaries for the separate account and the funds/variable investment options (vios). You should consider the investment objectives, risks and charges, and expenses of the variable product and its underlying fund options carefully before investing. The prospectus contains this and other information. Anyone who wishes to obtain a free copy of the separate account and/or fund/vios prospectuses may call their Voya representative or the number above. Please read the prospectus or prospectus summaries carefully before investing. Returns less than one year are not annualized. Fund Inception Date is the date of inception for the underlying fund, and is the date used in calculating the periodic returns. The fund inception date indicates the inception date of the underlying investment portfolio, which may precede the portfolio's inclusion in the product. Investment Options 1-Mo 3-Mo YTD 1-Yr 3-Yr 5-Yr 10-Yr Money Market Voya Money Market Portfolio - Class I (2) -0.05 -0.14 -0.05 -0.53 -0.49 The 7-day annualized Subaccount yield as of 01/31/2015 is -0.55%, which more closely reflects current earnings. (14) -0.38 1.20 Stability of Principal Voya Fixed Account (1)(13) This fund is not part of the product's separate account. Incept Fund Inception Date Stability of Principal 01/01/1980 0.25 0.75 0.25 3.00 3.00 3.07 3.29 High Yield Bond Fidelity® VIP High Income Portfolio - Initial Class Voya High Yield Portfolio - Institutional Class 0.26 0.73 -2.48 -1.93 0.26 0.73 -0.37 0.46 4.72 5.11 6.41 6.70 5.27 6.18 09/19/1985 05/03/2004 Inflation-Protected Bond American Century Inflation-Adjusted Bond Fund - Inv Class PIMCO VIT Real Return Portfolio - Administrative Class 3.00 3.42 1.75 1.41 3.00 3.42 2.55 3.15 -1.02 -0.24 2.71 3.30 3.20 3.54 02/10/1997 09/30/1999 Bonds Intermediate-Term Bond Page 1 of 12 See Performance Introduction Page for Important Information Investment Options Incept Fund Inception Date 1-Mo 3-Mo YTD 1-Yr 3-Yr 5-Yr 10-Yr Voya Aggregate Bond Portfolio - Service Class Voya Intermediate Bond Portfolio - Class I 2.09 1.84 3.11 2.07 2.09 1.84 4.85 5.75 2.47 4.11 3.35 5.41 4.01 3.84 Long-Term Bond Nuveen U.S. Infrastructure Income Fund - Class I 2.55 3.48 2.55 Short Government Loomis Sayles Limited Term Government and Agency Fund - Cl Y 0.58 0.40 0.58 0.79 0.32 1.23 2.48 03/31/1994 World Bond Voya Global Bond-Int / Janus Aspen Flexible Inc-Inst (3) Voya Global Bond Portfolio - Initial Class 0.57 0.57 -2.07 -2.07 0.57 0.57 -0.96 -0.96 -0.69 -0.69 3.40 3.40 3.40 3.35 09/13/1993 11/08/2004 Lifecycle Voya Solution 2015 Portfolio - Initial Class (4) Voya Solution 2025 Portfolio - Initial Class (4) Voya Solution 2035 Portfolio - Initial Class (4) Voya Solution 2045 Portfolio - Initial Class (4) Voya Solution 2055 Portfolio - Initial Class (4) Voya Solution Income Portfolio - Initial Class (4) 0.31 -0.48 -0.99 -1.25 -1.41 0.58 0.59 -0.22 -0.74 -0.95 -0.99 0.88 0.31 -0.48 -0.99 -1.25 -1.41 0.58 5.99 6.31 7.05 7.64 7.73 5.83 6.43 8.71 10.10 11.11 11.19 5.57 6.80 8.64 9.57 10.30 Lifestyle Voya Strategic Allocation Conservative Portfolio - Class I Voya Strategic Allocation Growth Portfolio - Class I Voya Strategic Allocation Moderate Portfolio - Class I 0.30 -1.04 -0.40 0.49 -0.81 -0.07 0.30 -1.04 -0.40 6.82 7.65 7.31 7.93 10.96 9.29 7.85 9.91 8.79 4.01 4.21 4.05 07/05/1995 07/05/1995 07/05/1995 Aggressive Allocation Pax World Balanced Fund - Individual Investor Class -1.70 -0.60 -1.70 7.60 8.22 8.14 4.00 08/10/1971 Moderate Allocation Calvert VP SRI Balanced Portfolio Fidelity® VIP Asset Manager Portfolio - Initial Class Voya Balanced Portfolio - Class I VY Inv Eqty & Inc Port I/Janus Asp Balanced I (3) VY® Invesco Equity and Income Portfolio - Initial Class -1.46 0.66 -0.64 -2.91 -2.91 -0.43 0.30 -0.57 -1.25 -1.25 -1.46 0.66 -0.64 -2.91 -2.91 8.74 5.00 6.59 6.72 6.72 9.52 8.56 9.03 11.84 11.84 9.88 8.34 8.67 9.71 9.71 4.33 5.28 4.05 5.85 6.05 09/02/1986 09/06/1989 04/03/1989 09/13/1993 12/10/2001 Large Blend Amana Income Fund - Investor Class Fidelity® VIP Index 500 Portfolio - Initial Class Invesco V.I. Core Equity Fund - Series I Shares Voya Growth and Income Portfolio - Class I Voya Index Plus LargeCap Portfolio - Class I -3.25 -3.10 -3.17 -2.25 -2.54 -1.62 -0.96 -2.39 -1.08 -0.62 -3.25 -3.10 -3.17 -2.25 -2.54 9.30 12.75 6.37 10.46 13.96 12.37 16.01 12.20 14.83 16.01 11.00 14.24 10.20 12.92 13.56 8.66 6.44 6.36 6.36 5.67 06/23/1986 08/27/1992 05/02/1994 12/31/1979 09/16/1996 Large Value American Century Income & Growth Fund - A Class (5) American Funds Washington Mutual Investors FundSM - R-4 (6) Fidelity VIP Equity-Income Portfolio - Initial Class Voya Large Cap Value Pt Inst/Pioneer EqtyInc VCT - I ++ (7) Voya Large Cap Value Portfolio - Institutional Class VY® Invesco Comstock Portfolio - Service Class -3.19 -3.31 -3.52 -3.22 -3.22 -5.12 -1.46 -1.88 -2.72 -1.90 -1.90 -3.59 -3.19 -3.31 -3.52 -3.22 -3.22 -5.12 11.81 10.06 7.49 10.05 10.05 6.56 15.94 14.59 13.75 14.32 14.32 15.09 14.11 13.56 12.40 13.97 13.97 12.73 5.42 6.04 5.03 6.43 5.22 12/17/1990 07/31/1952 10/09/1986 03/01/1995 05/11/2007 05/01/2002 -2.19 -3.36 -1.28 -2.56 -1.10 -0.28 -0.51 -0.72 -1.18 -0.43 -2.19 -3.36 -1.28 -2.56 -1.10 5.28 11.96 8.93 10.79 9.23 13.22 11.46 16.23 15.26 15.28 10.61 11.04 13.01 13.52 13.84 7.14 8.56 7.06 7.63 6.95 12/04/2000 02/03/1994 12/01/1973 01/03/1995 07/03/1995 05/01/2002 05/23/1973 6.05 05/08/2014 Asset Allocation 3.85 4.22 4.63 4.90 9.14 3.77 5.74 04/29/2005 04/29/2005 04/29/2005 04/29/2005 03/08/2010 04/29/2005 Balanced Large Cap Value 3.81 Large Cap Growth Large Growth Alger Green Fund - Class A Amana Growth Fund - Investor Class American Funds The Growth Fund of America - Class R-4 (8) Fidelity VIP Contrafund Portfolio - Initial Class Invesco V.I. American Franchise Fund - Series I Shares Page 2 of 12 See Performance Introduction Page for Important Information Incept Fund Inception Date Investment Options 1-Mo 3-Mo YTD 1-Yr 3-Yr 5-Yr 10-Yr Voya Large Cap Growth Portfolio - Institutional Class Voya Russell Large Cap Growth Index Portfolio - Class I VY® T. Rowe Price Growth Equity Portfolio - Initial Class -1.05 -1.66 -0.29 0.61 -0.26 0.18 -1.05 -1.66 -0.29 15.12 13.65 9.17 16.51 15.53 17.58 15.43 14.42 15.88 9.38 7.72 05/03/2004 05/01/2009 11/28/1997 Mid-Cap Blend Invesco Mid Cap Core Equity Fund - Class A Lord Abbett Series Fund - Mid Cap Stock Portfolio - Cl VC Voya Index Plus MidCap Portfolio - Class I -2.99 -3.06 -1.85 -3.31 0.17 0.12 -2.99 -3.06 -1.85 2.77 9.94 9.42 9.53 14.08 15.39 8.35 13.61 14.92 5.69 5.41 7.16 06/09/1987 09/15/1999 12/16/1997 Mid-Cap Growth Voya MidCap Opportunities Portfolio - Class I VY® Baron Growth Portfolio - Service Class VY T.Rowe Price Div MidCap-I/Janus Aspen MidCap - I (3) VY® T. Rowe Price Diversified Mid Cap Growth Port - Initial -1.81 -1.05 -1.50 -1.50 2.18 1.56 1.55 1.55 -1.81 -1.05 -1.50 -1.50 8.86 6.39 10.75 10.75 13.46 16.78 15.77 15.77 15.90 16.86 16.14 16.14 9.69 7.66 8.37 8.40 05/05/2000 05/01/2002 09/13/1993 12/10/2001 Mid-Cap Value BlackRock Mid Cap Value Opportunities Fund - Inv A Shares Invesco American Value Fund - Class R5 -3.14 -2.61 -2.54 -0.51 -3.14 -2.61 4.45 9.05 12.42 15.78 13.72 15.07 7.47 8.43 02/01/1995 10/18/1993 Small Blend Voya Index Plus SmallCap Portfolio - Class I Voya Small Company Portfolio - Class I -2.89 -3.19 -0.25 0.19 -2.89 -3.19 5.02 5.30 14.16 13.86 14.39 14.02 5.76 8.27 12/19/1997 12/27/1996 Small Growth Voya SmallCap Opportunities Portfolio - Class I -2.49 -0.26 -2.49 5.48 14.50 16.58 8.96 05/06/1994 Small Value Franklin Small Cap Value VIP Fund - Class 2 (9) Wells Fargo Advantage Special Small Cap Value Fund - Class A -5.65 -3.58 -4.81 -0.83 -5.65 -3.58 -0.88 5.65 11.41 13.70 13.07 13.62 6.34 6.93 05/01/1998 05/07/1993 Specialty - Commodities PIMCO CommodityRealReturn Strategy Fund® - Admin Class -1.91 -15.52 -1.91 -21.27 -13.00 -4.95 -1.86 02/14/2003 Specialty - Natural Resources Voya Global Resources Portfolio - Service Class -4.60 -14.88 -4.60 -12.80 -4.67 0.96 5.23 01/24/1989 Specialty - Precious Metals USAA Precious Metals and Minerals Fund - Adviser Shares 14.65 20.80 14.65 -5.44 -26.98 4.44 4.74 4.44 19.46 11.90 11.84 Diversified Emerging Mkts Oppenheimer Developing Markets Fund - Class A VY® JPMorgan Emerging Markets Equity Portfolio - Inst (10) -1.36 2.14 -9.83 -5.01 -1.36 2.14 0.80 10.56 2.93 0.47 5.11 3.11 9.86 8.28 11/18/1996 02/18/1998 Foreign Large Blend American Funds EuroPacific Growth Fund - Class R-4 (11) Fidelity VIP Overseas Portfolio - Initial Class Voya International Index Portfolio - Class I 0.92 -0.15 0.75 -1.35 -2.42 -3.07 0.92 -0.15 0.75 1.28 -4.40 -1.76 8.65 9.30 7.66 5.93 6.39 5.24 5.81 3.95 0.09 04/16/1984 01/28/1987 03/04/2008 Foreign Large Value VY® Templeton Foreign Equity Portfolio - Initial Class 0.32 -1.84 0.32 -2.76 7.13 5.16 2.80 01/03/2006 World Allocation Voya Global Perspectives Portfolio - Class I 0.17 -0.48 0.17 5.04 4.41 04/25/2013 -0.49 0.64 0.05 0.31 -0.49 0.64 5.68 15.40 12.66 12.97 10.32 11.67 7.19 -0.42 -0.42 -1.14 -1.14 -0.42 -0.42 4.60 4.60 13.16 13.16 10.46 10.46 6.60 6.52 16.32 Small/Mid/Specialty Specialty - Real Estate VY® Clarion Global Real Estate Portfolio - Institutional -16.44 08/02/2010 4.79 01/03/2006 Global / International World Stock American Funds New Perspective Fund - Class R-4 (12) Nuveen Global Infrastructure Fund - Class I Voya Global Value Advantage Portfolio - Class S VY Oppenheimer Global-Int/Janus Aspen Worldwide Gr-Inst (3) VY® Oppenheimer Global Portfolio - Initial Class Page 3 of 12 4.48 03/13/1973 12/17/2007 01/28/2008 09/13/1993 05/01/2002 The risks of investing in small company stocks may include relatively low trading volumes, a greater degree of change in earnings and greater short-term volatility. Foreign investing involves special risks such as currency fluctuation and public disclosure, as well as economic and political risks. Some of the Funds invest in securities guaranteed by the U.S. Government as to the timely payment of principal and interest; however, shares of the Funds are not insured nor guaranteed. High yielding fixed-income securities generally are subject to greater market fluctuations and risks of loss of income and principal than are investments in lower yielding fixed-income securities. Sector funds may involve greater-than average risk and are often more volatile than funds holding a diversified portfolio of stocks in many industries. Examples include: banking, biotechnology, chemicals, energy, environmental services, natural resources, precious metals, technology, telecommunications, and utilities. Page 4 of 12 PERFORMANCE UPDATE Voya Retirement Insurance and Annuity Company OPPORTUNITY PLUS Variable Annuity Account C, Non-Standardized Returns with a Deferred Sales Charge Average Annual Total Returns as of: 01/31/2015 (shown in percentages) The performance data quoted represents past performance. Past performance does not guarantee future results. For monthend performance which may be lower or higher than the performance data shown please call 800-677-4636. Investment return and principal value of an investment will fluctuate so that, when sold, an investment may be worth more or less than the original cost. These numbers reflect annual deductions from the Separate Account as follows: for Voya Money Market Portfolio, a 1.25% annual deduction prior to February 15, 2000, a 0.35% annual deduction between February 16, 2000 and January 31, 2012, and 0.45% annual from February 1, 2012 through April 30, 2013, and a 0.55% annual deduction thereafter; and for all other sub accounts, a 1.25% annual deduction prior to February 15, 2000, a 1.10% annual deduction from February 15, 2000 through February 14, 2001, a 1.05% annual deduction from February 15, 2001 through February 14, 2002, a 1.00% annual deduction from February 15, 2002 through January 31, 2012, and a 1.10% annual deduction thereafter from February 1, 2012 through April 30, 2013, and a 1.20% annual deduction thereafter. They also assume reinvestment of all dividends (ordinary income and capital gains) and are net of management fees and other fund operating expenses. The maximum applicable deferred sales charge , which declines over 10 as follows: 5%, 5%, 5%, 5%, 5%, 4%, 4%, 3%, 3%, 2%. Returns less than one year are not annualized. Fund Inception Date is the date of inception for the underlying fund, and is the date used in calculating the periodic returns. The fund inception date indicates the inception date of the underlying investment portfolio, which may precede the portfolio's inclusion in the product. Investment Options 1-Mo 3-Mo YTD 1-Yr Incept Fund Inception Date 3-Yr 5-Yr 10-Yr Money Market Voya Money Market Portfolio - Class I (2) -5.04 -5.13 -5.04 -5.51 -2.17 The 7-day annualized Subaccount yield as of 01/31/2015 is -0.55%, which more closely reflects current earnings. (14) -1.40 1.20 01/01/1980 Stability of Principal Bonds High Yield Bond Fidelity® VIP High Income Portfolio - Initial Class Voya High Yield Portfolio - Institutional Class -4.75 -4.31 -7.36 -6.83 -4.75 -4.31 -5.35 -4.56 2.94 3.32 5.33 5.61 5.27 6.18 09/19/1985 05/03/2004 Inflation-Protected Bond American Century Inflation-Adjusted Bond Fund - Inv Class PIMCO VIT Real Return Portfolio - Administrative Class -2.15 -1.75 -3.34 -3.66 -2.15 -1.75 -2.58 -2.01 -2.70 -1.93 1.66 2.24 3.20 3.54 02/10/1997 09/30/1999 Intermediate-Term Bond Voya Aggregate Bond Portfolio - Service Class Voya Intermediate Bond Portfolio - Class I -3.01 -3.25 -2.05 -3.03 -3.01 -3.25 -0.40 0.47 0.73 2.35 2.29 4.34 4.01 3.84 05/01/2002 05/23/1973 Long-Term Bond Nuveen U.S. Infrastructure Income Fund - Class I -2.57 -1.69 -2.57 Short Government Loomis Sayles Limited Term Government and Agency Fund - Cl Y -4.45 -4.62 -4.45 -4.25 -1.38 0.20 2.48 03/31/1994 World Bond Voya Global Bond-Int / Janus Aspen Flexible Inc-Inst (3) Voya Global Bond Portfolio - Initial Class -4.46 -4.46 -6.97 -6.97 -4.46 -4.46 -5.91 -5.91 -2.37 -2.37 2.35 2.35 3.40 3.35 09/13/1993 11/08/2004 Asset Allocation Lifecycle Page 5 of 12 0.75 05/08/2014 See Performance Introduction Page for Important Information 10-Yr Incept Fund Inception Date 3.31 3.67 4.09 4.35 8.00 3.23 04/29/2005 04/29/2005 04/29/2005 04/29/2005 03/08/2010 04/29/2005 Investment Options 1-Mo 3-Mo YTD 1-Yr 3-Yr 5-Yr Voya Solution 2015 Portfolio - Initial Class (4) Voya Solution 2025 Portfolio - Initial Class (4) Voya Solution 2035 Portfolio - Initial Class (4) Voya Solution 2045 Portfolio - Initial Class (4) Voya Solution 2055 Portfolio - Initial Class (4) Voya Solution Income Portfolio - Initial Class (4) -4.71 -5.46 -5.94 -6.19 -6.34 -4.45 -4.44 -5.21 -5.71 -5.90 -5.94 -4.16 -4.71 -5.46 -5.94 -6.19 -6.34 -4.45 0.69 0.99 1.70 2.26 2.35 0.54 4.63 6.87 8.23 9.23 9.31 3.78 5.71 7.53 8.45 9.17 Lifestyle Voya Strategic Allocation Conservative Portfolio - Class I Voya Strategic Allocation Growth Portfolio - Class I Voya Strategic Allocation Moderate Portfolio - Class I -4.72 -5.99 -5.38 -4.53 -5.77 -5.07 -4.72 -5.99 -5.38 1.48 2.26 1.95 6.10 9.08 7.44 6.75 8.79 7.68 4.01 4.21 4.05 07/05/1995 07/05/1995 07/05/1995 Aggressive Allocation Pax World Balanced Fund - Individual Investor Class -6.62 -5.57 -6.62 2.22 6.39 7.03 4.00 08/10/1971 Moderate Allocation Calvert VP SRI Balanced Portfolio Fidelity® VIP Asset Manager Portfolio - Initial Class Voya Balanced Portfolio - Class I VY Inv Eqty & Inc Port I/Janus Asp Balanced I (3) VY® Invesco Equity and Income Portfolio - Initial Class -6.39 -4.37 -5.61 -7.76 -7.76 -5.41 -4.71 -5.54 -6.19 -6.19 -6.39 -4.37 -5.61 -7.76 -7.76 3.30 -0.25 1.26 1.39 1.39 7.66 6.72 7.18 9.94 9.94 8.76 7.24 7.56 8.59 8.59 4.33 5.28 4.05 5.85 6.05 09/02/1986 09/06/1989 04/03/1989 09/13/1993 12/10/2001 Large Blend Amana Income Fund - Investor Class Fidelity® VIP Index 500 Portfolio - Initial Class Invesco V.I. Core Equity Fund - Series I Shares Voya Growth and Income Portfolio - Class I Voya Index Plus LargeCap Portfolio - Class I -8.09 -7.95 -8.01 -7.14 -7.42 -6.54 -5.91 -7.27 -6.03 -5.59 -8.09 -7.95 -8.01 -7.14 -7.42 3.84 7.11 1.05 4.94 8.26 10.47 14.04 10.30 12.88 14.04 9.86 13.08 9.08 11.77 12.40 8.66 6.44 6.36 6.36 5.67 06/23/1986 08/27/1992 05/02/1994 12/31/1979 09/16/1996 Large Value American Century Income & Growth Fund - A Class (5) American Funds Washington Mutual Investors FundSM - R-4 (6) Fidelity VIP Equity-Income Portfolio - Initial Class Voya Large Cap Value Pt Inst/Pioneer EqtyInc VCT - I ++ (7) Voya Large Cap Value Portfolio - Institutional Class VY® Invesco Comstock Portfolio - Service Class -8.03 -8.14 -8.34 -8.05 -8.05 -9.86 -6.38 -6.79 -7.58 -6.80 -6.80 -8.41 -8.03 -8.14 -8.34 -8.05 -8.05 -9.86 6.22 4.56 2.11 4.54 4.54 1.24 13.98 12.65 11.82 12.38 12.38 13.14 12.94 12.40 11.25 12.80 12.80 11.58 5.42 6.04 5.03 6.43 12/17/1990 07/31/1952 10/09/1986 03/01/1995 05/11/2007 05/01/2002 -7.08 -8.20 -6.21 -7.43 -6.04 -5.99 -6.57 -5.27 -5.27 -5.48 -5.69 -6.12 -5.41 -4.42 -5.24 -4.83 -7.08 -8.20 -6.21 -7.43 -6.04 -5.99 -6.57 -5.27 0.01 6.36 3.48 5.25 3.76 9.36 7.97 3.71 11.30 9.57 14.26 13.31 13.33 14.54 13.57 15.59 9.48 9.91 11.85 12.37 12.67 14.25 13.25 14.70 7.14 8.56 7.06 7.63 6.95 9.38 7.72 12/04/2000 02/03/1994 12/01/1973 01/03/1995 07/03/1995 05/03/2004 05/01/2009 11/28/1997 Mid-Cap Blend Invesco Mid Cap Core Equity Fund - Class A Lord Abbett Series Fund - Mid Cap Stock Portfolio - Cl VC Voya Index Plus MidCap Portfolio - Class I -7.84 -7.90 -6.75 -8.14 -4.84 -4.89 -7.84 -7.90 -6.75 -2.37 4.45 3.95 7.67 12.14 13.44 7.24 12.45 13.75 5.69 5.41 7.16 06/09/1987 09/15/1999 12/16/1997 Mid-Cap Growth Voya MidCap Opportunities Portfolio - Class I VY® Baron Growth Portfolio - Service Class -6.72 -6.00 -2.92 -3.52 -6.72 -6.00 3.42 1.07 11.54 14.80 14.72 15.66 9.69 7.66 05/05/2000 05/01/2002 4.66 Balanced Large Cap Value 3.13 5.22 Large Cap Growth Large Growth Alger Green Fund - Class A Amana Growth Fund - Investor Class American Funds The Growth Fund of America - Class R-4 (8) Fidelity VIP Contrafund Portfolio - Initial Class Invesco V.I. American Franchise Fund - Series I Shares Voya Large Cap Growth Portfolio - Institutional Class Voya Russell Large Cap Growth Index Portfolio - Class I VY® T. Rowe Price Growth Equity Portfolio - Initial Class 15.29 Small/Mid/Specialty Page 6 of 12 See Performance Introduction Page for Important Information Investment Options 1-Mo 3-Mo YTD 1-Yr 3-Yr 5-Yr 10-Yr VY T.Rowe Price Div MidCap-I/Janus Aspen MidCap - I (3) VY® T. Rowe Price Diversified Mid Cap Growth Port - Initial -6.42 -6.42 -3.53 -3.53 -6.42 -6.42 5.21 5.21 13.80 13.80 14.95 14.95 8.37 8.40 09/13/1993 12/10/2001 Mid-Cap Value BlackRock Mid Cap Value Opportunities Fund - Inv A Shares Invesco American Value Fund - Class R5 -7.98 -7.48 -7.42 -5.48 -7.98 -7.48 -0.77 3.60 10.51 13.81 12.56 13.90 7.47 8.43 02/01/1995 10/18/1993 Small Blend Voya Index Plus SmallCap Portfolio - Class I Voya Small Company Portfolio - Class I -7.75 -8.03 -5.24 -4.82 -7.75 -8.03 -0.23 0.04 12.22 11.93 13.22 12.86 5.76 8.27 12/19/1997 12/27/1996 Small Growth Voya SmallCap Opportunities Portfolio - Class I -7.37 -5.25 -7.37 0.21 12.56 15.39 8.96 05/06/1994 -10.37 -8.40 -9.57 -5.79 -10.37 -8.40 -5.83 0.37 9.52 11.77 11.92 12.46 6.34 6.93 05/01/1998 05/07/1993 Specialty - Commodities PIMCO CommodityRealReturn Strategy Fund® - Admin Class -6.82 -19.74 -6.82 -25.20 -14.47 -5.92 -1.86 02/14/2003 Specialty - Natural Resources Voya Global Resources Portfolio - Service Class -9.37 -19.13 -9.37 -17.16 -6.29 -0.07 5.23 01/24/1989 Specialty - Precious Metals USAA Precious Metals and Minerals Fund - Adviser Shares 8.92 14.76 8.92 -10.17 -28.22 Specialty - Real Estate VY® Clarion Global Real Estate Portfolio - Institutional -0.79 -0.50 -0.79 13.49 10.01 10.70 Diversified Emerging Mkts Oppenheimer Developing Markets Fund - Class A VY® JPMorgan Emerging Markets Equity Portfolio - Inst (10) -6.30 -2.96 -14.34 -9.76 -6.30 -2.96 -4.24 5.03 1.19 -1.23 4.04 2.06 9.86 8.28 11/18/1996 02/18/1998 Foreign Large Blend American Funds EuroPacific Growth Fund - Class R-4 (11) Fidelity VIP Overseas Portfolio - Initial Class Voya International Index Portfolio - Class I -4.13 -5.14 -4.28 -6.28 -7.30 -7.92 -4.13 -5.14 -4.28 -3.78 -9.18 -6.67 6.81 7.44 5.84 4.84 5.31 4.17 5.81 3.95 -0.65 04/16/1984 01/28/1987 03/04/2008 Foreign Large Value VY® Templeton Foreign Equity Portfolio - Initial Class -4.70 -6.75 -4.70 -7.62 5.32 4.08 2.22 01/03/2006 World Allocation Voya Global Perspectives Portfolio - Class I -4.83 -5.46 -4.83 -0.21 1.42 04/25/2013 -5.46 -4.39 -4.95 -4.71 -5.46 -4.39 0.40 9.63 10.76 11.06 9.20 10.53 7.19 -5.40 -5.40 -6.08 -6.08 -5.40 -5.40 -0.63 -0.63 11.24 11.24 9.33 9.33 6.60 6.52 Small Value Franklin Small Cap Value VIP Fund - Class 2 (9) Wells Fargo Advantage Special Small Cap Value Fund - Class A Incept Fund Inception Date -17.39 08/02/2010 4.20 01/03/2006 Global / International World Stock American Funds New Perspective Fund - Class R-4 (12) Nuveen Global Infrastructure Fund - Class I Voya Global Value Advantage Portfolio - Class S VY Oppenheimer Global-Int/Janus Aspen Worldwide Gr-Inst (3) VY® Oppenheimer Global Portfolio - Initial Class 3.73 The risks of investing in small company stocks may include relatively low trading volumes, a greater degree of change in earnings and greater short-term volatility. Foreign investing involves special risks such as currency fluctuation and public disclosure, as well as economic and political risks. Some of the Funds invest in securities guaranteed by the U.S. Government as to the timely payment of principal and interest; however, shares of the Funds are not insured nor guaranteed. High yielding fixed-income securities generally are subject to greater market fluctuations and risks of loss of income and principal than are investments in lower yielding fixed-income securities. Sector funds may involve greater-than average risk and are often more volatile than funds holding a diversified portfolio of stocks in many industries. Examples include: banking, biotechnology, chemicals, energy, environmental services, natural resources, precious metals, technology, telecommunications, and utilities. Page 7 of 12 03/13/1973 12/17/2007 01/28/2008 09/13/1993 05/01/2002 PERFORMANCE UPDATE Voya Retirement Insurance and Annuity Company OPPORTUNITY PLUS Variable Annuity Account C, Standardized Returns with a Deferred Sales Charge Average Annual Total Returns as of: 12/31/2014 (shown in percentages) The performance data quoted represents past performance. Past performance does not guarantee future results. For monthend performance which may be lower or higher than the performance data shown please call 800-677-4636. Investment return and principal value of an investment will fluctuate so that, when sold, an investment may be worth more or less than the original cost. These numbers reflect annual deductions from the Separate Account as follows: for Voya Money Market Portfolio, a 1.25% annual deduction prior to February 15, 2000, a 0.35% annual deduction between February 16, 2000 and January 31, 2012, and 0.45% annual from February 1, 2012 through April 30, 2013, and a 0.55% annual deduction thereafter; and for all other sub accounts, a 1.25% annual deduction prior to February 15, 2000, a 1.10% annual deduction from February 15, 2000 through February 14, 2001, a 1.05% annual deduction from February 15, 2001 through February 14, 2002, a 1.00% annual deduction from February 15, 2002 through January 31, 2012, and a 1.10% annual deduction thereafter from February 1, 2012 through April 30, 2013, and a 1.20% annual deduction thereafter. They also assume reinvestment of all dividends (ordinary income and capital gains) and are net of management fees and other fund operating expenses. The maximum applicable deferred sales charge , which declines over 10 as follows: 5%, 5%, 5%, 5%, 5%, 4%, 4%, 3%, 3%, 2%. Returns less than one year are not annualized. VAA Inception Date is the date on which contributions were first received in this fund under the Variable Annuity Account, and is the date used in calculating the periodic returns. Investment Options 1-Mo 3-Mo YTD 1-Yr 3-Yr 5-Yr 10-Yr Money Market Voya Money Market Portfolio - Class I (2) -5.05 -5.13 -5.51 -5.51 -2.17 The 7-day annualized Subaccount yield as of 12/31/2014 is -0.55%, which more closely reflects current earnings. (14) -1.39 1.21 5.17 Incept VAA Inception Date Stability of Principal 09/30/1975 Bonds High Yield Bond Fidelity® VIP High Income Portfolio - Initial Class Voya High Yield Portfolio - Institutional Class -6.90 -6.72 -6.61 -6.50 -5.05 -4.81 -5.05 -4.81 3.96 4.08 5.45 5.79 Inflation-Protected Bond American Century Inflation-Adjusted Bond Fund - Inv Class PIMCO VIT Real Return Portfolio - Administrative Class -6.31 -7.05 -5.61 -6.14 -3.63 -3.23 -3.63 -3.23 -2.98 -2.29 1.31 1.92 3.16 05/11/2009 05/03/2004 Intermediate-Term Bond Voya Aggregate Bond Portfolio - Service Class Voya Intermediate Bond Portfolio - Class I -4.94 -5.27 -3.25 -4.01 -1.26 0.13 -1.26 0.13 0.72 2.27 2.15 4.37 3.81 3.72 05/03/2002 05/31/1978 Long-Term Bond Nuveen U.S. Infrastructure Income Fund - Class I -4.56 -2.90 -2.78 06/23/2014 Short Government Loomis Sayles Limited Term Government and Agency Fund - Cl Y -5.32 -4.95 -5.11 05/19/2014 World Bond Voya Global Bond-Int / Janus Aspen Flexible Inc-Inst (3) Voya Global Bond Portfolio - Initial Class -6.80 -6.80 -6.90 -6.90 2.97 10/31/1994 03/23/2005 Asset Allocation Lifecycle Page 8 of 12 -5.73 -5.73 -5.73 -5.73 -1.53 -1.53 2.37 2.37 5.81 2.27 3.37 05/12/1998 05/10/2006 See Performance Introduction Page for Important Information 3-Yr 5-Yr 10-Yr Incept VAA Inception Date 4.10 7.29 9.34 10.79 8.90 2.93 09/04/2012 09/04/2012 09/04/2012 09/04/2012 09/14/2012 09/04/2012 Investment Options 1-Mo 3-Mo YTD 1-Yr Voya Solution 2015 Portfolio - Initial Class (4) Voya Solution 2025 Portfolio - Initial Class (4) Voya Solution 2035 Portfolio - Initial Class (4) Voya Solution 2045 Portfolio - Initial Class (4) Voya Solution 2055 Portfolio - Initial Class (4) Voya Solution Income Portfolio - Initial Class (4) -5.71 -5.89 -6.15 -6.18 -6.14 -5.58 -3.41 -3.15 -3.06 -2.84 -2.67 -3.50 -0.47 -0.67 -0.56 -0.18 0.02 -0.49 -0.47 -0.67 -0.56 -0.18 0.02 -0.49 Lifestyle Voya Strategic Allocation Conservative Portfolio - Class I Voya Strategic Allocation Growth Portfolio - Class I Voya Strategic Allocation Moderate Portfolio - Class I -5.70 -6.12 -5.89 -3.61 -3.04 -3.15 0.08 0.03 0.14 0.08 0.03 0.14 7.20 11.24 9.05 6.42 8.17 7.20 3.90 4.13 3.96 07/05/1995 07/05/1995 07/05/1995 Aggressive Allocation Pax World Balanced Fund - Individual Investor Class -5.84 -2.62 1.37 1.37 8.67 6.68 4.03 02/21/2001 Moderate Allocation Calvert VP SRI Balanced Portfolio Fidelity® VIP Asset Manager Portfolio - Initial Class Voya Balanced Portfolio - Class I VY Inv Eqty & Inc Port I/Janus Asp Balanced I (3) VY® Invesco Equity and Income Portfolio - Initial Class -5.92 -6.05 -6.07 -4.84 -4.84 -1.65 -4.51 -3.57 -3.35 -3.35 2.88 -0.66 -0.30 2.27 2.27 2.88 -0.66 -0.30 2.27 2.27 9.46 8.12 8.94 12.12 12.12 8.55 6.65 7.37 8.94 8.94 4.37 5.07 4.02 5.99 05/31/1989 03/31/1994 04/03/1989 06/30/1995 03/22/2005 Large Blend Amana Income Fund - Investor Class Fidelity® VIP Index 500 Portfolio - Initial Class Invesco V.I. Core Equity Fund - Series I Shares Voya Growth and Income Portfolio - Class I Voya Index Plus LargeCap Portfolio - Class I -5.83 -5.35 -5.88 -5.87 -5.52 -1.01 -0.65 -4.21 -2.47 -1.43 2.44 6.60 1.51 3.93 6.88 2.44 6.60 1.51 3.93 6.88 12.52 16.90 13.47 15.40 16.71 9.82 12.95 9.41 11.39 12.15 Large Value American Century Income & Growth Fund - A Class (5) American Funds Washington Mutual Investors FundSM - R-4 (6) Fidelity VIP Equity-Income Portfolio - Initial Class Voya Large Cap Value Pt Inst/Pioneer EqtyInc VCT - I ++ (7) Voya Large Cap Value Portfolio - Institutional Class VY® Invesco Comstock Portfolio - Service Class -5.66 -5.30 -5.71 -5.06 -5.06 -4.94 -0.80 -2.06 -3.50 -2.24 -2.24 -3.40 5.34 4.34 2.05 3.34 3.34 2.44 5.34 4.34 2.05 3.34 3.34 2.44 16.80 14.79 14.47 14.89 14.89 17.07 12.80 12.45 11.32 12.93 12.93 12.13 -6.44 -5.96 -5.94 -5.42 -6.60 -6.09 -6.41 -6.51 -1.41 0.93 -2.71 -1.65 -2.77 -0.37 -1.32 -1.20 -1.64 7.03 2.56 5.08 1.79 6.65 6.16 2.02 -1.64 7.03 2.56 5.08 1.79 6.65 6.16 2.02 14.18 12.65 17.39 16.23 8.66 9.77 11.11 11.95 17.26 16.19 18.20 12.57 13.36 7.43 05/12/2009 09/29/2008 05/03/2004 05/31/1995 04/27/2012 06/18/2010 07/17/2009 11/28/1997 Mid-Cap Blend Invesco Mid Cap Core Equity Fund - Class A Lord Abbett Series Fund - Mid Cap Stock Portfolio - Cl VC Voya Index Plus MidCap Portfolio - Class I -5.37 -4.74 -4.60 -5.73 0.81 -0.08 -1.90 4.69 2.84 -1.90 4.69 2.84 11.00 15.17 16.77 7.18 12.51 13.47 5.78 5.41 7.11 07/14/2004 07/26/2001 05/04/1998 Mid-Cap Growth Voya MidCap Opportunities Portfolio - Class I VY® Baron Growth Portfolio - Service Class -5.03 -4.43 1.31 1.02 2.17 -2.06 2.17 -2.06 14.60 16.74 13.81 15.06 9.64 7.73 08/02/2001 05/01/2002 Balanced 5.89 Large Cap Value 9.27 6.50 6.46 6.35 5.71 5.47 6.15 5.14 6.57 3.41 5.44 09/29/2008 05/31/1995 05/10/1999 05/01/1975 10/31/1996 01/30/2001 05/03/2004 05/31/1994 07/26/2001 05/31/2007 05/06/2002 Large Cap Growth Large Growth Alger Green Fund - Class A Amana Growth Fund - Investor Class American Funds The Growth Fund of America - Class R-4 (8) Fidelity VIP Contrafund Portfolio - Initial Class Invesco V.I. American Franchise Fund - Series I Shares Voya Large Cap Growth Portfolio - Institutional Class Voya Russell Large Cap Growth Index Portfolio - Class I VY® T. Rowe Price Growth Equity Portfolio - Initial Class 12.74 9.39 6.92 7.75 12.31 15.23 14.76 Small/Mid/Specialty Page 9 of 12 See Performance Introduction Page for Important Information Investment Options 1-Mo 3-Mo YTD 1-Yr 3-Yr 5-Yr 10-Yr VY T.Rowe Price Div MidCap-I/Janus Aspen MidCap - I (3) VY® T. Rowe Price Diversified Mid Cap Growth Port - Initial -5.04 -5.04 1.37 1.37 4.97 4.97 4.97 4.97 17.23 17.23 14.34 14.34 8.28 8.20 Mid-Cap Value BlackRock Mid Cap Value Opportunities Fund - Inv A Shares Invesco American Value Fund - Class R5 -4.73 -4.85 -2.68 -0.23 -0.12 -0.12 13.79 12.48 Small Blend Voya Index Plus SmallCap Portfolio - Class I Voya Small Company Portfolio - Class I -2.51 -3.15 3.93 3.82 -1.03 0.01 -1.03 0.01 15.77 15.54 13.15 12.89 5.87 8.22 05/04/1998 05/30/1997 Small Growth Voya SmallCap Opportunities Portfolio - Class I -3.37 2.68 -0.86 -0.86 15.74 15.10 8.80 08/03/2001 Small Value Franklin Small Cap Value VIP Fund - Class 2 (9) Wells Fargo Advantage Special Small Cap Value Fund - Class A -4.16 -2.56 1.10 2.63 -5.60 0.77 -5.60 0.77 14.18 15.56 12.44 12.66 6.76 7.09 08/31/2001 01/16/2001 Specialty - Commodities PIMCO CommodityRealReturn Strategy Fund® - Admin Class Incept VAA Inception Date 06/30/1994 12/26/2002 15.79 -3.05 -14.24 -18.90 Specialty - Natural Resources Voya Global Resources Portfolio - Service Class -5.82 -20.74 -17.20 -17.20 -3.69 Specialty - Precious Metals USAA Precious Metals and Minerals Fund - Adviser Shares -4.65 -17.60 -13.99 -13.99 -28.93 Specialty - Real Estate VY® Clarion Global Real Estate Portfolio - Institutional -4.72 1.81 7.07 7.07 11.12 8.21 -11.55 -11.43 -11.67 -8.04 -10.64 -5.08 -10.64 -5.08 4.58 1.53 3.12 0.28 10.07 Foreign Large Blend American Funds EuroPacific Growth Fund - Class R-4 (11) Fidelity VIP Overseas Portfolio - Initial Class Voya International Index Portfolio - Class I -8.89 -8.12 -8.80 -6.92 -7.63 -9.26 -8.63 -13.72 -11.71 -8.63 -13.72 -11.71 8.57 9.93 7.57 3.46 4.06 2.93 5.58 3.67 Foreign Large Value VY® Templeton Foreign Equity Portfolio - Initial Class -8.23 -9.64 -12.32 -12.32 7.02 2.86 World Allocation Voya Global Perspectives Portfolio - Class I -6.13 -3.71 -7.11 -5.96 -3.65 -3.26 -3.14 -7.80 -7.80 -5.59 -5.59 -3.95 -3.95 -0.65 05/18/2009 06/16/2014 -24.78 08/14/2014 0.89 01/12/2007 -26.95 05/11/2011 4.89 09/05/2008 5.78 02/21/2001 11/10/2005 -2.10 05/03/2004 05/31/1994 05/13/2008 -1.09 04/25/2008 -4.30 05/12/2014 -1.06 05/03/2004 05/15/2014 6.12 05/31/1995 03/22/2005 Global / International Diversified Emerging Mkts Oppenheimer Developing Markets Fund - Class A VY® JPMorgan Emerging Markets Equity Portfolio - Inst (10) World Stock American Funds New Perspective Fund - Class R-4 (12) Nuveen Global Infrastructure Fund - Class I Voya Global Value Advantage Portfolio - Class S VY Oppenheimer Global-Int/Janus Aspen Worldwide Gr-Inst (3) VY® Oppenheimer Global Portfolio - Initial Class -3.14 -3.95 -3.95 13.18 13.25 13.25 8.15 8.71 8.71 6.94 6.44 The risks of investing in small company stocks may include relatively low trading volumes, a greater degree of change in earnings and greater short-term volatility. Foreign investing involves special risks such as currency fluctuation and public disclosure, as well as economic and political risks. Some of the Funds invest in securities guaranteed by the U.S. Government as to the timely payment of principal and interest; however, shares of the Funds are not insured nor guaranteed. High yielding fixed-income securities generally are subject to greater market fluctuations and risks of loss of income and principal than are investments in lower yielding fixed-income securities. Sector funds may involve greater-than average risk and are often more volatile than funds holding a diversified portfolio of stocks in many industries. Examples include: banking, biotechnology, chemicals, energy, environmental services, natural resources, precious metals, technology, telecommunications, and utilities. Additional Notes Page 10 of 12 Additional Notes (1)The CURRENT rate for the Voya Fixed Account Large Case is 3.00%, expressed as an annual effective yield, and is guaranteed not to drop below 3.00% through 12/31/2015. The annual rate of interest applied to your account may be higher or lower than the current rate. Restrictions may apply to transfers of funds from the Fixed Account to other contract investment options. Please refer to your product prospectus / disclosure booklet and call your 800 number for more information. (2)An investment in the Fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although the Fund seeks to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in the Fund. (3)The latter fund listed was replaced with the applicable Voya Investment Trust Co. Portfolio (the first fund listed). For most customers this occurred after the close of business on April 15, 2005. The performance shown is based on the performance of the replaced fund until April 15, 2005, and the performance of the applicable Voya Investment Trust Co. Portfolio after that date. The replaced fund may not have been available under all contracts. This replacement may have occurred for some customers on April 8, 2005. (4)There is no guarantee that any investment option will achieve its stated objective. Principal value fluctuates and there is no guarantee of value at any time, including the target date. The "target date" is the approximate date when you plan to start withdrawing your money. When your target date is reached, you may have more or less than the original amount invested. For each target date Portfolio, until the day prior to its Target Date, the Portfolio will seek to provide total returns consistent with an asset allocation targeted for an investor who is retiring in approximately each Portfolio's designation Target Year. Prior to choosing a Target Date Portfolio, investors are strongly encouraged to review and understand the Portfolio's objectives and its composition of stocks and bonds, and how the asset allocation will change over time as the target date nears. No two investors are alike and one should not assume that just because they intend to retire in the year corresponding to the Target Date that that specific Portfolio is appropriate and suitable to their risk tolerance. It is recommended that an investor consider carefully the possibility of capital loss in each of the target date Portfolios, the likelihood and magnitude of which will be dependent upon the Portfolio's asset allocation. On the Target Date, the portfolio will seek to provide a combination of total return and stability of principal. Stocks are more volatile than bonds, and portfolios with a higher concentration of stocks are more likely to experience greater fluctuations in value than portfolios with a higher concentration in bonds. Foreign stocks and small and midcap stocks may be more volatile than large cap stocks. Investing in bonds also entails credit risk and interest rate risk. Generally investors with longer timeframes can consider assuming more risk in their investment portfolio. The Voya Solution PortfoliosSM are actively managed and the asset allocation adjusted over time. The portfolios may merge with or change to other portfolios over time. Refer to the prospectus for more information about the specific risks of investing in the various asset classes included in the Voya Solution Portfolios. (5)The performance of the Advisor Shares prior to December 15, 1997 reflects the performance of a different class of American Century Fund shares, restated estimated fees and expenses, ignoring any fee and expense limitations. (6)The Washington Mutual Investors FundSM - Class R-4 commenced operations on May 20, 2002. The fund has identical investment objectives and policies, the same portfolio manager, and invests in the same holdings as Class A of this fund. The performance information for the Washington Mutual Investors FundSM - Class R-4 prior to May 20, 2002 is based upon the Class A performance, adjusted by fees associated with Class R-4. (7)The performance shown is based on the performance of the replaced fund until July 27, 2007, and the performance of the applicable Voya Portfolio after that date. The replaced fund may not have been available under all contracts. (8)The Growth Fund of America - Class R-4 commenced operations on May 15, 2002. Class R-4 has identical investment objectives and policies, the same portfolio manager, and invests in the same holdings as Class A. The performance information above prior to May 15, 2002 is based upon the Class A performance adjusted by the fee differences between classes. (9)The FTVIP Franklin Small Cap Value Securities Fund - Class 2 commenced operations on January 6, 1999. The fund has identical investment objectives and policies, the same portfolio manager, and invests in the same holdings as Class 1 of this fund. The performance information for the FTVIP Franklin Small Cap Value Securities Fund - Class 2 prior to January 6, 1999 is based upon the Class 1 performance, adjusted by fees associated with the Class 2. (10)VY JPMorgan Emerging Markets Equity Portfolio - Institutional Class commenced operations on April 29, 2005. The Institutional Class has the identical investment objectives and policies, the same portfolio manager, and invests in the same holdings as the Service Class. The performance information shown above prior to April 29, 2005 is based upon the Service Class performance adjusted by the fee differences between classes. (11)EuroPacific Growth Fund - Class R-4 commenced operations on May 15, 2002. Class R-4 has identical investment objectives and policies, the same portfolio manager, and invests in the same holdings as Class A. The performance information above prior to May 15, 2002 is based upon the Class A performance adjusted by the fee differences between classes. (12)The New Perspective Fund - Class R-4 commenced operations on May 28, 2002. The fund has identical investment objectives and policies, the same portfolio manager, and invests in the same holdings as Class A of this fund. The performance information for the New Perspective Fund - Class R-4 prior to May 28, 2002 is based upon the Class A performance, adjusted by fees associated with Class R-4. Page 11 of 12 See Performance Introduction Page for Important Information Additional Notes (13)The Investment Option is not part of the Separate Account. The returns listed do not include the impact of contract charges. Please refer to the contract to determine which Fixed Interest Options are available for your specific plan. The CURRENT rate for the Voya Short Term Guaranteed Accumulation Account is 3.00%, expressed as an annual effective yield, and is guaranteed between 01/31/2015 and 02/28/2018. The CURRENT rate for the Voya Long Term Guaranteed Accumulation Account is 3.00%, expressed as an annual effective yield, and is guaranteed between 01/31/2015 and 03/31/2020. Deposits received from 01/31/2015 through 02/27/2015 will receive this rate of interest. The annual rate of interest applied to your account may be higher or lower than the current rate. For more information regarding the GAA rates and terms, call 1-800-GAA-FUND. (14)The current yield reflects the deduction of all charges that are deducted from the total return quotations shown, except the maximum 5% deferred sales charge. Insurance products, annuities and funding agreements issued by Voya Retirement Insurance and Annuity Company One Orange Way Windsor, CT 06095, (VRIAC), which is solely responsible for meeting its obligations. Plan administrative services provided by VRIAC or Voya Institutional Plan Services, LLC. All companies are members of the Voya family of companies. Securities are distributed by or offered through Voya Financial Partners, LLC (member SIPC) or other broker-dealers with which it has a selling agreement. Important Note for Opportunity Plus Participants: The Voya Fixed Account and Guaranteed Accumulation Account (GAA) will credit the greater of the above referenced current rate or your certificate's lifetime minimum guaranteed interest rate. Participants enrolled in the Opportunity Plus Program on or after 9/1/04 have a lifetime minimum guaranteed interest rate of 3%. Participants enrolled in the Opportunity Plus Program prior to 9/1/04 have a lifetime minimum guaranteed interest rate of 4%. The current rate for the Voya Short Term GAA is 3.00%, which may vary from the rate displayed for Voya Short-Term GAA above. The current rate for the Voya Long-Term GAA is 3.00%, which may vary from the rate displayed for Voya Long-Term GAA above. A deferred sales charge will not be deducted if the withdrawal is from the portion of the Account Value invested in the subaccount(s) and/or GAA attributable to Purchase Payments made on or after April 1, 1995. The deferred sales charge is also waived for other circumstances described in the prospectus. Creation Date: Saturday, January 31, 2015 Page 12 of 12

© Copyright 2026