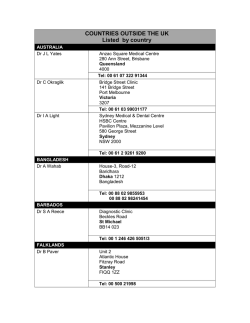

Phillip Securities (Thailand)

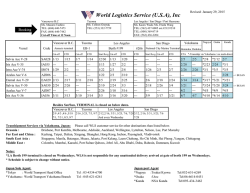

Weekly SET Strategy February 9-13, 2015 Thai stock market outlook: Earnings and foreign fund flow to set tone for Thai stocks this week • This week more weight would continue to be given to corporate earnings season in the ICT sector and foreign fund flow while external factors, especially key market-moving economic data out of major economies including the likes of trade balance and CPI reading from China, retail sales numbers in the US as well as trade balance and GDP figures from the euro zone, may be a source of day-to-day volatility for the Thai stock market. • ADVANC kicked off the earnings season in the ICT sector late last week. Other ICT-related bellwethers due to release their earnings results this week include DTAC on Feb 10, THCOM and JAS on Feb 11 and INTUCH on Feb 13. THCOM is our most favorite in the ICT space. • In terms of foreign fund flow, the accelerating pace of net foreign buying in Thai equities from mid-Jan to present balanced out net foreign selling since the start of the year but bouts of foreign selloffs however emerged in bonds. Overall foreign investors remained on the net selling side in both Thai equities and bond markets in the YTD. In our view, overall economic and earnings outlook would dictate the direction of fresh foreign fund inflows which are likely to take place before the end of the earnings season or in the latter half of this month. • Based on quantitative indicators, the Z-score of P/E crossed back above the ‘+1SD’ level at 1595 points, flashing a potentially bullish signal. The upside resistance for the SET index in this round of bull run is pegged at the ‘+2SD’ level or 1650 points while the downside should not be below the +0.75SD level or between 1575-1580 points. For short-term strategy, we still view any market pullbacks as an opportunity to accumulate positions to bet on a rebound. Resistance for the SET index is seen at 1625, 1650 points this week. • Technical outlook: SET looking up despite consolidation The SET index had moved higher with candlestick making a series of higher highs for a fifth consecutive week. The Modified Stochastic now entered overbought levels on both daily and weekly charts. The odds are still bullish but the upside looks limited, pointing to a likelihood of sideways or even a pullback. First resistance is pegged at 1625 points and a breakout would open way toward next barrier at 1650 points. Supprot 1580-1570 Resistance 1625, 1650 Weekly Statistic YTD Asian Market Return Price returns (%) WoW MTD YTD Total Return YTD US$ Thailand 1.4% 2% 7% 8% Malaysia 1.2% 1% 2% 0% Taiwan 0.9% Philipines 0.7% Hong kong 0.7% Indonesia 2% 3% 3% 0% 6% 8% 1% 5% 5% 0% 1% -1% 0% 2% 3% 0% 1% -1% -2% 6% 6% -1% 5% 8% -2% -1% -2% 18.51 Mean 14.46 15.93 15.40 15.40 15 13.89 13.25 12.70 12.21 11.51 10 5 0.1% China Hong Kong China Vietnam Taiwan Singapore Indonesia Thailand -2.8% India Malaysia -2.8% Philippines Vietnam India 0 -0.4% Singapore -3.9% -5.0% -4.0% -3.0% -2.0% -1.0%Asian 0.0% 1.0% 2.0% Performance of major currencies against US dollar 2.5% Appreciation 19.23 20 0.3% Korea 2015 (E) P/E ratios of Asian stock markets 25 WOW MTD Performance of major Asian currencies against US dollar 5,000 YTD 2.0% 4,000 1.5% 3,000 Unit: Mil US$ 2,000 1.0% 1,000 0.5% 0 0.0% -1,000 Thailand Philippines S.Korea Taiwan Vietnam Indonesia 5 Feb 15 26 Jan 15 19 Jan 15 12 Jan 15 5 Jan 15 29 Dec 14 Indonesia Philipines China Hong kong Taiwan Vietnam India Korea Thailand Singapore -2.5% 22 Dec 14 -5,000 15 Dec 14 -4,000 -2.0% 8 Dec 14 -3,000 -1.5% 1 Dec 14 -2,000 -1.0% Malaysia Depreciation -0.5% India Source: Bloomberg, data as of Nov 6, 2014 2 Commodity Watch Source: Bisnews, Bloomberg Gross Refinery Margin Positive Negative 54 1,200 500 1,000 400 800 600 400 200 200 JUTHA, PSL,TTA Baltic Dry Index 564(+0) 0 Jan-15 VIX Index Negative Positive Dec-14 Nov-14 Oct-14 Jan-15 Dec-14 Nov-14 Sep-14 0 20 Jan-15 1,400 600 Unit: Cents/Ib KBS, KSL, KTIS Dec-14 1,600 700 100 Sugar#11 Positive Negative Nov-14 BDI Index Positive Negative 300 PX spread 301.47(-76.29) BJI 67.45(+1.6) 50 800 SET Index 31 26 18 Rubber RSS3 181.9(+2.9) 21 16 180 16 160 14 11 140 Sugar#11 14.62(+0.21) VIX index 16.85(+0) 6 70 60 70 Jan-15 80 Unit: US$/ounce SET Index 1,400 90 80 Dec-14 GOLD Negative Positive 1,500 100 90 Nov-14 100 Oct-14 110 110 Unit: US$/ton IVL Sep-14 120 Jan-15 Cotton Positive Negative Dec-14 Nov-14 Oct-14 Sep-14 Unit: US cents/bushel TVO CPF, GFPT, TUF Aug-14 Jan-15 Dec-14 Nov-14 Oct-14 Sep-14 Aug-14 Soybeans Positive Negative Negative Positive Aug-14 12 120 50 40 58 Oct-14 Spread: Paraxylene-Naphtha (RHS) Paraxylene (LHS) Naphtha (LHS) 220 200 62 Sep-14 1,800 1,600 1,400 1,200 1,000 800 600 400 200 0 Oct-14 240 Unit: US$/ton IRPC, PTTGC, TOP Aromatic Spread Positive Negative Sep-14 Unit: US cents/Kg STA 0 Aug-14 Jan-15 Dec-14 Nov-14 Oct-14 Sep-14 Aug-14 Rubber RSS3 Positive Negative 70 Aug-14 0 78 Aug-14 Dubai 55.53(+0.59) 82 Jan-15 40 200 HDPE spread 603.38(-26.46) Dec-14 60 Unit: US$/ton BANPU 66 400 Nov-14 80 BJI Index (Weekly) Positive Negative 74 600 Oct-14 100 1,000 800 Sep-14 Jan 15 Dec 14 Nov 14 Oct 14 Sep 14 Aug 14 Unit: US$/bbl BCP, IRPC, PTTGC TOP, PTTEP Dubai Positive Negative Unit: US$/ton IRPC, PTTGC, SCC Spread: HDPE-Naphtha (RHS) HDPE (LHS) Naphtha (LHS) 2,000 1,800 1,600 1,400 1,200 1,000 800 600 400 200 0 GRM 8.29(-0.16) 20 Olefin Spread Positive Negative Aug-14 10 9 8 7 6 5 4 3 2 1 0 Unit: US$/bbl BCP, IRPC, PTTGC TOP GOLD 1264(+0.25) 1,300 1,200 60 Cotton 61.54(-0.25) Soybeans 55.18(+2.94) 50 Jan-15 Dec-14 Nov-14 Oct-14 Sep-14 Aug-14 Jan-15 Dec-14 Nov-14 Oct-14 Sep-14 Aug-14 Jan-15 Dec-14 Nov-14 Oct-14 Sep-14 Aug-14 1,100 3 Research Team Fundamental: Name Sasikorn Charoensuwan, CFA, CAIA Rutsada Tweesaengsakulthai Analyst Reg No. Capital Market Investment Analyst#9744 Securities Investment Analyst#17972 Tel 662 635 1700#480 662 635 1700#482 Danai Tunyaphisitchai, CFA Capital Market Investment Analyst #2375 662 635 1700#481 Naree Apisawaittakan Securities Investment Analyst #17971 662 635 1700#484 Siam Tiyanont Securities Investment Analyst #17970 662 635 1700#483 Ornmongkol Tantitanatorn Capital Market Investment Analyst #34100 662 635 1700#491 Adisorn Muangparnchon Securities Investment Analyst #18577 662 635 1700#497 Vichuda Siriployprakray Suthanuch Chaisumrej Chitphan Kwanchit Securities Investment Analyst #55956 Assistant Analyst Assistant Analyst 662 635 1700#525 Strategy: Teerada Charnyingyong Chutikarn Santimetvirul Werajak Jungkiatkajorn Rittiporn Songsermsawad Phoobate Wiriyayuttama Securities Investment Analyst #9501 Derivatives Investment Analyst #37928 Capital Market Investment Analyst #28087 Securities Investment Analyst #39756 Assistant Analyst 662 635 1700#487 662 635 1700#491 662 635 1700#495 662 635 1700#527 Technical: Sasima Hattakitnikorn Kanoksak Vutipan Securities Investment Analyst #8328 Capital Market Investment Analyst #32423 662 635 1700#490 662 635 1700#485 Sector Consumer, Commerce ICT, Energy, Health Care Construction Materials, Property Development Agro & Food, Electronics Transportation, Media & Publishing, Tourism Automotive, Energy, Packaging Banking, Securities & Finance, Insurance Database & Production: Manunpat Yuenyongwatanakorn Sutiporn Oupkaew Sornsawan Chimklin Translation: Chaiyot Ingkhasorarat Naowarat Angurasuchon Results Presentation Score Range Number of Logo Less than 50 No logo given 50 - 59 The disclosure of the survey result of the Thai Institute of Directors Association (IOD) regarding corporate governance is made pursuant to the Office of the Securities and Exchange Commission. The survey of the IOD is based on the information of a company listed on the Stock Exchange of Thailand and the Market for Alternative disclosure to the public and able to be accessed by a general public investor. The results, therefore, is from the perspective of a third party. It is not an evaluation of operation and is not based on inside information. 60 - 69 70 - 79 80 - 89 The survey result is as of the date appearing in the Corporate Governance Report of Thai Listed Companies. As a result, the survey result may be changed after that data. Phillip Securities (Thailand) of securities company does not confirm nor certify the accuracy of such survey result. 90 - 100 Bangkok Offices 4 Offices Head Office Srinakarindr Viphavadi Yaowarat Bangkapi 1 Bangkapi 2 Hua Lumphong Rangsit Sindhorn Siam Discovery 15th Fl., Vorawat Bldg. Tel : 0 2635 1700 , 0 2268 0999 17th Fl., Modernform Tower Tel : 0 2722 8344-53 15th Fl., Lao Peng Nguan Tower 1 Tel : 0 2618 8400 19th Fl., Kanchanadhat Bldg. Tel : 0 2622 7833 8th Fl., The Mall Office Tower-Bangkapi Tel : 0 2363 3263 9th Fl., The Mall Office Tower-Bangkapi Tel : 0 2363 3269 4th Fl., Tang Hua Pak Bldg., 320 Rama 4 Rd. Tel : 0 2639 1200 G Fl., Room#PLZ.G.SHP065A Future Park Rangsit Tel : 0 2958 5040 19th Fl., Sindhorn Tower 3 Building, Tel : 0 2650 9717 11st Floor, Unit A2, Siam Tower,Tel : 02 658 0776 Provincial Offices Chaing Mai Khon Kaen Khon Kaen - Rim Bueng Phisanulok Had Yai Had Yai - Petkasem Suratthan Chumporn Investor Center 313/15 Moo6 Chaing Mai – Lamphun Nong Hoi, Tel 053-141969 4th Fl., Kow Yoo Hah Bldg.Tel : 0 4332 5044-8 3rd Fl., Arokaya Bldg., Tel : 0 4322 6026 2nd Fl., Thai Sivarat Bldg., Tel : 0 5524 3646 4th Fl., Southland Rubber Bldg., Tel : 0 7423 4095-99110 3rd Fl., Unit 3D, Redar Group Bldg., Tel : 0 7422 3044 62/9 Donnok Rd., Tel : 077 206 131 25/45 Krom Luang Chumporn Rd.,Tel : 0 7757 0652-3 Overseas Offices SINGAPORE HONG KONG MALAYSIA JAPAN INDONESIA CHINA FRANCE UNITED KINGDOM UNITED STATES AUSTRALIA SRI LANKA TURKEY INDIA DUBAI CAMBODIA Phillip Securities Pte Ltd Raffles City Tower Tel : (65) 6533 6001 www.poems.com.sg Phillip Securities (HK) Ltd 11/F United Centre 95 Queensway, Tel (852) 22776600 www.phillip.com.hk Phillip Capital Management Sdn Bhd, Block B Level 3 Megan Avenue II Tel (603) 21628841 www.poems.com.my Phillip Securities Japan, Ltd 4-2 Nihonbashi Kabuto-cho, Chuo-ku, Tokyo Tel (81-3) 36662101 PT Phillip Securities Indonesia ANZ Tower Level 23B, Tel (62-21) 57900800 www.phillip.co.id Phillip Financial Advisory (Shanghai) Co. Ltd Ocean Tower Unit 2318 Tel (86-21) 51699200 www.phillip.com.cn King & Shaxson Capital Limited 3rd Flr, 35 Rue de la Bienfaisance Tel (33-1) 45633100 www.kingandshaxson.com King & Shaxson Capital Limited 6th Flr, Candlewick House, Tel (44-20) 7426 5950 www.kingandshaxson.com Phillip Futures Inc The Chicago Board of Trade Building Tel +1.312.356.9000 PhillipCapital Australia Level 37, Collins Street, Melbourne, Tel (613) 96298380 Fwww.phillipcapital.com.au Asha Phillip Securities Ltd Level 4, Millennium House, Tel: (+94) 11 2429 100 [email protected] Hak Menkul Kiymetler A.Ş Dr.Cemil Bengü Cad. Tel: (+90) (212) 296 84 84 (pbx) [email protected] PhillipCapital (India) Private Limited No. 1, C‐ Block, 2nd Floor,Modern Center , Jacob Circle, K. K. Marg, Mahalaxmi Mumbai 400011 Tel: (9122) 2300 2999 Website: www.phillipcapital.in PhillipCapital (India) Pvt Ltd.601, White Crown Building Plot no 58, Sheikh Zayed Road P.O, Box 212291, Dubai UAE. Mahalaxmi Mumbai 400011 Tel: (9122) 2300 2999 Website: www.phillipcapital.in Building No71, St 163, Sangkat Toul Svay Prey I, Khan Chamkarmorn, Phnom Penh, Kingdom of Cambodia Tel: (855) 23 217 942 Website: www.kredit.com.kh 5 Disclaimers 6 Disclaimers 7

© Copyright 2026