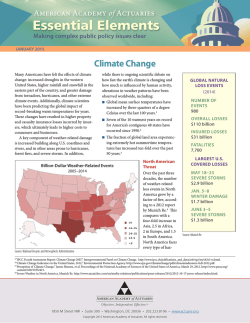

PDF, 10.2 MB