For personal use only

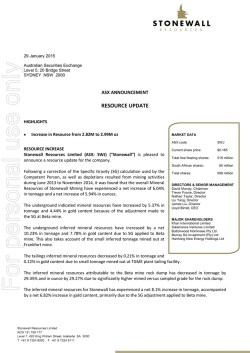

Quarterly Report For the three months ending December 2014 Vital Metals Limited For personal use only ASX Code: VML ACN: 112 032 596 64 Churchill Avenue, Subiaco, WA 6008 Tel: +61 8 9388 7742 Fax: +61 8 9388 0804 VITAL SHAREHOLDERS GET ON BOARD TO SUPPORT WATERSHED TUNGSTEN PROJECT AS IT CLOSES IN ON DEVELOPMENT Highlights: $1M raised to progress the Watershed Tungsten Project following a strong response from shareholders to the Company’s Share Purchase Plan. Project financials significantly enhanced as a result of the depreciation in the Australian Dollar and lower input costs. Slaty Range Prospect identified as a substantial tungsten (W) and tin (Sn) anomaly following a review of historical stream sediment geochemical data on 100%-owned EPM25102. Email:[email protected] www.vitalmetals.com.au Capital Structure 304 million shares 80 million unlisted options Board & Management David Macoboy Chairman Mark Strizek CEO and Managing Director Peter Cordin Non-Executive Director Andrew Simpson Non-Executive Director Ian Hobson Company Secretary For further information: Investors: Mark Strizek Managing Director Vital Metals (08) 9388 7742 Vital maintained significant momentum during the December Quarter in advancing its flagship 70%-owned Watershed Tungsten Project in North Queensland towards financing and development with key highlights including completion of a strongly supported Share Purchase Plan (SPP) which raised $1 million. Vital’s Managing Director, Mr Mark Strizek, said that he was pleased to see the strong level of shareholder support and backing for Vital’s strategy given the challenging circumstances for equity markets. “I was very pleased that most of the SPP funds came from our shareholders and I appreciate their support during what is a pivotal time for our company, with Watershed on the cusp of being developed into a mine,” he said. “During the December Quarter, our joint venture partners JOGMEC moved into high gear on their transfer process whereby they are looking transfer their 30% interest to a Japanese company that would be a long-term off-take, financing and development partner. Media: Nicholas Read Read Corporate (08) 9388 1474 “As I said in December, we are also seeing a favourable resetting in the Australian mining industry and also in the Australian dollar. This is going to make Watershed even more competitive. The bottom line is that with the dollar falls and Australian mining costs declining, the project delivers increasing returns. “Watershed is well placed to take advantage of this, being development-ready with all environmental approvals and mining licences in place. We are ready to go.” -1- Watershed Tungsten Project – Queensland (Vital 70%) For personal use only The DFS shows that the Watershed Tungsten Project is a premier, long-life asset. The key conclusions of the DFS, are that a 2.5Mtpa project has the ability to produce high quality tungsten concentrate over a 10-year mine life at competitive mine operating costs. During the December Quarter, Vital undertook a review of the cost inputs used in the DFS. Changes to the exchange rate and diesel costs, along with increased labour availability, have largely moved outside of the range considered for the DFS. Vendors were approached for the review and in most cases provided updates to previous estimates. In the case of diesel - which is a significant component of the mining cost - the quoted price is at a significant discount to the pricing assumed for the DFS. The combined effect of changes to exchange rate and operating cost base has made Watershed an even more compelling proposition. The Project is therefore well placed for immediate development and the DFS has shown that it will generate very attractive returns for its shareholders and Joint Venture partners alike. Project returns1 for a range of prices and an exchange rate of US$0.80 and a 100% equity case are shown in Table 1 below. The combination of a lower exchange rate and lower operating costs mean that the project will now generate similar returns at a price of US$375/mtu APT compared to the previously reported case2, which used a price of US$450/mtu and an exchange rate of US$0.90. Life-of-mine cash costs are extremely competitive at US$156/mtu. Table 1: Project Returns 100% Equity Case. Project Returns Updated Case Updated Case Updated Case Updated Case Updated Case APT US$325/mtu APT US$350/mtu APT US$375/mtu APT US$400/mtu APT US$450/mtu FX US$0.80 FX US$0.80 FX US$0.80 FX US$0.80 FX US$0.80 Pre Tax Post Tax Pre Tax Post Tax Pre Tax Post Tax Pre Tax Post Tax Pre Tax Post Tax NPV @ 8% $63M $31M $111M $65M $160M $100M $207M $132M $300M $200M IRR 16.0% 12.3% 21.5% 16.6% 26.8% 20.6% 31.7% 24.5% 40.8% 31.6% Payback Years Free Cashflow 4.8 $184M Cash Costs US$/ mtu 156 Total Costs US$/ mtu 212 $130M 3.4 $259M 2.8 $182M $335M $235M 2.5 $410M $288M 2.1 $561M $394M Vital will continue to review the DFS, seeking opportunities to further improve the financial metrics where possible. The Company believes that there are good opportunities to reduce some of the capital expenditure given the opportunity presented by new equipment that was landed and not purchased, as well as second-hand equipment. For example, there are excellent opportunities for deep discounts with offers for mining camps and mobile equipment currently being received. 1 2 ASX Announcement 22 January 2015 ASX Announcement 17 September 2014 2 Exploration - Australia For personal use only Our exploration team was on the ground at Slaty Range during the December Quarter and was able to confirm the geology and extent of the previously identified tungsten anomaly. First-pass 500mN by 200mE soil geochemical sampling and mapping was completed over the Slaty Range anomaly during November. The anomaly was previously identified from stream sediment sampling completed by BHP in 1981. From this data, a 7km long zone of elevated tungsten and tin values was identified with peak values of 132ppm W and 3,910ppm Sn. Mapping of the area by Vital’s geologists has confirmed the geology of the anomaly with the area dominated by arenites and the S-type Northedge granite (Figure 4). Mafic volcanics, zones of manganese veining and an increased quantity of pegmatite veining were observed in the east of the anomaly. In one location coarse grained cassiterite grains of up to 10mm were observed within pegmatite and an associated hydrothermal quartz vein hosted by hornfelsed arenites. A total of 123 samples were collected during sampling, completing the southern section of Phase 1 sampling. A review of the analytical results of the soil sampling program shows that 15 samples exceed the 30ppm W limit and 12 exceeding 50ppm with a highest value of 240ppm received (Figure 5). For tin, 26 samples exceeded the 30ppm lower cut-off and 13 exceeded 50ppm with a maximum value of 100ppm received (Figure 6). Tungsten is anomalous in the Slaty Range with the majority of values >50ppm W located within the Northedge Granite. It may be observed that tin is spatially correlated with the occurrence of granite and arsenic is anomalous in the region (Figure 7). Sampling in the north of the anomaly will continue after the wet season with 52 samples remaining. The streams draining the north of the granite have returned the highest tin values (6270ppm), demonstrating considerable potential for a hard rock tin deposit in this area. Follow-up exploration activities over the Slaty Range prospect are being planned in preparation for the 2015 field season, which will commence after the wet season. 3 Tungsten Market For personal use only Tungsten prices remain positive (see following chart). Lower demand being experienced currently is largely driven by a seasonal cycle and it is expected that prices will start to pick up following end of the holiday season. The APT price averaged around US$360/mtu in 2014 and most market forecasters expect it to head above US$350/mtu in the second half of the year with higher prices expected in 2016. The fall of the Australian Dollar against the US Dollar means that Australian prices are relatively buoyant. Figure 1: APT price The low oil price should help boost global economic growth and tungsten demand relates closely to GDP growth. On the supply side, there is very little new production coming through (only Hemerdon towards the end of the year). The Chinese Government remains keen to control domestic output which suggests that production from China is unlikely to grow in 2015. 4 Doulnia Gold Project – Burkina Faso For personal use only During the December Quarter notification was received from the Ministère des Mines et de l'Energie that the Doulnia and Zeko permits are to be renewed for an additional term. In addition the Arête for the Kampala permit has been received. The recent leadership change in Burkina Faso appears to have been accepted as a step in the right direction by the people. The situation in Ouagadougou is stable and business is operating as normal. The change to the leadership of in the Ministère des Mines et de l'Energie appears to have sped up the processing of exploration permit applications which are now being processed in months rather than years. Corporate Vital had a cash balance of $0.87 million as at 31 December 2014. The Company successfully completed a Share Purchase Plan (SPP) for $1 million that was underwritten Patersons Securities Limited during the December Quarter. Looking ahead, Vital believes that the combined effect of changes to exchange rate and operating cost base will make the Watershed Tungsten Project an even more compelling development proposition. The Watershed Tungsten Project is well placed for immediate development and the DFS has shown that it will generate very attractive returns for its shareholders and Joint Venture partners alike. For further details, refer to the Company’s website, www.vitalmetals.com.au: Contact: Mark Strizek Managing Director Vital Metals Ltd Phone: +61 8 9388 7742 Email: [email protected] Media Inquiries: Nicholas Read Read Corporate Telephone: +61-8 9388 1474 Email: [email protected] 5 Competent Person’s Statement For personal use only The information that refers to Mineral Resources in this announcement was prepared and first disclosed under the JORC Code 2004. It has not been updated since to comply with the JORC Code 2012 on the basis that the information has not materially changed since last reported. The information in this report that relates to Exploration Targets, Exploration Results, Mineral Resources or Ore Reserves is based on information compiled by Mr Mark Strizek, a Competent Person who is a Member or The Australasian Institute of Mining and Metallurgy. Mr Strizek is a full time employee of the Company. Mr Strizek has sufficient experience that is relevant to the style of mineralisation and type of deposit under consideration and to the activity being undertaking to qualify as a Competent Person as defined in the 2012 edition of the “Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves”. Mr Strizek consents to the inclusion in the announcement of the matters based on his information in the form and context in which it appears. The information in this report that relates to Mineral Resources for the Watershed Deposit is based on information evaluated by Mr Simon Tear who is a Member of The Australasian Institute of Mining and Metallurgy (MAusIMM) and who has sufficient experience relevant to the style of mineralisation and type of deposit under consideration and to the activity which he is undertaking to qualify as a Competent Person as defined in the 2012 edition of the “Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves”. Mr Tear is a Director of H&S Consultants Pty Ltd and he consents to the inclusion of the estimates in the report of the Mineral Resource in the form and context in which they appear. This Ore Reserves statement has been compiled in accordance with the guidelines defined in the Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves (JORC Code – 2012 Edition). The Ore Reserves have been compiled by Mr Steve Craig of Orelogy Group Pty Ltd, who is a Fellow of Australasian Institute of Mining and Metallurgy. Mr Craig has had sufficient experience in Ore Reserve estimation relevant to the style of mineralisation and type of deposit under consideration to qualify as Competent Person as defined in the 2012 Edition of the “Australasian Code for Reporting of Mineral Resources and Ore Reserves”. Mr Craig consents to the inclusion in the announcement of the matters based on his information in the form and context in which it appears. Forward looking statements Certain written statements contained or incorporated by reference in this report, including information as to the future financial or operating performance of the Company and its projects, constitute forward-looking statements. All statements, other than statements of historical fact, are forward-looking statements. The words “believe”, “expect”, “anticipate”, “contemplate”, “target”, “plan”, “intend”, “continue”, “budget”, “estimate”, “may”, “will”, “schedule” and similar expressions identify forward-looking statements. Forward-looking statements include, among other things, statements regarding targets, estimates and assumptions in respect of tungsten, gold or other metal production and prices, operating costs and results, capital expenditures, mineral reserves and mineral resources and anticipated grades and recovery rates. Forward-looking statements are necessarily based upon a number of estimates and assumptions related to future business, economic, market, political, social and other conditions that, while considered reasonable by the Company, are inherently subject to significant uncertainties and contingencies. Many known and unknown factors could cause actual events or results to differ materially from estimated or anticipated events or results reflected in such forward-looking statements. Such factors include, but are not limited to: competition; mineral prices; ability to meet additional funding requirements; exploration, development and operating risks; uninsurable risks; uncertainties inherent in ore reserve and resource estimates; dependence on third party smelting facilities; factors associated with foreign operations and related regulatory risks; environmental regulation and liability; currency risks; effects of inflation on results of operations; factors relating to title to properties; native title and aboriginal heritage issues; dependence on key personnel; and share price volatility and also include unanticipated and unusual events, many of which are beyond the Company's ability to control or predict. For further information, please see the Company's most recent annual financial statement, a copy of which can be obtained from the Company on request or at the Company's website: www.vitalmetals.com.au. The Company disclaims any intent or obligation to update any forward-looking statements, whether as a result of new information, future events or results or otherwise. All forward-looking statements made in this presentation are qualified by the foregoing cautionary statements. Investors are cautioned that forward-looking statements are not guarantees of future performance and, accordingly, not to put undue reliance on such statements. 6 For personal use only Cautionary Statement The Definitive Feasibility Study (DFS) referred to in this report is based on a Proved and Probable Ore Reserve derived from a Measured and Indicated Mineral Resource, plus a small proportion of mining inventory, which comprises material that is currently classified as Inferred Mineral Resource. There is a low level of geological confidence associated with Inferred Mineral Resources and there is no certainty that further exploration work will result in the determination of Indicated Mineral Resources or that the production target itself will be realised. The Company advises that the Proved and Probable Ore Reserve provides 93% of the total tonnage and 93% of the total WO3 metal underpinning the forecast production target and financial projections, and that the additional life of mine plan material comprises less than 7% of the total tonnage and WO3 metal. Furthermore, in the first five years of production, 95% of the material planned to be processed is based on Proved and Probable Ore Reserves. As such, the dependence of the outcomes of the DFS and the guidance provided in this announcement on the lower confidence Inferred Mineral Resource material contained in the life of mine plan is minimal. The Company has concluded that it has a reasonable basis for providing the forward looking statements included in this report. 7 ABOUT VITAL METALS Vital Metals Limited (ASX: VML) is an explorer and developer , focused on progressing two highly prospective mineral Projects: the advanced Watershed Tungsten Project in far north Queensland, Australia and the Doulnia Gold Project in southern Burkina Faso, West Africa. For personal use only Watershed Tungsten Project – Queensland The Watershed scheelite (calcium tungstate) Project, in far north Queensland, 150 kilometres northwest of Cairns, is the Company’s flagship venture. Vital entered into a formal Earn-In Agreement with JOGMEC (Japan Oil, Gas and Metals National Corporation) where JOGMEC has earnt 30% of the Project for $5.4M (valuing the Project at the time of the farm-in at $18M). The funds have been used to complete the Definitive Feasibility Study (DFS). Doulnia Gold Project – Burkina Faso The Doulnia Gold Project (100% Vital) is located in southern Burkina Faso. The Project is made up of three contiguous permits; the Doulnia, Kampala and Zeko exploration permits. The Project is located in highly prospective Birimian Greenstone terrain with over 400 sq. km of contiguous tenements lying on the trend of the Markoye Fault Corridor and the Bole shear zone and hosting the Kollo Gold Project and Boungou South Gold Prospect. About JOGMEC Japan Oil, Gas and Metals National Corporation (JOGMEC) were established in 2004. JOGMEC is Government owned and integrates the functions of the former Japan National Oil Corporation, which was in charge of securing a stable supply of oil and natural gas and the former Metal Mining Agency of Japan, which was in charge of ensuring a stable supply of nonferrous metal and mineral resources and implementing mine pollution control measures. It has an annual budget of around 1,600 billion yen ($18B) and provides financial assistance, technology development and technical support to Japanese companies and their foreign subsidiaries. Figure 2: Vital Metals Project Locations 8 For personal use only Figure 3: Vital Metals North Queensland Permits 9 For personal use only Watershed Mineral Resources Tonnage Mt WO3% Measured 9.5 0.16 Indicated 28.4 0.14 Sub Total: Measured and Indicated 37.8 0.15 Inferred 11.5 0.15 Total: Measured, Indicated and Inferred 49.3 0.14 Table 2: Watershed Mineral Resources Watershed Ore Reserves 3 Tonnage Mt WO3% Proved 6.4 0.16 Probable 15 0.14 Total: Proved and Probable 21.3 Table 3: Watershed Ore Reserves 0.15 4 Name Tenement Elements of Interest Tonnage Range (kt) Grade Range Watershed Deeps ML20536 W 10,500 – 14,000 0.14 - 0.25% Watershed South MDL127 W 830 - 1,000 0.06 - 0.15% Desailly North MDL127 W 830 - 1,000 0.06 - 0.15% Desailly MDL127 W 1,150 – 1,500 0.06 - 0.15% Mt Elephant EPM 14735 W, Sn 1,000 - 3,000 0.06 - 0.15% Slaty Range EPM 25102 W, Sn 35,000 – 60,000 0.10-0.18% W 49,000 – 80,000 0.10-0.19% Exploration Potential exclusive of current Mineral Resource Table 4: Watershed Tungsten Project Exploration Targets 3 Watershed Mineral Resources first reported in ASX release 30 July 2012. Watershed Ore Reserves first reported in ASX release 17 September 2014. Watershed Mineral Resources are inclusive of Ore Reserves. Watershed Mineral Resources and Ore Reserves reported at a cut-off grade of 0.05% WO3. 5 Exploration Targets reported 25 November 2013, AGM Presentation. Please refer to Competent Persons statement accompanying this release. 4 10 Comments These Exploration Targets are conceptual in nature, and there has been insufficient exploration to define a Mineral Resource. It is uncertain if further exploration will result in the estimation of a Mineral Resource. 5 For personal use only Doulnia Percentage held / earning at beginning of Quarter 100% Percentage held / earning at end of Quarter 100% Kampala 100% 100% Burkina Faso Zeko 100% 100% Watershed EPM 25102 100% 100% Watershed MDL127 70% 70% Watershed EPM 18171 70% 70% Watershed EPM 14735 70% 70% Watershed EPM 15544 70% 70% Watershed EPM 15064 70% 70% Watershed EPM 19089 70% 70% Watershed EPM 25139 70% 70% Watershed ML 20535 70% 70% Watershed ML 20536 70% 70% Watershed ML 20537 70% 70% Watershed ML 20538 70% 70% Watershed ML 20566 70% 70% Watershed ML 20567 70% 70% Watershed ML 20576 Location Tenement Burkina Faso Burkina Faso 70% 70% Table 5: Interests in Mining Tenements. 11 ILUA Environmental Approval For personal use only Mining Lease Strategic Partner Mineral Resource Mineral Reserves Definitive Feasibility Study JV Partner Exploration Pipeline Agreement with the Western Yalanji people for development of the open pit operation secured and registered with the National Native Title Tribunal. Open pit operation permitted by the Department of Environment and Heritage Protection on 3rd September 2013. Seven Mining Leases for a total of 1,904 hectares were granted on the 1st December 2013 for a period of 20 years by the Department of Natural Resources and Mines. Listed global mineral processing and infrastructure solution provider Sedgman Limited acquired a strategic interest in Vital Metals on 1st July 2014. Measured, Indicated and Inferred Mineral Resources. At a cut-off grade of 0.05% WO3 the Watershed deposit contains Mineral Resources of 49.32Mt at 0.14% WO3 for 70,400 tonnes of WO3.6 Proved and Probable Ore Reserve derived from Measured and Indicated Mineral Resources. Total in-ground ore inventory within final design pits is 21.3 Mt at an average WO3 grade of 0.15% using a cut-off grade of 0.05% WO3 and is inclusive of a 95% mining recovery.7 DFS considered 10-year open pit operation processing 2.5Mtpa with only ~40% of resources extracted. Significant near-mine exploration potential.8 JOGMEC expected to transfer their 30% interest in the Watershed Project to a Japanese company (with interests in the tungsten industry). This company will have responsibility for arranging its share of project finance in addition to its off-take interest. World-class pipeline of tungsten exploration prospects to drive growth.9 Table 6: Milestones towards Development. 6 Mineral Resources initially reported ASX release 30 June 2012. Mineral Resources classified using JORC 2004 guidelines. Watershed Ore Reserves first reported in ASX release 17 September 2014. Mineral Reserves classified using JORC 2012 guidelines. 8 Key finding Watershed DFS first reported in ASX release 17 September 2014. 9 Exploration Targets reported in ASX release 13 October 2014. 7 12 For personal use only Figure 4: Slaty Range completed sampling locations with logged lithology. 13 For personal use only Figure 5: Slaty Range soil sampling results for tungsten. 14 For personal use only Figure 6: Slaty Range soil sample results for tin. 15 For personal use only Figure 7: Slaty Range soil sampling results for arsenic. 16 JORC Code, 2012 Edition – Table 1 – Slaty Range geochemical soil sampling Geochemical soil sampling was completed over the Slaty Range Prospect. Section 1: Sampling Techniques and Data For personal use only Criteria Sampling Technique JORC Code Explanation Nature and quality of sampling (eg cut channels, random chips, or specific specialised industry standard measurement tools appropriate to the minerals under investigation, such as downhole gamma sondes, or handheld XRF instruments, etc.). These examples should not be taken as limiting the broad meaning of sampling Include reference to measures taken to ensure sample representivity and the appropriate calibration of any measurement tools or systems used. Aspects of the determination of mineralisation that are Material to the Public Report. Commentary Geochemical soil sampling was completed by Vital Metals’ geologists. Samples were obtained from the lower B-horizon using picks and sieved to -40 mesh (-0.389mm) in the field to achieve a 100g sub sample before being submitted to the laboratory. Multi-element analysis was completed for 33 elements using ALS method ME-ICP61. The elements of primary interest are W, Sn, Cu and As. The geochemical sampling methods utilised are consistent with the practices at Watershed. In cases where ‘industry standard’ work has been done this would be relatively simple (eg ‘reverse circulation drilling was used to obtain 1 m samples from which 3 kg was pulverised to produce a 30 g charge for fire assay’). In other cases more explanation may be required, such as where there is coarse gold that has inherent sampling problems. Unusual commodities or mineralisation types (eg submarine nodules) may warrant disclosure of detailed information. Drilling Drill type (eg core, reverse circulation, open- hole hammer, rotary air blast, auger, Bangka, sonic, etc.) and details (eg core diameter, triple or standard tube, depth of diamond tails, face- sampling bit or other type, whether core is oriented and if so, by what method, etc.). Drill Sample Recovery Method of recording and assessing core and chip sample recoveries and results assessed. Measures taken to maximise sample recovery and ensure representative nature of the samples. Whether a relationship exists between sample recovery and grade and whether sample bias may have occurred due to preferential loss/gain of fine/coarse material. Logging Whether core and chip samples have been geologically and geotechnical logged to a level of detail to support appropriate Mineral Resource estimation, mining studies and metallurgical studies. Whether logging is qualitative or quantitative in nature. Core (or costean/Trench, channel, etc.) photography. The total length and percentage of the relevant intersections logged. No new drilling being reported. No new drilling being reported No new drilling being reported 17 For personal use only Sub-Sampling Technique and Sample Preparation If core, whether cut or sawn and whether quarter, half or all core taken. If non-core, whether riffled, tube sampled, rotary split, etc. and whether sampled wet or dry. For all sample types, the nature, quality and appropriateness of the sample preparation technique. Quality control procedures adopted for all sub-sampling stages to maximise representivity of samples. Measures taken to ensure that the sampling is representative of the in situ material collected, including for instance results for field duplicate/ second-half sampling. Whether sample sizes are appropriate to the grain size of the material being sampled. Samples are firstly dried, a prepared sample (0.25 g) is then digested with perchloric, nitric, hydrofluoric and hydrochloric acids. The residue is topped up with dilute hydrochloric acid and the resulting solution is analysed by inductively coupled plasmaatomic emission spectrometry. Results are corrected for spectral interelement interferences. Assays which exceed equipment maximum tolerances are analysed by additional methods. The sample preparation technique is in accordance with current standard industry practices. The sample size is more than sufficient considering the targeted grainsize. Multielement standards were submitted with the samples at a rate of 1 in 30. Quality of Assay Data and Laboratory Tests The nature, quality and appropriateness of the assaying and laboratory procedures used and whether the technique is considered partial or total. For geophysical tools, spectrometers, handheld XRF instruments, etc., the parameters used in determining the analysis including instrument make and model, reading times, calibrations factors applied and their derivation, etc. Nature of quality control procedures adopted (eg standards, blanks, duplicates, external laboratory checks) and whether acceptable levels of accuracy (ie lack of bias) and precision have been established. Verification of Sampling and Assaying The verification of significant intersections by either independent or alternative company personnel. The use of twinned holes The verification of significant intersections by either independent or alternative company personnel. Discuss any adjustment to assay data Location of Data points Accuracy and quality of surveys used to locate drill holes (collar and down- hole surveys), trenches, mine workings and other locations used in Mineral Resource estimation. Specification of the grid system used Quality and adequacy of topographic control Data Spacing and Distribution Data spacing for reporting of Exploration Results Whether the data spacing and distribution is sufficient to establish the degree of geological and grade continuity appropriate for the Mineral Resource and Ore Reserve estimation procedure(s) and classifications applied. Whether sample compositing has been applied Analysis for all elements including tungsten, tin, copper and arsenic was completed by Mass Spectrometry following four acid digestion method. The sample preparation techniques used are in accordance with current practices. All techniques are assumed to be total for the element of interest. The analytical techniques are appropriate for the elements of interest. Quality control procedures adopted by the laboratory include internal standards and duplicates. Acceptable levels of accuracy have been established. No independent verification has been completed to date. Geochemical soil sample locations have been captured with Garmin handheld GPS. Accuracy is stated to be <12m in easting and northing. Samples taken on a grid of 200mE by 500mN however there is some variation where the terrain was difficult. 18 For personal use only Orientation of Data in Relation to Geological Structure Whether the orientation of sampling achieves unbiased sampling of possible structures and the extent to which this is known, considering the deposit type. If the relationship between the drilling orientation and the orientation of key mineralised structures is considered to have introduced a sampling bias, this should be assessed and reported if material. Sample Security The measures taken to ensure sample security Audits or reviews The results of any audits or reviews of sampling techniques and data The Slaty Range anomaly is orientated NNW, as identified in historical stream sediment sampling completed by BHP. Major structures in the region strike to the NNW and NE. Ticket books and labels were used to ensure the sample id’s were not compromised. No external reviews or audits have been completed to date. Section 2 Reporting of Exploration Results Criteria Mineral Tenement and Land Tenure Status Exploration Done by Other Parties JORC Code Explanation Type, reference name/number, location and ownership including agreements or material issues with third parties such as joint ventures, partnerships, overriding royalties, native title interests, historical sites, wilderness or national park and environmental settings. The security of the tenure held at the time of reporting along with any known impediments to obtaining a licence to operate in the area. Acknowledgment and appraisal of exploration by other parties. Commentary The EPM25102 was granted by the Mines Minister of Queensland on November 22 2013 for 5 years. The EPM is held by North Queensland Tungsten Pty Ltd a wholly owned subsidiary of Vital Metals Ltd, this MDL is not subject to any JV agreements. Previous exploration by other parties is detailed in historical annual reports submitted to the Department of Mines. The previous holders of the area who completed the greatest amount of work was Broken Hill Proprietary and CRA Exploration. The standard of work completed by the companies appears to be of a high standard. Preliminary exploration techniques and quality control practices reported appear to be in line with industry best practice procedures and practices. Geology Drill Hole Information Deposit type, geological setting and style of mineralisation. A summary of all information material to the understanding of the exploration results including a tabulation of the following information for all Material drill holes: • easting and northing of the drill hole collar • elevation or RL (Reduced Level – elevation above sea level in metres) of the drill hole collar • dip and azimuth of the hole • down hole length and interception depth • hole length • If the exclusion of this information is justified on the basis that the information is not Material and this exclusion does not detract from the understanding of the report, the Competent Person should clearly explain why this is the case. Mapping by BHP geologists reported casitterite within pegmatites and dykes in addition to alluvial tin. No new drill holes being reported. Tungsten in soil assays are typically considered anomalous when greater than 20ppm. 19 For personal use only Data Aggregation Methods In reporting Exploration Results, weighting averaging techniques, maximum and/or minimum grade truncations (eg cutting of high grades) and cut-off grades are usually Material and should be stated. Where aggregate intercepts incorporate short lengths of high grade results and longer lengths of low grade results, the procedure used for such aggregation should be stated and some typical examples of such aggregations should be shown in detail. The assumptions used for any reporting of metal equivalent values should be clearly stated. Relationship Between Mineralisation Widths and Intercept Lengths These relationships are particularly important in the reporting of Exploration Results If the geometry of the mineralisation with respect to the drill hole angle is known, its nature should be reported. If it is not known and only the down hole lengths are reported, there should be a clear statement to this effect (eg ‘down hole length, true width not known’). No new drill holes being reported, orientation of mineralisation is currently unknown. Appropriate maps and sections (with scales) and tabulations of intercepts should be included for any significant discovery being reported These should include, but not be limited to a plan view of drill hole collar locations and appropriate sectional views. Where comprehensive reporting of all Exploration Results is not practicable, representative reporting of both low and high grades and/or widths should be practiced to avoid misleading reporting of Exploration Results. Other exploration data, if meaningful and material, should be reported including (but not limited to): geological observations; geophysical survey results; geochemical survey results; bulk samples – size and method of treatment; metallurgical test results; bulk density, groundwater, geotechnical and rock characteristics; potential deleterious or contaminating substances. The appropriate location plans have been included in the text of this document. The nature and scale of planned further work (eg tests for lateral extensions or large scale step out drilling. Further exploration work is planned this will include follow up sampling and mapping. Once the results of this work have been received Vital will be able to better identify the extents of mineralisation and prepare for drilling. Diagrams Balanced Reporting Other Substantive Exploration Data Further Work Diagrams clearly highlighting the areas of possible extensions, including the main geological interpretations and future drilling areas, provided this information is not commercially sensitive. No data aggregation completed. Reporting is on geochemical soil samples and as such may be biased to some extent. Additional sampling and drilling is required on the prospect. Geophysical exploration is limited to magnetic surveys; this technique is not applicable to the mineralisation styles being explored for. Tin mineralisation is observed to be as coarse cassiterite within pegmatites. Manganese mineralisation has been observed as veins within siliceous sediments. No other mineralisation has been observed to date. 20

© Copyright 2026