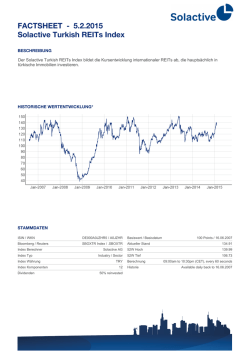

Hong Kong REITs