European equities: Eurozone comeback

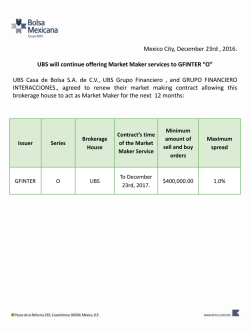

28 January 2015 CIO WM Research European equities Eurozone comeback • Leading economic indicators have troughed and are signaling a tentative near-term pickup in eurozone economic growth. In our view, both economic growth and inflation will improve over the course of 2015. • The weaker euro will provide a tailwind for eurozone corporate earnings, which are far below their pre-crisis levels. • The European Central Bank's decision to ease monetary policy further by purchasing sovereign bonds provides an additional support factor for the market. • We expect eurozone equities to outperform our non-US developed market benchmark (EAFE) over the next 6 months on a currency-hedged basis. Brian Rose, Sr. Investment Strategist, UBS FS [email protected], +1 212 713 3671 Fig. 1: GDP still below pre-crisis peak Real GDP index, seasonally adjusted 106 104 102 Eurozone corporate profit rebound to begin 100 98 The unique economic structure of the eurozone, with its shared currency, vulnerable peripheral members, and heavy reliance on bank lending for corporate finance, has made it difficult to generate a sustained recovery following the global financial crisis. As shownin Fig. 1, seven years after the onset of the crisis, eurozone GDP remains below its pre-crisis peak. Under these circumstances it is not surprising that eurozone corporate earnings remain depressed. However, we now believe that a sustainable recovery is starting to take hold, and with a weaker euro providing a tailwind for corporate earnings, eurozone equities appear attractive relative to other international markets. 96 94 92 90 2004 2006 2008 2010 2012 2014 Source: European Central Bank, as of 3Q 2014 ECB finally implements full-blown QE Headline inflation in the Eurozone fell into negative territory in December. With inflation below target and inflation expectations declining, the European Central Bank (ECB) finally decided to pull the trigger on full-blown quantitative easing, including sovereign bond purchases. Having already introduced negative deposit rates and a variety of other monetary stimulus measures, the ECB will now purchase EUR 60bn of private and public assets a month at least through September 2016. It intends to expand its balance sheet from EUR 2trn to about EUR 3trn, which should help to keep downward pressure on the euro in foreign exchange markets. This report has been prepared by UBS Financial Services Inc. (UBS FS). Please see important disclaimers and disclosures that begin on page 3. European equities Economy starting to improve Ironically, the ECB's decision came against a backdrop of improving economic data. Leading indicators have troughed and are signaling a tentative near-term pickup in eurozone economic growth. For example, the German Ifo, historically a lead indicator for eurozone equities, has turned and is pointing to a positive outlook among German purchasing managers. While the negative inflation data spurred the ECB into action, deflationary pressure is coming mainly from lower prices for oil and other commodities. Eurozone equities are actually net beneficiaries from a lower oil price. The energy sector represents only 5% of the equity market, while consumer staples and discretionary combined are about 25%. In our view, despite the recent downtrend in prices, both economic growth and inflation will improve over the course of 2015. Earnings outlook positive The ECB's actions combined should amplify key drivers of our positive stance towards Eurozone equities: the depreciation of the euro and low refinancing costs for companies. The exchange rate turned into a year-over-year tailwind for earnings in the fourth quarter of 2014, and the euro has weakened further in 2015. We expect companies therefore to report a positive earnings impact from translational currency effects in the upcoming earnings season and into 2015 overall. As shown in Fig. 3, eurozone corporate earnings are far below their pre-crisis peak. With support from an economic recovery and a weaker euro, we see great potential for earnings to grow at a robust pace in the years ahead. Recommend hedging currency, but only in the short term On a 6-month time horizon we would recommend that dollar-based investors hedge the currency exposure on their euro assets. However, in our view the euro is far below its equilibrium value against the dollar. For investors intending to maintain a position in eurozone equities for a year or more, leaving the currency exposure unhedged may be the better option. Fig. 2: Euro weakness will help earnings EUR/USD exchange rate 1.70 1.60 1.50 1.40 1.30 1.20 1.10 1.00 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 Source: Factset, as of 26 January 2015 Fig. 3: Earnings have potential to rebound from depressed levels Eurozone 12-month trailing earnings per share 25 20 15 10 5 0 2006 2008 2010 2012 2014 Source: Datastream, as of 22 January 2015 Germany a bastion of strength Relative to the rest of the eurozone, Germany has enjoyed better economic conditions and corporate earnings. While it does not have the same potential for earnings to rebound off of depressed levels, we still expect double-digit earnings growth in 2015 and 2016. The German market has historically traded at a valuation premium (i.e., a higher price-earnings ratio) to the eurozone, but currently trades at a discount. One attractive way to invest in eurozone equities is therefore through a fund concentrating on Germany. See our publication German Equities: Attractive fundamentals at a discount, for details. Greek politics unlikely to derail recovery With the far-left party Syriza earning the most votes in the recent Greek national elections, there is heightened uncertainty regarding the new government's willingness to abide by previous agreements with the Troika. While eurozone equities face headline risk regarding Greece, we believe that an agreement will eventually be reached that will avoid significant damage to eurozone recovery prospects. UBS CIO WM Research 28 January 2015 2 European equities Appendix Terms and Abbreviations Term / Abbreviation Description / Definition Term / Abbreviation Description / Definition 1Q, 2Q, etc. or 1Q11, 2Q11, etc. E UP First quarter, second quarter, etc. or first quarter 2011, second quarter 2011, etc. expected i.e. 2011E Underperform: The stock is expected to underperform the sector benchmark UBS Chief Investment Office A actual i.e. 2010A GDP WMR Gross domestic product UBS Wealth Management Research CIO UBS CIO WM Research 28 January 2015 3 European equities Appendix Global Disclaimer Chief Investment Office (CIO) Wealth Management (WM) Research is published by UBS Wealth Management and UBS Wealth Management Americas, Business Divisions of UBS AG (UBS) or an affiliate thereof. CIO WM Research reports published outside the US are branded as Chief Investment Office WM. In certain countries UBS AG is referred to as UBS SA. This publication is for your information only and is not intended as an offer, or a solicitation of an offer, to buy or sell any investment or other specific product. The analysis contained herein does not constitute a personal recommendation or take into account the particular investment objectives, investment strategies, financial situation and needs of any specific recipient. It is based on numerous assumptions. Different assumptions could result in materially different results. We recommend that you obtain financial and/or tax advice as to the implications (including tax) of investing in the manner described or in any of the products mentioned herein. Certain services and products are subject to legal restrictions and cannot be offered worldwide on an unrestricted basis and/ or may not be eligible for sale to all investors. All information and opinions expressed in this document were obtained from sources believed to be reliable and in good faith, but no representation or warranty, express or implied, is made as to its accuracy or completeness (other than disclosures relating to UBS and its affiliates). All information and opinions as well as any prices indicated are current only as of the date of this report, and are subject to change without notice. Opinions expressed herein may differ or be contrary to those expressed by other business areas or divisions of UBS as a result of using different assumptions and/or criteria. At any time, investment decisions (including whether to buy, sell or hold securities) made by UBS AG, its affiliates, subsidiaries and employees may differ from or be contrary to the opinions expressed in UBS research publications. Some investments may not be readily realizable since the market in the securities is illiquid and therefore valuing the investment and identifying the risk to which you are exposed may be difficult to quantify. UBS relies on information barriers to control the flow of information contained in one or more areas within UBS, into other areas, units, divisions or affiliates of UBS. Futures and options trading is considered risky. Past performance of an investment is no guarantee for its future performance. Some investments may be subject to sudden and large falls in value and on realization you may receive back less than you invested or may be required to pay more. Changes in FX rates may have an adverse effect on the price, value or income of an investment. This report is for distribution only under such circumstances as may be permitted by applicable law. Distributed to US persons by UBS Financial Services Inc., a subsidiary of UBS AG. UBS Securities LLC is a subsidiary of UBS AG and an affiliate of UBS Financial Services Inc. UBS Financial Services Inc. accepts responsibility for the content of a report prepared by a non-US affiliate when it distributes reports to US persons. All transactions by a US person in the securities mentioned in this report should be effected through a US-registered broker dealer affiliated with UBS, and not through a non-US affiliate. The contents of this report have not been and will not be approved by any securities or investment authority in the United States or elsewhere. UBS specifically prohibits the redistribution or reproduction of this material in whole or in part without the prior written permission of UBS and UBS accepts no liability whatsoever for the actions of third parties in this respect. Version as per May 2014. © UBS 2015. The key symbol and UBS are among the registered and unregisteredtrademarks of UBS. All rights reserved. UBS CIO WM Research 28 January 2015 4

© Copyright 2026