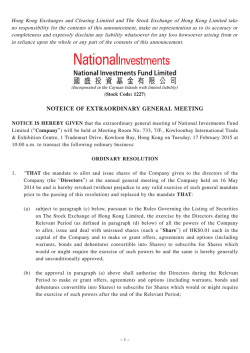

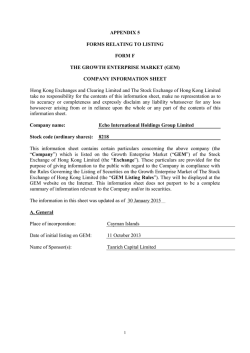

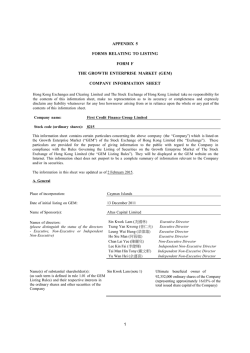

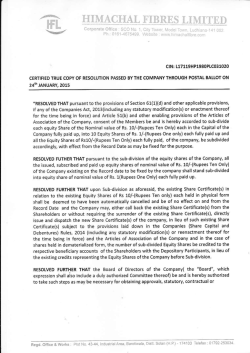

Admission Document