康健國際醫療集團有限公司 Town Health International Medical Group

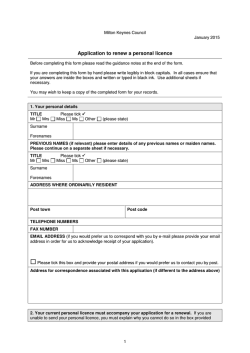

THIS CIRCULAR IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION If you are in any doubt as to any aspect of this circular or as to the action to be taken, you should consult your stockbroker or other registered dealer in securities, bank manager, solicitor, professional accountant or other professional adviser. If you have sold or transferred all your shares in Town Health International Medical Group Limited (‘‘Company’’), you should at once hand this circular, together with the enclosed form of proxy, to the purchasers or transferees or to the bank, stockbroker or other agent through whom the sale or transfer was effected for transmission to the purchasers or transferees. Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this circular, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this circular. Town Health International Medical Group Limited 康健國際醫療集團有限公司 (Incorporated in the Cayman Islands and continued in Bermuda with limited liability) (Stock Code: 3886) CONTINUING CONNECTED TRANSACTIONS AND NOTICE OF SPECIAL GENERAL MEETING Independent Financial Adviser to the Independent Board Committee and the Independent Shareholders A notice convening the special general meeting of the Company to be held at 9:30 a.m. on Monday, 23 February 2015 at 1st Floor, Town Health Technology Centre, 10-12 Yuen Shun Circuit, Siu Lek Yuen, Shatin, New Territories, Hong Kong is set out on pages SGM-1 to SGM-3 of this circular. Whether or not you are able to attend the meeting, you are requested to complete and return the enclosed form of proxy in accordance with the instructions printed thereon as soon as possible and in any event not less than 48 hours before the time appointed for holding the meeting or any adjournment thereof to the office of the Company’s branch share registrar and transfer office in Hong Kong, Tricor Tengis Limited at Level 22, Hopewell Centre, 183 Queen’s Road East, Hong Kong. Completion and return of the form of proxy will not preclude you from attending and voting in person at the meeting or any adjournment thereof should you so wish, and in such event, the instrument appointing a proxy shall be deemed to be revoked. 3 February 2015 CONTENTS Page Definitions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1 Letter from the Board . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7 Letter from the Independent Board Committee . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14 Letter from the Independent Financial Adviser . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15 Appendix – General information . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . I-1 Notice of the SGM . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . SGM-1 –i– DEFINITIONS In this circular, unless the context otherwise requires, the following expressions have the following meanings: ‘‘Acquisition’’ the acquisition of 1,000 shares in the share capital of the Target, representing 100% of the issued share capital of the Target as at completion, which took place on 1 January 2015, at the consideration of HK$423,780,000 ‘‘Annual Caps’’ the aggregate amount of the licence fees payable by the Group under the Licence Agreements in each of the three years ending 31 December 2017 in the amounts of HK$30 million, HK$30.8 million and HK$25.6 million respectively ‘‘associates’’ has the meaning ascribed to it in the Listing Rules ‘‘Board’’ the board of Directors ‘‘Bonjour Holdings’’ Bonjour Holdings Limited, a company incorporated in the Cayman Islands with limited liability and the ordinary shares of which are listed on the Main Board of the Stock Exchange (Stock Code: 653) ‘‘Bonjour Holdings Group’’ Bonjour Holdings and its subsidiaries ‘‘Broad Idea’’ Broad Idea International Limited, a company incorporated in the BVI with limited liability ‘‘BVI’’ the British Virgin Islands ‘‘China Life’’ 中國人壽保險 (集團)公司, in English for identification purposes only, China Life Insurance (Group) Company ‘‘Company’’ Town Health International Medical Group Limited, a company incorporated in the Cayman Islands and continued in Bermuda with limited liability and the ordinary shares of which are listed on the Main Board of the Stock Exchange ‘‘connected person(s)’’ has the meaning ascribed to it under the Listing Rules ‘‘Convertible Preference Share(s)’’ perpetual non-voting redeemable convertible preference share(s) of HK$0.01 each in the share capital of the Company –1– DEFINITIONS ‘‘CPS Subscription Agreement’’ the perpetual non-voting redeemable convertible preference shares subscription agreement dated 31 October 2014 entered into between the Company, Fubon Life, Fubon Insurance and Broad Idea in relation to (i) Fubon Life’s conditional subscription, and the Company’s conditional allotment and issue, of 212,121,212 Convertible Preference Shares at the cash consideration of HK$254,545,455; (ii) Fubon Insurance’s conditional subscription, and the Company’s conditional allotment and issue, of 79,545,454 Convertible Preference Shares at the cash consideration of HK$95,454,545; and (iii) Broad Idea’s conditional subscription, and the Company’s conditional allotment and issue, of 83,333,333 Convertible Preference Shares at the cash consideration of HK$100,000,000, each at the subscription price of HK$1.20 per Convertible Preference Share, details of which are set out in the circular of the Company dated 28 November 2014 ‘‘Director(s)’’ the director(s) of the Company ‘‘Dr. Cho’’ Dr. Cho Kwai Chee, an executive Director and the executive vice chairman of the Company ‘‘Dr. Choi’’ Dr. Choi Chee Ming, GBS, JP, the non-executive Director and the vice-chairman of the Company ‘‘Dr. Ip’’ Dr. Ip Chun Heng, Wilson, an executive Director ‘‘Existing HK Licence Agreement’’ the licence agreement dated 1 January 2015 in relation to the grant by Bonjour Cosmetic Wholesale Center Limited to Bonjour Beauty Limited of the exclusive right to use, enjoy and occupy the Existing HK Premises ‘‘Existing HK Premises’’ the premises used and occupied by the Group under the Existing HK Licence Agreement, details of which are disclosed in the paragraph headed ‘‘(i) Existing HK Licence Agreement’’ in the letter from the Board of this circular ‘‘Fubon Insurance’’ Fubon Insurance Co., Ltd., a company incorporated in Taiwan with limited liability –2– DEFINITIONS ‘‘Fubon Life’’ Fubon Life Insurance Co., Ltd., a company incorporated in Taiwan with limited liability ‘‘Group’’ the Company and its subsidiaries ‘‘HK$’’ Hong Kong dollars, the lawful currency of Hong Kong ‘‘Hong Kong’’ the Hong Kong Special Administrative Region of the People’s Republic of China ‘‘Independent Board Committee’’ the independent board committee comprising all the independent non-executive Directors, i.e. Mr. Chan Kam Chiu, Mr. Ho Kwok Wah, George, Mr. Wai Kwok Hung, SBS, JP and Mr. Wong Tat Tung, who have no material interest in the Licence Agreements and the transactions contemplated thereunder, which has been established by the Board to advise the Independent Shareholders in relation to the Licence Agreements and the transactions contemplated thereunder and the Annual Caps ‘‘Independent Financial Adviser’’ Goldin Financial Limited, a corporation licensed to carry out type 6 (advising on corporate finance) regulated activity as defined under the SFO, being the independent financial adviser appointed by the Company to advise the Independent Board Committee and the Independent Shareholders in relation to the Licence Agreements and the transactions contemplated thereunder and the Annual Caps ‘‘Independent Shareholder(s)’’ Shareholder(s) other than those who are required by the Listing Rules to abstain from voting on the resolution approving the Licence Agreements and the transactions contemplated thereunder and the Annual Caps ‘‘Investment Agreement’’ the investment agreement dated 5 January 2015 entered into between China Life and the Company in relation to the subscription for 1,785,098,644 new Shares by China Life, details of which are set out in the circular of the Company dated 3 February 2015 ‘‘Latest Practicable Date’’ 30 January 2015, being the latest practicable date prior to the publication of this circular for the purpose of ascertaining certain information contained in this circular –3– DEFINITIONS ‘‘Licence Agreements’’ the Existing HK Licence Agreement, the Macau Licence Agreement and the New HK Licence Agreement ‘‘Listing Rules’’ the Rules Governing the Listing of Securities on the Stock Exchange ‘‘Macau’’ the Macau Special Administrative Region of the People’s Republic of China ‘‘Macau Licence Agreement’’ the licence agreement dated 1 January 2015 in relation to the grant by Full Gain Developments Limited to Speedwell Group Limited of the exclusive right to use, enjoy and occupy the Macau Premises ‘‘Macau Premises’’ the premises used and occupied by the Group under the Macau Licence Agreement, details of which are disclosed in the paragraph headed ‘‘(iii) Macau Licence Agreement’’ in the letter from the Board of this circular ‘‘New HK Licence Agreement’’ the licence agreement dated 1 January 2015 in relation to the grant by Apex Frame Limited to Bonjour Beauty Limited of the exclusive right to use, enjoy and occupy the New HK Premises ‘‘New HK Premises’’ the premises to be used and occupied by the Group under the New HK Licence Agreement, details of which are disclosed in the paragraph headed ‘‘(ii) New HK Licence Agreement’’ in the letter from the Board of this circular ‘‘Option Shares’’ the maximum number of Shares held by China Life and which Shares are acquired by China Life through the subscription for new Shares from the Company pursuant to the Investment Agreement which when aggregated with the then shareholding of Broad Idea in the Company immediately before the exercise of the Put Option will result in Broad Idea’s shareholding interest in the Company being 29.90% of the total issued share capital of the Company with voting rights immediately after completion of the transfer of the Option Shares pursuant to the exercise of the Put Option –4– DEFINITIONS ‘‘Put Option’’ the option entitling China Life to require Broad Idea to purchase from China Life the Option Shares at the Put Option Sale Price ‘‘Put Option Deed’’ the put option deed dated 5 January 2015 entered into by Broad Idea, Dr. Cho and Dr. Choi in favour of China Life, in relation to the grant of the Put Option, details of which are set out in the circular of the Company dated 3 February 2015 ‘‘Put Option Sale Price’’ the price at which China Life may sell the Option Shares to Broad Idea on the exercise of the Put Option, which is initially fixed at HK$1.20 per Option Share subject to adjustment in accordance with the Put Option Deed ‘‘SFO’’ the Securities and Futures Ordinance (Chapter 571 of the Laws of Hong Kong) ‘‘SGM’’ a special general meeting of the Company convened to be held at 9:30 a.m. on Monday, 23 February 2015 at 1st Floor, Town Health Technology Centre, 10-12 Yuen Shun Circuit, Siu Lek Yuen, Shatin, New Territories, Hong Kong for the purpose of considering and, if thought fit, approving the Licence Agreements and the transactions contemplated thereunder and the Annual Caps ‘‘Share(s)’’ ordinary share(s) of HK$0.01 each in the share capital of the Company ‘‘Shareholder(s)’’ holder(s) of the Share(s) –5– DEFINITIONS ‘‘Share Subscription Agreement’’ the share subscription agreement dated 31 October 2014 entered into between the Company, Fubon Life, Fubon Insurance and Broad Idea in relation to (i) Fubon Life’s conditional subscription, and the Company’s conditional allotment and issue, of 259,740,260 Shares at the cash consideration of HK$254,545,455; (ii) Fubon Insurance’s conditional subscription, and the Company’s conditional allotment and issue, of 97,402,597 Shares at the cash consideration of HK$95,454,545; and (iii) Broad Idea’s conditional subscription, and the Company’s conditional allotment and issue, of 102,040,816 Shares at the cash consideration of HK$100,000,000, each at the subscription price of HK$0.98 per Share, details of which are set out in the circular of the Company dated 28 November 2014 ‘‘SP Agreement’’ the agreement for sale and purchase dated 20 August 2014 entered into between Bonjour Group Limited as the vendor and the Company as the purchaser in respect of the Acquisition, details of which are set out in the circular of the Company dated 19 November 2014 ‘‘Stock Exchange’’ The Stock Exchange of Hong Kong Limited ‘‘Target’’ Bonjour Beauty International Limited, a company incorporated in the BVI with limited liability ‘‘Target Group’’ the Target and its subsidiaries upon completion of the Acquisition –6– LETTER FROM THE BOARD Town Health International Medical Group Limited 康健國際醫療集團有限公司 (Incorporated in the Cayman Islands and continued in Bermuda with limited liability) (Stock Code: 3886) Executive Directors: Registered office: Miss Choi Ka Yee, Crystal (Chairperson) Canon’s Court Dr. Cho Kwai Chee (Executive Vice Chairman) Dr. Hui Ka Wah, Ronnie, JP (Chief Executive Officer) 22 Victoria Street Hamilton HM12 Dr. Ip Chun Heng, Wilson Mr. Lee Chik Yuet Bermuda Dr. Chan Wing Lok, Brian Head office and principal place of Mr. Wong Seung Ming (Chief Financial Officer) business in Hong Kong: 6th Floor Non-executive Director: Dr. Choi Chee Ming, GBS, JP (Vice-Chairman) Town Health Technology Centre 10-12 Yuen Shun Circuit Independent non-executive Directors: Siu Lek Yuen, Shatin New Territories, Hong Kong Mr. Chan Kam Chiu Mr. Ho Kwok Wah, George Mr. Wai Kwok Hung, SBS, JP Mr. Wong Tat Tung 3 February 2015 To the Shareholders Dear Sir or Madam, CONTINUING CONNECTED TRANSACTIONS INTRODUCTION Reference is made to the announcement of the Company dated 1 January 2015 in which the Company announced that, among other things, on 1 January 2015, certain subsidiaries of Bonjour Holdings as licensors, and certain subsidiaries of the Target as licensees, entered into (i) the Existing HK Licence Agreement; (ii) the New HK Licence Agreement; and (iii) the Macau Licence Agreement. –7– LETTER FROM THE BOARD The Group intends to continue to use the Existing HK Premises and the Macau Premises and will use the New HK Premises under the arrangements as contemplated under the Licence Agreements. The purpose of this circular is to provide you with, among other things, (i) details of the Licence Agreements and the transactions contemplated thereunder and the Annual Caps; (ii) the recommendation of the Independent Board Committee to the Independent Shareholders regarding the Licence Agreements and the transactions contemplated thereunder and the Annual Caps; (iii) the advice of the Independent Financial Adviser to the Independent Board Committee and the Independent Shareholders regarding the Licence Agreements and the transactions contemplated thereunder and the Annual Caps; (iv) other information as required to be disclosed under the Listing Rules; and (v) the notice of the SGM. THE LICENCE AGREEMENTS Set out below is a summary of each of the Licence Agreements: (i) Existing HK Licence Agreement Licensor Licensee Date Premises Area of premises (sq. feet) Term of licence Authorised use of the premises Security deposit (HK$) Monthly licence fee 1 January Bonjour Beauty Limited, a 1. Bonjour Cosmetic Wholesale 2015 wholly-owned subsidiary of Center Limited, a whollythe Company and a company owned subsidiary of Bonjour incorporated in Hong Kong Holdings and a company with limited liability and incorporated in Hong Kong principally engaged in the with limited liability and operation of beauty and health principally engaged in salons in Hong Kong wholesaling and retailing of beauty and health-care products in Hong Kong (Note) Shop B on the Ground Floor and Offices on the First and Second Floors of Anho House, Nos. 22, 24, 26 and 28 Nullah Road, Kowloon, Hong Kong 6,000 From 1 January 2015 to Lawful commercial 31 December 2017 purpose 1,559,955 (a) From 1 January 2015 to 20 March 2015: HK$519,985 (inclusive of government rent, rates and management fees); and (b) from 21 March 2015 to 31 December 2017: HK$598,385 (inclusive of government rent, rates and management fees) 2. First Floor, Nos. 50 and 50A Tung Choi Street, Mongkok, Kowloon, Hong Kong 2,200 From 1 January 2015 to Lawful commercial 31 December 2017 purpose 47,580 (a) From 1 January 2015 to 31 March 2015: HK$15,860 (inclusive of government rent, rates and management fees); and (b) from 1 April 2015 to 31 December 2017: HK$38,620 (inclusive of government rent, rates and management fees) 3. Part of Ground Floors of Nos. 40, 42, 44, 46, 48 & 50, Tung Choi Street, Mongkok, Kowloon, Hong Kong 5,100 From 1 January 2015 to Lawful commercial 1,979,902.50 31 December 2017 purpose (a) From 1 January 2015 to 31 March 2015: HK$659,967.50 (inclusive of government rent, rates and management fees); and (b) from 1 April 2015 to 31 December 2017: HK$759,967.50 (inclusive of government rent, rates and management fees) 4. Portions on Basement of Mirador Mansion, No. 58, Nathan Road, Tsimshatsui, Kowloon, Hong Kong 5,000 From 1 January 2015 to Lawful commercial 31 July 2017 purpose 1,674,420 HK$558,140 (inclusive of government rent, rates and management fees) 5. Fifth and Eleventh Floors, No. 3 Yuk Yak Street, Tokwawan, Kowloon, Hong Kong (‘‘Office’’) 11,588 From 1 January 2015 to Lawful commercial 30 June 2015 purpose 450,000 HK$150,000 (inclusive of government rent, rates and management fees) –8– LETTER FROM THE BOARD (ii) New HK Licence Agreement Licensor 1. Apex Frame Limited, a whollyowned subsidiary of Bonjour Holdings and a company incorporated in Hong Kong with limited liability and is an investment holding company (Note) Licensee Date Premises Bonjour Beauty Limited, a 1 January 11th Floor, Harrington wholly-owned subsidiary of 2015 Building, Nos. 36-50 the Company and a company Wang Wo Tsai Street, incorporated in Hong Kong Tsuen Wan, New with limited liability and Territories, Hong Kong principally engaged in the operation of beauty and health salons in Hong Kong Area of premises (sq. feet) 14,292 Authorised use of the premises Security deposit (HK$) From 1 July 2015 to Lawful commercial 30 June 2017 purpose 580,423.20 Authorised use of the premises Security deposit (HK$) Term of licence Monthly licence fee HK$193,474.40 (inclusive of government rent, rates and management fees) (iii) Macau Licence Agreement Licensor Licensee 1. Full Gain Developments Limited, Speedwell Group Limited, a a wholly-owned subsidiary of wholly-owned subsidiary of Bonjour Holdings and a the Company and a company company incorporated in the incorporated in the BVI with BVI with limited liability and limited liability and principally engaged in principally engaged in retailing of beauty and provision of beauty and healthcare products in Macau healthcare related consultancy (Note) services in Macau Date Premises 1 January The First Floor, the Second 2015 Floor and part of the Fifth Floor of the building erected on 7 Domingos Road, Macau Area of premises (sq. feet) 6,512.5 Term of licence From 1 January 2015 Commercial to 30 September purpose 2017 1,242,900 Monthly licence fee HK$414,300 (inclusive of government rent, rates and management fees) Note: Bonjour Holdings Group is principally engaged in the retail and wholesale of brand name beauty and healthcare products. Conditions precedent Each of the Licence Agreements is conditional upon the passing of an ordinary resolution by the Independent Shareholders at the SGM to be convened for the purpose of approving the terms of the Licence Agreements and the transactions contemplated thereunder and the Annual Caps. If this condition is not fulfilled by 30 April 2015 (or such other date agreed by the parties to the relevant Licence Agreements in writing), all rights and obligations of the parties under the relevant Licence Agreements shall cease and terminate, and no party thereto shall have any claim against the other save for claim (if any) in respect of any antecedent breach thereof. –9– LETTER FROM THE BOARD Annual Caps Taking into account the fact that the Group intends to continue to use the Existing HK Premises and the Macau Premises and will use the New HK Premises, it is expected that the Annual Caps are as follows: Annual Cap amounts For the For the For the year ending 31 December year ending 31 December year ending 31 December 2015 2016 2017 HK$30,000,000 HK$30,800,000 HK$25,600,000 The above Annual Caps are determined based on the licence fees payable by the Target Group to the Bonjour Holdings Group under the Licence Agreements for the three years ending 31 December 2017. Licence fees The monthly licence fees under the Existing HK Licence Agreement and the Macau Licence Agreement were determined by the parties thereto with reference to (i) the rents (which were determined by the then prevailing market rents on the premises comparable in location, area and permitted use) and other outgoings (such as government rents, rates and management fees) (if any) payable by the licensors under the relevant Licence Agreements as tenant to the landlord under the underlying tenancy agreements in relation to the Existing HK Premises and the Macau Premises; and (ii) the area of the premises licensed under the Existing HK Licence Agreement and the Macau Licence Agreement. In addition, the monthly licence fee under the New HK Licence Agreement was determined by the parties to the New HK Licence Agreement with reference to the prevailing market rents on the premises comparable in location, area and permitted use. Reasons for the transactions The Group is principally engaged in (i) healthcare business investments; (ii) provision and management of healthcare and related services; and (iii) properties and securities investments and trading. The Target Group is principally engaged in the operation of 17 beauty and health salons under the brands of ‘‘About Beauty’’, ‘‘Dr. Protalk’’ and ‘‘Top Comfort’’ in Hong Kong, Macau and Shanghai, and provision of beauty and health-care related consultancy services in Hong Kong and Macau. – 10 – LETTER FROM THE BOARD The Target Group has been occupying the Existing HK Premises and the Macau Premises before the date of the SP Agreement for the operation of the Target Group’s beauty salons and office in Hong Kong and Macau respectively. In addition, the Target Group has decided to relocate its office from the Office to the New HK Premises and the preparation for the renovation of the New HK Premises has commenced before the date of the SP Agreement. It is considered that it is in the interests of the Group for the Target Group to continue to use the Existing HK Premises and the Macau Premises as it can shelter the Group from any potential loss due to relocation of its existing beauty salons and office and save the relocation costs of the Group. It is also considered that using the New HK Premises will avoid extra expenditure and time cost to be incurred for the relocation and renovation of new office premises. Having considered the above, the Directors (including the independent non-executive Directors) are of the view that the terms of the Licence Agreements and the Annual Caps are fair and reasonable and the entering into of the Licence Agreements is in the interests of the Company and the Shareholders as a whole. Listing Rules implications As Bonjour Holdings is indirectly and beneficially owned as to 61.10% by Dr. Ip, a connected person of the Company by virtue of him being an executive Director, each of Bonjour Holdings and its subsidiaries is a connected person of the Company under the Listing Rules. Accordingly, the transactions contemplated under the Licence Agreements constitute continuing connected transactions for the Company under Chapter 14A of the Listing Rules. Since certain applicable percentage ratios relating to the proposed Annual Caps for the continuing connected transactions under the Licence Agreements exceed 5% and the Annual Caps are more than HK$10 million, the continuing connected transactions under the Licence Agreements are subject to the reporting, announcement, annual review and independent shareholders’ approval requirements under Chapter 14A of the Listing Rules. Dr. Ip has abstained from voting at the relevant Board resolution for approving the Licence Agreements since he was deemed to have a material interest in the transactions contemplated under the Licence Agreements for the reasons mentioned above. Save as disclosed above, none of the other Directors has a material interest in the Licence Agreements and the transactions contemplated thereunder. General The Independent Board Committee, comprising all the independent non-executive Directors has been established to advise the Independent Shareholders in relation to the Licence Agreements and the transactions contemplated thereunder and the Annual Caps. The Independent Financial Adviser has been appointed by the Company to advise the Independent Board Committee and the Independent Shareholders on the Licence Agreements and the transactions contemplated thereunder and the Annual Caps. – 11 – LETTER FROM THE BOARD As Dr. Ip is deemed to have a material interest in the transactions contemplated under the Licence Agreements for the reasons mentioned above, Dr. Ip and his associates will be required to abstain from voting at the SGM in respect of the resolution relating to the Licence Agreements and the transactions contemplated thereunder and the Annual Caps. Given that (i) Bonjour Group Limited, holding 365,327,586 Shares, which represented approximately 7.15% of the total issued Shares as at the Latest Practicable Date, is a wholly-owned subsidiary of Bonjour Holdings, which in turn is indirectly and beneficially owned as to 61.10% by Dr. Ip; and (ii) Promised Return Limited, holding 10,176,000 Shares, which represented approximately 0.20% of the total issued Shares as at the Latest Practicable Date, is wholly-owned by Deco City Limited, which is owned as to 50% by Dr. Ip and 50% by Dr. Ip’s spouse, Bonjour Group Limited and Promised Return Limited are associates of Dr. Ip and they will be required to abstain from voting at the SGM in respect of the resolution relating to the Licence Agreements and the transactions contemplated thereunder and the Annual Caps. Save as disclosed above, to the best of the Directors’ knowledge, information and belief, having made all reasonable enquiries, no other Shareholder has a material interest in the Licence Agreements and the transactions contemplated thereunder and no other Shareholder will be required to abstain from voting at the SGM in respect of the resolution relating to the Licence Agreements and the transactions contemplated thereunder and the Annual Caps. SGM The SGM is convened to be held at 9:30 a.m. on Monday, 23 February 2015 at 1st Floor, Town Health Technology Centre, 10-12 Yuen Shun Circuit, Siu Lek Yuen, Shatin, New Territories, Hong Kong, the notice of which is set out on pages SGM-1 to SGM-3 of this circular, for the Independent Shareholders to consider and, if thought fit, approve the Licence Agreements and the transactions contemplated thereunder and the Annual Caps. In compliance with the Listing Rules, the resolution will be voted on by way of poll at the SGM. You will find enclosed a form of proxy for use at the SGM. Whether or not you are able to attend the SGM, you are requested to complete and return the enclosed form of proxy in accordance with the instructions printed thereon as soon as possible and in any event not less than 48 hours before the time appointed for holding the SGM or any adjournment thereof to the office of the Company’s branch share registrar and transfer office in Hong Kong, Tricor Tengis Limited at Level 22, Hopewell Centre, 183 Queen’s Road East, Hong Kong. Completion and return of the form of proxy will not preclude you from attending and voting in person at the SGM or any adjournment thereof should you so wish, and in such event, the instrument appointing a proxy shall be deemed to be revoked. – 12 – LETTER FROM THE BOARD RECOMMENDATION The Independent Board Committee, having taken into account the advice of the Independent Financial Adviser, considers that the terms of the Licence Agreements and the Annual Caps are fair and reasonable, on normal commercial terms so far as the Independent Shareholders are concerned, and the entering into of the Licence Agreements are in the ordinary and usual course of business and in the interests of the Company and the Shareholders as a whole. Accordingly, the Independent Board Committee recommends the Independent Shareholders to vote for the resolution to approve the Licence Agreements and the transactions contemplated thereunder and the Annual Caps. The text of the letter from the Independent Board Committee is set out on page 14 of this circular. Having considered the above-mentioned benefits to the Group, the Directors believe that the terms of the Licence Agreements and the Annual Caps are fair and reasonable and in the interests of the Company and the Shareholders as a whole. The Board recommends the Independent Shareholders to vote in favour of the resolution as set out in the notice of the SGM. ADDITIONAL INFORMATION Your attention is also drawn to the additional information set out in the appendix to this circular. By order of the Board Town Health International Medical Group Limited Lee Chik Yuet Executive Director – 13 – LETTER FROM THE INDEPENDENT BOARD COMMITTEE Town Health International Medical Group Limited 康健國際醫療集團有限公司 (Incorporated in the Cayman Islands and continued in Bermuda with limited liability) (Stock Code: 3886) 3 February 2015 To the Independent Shareholders Dear Sir or Madam, CONTINUING CONNECTED TRANSACTIONS This Independent Board Committee has been appointed to advise you on the terms of the Licence Agreements, details of which are set out in the letter from the Board contained in the circular to the Shareholders dated 3 February 2015 (‘‘Circular’’) of which this letter forms part. Terms defined in the Circular shall have the same meanings when used in this letter unless the context otherwise requires. Having considered the terms of the Licence Agreements and the advice of the Independent Financial Adviser in relation thereto as set out on pages 15 to 23 of the Circular, we are of the opinion that the terms of the Licence Agreements and the Annual Caps are fair and reasonable, on normal commercial terms so far as the Independent Shareholders are concerned, and the entering into of the Licence Agreements are in the ordinary and usual course of business and in the interests of the Company and the Shareholders as a whole. We therefore recommend the Independent Shareholders to vote in favour of the ordinary resolution to be proposed at the SGM to approve the Licence Agreements and the transactions contemplated thereunder and the Annual Caps. Yours faithfully, Independent Board Committee of Town Health International Medical Group Limited Chan Kam Chiu Wai Kwok Hung, SBS, JP Ho Kwok Wah, George Independent non-executive Directors – 14 – Wong Tat Tung LETTER FROM THE INDEPENDENT FINANCIAL ADVISER Set out below is the full text of a letter of advice from the Independent Financial Adviser to the Independent Board Committee and the Independent Shareholders, which has been prepared for the purpose of incorporation in this circular in respect of the continuing connected transactions contemplated under the Licence Agreements and the proposed Annual Caps. Goldin Financial Limited 23/F Two International Finance Centre 8 Finance Street Central Hong Kong 3 February 2015 To the Independent Board Committee and the Independent Shareholders of Town Health International Medical Group Limited Dear Sirs, CONTINUING CONNECTED TRANSACTIONS INTRODUCTION We refer to our appointment as the Independent Financial Adviser to the Independent Board Committee and the Independent Shareholders in relation to the Existing HK Licence Agreement, the New HK Licence Agreement and the Macau Licence Agreement and the transactions contemplated thereunder and the proposed Annual Caps, details of which are set out in the letter from the Board (the ‘‘Letter from the Board’’) contained in the circular issued by the Company to the Shareholders dated 3 February 2015 (the ‘‘Circular’’), of which this letter forms part. Capitalized terms used in this letter shall have the same meanings as defined in the Circular unless the context requires otherwise. It was announced by the Company on 1 January 2015 that, among other things, on 1 January 2015, certain subsidiaries of Bonjour Holdings as licensors, and certain subsidiaries of the Target as licensees, entered into (i) the Existing HK Licence Agreement in relation to the grant by the licensor to the licensee of the exclusive right to use, enjoy and occupy the Existing HK Premises; (ii) the New HK Licence Agreement in relation to the grant by the licensor to the licensee of the exclusive right to use, enjoy and occupy the New HK Premises; and (iii) the Macau Licence Agreement in relation to the grant by the licensor to the licensee of the exclusive right to use, enjoy and occupy the Macau Premises. – 15 – LETTER FROM THE INDEPENDENT FINANCIAL ADVISER Bonjour Holdings is indirectly and beneficially owned as to 61.10% by Dr. Ip, a connected person of the Company by virtue of him being an executive Director, each of Bonjour Holdings and its subsidiaries is a connected person of the Company under the Listing Rules. Accordingly, the transactions contemplated under the Licence Agreements constitute continuing connected transactions for the Company under Chapter 14A of the Listing Rules. As one or more of the applicable percentage ratios (as defined under the Listing Rules and other than the profits ratio) in respect of the proposed Annual Caps for the continuing connected transactions under the Licence Agreements exceed 5% and the Annual Caps are more than HK$10 million, the continuing connected transactions under the Licence Agreements are subject to the reporting, announcement, annual review and independent shareholders’ approval requirements under Chapter 14A of the Listing Rules. The Directors will convene the SGM to seek the approval of the Independent Shareholders on the Licence Agreements and the transactions contemplated thereunder and the proposed Annual Caps by way of poll in accordance with the requirements under the Listing Rules. As Dr. Ip is deemed to have a material interest in the transactions contemplated under the Licence Agreements for the reasons mentioned above, Dr. Ip and his associates will be required to abstain from voting at the SGM in respect of the resolution relating to the Licence Agreements and the transactions contemplated thereunder and the proposed Annual Caps. Given that (i) Bonjour Group Limited, holding 365,327,586 Shares, which represented approximately 7.15% of the total issued Shares as at the Latest Practicable Date, is a wholly-owned subsidiary of Bonjour Holdings, which in turn is indirectly and beneficially owned as to 61.10% by Dr. Ip; and (ii) Promised Return Limited, holding 10,176,000 Shares, which represented approximately 0.20% of the total issued Shares as at the Latest Practicable Date, is wholly-owned by Deco City Limited, which is owned as to 50% by Dr. Ip and 50% by Dr. Ip’s spouse, Bonjour Group Limited and Promised Return Limited are associates of Dr. Ip and they will be required to abstain from voting at the SGM in respect of the resolution relating to the Licence Agreements and the transactions contemplated thereunder and the proposed Annual Caps. Save as disclosed above, to the best of the Directors’ knowledge, information and belief, having made all reasonable enquiries, no other Shareholder has a material interest in the Licence Agreements and the transactions contemplated thereunder and no other Shareholder will be required to abstain from voting at the SGM in respect of the resolution relating to the Licence Agreements and the transactions contemplated thereunder and the proposed Annual Caps. INDEPENDENT BOARD COMMITTEE The Independent Board Committee comprising Mr. Chan Kam Chiu, Mr. Wai Kwok Hung, SBS, JP, Mr. Ho Kwok Wah, George, and Mr. Wong Tat Tung, being all the independent non-executive Directors, has been formed to advise the Independent Shareholders in relation to the Licence Agreements and the transactions contemplated under and the proposed Annual Caps. – 16 – LETTER FROM THE INDEPENDENT FINANCIAL ADVISER We, Goldin Financial Limited, have been appointed by the Company as the Independent Financial Adviser to advise the Independent Board Committee and the Independent Shareholders in relation to the Licence Agreements and to make a recommendation as to, among others, whether the terms of the Licence Agreements and the transactions contemplated thereunder, and the proposed Annual Caps are fair and reasonable, on normal commercial terms so far as the Independent Shareholders are concerned, and the entering into of the Licence Agreements is in the interests of the Company and the Shareholders as a whole, and as to voting in respect of the resolution at the SGM. BASIS OF OUR ADVICE In formulating our opinion and recommendations, we have reviewed, inter alia, the announcement of the Company dated 1 January 2015 and the Licence Agreements. We have also reviewed the underlying tenancy agreements in relation to the Existing HK Premises and the Macau Premises respectively. In addition, we have also reviewed certain information provided by the management of the Company relating to the operations, financial condition and prospects of the Group. We have also (i) considered such other information, analyses and market data which we deemed relevant; and (ii) conducted verbal discussions with the management of the Company regarding the terms of the Licence Agreements, the financials, businesses and future outlook of the Group. We have assumed that such information and statements, and any representation made to us, are true, accurate and complete in all material respects as of the date hereof and we have relied upon them in formulating our opinion. The Directors collectively and individually accept full responsibility for the accuracy of the information contained in the Circular and confirm, having made all reasonable inquiries, that to the best of their knowledge, opinions expressed in the Circular have been arrived at after due and careful consideration and there are no other facts not contained in the Circular, the omission of which would make any statement herein or in the Circular misleading. We consider that we have been provided with, and we have reviewed, all currently available information and documents which are available under present circumstances to enable us to reach an informed view regarding the terms of the Licence Agreements and to justify reliance on the accuracy of the information contained in the Circular so as to provide a reasonable basis of our opinion. We have no reason to suspect that any material information has been withheld by the Directors or management of the Company, or is misleading, untrue or inaccurate. We have not, however, conducted an independent verification of the information nor have we conducted any form of in-depth investigation into the businesses and affairs or other prospects of the Group or its associates. Our opinion was necessarily based on financial, economic, market and other conditions in effect, and the information made available to us, as at the Latest Practicable Date. – 17 – LETTER FROM THE INDEPENDENT FINANCIAL ADVISER This letter is issued of the information for the Independent Board Committee and the Independent Shareholders solely in connection with their consideration and approval of the Licence Agreements and the transactions contemplated thereunder and the proposed Annual Caps, and this letter, except for its inclusion in the Circular, is not to be quoted or referred to, in whole or in part, nor shall this letter be used for any other purposes, without our prior written consent. PRINCIPAL FACTORS AND REASONS CONSIDERED In assessing the fairness and reasonableness of the Licence Agreements and the transactions contemplated thereunder and the proposed Annual Caps, and in giving our recommendation to the Independent Board Committee and the Independent Shareholders, we have taken into account the following principal factors and reasons: 1. Background to and reasons for the entering into of the Licence Agreements The Group is principally engaged in (i) healthcare business investments; (ii) provision and management of healthcare and related services; and (iii) properties and securities investments and trading. The Target Group is principally engaged in the operation of 17 beauty and health salons under the brands of ‘‘About Beauty’’, ‘‘Dr. Protalk’’ and ‘‘Top Comfort’’ in Hong Kong, Macau and Shanghai, and provision of beauty and health-care related consultancy services in Hong Kong and Macau. Bonjour Holdings is principally engaged in retail and wholesale of brand name beauty and health-care products. The Target Group has been occupying the Existing HK Premises and the Macau Premises before the date of the SP Agreement for the operation of the Target Group’s beauty salons and office in Hong Kong and Macau respectively. The Licence Agreements were entered into between certain subsidiaries of Bonjour Holdings as licensors, and certain subsidiaries of the Target as licensees, in relation to the licensing of the Existing HK Premises, the Macau Premises and the New HK Premises (the ‘‘Premises’’), and the continuing connected transactions contemplated under the Licence Agreements form an integral part of the ordinary and usual course of business of the Group and has been conducted on normal commercial terms and on an arm’s length basis. As advised by the management of the Company, it is the intention of the Group to continue to operate the Target Group’s beauty salons and office at the Existing HK Premises and the Macau Premises since it can shelter the Group from any potential loss due to relocation of its existing beauty salons and office and save the relocation costs of the Group. – 18 – LETTER FROM THE INDEPENDENT FINANCIAL ADVISER In addition, the Target Group has decided to relocate its office from the Office to the New HK Premises and the preparation for the renovation of the New HK Premises has commenced before the date of the SP Agreement. As advised by the management of the Company, using the New HK Premises will avoid extra expenditure and time cost to be incurred for the relocation and renovation of new office premises. In view of the profitable track record of the Target Group and the intention of the Company to maintain and further develop the existing business of the Target Group, details of which are set out in the circular issued by the Company dated 19 November 2014, we are of the view that the entering into of the Licence Agreements would secure the Premises for the business operation of the Target Group, which is important to the Group’s ongoing business and positive to the Group’s financial performance. In light of the foregoing, we are of the opinion that the continuing connected transactions contemplated under the Licence Agreements which are and will be carried out in the ordinary and usual course of business of the Group, and are in the interests of the Company and the Shareholders as a whole. 2. Principal terms of the Licence Agreements The summary of each of the Licence Agreements are set out in the section headed ‘‘The Licence Agreements’’ in the Letter from the Board. Our analysis on the principal terms of the Licence Agreements are as follows. Licence fees The monthly licence fees under the Existing HK Licence Agreement and the Macau Licence Agreement were determined by the parties to the Existing HK Licence Agreement and the Macau Licence Agreement with reference to (i) the rents (which were determined by the then prevailing market rents on the premises comparable in location, area and permitted use) and other outgoings (such as government rents, rates and management fees) (if any) payable by the licensors under the relevant Licence Agreements as tenant to the landlord under the underlying tenancy agreements in relation to the Existing HK Premises and the Macau Premises; and (ii) the area of the premises licensed under the Existing HK Licence Agreement and the Macau Licence Agreement. In addition, the monthly licence fee under the New HK Licence Agreement was determined by the parties to the New HK Licence Agreement with reference to the prevailing market rents on the premises comparable in location, area and permitted use. To assess the fairness and reasonableness of the licence fees as determined between the licensors and the licensees under the relevant Licence Agreements, we have researched on the public domain to study the recent commercial rental atmosphere in Hong Kong and Macau. – 19 – LETTER FROM THE INDEPENDENT FINANCIAL ADVISER All Existing HK Premises excluding the Office (the ‘‘Beauty Salons’’) We have reviewed the breakdown of the monthly licence fees of the Beauty Salons as provided by the management of the Company. In assessing the rents of the Beauty Salons, the rental rate of each of the Beauty Salons, being the monthly licence fee net of the rates, government rent and management fees, is used in our comparison. As advised by the management of the Company, we were given to understand that all the Beauty Salons are used for the operation of the Target Group’s beauty salons in Kowloon areas. Considering the usage, nature and locations of the Beauty Salons, we consider that the comparison between the rental rate of the Beauty Salons and the average rents of private retail in Kowloon areas in November 2014 according to the ‘‘Hong Kong Property Review – Monthly Supplement’’ (‘‘Hong Kong Property Review’’) published in January 2015 by the Rating and Valuation Department of the Government of HKSAR are fair and reasonable. In respect of the Beauty Salons, the premises as numbered 2 (‘‘Shop B’’) and 3 (‘‘Shop C’’) in the table set out in the section headed ‘‘The Licence Agreements’’ in the Letter from the Board are adjacent to each other and we were given to understand that the Group is currently using both Shop B and Shop C as a whole to operate business. Therefore, the monthly licence fees of Shop B and Shop C are analysed as a whole. We noted that the rental rates of the Beauty Salons (including Shop B and Shop C as analysed as a whole) per square feet are lower than that of the average rental rates of private retails in Kowloon areas (based on the conversion rate of 1 square feet = 0.09290304 square meters). The Office and the New HK Premises We have reviewed the breakdown of the monthly licence fees of the Office and the New HK Premises as provided by the management of the Company. In assessing the rents of the Office and the New HK Premises, the rental rates of the Office and the New HK Premises, being the monthly licence fees net of the rates, government rent and management fees, are used in our comparison. We noted that each of the respective buildings which the Office and the New HK Premises is located is in the industrial district of Tokwawan, Kowloon and Tsuen Wan, New Territories respectively. Considering the usage, nature and locations of the Office and the New HK Premises, we consider that the comparison between the rental rates of each of the Office and the New HK Premises and the respective average rents of the transacted leases for industrial buildings in Tokwawan, Kowloon and Tsuen Wan, New Territories for the fourth quarter of 2014 according to the research report (‘‘Midland Research Report’’) released on 15 January 2015 by Midland IC&I Group, one of the leading property agency companies in Hong Kong, are fair and reasonable. – 20 – LETTER FROM THE INDEPENDENT FINANCIAL ADVISER We noted that the rental rates of the Office per square feet are lower than the average rental rates of the transacted leases for industrial buildings in Tokwawan, Kowloon from the Midland Research Report. In respect of the New HK Premises, we noted that the rental rates of the New HK Premises per square feet represents a slight premium of approximately 4.02% over the average rental rates of the transacted leases for industrial buildings in Tsuen Wan, New Territories. Macau Premises We have reviewed the breakdown of the monthly licence fee of the Macau Premises as provided by the management of the Company. In assessing the rents of the Macau Premises, the rental rate of the Macau Premises, being the monthly licence fee net of the rates, government rent and management fees, is used in our comparison. We noted that the Macau Premises is located at Domingos Road, being one of the premier shopping districts in Macau. With reference to a news article released by Jones Lang LaSalle Incorporated dated 10 July 2014 in relation to the property market in Macau, it is stated that the overall retail rentals recorded a 7.4% year to year growth in the 2nd quarter of 2014 and the retail rentals in S. Domingos and S. Paulo areas recorded the strongest growth among districts. We have researched on the public domain and on our best effort basis, have identified one similar transaction (‘‘Comparable’’) in respect of the retail shop lease at S. Domingos area, Macau, which was extracted from the Macao Daily News as published on 20 November 2014. Considering the nature and location of the Macau Premises, we consider that the comparison between the rental rate of the Macau Premises and the rent of the Comparable relevant. We noted that the rental rate of the Macau Premises per square feet is lower than that of the Comparable. As stated above, we note that the monthly rental rate for most of the Premises under the Licence Agreements are lower than the current market monthly average rental values, save for the New HK Premises. Given that the usage of the New HK Premises will avoid extra expenditure and time cost to be incurred for the relocation and renovation of new office premises, we consider that the slight premium as represented by the rental rate fee of the New HK Premises commercially justifiable. Security deposit The security deposits of each of the Premises contemplated under each of the Licence Agreements is equivalent to three times of the respective monthly licence fee for each Premises, and in the case of any revision of the monthly licence fees during the term of the Licence Agreements, the initial monthly licence fee for such Premises, as contemplated under each of the Licence Agreements respectively. According to the guidelines of ‘‘Setting up your company’’ as released by InvestHK of the Government of HKSAR, a cash security deposit of up to three months’ rent including service – 21 – LETTER FROM THE INDEPENDENT FINANCIAL ADVISER charge and government rates is required when leasing an office in Hong Kong. As such, we consider that the arrangement of the security deposit is in consistence with the advice from Invest HK. In light of the foregoing, we are of the view that the terms of the continuing connected transactions contemplated under the Licence Agreements are normal commercial terms, and fair and reasonable so far as the Independent Shareholders are concerned. PROPOSED ANNUAL CAPS UNDER THE LICENCE AGREEMENTS The table below summarises the proposed Annual Caps for each of the three years ending 31 December 2015, 2016 and 2017 respectively, with respect to the transactions contemplated under the Licence Agreements: Annual Caps For the year For the year For the year ending 31 December 2015 ending 31 December 2016 ending 31 December 2017 HK$30,000,000 HK$30,800,000 HK$25,600,000 As stated in the Letter from the Board, the above Annual Caps are determined based on the licence fees payable by the Target Group to the Bonjour Holdings Group under the Licence Agreements for the three years ending 31 December 2017. We have discussed with the Directors on the determination of the proposed Annual Caps and noted that the proposed Annual Caps for each of the years ending 31 December 2015, 2016 and 2017 respectively is determined based on the aggregate sum of the monthly licence fees of each of the Premises according to their respective terms as stipulated under the Licence Agreements. The monthly licence fees payable by the Group for each of the Premises under the Licence Agreements are fixed during their whole respective term with reference to the prevailing market rents at the time of entering into the relevant Licence Agreements. We have reviewed the calculation of the proposed Annual Caps and we considered that the proposed Annual Caps under the Licence Agreements are fair and reasonable so far as the Independent Shareholders are concerned. – 22 – LETTER FROM THE INDEPENDENT FINANCIAL ADVISER ANNUAL REVIEW OF THE CONTINUING CONNECTED TRANSACTIONS The proposed Annual Caps will be subject to the annual review by the independent nonexecutive Directors, details of which must be included in the Company’s subsequent published annual report and accounts. In addition, pursuant to the Listing Rules, the auditors of the Company must provide a letter to the Board confirming, among others, that the continuing connected transactions under the Licence Agreements are conducted in accordance with their terms and that the proposed Annual Caps are not being exceeded. Moreover, pursuant to the Listing Rules, the Company shall publish an announcement if it knows or has reason to believe that the independent non-executive Directors and/or its auditors will not be able to confirm the terms of such transactions or the relevant Annual Caps not being exceeded. We are of the view that there are appropriate measures in place to govern the conduct of the transactions contemplated under the Licence Agreements and safeguard the interests of the Independent Shareholders. RECOMMENDATIONS Taking into consideration of the above mentioned principal factors and reasons, we consider that the terms of the Licence Agreements and the proposed Annual Caps are fair and reasonable, on normal commercial terms so far as the Independent Shareholders are concerned, and the entering into of the Licence Agreements are in the ordinary and usual course of business and in the interests of the Company and the Shareholders as a whole. Accordingly, we recommend the Independent Shareholders, as well as the Independent Board Committee to advise the Independent Shareholders, to vote in favour of the resolution to be proposed at the SGM to approve the Licence Agreements and the transactions contemplated thereunder and the proposed Annual Caps. Yours faithfully, For and on behalf of Goldin Financial Limited Billy Tang Director * For identification purposes only – 23 – APPENDIX 1. GENERAL INFORMATION RESPONSIBILITY STATEMENT This circular, for which the Directors collectively and individually accept full responsibility, includes particulars given in compliance with the Listing Rules for the purpose of giving information with regard to the Company. The Directors, having made all reasonable enquiries, confirm that to the best of their knowledge and belief the information contained in this circular is accurate and complete in all material respects and not misleading or deceptive, and there are no other matters the omission of which would make any statement herein or this circular misleading. 2. DISCLOSURE OF INTERESTS (i) Interests of Directors As at the Latest Practicable Date, the interests and short positions of the Directors and chief executives of the Company in the Shares, underlying Shares and debentures of the Company or its associated corporations (within the meaning of Part XV of the SFO) which (i) were required to be notified to the Company and the Stock Exchange pursuant to Divisions 7 and 8 of Part XV of the SFO (including interests and short positions which they were taken or deemed to have under such provisions of the SFO); or (ii) were required, pursuant to section 352 of the SFO, to be entered in the register referred to therein; or (iii) were required to be notified to the Company and the Stock Exchange pursuant to the Model Code for Securities Transactions by Directors of Listed Issuers contained in the Listing Rules were as follows: Long position in the Shares and underlying Shares Approximate percentage of the total issued share capital of the Company (Note 1) Number of Shares held Number of underlying Shares held 1,335,243,431 (Note 2) 985,384,806 (Note 3) 42.38% Beneficial owner 2,760,000 – 0.05% Lee Chik Yuet Beneficial owner – 5,000,000 0.09% Dr. Choi Interest in controlled corporation 1,335,243,431 (Note 2) 985,384,806 (Note 3) 42.38% Dr. Ip Interest in controlled corporation 375,503,586 (Note 4) – 6.85% Name of Director Capacity Dr. Cho Interest in controlled corporation Chan Wing Lok, Brian I–1 APPENDIX GENERAL INFORMATION Notes: 1. The total number of issued Shares as at the Latest Practicable Date (that was, 5,475,699,809 Shares) have been used for the calculation of the approximate percentage. 2. Such Shares were held by Broad Idea which is owned as to 50.1% by Dr. Cho and as to 49.9% by Dr. Choi. Accordingly, Dr. Cho and Dr. Choi are both deemed to be interested in the 1,335,243,431 Shares held by Broad Idea under Part XV of the SFO. Dr. Cho and Dr. Choi are also directors of Broad Idea. 3. Such underlying Shares were held by Broad Idea which is owned as to 50.1% by Dr. Cho and as to 49.9% by Dr. Choi. Accordingly, Dr. Cho and Dr. Choi are both deemed to be interested in the 985,384,806 underlying Shares held by Broad Idea under Part XV of the SFO. Out of the 985,384,806 underlying Shares, (i) 83,333,333 underlying Shares represent the Shares that may be allotted and issued to Broad Idea upon full conversion of the Convertible Preference Shares held by Broad Idea based on the initial conversion price of HK$1.20 per Share (subject to adjustment in accordance with the terms of the Convertible Preference Shares); and (ii) 902,051,473 underlying Shares are the maximum number of Option Shares that may be sold by China Life to Broad Idea upon the exercise of the Put Option to be granted to China Life under the Put Option Deed. Dr. Cho and Dr. Choi are also directors of Broad Idea. 4. Such Shares were held as to (i) 365,327,586 Shares by Bonjour Group Limited; and (ii) 10,176,000 Shares by Promised Return Limited. Bonjour Group Limited is wholly-owned by Bonjour Holdings. Bonjour Holdings is owned as to 54.01% by Promised Return Limited. Promised Return Limited is wholly-owned by Deco City Limited, which is owned as to 50% by Dr. Ip and 50% by his spouse, Ms. Chung Pui Wan. As such, Dr. Ip is deemed to be interested in the aggregate of 375,503,586 Shares held by Bonjour Group Limited and Promised Return Limited under Part XV of the SFO. Dr. Ip is also a director of each of Bonjour Group Limited, Bonjour Holdings, Promised Return Limited and Deco City Limited. Save as disclosed above, as at the Latest Practicable Date, none of the Directors or chief executives of the Company had or was deemed to have any interests and short positions in the Shares, underlying Shares and debentures of the Company or any of its associated corporations (within the meaning of Part XV of the SFO) which (i) were required to be notified to the Company and the Stock Exchange pursuant to Divisions 7 and 8 of Part XV of the SFO (including interests and short positions which they were taken or deemed to have under such provisions of the SFO); or (ii) were required, pursuant to section 352 of the SFO, to be entered in the register referred to therein; or (iii) were required to be notified to the Company and the Stock Exchange pursuant to the Model Code for Securities Transactions by Directors of Listed Issuers contained in the Listing Rules. I–2 APPENDIX (ii) GENERAL INFORMATION Interests of substantial Shareholders As at the Latest Practicable Date, so far as was known to the Directors, the following parties, other than the Directors or chief executives of the Company, had interests or short positions in the Shares and underlying Shares, which would fall to be disclosed to the Company and the Stock Exchange under the provisions of Divisions 2 and 3 of Part XV of the SFO. Long position in the Shares and underlying Shares Number of Shares held Number of underlying Shares held Approximate percentage of the total issued share capital of the Company (Note 1) Name Capacity Broad Idea (Note 2) Beneficial owner 1,335,243,431 985,384,806 (Note 3) 42.38% Bonjour Group Limited (Note 4) Beneficial owner 365,327,586 (Note 5) – 6.67% Bonjour Holdings Interest in controlled corporation 365,327,586 (Note 5) – 6.67% Fubon Financial Holding Co., Ltd. (‘‘Fubon Financial’’) Interest in controlled corporation 357,142,857 (Note 6) 291,666,666 (Note 7) 11.84% Fubon Life Beneficial owner 259,740,260 (Note 6) 212,121,212 (Note 7) 8.61% China Life Beneficial owner 1,785,098,644 – 32.60% Notes: 1 The total number of issued Shares as at the Latest Practicable Date (that was, 5,475,699,809 Shares) have been used for the calculation of the approximate percentage. 2. Broad Idea is beneficially owned as to 50.1% by Dr. Cho and as to 49.9% by Dr. Choi. They are also directors of Broad Idea. I–3 APPENDIX 3. GENERAL INFORMATION Such underlying Shares were held by Broad Idea which is owned as to 50.1% by Dr. Cho and as to 49.9% by Dr. Choi. Accordingly, Dr. Cho and Dr. Choi are both deemed to be interested in the 985,384,806 underlying Shares held by Broad Idea under Part XV of the SFO. Out of the 985,384,806 underlying Shares, (i) 83,333,333 underlying Shares represent the Shares that may be allotted and issued to Broad Idea upon full conversion of the Convertible Preference Shares held by Broad Idea based on the initial conversion price of HK$1.20 per Share (subject to adjustment in accordance with the terms of the Convertible Preference Shares); and (ii) 902,051,473 are the maximum number of Option Shares that may be sold by China Life to Broad Idea pursuant to the possible exercise of the Put Option to be granted to China Life under the Put Option Deed. Dr. Cho and Dr. Choi are also directors of Broad Idea. 4. Dr. Ip, who is an executive Director, is a director of each of Bonjour Group Limited and Bonjour Holdings. 5. Bonjour Group Limited, a wholly-owned subsidiary of Bonjour Holdings, was the beneficial owner of the 365,327,586 Shares. Accordingly, Bonjour Holdings is deemed to be interested in these Shares under part XV of the SFO. 6. Such Shares were held as to (i) 259,740,260 Shares by Fubon Life; and (ii) 97,402,597 Shares by Fubon Insurance. Each of Fubon Life and Fubon Insurance is a wholly-owned subsidiary of Fubon Financial. Accordingly, Fubon Financial is deemed to be interested in the aggregate of 357,142,857 Shares held by Fubon Life and Fubon Insurance under Part XV of the SFO. 7. Such underlying Shares were held as to (i) 212,121,212 underlying Shares by Fubon Life; and (ii) 79,545,454 underlying Shares by Fubon Insurance. Each of Fubon Life and Fubon Insurance is a wholly-owned subsidiary of Fubon Financial. Accordingly, Fubon Financial is deemed to be interested in the aggregate of 291,666,666 underlying Shares held by Fubon Life and Fubon Insurance under Part XV of the SFO. Short position in the Shares and underlying Shares Name Capacity China Life Beneficial owner Number of Shares held Number of underlying Shares held Approximate percentage of the total issued share capital of the Company (Note) – 835,735,306 15.26% Note: The total number of issued Shares as at the Latest Practicable Date (that was, 5,475,699,809 Shares) have been used for the calculation of the approximate percentage. I–4 APPENDIX GENERAL INFORMATION Save as disclosed above, the Directors were not aware of any party who, as at the Latest Practicable Date, had interests or short positions in the Shares and underlying Shares, which would fall to be disclosed to the Company and the Stock Exchange under the provisions of Divisions 2 and 3 of Part XV of the SFO. 3. DIRECTORS’ SERVICE CONTRACTS As at the Latest Practicable Date, none of the Directors had any existing or proposed service contract with any member of the Group (excluding contracts expiring or determinable by the employer within one year without payment of compensation other than statutory compensation). 4. EXPERT AND CONSENT The following is the qualification of the expert who has been named in this circular or have given opinions, letters or advice contained in this circular: Name Qualification Goldin Financial Limited Goldin Financial Limited is a corporation licensed under the SFO to carry out type 6 (advising on corporate finance) regulated activity as defined under the SFO Goldin Financial Limited has given and has not withdrawn its written consent to the issue of this circular with the inclusion therein of its letter and/or reference to its name, in the form and context in which they appear. As at the Latest Practicable Date, Goldin Financial Limited was not beneficially interested in the share capital of any member of the Group nor had any right, whether legally enforceable or not, to subscribe for or to nominate persons to subscribe for securities in any member of the Group, nor did it have any interest, either directly or indirectly, in the assets which have been acquired or disposed of by or leased to any member of the Group since 31 December 2013, being the date to which the latest published audited consolidated financial statements of the Group were made up. 5. DIRECTORS’ COMPETING INTERESTS To the best knowledge of the Directors, as at the Latest Practicable Date, none of the Directors or any proposed Director nor their respective close associates had any interests in a business, which competes or is likely to compete either directly or indirectly with the business of the Group which would be required to be disclosed under Rule 8.10 of the Listing Rules, as if each of them were treated as a controlling Shareholder. I–5 APPENDIX 6. GENERAL INFORMATION DIRECTORS’ INTERESTS IN CONTRACTS OR ARRANGEMENTS Save for the interests of (i) Dr. Cho, an executive Director and Dr. Choi, the non-executive Director, under the Share Subscription Agreement, the CPS Subscription Agreement, the Investment Agreement and the Put Option Deed; and (ii) Dr. Ip, an executive Director, under the SP Agreement and the Licence Agreements, none of the Directors was materially interested in any contract or arrangement subsisting as at the Latest Practicable Date which is significant in relation to the business of the Group, nor, had any Director had any direct or indirect interests in any assets which have been acquired or disposed of by or leased to, or are proposed to be acquired or disposed of by or leased to, any member of the Group since 31 December 2013, being the date to which the latest published audited consolidated financial statements of the Group were made up. 7. NO MATERIAL ADVERSE CHANGE The Directors confirm that as at the Latest Practicable Date, they were not aware of any material adverse change in the financial or trading position of the Group since 31 December 2013, being the date to which the latest published audited financial statements of the Group were made up. 8. GENERAL (a) The registered office of the Company is at Canon’s Court, 22 Victoria Street, Hamilton HM 12, Bermuda. (b) The head office and principal place of business of the Company in Hong Kong is at 6th Floor, Town Health Technology Centre, 10-12 Yuen Shun Circuit, Siu Lek Yuen, Shatin, New Territories, Hong Kong. (c) The company secretary of the Company is Mr. Wong Seung Ming, who is a fellow member of the Association of Chartered Certified Accountants and a Certified Public Accountant of the Hong Kong Institute of Certified Public Accountants. (d) The Company’s branch share registrar and transfer office in Hong Kong is Tricor Tengis Limited at Level 22, Hopewell Centre, 183 Queen’s Road East, Hong Kong. (e) The English text of this circular shall prevail over the Chinese text. I–6 APPENDIX 9. GENERAL INFORMATION DOCUMENTS AVAILABLE FOR INSPECTION Copies of the following documents will be available for inspection during normal business hours (Saturdays and public holidays excepted) from 10:00 a.m. to 1:00 p.m. and from 2:00 p.m. to 5:00 p.m. at the office of Messrs. Leung & Lau at Unit 7208-10, 72nd Floor, The Center, 99 Queen’s Road C., Central, Hong Kong from the date of this circular up to and including the date of the SGM: (a) the Licence Agreements; (b) the letter from the Independent Board Committee, the text of which is set out on page 14 of this circular; (c) the letter from the Independent Financial Adviser, the text of which is set out on pages 15 to 23 of this circular; (d) the written consent referred to in the section headed ‘‘Expert and Consent’’ in this appendix; (e) the Investment Agreement; (f) the Put Option Deed; (g) the Share Subscription Agreement; (h) the CPS Subscription Agreement; and (i) the SP Agreement. I–7 NOTICE OF THE SGM Town Health International Medical Group Limited 康健國際醫療集團有限公司 (Incorporated in the Cayman Islands and continued in Bermuda with limited liability) (Stock Code: 3886) NOTICE OF SPECIAL GENERAL MEETING NOTICE IS HEREBY GIVEN that the special general meeting of Town Health International Medical Group Limited (‘‘Company’’) will be held at 9:30 a.m. on Monday, 23 February 2015 at 1st Floor, Town Health Technology Centre, 10-12 Yuen Shun Circuit, Siu Lek Yuen, Shatin, New Territories, Hong Kong to consider and, if thought fit, pass the following resolution as an ordinary resolution: ORDINARY RESOLUTION ‘‘THAT: (a) the licence agreement in relation to the grant by Bonjour Cosmetic Wholesale Center Limited to Bonjour Beauty Limited of the exclusive right to use, enjoy and occupy the Existing HK Premises (as defined in the circular of the Company dated 3 February 2015 (‘‘Circular’’), a copy of which is marked ‘‘A’’ and signed by the chairman of the meeting for identification purpose has been tabled at the meeting) (‘‘Existing HK Licence Agreement’’) (a copy of the Existing HK Licence Agreement is marked ‘‘B’’ and signed by the chairman of the meeting for identification purpose has been tabled at the meeting) and the transactions contemplated thereunder be and are hereby approved, confirmed and ratified; (b) the licence agreement in relation to the grant by Full Gain Developments Limited to Speedwell Group Limited of the exclusive right to use, enjoy and occupy the Macau Premises (as defined in the Circular) (‘‘Macau Licence Agreement’’) (a copy of the Macau Licence Agreement is marked ‘‘C’’ and signed by the chairman of the meeting for identification purpose has been tabled at the meeting) and the transactions contemplated thereunder be and are hereby approved, confirmed and ratified; SGM – 1 NOTICE OF THE SGM (c) the licence agreement in relation to the grant by Apex Frame Limited to Bonjour Beauty Limited of the exclusive right to use, enjoy and occupy the New HK Premises (as defined in the Circular) (‘‘New HK Licence Agreement’’, together with the Existing HK Licence Agreement and the Macau Licence Agreement, collectively, ‘‘Licence Agreements’’) (a copy of the New HK Licence Agreement is marked ‘‘D’’ and signed by the chairman of the meeting for identification purpose has been tabled at the meeting) and the transactions contemplated thereunder be and are hereby approved, confirmed and ratified; (d) the Annual Caps (as defined in the Circular) for the three years ending 31 December 2017 be and are hereby approved; and (e) any one of the directors of the Company (‘‘Directors’’) be and is authorised to do all such acts and things, to sign and execute such documents or agreements or deeds on behalf of the Company and to do such other things and to take all such actions as he/ she considers necessary, appropriate, desirable and expedient for the purposes of giving effect to or in connection with the Licence Agreements and all transactions contemplated thereunder and the Annual Caps, and to agree to such variation, amendments or waiver or matters relating thereto (including any variation, amendments or waiver of such documents or any terms thereof, which are not fundamentally different from those as provided in the Licence Agreements) as are, in the opinion of such Director, in the interests of the Company and its shareholders as a whole.’’ By order of the Board Town Health International Medical Group Limited Lee Chik Yuet Executive Director Hong Kong, 3 February 2015 Registered office: Head office and principal place of Canon’s Court 22 Victoria Street business in Hong Kong: 6th Floor Hamilton HM12 Bermuda Town Health Technology Centre 10-12 Yuen Shun Circuit Siu Lek Yuen, Shatin New Territories, Hong Kong SGM – 2 NOTICE OF THE SGM Notes: (1) A member of the Company entitled to attend and vote at the special general meeting convened by the above notice is entitled to appoint one or more proxy to attend and, subject to the provisions of the bye-laws of the Company, to vote on his/her behalf. A proxy need not be a shareholder of the Company but must be present in person at the special general meeting to represent the shareholder. If more than one proxy is so appointed, the appointment shall specify the number and class of shares in respect of which each such proxy is so appointed. (2) To be valid, the form of proxy, together with the power of attorney or other authority (if any) under which it is signed (or a notarially certified copy thereof), must be deposited at the office of the Company’s branch share registrar and transfer office in Hong Kong, Tricor Tengis Limited at Level 22, Hopewell Centre, 183 Queen’s Road East, Hong Kong not less than 48 hours before the time appointed for holding the meeting or any adjourned meeting (as the case may be). (3) Completion and return of an instrument appointing a proxy should not preclude a member of the Company from attending and voting in person at the meeting and/or any adjournment thereof and in such event, the instrument appointing a proxy shall be deemed to be revoked. (4) As required under the Rules Governing the Listing of Securities on The Stock Exchange of Hong Kong Limited, the above resolution will be decided by way of poll. As at the date of this notice, the executive Directors are Miss Choi Ka Yee, Crystal (Chairperson), Dr. Cho Kwai Chee (Executive Vice Chairman), Dr. Hui Ka Wah, Ronnie, JP (Chief Executive Officer), Dr. Ip Chun Heng, Wilson, Mr. Lee Chik Yuet, Dr. Chan Wing Lok, Brian and Mr. Wong Seung Ming (Chief Financial Officer); the non-executive Director is Dr. Choi Chee Ming, GBS, JP (Vice-Chairman) and the independent non-executive Directors are Mr. Chan Kam Chiu, Mr. Ho Kwok Wah, George, Mr. Wai Kwok Hung, SBS, JP and Mr. Wong Tat Tung. SGM – 3

© Copyright 2026