Runnels County

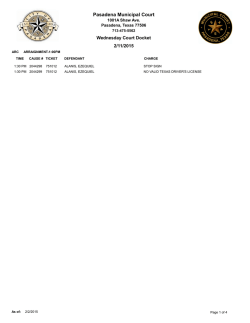

DELINQUENT TAX SALE THE COUNTY OF RUNNELS, TEXAS RUNNELS COUNTY, TEXAS March 3, 2015 at 10:00 a.m. Runnels County Courthouse, 613 Hutchings, Ballinger, Texas GENERAL INFORMATION REGARDING THE TAX SALE You must READ THE FOLLOWING IMPORTANT INFORMATION regarding the property to be offered for sale. 1. Prior to the beginning of the tax sale, a person intending to bid is required to register with the person conducting the sale and present a valid Driver’s License or identification card issued by a State agency or the United States government. 2. The property will be sold at public auction and will be sold for cash to the highest bidder, based on oral bids. Successful bidders must pay for their property with cash or a cashier’s check payable to Runnels County Sheriff’s Office. Any bidder who fails to make payment shall be held liable for twenty percent of the value of the property plus costs incurred as a result of the bidder’s default pursuant to Rule 652 of the Texas Rules of Civil Procedure. 3. The amount of the opening bid is set out below each tract, and the bidding must start at that figure or higher, and sums less than the given figure cannot be accepted. The minimum bid amount includes taxes which were delinquent at the date of judgment. This does not include the current tax year. Purchasers will be required to pay all taxes which accrued subsequent to the date of judgment. 4. Purchasers at this tax foreclosure sale will receive an ordinary type of Sheriff’s Deed which is without warranty, express or implied. Title to property is NOT guaranteed. A policy of title insurance may be difficult to obtain. 5. All property purchased at this sale is subject to a statutory right of redemption. This redemption period commences to run from the date the purchaser’s deed is filed for record in the County Clerk’s office. Purchasers have the right of possession during the redemption period. There is a two year right of redemption for homestead property and property appraised as agricultural land. There is a 180 day right of redemption for all other property. 6. Anyone having an ownership interest in the property at the time of the sale may redeem the property from the purchaser during the redemption period. The redemption price is set by the Texas Tax Code as follows: purchase amount, deed recording fee, taxes paid by purchaser after the tax sale, and costs expended on the property, plus a redemption premium of 25 percent of the aggregate total during the first year or 50 percent of the aggregate total during the second year. “Costs” are defined as the amount reasonably spent by the purchaser for the maintenance, preservation and safekeeping of the property as provided by Section 34.21 (g) of the TEXAS TAX CODE. 7. Property is sold by legal description. Bidders must satisfy themselves concerning the location and condition of the property on the ground, including the existence of improvements on the property, prior to this tax sale. Property is sold “AS IS” with all faults. All sales are final. There are no refunds. Deeds, maps and plats of the properties are in the County Clerk’s office or the Appraisal District. Lawsuit files on which this sale is based are in the office of the District Clerk. The approximate property address reflected on the bid sheet is the address on the tax records and may not be accurate. 8. Property purchased at this tax sale may be subject to liens for demolition, mowing, or maintenance fees due to the City or Property Owners Association in which the property is located. If you have any questions, please contact our office in Brady at (325) 597-1412. PROPERTIES TO BE SOLD ON MARCH 3, 2015: TRACT 1. 2. 3. 4. 5. SUIT # 4236 4397 4411 4411 4417 STYLE Winters Independent School District v Robert Castillo, Jr. et al The County of Runnels, Texas v Rudy Amaro, Sr. et al The County of Runnels, Texas v Sam Farmer Garner AKA Sam Garner et al The County of Runnels, Texas v Sam Farmer Garner AKA Sam Garner et al The County of Runnels, Texas v David Richard Howard et al PROPERTY DESCRIPTION, APPROXIMATE ADDRESS, ACCT # all of Lot 7, SAVE & EXCEPT 13 feet off the East side of Lot 7 and the East 1/2 of Lot 8, Block 10, Vancil Addition to the City of Winters, Runnels County, Texas (Vol. 191, Page 3, Official Public Records) Account #R000013219 Judgment Through Tax Year: 2006 610 BOWEN LOT: 3, BLK: 22, SUBD: LOCATED WEST END, SER: TXFLW66B03192WP11 & A03192WP11, LAB: RAD1058853 & 4, 1998 WOODLAND PARK, 28X40 ACRES:0.000 Account #R000022733 Judgment Through Tax Year: 2012 1404 BROAD A tract of land consisting of 3.03 Acres, more or less, in Abstract 782 of the E.I. Field Survey No. 86, Runnels County, Texas (Volume 180, Page 103 of the Official Public Records, Runnels County, Texas) Account #R000005062 Judgment Through Tax Year: 2012 N/A 0.303 of an Acre, more or less, in Abstract 871, C. Willingham Survey No. 871, Runnels County, Texas (Volume 180, Page 103 of the Official Public Records, Runnels County, Texas) Account #R000005406 Judgment Through Tax Year: 2012 N/A A tract of land in Abstract 782 of the T&NO RR Survey No 86 in the City of Miles, Runnels County, Texas (Volume 345, Page 355 of the Deed Records, Runnels County, Texas) Account #R000011223 Judgment Through Tax Year: 2012 N/A MIN BID $1,540.00 $4,833.40 $854.70 $869.70 $1,650.00 TRACT 6. 7. 8. 9. 10. 11. SUIT # 4486 4511 4513 4514 4565 4593 STYLE The County of Runnels, Texas v Lessie Marie Luna et al The County of Runnels, Texas v Joe Lee Taylor et al The County of Runnels, Texas v Domingo Lemus The County of Runnels, Texas v Minnie Armendariz The County of Runnels, Texas v Ruth A. Ledbetter et al The County of Runnels, Texas v Bishop & Sons Dirt Contractors, Inc. PROPERTY DESCRIPTION, APPROXIMATE ADDRESS, ACCT # Lots 2 & 3, Block 10, Guion Subdivision, City of Ballinger, Runnels County, Texas (Volume 303, Page 697 (Contract for Deed)) Account #R000022383 Judgment Through Tax Year: 2012 707 N. 15TH The East 30' of Lot 4 & all of Lot 5, Block 7, Southside Addition to the City of Winters, Runnels County, Texas (Volume 219, Page 545, Official Public Records) Account #R000012878 Judgment Through Tax Year: 2012 409 E. WOOD Lot 2, Cameron Subdivision of the Northwest 1/2 of Block 25 of the West End Addition, City of Ballinger, Runnels County, Texas (Volume 312, Page 466, Official Public Records) Account #R000008021 Judgment Through Tax Year: 2012 MIN BID $3,476.19 $3,553.19 $1,308.40 1103 AVENUE A .520 acres, more or less, out of the South part of Block 78, West End Addition, City of Ballinger, Runnels County, Texas (Volume 181, Page 77, Official Public Records) Account #R000010141 Judgment Through Tax Year: 2012 $1,278.40 1700 N. 13TH the North 150' of Lot 2, Block 14, of the South Side Addition, City of Winters, Runnels County, Texas (Vol. 274, Page 187, Deed Records), 403 E. Broadway St., Winters, Texas 79567-5609 Account #R000021817 Judgment Through Tax Year: 2013 $6,171.40 403 E. BROADWAY a 200 x 150 foot tract of land in Abstract 195 of the M. Fitzpatrick Survey #492, Runnels County, Texas (Vol. 419, Page 377, Deed Records) Account #R000013385 Judgment Through Tax Year: 2013 $1,318.40 810 N. MAIN TRACT 12. 13. SUIT # 4598 4602 STYLE The County of Runnels, Texas v Rose Hiner et al The County of Runnels, Texas v Elma Santoya PROPERTY DESCRIPTION, APPROXIMATE ADDRESS, ACCT # All of Block 12, College Heights Addition to the City of Winters, SAVE & EXCEPT that property more particularly described as 120' x 200' out of the Southwest corner of Block 12, (North and South) and 166' off of and entirely across the East side of Block 12, Runnels County, Texas (Vol. 367, Page 343, Official Public Records) Account #R000011928 Judgment Through Tax Year: 2013 501 E. PIERCE Lot 1, Block 12, Dale West Subdivision, City of Winters, Runnels County, Texas (Vol. 221, Page 373, Official Public Records) Account #R000021869 Judgment Through Tax Year: 2013 MIN BID $3,572.40 $2,608.40 600 W. DALE Lot 10, Block 10, Vancil Addition, City of Winters, Runnels County, Texas (Vol. 372, Page 494, Official Public Records) Account #R000021938 Judgment Through Tax Year: 2013 14. 15. 4605 4612 The County of Runnels, Texas v Jesus Sanchez et al The County of Runnels, Texas v Mary Campbell et al $3,351.40 600 BOWEN Lot 3, Block 125, of the First Addition a/k/a First Railroad Addition, City of Ballinger, Runnels County, Texas (Vol. 108, Page 444, Deed Records) Account #R000009618 Judgment Through Tax Year: 2013 $4,525.40 605 N. 3RD

© Copyright 2026