Forward Looking Statements

Forward Looking Statements

This presentation contains certain statements that may be deemed “forward-looking”

statements. Forward looking statements are statements that are not historical facts and

are generally, but not always, identified by the words “expects”, “plans”, “anticipates”,

“believes”, “intends”, “estimates”, “projects”, “potential” and similar expressions, or that

events or conditions “will”, “would”, “may”, “could” or “should” occur and include,

without limitation, statements regarding the Company’s plans with respect to statements

about the Company’s ability to fund and execute the proven ore processing business

model, and the potential economics and returns of that business model, outlined in this

presentation. Although Standard Tolling believes the expectations expressed in such

forward-looking statements are based on reasonable assumptions, such statements are

not guarantees of future performance and actual results may differ materially from those

in forward looking statements. Forward looking statements are based on the beliefs,

estimates and opinions of the Company’s management on the date the statements are

made. Except as required by law, the Company undertakes no obligation to update these

forward-looking statements in the event that management’s beliefs, estimates, opinions, or

other factors, should change.

Corporate Overview

Standard Tolling intends to design, build, own and operate its first gold toll

processing plant in Peru

! Standard Tolling is preparing a comprehensive study to develop its first plant by

Q2 2014. The Company will also announce the selection of the plant location.

! Standard Tolling will look to purchase high-grade ore from small and artisanal

miners throughout Peru, who are legally compliant, and then process it for sale.

! The plant will have an initial capacity of approximately 100 to 125 TPD. Within 36

months, the plant can be expanded using debt to 350 TPD.

! The study will look to establish cost certainty providing equity investors a clear

understanding of dilution while also providing a template for future facilities.

! PROVEN TEAM with extensive toll milling experience

The Processing Business Advantage

!

ALLOWS FOR RAPID ENTRY into gold production and positive cash flow

!

REQUIRES NO MINE OWNERSHIP which greatly reduces the risks associated with

exploration and mining

!

LIMITED COMMODITY EXPOSURE provides for steady and predictable cash

flow returns even in a difficult gold and silver market

!

PROVEN SUPERIOR RETURN ON EQUITY and has proven scalability potential

!

MASSIVE GLOBAL GROWTH POTENTIAL and a clear leader has yet to emerge

in the toll processing space

!

PROVIDES STAKEHOLDER BENEFITS to Standard Tolling shareholders, small scale

miners, communities, and multiple levels of government

A Proven Business Model

Two publically traded ore processors have already successfully executed this

business model in Peru.

! Dynacor Gold Mines (TSX: DNG)

Owns and operates a 230 TPD facility in Peru, running at full capacity

Production target of 71,000 Au oz. in 2014 with an approx. grade of 30 g/t

A 49% ROE, which ranks among the highest in the entire gold sector

Expanding with a second plant that will have a 350 TPD capacity

Stellar stock performance since 2010

! Inca One Resources (TSX-V: IO)

Operate the 25 TPD Chala One plant; currently expanding to 50 TPD

Successful roll out in a short-time frame with initial mill purchase in July 2013 and

production by December 2013

Successfully closed numerous rounds of financing

Outperformance

A Look At Dynacor (2010 – 2013)

Dynacor Gold Mines

~550% Return

Since 2010

Gold Miners ETF

~50% Decline

Since 2010

Why Peru?

Ultra Supportive New Legislative Regime!

PERU is playing a leading role in regulating small mining

! Recent quote from Jorge Merino, Minister of Energy and Mines. “Peru has reached a

point of no return in the fight against illegal mining.”

! Small mining industry in Peru undergoing significant regulatory change whereby new

regulations require the formalization of small miners by April 2014 deadline.

! New small mining regulations should provide the government with previously missed

taxation opportunities, reduce the devastating impact to the environment, create

better conditions for miners, and tackle the underground economy.

! Peru produces approximately 160 tons of gold annually and it is estimated that small

mining accounts for 20% of this total (~32 tons of gold).

! There is a strong enforcement mechanism in place through the requirement that ore

processing be done by legally compliant mills. This has created a significant opening

for new players as illegal miners become formalized.

Window of Opportunity

New Mining Regulations!

A Win Win Win

1

Multiple Stakeholder Benefits!

OUR SHAREHOLDERS BENEFIT – a low-risk proven model with profitability ensured

in most gold price scenarios, diversified ore feed from multiple mines, and limited

operating risks typically associated with exploration and mining companies.

2

SMALL SCALE PERUVIAN MINERS – autonomy is maintained as Standard Tolling

will work in cooperation with the miners rather than at odds, which is often the

case with a large mining company. Proximity to the Company’s initial mill could

provide additional processing options for miners and/or lower transport costs.

Better recovery rates at the Company’s plant means higher pay to the miner.

3

GOVERNMENT OF PERU – improved tax collection and monitoring capabilities

are immediate benefits to the government. The intended policy outcomes of

requiring all miners to utilize permitted facilities for processing is reduced mercury

consumption and reduced environmental impact.

Comprehensive Study

Now Underway!

BENEFITS OF COMPLETING THE STUDY

Establishes a template for build out of the first facility and the basis for more.

Utilizes multiple expert independent consultants to ensure accuracy.

Investor friendly. It will establish cost certainty which will allow equity investors to

more accurately forecast share dilution. Establishes the “last financing” concept.

Uncovers market inefficiencies, makes key findings, and challenges assumptions.

INITIAL DISCOVERIES OF THE STUDY

PHASE I mapping depicts all small mining activity, existing processing plants and

transportation routes (has uncovered a district of choice for the first plant).

Having the proper financing to complete ore purchases quickly can create large

advantages over competitors who are underfunded.

To complete purchases quickly, quality control and processes are critical.

Establishing an ore-finance facility (in the form of junior debt) prior to equity offering

is important for modeling.

The Standard Team

COMPREHENSIVE STUDY CONSULTANTS

Former Manager of a Peru toll processing plant, to oversee ore purchase protocols

A metallurgical consulting firm to establish sampling, testing processes, plant design

A financial advisor to establish revenue model, assist in budgeting and planning

A Peruvian legal firm to understand and comply with regulations and permitting

A Peruvian geological team to complete two phase mapping plan

A Social Advisory firm to provide community relations plan

KEY ADVISORY PARTICIPANTS

Andrew Neale, Board Member, to oversee comprehensive study

Carlos Mirabal, Advisory Board, to assist with build out and commission

David Hutchins, Advisor Board, to assist to European financing initiatives

Proposed Timeline

Funding Requirements

Initial 100 TPD Plant!

!

PLANT BUILD OUT (Equity) ………………………............... $4,500,000

!

ORE PURCHASES (Junior Debt) ……………………………. $2,000,000

!

TOTAL FUNDING NEEDED …………….............................. $6,500,000

NOTES ABOUT STANDARD TOLLING’S INITIAL PROJECT

! Build out costs will be finalized in the Comprehensive Study, but are

approximated using industry average of $40,000/ton of capex

! Ore purchases could be made through the use of a dedicated debt

finance facility

! The Company looks to initially establish a 100 TPD facility and grow

using additional debt to expand to 350 TPD over 3 years

Growth Assumptions

100 & 350 TPD Facility!

! OPERATING ASSUMPTIONS

Operating Revenue Per Ton

…………………….

100 TPD

350 TPD

$240

$240

Operational Cost Per Ton

……………………….

$95

$95

Operating Capacity in %

……………………….

90%

90%

Spot Gold Price Per Oz

…………………………..

$1300

$1300

Average Grade Per Ton

………………………….

20 g/t

20 g/t

95%

95%

Recovery Rate in %

……………………………….

Gold Recovered Per Month

……………………...

1,700 oz

6,000 oz

! ANNUAL GOLD PRODUCTION

……………………...

20,400 oz

72,000 oz

$26.5M

$93.6M

$5.3M

$18.7M

! ANNUAL REVENUES

………………………………...

! OPERATING PROFIT (20%)

…………………………….

* Based on Dynacor Gold Mines Operating Assumptions (Sept. 2013). Standard Tolling’s results may differ materially

from Dynacor’s projections. Please see Disclaimer: Forward Looking Statements on page 2.

Creating Maximum Leverage

Standard Tolling is looking to create maximum leverage for equity investors

! Initial plant will require all-equity financing, debt only available upon production

! Future production goal of 350 TPD is to dilutive to fund upfront, start smaller

! SOLUTION: generate enough cash flow to meet threshold for bank financing

“Last Financing” Concept and Expansion Template

! At 100 – 125 TPD, cash flow could reach $5M / annum

! At 2 X cash flow, a bank could loan $10M for expansion to 350 TPD

! To achieve 100 TPD, equity needed is approx. $4.5M (plus ore purchases)

! Theoretically, a $4.5M equity investment (plus ore purchases) would be the “last”

equity required to ultimately get to 350 TPD

! At 350 TPD, the Company could justify a $100M market capitalization

* Based on Dynacor Gold Mines Operating Assumptions (Sept. 2013). Standard Tolling’s results may differ materially

from Dynacor’s projections. Please see Disclaimer: Forward Looking Statements on page 2.

Extensive Opportunities Exist

Standard Tolling believes that countries throughout

Latin America will eventually follow Peru’s lead and

enact laws to curb illegal mining. If the Company

can establish a successful ore-processing template

in Peru, there will be a huge opportunity to expand

operations throughout Latin America.

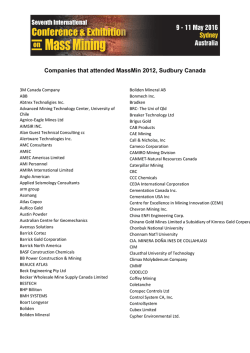

Top(Des8na8ons(for(Non:Ferrous(Explora8on,(2012(

Mining in Latin America:

! Brazil, Peru and Chile all rank among the Top 15

gold producers in the world

! Currently, South America receives more mining

exploration than any other part of the world

! 38% of worldwide investment in metallurgical

prospecting goes to South America

! Illegal mining is a huge problem looming over

much of Latin America, not just Peru

Source:(SNL(Metals(Economics(Group(

Management, Directors & Advisory Board

Len Clough, President, CEO & Chairman

Mr. Len Clough worked at RBC Dominion Securities in Vancouver from 1998 to 2010. From

2010 to 2013, he served as Managing Director of Kingfisher Advisors SA (“Kingfisher”), a

financial advisory firm that specialized in offering financial advisory services to institutional

and non-institutional clientele. Mr. Clough is a Director of Dynasty Metals and Mining Inc.,

an Ecuadorian mining company operating the Zaruma mine.

Andrew James Neale, Director

Mr. Andrew Neale is a mining industry executive with more than 25 years of experience in

international mine operations management, engineering, construction and environmental

management. For the past 3 years, he has been engaged by a private management

group to modernize and expand the HEMCO gold mining operation in Nicaragua. Mr.

Neale previously served for 12 years with Freeport-McMoRan Copper and Gold Inc.

Carlos H. Fernandez Mazzi, Director

Mr. Mazzi’s career is highlighted by his leadership in the development of the US $1.0 billion

San Cristobal project in Bolivia as CEO of Minera San Cristobal S.A. He was also the CEO

of the W.J. Clinton Foundation's Clinton Giustra Sustainable Growth Initiative with a focus

on impact investing and sustainable development in Latin America.

Management, Directors & Advisory Board

Carlos Mirabal, Advisor

Mr. Carlos Mirabal has more than 35 years of experience in the mining industry. From 2006

to 2010, he served as President & CEO of Orvana Minerals Corp. Prior to that, Mr. Mirabal

spent 33 years with Compania Minera del Sur S.A. ("Comsur”), where he served as Vice

President of Operations. In this position, he was a key member of the management team

responsible for the construction and operation of Orvana’s Don Mario Mine in Bolivia.

David Hutchins, Advisor

Mr. Hutchins has 30 years' experience as a resource analyst and fund manager. His career

began with the Melbourne Stock Exchange in 1979 and he later became an executive

director of M&G Investment Management in London. He was a founding director of

Resources Investment Trust plc at its launch in January 2002 and CEO of Ocean Resources

Capital Holdings plc. Mr. Hutchins is a member of the FTSE Gold Mines Index Committee.

Dan O’Brien, Chief Financial Officer

Mr. O'Brien is a member of the Institute of Chartered Accountants of British Columbia and

is also Chief Financial Officer for a number of publicly listed exploration companies that

trade on the Toronto Stock Exchange and TSX Venture Exchange. He was previously a

senior manager at a leading Canadian accounting firm where he specialized in the audit

of public companies in the mining and resource sector.

Capital Structure

Share Price (March 10, 2014) ……………………………

$0.12 CAD

Market Capitalization …………………………………………

$3.99M

Insider, Management & Related Ownership ………………...

~30%

Shares Issued ……………………………………………….

33,290,113

Warrants Outstanding …………………………………….

12,946,354

9,367,000

3,162,687

416,667

Exercise Price: $0.15

Exercise Price: $0.15

Exercise Price: $0.15

Expiry: 02-Apr-15

Expiry: 23-Dec-15

Expiry: 21-Jan-16

Options Outstanding …………………………………….....

2,336,662

Shares Fully Diluted …………………………………………

48,573,129

Contact Information

Corporate Head Office

Unit 1 – 15782 Marine Drive

White Rock, BC, Canada V4B 1E6

Tel: (604) 536 2711 Fax: (604) 536 2788

Shawn Perger, Shareholder Relations

Tel: +1 778 686 0135

[email protected]

[email protected]

www.standardtolling.com

Appendix & Endnotes

Comprehensive Study

Standard Tolling is contracting with a number of independent consultants to

complete a Comprehensive Study. It will be overseen by Andrew Neale.

The components of the report will be:

1 Ore Supply incl. Plant Location

2 Testing and Assay Plan

3 Ore Purchase Process with Small Miners

4 Legal, Permitting and Government Relations

5 Plant Design and Construction

6 Operations and Staffing

7 Financial incl. Budgeting and Modeling

Comprehensive Study

THREE PROFIT CENTERS:

1

GOLD SALES – based on spot price when buying and selling, with deductions to

cover gold price fluctuation risk and exchange rate risk. A spread is created

between Payable Metals (what is paid to the small miner) and Recovered Metals

(what is recovered at the plant and sold).

2

PROCESSING FEES – adjusted to account for changes in the gold price (referred

to as “price participation”) and includes refining and selling costs.

3

SALE OF RECOVERABLE METALS – seller is only paid by the toll processor for gold

content. Any recovered silver or base metals accrues to the account of

Standard Tolling.

Location, Location, Location

!

Standard Tolling has hired a Peru based geological consultant to

complete a two-phase survey to map

1 Small mining activity throughout Peru

2 Ore flow patterns

3 Existing mills, permitted and unpermitted

!

Must consider transport costs as miners incur the expense

!

Access to Pan American Highway is key

!

Upon completion of the survey, the Company will decide on the

best region for a plant and either pursue an existing mill purchase or

proceed with building a new facility

Plant Acquisition Plan

© Copyright 2026