PDF Version

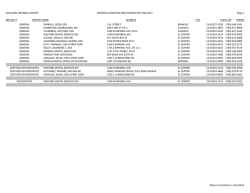

TM Imperial Tobacco Group plc Profile Corporate Information Ticker IMT | Primary Stock Exchange London Stock Exchange Address: 121 Winterstoke Road Bristol, England BS3 2LL Phone: 44 11 7963 6636 Fax: 44 11 7966 7405 Web Site: http://www.imperial-tobacco.com Auditors: I.R. Contact: John Nelson-Smith Employees: 33,900 Shareholders: Founded: 1901 Domicile: England Officers: Mark D. Williamson Chairman Alison J. Cooper Chief Executive Officer Oliver Tant Chief Financial Officer John M. Downing Secretary John Jones Treasurer John Nelson-Smith Investor Relations Contact Directors: Ken M. Burnett Alison J. Cooper David J. Haines Michael Hugh Creedon Herlihy Matthew R. Phillips Oliver Tant Mark D. Williamson Karen Witts Malcolm Ian Wyman Subsidiaries: 800 JR Cigar Inc. Altabana S.L. Altadis Distribution France S.A.S. Altadis Emisiones Financieras SAU Altadis Finance B.V. Altadis Maroc, S.A. Altadis Middle East Fzco. Altadis Polska, S.A. Altadis S.A. Altadis USA Inc. Commonwealth Brands Inc. Compania de Distribucion Integral Logista, S.A. Corporacion Habanos, S.A. Dunkerquoise des Blends S.A.S. Ets. L. Lacroix Fils N.V. Imperial Tobacco (EFKA) GmbH & Co. KG Imperial Tobacco Australia Limited Imperial Tobacco CR s.r.o Imperial Tobacco Finance PLC Imperial Tobacco Finland Oy Imperial Tobacco Hellas S.A. Imperial Tobacco Holdings (2007) Limited Imperial Tobacco International Limited Imperial Tobacco Italia Srl. Imperial Tobacco Limited Imperial Tobacco Magyarorszag Dohanyforgalmazo Kft Imperial Tobacco Mullingar Imperial Tobacco New Zealand Limited Imperial Tobacco Norway A.S. (Continued on next page of this report) Overview: This British company manufactures, markets, and sells various tobacco products, including a range of cigarettes, tobaccos, cigars, rolling papers, tubes and fine cut tobacco. Incorporated: INCORPORATED in England and Wales Aug. 6, 1996, to operate the tobacco business of Hanson PLC, which spun-off its tobacco business to the company on Oct. 1, 1996. The company's tobacco business dates back to 1901, when 13 independent British tobacco companies merged into one concern. January 25, 2008, completed the acquisition of Altadis, S.A. for a total cash consideration of Euro 50 per share representing an enterprise value for Altadis of Euro 15.2 billion (British Pounds Sterling 11.3 billion as of Jan. 25, 2008), taking into account Altadis' net debt and the interests of minority shareholders at that date. Background: Imperial Tobacco Group PLC, together with its subsidiaries, manufactures, markets, and sells tobacco and tobacco-related products. The company operates in two segments, Tobacco and Logistics. It offers cigarettes, fine cut tobacco, papers, cigars, snus, and smokeless tobacco products. The company sells its products under the Davidoff, Gauloises Blondes, JPS, West, Fine, News, USA Gold, Bastos, Lambert & Butler, Parker & Simpson, Style, Gitanes, Golden Virginia, Drum, Route 66, Cohiba, Montecristo, Romeo Y Julieta, Backwoods, Skruf, and Rizla brand names in approximately 160 countries. It also provides logistics services that include the distribution of tobacco products for tobacco product manufacturers; and various non-tobacco products and services. In addition, the company provides financial services. Imperial Tobacco Group PLC was founded in 1901 and is headquartered in Bristol, the United Kingdom. Stock Data (Capitalization as of: September 30, 2014) Stock: Ordinary 10p par | Authorized Shares N.R. | Outstanding Shares 1,036,000,000 Long Term Debt British Pounds Sterling 9,464,000,000. Stockholders (as of ): Principal Stockholder: Transfer Agent: Equiniti, West Sussex, England Additional Notes: Dividends Common Stock 4.00 3.38 3.11 2.86 2.35 1.89 2.80 2.53 2.08 1.91 0.57 1.11 6.13 0.93 0.90 Exchange London Stock Exchange 2014 2013 2012 2011 2010 2009 2008 2007 2006 2005 2004 2003 2002 2001 2000 Footnote: 1 Prices reported in pence. Year 2014 2013 2013 2012 2012 2011 2010 2009 2008 2007 1 High 2906.0000 24.6900 2469.0000 2591.0000 2591.0000 2450.0000 2154.0000 1962.0000 2394.7800 2366.0700 Low 2185.0000 21.4000 2140.0000 225.0000 2250.0000 1741.0000 1753.0000 1430.0000 1440.0000 1768.2400 This information should not be used for determining a company’s manual exemption status. Only the listing from Corporation Records should be used for that purpose. This report is for informational purposes and should not be considered a solicitation to buy or sell any security nor is this report considered investment advice. Neither S&P Capital IQ nor any other party guarantees its accuracy or makes warranties regarding results from its usage. S&P Capital IQ receives compensation from the issuer or an agent thereof for initiating coverage, and for distribution including licensed redistribution of this report, and/or for inclusion in other S&P Capital IQ publications, generally in amounts up to U.S. $3,995. per year. Redistribution is prohibited without written permission. Page 1 TM | February 05, 2015 Imperial Tobacco Group plc | Ticker IMT | Primary Exchange London Stock Exchange Annual Report IncomeStatement as of Sep. 30 (Mil. POUND STERLING) Net sales Cost of sales Gross profit Distribution, advertising and selling costs Administrative and other expenses Acquisition costs Impairment of acquired intangibles Amortization of acquired intangibles Restructuring costs Operating profit Investment income Interest exp. Income tax Net income Attributable to: Owners of the parent Non-controlling interests Share earns. basic Share earns. diluted 2014 2013 26,625 21,350 5,275 1,946 303 13 28,269 22,740 5,529 2,053 296 644 305 2,064 517 1,061 69 1,451 580 372 270 1,958 724 1,463 290 929 1,422 29 1.49 1.48 905 24 0.93 0.93 BalanceSheet as of Sep. 30 (Mil. POUND STERLING) Assets: Cash & equiv. Investments Receivables, net Inventories Income tax Tot. curr. assets Investments Net property Intangibles Defr. inc. tax Other assets Total assets Liabilities: Borrowings Payables Taxes Other curr. liabs. Tot. curr. liabs. Long-term debt Long-term defr. inc. tax Minority int. Other liabs. Ord. stk. p.10p Share premium Retained earns. Fgn. currency transl. Total liabs. This listing from S&P Capital IQ Market Access Program including Corporate Records should not be used for determining a company's manual exemption status. Only the listing from Corporation Records should be used for that purpose. Redistribution is prohibited without written permission. 2014 2013 1,431 38 2,806 2,935 96 7,306 622 1,862 15,859 241 119 26,009 1,809 245 2,966 3,296 72 8,388 329 2,080 17,382 153 90 28,422 468 6,990 133 222 7,813 9,464 1,453 412 1,802 104 5,836 (756) (119) 26,009 3,276 7,354 141 311 11,082 7,858 1,820 56 2,010 107 5,833 (791) 447 28,422 Page 2

© Copyright 2026