Heritage Money Market Fund - Wells Fargo Advantage Funds

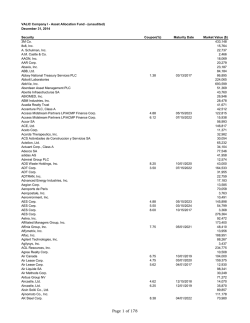

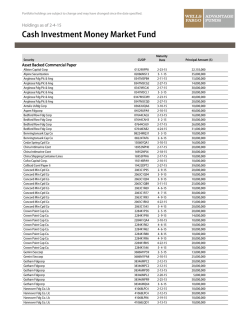

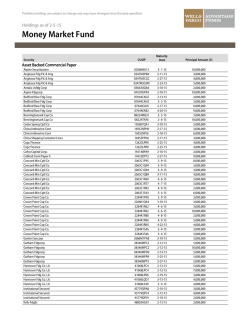

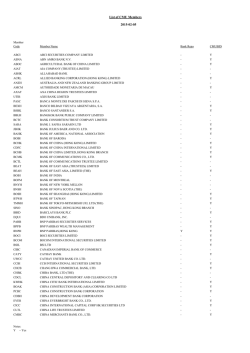

Portfolio holdings are subject to change and may have changed since the date specified. Holdings as of 2-4-15 Heritage Money Market Fund Security CUSIP Maturity Date 02086MS13 0347M3PB4 0347M5CC1 0347M5CG2 0347M5CH0 0347M5CJ6 0347M5CL1 0347M5CM9 0347M5CQ0 03663UQ24 03663UQA6 04529UPA9 04529UPA9 07644CAG5 07644CAH3 07644CAJ9 07644EAB2 08224MQ31 08224TAF6 12509TRT6 15060YQA1 16952NPH0 16952NPJ6 16953FPH6 12623LPS8 12623LPS8 19214BPA9 19422DPT2 2063C1P95 2063C1Q94 2063C1Q94 2063C1QB9 2063C1R69 2063C1R77 2063C1R93 2063C1RN2 2063C1S43 2284K1P56 2284K1P98 2284K1QA4 2284K1R62 2284K1R62 2284K1R88 2284K1R96 2284K1RN5 2284K1S46 2284K1S46 3686M1P59 3686M1PA8 3686M1PA8 38346MPC2 38346MPC2 5- 1-15 2-11-15 2- 9-15 2-27-15 2-17-15 2-17-15 3- 3-15 2-23-15 2-27-15 3- 2-15 3-10-15 2-10-15 2-10-15 2-13-15 3- 2-15 2-17-15 4-24-15 3- 3-15 2- 6-15 4-27-15 3-10-15 2-17-15 2-18-15 2-17-15 2-26-15 2-26-15 2-10-15 2-27-15 2- 9-15 3- 9-15 3- 9-15 3-11-15 4- 6-15 4- 7-15 4- 9-15 4-22-15 5- 4-15 2- 5-15 2- 9-15 3-10-15 4- 6-15 4- 6-15 4- 8-15 4- 9-15 4-22-15 5- 4-15 5- 4-15 2- 5-15 2-10-15 2-10-15 2-12-15 2-12-15 Principal Amount ($) Asset Backed Commercial Paper Alpine Securitzation Anglesea Fdg Plc & Ang Anglesea Fdg Plc & Ang Anglesea Fdg Plc & Ang Anglesea Fdg Plc & Ang Anglesea Fdg Plc & Ang Anglesea Fdg Plc & Ang Anglesea Fdg Plc & Ang Anglesea Fdg Plc & Ang Antalis Usfdg Corp Antalis Usfdg Corp Aspen Fdgcorp Aspen Fdgcorp Bedford Row Fdg Corp Bedford Row Fdg Corp Bedford Row Fdg Corp Bedford Row Fdg Corp Benningtonsark Cap Co Benningtonsark Cap Co Cdp Financial Inc Cedar Spring Cptl Co China Intlmarine Cont China Intlmarine Cont China Shipping Container Lines Cnpc Finance Cnpc Finance Cofco Capital Corp. Colltrzd Coml Paper Ii Concord Min Cptl Co Concord Min Cptl Co Concord Min Cptl Co Concord Min Cptl Co Concord Min Cptl Co Concord Min Cptl Co Concord Min Cptl Co Concord Min Cptl Co Concord Min Cptl Co Crown Point Cap Co. Crown Point Cap Co. Crown Point Cap Co. Crown Point Cap Co. Crown Point Cap Co. Crown Point Cap Co. Crown Point Cap Co. Crown Point Cap Co. Crown Point Cap Co. Crown Point Cap Co. Gemini Seccorp Gemini Seccorp Gemini Seccorp Gotham Fdgcorp Gotham Fdgcorp 162,000,000 65,000,000 270,000,000 67,000,000 100,000,000 40,000,000 130,000,000 13,000,000 80,000,000 12,710,000 30,340,000 65,004,000 110,000,000 66,000,000 96,000,000 94,000,000 70,300,000 27,000,000 80,000,000 35,000,000 56,129,000 149,000,000 154,000,000 131,000,000 38,000,000 55,000,000 94,000,000 165,000,000 99,000,000 54,000,000 56,000,000 57,000,000 56,000,000 151,000,000 77,000,000 55,000,000 58,000,000 52,000,000 28,000,000 61,000,000 54,000,000 164,000,000 77,000,000 77,000,000 65,000,000 3,000,000 25,000,000 56,000,000 20,004,000 25,000,000 47,828,000 106,000,000 Security Gotham Fdgcorp Gotham Fdgcorp Gotham Fdgcorp Gotham Fdgcorp Hannover Fdg Co. Llc Hannover Fdg Co. Llc Hannover Fdg Co. Llc Hannover Fdg Co. Llc Hannover Fdg Co. Llc Hannover Fdg Co. Llc Hannover Fdg Co. Llc Institutional Secured Institutional Secured Institutional Secured Institutional Secured Institutional Secured Kells Fdgllc Kells Fdgllc Kells Fdgllc Kells Fdgllc Kells Fdgllc Kells Fdgllc Kells Fdgllc Kells Fdgllc Kells Fdgllc Kells Fdgllc Kells Fdgllc Kells Fdgllc Kells Fdgllc Lexingtn Pkr Cap Co Ll Lexingtn Pkr Cap Co Ll Lexingtn Pkr Cap Co Ll Lexingtn Pkr Cap Co Ll Lexingtn Pkr Cap Co Ll Lexingtn Pkr Cap Co Ll Lexingtn Pkr Cap Co Ll Lexingtn Pkr Cap Co Ll Liberty Funding Llc Liberty Funding Llc Liberty Funding Llc Liberty Funding Llc Liberty Funding Llc Liberty Funding Llc Liberty Funding Llc Liberty Funding Llc Liberty Funding Llc Lma Sa Lmaamericas Lma Sa Lmaamericas Lma Sa Lmaamericas Lma Sa Lmaamericas Lma Sa Lmaamericas Macquariebank Limited Macquariebank Limited Manhattanasset Fdg. Manhattanasset Fdg. Manhattanasset Fdg. Manhattanasset Fdg. Manhattanasset Fdg. Manhattanasset Fdg. Matchpointmaster Tr Matchpointmaster Tr Metlife Short Term Fdg Mountcliff CUSIP 38346MPD0 38346MPL2 38346MPR9 38346MQ64 41068LPC4 41068LPC4 41068LPK6 41068LQD1 41068LQP4 41068LRT5 41068LS49 45779QPA8 45779QPA8 45779QPB6 45779QPC4 45779QPJ9 48803AGU3 48803AGV1 48803AGX7 48803AGX7 48803AHZ1 48803AJN6 48803AJR7 48803AJS5 48803AJV8 48803AJY2 48803AKF1 48803AKT1 48803AKV6 52952MP61 52952MP95 52952MQB9 52952MQB9 52952MR77 52952MR93 52952MRA0 52952MRD4 53127UP95 53127UPB0 53127UPP9 53127UPR5 53127UQP8 53127UR85 53127URE2 53127URQ5 53127URT9 53944RP69 53944RP69 53944RP93 53944RQ43 53944RQA9 55607LQT4 55607LQX5 56274MPJ5 56274MPR7 56274MQ96 56274MQA3 56274MQB1 56274MQT2 5766P1Q20 5766P1QL8 59157UPB0 62455BP58 Maturity Date 2-13-15 2-20-15 2-25-15 3- 6-15 2-12-15 2-12-15 2-19-15 3-13-15 3-23-15 4-27-15 5- 4-15 2-10-15 2-10-15 2-11-15 2-12-15 2-18-15 2- 5-15 2- 5-15 2-13-15 2-13-15 2-17-15 3- 9-15 4- 9-15 4- 9-15 4-13-15 4-20-15 4- 9-15 4- 9-15 4-13-15 2- 6-15 2- 9-15 3-11-15 3-11-15 4- 7-15 4- 9-15 4-10-15 4-13-15 2- 9-15 2-11-15 2-23-15 2-25-15 3-23-15 4- 8-15 4-14-15 4-24-15 4-27-15 2- 6-15 2- 6-15 2- 9-15 3- 4-15 3-10-15 3-27-15 3-31-15 2-18-15 2-25-15 3- 9-15 3-10-15 3-11-15 3-27-15 3- 2-15 3-20-15 2-11-15 2- 5-15 Principal Amount ($) 50,000,000 38,003,000 197,554,000 59,238,000 54,000,000 68,000,000 55,000,000 60,000,000 5,000,000 24,000,000 43,000,000 19,000,000 75,000,000 51,000,000 97,000,000 14,000,000 35,000,000 19,000,000 15,000,000 23,000,000 66,000,000 110,000,000 127,000,000 49,000,000 115,000,000 154,000,000 87,000,000 163,000,000 80,000,000 57,000,000 93,000,000 75,000,000 162,000,000 130,000,000 36,000,000 77,000,000 53,000,000 53,000,000 70,000,000 33,000,000 33,000,000 75,000,000 16,000,000 79,000,000 43,000,000 28,000,000 118,800,000 133,200,000 47,000,000 57,000,000 65,000,000 109,000,000 204,000,000 31,000,000 66,000,000 103,000,000 67,000,000 59,000,000 169,000,000 35,900,000 64,000,000 42,296,000 30,000,000 Security Mountcliff Newport Funding Corp Newport Funding Corp Old Line Funding Llc Ridgefieldfunding Co Ridgefieldfunding Co Ridgefieldfunding Co Ridgefieldfunding Co Ridgefieldfunding Co Salisburyreceivables Co Salisburyreceivables Co Scaldis &Scaldis Jo Scaldis &Scaldis Jo Scaldis &Scaldis Jo Shagang South Asia Sinochem Cp Co Ltd Starbird Fdg. Corp Starbird Fdg. Corp Sumitomo Mtsu Bkg Corp Sydney Capital Corp Versaillescds Llc Versaillescds Llc Versaillescds Llc Versaillescds Llc Victory Receivables Victory Receivables Victory Receivables Victory Receivables Victory Receivables Victory Receivables Victory Receivables White Plains Capital Working Cap. Man. Co Working Cap. Man. Co CUSIP 62455BP58 65184UPA6 65184UPA6 67983URL9 76582HAW8 76582HAW8 76582HAX6 76582KP54 76582KP54 79540BPA8 79540BPB6 80584UPD5 80584UPJ2 80584UPJ2 81900QPA5 82936QPH6 85520MPL1 85520MPQ0 86562LP63 87123MQQ6 92513HRL5 92513HRM3 92513HRN1 92513HRQ4 92646LP95 92646LPC8 92646LPC8 92646LPC8 92646LPJ3 92646LPL8 92646LPQ7 96437RP96 98137SP93 98137SPD4 Maturity Date 2- 5-15 2-10-15 2-10-15 4-20-15 2-12-15 2-12-15 2- 9-15 2- 5-15 2- 5-15 2-10-15 2-11-15 2-13-15 2-18-15 2-18-15 2-10-15 2-17-15 2-20-15 2-24-15 2- 6-15 3-24-15 2-20-15 2-20-15 2- 9-15 2- 6-15 2- 9-15 2-12-15 2-12-15 2-12-15 2-18-15 2-20-15 2-24-15 2- 9-15 2- 9-15 2-13-15 00279HS23 969ABB001 00850TAD9 05962P3T4 05962PZ85 06366CEZ7 06366CHY7 06366CLY2 06366CNE4 06366CPY8 06417FH52 06417HEQ5 06417HMC7 16949EMC0 21684BLV4 21684BQG2 21599U007 22999F004 22999F004 22999F004 22549TGE2 22549TUV8 ACI0BJ8G8 23328AHH0 23328AHW7 23328AJH8 23328AJK1 23328AJK1 3- 4-15 2- 5-15 2- 5-15 3-10-15 2- 5-15 2-17-15 2- 9-15 3- 2-15 3- 5-15 3-17-15 2-19-15 3- 4-15 3-30-15 2-25-15 4-13-15 2-27-15 2- 5-15 2- 5-15 2- 5-15 2- 5-15 3-24-15 2-19-15 2-23-15 2- 6-15 3-23-15 4-16-15 4-27-15 4-27-15 Principal Amount ($) 115,000,000 17,000,000 33,002,000 43,000,000 88,000,000 250,000,000 142,000,000 25,000,000 113,000,000 30,000,000 21,000,000 19,000,000 27,000,000 41,000,000 20,000,000 75,000,000 75,000,000 103,000,000 140,044,000 52,200,000 65,000,000 62,000,000 61,000,000 31,000,000 55,000,000 11,573,000 13,400,000 63,082,000 65,000,000 94,000,000 22,500,000 64,000,000 60,000,000 40,000,000 Certificate of Deposit Abbey Nat'L Treasury Abbey Natltsy Svcs Caym Agricultural Bk China Ny Banco Delestado De Chile Banco Delestado De Chile Bank Of MontrealBank Of MontrealBank Of MontrealBank Of MontrealBank Of MontrealBank Of Nova Scotia Bank Of Nova Scotia Bank Of Nova Scotia China Constr Bk Corp Cooperatieve Centrale Cooperatieve Centrale Credit Agricole Cib Ky Credit Industriel + Commrcl Ny Credit Industriel + Commrcl Ny Credit Industriel + Commrcl Ny Credit Suisse Ny Credit Suisse Ny Dexia Credit Local Dg Bank Nybranch Dg Bank Nybranch Dg Bank Nybranch Dg Bank Nybranch Dg Bank Nybranch 306,000,000 944,000,000 152,000,000 175,000,000 125,000,000 112,000,000 152,000,000 180,000,000 171,000,000 161,000,000 45,000,000 134,000,000 124,000,000 245,000,000 141,000,000 140,000,000 1,189,000,000 212,000,000 250,000,000 750,000,000 25,000,000 100,000,000 60,000,000 98,000,000 185,000,000 192,000,000 107,000,000 185,000,000 Security Dnb Nor Bank Asa Cayman Dz Bank Agdeutsche Dz Bank Agdeutsche Zentral Ge Erste Abwicklungsanstalt Hsbc Bankusa Na Kbc Bank Mitsubishitst&Bnk C Mitsubishitst&Bnk C Mitsubishitst&Bnk C Mizuho Bank Ltd Mizuho Bank Ltd Mizuho Bank Ltd Mizuho Bank Ltd Mizuho Bank Ltd Mizuho Corporate Bank (London) Natixis Ny Natixis Cayman Islands Natl Bankof Kuwait Ny Nordea Bank Fld Plc Norinchukin Bk Norinchukin Bk Norinchukin Bk Royal Bk Of Canada S.E. Banken Skandin Ens Banken Standard Chartered Bank Standard Chrtrd Bnkn Standard Chrtrd Bnkn Standard Chrtrd Bnkn Standard Chrtrd Bnkn Standard Chrtrd Bnkn Standard Chrtrd Bnkn Sumitomo Mitsui Bkg Corp Sumitomo Mtsu Bkg Corp Sumitomo Tr & Bkng C Sumitomo Tr & Bkng C Sumitomo Tr & Bkng C Swedbank Swedbank (Sparbank) Toronto-Dominion Toronto-Dominion Toronto-Dominion Toronto-Dominion Toronto-Dominion Toronto-Dominion Toronto-Dominion Toronto-Dominion Uob Westpac Bking Corp N Westpac Bking Corp N CUSIP 979ACW002 ACI0BKHJ9 ACI09W401 ACI04RLS7 40428AB97 910HYP000 60682ASF4 60682ATC0 60682AUH7 60688L2A3 60688L3V6 60688L4F0 60688L5L6 60688L5L6 ACI0B4W90 63873FEA2 959PXB006 986HJP006 65558E6Y9 65602TBQ3 65602TDF5 65602TDZ1 78009NRX6 988ANB005 83051HN28 85399A008 85325B2N3 85325B2T0 85325B3C6 85325B3G7 85325B4T8 85325B5H3 86562Y2T0 86562JAE7 86563KUR2 86563KUV3 86563KVL4 87099H002 87019TXZ0 89112T6U3 89112TN91 89112U2J9 89112U7J4 89112UHR5 89112UJ51 89112UM73 89112UY39 922UGN002 96121TVB1 96121TXS2 Maturity Date 2- 5-15 2- 5-15 2- 5-15 3-13-15 8- 3-15 2- 5-15 2-17-15 4- 2-15 5- 4-15 2-19-15 2-27-15 4- 8-15 5- 5-15 5- 5-15 3- 5-15 2-19-15 2- 5-15 2- 5-15 3- 2-15 2-24-15 2-13-15 4-13-15 3- 4-15 2- 5-15 4- 9-15 2- 5-15 2-13-15 2-23-15 4- 1-15 3- 3-15 4-16-15 5-15-15 4- 2-15 2-19-15 3-30-15 4- 1-15 4-17-15 2- 5-15 4- 2-15 4-15-15 2- 6-15 3-16-15 2-23-15 2-17-15 2- 6-15 2-18-15 3-12-15 2- 5-15 2-18-15 3- 3-15 0020P5ET2 05253CQG4 05253MED2 05952TQ30 05952TQ97 05952TQG1 05952TR88 05952TRN5 05990DR79 05990DRT1 05990DRT1 05968JPK7 2-27-15 3-16-15 3-23-15 3- 3-15 3- 9-15 3-16-15 4- 8-15 4-22-15 4- 7-15 4-27-15 4-27-15 2-19-15 Principal Amount ($) 917,000,000 159,000,000 157,000,000 38,000,000 50,000,000 1,189,000,000 145,000,000 143,000,000 196,000,000 119,000,000 192,000,000 161,000,000 113,000,000 229,000,000 150,000,000 280,000,000 618,600,000 409,000,000 160,000,000 68,400,000 226,000,000 164,000,000 187,000,000 653,000,000 81,000,000 380,000,000 105,000,000 153,000,000 138,000,000 88,000,000 214,000,000 187,000,000 68,100,000 133,000,000 308,000,000 108,000,000 192,000,000 656,000,000 163,000,000 223,000,000 171,000,000 100,000,000 120,000,000 97,000,000 89,000,000 148,000,000 174,000,000 770,000,000 140,000,000 295,000,000 Financial Company Commercial Paper Asb Finance Ltd. Aust & Newzea Aust & Newzea Banco De Chile Banco De Chile Banco De Chile Banco De Chile Banco De Chile Banco De Credito E Inversiones Banco De Credito E Inversiones Banco De Credito E Inversiones Banco Santander Chile 57,000,000 109,500,000 102,000,000 68,100,000 33,000,000 33,035,000 31,000,000 50,000,000 127,000,000 50,000,000 88,000,000 65,000,000 Security Banco Santander Chile Banco Santander Chile Bpce Caisse Centrale Djdn Caisse Centrale Djdn Caisse Centrale Djdn Caisse Centrale Djdn Cdp Financial Inc Cdp Financial Inc Cdp Financial Inc Cdp Financial Inc Cdp Financial Inc Cmmnwlth Bnk Of Aus Cmmnwlth Bnk Of Aus Cmmnwlth Bnk Of Aus Cmmnwlth Bnk Of Aus Cooperatieve Centrale Cppib Capital Inc Cppib Capital Inc Dbs Bank Ltd Dbs Bank Ltd Dbs Bank Ltd Dbs Bank Ltd Hsbc Bankplc J.P. Morgan Securities Macquariebank Limited Macquariebank Limited Mizuho Fdgllc N V Bk Nederlandse Gemeenten N V Bk Nederlandse Gemeenten Nat L Australia Fndg Natl Australia Bk Lt Natl Australia Bk Lt Nordea Bkab Publ Oversea Chinese Banking Oversea Chinese Banking Oversea Chinese Banking Psp Capital Inc. Psp Capital Inc. Psp Capital Inc. Psp Capital Inc. Psp Capital Inc. Psp Capital Inc. Shagang South Asia Sumitomo Mtsu Bkg Corp Sumitomo Mtsu Bkg Corp Suncorp Group Ltd Suncorp Group Ltd Suncorp Group Ltd Suncorp Group Ltd Suncorp Group Ltd Suncorp Group Ltd Suncorp Group Ltd Suncorp Group Ltd Suncorp Group Ltd Swedbank Swedbank United Overseas Bk Ltd United Overseas Bk Ltd United Overseas Bk Ltd United Overseas Bk Ltd United Overseas Bk Ltd Westpac Banking Corp. CUSIP 05968JQB6 05968JQK6 05571CP54 1280C3PA9 1280C3PJ0 1280C3PQ4 1280C3QT7 12509TPJ0 12509TQD2 12509TQP5 12509TR74 12509TRD1 20272AHN9 20272AHP4 20272AJB3 20272AJG2 21684BSY1 12624DPT3 12624EAN0 23305ER88 23305ER96 23305ERA3 23305ERD7 40433FDH9 46640CBB7 55607LQR8 55607NCG3 60688GRD1 62944FAD7 62944HQG9 63253LYC3 63254GAH8 63254GAN5 65558GR13 69033RQC3 69033RQQ2 69033RQR0 69370BPA4 69370BPH9 69370BPL0 69370BQK1 69370BRD6 69370BRF1 81900QP98 86562LR20 86562LR87 8672E3P59 8672E3PA8 8672E3PS9 8672E3QB5 8672E3QJ8 8672E3QJ8 8672E3QK5 8672E3R99 8672E3SE7 87019SPS7 87019SQD9 91127QP94 91127QPB9 91127QPR4 91127QQ93 91127QQG7 9612C4NN7 Maturity Date 3-11-15 3-19-15 2- 5-15 2-10-15 2-18-15 2-24-15 3-27-15 2-18-15 3-13-15 3-23-15 4- 7-15 4-13-15 2-20-15 2-23-15 3-23-15 2- 9-15 3- 4-15 2-27-15 3-20-15 4- 8-15 4- 9-15 4-10-15 4-13-15 2-12-15 2-19-15 3-25-15 4- 7-15 4-13-15 3- 3-15 3-16-15 2-10-15 2-20-15 2- 9-15 4- 1-15 3-12-15 3-24-15 3-25-15 2-10-15 2-17-15 2-20-15 3-19-15 4-13-15 4-15-15 2- 9-15 4- 2-15 4- 8-15 2- 5-15 2-10-15 2-26-15 3-11-15 3-18-15 3-18-15 3-19-15 4- 9-15 5-14-15 2-26-15 3-13-15 2- 9-15 2-11-15 2-25-15 3- 9-15 3-16-15 2-19-15 Principal Amount ($) 95,000,000 64,000,000 296,000,000 112,000,000 143,000,000 188,000,000 152,000,000 41,000,000 18,000,000 74,000,000 11,000,000 29,000,000 81,000,000 53,000,000 133,000,000 58,000,000 155,000,000 66,000,000 98,000,000 66,000,000 96,000,000 96,000,000 60,000,000 34,700,000 147,000,000 92,000,000 16,900,000 130,000,000 167,000,000 93,000,000 140,000,000 152,000,000 313,000,000 77,000,000 63,150,000 162,000,000 60,000,000 10,000,000 50,000,000 36,000,000 27,000,000 73,000,000 24,000,000 39,000,000 169,000,000 315,000,000 18,000,000 95,000,000 15,000,000 29,500,000 15,000,000 37,000,000 75,000,000 50,000,000 18,000,000 141,000,000 101,000,000 51,000,000 112,000,000 50,000,000 40,000,000 101,000,000 336,000,000 Security CUSIP Maturity Date 959NLF005 959JFZ007 987FTX001 2- 5-15 2- 5-15 2- 5-15 200,000,000 65,300,000 100,000,000 64952WBV4 4-29-15 40,000,000 12800BPP1 12800BPQ9 12800BPS5 12800BQC9 12800BQP0 12800BR12 15911LP60 16952NP98 16952NPA5 16953FP94 16953HPB5 12623LP58 12623LP66 12623LP66 12623LP90 12623LPA7 12623LPC3 12623LPC3 12623LPD1 12623LPD1 12623LPD1 12623LPR0 19213XPA2 19213XPC8 29604DPH7 29604DQ37 29604DQ52 29604DQP8 29604DR10 29604DTA8 29604DTB6 29604DTJ9 59738QP68 82936QPA1 82936NR99 87030KRP3 89233ADD8 89233ADZ9 2-23-15 2-24-15 2-26-15 3-12-15 3-23-15 4- 1-15 2- 6-15 2- 9-15 2-10-15 2- 9-15 2-11-15 2- 5-15 2- 6-15 2- 6-15 2- 9-15 2-10-15 2-12-15 2-12-15 2-13-15 2-13-15 2-13-15 2-25-15 2-10-15 2-12-15 2-17-15 3- 3-15 3- 5-15 3-23-15 4- 1-15 6-10-15 6-11-15 6-18-15 2- 6-15 2-10-15 4- 9-15 4-23-15 2- 9-15 2-10-15 61,000,000 93,000,000 158,000,000 250,000,000 180,000,000 270,000,000 150,000,000 32,000,000 74,000,000 157,000,000 34,500,000 38,100,000 35,160,000 53,000,000 50,000,000 81,850,000 57,400,000 64,000,000 10,000,000 45,000,000 85,000,000 69,000,000 26,400,000 34,400,000 20,000,000 68,000,000 86,000,000 33,000,000 54,000,000 75,000,000 66,000,000 82,000,000 12,594,000 55,000,000 188,000,000 250,000,000 144,000,000 148,000,000 17304UB58 2027A0GJ2 979SCM005 25215BAC7 40428AA98 40428AB55 48125LFS6 60682ASL1 67221YKB2 923KHX000 8574P1CX2 8574P1DG8 8574P1DP8 8574P1DY9 98647QJP1 98647SAP6 2- 6-15 3-18-15 2- 5-15 2-13-15 3- 5-15 3-11-15 4-20-15 2-25-15 3- 2-15 2- 5-15 3-17-15 4-10-15 4- 1-15 4-23-15 3- 2-15 3- 2-15 34,000,000 24,000,000 705,000,000 40,965,000 75,000,000 157,000,000 30,000,000 159,000,000 22,080,000 720,000,000 149,000,000 141,000,000 141,000,000 155,000,000 9,500,000 13,550,000 Principal Amount ($) Government Agency Repurchase Agreement Bank Of America Na Goldman Sachs + Co Merrill Pierce Fenner Sm Insurance Company Funding Agreement New York Life Global Fdg Other Commercial Paper Caisse Desdepots Et Caisse Desdepots Et Caisse Desdepots Et Caisse Desdepots Et Caisse Desdepots Et Caisse Desdepots Et Changhongtrading Ltd China Intlmarine Cont China Intlmarine Cont China Shipping Container Lines Chinatex Capital Ltd Cnpc Finance Cnpc Finance Cnpc Finance Cnpc Finance Cnpc Finance Cnpc Finance Cnpc Finance Cnpc Finance Cnpc Finance Cnpc Finance Cnpc Finance Cofco Capital Corp. Cofco Capital Corp. Erste Abwicklungsanstalt Erste Abwicklungsanstalt Erste Abwicklungsanstalt Erste Abwicklungsanstalt Erste Abwicklungsanstalt Erste Abwicklungsanstalt Erste Abwicklungsanstalt Erste Abwicklungsanstalt Midea Intlcorp Sinochem Cp Co Ltd Sinochem Cp Co. Ltd. Swedish Export Credt Toyota Motor Credit Toyota Motor Credit Other Instrument Citibank New York N. Commonwealth Bank Aust Dbs Dexia Credit Local Sa Ny Hsbc Bankusa Na Hsbc Bankusa Na Jp Morganchase Bank Na Mitsubishitst&Bnk C Oakld Alamcnty Col Ocbc State Street Bk & Tr State Street Bk & Tr State Street Bk & Tr State Street Bk & Tr York Cntys C York Cntys C Other Municipal Debt Security Imperial Irgtn Dst Rv Muni Elecauth Of Ga Ohiohealthcorp Port Of Seattle South Carolina Pub Svc State Of Ca G.O. CUSIP 45287MAB6 62621KSA3 677762AK2 73539CCX6 83706AAR1 13068CAR6 Maturity Date 2-13-15 2- 5-15 4- 2-15 2-10-15 2-17-15 4- 1-15 78010ULG0 83368N2N0 83368N2N0 12-16-15 2-26-15 2-26-15 106,000,000 152,000,000 162,000,000 959GHQ001 41899D000 2- 5-15 3-11-15 66,000,000 521,000,000 229995006 22599G006 959JGA001 01399W007 2- 5-15 2- 5-15 3- 8-15 2- 5-15 564,526,706 162,800,000 298,000,000 64,000,000 059231TD2 059231TD2 059231TD2 196479HT9 196479HT9 196479HU6 196479MJ5 213185FW6 25154CNG5 25154CVA9 25154LDE1 270618CX7 386442WB9 41652PAA7 41652PAA7 462467GE5 477181AK7 478271JK6 478271KA6 46641NAL1 46633VTB5 487437AA3 487437AA3 56052E6X1 56052E6Z6 56052E8J0 59447PCG4 59447PCG4 59447PCH2 59447PCJ8 59447PXU0 660043BF6 660043BF6 644614P37 646108EJ5 646108EJ5 64986UQ83 677525QC4 74926YK75 76252PEQ8 76252PES4 79765DXL9 79765DXL9 844090AB6 2-11-15 2-11-15 2-11-15 2-11-15 2-11-15 2-11-15 2-11-15 2-11-15 2-11-15 2-11-15 2-11-15 2-11-15 2-11-15 2-11-15 2-11-15 2-11-15 2-11-15 2-11-15 2-11-15 2-11-15 2-11-15 2-11-15 2-11-15 2-11-15 2-11-15 2-11-15 2-11-15 2-11-15 2-11-15 2-11-15 2-11-15 2-11-15 2-11-15 2-11-15 2-11-15 2-11-15 2- 5-15 2-11-15 2-11-15 2-11-15 2-11-15 2-11-15 2-11-15 2-11-15 3,080,000 16,255,000 28,955,000 4,745,000 8,155,000 7,020,000 87,900,000 32,500,000 29,205,000 80,945,000 24,790,000 16,280,000 16,250,000 25,000,000 25,000,000 6,295,000 30,000,000 1,445,000 11,075,000 47,195,000 8,000,000 9,500,000 12,165,000 36,585,000 23,000,000 50,000,000 50,000,000 50,000,000 25,000,000 22,000,000 22,000,000 10,000,000 10,000,000 19,700,000 4,560,000 9,625,000 180,000,000 26,000,000 35,000,000 67,100,000 37,375,000 1,000,000 4,000,000 250,000 Principal Amount ($) 10,000,000 8,355,000 10,000,000 7,000,000 28,000,000 14,885,000 Other Note Royal Bankof Canada Societe Generale Instl Societe Generale Instl Other Repurchase Agreement Credit Suisse Secs Usa Jp Morgan Treasury Repurchase Agreement Credit Agricole Credit Agricole Repo Goldman Sachs + Co Jp Morgan Variable Rate Demand Note Baltimoremd Revenue Baltimoremd Revenue Baltimoremd Revenue Colorado St Hsg Fin Auth Colorado St Hsg Fin Auth Colorado St Hsg Fin Auth Colorado St Hsg Fin Auth Cook Cntyil Deutsche Bank Spears/Lifers Tr Deutsche Bank Spears/Lifers Tr Deutsche Bank Spears/Lifers Tr E Baton Rouge Parish La Swr Co Grand River Ok Dam Auth Revenu Hartford Healthcare Corp Hartford Healthcare Corp Iowa St Fin Auth Sf Mtge Reven Jets Stadium Development Johnson City Tn Hlth Eductnl Johnson City Tn Hlth Eductnl Joint Venture Interest Trust R Jp Morganchase Putters/Driver Keep Memory Alive Keep Memory Alive Maine St Hsg Auth Mtge Revenue Maine St Hsg Auth Mtge Revenue Maine St Hsg Auth Mtge Revenue Michigan St Fin Auth Revenue Michigan St Fin Auth Revenue Michigan St Fin Auth Revenue Michigan St Fin Auth Revenue Michigan St Fin Auth Revenue N Hudson Nj Sewerage Auth Gros N Hudson Nj Sewerage Auth Gros New Hampshire St Hlth Edu Fa New Jerseyst Hsg Mtge Fin A New Jerseyst Hsg Mtge Fin A New York St Hsg Fin Agy Revenu Ohio St Air Quality Dev Auth Rbc Muni Products Inc Trust Rib Floater Trust Rib Floater Trust San Francisco City Cnty Ca C San Francisco City Cnty Ca C Sthrn Uteindian Tribe Of Sthr Security Sthrn Uteindian Tribe Of Sthr Sthrn Uteindian Tribe Of Sthr Texas St Muni Gas Acquisition Texas St Muni Gas Acquisition Texas St Muni Gas Acquisition Traer Creek Co Met Dist Revenu Univ Hospshlth Sys Inc Oh Hos Wisconsinst Hsg Econ Dev Au Wisconsinst Hsg Econ Dev Au Wisconsinst Hsg Econ Dev Au Yeshiva Univ Ny Yeshiva Univ Ny CUSIP 844090AB6 844090AB6 88256CFB0 88256CFB0 88256CFB0 892697AC7 914293AA3 976904MZ2 976904MZ2 976904NA6 98584UAA9 98584UAC5 Maturity Date 2-11-15 2-11-15 2-11-15 2-11-15 2-11-15 2-11-15 2-11-15 2-11-15 2-11-15 2-11-15 2-11-15 2-11-15 Principal Amount ($) 1,000,000 37,910,000 2,606,173 3,000,000 20,000,000 19,175,000 23,000,000 2,425,000 17,660,000 25,985,000 50,000,000 24,000,000 Carefully consider a fund’s investment objectives, risks, charges, and expenses before investing. For a current prospectus and, if available, a summary prospectus, containing this and other information, visit wellsfargoadvantagefunds.com. Read it carefully before investing. An investment in a money market fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although the fund seeks to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in a money market fund. The U.S. government guarantee applies to certain underlying securities and not to shares of the fund. A portion of the fund's income may be subject to federal, state, and/or local income taxes or the alternative minimum tax (AMT). Wells Fargo Funds Management, LLC, a wholly owned subsidiary of Wells Fargo & Company, provides investment advisory and administrative services for Wells Fargo Advantage Funds®. Other affiliates of Wells Fargo & Company provide subadvisory and other services for the funds. The funds are distributed by Wells Fargo Funds Distributor, LLC, Member FINRA/SIPC, an affiliate of Wells Fargo & Company. 221214 11-13

© Copyright 2026

![Download [ PDF ] - journal of evolution of medical and dental sciences](http://s2.esdocs.com/store/data/000477757_1-ee11b34baa3eb19239627634fc54fa04-250x500.png)