Cartera Semanal

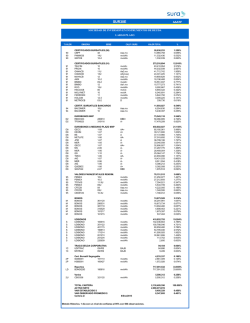

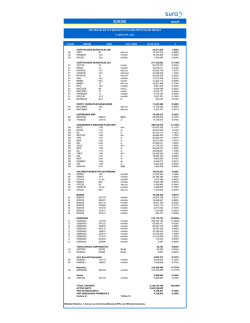

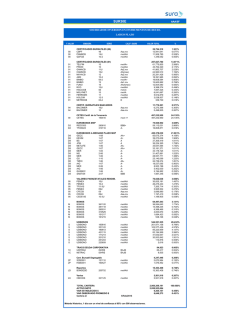

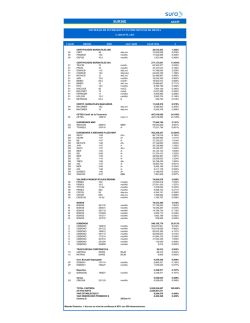

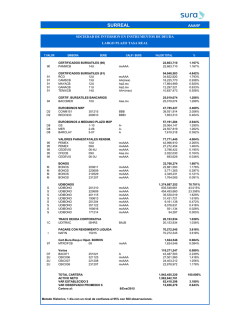

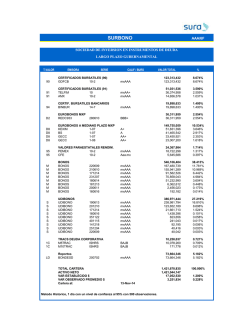

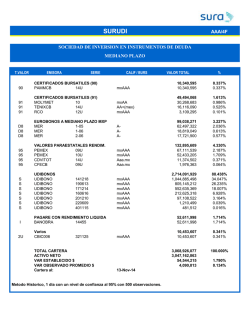

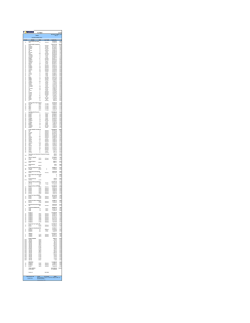

SUR30E AAA/5F SOCIEDAD DE INVERSION EN INSTRUMENTOS DE DEUDA LARGO PLAZO T.VALOR EMISORA SERIE CALIF / BURS VALOR TOTAL % 90 90 90 CERTIFICADOS BURSATILES (90) CBPF 48 PAMMCB 14U GDFCB 10-2 Aaa.mx mxAAA mxAAA 26,636,020 13,930,424 11,366,775 1,338,822 1.270% 0.664% 0.542% 0.064% 91 91 91 91 91 91 91 91 91 91 91 91 91 91 CERTIFICADOS BURSATILES (91) TELFIM 10 PROIN 10 GANACB 11U CAMSCB 13U MAYACB 12 AMX 10-2 BIMBO 09-2 BIMBO 12 RCO 12U HSCCICB 06 MOLYMET 10 FERROMX 11 HOLCIM 12-3 METROCB 03-2 mxAA+ mxAAA Aa2.mx AA(mex) Aa2.mx mxAAA mxAA+ Aa1.mx mxAAA mxCC mxAA mxAAA mxAAA D 273,911,997 61,425,267 44,330,611 41,604,624 24,339,311 20,066,638 18,283,480 16,537,916 15,817,934 9,298,955 6,917,245 6,050,127 5,877,241 3,022,920 339,730 13.056% 2.928% 2.113% 1.983% 1.160% 0.956% 0.871% 0.788% 0.754% 0.443% 0.330% 0.288% 0.280% 0.144% 0.016% 94 94 CERTIF. BURSATILES BANCARIOS BACOMER 10U BACOMER 10 Aaa.mx Aaa.mx 11,738,587 6,271,714 5,466,872 0.560% 0.299% 0.261% D2 D2 EUROBONOS MXP REDC933 TFON023 BBB+ A- 75,974,800 58,479,511 17,495,289 3.621% 2.787% 0.834% D8 D8 D8 D8 D8 D8 D8 D8 D8 D8 D8 D8 D8 D8 D8 D8 EUROBONOS A MEDIANO PLAZO MXP GECC 1-08 KEXIM 1-07 JPM 1-07 BS 1-07 METLIFE 1-06 MER 1-05 GECC 1-07 MS 2-06 MER 1-06 GS 1-10 TMCC 1-06 AIG 1-07 MER 2 06 2-06 QUEBEC 1-06 AIG 1-06 SANTAN 2-07 AA+ A+ A A AAAAA+ AAAAAAA AA+ ABBB 451,499,622 85,403,548 39,089,433 37,307,744 37,143,083 36,952,411 33,082,027 32,871,420 31,320,998 28,461,484 25,132,670 24,627,680 18,426,867 8 932 814 8,932,814 5,388,197 5,381,129 1,978,119 21.520% 4.071% 1.863% 1.778% 1.770% 1.761% 1.577% 1.567% 1.493% 1.357% 1.198% 1.174% 0.878% 0 426% 0.426% 0.257% 0.256% 0.094% 95 95 95 95 95 95 95 VALORES PARAESTATALES RENDIM. PEMEX 10U PEMEX 10-2 TFOVIS 11-3U PEMEX 09U CFECB 09 CFECB 09U CEDEVIS 10-3U mxAAA mxAAA mxAAA mxAAA Aaa.mx Aaa.mx mxAAA 78,614,814 31,522,386 27,339,732 7,417,594 5,573,651 4,219,536 1,351,997 1,189,918 3.747% 1.502% 1.303% 0.354% 0.266% 0.201% 0.064% 0.057% M M M M M M BONOS BONOS BONOS BONOS BONOS BONOS BONOS 361120 290531 381118 310529 151217 161215 mxAAA mxAAA mxAAA mxAAA mxAAA mxAAA 76,146,594 35,879,330 19,034,988 14,237,833 4,777,155 1,680,718 536,569 3.629% 1.710% 0.907% 0.679% 0.228% 0.080% 0.026% S S S S S S S S UDIBONOS UDIBONO UDIBONO UDIBONO UDIBONO UDIBONO UDIBONO UDIBONO UDIBONO 160616 351122 190613 401115 171214 201210 251204 220609 mxAAA mxAAA mxAAA mxAAA mxAAA mxAAA mxAAA mxAAA 443,092,275 102,280,586 101,236,421 85,446,063 81,351,304 41,716,219 30,945,195 113,886 2,601 21.120% 4.875% 4.825% 4.073% 3.878% 1.988% 1.475% 0.005% 0.000% 1C 1C TRACS DEUDA CORPORATIVA UDITRAC ISHRS M5TRAC ISHRS BAJB BAJB 94,508 85,034 9,474 0.005% 0.004% 0.000% 2P 2P Cert. Bursatil Segregable SCB0001 151110 HSB0001 160427 mxAAA mxAAA 4,233,518 2,663,964 1,569,553 0.202% 0.127% 0.075% LD Reportos BONDESD 190627 mxAAA 650,557,979 650,557,979 31.008% 31.008% 2U Varios CBIC006 321125 mxAAA 5,522,217 5,522,217 0.263% 0.263% 280610 310116 TOTAL CARTERA ACTIVO NETO VAR ESTABLECIDO $ VAR OBSERVADO PROMEDIO $ Cartera al: 2,098,022,930 2,097,371,946 9,438,174 8,444,448 15-Ene-15 Metodo Historico, 1 dia con un nivel de confianza al 95% con 500 observaciones. 100.000% 0.450% 0.405%

© Copyright 2026