SCOTIA PRECIOS.xlsx - Agility CMS

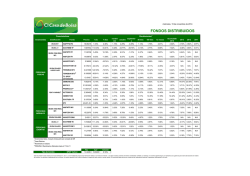

Precios y Rendimientos Fondos de Inversión (Gestión de Activos) Fondo Adquirentes Rango de Inversión Serie 1 Día 7 Días 29 Días 09-ene-15 Rendimientos Últimos 6 Meses 12 Meses En el Mes En el Año En el 2014 Precio Fondos de Inversión de Corto Plazo 0.00 a 1,499,999.99 1,500,000.00 a 4,999,999.99 5,000,000.00 a 14,999,999.99 15,000,000.00 En adelante 0.00 a 49,999.99 50,000.00 a 199,999.99 Personas Fisicas 200,000.00 a 749,999.99 750,000.00 a 1,499,999.99 1,500,000.00 a 4,999,999.99 5,000,000.00 a 9,999,999.99 10,000,000.00 En adelante 0.00 a 399,999.99 400,000.00 a 1,499,999.99 1,500,000.00 En adelante 0.00 a 749,999.99 SCOTIAG 750,000.00 a 1,499,999.99 1,500,000.00 a 4,999,999.99 Personas Morales 5,000,000.00 a 9,999,999.99 10,000,000.00 a 19,999,999.99 20,000,000.00 En adelante Cualquier Monto 5,000,000.00 En adelante 0.00 a 749,999.99 0.00 a 49,999,999.99 50,000,000.00 En adelante 0.00 a 19,999,999.99 P. M. N. C. 20,000,000.00 a 49,999,999.99 Cualquier Monto Cualquier Monto Cualquier Monto 0.00 a 249,999.99 Personas Fisicas 250,000.00 a 749,999.99 750,000.00 a 1,999,999.99 2,000,000.00 a 4,999,999.99 5,000,000,00 En adelante 0.00 a 1,999,999.99 SBANKCP Personas Morales P. M. N. C. 2,000,000.00 a 4,999,999.99 5,000,000.00 a 14,999,999.99 15,000,000.00 a 24,999,999.99 25,000,000.00 En adelante Cualquier Monto Cualquier Monto 0.00 a 1,499,999.99 1,500,000.00 a 4,999,999.99 5,000,000.00 a 14,999,999.99 15,000,000.00 En adelante Personas Fisicas 0.00 a 249,999.99 250,000.00 a 749,999.99 750,000.00 a 1,999,999.99 2,000,000.00 a 4,999,999.99 5,000,000.00 En adelante SCOTIA1 Cualquier Monto 0.00 a 1,999,999.99 2,000,000.00 a 4,999,999.99 Personas Morales 5,000,000.00 a 14,999,999.99 15,000,000.00 a 24,999,999.99 25,000,000.00 En adelante Cualquier Monto Cualquier Monto P. M. N. C. 0.00 a 2,999,999.99 3,000,000.00 En adelante Cualquier Monto SCOTGMP P. M. N. C. 0.00 a 49,999,999.99 Cualquier Monto Cualquier Monto Fondo Adquirentes Rango de Inversión 0.00 a 1,499,999.99 1,500,000.00 a 4,999,999.99 5,000,000.00 a 14,999,999.99 15,000,000.00 En adelante SCOTIA2 Personas Fisicas 0.00 a 249,999.99 250,000.00 a 749,999.99 750,000.00 a 1,999,999.99 2,000,000.00 a 4,999,999.99 5,000,000.00 En adelante Cualquier Monto P. Morales Personas Fisicas SCOTI10 Personas Morales P. M. N. C. Cualquier Monto Cualquier Monto 0.00 a 1,499,999.99 1,500,000.00 a 4,999,999.99 5,000,000.00 a 14,999,999.99 15,000,000.00 En adelante 0.00 a 249,999.99 250,000.00 a 749,999.99 750,000.00 a 1,999,999.99 2,000,000.00 a 4,999,999.99 Cualquier Monto 0.00 a 1,999,999.99 2,000,000.00 a 4,999,999.99 5,000,000.00 a 14,999,999.99 15,000,000.00 a 24,999,999.99 25,000,000.00 En adelante Cualquier Monto Cualquier Monto CU1 CU2 CU3 CU4 F1 F2 F3 F4 F5 F6 F7 TF1 TF2 TF3 M1 M2 M3 M4 M5 M6 EMP TM TM1 E1 E2 TE1 TE2 GOB II II0 1.52% 1.86% 2.10% 2.39% 1.36% 1.54% 1.73% 1.98% 2.09% 2.33% 2.51% 3.14% 1.78% 2.34% 1.73% 2.10% 2.27% 2.51% 2.69% 2.88% 3.04% 2.57% 3.14% 3.16% 3.63% 2.94% 3.28% 3.92% 2.93% 4.09% 0.89% 1.23% 1.47% 1.76% 0.73% 0.92% 1.10% 1.34% 1.47% 1.71% 1.89% 2.52% 1.15% 1.70% 1.09% 1.46% 1.64% 1.88% 2.06% 2.25% 2.40% 1.94% 2.52% 2.54% 3.00% 2.31% 2.65% 3.28% 2.31% 3.46% 0.57% 0.91% 1.15% 1.44% 0.41% 0.59% 0.78% 1.02% 1.14% 1.39% 1.57% 2.20% 0.82% 1.38% 0.77% 1.14% 1.32% 1.56% 1.74% 1.93% 2.08% 1.62% 2.20% 2.22% 2.68% 1.99% 2.33% 2.96% 1.99% 3.13% 0.56% 0.90% 1.14% 1.43% 0.40% 0.58% 0.77% 1.01% 1.13% 1.38% 1.56% ND ND 1.37% 0.76% 1.13% 1.31% 1.55% 1.74% 1.92% ND 1.61% ND 2.21% 2.83% 1.98% 2.33% 2.97% 2.13% 3.14% 0.82% 1.16% 1.41% 1.71% 0.65% 0.84% 1.03% 1.28% 1.41% 1.65% 1.84% ND ND 1.65% 1.02% 1.40% 1.59% 1.83% 2.02% 2.21% 0.43% 1.89% ND 2.51% 3.18% 2.28% 2.63% 3.29% 2.47% 3.47% 0.97% 1.30% 1.55% 1.84% 0.81% 0.99% 1.18% 1.42% 1.54% 1.78% 1.96% 2.59% 1.22% 1.78% 1.17% 1.54% 1.72% 1.96% 2.14% 2.32% 2.48% 2.02% 2.59% 2.61% 3.07% 2.39% 2.73% 3.36% 2.39% 3.53% 0.97% 1.30% 1.55% 1.84% 0.81% 0.99% 1.18% 1.42% 1.54% 1.78% 1.96% 2.59% 1.22% 1.78% 1.17% 1.54% 1.72% 1.96% 2.14% 2.32% 2.48% 2.02% 2.59% 2.61% 3.07% 2.39% 2.73% 3.36% 2.39% 3.53% 0.83% 1.17% 1.42% 1.72% 0.66% 0.85% 1.04% 1.29% 1.42% 1.66% 1.85% ND ND 1.66% 1.03% 1.41% 1.60% 1.84% 2.03% 2.22% 0.44% 1.90% ND 2.52% 3.20% 2.28% 2.64% 3.30% 2.48% 3.48% 2.679660 2.704617 2.722833 2.744677 2.489004 2.547552 2.597640 2.658788 2.688933 2.746803 2.785185 2.789412 2.793558 2.710247 2.563195 2.661154 2.709405 2.763506 2.813574 2.864531 2.794616 2.768510 2.789412 2.935927 3.107685 2.830845 2.922762 2.968966 2.798538 2.859855 F1 F2 F3 F4 F5 M1 M2 M3 M4 M5 E GOB 1.21% 1.49% 1.85% 2.25% 2.43% 1.79% 2.14% 2.38% 2.60% 2.84% 2.48% 3.62% 0.78% 1.08% 1.43% 1.83% 2.01% 1.37% 1.72% 1.96% 2.19% 2.42% 2.06% 3.20% 0.63% 0.93% 1.28% 1.68% 1.86% 1.22% 1.57% 1.81% 2.04% 2.27% 1.91% 3.05% 0.53% 0.83% 1.12% 1.48% 1.71% 1.06% 1.42% 1.71% 1.94% 2.18% ND 2.97% 0.86% 1.16% 1.43% 1.76% 2.03% 1.37% 1.73% 2.06% 2.30% 2.54% ND 3.35% 1.06% 1.35% 1.70% 2.11% 2.28% 1.64% 1.99% 2.23% 2.46% 2.70% 2.33% 3.48% 1.06% 1.35% 1.70% 2.11% 2.28% 1.64% 1.99% 2.23% 2.46% 2.70% 2.33% 3.48% 0.86% 1.16% 1.43% 1.76% 2.03% 1.37% 1.73% 2.07% 2.30% 2.55% ND 3.36% 5.874938 5.951445 6.020132 6.070183 6.140626 5.992632 6.092677 6.189889 6.193261 6.272673 6.036121 6.588921 CU1 CU2 CU3 CU4 F1 F2 F3 F4 F5 TF M1 M2 M3 M4 M5 TM E II1 II2 1.62% 1.93% 2.18% 2.49% 1.18% 1.30% 1.43% 1.57% 1.95% 2.35% 1.72% 2.06% 2.29% 2.42% 2.58% 2.40% 3.55% 1.84% 2.87% 1.07% 1.40% 1.65% 1.94% 0.65% 0.77% 0.91% 1.05% 1.41% 1.81% 1.18% 1.53% 1.76% 1.88% 2.06% 1.88% 3.02% 1.30% 2.33% 0.96% 1.30% 1.54% 1.83% 0.54% 0.67% 0.80% 0.94% 1.30% 1.71% 1.07% 1.42% 1.66% 1.78% 1.95% 1.77% 2.91% 1.19% 2.22% 0.75% 1.09% 1.33% 1.63% 0.23% 0.35% 0.52% 0.71% 1.07% 1.53% 0.86% 1.21% 1.45% 1.57% 1.75% 1.56% ND ND ND 1.03% 1.37% 1.62% 1.92% 0.20% 0.33% 0.57% 0.91% 1.28% 1.78% 1.14% 1.50% 1.74% 1.86% 2.05% 1.83% ND ND ND 1.19% 1.53% 1.77% 2.06% 0.77% 0.89% 1.03% 1.17% 1.53% 1.93% 1.30% 1.65% 1.89% 2.00% 2.18% 2.00% 3.14% 1.42% 2.45% 1.19% 1.53% 1.77% 2.06% 0.77% 0.89% 1.03% 1.17% 1.53% 1.93% 1.30% 1.65% 1.89% 2.00% 2.18% 2.00% 3.14% 1.42% 2.45% 1.03% 1.38% 1.63% 1.93% 0.19% 0.32% 0.56% 0.91% 1.28% 1.78% 1.15% 1.50% 1.75% 1.87% 2.05% 1.83% ND ND ND 1.511776 1.525848 1.536120 1.548438 1.338362 1.356961 1.406620 1.466393 1.513638 1.514706 1.509687 1.520010 1.540022 1.550125 1.565403 1.533197 1.540364 1.527907 1.530675 E II II0 TE 3.47% 3.34% 4.60% 3.46% 2.22% 2.11% 3.37% 2.22% 1.85% 1.73% 2.99% 1.85% 2.05% 2.01% 3.21% 2.02% 2.33% 2.31% 3.53% 2.23% 2.44% 2.32% 3.58% 2.44% 2.44% 2.32% 3.58% 2.44% 2.33% 2.31% 3.53% 2.22% 2.036430 2.035172 2.096619 2.008246 1 Día 7 Días 29 Días Serie CU1 CU2 CU3 CU4 F1 F2 F3 F4 F5 TF M TM CU1 CU2 CU3 CU4 F1 F2 F3 F4 TF M1 M2 M3 M4 M5 TM E Rendimientos Últimos 6 Meses 12 Meses En el Mes En el Año En el 2014 Fondos de Inversión de Mediano Plazo 11.78% 4.51% 2.51% 12.11% 4.85% 2.84% 12.35% 5.09% 3.09% 12.66% 5.38% 3.38% 11.13% 3.87% 1.87% 11.51% 4.24% 2.24% 11.87% 4.60% 2.60% 12.26% 4.96% 2.96% 12.57% 5.31% 3.31% 12.41% 5.14% 3.14% 12.59% 5.31% 3.31% 12.58% 5.32% 3.32% 14.14% 5.98% 3.90% 14.46% 6.31% 4.24% 14.71% 6.56% 4.49% 14.99% 6.85% 4.78% 14.08% 5.93% 3.86% 14.43% 6.29% 4.22% 14.69% 6.53% 4.46% 14.90% 6.74% 4.66% 14.76% 6.62% 4.54% 14.46% 6.31% 4.24% 14.82% 6.67% 4.60% 14.99% 6.85% 4.77% 15.18% 7.03% 4.95% 15.31% 7.15% 5.08% 14.96% 6.79% 4.72% 15.48% 7.34% 5.26% Página 1 de 3 1.08% 1.42% 1.66% 1.96% 0.32% 0.93% 1.20% 1.44% 1.64% 1.64% 1.96% 1.86% 1.52% 1.86% 2.10% 2.40% 1.54% 1.87% 2.05% 3.45% 2.16% 1.72% 2.09% 2.30% 2.54% 2.76% 2.30% 2.89% 1.10% 1.45% 1.70% 2.00% 0.28% 1.01% 1.24% 1.43% 1.57% 1.63% ND ND 1.70% 2.05% 2.30% 2.60% 1.75% 2.07% 2.23% 3.02% ND 1.86% 2.23% 2.46% 2.74% 3.00% ND 3.11% 3.79% 4.13% 4.37% 4.66% 3.15% 3.52% 3.88% 4.24% 4.59% 4.42% 4.60% 4.60% 5.05% 5.38% 5.63% 5.92% 5.00% 5.36% 5.60% 5.81% 5.68% 5.38% 5.74% 5.92% 6.10% 6.22% 5.86% 6.41% 3.79% 4.13% 4.37% 4.66% 3.15% 3.52% 3.88% 4.24% 4.59% 4.42% 4.60% 4.60% 5.05% 5.38% 5.63% 5.92% 5.00% 5.36% 5.60% 5.81% 5.68% 5.38% 5.74% 5.92% 6.10% 6.22% 5.86% 6.41% 1.08% 1.42% 1.67% 1.97% 0.25% 0.99% 1.22% 1.40% 1.53% 1.59% ND ND 1.64% 1.98% 2.23% 2.53% 1.69% 2.00% 2.16% 2.96% ND 1.79% 2.16% 2.39% 2.67% 2.94% ND 3.04% Precio 1.204958 1.216175 1.224362 1.234180 1.083837 1.132627 1.165318 1.192851 1.211832 1.207279 1.215733 1.222412 1.332400 1.344799 1.353849 1.364702 1.230382 1.263051 1.294716 1.366061 1.359305 1.304713 1.343489 1.357116 1.376208 1.397717 1.365128 1.463755 Precios y Rendimientos Fondos de Inversión (Gestión de Activos) Fondo Adquirentes Rango de Inversión 0.00 a 249,999.99 P. FISICAS 250,000.00 a 749,999.99 750,000.00 a 1,999,999.99 2,000,000.00 a 4,999,999.99 5,000,000,00 En adelante SCOTILP 0.00 a 1,999,999.99 P. Morales 2,000,000.00 a 4,999,999.99 5,000,000.00 a 14,999,999.99 Cualquier Monto P. M. N. C. Cualquier Monto Cualquier Monto Cualquier Monto 0.00 a 1,499,999.99 1,500,000.00 a 4,999,999.99 5,000,000.00 a 14,999,999.99 15,000,000.00 En adelante Personas Fisicas 0.00 a 249,999.99 250,000.00 a 749,999.99 750,000.00 a 1,999,999.99 2,000,000.00 a 4,999,999.99 5,000,000,00 En adelante Cualquier Monto SCOTIMB 0.00 a 1,999,999.99 Personas Morales 2,000,000.00 a 4,999,999.99 5,000,000.00 a 14,999,999.99 Cualquier Monto Cualquier Monto P. M. N. C. Cualquier Monto Cualquier Monto Cualquier Monto 0.00 a 1,499,999.99 Personas Fisicas SCOTLPG P. Morales P. M. N. C. 1,500,000.00 a 4,999,999.99 5,000,000.00 a 14,999,999.99 0.00 a 249,999.99 Cualquier Monto 0.00 a 1,999,999.99 Cualquier Monto Cualquier Monto 0.00 a 1,499,999.99 P. Fisicas SCOT-TR P. Morales P. M. N. C. 1,500,000.00 a 4,999,999.99 5,000,000.00 a 14,999,999.99 15,000,000.00 En adelante Cualquier Monto 0.00 a 1,999,999.99 2,000,000.00 a 4,999,999.99 5,000,000.00 a 14,999,999.99 15,000,000.00 a 24,999,999.99 Cualquier Monto 0.00 a 49,999,999.99 50,000,000.00 En adelante Cualquier Monto Fondo Adquirentes Rango de Inversión Serie 1 Día 7 Días 29 Días 09-ene-15 Rendimientos Últimos 6 Meses 12 Meses En el Mes En el Año En el 2014 Precio F1 F2 F3 F4 F5 M1 M2 M3 E TE II II0 Fondos de Inversión de Largo Plazo 66.10% 27.76% 12.92% 66.88% 28.57% 13.73% 67.06% 28.74% 13.91% 67.30% 28.97% 14.14% 67.70% 29.38% 14.55% 67.00% 28.68% 13.85% 67.35% 29.03% 14.20% 67.57% 29.26% 14.43% 68.27% 29.95% 15.11% 68.25% 29.95% 15.11% 68.09% 29.77% 14.94% 69.41% 31.10% 16.27% 1.20% 1.98% 2.16% ND ND ND ND 2.68% 3.36% 3.36% 3.44% 4.52% ND ND ND ND ND ND ND ND 4.91% 4.91% 5.06% 6.13% 23.72% 24.53% 24.70% 24.93% 25.34% 24.64% 24.99% 25.22% 25.91% 25.91% 25.73% 27.06% 23.72% 24.53% 24.70% 24.93% 25.34% 24.64% 24.99% 25.22% 25.91% 25.91% 25.73% 27.06% ND ND ND ND ND ND ND ND 4.30% 4.30% 4.46% 5.52% 1.332965 1.335717 1.340367 1.341947 1.344634 1.339800 1.342543 1.338709 1.338684 1.338683 1.340635 1.378655 CU1 CU2 CU3 CU4 F1 F2 F3 F4 F5 TF M1 M2 M3 TM E TE II II0 149.11% 149.43% 149.67% 149.98% 149.02% 149.23% 149.36% 149.49% 149.66% 149.62% 149.41% 149.81% 149.98% 149.92% 150.44% 150.46% 150.29% 151.61% 70.19% 70.53% 70.78% 71.07% 70.12% 70.32% 70.45% 70.59% 70.77% 70.72% 70.52% 70.90% 71.08% 71.02% 71.57% 71.57% 71.39% 72.73% 37.04% 37.39% 37.64% 37.94% 36.98% 37.18% 37.31% 37.45% 37.64% 37.58% 37.38% 37.77% 37.95% 37.88% 38.43% 38.43% 38.26% 39.61% 3.06% 3.40% 3.65% 3.94% 2.99% 3.19% 3.32% 3.45% 3.64% 3.32% 3.39% 3.77% 3.95% 3.66% -5.38% 4.41% 4.34% 5.58% 8.31% 8.68% 8.94% 9.26% 8.19% 8.44% 8.58% 8.72% 8.93% 8.51% 8.65% 11.13% ND 8.89% 4.41% 9.78% 9.75% 11.06% 62.15% 62.49% 62.74% 63.04% 62.08% 62.28% 62.41% 62.55% 62.74% 62.68% 62.49% 62.87% 63.05% 62.98% 63.53% 63.53% 63.36% 64.70% 62.15% 62.49% 62.74% 63.04% 62.08% 62.28% 62.41% 62.55% 62.74% 62.68% 62.49% 62.87% 63.05% 62.98% 63.53% 63.53% 63.36% 64.70% 6.45% 6.81% 7.08% 7.39% 6.31% 6.57% 6.72% 6.86% 7.06% 6.64% 6.78% 9.22% ND 7.02% 2.62% 7.90% 7.87% 9.16% 1.606833 1.621783 1.632696 1.645782 1.430925 1.486388 1.527491 1.578146 1.614706 1.613999 1.562448 1.661382 1.668917 1.645496 1.660448 1.733787 1.677480 1.707780 CU1 CU2 CU3 F1 TF M1 E II 123.66% 123.99% 124.23% 122.80% 124.18% 123.79% ND 124.85% 57.76% 58.10% 58.34% 56.91% 58.30% 57.89% ND 58.97% 32.17% 32.51% 32.77% 31.32% 32.72% 32.30% ND 33.38% 3.78% 4.13% 4.37% 2.95% 4.40% 3.91% ND 5.26% 6.97% 7.34% 7.60% 6.09% ND 7.10% ND 8.62% 51.79% 52.13% 52.38% 50.94% 52.33% 51.92% ND 53.00% 51.79% 52.13% 52.38% 50.94% 52.33% 51.92% ND 53.00% 5.66% 6.02% 6.28% 4.79% ND 5.79% ND 7.30% 1.263449 1.275206 1.283788 1.215742 1.313971 1.284520 1.316475 CU1 CU2 CU3 CU4 TF M1 M2 M3 M4 II0 II1 II2 E 43.51% 43.82% 44.11% 44.35% 43.99% 44.01% 44.16% 44.21% 44.32% 46.02% 44.71% 45.20% 44.90% 5.65% 5.98% 6.22% 6.51% 6.11% 6.17% 6.28% 6.34% 6.46% 8.17% 6.85% 7.31% 7.02% 8.63% 8.96% 9.21% 9.50% 9.10% 9.15% 9.27% 9.33% 9.44% 11.16% 9.84% 10.30% 10.01% 2.08% 2.42% 2.67% 2.96% 2.56% 2.61% 2.73% ND 2.90% 4.64% 3.40% 3.76% 3.65% 3.29% 3.64% 3.90% 4.20% ND ND ND ND ND 5.95% 4.70% ND ND 5.94% 6.27% 6.52% 6.80% 6.41% 6.46% 6.58% 6.63% 6.75% 8.46% 7.14% 7.60% 7.32% 5.94% 6.27% 6.52% 6.80% 6.41% 6.46% 6.58% 6.63% 6.75% 8.46% 7.14% 7.60% 7.32% 3.42% 3.77% 4.02% 4.32% ND ND ND ND ND 6.08% 4.82% ND ND 0.975848 0.980537 0.983076 0.986550 0.988138 0.983721 0.988545 0.990513 0.987260 1.004133 0.991632 0.994447 0.993110 1 Día 7 Días 29 Días Serie Rendimientos Últimos 6 Meses 12 Meses En el Mes En el Año En el 2014 Precio Fondo de Fondos Mediano Plazo 0.00 a 249,999.99 250,000.00 a 749,999.99 P. Fisicas 750,000.00 a 1,999,999.99 2,000,000.00 a 4,999,999.99 SBANKMP 5,000,000,00 En adelante 0.00 a 1,999,999.99 P. Morales 2,000,000.00 a 4,999,999.99 5,000,000.00 a 14,999,999.99 Fondo Adquirentes Rango de Inversión F1 F2 F3 F4 F5 M1 M2 M3 Serie 19.69% 19.93% 20.28% 20.82% 21.04% 19.69% 19.79% 20.20% 4.93% 5.16% 5.51% 6.08% 6.31% 4.93% 5.05% 5.45% 7.40% 7.63% 7.98% 8.56% 8.79% 7.40% 7.52% 7.92% 1 Día 7 Días 29 Días 1.54% 1.79% 2.14% 2.69% 2.94% 1.51% 1.66% 2.48% 1.31% 1.61% 1.97% 2.43% 2.73% ND ND ND 4.49% 4.73% 5.07% 5.65% 5.88% 4.50% 4.61% 5.02% 4.49% 4.73% 5.07% 5.65% 5.88% 4.50% 4.61% 5.02% 1.21% 1.52% 1.88% 2.33% ND ND ND ND Rendimientos Últimos 6 Meses 12 Meses En el Mes En el Año En el 2014 1.002710 1.010463 1.014317 1.019117 1.021961 1.008080 1.012046 1.016642 Precio Fondos de Fondos Largo Plazo 0.00 a 249,999.99 Personas Fisicas SCOTI12 250,000.00 a 749,999.99 750,000.00 a 1,999,999.99 2,000,000.00 a 4,999,999.99 5,000,000,00 En adelante Personas 0.00 a 1,999,999.99 P. M. N. C. Cualquier Monto Cualquier Monto 0.00 a 49,999.999.99 0.00 a 249,999.99 250,000.00 a 749,999.99 Personas Fisicas 750,000.00 a 1,999,999.99 2,000,000.00 a 4,999,999.99 5,000,000,00 En adelante SCOTI14 Cualquier Monto Personas Morales 0.00 a 1,999,999.99 2,000,000.00 a 4,999,999.99 Cualquier Monto P. M. N. C. Cualquier Monto 0.00 a 49,999.999.99 0.00 a 249,999.99 Personas Fisicas SBANK50 Personas Morales P.M.N.C. 250,000.00 a 749,999.99 750,000.00 a 1,999,999.99 2,000,000.00 a 4,999,999.99 5,000,000,00 En adelante 0.00 a 1,999,999.99 2,000,000.00 a 4,999,999.99 Cualquier Monto Cualquier Monto 0.00 a 49,999.999.99 F1 F2 F3 F4 F5 M1 E II0 II1 F1 F2 F3 F4 F5 TF M1 M2 E II0 II1 100.21% 100.57% 100.92% 101.29% 101.65% 99.97% 101.90% 103.39% 102.14% 213.78% 214.14% 214.49% 214.84% 215.20% 223.01% 213.54% 213.89% 215.32% 216.92% 215.64% -8.57% -8.21% -7.85% -7.49% -7.13% -8.80% -6.89% -5.40% -6.66% -30.97% -30.62% -30.27% -29.92% -29.57% -31.47% -31.20% -30.85% -29.46% -27.87% -29.12% 10.63% 10.99% 11.35% 11.72% 12.08% 10.40% 12.33% 13.83% 12.56% 18.66% 19.02% 19.38% 19.74% 20.10% 20.81% 18.43% 18.78% 20.22% 21.85% 20.57% 1.88% 2.24% 2.61% 2.97% 3.33% 1.65% 3.62% 5.14% 3.93% 5.40% 5.77% 6.13% 6.51% 6.88% 6.21% 5.16% 5.53% 7.11% 8.77% 7.54% 1.97% 2.34% 2.72% 3.09% 3.46% 1.73% 3.76% ND 4.10% 4.85% 5.23% 5.61% 6.00% 6.38% 4.88% 4.61% 4.99% 6.62% ND 7.09% -4.77% -4.41% -4.05% -3.69% -3.34% -5.00% -3.09% -1.61% -2.86% -20.38% -20.03% -19.68% -19.32% -18.97% -21.00% -20.61% -20.26% -18.87% -17.28% -18.53% -4.77% -4.41% -4.05% -3.69% -3.34% -5.00% -3.09% -1.61% -2.86% -20.38% -20.03% -19.68% -19.32% -18.97% -21.00% -20.61% -20.26% -18.87% -17.28% -18.53% 1.90% 2.27% 2.64% 3.02% 3.39% 1.66% 3.69% ND 4.03% 4.77% 5.15% 5.54% 5.92% 6.31% 4.80% 4.53% 4.91% 6.54% ND 7.02% 1.310153 1.343163 1.392987 1.437798 1.478204 1.304278 1.425997 1.436657 1.456282 1.454139 1.496976 1.544358 1.599326 1.653718 1.624286 1.447623 1.490269 1.603360 1.620315 1.622682 F1 F2 F3 F4 F5 M1 M2 E II0 II1 224.71% 225.06% 225.43% 225.79% 226.12% 224.48% 224.85% 226.21% 227.94% 226.68% -31.66% -31.32% -30.96% -30.61% -30.28% -31.89% -31.53% -30.18% -28.47% -29.72% 15.93% 16.29% 16.65% 17.01% 17.35% 15.70% 58.93% 17.47% 19.21% 17.93% 4.48% 4.84% 5.21% 5.57% 5.91% 4.24% 11.43% 6.12% 7.90% 6.67% 5.06% 5.43% 5.81% 6.20% 6.55% 4.81% 8.77% 6.72% ND 7.32% -20.91% -20.56% -20.21% -19.86% -19.53% -21.14% -20.78% -19.43% -17.72% -18.97% -20.91% -20.56% -20.21% -19.86% -19.53% -21.14% -20.78% -19.43% -17.72% -18.97% 4.25% 4.62% 5.00% 5.38% 5.73% 4.01% 7.94% 5.90% ND 6.50% 1.828746 1.875629 1.938170 2.004528 1.935481 1.820560 1.930895 1.942073 1.968920 1.977564 Página 2 de 3 Precios y Rendimientos Fondos de Inversión (Gestión de Activos) Fondo Rango de Inversión Adquirentes 0.00 a 1,499,999.99 1,500,000.00 a 4,999,999.99 Personas Fisicas 5,000,000.00 a 14,999,999.99 15,000,000.00 En adelante 0.00 a 249,999.99 750,000.00 a 1,999,999.99 SCOTDOL Cualquier Monto 0.00 a 1,999,999.99 Personas Morales 5,000,000.00 a 14,999,999.99 15,000,000.00 a 24,999,999.99 25,000,000.00 En adelante Cualquier Monto P.M.N.C. SCOTDOL Referencia Cualquier Monto Tipo de Cambio Spot Valmer 48 hrs. 0.00 a 1,499,999.99 SCOT-FX 1,500,000.00 a 4,999,999.99 5,000,000.00 a 14,999,999.99 15,000,000.00 En adelante 0.00 a 1,999,999.99 P. Morales 2,000,000.00 a 4,999,999.99 P. M. N. C. 5,000,000.00 a 14,999,999.99 Cualquier Monto SCOT-FX Referencia Tipo de Cambio Spot Valmer 48 hrs. Rango de Inversión Adquirentes P. M. N. C. Cualquier Monto Cualquier Monto Cualquier Monto Cualquier Monto Cualquier Monto Cualquier Monto Cualquier Monto P. Fisicas Cualquier Monto Cualquier Monto SCOTIPC P. Morales Referencia Cualquier Monto Cualquier Monto P. Morales Cualquier Monto P. M. N. C. Cualquier Monto Referencia Todos Cualquier Monto Cualquier Monto P. M. N. C. Cualquier Monto Referencia P. M. N. C. Cualquier monto Cualquier monto Todos Cualquier Monto Todos Cualquier Monto Cualquier Monto Cualquier Monto P. M. N. C. 0.00 a 49,999,999.99 Referencia SCOTGLO P. Morales P. M. N. C. Referencia SCOTQNT Cualquier Monto 0.00 a 49,999,999.99 P. Fisicas SCOTEUR P. Morales P.M.N.C. Fondo Adquirentes -0.44% -0.10% 0.14% 0.42% 1.14% 1.25% 1.36% 1.37% 27.67% 28.00% 28.25% 28.54% 28.85% 28.97% 29.09% 29.09% 21.09% 21.45% 21.72% 22.04% 22.15% 22.29% ND 22.50% 11.63% 12.01% 12.28% 12.61% 12.38% ND ND 13.44% -0.54% -0.21% 0.03% 0.32% 1.68% 1.79% 1.91% 1.91% -0.54% -0.21% 0.03% 0.32% 1.68% 1.79% 1.91% 1.91% 12.23% 12.61% 12.88% 13.21% 12.96% ND ND 14.07% 19.776491 19.959134 20.092442 20.252302 20.041296 20.188314 20.146030 20.843423 477.81% -404.45% 41.23% -39.77% 22.00% 6.73% -2.31% 24.76% 0.70% 11.60% 31.06% -29.16% 31.06% -29.16% 1.00% 12.69% NA 14.627400 1 Día 7 Días 29 Días Rendimientos Últimos 6 Meses 12 Meses En el Mes En el Año En el 2014 Precio 6.553408 6.955052 6.419706 6.553408 6.955074 6.580714 6.553852 42,402.31 L AIF TF M TM E 1.54% 1.54% 1.54% 1.55% 1.55% 1.55% 1.33% -0.19% -0.19% -0.19% -0.18% -0.17% -0.18% -0.32% 2.60% 2.60% 2.60% 2.62% 2.65% 2.62% 2.68% 17.31% 17.56% 16.91% 17.34% 20.39% 17.34% 18.70% 17.61% 18.45% 16.78% 17.64% 20.25% 17.64% 25.67% -0.87% -0.87% -0.87% -0.86% -0.85% -0.86% -1.26% -0.87% -0.87% -0.87% -0.86% -0.85% -0.86% -1.26% 19.19% 20.07% 18.33% 19.21% 21.83% 19.21% 27.35% 5.762492 6.065462 5.600648 5.763980 5.767368 5.764012 156.922658 L AI TL II 1.17% 1.17% 1.17% 1.17% 1.41% -1.57% -1.57% -1.57% -1.59% -1.72% 1.81% 1.81% 1.81% 1.72% 2.52% -4.36% -4.18% -4.89% -5.09% -1.73% 2.91% 3.61% 1.66% 1.46% 3.16% -1.38% -1.38% -1.38% -1.41% -1.43% -1.38% -1.38% -1.38% -1.41% -1.43% 1.49% 2.21% 0.24% 0.07% 1.14% 2.263478 2.396129 2.187003 2.221721 53,275.68 L T II0 0.20% 0.20% 0.21% 1.41% -2.42% -2.42% -2.38% -1.72% 1.99% 1.99% 2.17% 2.49% -2.69% -2.51% -1.26% -2.31% 11.14% ND 14.55% 2.14% 0.02% 0.02% 0.07% -1.43% 0.02% 0.02% 0.07% -1.43% 9.91% ND 13.37% 0.14% 1.146687 1.170947 1.187516 42,402.31 L 1.04% 0.24% -1.18% -1.87% -0.81% -1.65% -7.23% -0.04% -2.91% 8.49% -1.31% -2.21% -1.31% -2.21% -4.99% 8.31% 12.131885 102.173834 L TF TM II0 II1 1.22% 1.22% 1.21% 1.23% 1.22% 1.41% -1.55% -1.55% -1.56% -1.50% -1.55% -1.72% 1.82% 1.84% 1.77% 2.01% 1.82% 2.49% -4.08% ND ND -2.59% -3.37% -2.31% 1.56% ND ND 4.94% 3.51% 2.14% -1.31% -1.31% -1.33% -1.26% -1.31% -1.43% -1.31% -1.31% -1.33% -1.26% -1.31% -1.43% -0.15% ND ND 3.20% 1.82% 0.14% 1.220853 1.309729 1.312603 1.322565 1.281193 42,402.31 L TF TM II0 II1 1.14% 1.14% 1.13% 1.14% 1.14% 0.77% -1.04% -1.04% -1.05% -0.99% -1.04% -1.55% 1.12% 1.12% 1.17% 1.36% 1.17% 0.32% 8.03% ND ND 9.57% 8.69% 8.68% 11.84% ND ND 15.13% 13.56% 14.07% -1.62% -1.62% -1.62% -1.56% -1.61% -2.07% -1.62% -1.62% -1.62% -1.56% -1.61% -2.07% 12.55% ND ND 15.87% 14.33% 16.04% 1.345150 1.429368 1.434658 1.442552 1.397542 6,053.40 6.73% ND 13.54% ND 0.10% 0.13% 0.10% 0.13% 9.59% ND 1.008853 1.011516 Cualquier monto Cualquier monto Cualquier monto Cualquier monto Cualquier monto Cualquier monto L AIF TF M TM E 1.40% 1.40% 1.40% 1.40% 1.40% 1.40% -3.83% -3.83% -3.83% -3.83% -3.82% -3.83% -3.09% -3.09% -3.09% -3.08% -3.03% -3.08% ND ND ND ND ND ND ND ND ND ND ND ND -3.83% -3.83% -3.83% -3.83% -3.82% -3.83% -3.83% -3.83% -3.83% -3.83% -3.82% -3.83% ND ND ND ND ND ND 0.957548 0.958751 0.958205 0.957810 0.959714 0.958252 Rango de Inversión Serie 1 Día 7 Días 29 Días cualquier monto P. M. N. C. P. Fisicas P. Morales Cualquier monto I+CORP P. Fisicas P. M. N. C. Cualquier monto CRECE+ P. Fisicas y P. Morales Todos 67.31% 67.64% 67.88% 68.16% 67.99% 68.11% 68.22% 68.22% 1.94% 1.98% P. Fisicas P. Morales P. M. N. C. I+GLOBV 1.535325 1.547497 1.556370 1.567001 1.407647 1.555764 1.563335 1.466085 1.560600 1.554611 1.555426 1.568470 NA 14.627400 0.44% 0.45% cualquier monto BX+MP 10.16% 10.53% 10.80% 11.12% 10.45% 10.96% 11.19% 10.68% 11.14% ND ND 11.21% ND -1.99% 12.69% 0.49% 0.49% P. Fisicas P. Morales P. M. N. C. NAFINTR -17.03% -16.70% -16.46% -16.17% -16.64% -16.12% -16.12% -16.22% -15.99% -15.88% -15.76% -15.88% ND 12.60% -29.16% L E Cualquier Monto NAFCDVI -17.03% -16.70% -16.46% -16.17% -16.64% -16.12% -16.12% -16.22% -15.99% -15.88% -15.76% -15.88% ND 12.60% -29.16% Cualquier monto Cualquier monto P. Fisicas P. Morales P. M. N. C. FINDE1 9.49% 9.86% 10.12% 10.44% 9.80% 10.29% 10.51% 10.02% 10.47% ND ND 10.54% ND -1.62% 11.60% -1.88% -0.04% -1.53% -1.88% -0.04% 0.93% -1.87% 0.14% Morgan Stanley Capital Int. All Country World Index (MSCI_ACWI) P. Físicas P.M.N.C. 22.93% 23.30% 23.57% 23.89% 23.92% 23.89% 23.95% 23.73% 24.05% ND ND 24.00% ND -0.74% 24.76% -1.51% -1.51% -1.51% -1.51% -1.51% -1.51% -1.51% -1.43% IPC Cualquier Monto Cualquier Monto P. Físicas Precio -1.51% -1.51% -1.51% -1.51% -1.51% -1.51% -1.51% -1.43% Morgan Stanley Capital Int. Emerging Markets Index (MSCI EM) SCOT-CM 29 Días 0.07% 1.89% 0.44% 0.07% 1.89% 2.96% 0.08% 2.14% IPC Cualquier Monto 7 Días Fondos en Moneda Extranjera -168.52% -26.29% 8.34% -168.17% -25.96% 8.67% -167.95% -25.73% 8.92% -167.66% -25.44% 9.20% -164.74% -25.66% 9.41% -167.63% -25.38% 9.26% -167.62% -25.38% 9.26% -167.74% -25.50% 9.15% -167.50% -25.27% 9.38% -167.38% -25.16% 9.50% -167.27% -25.04% ND -167.23% -25.12% 9.50% ND ND ND 242.43% 14.22% 2.66% -404.45% -39.77% 6.73% -3.24% -2.55% -3.06% -3.24% -2.55% -0.63% -3.23% -2.31% L AIF TF M AIM TM E IRT Cualquier monto Todos 1 Día 09-ene-15 Rendimientos Últimos 6 Meses 12 Meses En el Mes En el Año En el 2014 Fondos de Renta Variable 1.40% -1.79% 2.27% 1.40% -1.79% 2.27% 1.40% -1.79% 2.27% 1.40% -1.79% 2.27% 1.40% -1.79% 2.27% 1.40% -1.79% 2.29% 1.40% -1.79% 2.27% 1.41% -1.72% 2.49% S&P 500 Cualquier Monto Referencia SCOTEME Referencia Serie IPC SCOTUSA SCOT-FR CU1 CU2 CU3 CU4 M1 M2 M3 E Rendimiento en Dólares (Referencia Serie M1) P. Fisicas SCOT-RV CU1 CU2 CU3 CU4 F1 F3 TF M1 M3 M4 M5 TM E Rendimiento en Dólares (Referencia Serie F1) Personas Fisicas Fondo Serie Cualquier Monto Cualquier Monto cualquier monto cualquier monto cualquier monto cualquier monto Cualquier monto Cualquier monto Cualquier monto Cualquier monto Cualquier monto Cualquier monto Cualquier monto Cualquier monto Rendimientos Últimos 6 Meses 12 Meses En el Mes En el Año En el 2014 Precio F M E 8.45% 8.37% 8.96% Fondo Privado* 3.73% 3.96% 3.64% 3.87% 4.23% 4.47% 2.84% 2.75% 3.35% 3.29% 3.19% 3.81% 3.59% 3.50% 4.09% 3.59% 3.50% 4.09% 3.31% 3.22% 3.83% 2.416420 2.397375 2.535571 F3 M3 X3 Fondos Codistribuidos** 44.25% 6.29% 6.09% 44.25% 6.29% 6.09% 44.92% 6.96% 6.77% 1.85% 1.85% 2.53% 3.98% 3.98% 4.69% 2.24% 2.24% 2.92% 2.24% 2.24% 2.92% 4.23% 4.23% 4.94% 15.157400 15.157400 15.475052 F3 M3 X3 31.62% 31.91% 32.59% 3.44% 3.73% 4.42% 5.43% 5.72% 6.41% 1.82% 2.11% 2.79% 3.17% 3.48% 4.19% 2.68% 2.97% 3.65% 2.68% 2.97% 3.65% 3.34% 3.64% 4.36% 11.005870 11.055453 11.168749 B-E1 B-F1 B-M1 28.31% 27.15% 27.18% 14.66% 13.50% 13.50% 7.09% 5.92% 5.92% 2.70% 1.53% 1.53% 4.27% 3.05% 3.05% 14.37% 13.21% 13.21% 14.37% 13.21% 13.21% 3.93% 2.71% 2.71% 1.491297 1.417121 1.417141 B-F1 B-E1 7.73% 8.56% 4.58% 5.41% 3.14% 3.96% 2.77% 3.60% 3.41% 4.27% 4.64% 5.46% 4.64% 5.46% 3.36% 4.22% 1.368812 1.383706 B-2 B-5 B-6 1.14% 1.14% 1.15% -1.40% -1.42% -1.37% 1.51% 1.42% 1.64% -6.24% -6.78% -5.49% -1.75% -2.67% -0.20% -1.17% -1.20% -1.14% -1.17% -1.20% -1.14% -2.99% -3.87% -1.46% 0.536541 0.541476 0.555529 B-1 B-2 1.25% 1.24% -0.16% -0.20% 1.37% 1.23% 9.00% 8.04% 13.68% 11.72% -0.86% -0.90% -0.86% -0.90% 13.99% 12.02% 1.888896 1.604840 Fondos Operados por Scotia Fondos S.A. de C.V. - La presente información no es para algún perfil de inversión en específico por lo que el cliente que tenga acceso a ella, bajo su responsabilidad, deberá adoptar sus decisiones de inversión procurándose el asesoramiento específico y especializado que pueda ser necesario. Los rendimientos históricos no garantizan rendimientos similares en el futuro. Scotiabank Inverlat S.A. reconoce el derecho innegable que tiene el cliente de contratar a través de un tercero independiente los productos y/o servicios adicionales o ligados a los mencionados en esta publicación o aquellos que pudieran ofrecer cualesquiera de las Entidades de su Grupo Financiero o Económico. Producto ofrecido por Scotiabank Inverlat, S.A., Institución de Banca Múltiple y/o Scotia Inverlat Casa de Bolsa, S.A. de C.V., ambas integrantes del Grupo Financiero Scotiabank Inverlat. Consulta comisiones, condiciones, guía de servicios de inversión y requisitos de contratación en www.scotiabank.com.mx - Los Precios y Rendimientos de este documento corresponden únicamente a la fecha arriba señalada. - Los rendimientos expresados en periodos de 12 meses están calculados en directo. *: Fondo no Ofertable. **: Fondos No Operados por Scotia Fondos S.A. de C.V. Página 3 de 3

© Copyright 2026