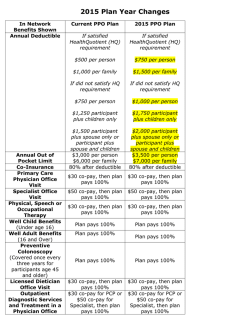

DECISION GUIDE FOR PLAN YEAR 2015