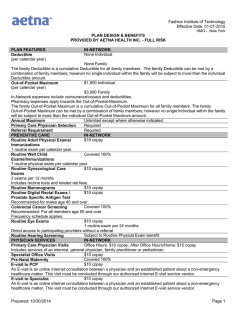

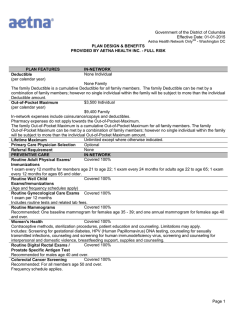

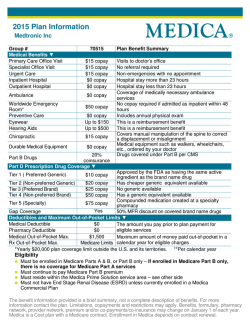

Download the 2015 brochure to compare all 2015 plans in your state.