2015 PPO — One Book Summary Guide

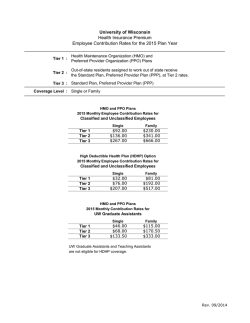

VALUE OF BLUE BASIC OPTION STANDARD OPTION HEALTH TOOLS REWARD PROGRAMS BLUE EXTRAS PHARMACY PROGRAMS 2015 STANDARD & BASIC OPTION BLUE CROSS AND BLUE SHIELD SERVICE BENEFIT PLAN SUMMARY WORLDWIDE COVERAGE VALUE OF BLUE VALUE OF BLUE While it’s important to choose the right healthcare coverage with benefits and rates that meet your needs and those of your family, there is more to health insurance than benefits and premiums. The Blue Cross and Blue Shield Service Benefit Plan offers added value in the form of programs and services that were designed with you and your family’s health and wellness in mind. This includes the value of our 24/7 Nurse Line that provides reliable, personalized advice from knowledgeable registered nurses. Our Preferred provider network of hospitals, physicians, pharmacies and other healthcare professionals is almost one million strong, so you can find a network provider near where you live or travel nationwide. Plus, you save money when you use Preferred providers. We also provide a special free assistance center to help you when you travel overseas. We reward you for taking charge of your health with our Wellness Incentive Program. You can earn up to $85 on a health card for taking the Blue Health Assessment and achieving goals related to a healthy lifestyle. The value of Blue is all these things and more. Learn more about what the Service Benefit Plan offers by reading the information in this book. You can also learn more about our 2015 benefits and value-added programs on our website: www.fepblue.org. If you have questions, you can call our Open Season Information Center at 1-800-411-BLUE (2583) beginning October 20 through December 19, 2014. You have peace of mind knowing that the Service Benefit Plan ID card is recognized in the U.S. and around the world. 2015 Standard & Basic Option Blue Cross and Blue Shield Service Benefit Plan Summary 11 BASIC OPTION 2015 Basic Option Benefits at a Glance Certain cost sharing amounts do not apply if Medicare is your primary coverage for medical services (it pays first). Please see the 2015 Service Benefit Plan brochure for more information. Brochure sections are identified for your reference. SERVICES Under Basic Option, you use Preferred providers for all the medical care you and your family need. Preferred providers file your claims, and payment will be made directly to the provider. Benefits are only available for care performed by Non-preferred providers in certain situations, such as emergency care. BASIC OPTION WHAT YOU PAY Network Providers 2015 BASIC OPTION NETWORK BENEFIT* PREVENTIVE CARE — 5(a) and 5(g) Preventive screenings and related office visit charge; routine physical exams Nothing for an annual physical and covered preventive screenings Preventive care for children, up to age 22 Nothing for covered services Routine dental care $25 copayment per evaluation; up to 2 per calendar year Preventive care only EXAMPLE OF YOUR SAVINGS WHEN YOU USE PREFERRED PROVIDERS PHYSICIAN CARE — 5(a) and 5(b) DOCTOR’S OFFICE VISIT PREFERRED PHYSICIAN Physician’s charge $250 Our allowance $100 We pay Our allowance minus copayment: $75 Your copayment $25 Plus any difference up to the provider’s charge $0 TOTAL YOU PAY $25 Surgical care $150 copayment per performing surgeon in an office visit setting; $200 copayment per performing surgeon in another setting Office visits, consultations and second surgical opinions $25 per visit copayment for primary care provider $35 per visit copayment for specialists MATERNITY CARE — 5(a) Inpatient/Outpatient hospital care (Precertification is not required for normal delivery) $175 copayment per inpatient admission; No out-of-pocket expenses for outpatient covered services Physician care Physician care including delivery and pre- and postnatal care: No out-of-pocket expenses for covered services HOSPITAL/FACILITY CARE — 5(c) Inpatient hospital/facility care (Precertification is required) $175 per day up to $875 per admission for unlimited days Outpatient hospital/facility care $100 per day per facility copayment ACCIDENTAL INJURY/MEDICAL EMERGENCY — 5(d) Accidental injury and medical emergency $125 copayment for emergency room care $35 copayment for urgent care center Regular benefits for physician care CHIROPRACTIC AND OSTEOPATHIC MANIPULATIVE TREATMENT — 5(a) Manipulative treatment $25 per visit copayment; up to 20 manipulations per year OTHER BENEFITS — 4 Catastrophic benefits 100% payment level begins after you pay $5,500 (Self Only) or $7,000 (Self and Family) out-of-pocket in eligible coinsurance and copayment expenses *When you receive care that is performed by a Non-preferred provider, benefits are not available under Basic Option, except in certain situations such as emergency care. 2 2015 Standard & Basic Option Blue Cross and Blue Shield Service Benefit Plan Summary 3 2015 Standard Option Benefits at a Glance STANDARD OPTION Certain cost sharing amounts do not apply if Medicare is your primary coverage for medical services (it pays first). Please see the 2015 Service Benefit Plan brochure for more information. Brochure sections are identified for your reference. WHAT YOU PAY SERVICES More Choices allowance and our payment. This is also true for Participating providers. You can choose to use Non-participating providers, but your out-of-pocket expenses will be higher than if you use Preferred or Participating providers. 2015 STANDARD OPTION USING NON-PREFERRED PROVIDERS* PREVENTIVE CARE — 5(a) and 5(g) Preventive screenings and related office visit Nothing for an annual physical and covered charge; routine physical exams preventive screenings 35% of the Plan allowance** Preventive care for children, up to age 22 Nothing for covered services 35% of the Plan allowance** Routine dental care Your out-of-pocket expenses are limited to the balance after our payment up to the Maximum Allowable Charge You are responsible for the balance after our payment, up to the billed charge Surgical care 15% of the Plan allowance** 35% of the Plan allowance** Office visits, consultations and second surgical opinions $20 per visit copayment for primary care provider 35% of the Plan allowance** STANDARD OPTION More network providers means more choices. Our nationwide network of almost one million hospitals, physicians, pharmacies and other healthcare providers makes it easy to use a Preferred provider. And when you use a Preferred provider, the provider files the claim. Payment is made directly to the provider, and you are only responsible for any difference between our 2015 STANDARD OPTION USING PREFERRED PROVIDERS PHYSICIAN CARE — 5(a) and 5(b) EXAMPLE OF YOUR SAVINGS WHEN YOU USE PREFERRED PROVIDERS* DIAGNOSTIC TEST (SUCH AS AN X-RAY OR BLOOD WORK) PREFERRED PROVIDER PARTICIPATING PROVIDER NON-PARTICIPATING PROVIDER Physician’s charge $250 $250 $250 Plan allowance $100 $100 $100 We pay 85% of the Plan allowance or $85 65% of the Plan allowance or $65 65% of the Plan allowance or $65 Your coinsurance 15% of the Plan allowance or $15 35% of the Plan allowance or $35 35% of the Plan allowance or $35 Plus any difference up to the provider’s charge $0 $0 $150 YOUR TOTAL ESTIMATED PAYMENT $15 $30 per visit copayment for specialists MATERNITY CARE — 5(a) Inpatient/Outpatient hospital care (Precertification is not required for normal delivery) No out-of-pocket expenses for covered services $350 per admission copayment plus 35% of the Plan allowance Physician care No out-of-pocket expenses for covered services 35% of the Plan allowance** (Precertification is required) $250 per admission copayment for unlimited days $350 per admission copayment plus 35% of the Plan allowance Outpatient hospital/facility care 15% of the Plan allowance** 35% of the Plan allowance** HOSPITAL/FACILITY CARE — 5(c) *This example assumes the calendar year deductible has been met. $35 $185 Inpatient hospital/facility care ACCIDENTAL INJURY/MEDICAL EMERGENCY — 5(d) Accidental injury within 72 hours of accident Nothing for covered services Medical emergency/facility care Emergency room: 15% of the Plan allowance** Emergency room: 15% of the Plan allowance** Medical emergency/professional care Nothing for covered services; you pay any difference between our allowance and billed charges Urgent care center: $30 copayment Urgent care center: 35% of the Plan allowance** $20 per visit copayment for primary care provider 35% of the Plan allowance** $30 per visit copayment for specialists OTHER BENEFITS — 4 Catastrophic Benefits 100% payment level begins after you pay $5,000 (Self Only) or $6,000 (Self and Family) out-of-pocket in eligible coinsurance, copayment and deductible expenses 100% payment level begins after you pay $7,000 (Self Only) and $8,000 (Self and Family) out-of-pocket in eligible coinsurance, copayment and deductible expenses * When you use Non-preferred hospitals/facilities and professionals, your out-of-pocket expenses are greater and you generally pay any difference between our allowance and the billed amount. Please see Section 1 of the 2015 Service Benefit Plan brochure. ** Subject to one $350 deductible per member per calendar year; $700 family limit each calendar year. 4 2015 Standard & Basic Option Blue Cross and Blue Shield Service Benefit Plan Summary 5 HEALTH TOOLS ON MYBLUE Health Tools on MyBlue website MyBlue now features mobile Health Tools and resources--the latest health and wellness information within easy reach from your computer, smartphone or tablet. It’s everything you already love about Blue— but better! ® New year, new start! Blue has you covered! Imagine simple, private and smart tools and resources that you can securely access anytime, anywhere--on your computer, tablet or smartphone: • Share your test results with a new doctor— in the doctor’s office. • Keep track of your prescriptions. • Access activities and trackers to help you achieve your health goals—from the gym, your home or the office. • Chat, call or email about your baby’s fever and sleep patterns with a nurse—on a Sunday morning. • Review your well-organized, comprehensive medical history—even at midnight. • Enter your symptoms and receive possible reasons for why you have that nagging cough—from the comfort of your home. Our tools offer support that’s motivational and realistic about the challenges real people face. Your data is secure. The Service Benefit Plan and WebMD take the safety and security of your health information very seriously. All of our systems operate in accordance with federal privacy laws, and we take every effort to protect your privacy when you use any of the tools and resources. 6 Start Here: Blue Health Assessment What you don’t know can hurt you. Take the redesigned BHA to address health risks before they become issues. Answer simple questions and in just 10 minutes receive a clear, concise, personalized approach to a healthier you. You can even take the BHA multiple times throughout the year to update your plan and see your progress. Earn $50 the first time you complete the BHA in 2015! Next: Online Health Coach It’s your own private cheering section! When you work with the Online Health Coach on your path to better health, you’ll get suggestions for realistic, personalized activities to help you stay on track. Start by taking the BHA, then earn rewards—up to $35— when you achieve your exercise, stress management, emotional health, weight loss and nutrition goals using the Online Health Coach. Also, get ideas and encouragement for managing your chronic conditions, like diabetes, asthma and others. Anytime: Benefits Statements Let your Benefits Statements be your benefits assistant! Find ways to save and see a snapshot of your claims and benefits in annual or quarterly time periods—anytime you need answers, not just when you’re close to your filing cabinet. Access your statements on your computer, smartphone or tablet— from home, the doctor’s office or pharmacy. Print your statements from home or you can contact 1-888-258-3432 to request paper statements. HEALTH TOOLS The Blue Cross and Blue Shield Service Benefit Plan is continuing to offer Health Tools, powered by WebMD, one of the most trusted healthcare brands in the U.S. In 2015, you’ll have new and improved wellness tools and resources, available on the MyBlue website. We’re even giving you more of an incentive to complete our Health Tools in 2015---$50 just for completing the Blue Health Assessment (BHA)! Anytime: Nurse Line Call, chat online or email the Nurse Line for reliable health information, anytime day or night. Visit www.fepblue.org/myblue or call 1-888-258-3432 to get reliable health information from knowledgeable, registered nurses. Anytime: Personal Health Record Anytime: Online Symptom Checker Your Personal Health Record (PHR) gives you easy access to your health information, making it simple for you to keep track of your medical history, appointments and lab results. There’s no need to worry that you’ve forgotten important health details—your PHR has you covered. When you complete the BHA and work with the Online Health Coach, this information is fed to your PHR. Plus, wherever your smartphone goes, your PHR goes, too! Use the Online Symptom Checker to receive possible reasons for your symptoms*—from your computer, smartphone or tablet. If you have questions while using the Online Symptom Checker, you can chat online with the Nurse Line, too! *Seek immediate medical attention for life-threatening health issues. 2015 Standard & Basic Option Blue Cross and Blue Shield Service Benefit Plan Summary 7 REWARD PROGRAMS MyBlue® Wellness Card The MyBlue Wellness Card is a debit card we use to reward our members for taking charge of their health. The card is available to members who complete specific activities to improve their health and may be used to pay for qualified medical expenses. MORE BENEFITS. MORE PEACE OF MIND. Please note: If you have a MyBlue Wellness Card, keep your card until it expires. Any new credits will be applied to your existing card. Wellness Incentive Program: Blue Health Assessment (BHA) and Online Health Coach Take steps toward better health and earn up to $85* WHEN YOU Complete the BHA in 2015 to receive $50 on your MyBlue Wellness Card. Members must be 18 years of age or older to be eligible for the incentive. Family contracts are eligible to receive two $50 cards when two adult members complete the BHA. $50 Complete the Blue Health Assessment $15 Achieve your first goal with the Online Health Coach** $10 Achieve your second goal with the Online Health Coach** You may also receive up to an additional $35 on your MyBlue Wellness Card for achieving goals related to a healthy lifestyle in the areas of exercise, nutrition, stress, weight management and emotional health. $10 Achieve your third goal with the Online Health Coach** Up to two covered adult family members can each earn up to $85 after completing all four steps! * Incentive rewards are added to your MyBlue Wellness Card to pay for qualified medical expenses. ** Goals must be started and completed within the calendar year. The Diabetes Management Incentive Program provides critical education if you have diabetes, assists in improving your blood sugar control and helps to manage or slow the progression of complications related to diabetes. To be eligible for this program, you must be 18 years of age or older and complete the BHA and indicate you have diabetes. This program is limited to two adult members if you have family coverage. You will receive credit on your MyBlue Wellness Card when you complete specific activities. Please note: Once you earn the maximum of $75 under the Diabetes Management Incentive Program, you will not earn additional credits to your MyBlue Wellness Card for completing additional activities under this incentive in 2015. EARN UP TO $75 WHEN YOU DO ANY COMBINATION OF THE FOLLOWING ACTIVITIES Have A1c tests performed by a covered provider, maximum of two per year, $10 each Report A1c levels, maximum of two per year, $5 each Purchase diabetic glucose test strips through our Retail or Mail Service Pharmacy, maximum of four per year, $10 each Have a diabetic foot exam from a covered provider, maximum of one per year, $10 Complete one of the following activities: • $20 for enrolling in a diabetic disease management program, one per year, OR • $20 for a diabetic education visit to a covered provider, one per year, OR • $5 each for completing web-based diabetes education programs on our website, up to four per year Tobacco Cessation Incentive Program REWARD PROGRAMS EARN After completing the BHA, you may choose to complete goals in any of these five areas, up to a maximum of three goals per calendar year to earn a reward. When you achieve your first goal, you will receive $15 on your card. For the second and third goals, you will receive $10 on your card for each one. All three goals must be completed during the calendar year to earn the reward. 8 Extra Motivation! Diabetes Management Incentive Program If you are ready to stop using tobacco, we have the support you need for success. Take the BHA and indicate that you use tobacco, and then use the Online Health Coach to select the tobacco cessation goal and create a plan to quit. After you complete these steps, you’ll be eligible to receive tobacco cessation products for free. Both prescription and over-the-counter (OTC) tobacco cessation products obtained from a Preferred retail pharmacy are included in this program for Standard Option and Basic Option members age 18 or older. When you use a Preferred pharmacy to get certain prescription tobacco cessation drugs, we will waive the cost share. You must have a physician’s prescription for each OTC tobacco cessation drug. 2015 Standard & Basic Option Blue Cross and Blue Shield Service Benefit Plan Summary 9 BLUE EXTRAS Health Club Membership Other Programs Finding Care You pay a $25 initiation fee and $25 monthly for unlimited visits to over 8,600 fitness facilities nationwide. You are not limited to a specific facility. For more information, go to www.fepblue.org. • WalkingWorks® is a good start for any exercise routine with a free pedometer and online walking guide. Visit www.fepblue.org for more information. National Doctor and Hospital Finder Our directory of Preferred providers gives you the control to choose your medical and wellness specialists while saving you money on medical costs through our negotiated discounted rates. Visit www.fepblue.org/provider for details. • Blue365® offers access to information, discounts and savings that make it easier and more affordable to make healthy choices. For more information, go to www.fepblue.org. With the Blue Finder smartphone app, finding a doctor or hospital has never been easier! One tap with the Blue Finder app connects you to the closest provider, hospital, or urgent care center. You can dial a provider’s phone number and use the interactive GPS map and driving directions to get to your selected location. Text and email options allow you to share and save your results. • Our Vision Care Affinity Program provides savings on routine eye exams, frames, lenses, contact lenses and laser vision correction when you use a network provider. Visit www.fepblue.org for additional information about this program or call 1-800-551-3337. • Care Management Programs, offered by Blue Cross and Blue Shield Plans, provide patient education and support for select diagnoses. Call your local Blue Cross and Blue Shield Plan for more information about these programs. Blue Distinction Centers® MyBlue Customer eService MyBlue Customer eService is like having your own personal customer service representative when you need help managing your enrollment. You can request duplicate ID cards, change your address, add children after a birth or adoption and let us know about a marriage or divorce. Visit www.fepblue.org for more information. You can decide to go paperless and access your Explanation of Benefits (EOB) online through MyBlue Customer eService. You can see and print information about claims processed for you and your family. It is easy to opt in to paperless EOBs. First, sign on to www.fepblue.org/myblue. 10 10 Blue Distinction Centers and Blue Distinction Centers+ are available nationwide no matter where you work, live or travel — and finding one is easy. Visit the Blue Distinction Center Finder at www.bcbs.com/bdcfinder. 2015 Standard & Basic Option Blue Cross and Blue Shield Service Benefit Plan Summary BLUE EXTRAS Online Explanation of Benefits The hospital you select can have a direct impact on the care you receive and your procedure results. But finding the right hospital can sometimes be a challenge. You deserve peace of mind when making important healthcare decisions with your doctor. That’s why we developed the Blue Distinction Centers® recognition program to identify hospitals with proven expertise in delivering specialty care. 11 PHARMACY PROGRAMS Mail Service Pharmacy Program— Standard Option Only Specialty Pharmacy Program— Both Options The Mail Service Pharmacy Program for Standard Option is an easy way to get drugs you take regularly with the convenience of home delivery. A specialty prescription drug is used to treat complex health conditions. Specialty drugs are usually high in costs and have one or more of these features: • Are injectable • Are infused • Are inhaled • Are products of biotechnology • Have special requirements for handling, shipping and storage • Need specialized patient training and coordination of care If you have any questions about the Mail Service Pharmacy Program or want to talk to a pharmacist about your drugs, you can call anytime. This benefit is not available under Basic Option. Using the Mail Service Pharmacy Program is easy. 1. Ask your physician to prescribe up to a 90-day supply (minimum 22-day supply) of your drug plus refills for up to one year. 2. Send your original prescription, the appropriate copayment amount and your completed mail service order form to the address on the form. You can download order forms on www.fepblue.org or request copies by calling 1-800-262-7890. Your doctor can order a prescription for you by calling 1-800-262-7890 and pressing Option 3. Retail Pharmacy Program— Both Options Basic Option members must use a Preferred retail pharmacy to obtain drugs. Standard Option members can use any Preferred or Non-preferred retail pharmacy. However, if you use a Non-preferred pharmacy, you pay the full cost of the drug and then file a claim for reimbursement. Your cost share is 45% of the Average Wholesale Price, plus any difference between our allowance and the billed amount. If you have questions about the Specialty Drug Program call 1-888-346-3731 from 7 a.m. – 9 p.m. Eastern time, Monday-Friday and 8 a.m. – 6:30 p.m. Eastern time, Saturday and Sunday. BENEFIT We have over 60,000 Preferred network retail pharmacies nationwide. You can locate a Preferred retail pharmacy near you by calling 1-800-624-5060 or by using the Provider Directory on www.fepblue.org. 2015 STANDARD OPTION COVERAGE 2015 BASIC OPTION COVERAGE Tier 1 (Generics)*: $15 copayment Tier 2 (Preferred brand name): $80 copayment Tier 3 (Non-preferred brand name): $105 copayment Covers 22-90-day supply Not a benefit PRESCRIPTION DRUGS Mail Service Pharmacy Program Nothing for the first 4 prescription fills or refills when you switch from certain brand name drugs to specific generic drugs Retail Pharmacy Program Tier 1 (Generics)*: 20% of the Plan allowance Tier 2 (Preferred brand name): 30% of the Plan allowance Tier 3 (Non-preferred brand name): 45% of the Plan allowance Tier 1 (Generics): $10 copayment Tier 2 (Preferred brand name): $45 copayment Tier 3 (Non-preferred brand name): 50% of the Plan allowance with a $55 minimum Covers up to a 90-day supply Covers 30-day supply, up to 90-day supply for additional copayments Tier 4 (Preferred specialty drugs): $60 copayment (30-day supply) Nothing for the first 4 prescription fills or refills when you switch from certain brand name drugs to specific generic drugs when you use a Preferred Pharmacy Tier 4 (Preferred specialty drugs): 30% of the Plan allowance (30-day supply) 3. All drugs and instructions are sent via U.S. Postal Service, except drugs that require overnight shipping. You should receive your prescription two weeks from the time you mail in your order. 4. You can order refills by sending in the refill slip included with your previous prescription fill, online at www.fepblue.org or by calling 1-877-337-3455, 24 hours a day, seven days a week. If you have any questions about the Retail Pharmacy Program, you can call 1-800-624-5060 to talk to a member service representative. WHAT YOU PAY WHEN YOU USE PREFERRED PROVIDERS Facts to know about specialty drugs • Specialty drugs in Tier 4 are Preferred. • Specialty drugs in Tier 5 are Non-preferred. • Tiers 4 and 5 both have limits on days’ supply (amount of drug) and where you can get refills. Just show your Service Benefit Plan ID card at a Preferred pharmacy. You pay only the appropriate copayment or coinsurance amount. Tier 5 (Non-preferred specialty drugs): 30% of the Plan allowance (30-day supply) Tier 4 and 5 specialty drugs are limited to a 30-day supply; only one fill allowed. All refills must be obtained from the Specialty Pharmacy Program. Tier 4 and 5 specialty drugs are limited to a 30-day supply; only one fill allowed. All refills must be obtained from the Specialty Pharmacy Program. Tier 4 (Preferred specialty drugs): $35 copayment (30day supply); $95 copayment (90-day supply) Tier 4 (Preferred specialty drugs): $50 copayment (30-day supply); $140 copayment (90-day supply) Tier 5 (Non-preferred specialty drugs): $55 copayment (30-day supply); $155 copayment (90-day supply) Tier 5 (Non-preferred specialty drugs): $70 copayment (30-day supply); $195 copayment (90-day supply) 90-day supply can only be obtained after 3rd fill 90-day supply can only be obtained after 3rd fill PHARMACY PROGRAMS Specialty Pharmacy Program Tier 5 (Non-preferred specialty drugs): $80 copayment (30-day supply) Certain prescription drugs require prior approval. *Your costs for generic prescription drugs are lower if you have Medicare Part B as your primary coverage. 12 2015 Standard & Basic Option Blue Cross and Blue Shield Service Benefit Plan Summary 13 WORLDWIDE COVERAGE When You Live or Travel Overseas How Benefits Work Overseas Filing Claims If you need medical care outside the United States, you can be assured that your Blue Cross and Blue Shield Service Benefit Plan ID card entitles you to world class service. Your Service Benefit Plan coverage protects you around the world. Inpatient Hospital Care: Under both options, benefits are paid at the Preferred level. Precertification is not required for hospital admissions outside the U.S. Members can mail claims to us, fax them to us or submit claims for medical care performed and prescription drugs purchased overseas through MyBlue on www.fepblue.org. For information about mailing and faxing claims to us, see Section 5(i) in the Service Benefit Plan brochure. Worldwide Assistance Center Physician Care: Benefits for physician care and care by other covered professional providers performed outside the U.S. are paid at the Preferred level using an Overseas Fee Schedule or a provider negotiated amount. The Worldwide Assistance Center offers help when you are traveling outside the U.S., Puerto Rico and the U.S. Virgin Islands, 24 hours a day, seven days a week. Bilingual operators are also available to help you. The Center can help you locate a provider. You can call the Center collect at 1-804-673-1678 or email [email protected] for help. Outpatient Hospital Care: Benefits under Standard and Basic Option are paid at the Preferred level. Prescription Drugs: Drugs that require a prescription overseas may differ from those that require a prescription in the U.S. Drugs purchased outside the U.S. must be an equivalent product that by U.S. federal law requires a prescription for purchase in the U.S., or there must be clinical evidence that prescribing the drug is consistent with the standard of medical practice in that country. To submit your claims electronically: 1. Go to www.fepblue.org/myblue and log in if you have already registered. If not, you will have to set up a MyBlue account. You can also take advantage of bank wire payment and get your payment faster for overseas medical claims. You can select to have the wire payment in a foreign currency or U.S. dollars. Just complete Section 6 of the online overseas medical claim form to select wire payments and the currency you prefer. Payments by check for covered drugs and supplies you purchase from pharmacies outside the U.S., Puerto Rico, and the U.S. Virgin Islands can only be made in U.S. dollars. 2. O n the MyBlue Welcome page, under Overseas Assistance, select “Submit an overseas claim.” 3. Follow the step-by-step directions to submit the claim, including completing the fillable claim form PDF, scanning your bills and uploading the files. • Standard Option members can order prescription drugs through the Mail Service Pharmacy Program if your address has a U.S. zip code and the prescribing physician is licensed in the U.S. • For both Standard and Basic Option, if you purchase a prescription drug at a local pharmacy outside the U.S., you pay for the drug and then file a claim for reimbursement. Payment will be made at the Preferred level. 14 2015 Standard & Basic Option Blue Cross and Blue Shield Service Benefit Plan Summary 15 WORLDWIDE COVERAGE Please note that for overseas countries with laws restricting the importation of prescription drugs from any other country, we are unable to ship drugs from our Mail Service Pharmacy Program to Standard Option members living overseas, or from our Specialty Drug Program to Standard or Basic Option members living overseas, even when a valid APO or FPO address is available. You may continue to obtain your prescription drugs from a local overseas pharmacy and submit a claim to us for reimbursement by faxing it to 001-480-614-7674 or filing it via our website at www.fepblue.org/myblue. 2015 Standard Option and Basic Option Benefit Comparison Chart Certain deductibles, copayments and coinsurance amounts do not apply if Medicare is your primary coverage for medical services (it pays first). WHAT YOU PAY WHEN YOU USE PREFERRED PROVIDERS WHAT YOU PAY WHEN YOU USE PREFERRED PROVIDERS BENEFIT 2015 STANDARD OPTION COVERAGE* 2015 BASIC OPTION COVERAGE** Office visits and outpatient consultations $20 per visit copayment for primary care provider $30 per visit copayment for specialists $25 per visit copayment for primary care provider $35 per visit copayment for specialists Routine exams and other preventive care services Nothing for covered services Nothing for covered services Surgical services 15% of the Plan allowance Prior approval is required for certain surgical services Subject to calendar year deductible $150 copayment per performing surgeon in an office visit setting $200 copayment per performing surgeon in another setting $250 per admission copayment for unlimited days $175 per day up to $875 per admission for unlimited days 15% of the Plan allowance $100 per day per facility copayment Precertification is required PRESCRIPTION DRUGS Certain prescription drugs require prior approval. Retail Pharmacy Program Specialty Pharmacy Program Tier 1 (Generics)***: $15 copayment Tier 2 (Preferred brand name): $80 copayment Tier 3 (Non-preferred brand name): $105 copayment Covers 22-90 day supply Nothing for the first 4 prescription fills or refills when you switch from certain brand name drugs to specific generic drugs Not a benefit 15% of the Plan allowance Subject to calendar year deductible $0 copayment for laboratory tests, pathology services and EKGs $40 copayment for diagnostic tests such as EEGs, ultrasounds and X-rays $100 copayment for angiography, bone density tests, CT scans, MRIs, PET scans, genetic testing, nuclear medicine and sleep studies at a professional provider; $150 copayment at a hospital Accidental injury: Nothing for outpatient, hospital and physician services within 72 hours Medical emergency: Regular benefits for physician and hospital care (Subject to calendar year deductible); $30 copayment for urgent care center Accidental injury and medical emergency: $125 copayment for emergency room care $35 copayment for urgent care center Regular benefits for physician care Inpatient/Outpatient hospital care: No out-of-pocket expenses for covered services Inpatient/Outpatient hospital care: $175 copayment per inpatient admission; No out-of-pocket expenses for outpatient covered services Physician care including delivery and pre- and postnatal care: No out-of-pocket expenses for covered services EMERGENCY CARE Accidental injury Tier 1 (Generics)***: 20% of the Plan allowance Tier 2 (Preferred brand name): 30% of the Plan allowance Tier 3 (Non-preferred brand name): 45% of the Plan allowance Covers up to a 90-day supply Nothing for the first 4 prescription fills or refills when you switch from certain brand name drugs to specific generic drugs when you use a Preferred Pharmacy Tier 4 (Preferred specialty drugs): 30% of the Plan allowance (30-day supply) Tier 5 (Non-preferred specialty drugs): 30% of the Plan allowance (30-day supply) Tier 4 and 5 specialty drugs are limited to a 30-day supply; only one fill allowed. All refills must be obtained from the Specialty Pharmacy Program. Tier 1 (Generics): $10 copayment Tier 2 (Preferred brand name): $45 copayment Tier 3 (Non-preferred brand name): 50% of the Plan allowance with a $55 minimum Covers 30-day supply, up to 90-day supply for additional copayments Tier 4 (Preferred specialty drugs): $60 copayment (30-day supply) Tier 5 (Non-preferred specialty drugs): $80 copayment (30-day supply) Tier 4 and 5 specialty drugs are limited to a 30-day supply; only one fill allowed. All refills must be obtained from the Specialty Pharmacy Program. Tier 4 (Preferred specialty drugs): $35 copayment (30-day supply); $95 copayment (90-day supply) Tier 5 (Non-preferred specialty drugs): $55 copayment (30-day supply); $155 copayment (90-day supply) 90-day supply can only be obtained after 3rd fill Tier 4 (Preferred specialty drugs): $50 copayment (30-day supply); $140 copayment (90-day supply) Tier 5 (Non-preferred specialty drugs): $70 copayment (30-day supply); $195 copayment (90-day supply) 90-day supply can only be obtained after 3rd fill Inpatient/Outpatient hospital care Precertification is not required for normal delivery Physician care Physician care including delivery and pre- and postnatal care: No out-of-pocket expenses for covered services DENTAL CARE Routine dental care * When you use Non-preferred hospitals/facilities and professionals, your out-of-pocket expenses are greater. Please see the 2015 Service Benefit Plan brochure for details. ** Basic Option does not generally provide benefits for services rendered by Non-preferred providers. *** Your costs for generic prescription drugs are lower if you have Medicare Part B as your primary coverage. Please see the 2015 Service Benefit Plan brochure for complete details. 16 2015 BASIC OPTION COVERAGE** MATERNITY CARE Subject to calendar year deductible Mail Service Pharmacy Program Diagnostic test (X-ray, blood work) Imaging (CT/PET scans, MRIs) Medical emergency HOSPITAL/FACILITY CARE Outpatient hospital/facility care 2015 STANDARD OPTION COVERAGE* LAB, X-RAY AND OTHER DIAGNOSTIC SERVICES PHYSICIAN CARE Hospital inpatient BENEFIT Up to age 13: The difference between the fee schedule and the Maximum Allowable Charge (MAC) Age 13 and over: The difference between the fee schedule and the MAC $25 copayment per evaluation; up to 2 per calendar year CHIROPRACTIC/OSTEOPATHIC MANIPULATIVE TREATMENT Manipulative treatment $20 per visit copayment; up to 12 manipulations per year $25 per visit copayment; up to 20 manipulations per year 100% payment level begins after you pay $5,000 (Self Only) or $6,000 (Self and Family) out-of-pocket in eligible coinsurance, copayment and deductible expenses with Preferred providers 100% payment level begins after you pay $5,500 (Self Only) or $7,000 (Self and Family) out-of-pocket in eligible coinsurance, copayment and deductible expenses OTHER BENEFITS Catastrophic benefits * When you use Non-preferred hospital/facilities and professionals, your out-of-pocket expenses are greater. Please see the 2015 Service Benefit Plan brochure for details. ** Basic Option does not generally provide benefits for services rendered by Non-preferred providers. This is a summary of the features for the Blue Cross and Blue Shield Service Benefit Plan. Before making a final decision, please read the Plan’s Federal brochure (RI 71-005). All benefits are subject to the definitions, limitations, and exclusions set forth in the Federal brochure. As You Make Your Open Season Choices The 2015 Blue Cross and Blue Shield Service Benefit Plan brochure is your best resource for detailed information about the benefits and services most important to you. Please do not rely solely on the summary of benefits in this pamphlet. You can access and download a copy of our 2015 brochure at www.fepblue.org. 2015 Standard & Basic Option Blue Cross and Blue Shield Service Benefit Plan Summary 17 Open Season Dates The 2014 Open Season for health insurance changes runs from Monday, November 10, 2014 through Monday, December 8, 2014. 2015 Premiums and Rates 2015 Premiums—Your Share TYPE OF ENROLLMENT NON-POSTAL PREMIUM BIWEEKLY MONTHLY POSTAL PREMIUM BIWEEKLY Category 1 Category 2 Standard Option Self Only (104) $91.03 $197.23 $77.00 $91.03 Standard Option Self & Family (105) $213.31 $462.17 $182.16 $213.31 Basic Option Self Only (111) $63.40 $137.38 $50.09 $63.40 Basic Option Self & Family (112) $148.46 $321.67 $117.29 $148.46 These rates do not apply to all Enrollees. If you are in a special enrollment category, please refer to the Guide to Federal Benefits or contact the agency or Tribal Employer which maintains your health benefits enrollment. Career non-law enforcement employees may also refer to the Guide to Federal Benefits for United States Postal Service Employees, RI 70-2, to determine their rates. Different rates apply and a special Guide is published for Postal Service Inspectors and Office of Inspector General (OIG) employees (see RI 70-21N). For additional assistance, Postal Service employees can call the Human Resources Shared Service Center at 1-877-477-3273 and select option 5. Postal rates do not apply to non-career postal employees, postal retirees or associate members of any postal employee organization who are noncareer postal employees. Refer to the applicable Guide to Federal Benefits. This is a summary of the features for the 2015 Blue Cross and Blue Shield Service Benefit Plan. Before making a final decision, please read the Plan’s Federal brochure (RI 71-005). All benefits are subject to the definitions, limitations and exclusions set forth in the 2015 Federal brochure. Please visit our website www.fepblue.org for more information about your Service Benefit Plan coverage. AskBlue for Federal Employees Do you ever wonder if your current option is still the right one for you and your family? AskBlue is designed to help you make this type of decision about your health insurance coverage. It is a personal guide that is simple and provides straightforward answers to your health insurance choice questions. Visit askblue.fepblue.org.

© Copyright 2026